Climate change monitoring report 2024

The fourth annual statutory monitoring report against the updated 2018 Climate Change Plan, as per the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019.

3. Chapter 2: Buildings

3.1 Part A - Overview of sector

The 2021 annual emissions envelope published in the CCPu for this sector was for 7.6 MtCO2e, whereas the outturn emission statistics for 2021 (published in 2023) show a position of 9.0 MtCO2e. These figures show that the sector was outside its envelope in 2021.

The CCPu sets out the following three policy outcomes for this sector, the indicators for which are summarised below:

| The heat supply to our homes and non-domestic buildings is very substantially decarbonised, with high penetration rates of renewable and zero emissions heating | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Number of existing domestic properties using low and zero direct emissions heating (LZDEH) systems (1.1) | - | - | Yes |

| Services sector fossil fuel heat consumption (1.2) | - | - | Yes |

| % of non-electrical heat consumption met from renewable sources (1.3) | - | - | Yes |

| Our homes and buildings are highly energy efficient, with all buildings upgraded where it is appropriate to do so, and new buildings achieving ultra-high levels of fabric efficiency. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Energy intensity of residential buildings (kWh per household) (2.1) | - | Yes | - |

| Emissions intensity of non-domestic buildings (tCO2e per £ million Gross Value Added) (2.2) | Yes | - | |

| % of homes with an EPC[3] (EER,[4] or equivalent) of at least C (2.3) | - | Yes | - |

| % new homes built with a calculated space heating demand of not more than 20 kWh/m2/year (2.4) | Yes | - | - |

| The heat transition is fair, leaving no-one behind and stimulates employment opportunities as part of the green recovery. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of households in fuel poverty (3.1) | - | Yes | - |

Just transition and cross economy impacts

We wish to understand and report on the broader just transition and cross-economy impacts of our emissions-reduction activities in addition to these sector specific policy outcomes and indicators. To do this, in this report we use data from the Office of National Statistics (ONS): Low Carbon Renewable Energy Economy (LCREE) publication. The LCREE data presented in this report is based on survey data of businesses which perform economic activities that deliver goods and services that are likely to help generate lower emissions of greenhouse gases, for example low carbon electricity, low emission vehicles and low carbon services.

The LCREE indicator is narrowly defined and, while useful within its limited scope, does not give us the full picture of the impacts on workforce, employers and communities and progress towards a just transition. Over the next few years we will work to develop a more meaningful set of success outcomes and indicators aimed at tracking the impacts of our policies on a just transition to net zero.

Sector commentary on progress

The Scottish Government published the Heat in Buildings Strategy in October 2021, which set out our vision for decarbonising Scotland’s buildings by 2045. We remain committed to this vision and continue to lay the foundations which will support the growth of the clean heat and energy efficiency sectors in Scotland. This includes introducing the New Build Heat Standard in April, consulting on proposals for a Heat in Buildings Bill to decarbonise the existing building stock and a new Social Housing Net Zero Heat Standard for the social housing sector. We also continue to keep under review our delivery and support schemes as part of our commitment to ensuring a just transition to net zero.

The emissions reported in Part A of 9.0 MtCO2e for 2021 relate to the period when the Heat in Buildings Strategy was first published.

Part B reports on progress against the indicators for the buildings sector, as set out in Part A. We have marked indicator 2.4, percentage of new homes built with a calculated space heating demand of not more than 20 kWh/m²/yr, as “on track”, reflecting improvements of the standards for building fabric set by building regulations. Meanwhile, we have marked three indicators as “too early to say”: number of existing domestic properties using low and zero direct emissions heating, services sector fossil fuel heat consumption and percentage of non-electrical heat consumption met from renewable sources. This is due to these targets/indicators being reviewed, the outcome of which will depend on our response to the Heat in Buildings Bill consultation and the development of the next CCP. Three indicators are currently marked as “off track”: energy intensity of residential buildings, percentage of homes with an EPC, percentage of households in fuel poverty. We set out our reasons for marking these indicators as “off track” in Part B.

Part C shows that significant steps have been made towards progressing key commitments in the buildings sector as set out in the CCPu.

Developments in monitoring arrangements since last report

We said last year that the constraints of devolution coupled with the Scottish Government’s stated view that hydrogen will not play a central role in the overall decarbonisation of domestic heat meant that we were removing outcome 3 from our Buildings chapter. However, we continue to report against it in section C given the important and welcome progress being made with the H100 demonstrator.

In November 2023, we published a Heat in Buildings monitoring and evaluation framework to track progress against the strategy. We will report against this framework annually from October 2024, which will fulfil a requirement under the Climate Change (Scotland) Act 2009. We will continue to evolve the framework and look to align it with our Climate Change Plan Monitoring and reporting.

As set out in last year’s report, we are continuing to explore alternative and potentially more suitable approaches to using the Renewable Heat Target (RHT) to measure progress against our strategy. As such, we invited views on a more suitable metric as part of our recent consultation.

3.2 Part B - Progress to Policy Outcome Indicators

Policy Outcome: Cross-sectoral social and economic

Indicator: FTE employment in Low Carbon Renewable Energy Economy Indicator

On-Track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 2022

Data Source(s): Low Carbon and Renewable Energy Estimates, Office of National Statistics

Assessment: Too early to say

Commentary:

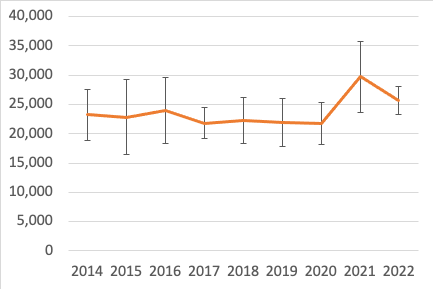

- In 2022, the Scottish low carbon renewable energy economy (LCREE) sectors were estimated to provide 25,700 FTE jobs.

- The estimates of LCREE are based on a relatively small sample of businesses and hence are subject to a wide confidence interval.

- Scottish LCREE employment in 2022 is lower than in 2021 but the difference is not statistically significant and caution should be exercised when interpreting year on year changes due to a high degree of uncertainty in estimates.

Source: Office of National Statistics (ONS) Low Carbon and Renewable Energy Economy Estimates

Policy Outcome: 1

Indicator: Number of existing domestic properties using low and zero direct emissions heating (LZDEH) systems.

On-track Assessment (Milestones/Targets): Under review

Most Recent Data: 323,000 domestic properties use low and zero direct emissions heating (LZDEH) systems as of 2022.

Data Source(s): SHCS 2022- Chapter 01 Key Attributes of the Scottish Housing Stock - tables and figures, Table KA7b. Comprises households for which their primary heating fuel is (a) Electricity, (b) Communal Heating, or (c) Biomass.

Assessment: Too early to say

Commentary: In 2022, there were 323,000 households using low and zero direct emissions heating (LZDEH) systems (and which this document will refer to from here as ‘clean heating systems’[5] for the sake of simplicity). These were households with either electricity, communal heating or biomass as their primary heating fuel.

The last year for which comparable data is available is 2019 (due to the COVID-19 pandemic, fieldwork for the 2020 SHCS was suspended and the methodology for the 2021 SHCS was also impacted).

In 2019, there were 312,000 domestic properties using LZDEH systems. The number of households using LZDEH systems was similar between 2019 and 2022.

