Natural capital: economic benefits assessment

Outlines new economic analysis that quantifies the likely economic impacts, measured as output and jobs created, from hypothetical cross-sector regional and national programmes of natural capital investment in Scotland.

Project approach and analytical framework

Project approach

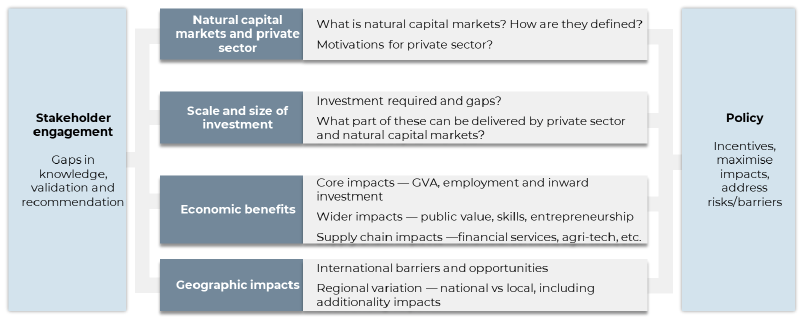

A summary of the approach is provided in Figure 1. The project comprises four key elements focusing on: (1) natural capital markets and private sector; (2) scale and size of investment; (3) economic benefits; and (4) geographic impacts. Further detail of each of the following phases is provided below in Figure 1.

Natural capital markets and private sector

The project needed to define a working typology of natural capital markets and private sector investment. This relied on the definition of the finance gap for natural capital investment from the 'The Finance Gap for UK Nature' report commissioned by the Green Finance Institute (GFI) (the 'GFI report' henceforth). The GFI report estimated the finance gap to achieve seven "nature-related outcomes" (henceforth referred to as 'GFI outcomes'), based on public policies like the Defra's 25 Year Environment Plan in England and equivalent policies for the Devolved Administrations[5]. Private investment, along with public and third sector funding initiatives, is considered key for closing the finance gap. Private sector motivations for investing in natural capital were also analysed in this stage of the project.

Scale and size of investment

The "GFI model" refers to the nature finance gap model developed to estimate the current and required spending on nature across the UK. The GFI model analysis in this current study focuses only on Scotland-specific estimates. The seven GFI model "nature-related outcomes" were used to identify the scale and size of the finance gap for nature across Scotland.

A desktop review of existing public, private and blended funding mechanisms was conducted in order to assess the committed and required investment in natural capital (and hence to refine the finance gap estimates from the 2021 report for Scotland).

Consultations with Scottish Government and wider stakeholders were undertaken in order to define a natural capital markets typology and validate the three main nature spending results – committed spend, required spend and the finance gap (the difference between the two) – for Scotland. The workshop resulted in:

- Agreeing modelling assumptions for the GFI model adapted for Scotland, in relation to: natural capital funding, funding gaps, categorisation of different funds, classification of timescales for funds mobilisation (short, medium and long term), and information on new funds being allocated;

- Discussing public sector and private sector expenditure data being used for the GFI model for Scotland, including where there are overlaps between public funding initiatives, e.g. Peatland ACTION, Forestry Grants Scheme (FGS), and the Nature Recovery Fund (NRF);

- Soliciting views on the scale of demand in natural capital markets; and

- Discussing potential regional case studies to be applied to economic model.

Economic benefits

Building on the identification of the funding gap and market drivers for natural capital investment in Scotland, an assessment of the quantitative economic impacts of natural capital investment in various activities and markets was conducted. This stage of the project required drawing on the environment-economy model developed in the previous study for Scottish Government 'Understanding the local economic impacts of natural capital investment' and understanding how the nature-based activities in the previous environment-economy model (what are henceforth in this report referred to as natural capital interventions) are associated with GFI outcomes. An assessment was carried out as to how investment in natural capital interventions spill over to other sectors, through input-output analysis and multiplier effects. The GFI outcomes were mapped onto natural capital interventions (e.g. woodland creation, peatland creation) and these in turn are underpinned by a set of component activities that take place (e.g. silviculture, support services to forestry and hunting). Component activities are classified according to ONS SIC codes and go beyond labour and capital, e.g. activities further up the value chain that are office-based.

Geographic impacts

The key outputs of this stage were to summarise regional impacts, where possible outlining risks and caveats of expressing the economic impacts at different geographical levels; and testing the environment-economy model by applying it to regional case studies in close consultation with the Scottish Government.

To achieve this, a combination of regional case studies and regional SIC data linked to natural capital activity was used to better understand the regional impact of investing in natural capital projects, in that region. Where possible, the regional case studies included a qualitative description of supply chain impacts and wider economic impacts and potential barriers relating to skills gaps, skills development, and land use diversification.

Judgement on leakage factors was applied to account for jobs that could leak out and be created beyond the area studied into another region or even beyond Scotland. Location quotients compare the concentration of an industry within a region in Scotland, compared to that of the whole and Scotland and/or England. The use of location quotients gave an indication as to where particular specialisms and high concentrations of labour supply, and therefore skillsets, existed within the different regions of Scotland. Conversely, low location quotients revealed skills gaps in regions and gave insights into geographic locations where leakage outside a region may occur, indicating where these skills gaps may be met, whether that be another region in Scotland or a neighbouring country (i.e. England).

This analysis was developed further through the regional case studies where a wide range of economic benefits for the local regional were predicted including:

- The core economic indicators of GVA, employment and inward investment

- The value added to public sector spend;

- Current skills gaps; and

- The associated local supply chain impacts of investing in natural capital across all relevant sectors.

Finally, this stage involved exploring international market opportunities and barriers in relation to Scotland's natural capital and where Scotland's natural capital has a competitive international advantage; and providing a high-level description of the trends and status of international natural capital markets.

It is hoped that, where supply chains and labour market development occur as a result of natural capital investment in regions or across Scotland, it will also create opportunities to market these services internationally. This is expected to be linked to the required innovation needed to drive this development, such as in nature fintech and remote sensing. By reviewing the current availability of technical expertise and the locations of labour supply, this also helped to understand the potential aspects of natural capital supply chains in Scotland that could be marketed internationally.

Analytical framework

The analytical framework adopted for this study is shown in Figure 2 below. The framework comprises four pillars: 1) financing sources; 2) drivers and enabling mechanisms to stimulate investment in natural capital; 3) natural capital interventions funded by natural capital investment; and 4) economic impacts derived from natural capital interventions (through analysis of component activities).

The analytical framework and ensuing model is agnostic of the source of finance. The framework can be viewed as sequential, such that when natural capital investment is resourced, there are market drivers and enabling mechanisms that facilitate the flow of investment through to natural capital interventions such as peatland restoration, woodland creation and management, regenerative agriculture, and so on. When finance (private, public or blended) is mobilised to enable these natural capital interventions to take place, this generates economic impacts through labour, materials, research activities, energy, transport, further finance, and so on.

The framework captures current as well as new or potential natural capital markets. The framework highlights the role of policy in creating clear, transparent frameworks, as well as stakeholder engagement. Policies influencing and supporting financing can be at the national level, for example at the level of the Department of Environment, Food & Rural Affairs (DEFRA), Scottish Forestry, or Scottish Environment Protection Agency (SEPA); by contrast, policy and support related to economic impacts can include those implemented by Scottish Enterprise, or local authorities.

Crucial to the analytical framework for this project is the role of stakeholder consultations, from developing a typology of natural capital markets with corresponding time horizons for market development and maturity, through to assessing the economic impacts of natural capital interventions at the regional level.

Contact

Email: peter.phillips@gov.scot

There is a problem

Thanks for your feedback