Individuals, households, and businesses pay taxes on things like income, property transactions, and certain goods and services. These taxes fund public services like health and social care, education, and transport.

You can find out more about taxes in Scotland in our animated video, ‘Raised in Scotland. Spent in Scotland.’

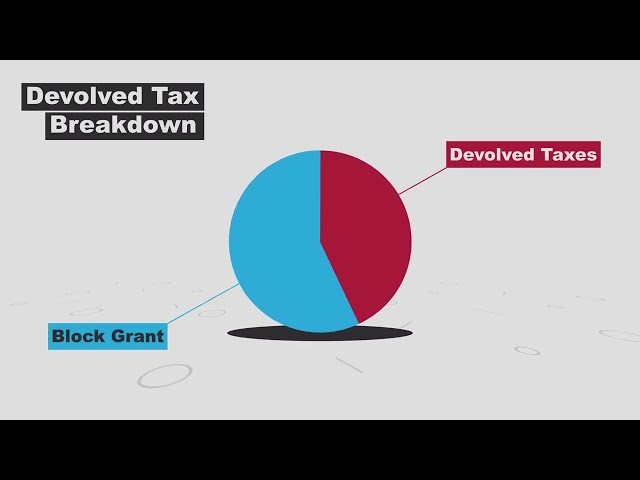

There are three different types of tax in Scotland:

- devolved taxes (partially and fully)

- local taxes

- taxes reserved to the UK Government

Taxes paid in Scotland are collected by local authorities, Revenue Scotland and HM Revenue and Customs (HMRC), depending on the tax.

Actions

We:

- published the Framework for Tax which sets out the principles and policy objectives that underpin the Scottish Approach to Taxation

- published Scotland’s Tax Strategy which builds on the principles set out in the Framework for Tax and forms part of our approach to ensure the public finances are on a sustainable trajectory

These actions help us move towards a tax system that:

- aligns policy aims with outcomes

- is informed by more robust evidence and engagement with others

- enables us to take a system wide and comprehensive approach to tax policy in Scotland

Responsibilities

The Scottish Parliament has partial or full power over these taxes:

- Income Tax - This is partially devolved. The Scottish Parliament sets rates and bands for non-savings and non-dividend income only. Allother aspects are reserved to the UK Government. It is collected and administered by HMRC.

- Land and Buildings Transaction Tax - fully devolved to the Scottish Parliament and administered by Revenue Scotland.

- Landfill Tax - set by the Scottish Parliament and administered by Revenue Scotland.

- Council Tax - set, administered, and spent by local authorities

- Non-Domestic Rates - set by the Scottish Parliament, administered and collected by local authorities who retain all of the revenue raised locally.

In addition, the Scotland Act 2016 included powers in relation to:

- Air Departure Tax,

- Scottish Aggregates Tax

- the assignment of a share of Scottish VAT revenues.

The Scottish Aggregates Tax is planned to go live on 1 April 2026. We have also secured the transfer of powers to create a new devolved tax, a Scottish Building Safety Levy.

Background

Our approach to tax reflects Adam Smith’s four principles of taxation:

- certainty

- proportionality to the ability to pay

- convenience

- efficiency

Despite being more than 200 years old, these principles continue to be pillars of sound tax policy making. We have added two additional principles, signifying our commitment to engaging and collaborating on tax policy, and designing effective tax policies that minimise the scope for avoidance activities:

- effectiveness

- engagement

These six principles form the foundation of the Scottish Government’s strategic approach to tax policy-making. They also help set our priorities in five areas:

- our priorities for the existing system

- the economy and tax

- administration

- evidence and evaluation

- future priorities

These form part of our three pillar approach to ensuring the public finances are on a sustainable trajectory, as set out in the Medium-Term Financial Strategy published in 2023.

Bills and legislation

The Scottish Government has gained more tax and revenue raising powers through legislation:

Scotland Act 1998 established the Scottish Parliament, devolved powers in relation to local taxes such as council tax and non-domestic rates, and provided for the variation of the basic rate of income tax in relation to the income of Scottish taxpayers.

Scotland Act 2012 amended the 1998 Act by devolving further powers to Scotland, including the ability to set a Scottish Rate of Income Tax and to legislate for and administer taxes to replace UK Stamp Duty Land Tax and Landfill Tax. The 2012 act also introduced a mechanism to devolve further tax powers, including new taxes.

The Smith Commission report, published in November 2014, recommended further devolution over elements of taxation and public spending to the Scottish Parliament. This proposal was taken forward in the Scotland Act 2016, which received royal assent on 23 March 2016.

Scotland Act 2016 extended Income Tax powers by enabling the Scottish Parliament to set rates and bands on non-saving, non-dividend income, for example earnings from employment, pensions and property income. Powers over Air Passenger Duty (now Air Departure Tax) and Aggregates Levy were also included. Powers over Aggregates were also included, with a Scottish Aggregates Tax expected to be introduced on 1 April 2026

As part of the implementation of the Smith Commission report, the Scottish and UK governments also agreed a fiscal framework, which includes a mechanism for adjusting the block grant to reflect the tax and social security responsibilities that have been devolved to the Scottish Government.

Scotland Acts

Devolved taxes

Landfill Tax (Scotland) Act 2014

Land and Buildings Transaction Tax (Scotland) Act 2013

Land and Buildings Transaction Tax (Amendment) (Scotland) Act 2016

Land and Buildings Transaction Tax (Relief from Additional Amount) (Scotland) Act 2018

Air Departure Tax (Scotland) Act 2017

Aggregates Tax and Devolved Taxes Administration (Scotland) Act 2024

Local government taxes

View a full list of Council tax: legislation

View a full list of Non-domestic rates: legislation

Contact

Email: Central Enquiries Unit ceu@gov.scot