Climate change monitoring report 2024

The fourth annual statutory monitoring report against the updated 2018 Climate Change Plan, as per the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019.

2. Chapter 1: Electricity

2.1 Part A - Overview of sector

The 2021 annual emissions envelope published in the Climate Change Plan update (CCPu) for this sector was for 1.6 MtCO2e, and the outturn emission statistics for 2021 (published in 2023) show a position of 1.6 MtCO2e. These figures therefore show that the sector was within its envelope in 2021.

The CCPu sets out the following three policy outcomes for this sector, the indicators for which are summarised below:

| The electricity system will be powered by a high penetration of renewables, aided by a range of flexible and responsive technologies. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Electricity grid intensity (CO2e per kilowatt hour) | Yes | - | - |

| Installed capacity of renewable generation (GW) | Yes | - | - |

| Renewable capacity at planning stages (GW: 3 categories) | Yes | - | - |

| Scotland’s energy supply is secure and flexible, with a system robust against fluctuations and interruptions to supply. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Loss of Load Expectation (hours per year) | Yes | - | - |

Scotland secures maximum economic benefit from the continued investment and growth in electricity generation capacity and support for the new and innovative technologies which will deliver our decarbonisation goals.

There are no existing indicators for this policy outcome. More information is provided in Part C.

Just transition and cross economy impacts

We wish to understand and report on the broader just transition and cross-economy impacts of our emissions-reduction activities in addition to these sector specific policy outcomes and indicators. To do this, in this report we use data from the Office of National Statistics (ONS): Low Carbon Renewable Energy Economy (LCREE) publication. The LCREE data presented in this report is based on survey data of businesses which perform economic activities that deliver goods and services that are likely to help generate lower emissions of greenhouse gases, for example low carbon electricity, low emission vehicles and low carbon services.

The LCREE indicator is narrowly defined and, while useful within its limited scope, does not give us the full picture of the impacts on workforce, employers and communities and progress towards a just transition. Over the next few years we will work to develop a more meaningful set of success outcomes and indicators aimed at tracking the impacts of our policies on a just transition to net zero.

Sector commentary on progress

Scotland has made significant progress decarbonising the electricity sector, and has maintained an electricity grid intensity of below 50 gCO2e/kWh for the years 2017-2021. The overall downward trend from a carbon intensity of 320 gCO2e/kWh in 2010, is chiefly the result of the closure of two coal fired power stations in 2013 and 2016, as well as reduced reliance on gas for power generation.

Scotland’s renewable electricity generation has grown rapidly over the last twenty years. In 2022, the equivalent of 113% of Scotland’s gross electricity consumption was generated from renewable sources, an increase of 26 percentage points compared to 2021.

Our climate change targets mean that we need to continue our progress and move from a low to a zero-carbon electricity system, with the potential for Negative Emission Technologies (NETs) to deliver negative emissions from electricity generation, for example through the use of bioenergy for electricity generation combined with carbon capture and storage (BECCS).

In further decarbonising our electricity system, we must address the remaining sources of emissions arising from Scottish electricity generation, while maintaining security of supply and a resilient electricity system. The focus of the CCP electricity emissions is on targeting and reducing these remaining sources of emissions. Our Fourth National Planning Framework (NPF4) signals a turning point for planning, placing climate and nature at the centre of our planning system and making clear our support for all forms of renewable, low-carbon and zero emissions technologies.

The Scottish Government have responsibility for determining applications for consent made under the UK Electricity Act 1989 and granting deemed planning permission for certain electricity generating stations and overhead electric lines.

Any development not meeting the criteria for consenting under the UK Electricity Act 1989, requires planning permission from the relevant Local Authority. The Town and Country Planning (Scotland) Act 1997 allows Scottish Ministers to ‘call-in’ applications for planning permission made to Local Authorities for their own determination. In practice, Scottish Ministers rarely exercise such powers and generally only use them where a development raises issues of national significance.

However, markets, policies and regulation affecting the electricity sector are largely reserved to the UK Government under the UK Electricity Act (1989). The UK Government holds authority on decisions regarding the generation, transmission (grid), and supply of electricity (retail market); coal ownership and exploitation; nuclear energy and safety; energy conservation (except schemes to promote energy efficiency); interconnectors (The Office of Gas and Electricity Markets (Ofgem) make decisions on investment and use of interconnection) and the electricity market.