The target for this indicator is under review and so progress towards the target is assessed as too early to say. In the Climate Change Plan update (CCPu) and subsequent Heat in Buildings Strategy, we highlighted that reducing carbon emissions in line with our very ambitious targets would require the equivalent of converting over one million homes to clean heating by 2030. While the Scottish Government remains committed to decarbonising all of Scotland’s buildings by 2045, we also recognise that we must do so in a way that is fair and feasible. The cost of living crisis and surge in energy prices meant that we have reassessed what would be fair and feasible to achieve over the short term.

We recently consulted on proposals for a Heat in Buildings Bill[6]. However, it has long been clear that much more than legislation in devolved matters is needed to achieve the progress required. That includes reforms to pricing of electricity, greater control over capital investment and levers over products and suppliers – all of which lie in UK Government hands – alongside other powers in Scotland including social housing standards, funding support and standards for new buildings. We have also taken account of dramatically increased cost pressures which have affected households and public funding.

The Scottish Government has made clear its plan to make meaningful, tangible progress towards our goals and in a way that is fair, affordable and feasible.

The outcome of the consultation will support the development of policies to include in the next Climate Change Plan (CCP) which we intend to publish in draft as soon as possible, ahead of March 2025. This Plan will cover the period 2025-2040, and will set out any updates to sector envelopes in line with our emissions reduction pathway out to 2040.

Policy Outcome: 1

Indicator: Commercial[7] sector fossil fuel heat consumption

On-track Assessment (Milestones/Targets): Under review

Most Recent Data: Commercial sector fossil fuel heat consumption was 11,172 GWh in 2021.

Data Source(s): Scottish Energy Statistics Hub (SESH) > Energy Efficiency > Heat Consumption > Data – Non-electrical heat demand by sector (GWh). Internal analysis was conducted to remove Bioenergy & Wastes from the figure of 12,940 GWh presented on SESH.

Assessment: Too early to say

Commentary: In 2021, commercial sector fossil fuel heat consumption was 11,172 GWh. This includes consumption of coal, manufactured fuels, petroleum products and gas. This is a 4% decrease compared to 2020, when commercial sector fossil fuel heat consumption was 11,684 GWh[8]. This reduction may reflect elevated energy prices in the latter half of 2021, as well as other factors such as improvements to energy efficiency, changes in economic activity and fuel switching.

The target for this indicator is under review and so progress towards the target is assessed as too early to say. As with indicator 1.1, the target will depend on the outcome of the Heat in Buildings Bill consultation and development of the next CCP. Over half of Scotland’s non-domestic buildings already use low or zero emissions sources and we remain committed to transitioning all other buildings to clean heating systems by 2045.

Policy Outcome: 1

Indicator: % of non-electrical heat consumption met from renewable sources

On-track Assessment (Milestones/Targets): Our consultation on proposals for a Heat in Buildings Bill also sought views on including powers requiring a new or amended renewable heat target. We are currently analysing the responses to the consultation. In the meantime, we will continue to report against this indicator.

Most Recent Data: May 2024 publication

Data Source(s): Renewable Heat Dataset from Energy Saving Trust

Assessment: Too early to say

Commentary: In order to comply with existing statutory requirements, our Heat in Buildings Strategy set out a provisional target (22%) for the proportion of non-electrical heat demand in buildings supplied by renewable sources (either directly, or via a heat network). The Renewable Heat Target (RHT), as currently defined, is an important factor in monitoring Scotland’s wider 2030 renewable ambitions. However, we believe that reporting against the Heat in Buildings Monitoring and Evaluation Framework which we published in November 2023 will provide a more useful and relevant means for tracking progress against the Heat in Buildings Strategy.

Our Heat in Buildings Strategy made clear that the scope of the RHT does not include industrial heat. However, we only provide the proportion of all non-electrical heat demand met by renewable sources below. This is because it is not possible to robustly estimate the amount of some fuels (including gas) used for industrial purposes and thus to separate these out. Neither is it always possible to determine whether renewable heat output is used for industrial purposes.

Accordingly, we are not presenting in this year’s report (as we did last year) an upper and lower estimate of the proportion of non-industrial, non-electrical heat demand met by renewables due to the change in method used to estimate non-electrical heat demand (please see the methodology section below for more details).

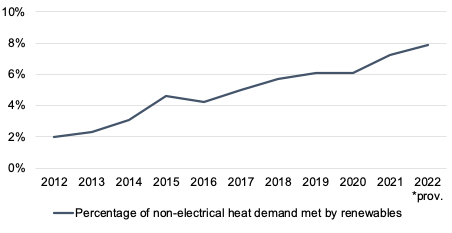

In 2022, the percentage of non-electrical heat demand met by renewable sources was estimated at 7.9%[9]. The non-electrical heat demand estimated for 2022 is provisional as sub-national consumption estimates for non-gas fuels will not be available until released by the Department for Energy Security and Net Zero (DESNZ) in September 2024.

Renewable heat output in 2022 was 4% higher than the previous year, while estimated demand was 5% lower. These estimates demonstrate a continued rise in renewable heat output over the longer term, increasing by 70% since 2016. Demand for non-electrical heat has fallen in recent years and is lower than any year in the time series, which goes back to 2005.

Figure 1 presents a time series of the percentage of non-electrical heat demand met by renewable sources from 2012 to 2022. The headline percentage reported for 2022 is dependent on overall non-electrical heat demand. This continues to underline the importance of improving the energy efficiency of Scotland’s buildings in contributing to progress against this metric.

* Non-electrical heat demand data for 2022 is provisional as it is based on 2022 gas consumption and 2021 consumption for all other non-gas fuels.

Renewable technologies:

There was moderate growth in overall renewable heat output in 2022, increasing 199 GWh to 5,620 GWh. Most of the increase (143 GWh) came from heat pump and biomass installations (increasing 73 GWh and 70 GWh respectively). Nearly all (70 GWh) of the 73 GWh growth from heat pumps in 2022 was from sites which were newly operational in 2022. The rest was from changes in operation at existing sites.

Although heat pumps provided the biggest contribution to the increase in 2022, they make up a relatively small share of total renewable heat output (644 GWh, 11%). This is because heat pumps are mostly installed in domestic settings where capacities are likely to be small and have lower running hours compared to other potential heat uses. Similar to previous years, heat pumps remain the technology with the most installations overall and the biggest increase in the number of installations.

Biomass was the second largest contributor to the increase in 2022 with output increasing by 70 GWh. However, the majority of the growth in biomass output was in the industrial sector, rather than in domestic or non-domestic sectors. This technology continues to make up the largest share of total output (3,737 GWh, 67%) and capacity (1,808 MW, 79%). This is likely due to biomass installations being typically larger and/or having higher running hours throughout the year.

Biomethane is the technology with the second largest share of total renewable heat output (920 GWh, 16%). Biomethane output increased by 52 GWh, with nearly all biomethane sites in operation in 2021 reporting an increase in output.

Future reporting:

The first report against the Heat in Buildings Monitoring and Evaluation Framework will be published in October 2024.

While we are considering alternative approaches to measure our progress on heat decarbonisation, and have recently consulted on this as part of proposals for a Heat in Buildings Bill, we will continue to report on renewable heat statistics against the provisional target as required by the Climate Change (Scotland) Act 2009.

Statistics on renewable heat in Scotland are compiled by Energy Saving Trust and will be updated, following publication, on the Energy Statistics Hub.

Methodology:

The method we used last year to estimate non-industrial, non-electrical heat demand relied on applying the end-use estimates for energy consumption across the UK (produced by DESNZ) to the consumption figures for Scotland. However, the end-use estimates are derived from the English Housing Survey and the Business Energy Efficiency Survey 2014-15. Also, the splits of energy use for petroleum in services and industrial settings were applied to petroleum in agriculture although this fuel is primarily used for agricultural vehicles.