This means that achieving our targets is dependent on the UK government taking the right decisions and actions and acting with urgency to do so. In particular, the Scottish Government is calling for a reform to the Contract for Difference mechanism and to transmission charging. Noting that the legislative and regulatory levers required to deliver carbon capture and storage (CCS) are reserved to the UK Government, in order reduce the use of unabated fossil fuels for electricity generation, we will continue to work with the UK Government on options for accelerated decarbonisation of unabated combined-cycle gas turbine (CCGT). We are asking the UK Government, as a matter of urgency, to begin working with us on consenting reforms to enable a more efficient determinations process in Scotland. To modernise and accelerate consenting of electricity infrastructure, we are also seeking further powers from the UK Government. We are working constructively with the UK Government on the development of CCUS in the UK and will continue to input into the Track-2 sequencing process to ensure it does not unfairly disadvantage Scotland and considers Scottish statutory emissions reduction targets.

Developments in monitoring arrangements since last report

N/A

2.2 Part B – Progress to policy outcome indicators

Policy Outcome: Cross-sectoral social and economic

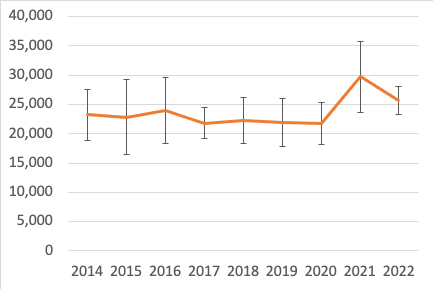

Indicator: Full-time equivalent (FTE) employment in Low Carbon Renewable Energy Economy Indicator

On-Track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 2022

Data Source(s): Low Carbon and Renewable Energy Estimates, Office of National Statistics

Assessment: Too Early to Say

Commentary:

- In 2022, the Scottish low carbon renewable energy economy (LCREE) sectors were estimated to provide 25,700 FTE jobs.

- The estimates of LCREE are based on a relatively small sample of businesses and hence are subject to a wide confidence interval.

- Scottish LCREE employment in 2022 is lower than in 2021 but the difference is not statistically significant and caution should be exercised when interpreting year on year changes due to a high degree of uncertainty in estimates.

Source: Office of National Statistics (ONS) Low Carbon and Renewable Energy Economy Estimates

Policy Outcome: 1

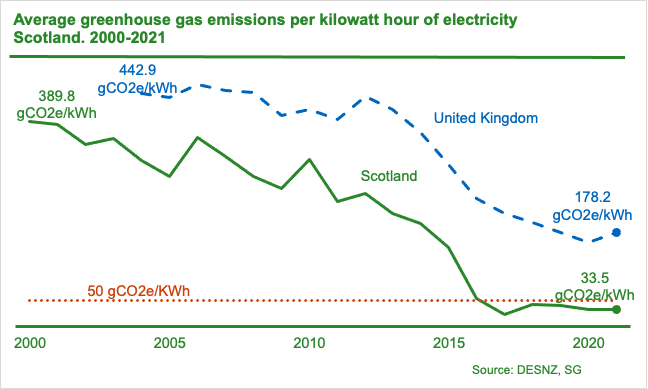

Indicator: Electricity grid intensity (CO2e per kilowatt hour)

On-Track Assessment (Milestones/Targets): Maintain below 50g CO2e per kilowatt hour

Most Recent Data: 2021

Data Source(s): Department for Energy Security & Net Zero (DESNZ) Energy Trends, Scottish Greenhouse Gas Statistics

Assessment: On Track

Commentary:

- Scottish grid emissions are calculated by taking emissions from the electricity sector divided by total electricity generated.

- Scotland has maintained an electricity grid intensity of below 50 gCO2e/kWh since 2017.

- 2021 saw grid emissions remain similar to 2020 levels at 33.5 gCO2e/kWh.

- The overall downward trend observed from a carbon intensity of 320 gCO2e/kWh in 2010, is chiefly a result of the closures of Cockenzie and Longannet coal fired power stations in 2013 and 2016 respectively, as well as a reduced reliance on gas for power generation.

- With the closure of Hunterston B Nuclear power station in 2022, Scotland now has just one nuclear power plant left at Torness that is due to close in 2028.

- Emissions from power generation are now concentrated in one large gas fired power plant at Peterhead and a handful of small sites across the country, primarily on the Islands.

- Our expectation is that with an increased penetration of renewables, and no planned expansion of unabated fossil fuel power generation, Scottish grid intensity will remain consistently below 50 gCO2e/kWh in the future.

Policy Outcome: 1

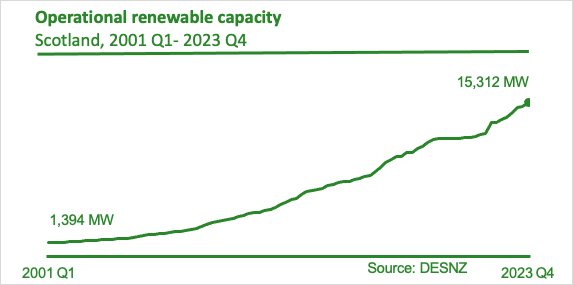

Indicator: Installed capacity of renewable generation (GW)

On-Track Assessment (Milestones/ Targets): Year-to-year change

Most Recent Data: 2023 Q3

Data Source(s): Department for Energy Security and Net Zero (DESNZ) Energy trends, DESNZ Renewable Energy Planning Database (REPD)

Assessment: On Track

Commentary:

- Scotland had 15 GW (15,312 MW) of installed renewable electricity generation capacity operational in 2023 Q4. This is an increase of 1.4 GW since 2022 Q4.

- The bulk of this capacity (9.5 GW) is onshore wind with the next largest capacity coming from offshore wind (3 GW).

- The capacity of other renewable technologies has also risen. Solar capacity has increased from 264 MW in 2015 to 600 MW in 2023 Q4.

- It is expected that renewables capacity will continue to increase in the 2020s and 2030s.

Policy Outcome: 1

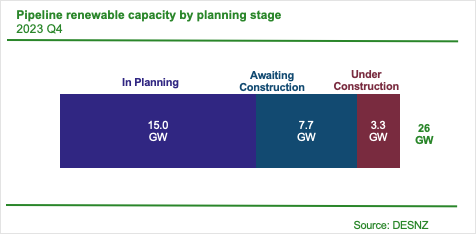

Indicator: Renewable capacity at planning stages (GW: 3 categories)

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 2023 Q4

Data Source(s): DESNZ Renewable Energy Planning Database (REPD)

Assessment: On Track

Commentary:

- As of December 2023, over 500 renewable electricity projects with a capacity of 26 GW are in the pipeline. 3.3 GW of these are under construction, most of which are wind farm projects. 7.7 GW are awaiting construction and 15.0 GW in planning.

- Pipeline estimates do not include all of the potential 28GW of offshore wind that the ScotWind leasing round, or Innovation and Targeted Oil and Gas (INTOG), could add. This is due to projects not yet being included in the REPD, which is used for calculating pipeline capacity, as these projects are still subject to planning and consenting decisions.

Policy Outcome: 1

Indicator: Loss of Load Expectation (hours per year)

On-track Assessment (Milestones/Targets): Maintain Great Britain (GB) standard below 3 hours per year

Most Recent Data: September 2023

Data Source(s): National Grid Winter Outlook

Assessment: On Track

Commentary:

- Loss of Load Expectation (LOLE) is a measure of security of supply of the GB electricity system. This is measured through the number of probability projected hours of a year in which demand could exceed supply, and which would require measures be taken by National Grid Electricity System Operator.

- Their modelling indicates that across the scenarios the GB grid should remain within the GB standard of 3 hours LOLE per year.

2.3 Part C - Information on implementation of individual policies

Outcome 1: The electricity system will be powered by a high penetration of renewables, aided by a range of flexible and responsive technologies

Policy: Support the development of a wide range of renewable technologies by addressing current and future challenges, including market and policy barriers.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu:

Onshore Wind: In December 2022, the Scottish Government published its onshore wind policy statement, setting an ambition of 20 GW of onshore wind by 2030. The Scottish Government continues to maintain its focus on tackling barriers to deployment, – such as aircraft and seismological radar issues – working in partnership with the industry and other stakeholders through our onshore wind strategic leadership group.