Due to these issues, a revised method has been used to estimate non-electrical heat demand. This is based on the measured final energy consumption statistics published by DESNZ. Combustion fuels (petroleum, gas, coal, bioenergy and wastes, and manufactured fuels) always produce heat when they are consumed. The specific use of that heat for transport vehicles (petroleum for road transport and rail transport, petroleum for agriculture, coal for rail transport, bioenergy and wastes for transport) is separated out in the DESNZ statistics. All other combustion fuel consumption can be assumed to be used for heat; therefore non-electrical heat demand is defined as the final consumption of:

- Coal – industrial, commercial, domestic, public sector

- Manufactured fuels – industrial, domestic

- Petroleum – industrial, commercial, domestic, public sector

- Gas – domestic, industrial, commercial and other

- Bioenergy and wastes – domestic, industrial and commercial

The final energy consumption statistics for 2022 will be published by DESNZ in September 2024. To estimate the provisional non-electrical heat demand for 2022, the gas consumption figure for 2022 from the Regional and local authority gas consumption statistics has been used alongside the 2021 figures from the final energy consumption statistics for non-gas combustion fuels (as detailed above).

Policy Outcome: 2

Indicator: Energy intensity of residential buildings (kWh per household)

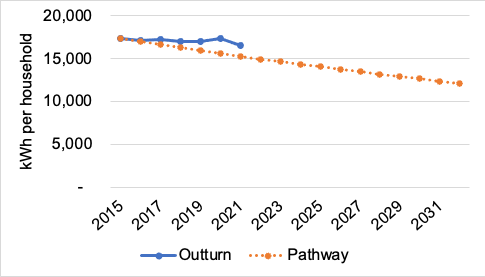

On-track Assessment (Milestones/Targets): To fall by at least 30% by 2032 (relative to 2015).

Most Recent Data: Residential energy intensity was 16,545 kWh per household in 2021

Data Source(s): Sub-national total final energy consumption data - GOV.UK (www.gov.uk)

Households and Dwellings in Scotland, 2021 | National Records of Scotland (nrscotland.gov.uk)

Assessment: Off-track

Commentary: In 2021, household energy intensity was 16,545 kWh per household. This is a reduction of 4.4% compared to 2015, and 4.3% compared to 2020. This reduction may reflect factors such as improvements to the energy efficiency of domestic properties, varying levels of home working due to changes to restrictions as a result of COVID-19, as well as the impact of increased energy prices in the latter half of 2021.

A simple pathway to meet the 2032 target is shown below. As the recorded energy intensity of households in 2021 is above the target of 15,254 kWh per household, by 1,290 kWh per household, progress is currently rated as off track. However, there was a narrowing in the gap in 2021 after a spike in household energy intensity in 2020, likely driven by a rise in home working.

Policy Outcome: 2

Indicator: Emissions intensity of non-domestic buildings (tCO2e per £ million Gross Value Added)

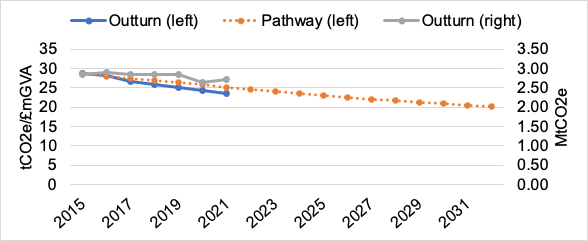

On-track Assessment (Milestones/Targets): To fall by at least 10% by 2020, 20% by 2025, and 30% by 2032 (relative to 2015)

Most Recent Data: 23.52 tCO2e/£mGVA in 2021

Data Source(s): Supporting documents - Scottish Greenhouse Gas Statistics 2021 - gov.scot (www.gov.scot)

Assessment: On-track

Commentary: The emissions intensity of the Services sector was 23.52 tCO2e/£mGVA in 2021, representing a decrease of 3% (0.70 tCO2e/£mGVA) compared to 2020[10]. This is because while Services emissions increased by 3% (from 2.64 MtCO2e to 2.73 MtCO2e), Services GVA increased at a greater rate, rising by 7% (from £108,855m to £116,014m). This represents a continuing downward trend in Services emissions intensity since 2015.

The 2018 CCP set an ambition in the Services sectors to reduce emissions intensity by 10% by 2020, 20% by 2025, and 30% by 2023, relative to a 2015 baseline of 28.7 tCO2e/£mGVA. In last year’s monitoring report we committed to reviewing this indicator. This review will take place alongside a fuller review of all indicators when the next Climate Change Plan (CCP) is published, to ensure they are fit for purpose under the new plan and to avoid making successive changes to the set of indicators.

A simple pathway to meet the 2020, 2025 and 2032 targets is shown below. As the recorded emissions intensity of the Services sector in 2021 is below the target of 25.2 tCO2e/£mGVA by 1.7 tCO2e/£mGVA, progress is currently considered to be on-track. To note, the figure also plots the outturn of Services emissions in MtCO2e on the right-hand side axis.

Policy Outcome: 2

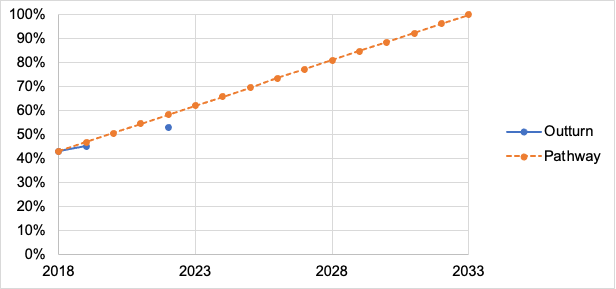

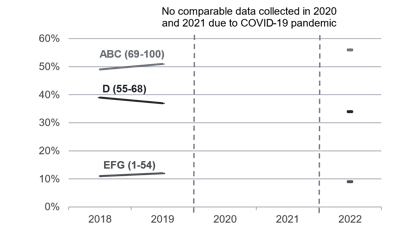

Indicator: % of homes with an Energy Performance Certificate (EPC) (EER, or equivalent) of at least C

On-track Assessment (Milestones/Targets): To reach 100% by 2033, subject to technical feasibility and cost-effectiveness

Most Recent Data: 52% of Scottish homes rated as EPC band C or better under Standard Energy Procedure (SAP) 2012 (RdSAP v 9.93) in 2022.

Data Source(s): Scottish House Condition Survey (SHCS) 2022.

Assessment: Off-track

Commentary: In 2022, 52% of Scottish homes were rated as EPC band C or better under SAP 2012 (RdSAP v9.93), compared to 45% in 2019. The proportion of properties in the lowest EPC bands (E, F or G) under SAP 2012 (RdSAP v9.93), was 12% in 2022, down from 15% in 2019.

A simple pathway to meet the 2033 target is shown below. Although there has been continued improvement in the energy efficiency of Scotland’s building stock, as the proportion of dwellings with an EPC rating of C or better is lower than the estimated, simple pathway approach, this indicator is assessed as being off-track. The recent Scottish Housing Condition Survey results highlight progress on energy efficiency, and our recent consultations (referred to above) have sought views on potential measures which would build on this progress.

Indicator: % new homes built with a calculated space-heating demand of not more than 20 kWh/m2/yr

On-track Assessment (Milestones/Targets): Positive year-to-year change

Most Recent Data: Analysis of new-build domestic Energy Performance Certificates (EPCs) lodged in 2023.