Through the onshore wind strategic leadership group an onshore wind sector deal was developed and agreed with industry, in 2023. The onshore wind sector deal is a joint commitment between industry and the Scottish Government to enable the delivery of the 20 GW ambition, whilst ensuring maximum benefits to the people of Scotland.

Offshore Wind: In January 2022, Crown Estate Scotland (CES) announced the winners of the ScotWind leasing round. The developer ambitions for ScotWind add up to around 28 GW of offshore wind across 20 projects.

The INTOG leasing round is a first of its kind, with 13 projects granted exclusivity agreements on 24 March 2023. The INTOG leasing round could also potentially add around 5.5 GW of capacity - up to 449 MW for innovation projects and 5 GW for targeted oil and gas decarbonisation.

INTOG presents significant opportunities to decarbonise oil and gas production in Scotland while, crucially, enabling the offshore wind sector to expand and test new technologies.

Our Offshore Wind Policy Statement (2020) set out the Scottish Government’s ambition for 8-11 GW of offshore wind in Scotland by 2030. This is currently being reviewed in light of the significant ambition demonstrated by industry via the ScotWind and INTOG leasing rounds.

In August 2023, the First Minister announced strategic commercial and grant investment of up to £500 million will be delivered over the next five years to stimulate and support private investment in the infrastructure and manufacturing facilities critical to the growth of our world-leading offshore wind sector.

It will provide market certainty, helping to create a highly productive, competitive economy, providing thousands of new jobs, embedding innovation and boosting skills. To do this we have worked with public sector partners to develop a framework which will achieve strategic alignment of public sector investment in offshore renewables supply chain and infrastructure development.

We are engaging with the Strategic Investment Model (SIM) to move from project-led to sector level investment that better supports growth in port and supply chain capacity and capability.

Our approach has already proven successful, as illustrated by Sumitomo Electric Industries’ decision to locate its first European high voltage cable factory at Nigg– creating hundreds of jobs and bringing an estimated £350 million inward investment to Scotland.

Solar: We are clear on the importance of solar in contributing to the decarbonisation of Scotland’s energy supply, and of the potential of solar to help deliver flexibility and resilience for the electricity system. In October 2023 we proposed a potential solar ambition of 4-6 GW by 2030 and we are continuing to engage with industry on this proposed ambition. The ambition would be largely in line with the calls from industry, is roughly 10% of the UK Government’s ambition of 70GW by 2035 and would support deployment of this important renewable energy source which would help increase the diversity of Scotland’s energy mix.

We are working with industry to agree on a voluntary level of community benefit that is reflective of the sector’s costs but maximises the benefits flowing to communities from the energy transition.

Support for deployment of solar continues to be provided through our Home Energy Scotland (HES) Grant and Loan scheme and the Community and Renewable Energy Scheme (CARES).

Hydro: Pumped Hydro Storage is a well-established technology with a long lifespan. National Planning Framework 4 (NPF4) recognises Pumped Hydro Storage as being of national importance that can support the transition to a net zero economy. The perceived barriers to further deployment are that it requires high upfront costs and long lead times, there is lack of revenue certainty and currently a lack of market signals. We have consistently urged the UK government to provide an appropriate market mechanism for hydro power, to ensure its potential is fully realised. Our support for the introduction of a cap and floor mechanism (similar to the funding mechanism for interconnectors) administered by Ofgem was set out in the Scottish Government’s consultation response to the UK Government’s consultation on Long Duration Electricity Storage (LDES).

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these:

Onshore wind: The Onshore Wind Sector Deal was signed with industry on the 21 September 2023. The sector deal has set target dates for the various commitments within it and the Onshore Wind Strategic Leadership Group meets quarterly to track the delivery of the commitments in the deal.

Solar: The Solar Vision for Scotland, which will be published in the forthcoming ESJTP, will set out the commitments that we have already taken and that we are still to deliver, to enable greater deployment of solar in Scotland. We are continuing to engage with the solar industry on the proposed ambition of 4-6GW of solar by 2030.

Hydro: On 9 January 2024, UK Government published a consultation setting out their intention to develop a cap and floor mechanism for long duration energy storage. The consultation closed on 5 March 2024. Whilst we welcome the proposals it is vital that the UK Government continues to engage with industry to ensure the finer details of this mechanism can maximise the generation and economic potential PHS.

Timeframe and expected next steps: The ESJTP is due to be published by summer 2024.

Timeframe and expected next steps:

- Onshore Wind – Deliver commitments set out in the onshore wind sector deal in line with agreed timeline.

- Offshore Wind – Deliver commitments set out in the offshore wind policy statement in line with agreed timeline

- Solar – Published a final Solar Vision in the forthcoming ESJTP.

- Hydro – Await outcome of the UK Government’s Long Duration Energy Storage LDES consultation.

Policy: Support improvements to electricity generation and network asset management, including network charging and access arrangements that encourage the deployment and viability of renewables projects in Scotland.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: We welcomed the UK Electricity Networks Commissioner’s report on how to accelerate the deployment of transmission infrastructure and we welcomed the UK Government’s response to it, which was published as part of its Transmission Acceleration Action Plan. The UK Government has established the Electricity Networks Delivery Forum, to oversee implementation of the Transmission Acceleration Action Plan (TAAP) and the joint UK Government and Ofgem Connections Action Plan (CAP). We are using this forum to continue to push for reform and ensure that the proposals are robust, fit for purpose and tailored to GB as a whole. We also continue to press for urgent reforms to the transmission charging arrangements through Ofgem’s strategic review of transmission charging and its transmission charging task force.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We will continue to work with UK Government, Electricity System Operator (and National Energy System Operator once established in summer 2024), Ofgem, network companies and wider stakeholders to implement the necessary reforms.

Policy: Publish a revised and updated Energy Strategy, reflecting our commitment to net zero and key decisions on the pathways to take us there.

Date announced: March 2020

Progress on implementation since time of last report / CCPu: Following intensive stakeholder engagement in 2022, the draft Energy Strategy and an Energy Just Transition Plan (ESJTP) was published for consultation on 10 January 2023, setting out over 150 actions to help deliver the transition to a net zero energy system, as well as consulting on a range of questions. The consultation closed on 9 May and received over 1,500 responses, which confirmed broad support for our net zero energy vision and level of ambition. On 28 September we published an independent consultation analysis.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: In September 2023, Gillian Martin, Energy Minister made a statement to Parliament confirming that a final ESJTP would be published by Summer 2024.

Policy: Develop and publish a Hydrogen Policy Statement by the end of 2020, followed by a Hydrogen Action Plan during 2021.

Date announced: 2020/21 PfG

Progress on implementation since time of last report / CCPu: The final Hydrogen Action Plan was published in December 2022.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: There are no specific indicators in the CCPu.

Timeframe and expected next steps: The actions set out within the Hydrogen Action Plan cover this Parliamentary term.

Policy: A new renewable, all energy consumption target of 50% by 2030, covering electricity, heat and transport.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu:

- Provisional figures for 2021 indicate that the equivalent of 23.7% of total Scottish energy consumption came from renewable sources. It decreased from 26.8% in 2020.

- Renewable energy generated decreased by over 3,500 GWh between 2020 and 2021.

- Renewable electricity contributes about four-fifths of all Scotland’s renewable energy, followed by renewable heat and biofuels in transport.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing.

Policy: Introduce a new framework of support for energy technology innovation, delivering a step change in emerging technologies funding to support the innovation and commercialisation of renewable energy generation, storage and supply.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Scottish Government established the Scottish Marine Energy Industry Working Group as a platform for sector collaboration, aiming to unify priorities and uphold Scotland's competitive edge. The group reconvened to generate papers outlining opportunities, barriers, and collective actions to bolster sector progress. Published in January 2023, these papers contain industry recommendations that influenced the formulation of a marine 'vision' for Scotland's future, as detailed in the draft ESJTP. This draft also presents inquiries regarding heightened ambition for marine energy and potential immediate actions for attainment.

The Scottish Government will continue to support the Wave Energy Scotland programme, as it drives further innovation and international collaboration, and prepares for the larger-scale demonstration of wave energy technology in Scotland.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The current consultation of the ESJTP provides an opportunity to engage further with the sector and to develop our strategic approach to marine energy.