Data Source(s): EPC data for Q1 to Q4 2023 lodged with the Scottish Energy Performance Certificate Register (SEPCR)

Assessment: On-track

Commentary: Without applying any moderation to remove potentially erroneous values, 2,501 records reported a space-heating demand intensity of 20 kW/m2/year or less. This represents 12.3% of new-build domestic EPCs lodged for 2023. In both absolute and relative terms, this is an increase on previous years[11].

Distribution of space-heating demand intensity of new-build EPCs lodged in 2023 (kW/m2/year)

| Minimum | 1st Quartile | Median | 3rd Quartile | Maximum |

|---|---|---|---|---|

| 0.00 | 25.78 | 33.92 | 41.72 | 766.19 |

Removing the 0.5% of lodged records with the lowest space-heating demand intensity and the 0.5% with the highest space-heating demand intensity in effect removes all records with a space-heating demand intensity of less than approximately 3.1 kW/m2/year, and removes all records with a space-heating demand intensity of greater than approximately 105.8 kW/m2/year. This leaves 2,400 records (12%) with a space-heating demand intensity of 20 kW/m2/year or less. Last year we reported data for 2021, when this adjusted figure was 7.7%. Subsequent analysis for 2022 finds this figure to be similar, at 7.6%.

| Minimum | 1st Quartile | Median | 3rd Quartile | Maximum |

|---|---|---|---|---|

| 3.11 | 25.92 | 33.92 | 41.63 | 105.78 |

Whilst positive year-to-year change is occurring, further significant improvement in the indicator is likely linked to review and improvement to the minimum standards for building fabric set by building regulations.

Implementation of the February 2023 energy standard for new homes included improvement in the minimum levels of insulation for all new homes, improving element values by 13% to 23%. This will reduce space heating demand further and increase the percentage of new homes delivered that achieve or improve upon the indicator value.

As data to report on this indicator relies on information available on completed new homes, it is too soon to assess the impact of the changes made in February 2023.

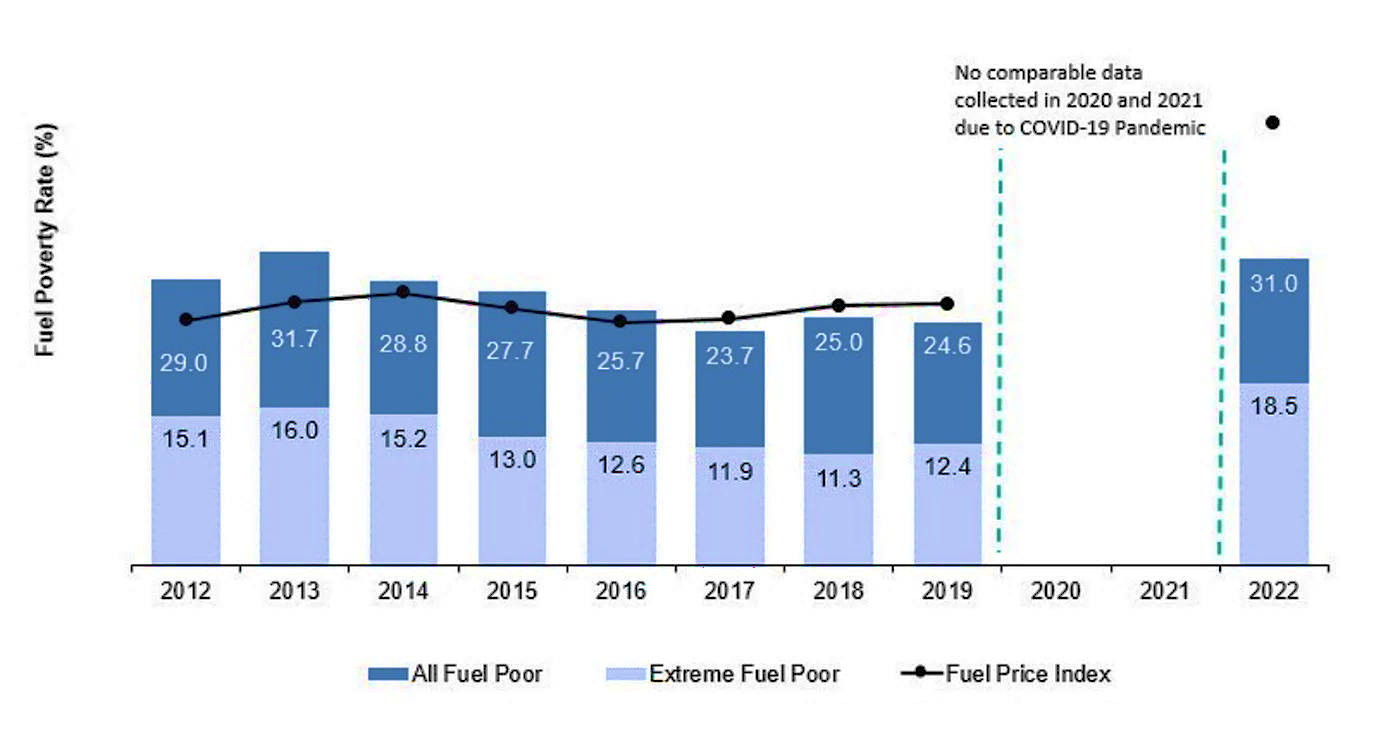

Policy Outcome: 3

Indicator: % of households in fuel poverty

On-track Assessment (Milestones/Targets): 2030: No more than 15%, 2035: No more than 10%, 2040: No more than 5%

Data Source(s): 2022 Scottish House Condition Survey Chapter 3[12][13]

Assessment: Off-track

Commentary: In 2022, 791,000 households (31% of all households) were estimated to be in fuel poverty, of which 472,000 (18.5% of all households) were in extreme fuel poverty. This is higher than the 2019 estimates of 24.6% (613,000 households) and 12.4% (311,000 households) respectively.

The increase in fuel prices has been the greatest driver of fuel poverty rates between 2019 and 2022. While the Scottish Government continues to help people make their homes warmer and easier to heat through our energy efficiency delivery programmes, and support those in fuel crisis, the powers to make a real difference remain with the UK Government. We have called repeatedly for the introduction of a social tariff to provide the right and fair support for some of the most vulnerable people in society.

3.3 Part C - Information on implementation of individual policies

Outcome 1: The heat supply to our homes and non-domestic buildings is very substantially decarbonised, with high penetration rates of renewable and zero emissions heating

Outcome 2: Our homes and buildings are highly energy efficient, with all buildings upgraded where it is appropriate to do so, and new buildings achieving ultra-high levels of fabric efficiency

Policy: Energy Company Obligation (ECO) requires obligated energy supply companies to deliver energy efficiency measures in homes. Historically these have mainly been insulation-based measures and gas boiler replacements.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Scottish Government formally proposed replacing ECO in Scotland in 2021 with a more flexible and simpler to administer scheme for energy suppliers. However the UK Government expressed their preference for continuing a GB-wide scheme and regulations establishing the ECO4 scheme were approved in 2022.

While Scotland’s overall share of measures has declined compared with previous ECO schemes, Scottish households have benefitted from a higher share of clean heat and microgeneration measures. The Scottish Government continues to work with local councils, energy suppliers and other local delivery partners to support take-up of ECO finance in Scotland.