Policy: Renewed focus on developing local energy projects and models, including through Community and Renewable Energy Scheme (CARES), supporting the achievement of 2 GW of renewable energy being in Local Community ownership by 2030.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: Local and community energy projects and models continue to be supported through the Scottish Government CARES Programme.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: An annual report on Community and Locally Owned Energy in Scotland monitors progress towards the Scottish Government’s ambition of 2 GW of community and locally owned energy by 2030. This report is produced by EST on behalf of the Scottish Government through the CARES contract. As of December 2022, an estimated 908 MW of community and locally owned renewable energy capacity was operational in Scotland. This represents 45% progress towards the 2030 target.

Timeframe and expected next steps: The CARES contract that began in 2021 and continues to run until 2025 has a focus on heat decarbonisation. The CARES ‘Off Electricity Grid Communities Fund’ closed in March 2024. Other support such as the Community Buildings Fund, and Community Heat Development Programme, were launched in 2022 and will run until the end of the contract, subject to funding availability. The Scottish Government commissioned ClimateXChange to undertake research into opportunities to progress community and local energy policy in Scotland. Their report was published in January 2024, and we will carefully consider its recommendations to inform our policy and ongoing support for community and local energy.

Policy: We will carry out detailed research, development and analysis during 2021 to improve our understanding of the potential to deliver negative emissions from the electricity sector.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Research has been undertaken to better understand the potential for negative emissions technologies in Scotland, including a published Feasibility Study. See NETs chapter for more detail.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing – see NETs chapter

Policy: We will continue to review our energy consenting processes, making further improvements and efficiencies where possible, and seeking to reduce determination timescales for complex electricity generation and network infrastructure applications.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Energy Consents Unit are always reviewing its current processes and engaging with planning authorities and statutory consultees with the aim of streamlining processes.

Scottish Power Energy Networks (SPEN) and Scottish Southern Electricity Networks (SSEN) have worked with Energy Consents Unit officials to consider the challenges around the consenting of major grid developments through a short life working group. This group produced a list of recommendations and actions to accelerate consenting timescales for grid networks. The Onshore Wind Sector Deal, signed in September 2023, envisages streamlined applications to the Energy Consents Unit for projects with 50+ MW capacity. Energy Consents Unit is undertaking further work on standardisation of consent conditions.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these:The Onshore Wind Sector Deal includes an aim to determine applications for new sites and for re-powering existing sites within 12 months (or 24 months, with a public inquiry). Applications to extend the operational life of existing facilities will be decided within 5 months and applications to amend existing consents within 9 months (absent a public inquiry).

The Short Life Working Group recommended a similar ambition to determine section 37 applications for National Development within 12 months.

Timeframe and expected next steps: The UK Government’s response to Nick Winser’s report made it clear that legislative changes to the consenting regime in Scotland are necessary to accelerate the determinations process. We are working closely together with the UK Government to agree a wide-ranging set of proposals for consultation, which can enable the milestones described above.

Policy: We will deliver the actions from our Offshore Wind Policy Statement, published in 2020. These actions, ranging from support for supply chain, planning, innovation and skills, will support the development of between 8 and 11 GW off offshore wind capacity by 2030.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The ScotWind leasing round results, announced in January 2022, revealed an ambitious total generating capacity around 28 GW. While the exact scale of future developments remains unclear pending planning and consenting processes, we are committed to seizing the opportunities offered by ScotWind and realising the goals set forth in our 2020 Offshore Wind Policy Statement. We recognise the need to align our ambitions with market trends and are utilising the draft ESJTP to inform any future recommendations.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing.

Policy: Accelerate our work with aviation, energy and other stakeholders to ensure that all radars are wind turbine tolerant/neutral during the coming decade

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The finalised Onshore Wind Policy statement was published in December 2022. The Onshore Wind Aviation Radar Delivery 2030 group (OnWARD 2030) has now been formed, led by RenewableUK, and formed at the request of the DESNZ led Aviation Management Board. The aim of this group is to create a more collaborative and strategic relationship between the aviation and renewables industries; delivering mutual benefit and allowing for strategic solutions to barriers for deployment.