With support from the Scottish Government, 31 out of 32 Scottish councils have published an ECO4 Statement of Intent to enable local ECO flex schemes to operate. As of December 2023, Scotland has benefitted from the second highest share of ECO4 Flex referrals across Britain (7,076 measures or 17% of the GB total). We estimate that these measures helped attract around £40 million in ECO finance over the last nine months of the ECO4 scheme. This has included a higher share of heat pump and renewable installations funded by energy suppliers, particularly in rural areas such as Dumfries and Galloway.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Scotland has the second highest number of flex measures installed of any UK region, with around 17% respectively of all the ECO4 flex measures in Great Britain.

Timeframe and expected next steps: Decisions about the design of the ECO scheme in Scotland require the approval of the UK Government and we continue to engage with them about this.

Policy: Energy Efficient Scotland Delivery Schemes:

- Area Based Schemes

- Warmer Homes Scotland.

- Home Energy Scotland Advice Service

- Home Energy Scotland Grant and Loan Scheme for zero emissions heating technologies and energy efficiency measures

- Business Energy Scotland

- Small and Medium Enterprises (SME) Loans and cashback scheme for zero emissions heating technologies and energy efficiency measures

- Social Housing Net Zero Heat Fund (SHNZF)

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Area Based Schemes - The programme continues to target fuel poor households living in ‘hard to treat’ properties requiring external wall or complex cavity wall insulation.

In 2022-2023, the Area Based Schemes (ABS) programme delivered improvements that benefitted around 6,800 fuel poor households and we anticipate that this provided around £68.3 million in lifetime savings. The reduction in emissions is likely to have been around 152 ktCO2e over their lifetime.

Warmer Homes Scotland - In October 2023, the successor to our Warmer Homes Scotland scheme was launched. The refreshed scheme continues our approach to supporting those at risk of fuel poverty through the net zero transition with a whole house approach and focus on clean heating allowing deep retrofit of individual homes.

Home Energy Scotland Advice Service - During 2022-2023, Home Energy Scotland (HES) supported over 138,000 unique households in Scotland with energy efficiency, clean heating and fuel poverty advice. Of these households, over 71,000 were vulnerable to fuel poverty.

Home Energy Scotland Grant and Loan Scheme for zero emissions heating technologies and energy efficiency measures - The Home Energy Scotland (HES) Grant and Loan Scheme, which was launched in December 2022, has continued to deliver funding to households for clean heating systems and energy efficiency measures. Funding was increased between 2023-2024 to increase output and measures delivered.

HES received over 6,000 applications since launching to the end of August 2023, with over 1,900 funding offers issued for heat pump installations in this period. This reflects a 22% increase in funding offers for heat pumps as compared to the previous year under the HES Loan and Cashback scheme.

Business Energy Scotland - Business Energy Scotland remains in high demand. We introduced measure specific fast track energy assessments in 2023-2024 to enable more businesses to quickly access advice and financial support.

SME Loan and Cashback scheme for zero emissions heating technologies and energy efficiency measures - The SME Loan and Cashback scheme continues to deliver funding to Scottish organisations for the implementation of energy efficiency and renewable heating technologies. In 2022-2023 over 300 projects were supported through the scheme.

Social Housing Net Zero Heat Fund (SHNZF) - The Social Housing Net Zero Heat Fund launched in August 2020 for social landlords to retrofit their existing housing stock. The fund supports both the deployment of clean heating and ”fabric first” enhancements, helping landlords deliver warmer and more energy efficient homes.

To date the fund has awarded £58 million to 64 social housing projects across Scotland.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Area Based Schemes and Warmer Homes Scotland - Since 2013, the programme has supported over 118,000 households (as of March 2023) to improve the warmth and energy efficiency of their home. Area Based Schemes (ABS) has been particularly effective in enabling improvements to mixed tenure blocks of flatted and terraced properties.

The Scottish Government has maintained our investment in ABS at £64 million as part of the 2024-2025 Budget. This is expected to help around 7,000 fuel poor households to benefit from warmer homes and reduced heating costs.

Since 2015, Warmer Homes Scotland has supported over 35,000 households.

Home Energy Scotland Advice Service - The Scottish Government will continue to fund the service in 2024-2025.

Home Energy Scotland Grant and Loan Scheme for zero emissions heating technologies and energy efficiency measures - Measures supported and funding amounts available through the Home Energy Scotland (HES) Grant and Loan are currently under review to ensure alignment with forthcoming regulations.

Business Energy Scotland - Since launching in 2022, Business Energy Scotland has provided energy assessment reports to over 2,000 Scottish businesses, identifying on average 24% cost savings per business.

SME Loan and Cashback scheme for zero emissions heating technologies and energy efficiency measures - since the scheme started, it has paid out almost £50 million in loan and cashback finance and supported over 2,000 projects.

Social Housing Net Zero Heat Fund (SHNZF) - N/A

Timeframe and expected next steps: N/A

Policy: Review support programmes: we will review existing Scottish Government funding schemes to ensure that they support the deployment of low and zero emissions heat. We will expand the provision of loans to the SME sector, and enhance the wider energy efficiency and heat advice service and provision of tailored start-to-end support.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: The new Warmer Homes Scotland scheme, launched on 2 October 2023, follows a whole house retrofit process and a clean heating first approach to maximise the number of households able to install clean heating were not detrimental to fuel poverty objectives.

As part of a refresh in 2023 to the Social Housing Net Zero Heat Fund, the intervention rate for the costs of clean heating systems was increased to 60% while energy efficiency measures will continue to be supported at 50%.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Procure a new national delivery scheme, to replace the existing

Warmer Homes Scotland contract, to open in 2022.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The successor scheme for Warmer Homes Scotland was successfully procured and the new contract commenced on 2 October 2023. As of 29 February 2024, 693 households have had completed installations through the second phase of Warmer Homes Scotland.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: From April 2024, we will review the scheme’s progress against its stated aims.

Policy: Energy Efficiency Standard for Social Housing: will be met by social landlords by 2020.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Scottish Housing Regulator (SHR), who has responsibility for monitoring social landlord’s performance with EESSH1, reports that 88% of social rented homes met the 2020 milestone at 31 March 2022.

EESSH was reviewed in 2018-19 with a view to setting a new milestone for 2032, known as EESSH2. The Scottish Government has recently consulted on proposals for a new Social Housing Net Zero Standard to align with net zero targets and replace EESSH2.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We are currently analysing responses to the consultation.

Policy: New Build Heat Standard (NBHS): requiring new buildings, applying for a building warrant from 2024 onwards, to use clean heating systems.

Date announced: 2020-2021 PfG + CCPu

Progress on implementation since time of last report / CCPu: Regulations have been passed and Building Standards Technical Handbooks detailing the provisions have been updated. The New Build Heat Standard means that no new buildings - constructed under a building warrant applied for from 1 April 2024 - will be built with polluting heating systems, like gas and oil boilers. Instead, these new buildings will be required to use clean heating systems which produce zero or negligible levels of greenhouse gas emissions at point of use.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: This policy came into force from 1 April 2024.

Policy: Review of energy standards within building regulations. The review investigates the potential for further, significant improvement on 2015 standards and how building standards can support other carbon and energy policy outcomes, including our decarbonisation of heat agenda.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The review commenced in 2020 and its outcomes were published in June 2022. We have published revised standards and guidance applicable to new construction from 1 February 2023, which set more challenging energy and emission targets for new development and enable early adoption/response to the components of the 2024 New Build Heat Standard.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these:

The revised standards and guidance from 1 February 2023 are expected to improve outcomes reported under indicator 2.4 – ‘% new homes built with a calculated space heating demand of not more than 20 kWh/m²/yr’ from 2024 onward.

Timeframe and expected next steps: There is a Ministerial commitment to Parliament on further review of standards to deliver ‘a Scottish equivalent to Passivhaus’, including laying of regulations in December 2024. This further review is underway and consultation on proposals is planned for summer 2024.

Policy: Heat in Buildings regulation: Put in place regulation to increase uptake of zero emissions heating systems and improve energy efficiency standards across owner occupied and private rented homes to come into force from 2025.

Date announced: Heat in Buildings Strategy

Progress on implementation since time of last report / CCPu: We consulted on proposals for a Heat in Buildings Bill from 28 November to 8 March. This consultation set out our proposals to prohibit the use of polluting heating systems in all privately owned and privately rented homes and non-domestic properties after 2045 and to introduce a minimum energy efficiency standard in privately owned and privately rented homes.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A.

Timeframe and expected next steps: We are currently analysing responses to the consultation.

Policy: Low Carbon Infrastructure Transition Programme (LCITP) - supports investment in decarbonisation of business and the public sector.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: The LCITP is now closed to applications but is supporting projects that are currently under construction that will deliver significant carbon savings including strategically important low carbon heat networks.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The LCITP formally drew to a close in April 2022.

Timeframe and expected next steps: N/A

Policy: Expanded £1.6 billion Heat in Buildings capital funding over the next parliament building on the Low Carbon Infrastructure Transition Programme (LCITP) and existing energy efficiency and zero emissions heat support programmes.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu:

To the end of 23/24 we have allocated around £1 billion.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Capital funding allocations will be subject to future budget decisions.

Policy: Non Domestic Public Sector Energy Efficiency (NDEE) Framework: a four year framework launched in March 2016, designed to support public and third sector organisations to procure Energy Efficiency retrofit work. The Framework will continue for a further four years commencing in 2020. NDEE Support Unit accelerates the number of projects and delivery timescales of public sector energy efficiency projects using the NDEE Framework and supports our wider ambitions around energy demand reduction.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The current framework contract will come to an end on 31 March 2024. We are currently in the process of procuring a new framework and project support unit.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Launch late 2024-2025.

Policy: The Renewable Heat Incentive (RHI) - a GB-wide scheme created by the UK Government (with the agreement of the Scottish Government). UK Government is extending both the domestic and non-domestic RHI out to 2022.

Date announced: August 2020

Progress on implementation since time of last report / CCPu: 1,133.3 MW of accredited capacity under the non-domestic RHI (NDRHI) between November 2011 and March 2023[14].

1,813 GWh of heat had been paid for between April 2014 and March 2023 under the domestic RHI scheme in Scotland[15].

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The domestic RHI closed from 31 March 2022. The non-domestic RHI closed to new applicants on 31 March 2021, but the UK Government extended the deadline for commissioning for eligible tariff guarantee or extension applications from 31 March 2022 to 31 March 2023.

Policy: UK Green Gas Support Scheme – a GB-wide Green Gas Scheme is planned to come into force in 2022, stimulating biomethane injection into the gas grid

Date announced: UK Government announcement.

Progress on implementation since time of last report / CCPu:

The UK Government’s Green Gas Support Scheme (GGSS) provides tariff-based support for plants producing biomethane via anaerobic digestion which is injected into the gas grid. The scheme is funded by the Green Gas Levy which is applied to all licenced fossil fuel gas suppliers. It follows the non-domestic RHI after it closed. The GGSS opened on 30 November 2021 and was originally open for applications until November 2025, but has now recently been extended to 31 March 2028 following UK Government consultation on a mid-scheme review.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: UK Clean Heat Grant - a GB-wide Clean Heat Grant is planned to come into force in 2022, supporting uptake of heat pumps (and limited biomass boilers) via upfront grants.

Date announced: UK Government announcement

Progress on implementation since time of last report / CCPu: The UK Government launched the Boiler Upgrade Scheme, (formally the Clean Heat Grant) in April 2022. The Boiler Upgrade Scheme (BUS) provides upfront capital grants to support the installation of heat pumps and biomass boilers in homes and non-domestic buildings in England and Wales. The scheme will run until 2025. The Scottish Government opted out of the Boiler Upgrade Scheme in favour of boosting our existing programmes.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Statistics for the scheme published monthly[16].

Timeframe and expected next steps: N/A

Policy: Support for Heat Networks: continue providing funding towards the capital costs of heat networks through Scotland’s Heat Network Fund and through low interest loans offered by the District Heating Loan Fund.

Date announced: Originally: CCP 2018, updated 2023

Progress on implementation since time of last report / CCPu: Scotland’s Heat Network Fund continues to be open to support the establishment and expansion of district and communal heating systems utilising clean heat sources. Together with the funding awarded under the Low Carbon Infrastructure Transition Programme, £19.4 million (as of March 2024) has been awarded to heat network projects since the CCP was published.

Following a review of our support for heat networks and the financial position of projects in development, the District Heating Loan Fund will close to new applications in 2024. This will help prioritise capital budgets for awarding grants through Scotland’s Heat Network Fund to help deliver strategically important heat networks with funding gaps.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps We expect demand for Scotland’s Heat Network Fund to increase due to the activity of the Heat Network Support Unit and growth of the heat network market.

Policy: Implement the provisions of the Heat Networks (Scotland) Act 2021 to create a strong regulatory framework to support delivery in 2024.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu:

We published a review of the Heat Network Delivery Plan in March 2024. This report will provide a further update on progress towards meeting the provisions of the Act and other supporting policies.

The Heat Networks (Supply Targets) (Scotland) Regulations 2023 came into force on 24 November 2023. This means the combined supply of thermal energy (heating and cooling) supplied by heat networks in Scotland must reach at least 7 TWh by 2035.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The Heat Networks (Heat Network Zone and Building Assessment Reports) (Scotland) Regulations have been introduced alongside guidance and proformas. These regulations have introduced duties on local authorities to identify areas particularly suitable for the development of heat networks and for those responsible for public sector buildings to provide data on their energy use and current heating systems.

Timeframe and expected next steps: Work continues on the development of the heat network licensing and consenting regime. Ofgem has been appointed as the Scottish licensing authority and we are working to introduce the new regulator regimes in alignment with the planned UK regulations by Spring 2025.

We will provide a further update on progress through a review of the Heat Network Delivery Plan by March 2026.

We will review the 2035 and, if appropriate, other heat network targets once more evidence is available. The 2021 Act allows Ministers to modify these targets, if appropriate.

Policy: Continue supporting the development of heat network projects in Scotland through the Heat Network Support Unit, which is a collaboration between organisations offering advice, guidance and funding to heat networks projects in the pre-capital stages of development.

Date announced: Maintained

Progress on implementation since time of last report / CCPu: The Scottish Government launched its Heat Network Support Unit (HNSU) in 2022 to support prospective heat network projects in the pre-capital development stages. It is a partnership between the Scottish Government, Zero Waste Scotland and Scottish Futures Trust and acts as the successor to the Heat Network Partnership.

Since September 2022, the HNSU has supported 28 projects across Scotland.

In September 2023, the Scottish Government in collaboration with the Danish Board of District Heating, the Danish Energy Agency and the Royal Danish Embassy in London launched a new 12-month District Heating Mentoring Programme for 2023-2024. This programme brings together senior members from Danish district heating companies with 19 Scottish local authorities to share knowledge and learning about district heating.