The Scottish Government has ensured ongoing official representation on the Air Defence and Offshore Wind Programme Board, within the OWIC Aviation and Radar workstream. This sustained engagement aims to address both defence and civil radar concerns and coordinate efforts to mitigate impacts effectively. The onshore wind sector deal has a number of commitments under the technical theme relating to aviation. These are being progressed by OnWard 2030 and the Scottish Government.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: OnWARD 2030 meets regularly and feeds into the UK Government led Aviation Management Board. The Scottish Government is an active member of both of these groups. In addition the Onshore Wind Strategic Leadership Group is monitoring delivery of the Onshore Wind Sector Deal, which contains a number of aviation related commitments in the ‘Technical Barriers’ section or the deal.

Timeframe and expected next steps: Onshore wind – ongoing.

Policy: Review and publish an updated Electricity Generation Policy Statement ahead of the next CCP.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The draft ESJTP set out a strategic vision for the future of the electricity sector in Scotland and actions to deliver that, and the ESJTP will build on this.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The ESJTP will be published by summer 2024, and will provide further detail on the future of Scotland’s electricity sector.

Outcome 2: Scotland’s electricity supply is secure and flexible, with a system robust against fluctuations and interruptions to supply

Policy: Support the development of technologies which can deliver sustainable security of supply to the electricity sector in Scotland and ensure that Scottish generators and flexibility providers can access revenue streams to support investments.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Scottish Government provided £550,000 of match funding (through the Low Carbon Infrastructure Transition Programme) to support demonstration of wind energy providing services (including frequency response and black start) at the Dersalloch Wind Farm in Ayrshire, and we have engaged with ESO to apply lessons learned from Dersalloch. The Scottish Government welcomed the UK Government’s recently closed consultation on LDES, to which we provided a response.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Further work and analysis is needed to detail delivery of the proposed LDES mechanism, and we will continue to call on the UK Government and Ofgem to work with the Scottish Government and industry to ensure this policy works for all.

Policy: Press the UK Government for market mechanisms and incentives which recognise locational value, both for energy and for security of supply, and which do not create undue barriers for investment in Scotland.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Scottish Government have continued to engage with UK Government, Scottish industry and other key stakeholders on the Review of Electricity Market Arrangements (REMA) following our response to the first REMA consultation. We also commissioned an external study through ClimateXChange to investigate the potential impacts of locational marginal pricing (LMP) in Scotland. We also formed a short-life expert advisory panel made up of a range of industry experts to add rigour to this study. This study and our broader stakeholder engagement will be used to inform our final position in the ESJTP and our response to the second REMA consultation.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We expect the UK Government to publish their second REMA consultation this month (March 2024) and Scottish Government will provide a Ministerial response in due course. The Scottish Government will set out our position on wholesale market reform in the ESJTP.

Policy: Collaborate on actions to support investment in new pumped storage hydro capacity.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: In January 2024 the UK Government published its consultation on an appropriate support mechanism for long duration energy storage (LDES), including pumped hydro storage (PHS). Scottish Ministers provided a response on 5 March 2024, welcoming the use of a cap and floor mechanism, which we have long called for, while setting out specific concerns regarding the proposed approach to the mechanism.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We expect the UK Government to publish its LDES consultation response in a timely fashion following its closure on 5 March.

Policy: Work with all parties to secure maximum benefits from the move towards smarter and more flexible electricity systems and networks, as set out in the UK Smart Systems and Flexibility Plan (2017).

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: In 2022 the Scottish Government engaged with the Distribution Network Operators (DNOs) to support the development of the electricity distribution price control (Revenue = Incentives + Innovation + Outputs. ED2 stands for: Electricity Distribution 2. RIIO ED2) business plans. This led to a fair RIIO ED2 outcome for the DNOs and consumers which can support the network investment necessary to meet the Scottish Government’s decarbonisation goals. The Scottish Government established a forum to enable developers to directly communicate any concerns with the DNOs through a local electricity network engagement group. This will identify consider and address overlapping, and strategic issues and opportunities related to the decarbonisation of heat and transport. In 2022 research was taken forward to understand the impact of heat decarbonisation on the electricity networks.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing.