In November 2023, the HNSU launched its Strategic Heat Network Support for local authorities. This support includes both funding and advise to help local authorities build on their Local Heat and Energy Efficiency Strategies (LHEES) to develop their approach to establishing district heating networks in their areas.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The HNSU will continue to support projects in the financial year 2024-2025.

Policy: Net Zero Carbon Public Sector Buildings Standard will be introduced in 2021 and progressively rolled out across the public sector, as announced in the Programme for Government 2019.

Date announced: 2020-2021 PfG + CCPu

Progress on implementation since time of last report / CCPu: The original Standard Document Suite was launched in 2021 to address new buildings and major refurbishment. In August 2023, the scope of the Standard was extended to include the transition of existing buildings. As such, documents in this suite will be progressively re-released to reflect this update.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We intend to review the Standard every five years from 2025 to account for relevant developments.

Policy: Local Heat and Energy Efficiency Strategies (LHEES) will be in place by the end of 2023, setting out preferred heat solutions zones, guiding building owner decision making about replacement heating systems, and forming the basis for local delivery plans targeting heat and energy efficiency investment.

Date announced: 2020-2021 Programme for Government (PFG) + CCPu

Progress on implementation since time of last report / CCPu: The LHEES (Scotland) Order 2022 placed a duty on all local authorities to publish a Local Heat and Energy Efficiency Strategy and Delivery Plan by the end of 2023 and update them every five years. Thirteen of 32 local authorities have published their LHEES (as of May 2024). We continue to provide multi-year funding (until 2027/28) for local authorities to resource the development of their LHEES, as well as capacity building training and support from Zero Waste Scotland. We are closely engaged with the local authorities and are monitoring their progress.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The statutory deadline for publishing LHEES sits with the local authorities themselves.

Timeframe and expected next steps: We expect the majority of local authorities to have published final LHEES by the end of Summer 2024. We are working to align Scottish Government delivery programmes with the emerging LHEES Delivery Plans. For example, our Heat Network Support Unit is working with local authorities to take the indicative heat network zones identified through LHEES and develop them into projects through feasibility and business case support.

Policy: Assessment of Energy Performance and Emissions Regulations (Non-Domestic Buildings) - The Assessment of Energy Performance of Non-domestic Buildings (Scotland) Regulations 2016 require assessment of the energy performance and emissions of larger non-domestic buildings (those over 1,000 m²). A review programmed for 2021 will investigate and consult upon amended scope of standards and more challenging improvement targets to create a viable pathway for all existing non-domestic buildings to deliver the level of energy demand and emissions reductions needed.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: Our consultation on proposals for a Heat in Buildings Bill set out a proposed regulatory framework to decarbonise non-domestic buildings.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We are currently analysing the responses to our consultation.

Policy: Support for community low and zero emissions heat projects through CARES.

Date announced: CCPu

Progress on implementation since time of last report / CCPu:

CARES continues to provide advice and funding to assist community groups in developing renewable energy, heat decarbonisation and energy efficiency projects in Scotland. Heat decarbonisation is a key focus of the current CARES contract, with support available to eligible applicants.

The Scottish Government commissioned ClimateXChange to undertake research into opportunities to progress community and local energy policy in Scotland. Its report was published in January, and we will carefully consider the recommendations to inform our policy and ongoing support for community and local energy.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Strategic policy direction is provided to the contract delivery body through the Scottish Government’s contract manager to ensure CARES is aligned with Scottish Government objectives, with feedback on progress monitored through regular engagement and reporting commitments.

CARES has advised over 1,000 organisations and provided over £61 million in funding to communities throughout Scotland, supporting over 800 projects to install 58.6 MW of renewable energy.

Timeframe and expected next steps: The current CARES contract runs from April 2021 – March 2025. Learning is gathered from the projects supported and used to inform future support.

Policy: Salix financing facility to support investment in non-domestic buildings retrofit.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Scottish Government has worked in partnership with Salix Finance to develop and launch Scotland’s Public Sector Heat Decarbonisation Fund in 2023. This scheme provides grant funding to local authorities, universities and arm’s-length external organisations to decarbonise their buildings.

Salix Finance continues to deliver the Public Sector Energy Efficiency Loan Scheme on behalf of Scottish Government.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We have recently finished reviewing the first round of applications for projects that we expect to start in 2024-2025.

Policy: Work with social landlords to bring forward the review of the existing

Energy Efficiency Standard for Social Housing (EESSH2) with a view to strengthening and realigning the standard with net zero requirements.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Scottish Government has been working with a stakeholder review group, since September 2022, on a review of EESSH2. We have recently consulted on proposals for a new Social Housing Net Zero Standard.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The Scottish Government is currently analysing the responses to the consultation.

Policy: Work with our partners, including the UK Government, local authorities and utility providers to determine the best approach to heat decarbonisation for buildings currently heated by natural gas.

Date announced: CCPu

Progress on implementation since time of last report / CCPu: Work is underway to develop an understanding of the decarbonisation options for buildings currently using gas. Local authorities have published Local Heat and Energy Efficiency Strategies (LHEES) which set out the long-term plan for decarbonising heat in buildings and improving their energy efficiency across their local authority area. LHEES will identify strategic heat decarbonisation zones and set out the principal measures for reducing buildings emissions within each zone.

We also continue to call on the UK Government to accelerate decisions on the role of hydrogen and the future of the gas network, and to follow through on its commitment to publish proposals on rebalancing gas and electricity prices, which we believe will help to influence the cost of clean heating systems and their uptake.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: As of May 2024, 13 of 32 local authorities have published their LHEES

Timeframe and expected next steps: We expect the majority of local authorities to have published final LHEES by the end of Summer 2024.

Policy: Review the system of building assessments and reports on energy performance and heat to ensure a system that is fit for purpose in meeting net zero emissions objectives for heat in buildings.

Date announced: CCPu

Progress on implementation since time of last report / CCPu: In Summer 2023 we consulted on revised proposals for EPC reform, building on feedback from previous consultations. We are currently analysing the feedback to this consultation and will publish the government response alongside our response to the consultation on proposals for a Heat in Buildings Bill.

In January 2024, we started a review of the existing EPC Operational Framework to ensure that it is fit for purpose in meeting net zero emissions objectives for heat in buildings.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We are currently analysing consultation feedback.

Policy: Work with stakeholders to further understand and support the application and use of low and zero emissions heating within designated historic environment assets and traditional buildings.

Date announced: CCPu

Progress on implementation since time of last report / CCPu:

We published recommendations from the Tenements Short Life Working Group on options to decarbonise tenement buildings, to which we will issue a response in due course.

We also commissioned research from Energy Saving Trust (EST) into heat decarbonisation solutions for buildings which have multiple owners and mixed uses.

We have also commissioned research into clean heating options for challenging building types, which we expect to publish over the Summer.

We continue to work closely with Historic Environment Scotland and the historic environment sector more widely on policy development.

The Scottish Ministers will continue to press UK Government to remove/reduce VAT for retrofitting of traditional buildings to encourage energy efficient improvements in traditional homes

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Our consultation on proposals for a Heat in Buildings Bill set out how we intend to provide flexibility for certain types of properties, including historic and traditional buildings, and set out how we intend to provide this in future regulation.

Policy: Develop and introduce future regulation for non-domestic buildings and launch a consultation on these proposals.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

Our proposed regulatory approach for non-domestic buildings was included within the consultation on proposals for a Heat in Buildings Bill.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A.

Timeframe and expected next steps: The Scottish Government are currently analysing consultation feedback.