Policy: Encourage and support increased interconnection which can enhance Scottish system security while considering effects on domestic capacity and investment.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: Orkney ‘Needs Case’ was provisionally approved by Ofgem in March 2023. Western Isles ‘Needs Case’ – was approved. In May 2023 Ofgem provisionally approved SSEN Transmission's proposed Fort Augustus to Skye overhead line replacement.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Shetland HVDC is due to be connected this year. The Scottish Government is exploring how best to support existing work to establish new interconnectors between islands and the mainland (such as the Shetlands HVDC connection).

Policy: Launch a call in 2021 for evidence and views on technologies that can transform our electricity system, including energy storage, smart grid technologies, and technologies to deliver sustainable security of supply. This will help ensure that our funding and interventions support world leading activity in Scottish based companies.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Requirement for a call for evidence has been superseded by research commissioned into security of supply and the consultation process that is being undertaken as part of the draft ESJTP.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Our position on the role and support of storage and flexibility will be published in the final ESJTP, to be published by summer. The final security of supply report was published in December 2023.

Policy: Develop a series of whole system energy scenarios to guide infrastructure investment decisions for Scotland.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Energy Systems Catapult have produced a comprehensive set of Scotland-specific whole energy system scenarios providing options to reach the 2030 and 2045 energy system targets. These scenarios are not exclusive pathways to net zero, nor are they ‘preferred options’. They provide important insights to inform discussions on the trade-offs needed to meet statutory targets.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The final report was published in September 2022. Scottish whole energy system scenarios (climatexchange.org.uk)

Policy: Ensure that sustainable security of electricity supply is included as a priority within future Scottish Government energy innovation funding programmes.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Scottish Government provided £550,000 of match funding through the Low Carbon Infrastructure Transition Programme to support demonstration of wind energy providing services including frequency response and black start, at the Dersalloch wind farm in Ayrshire. This is the first example in the world of a commercial wind farm demonstration black start and it highlights opportunities to operate the electricity system in line with net zero ambitions.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: National Grid ESO is continuing to work with industry to apply lessons learned from Dersalloch.

Outcome 3: Scotland secures maximum economic benefit from the continued investment and growth in electricity generation capacity and support for the new and innovative technologies which will deliver our decarbonisation goals.

Policy: Press the UK Government to further reform and maintain the Contracts for Difference (CfD) mechanism in a manner which better captures the economic benefits and total value added for the Scottish and UK supply chains.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: In the fifth Cf Allocation Round 5 (AR5) in September, no contracts were awarded to offshore wind generators because of the strike price being set too low – despite prior warnings from industry. Consequently, Scottish Ministers urged the UK Government to listen and engage with industry and take urgent action to ensure that Round 6 of the Contracts for Difference properly reflects the fundamentally important role renewable energy has in the net zero objectives of not just Scotland, but the UK. It must so as part of a wholesale package of reform that delivers for our shared net zero and just transition ambition, for our communities, environment and economy. The Scottish Government continues to press the UK Government to maintain the CfD mechanism in a manner that captures economic benefits for Scottish and UK supply chains. This included responding to the UK Government consultation which proposed changes to various elements of the CfD regime in February 2023 , and further consultation on CfD Sustainable Industry Rewards in January 2024.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: UKG confirmed that annual auctions will take place. The process for Supply Chain Plans has been strengthened since consultation in 2021.

Timeframe and expected next steps: CfD Allocation Round 6 opened on 27 March 2024. The budget for the sixth CfD allocation round was confirmed by the UK Chancellor at Spring Budget, and amounts to over £1bn, including £800 million for offshore wind.

Policy: Introduce new requirements for developers to include supply chain commitments when applying to the ScotWind leasing process run by Crown Estate Scotland.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: As part of the ScotWind bidding round, applicants were required to submit a Supply Chain Development Statement (SCDS) to Crown Estate Scotland, outlining the supply chain activity they commit to undertaking within Scotland, the UK and overseas. We welcome the commitment of developers to invest an average projection of £1.5 bn in Scotland per project across the 20 ScotWind offshore wind projects.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing.

Contact

Email: climate.change@gov.scot

There is a problem

Thanks for your feedback