Policy: Undertake work to identify the capacity and output of renewable electricity generation required in Scotland to support the projected rollout of heat pumps.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: As part of research we have commissioned into the energy transition in Scotland, we have assessed potential ranges of energy demand and generation, including for electricity, out to 2045 under three future energy scenarios[17]. These scenarios have informed the roadmap included in the draft Energy Strategy and Just Transition Plan and further assessments are underway as part of the next CCP.

These scenarios suggest that if current renewables deployment ambitions are met, Scotland will continue to be a net exporter of electricity to the rest of Great Britain (GB), even after accounting for increased demand from electrification (including from heat pumps) across Scotland. This is further evidenced by National Grid ESO Future Energy Scenarios[18], which explores decarbonisation pathways for the GB energy system and also suggests that even under high electrification scenarios, Scotland will continue to be a net exporter of electricity due to the significant increases in renewable electricity generation capacity that are projected.

We will continue to update our assessments.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing

Policy: Consider whether to extend Permitted Development Rights (PDR) for zero-emission heat networks (HNs) and micro-renewable technologies.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: We are carrying out a multi-phase review of permitted development rights (PDR) in Scotland. Phase 3 of the review has focussed on new and extended PDR for domestic and non-domestic renewable energy equipment. The measures brought forward streamline the planning process for various low carbon technologies and alteration/replacement windows by removing the need to apply for planning permission to install them. Legislation was laid in the Parliament on 28 March 2024 and subject to Parliamentary scrutiny is due to come into force on 24 May 2024.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Work is in part dependent on progress with the wider legislative framework on heat networks.

Timeframe and expected next steps: We are continuing to explore delivery of improvements via (i) exemption from heat network consenting, and (ii) inclusion in the scope of PDR, if more appropriate. We will know more about our plans to take this forward following our consultation on consenting proposals, which is planned over Summer.

Policy: Undertake work to better understand the impact on electricity networks of projected heat pump deployment. Work with the Distribution Network Operators through the Heat Electrification Partnership to build an evidence base to inform business planning. Work with industry and networks to understand need for heat pumps systems to be smart enabled, and identify options to integrate smart systems into our delivery programmes; and to explore how innovation can help to improve the consumer experience.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Scottish Government established a Local Electricity Networks Coordination Group (LENCG) in 2023 which brings together the networks companies and the heat and transport sectors to help tackle challenges relating to the electricity network, with a particular focus on identifying barriers these sectors face in connecting to the grid. The LENCG aims to foster transparency among industry stakeholders and the networks companies through effective communication, data flows, and support for implementing solutions to barriers. It is also an important forum for identifying where further investment in the networks is required to meet current and future demand, and further enable the uptake of low carbon technologies such as heat pumps to help support wider Scottish Government policies and ambitions. We commissioned research published in October 2023 which looked into the network investment costs of the heat and transport transition in Scotland. It will form part of the evidence base for how we approach decarbonising our buildings in Scotland.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps:Through the LENCG, the Scottish Government will continue to work with the Distribution Network Operators and wider stakeholders in the heat sector to facilitate effective communication and continue to build the evidence base for current and future demand.

Policy: Support heat networks through: Introducing a Non-Domestic Rates Relief for renewable and low carbon heat networks until 2023-2024.

Date announced: CCPu

Progress on implementation since time of last report / CCPu: We carried out a review of rates relief for district heat networks during 2023.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: From April 2024, we will introduce a 90% rates relief for district heat networks, where at least 80% of the thermal energy generated by that network in any given year is derived from renewable generation.

Timeframe and expected next steps: A review of rates relief regulations for district heating networks will take place in 2027.

Policy: Through National Planning Framework 4 (NPF4), ensure that local development plans take account of where a Heat Network Zone has been identified.

Date announced: CCPu

Progress on implementation since time of last report / CCPu: As set out in last year’s report, NPF4 (adopted in February 2023) sets out that Local Development Plans (LDP) should take into account the area’s Local Heat & Energy Efficiency Strategy (LHEES). The spatial strategy should take into account areas of heat network potential and any designated Heat Network Zones.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Complete

Policy: Explore how local tax powers could be used to incentivise or encourage the retrofit of buildings, and commission further analysis to identify potential options.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: We will continue to explore options to incentivise buildings retrofit / transition to clean heat using local tax powers.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: We are considering policy options in the non-domestic buildings sector ahead of the next review of non-domestic business rates in 2026.

Policy: Design future delivery programmes to ensure significantly accelerated retrofit of buildings, with new programmes to be in place from 2025.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: In October 2023, the successor to our Warmer Homes Scotland scheme was launched. The refreshed scheme continues our approach to supporting those at risk of fuel poverty through the net zero transition with a whole house approach and focus on clean heating allowing deep retrofit of individual homes.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Our delivery programmes will continue to evolve to meet the scale of change required and align with any regulations we introduce.

Outcome 3: Our gas network supplies an increasing proportion of green gas (hydrogen and biomethane) and is made ready for a fully decarbonised gas future.

Policy: Hydrogen for heat demonstrator – providing £6.9m support for SGN’s H100 hydrogen for domestic heat demonstrator.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: SGN’s H100 project continues to make good progress towards their expected launch date of Summer 2025. Key contracts have been awarded, and customer sign-ups have reached over 300 households. Scottish Government representatives remain engaged with this work, attending monthly board meetings and inputting providing views on risk and policy where appropriate.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The H100 Fife hydrogen network is scheduled to go live in 2025.

Policy: Work with UK Government on product standards, with a view to making new gas boilers hydrogen-ready.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Product standards for boilers are a reserved matter but the Scottish Government continues to engage with the UK Government on this policy area, while calling for the phase-out of gas boilers to be expedited from the mid-2030s.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: 2026

Outcome 4: The heat transition is fair, leaving no-one behind and stimulates employment opportunities as part of the green recovery

Policy: Develop a long-term public engagement strategy and begin implementation of early actions.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

We published the Heat in Buildings Public Engagement Strategy (PES) in December 2023.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: In Chapter 5 of our strategy, we set out the indicators we will use to track Scottish public awareness and understanding of clean heating and public engagement in the heart transition.

Timeframe and expected next steps: The PES covers the period 2023 to 2026 and will be reviewed at the end of 2026. The next steps are to progress short term actions which include: launching the strategic partnership group, undertaking marketing campaigns and progressing work to improve the consumer journey.

Policy: Smart Meter installation: All homes and businesses will be offered a smart meter by 2020 under a UK Government initiative, providing the opportunity for a greater understanding of final energy consumption.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The smart meter programme is owned and led by the UK Government who have responsibility for the policy, regulatory and commercial framework. The UK Government introduced a four-year ‘Targets Framework’ on 1 January 2022, which sets energy suppliers annual smart meter installation targets.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The UK Government has set expectations for suppliers to achieve a minimum installation coverage in homes of 74% by the end of 2025. These targets are binding obligations set out in licence conditions and Ofgem is responsible for regulation and enforcement. There are now over 34.8 million smart and advanced meters in homes and small businesses across Great Britain. Latest statistics show over half (61%) of energy meters in Great Britain are now smart meters. Latest data (March 2023) show that 43% of domestic electricity meters in Scotland are smart meters[19].

Timeframe and expected next steps: The UK Government is currently in Year 3 of the four-year smart meter Targets Framework. Following the completion of this framework, work will continue towards making smart meters available for all consumers who wish to install them. The Smart Metering Implementation Programme is in the process of looking into the future of the smart metering framework, including maintaining smart meter functionality, ensuring 4G compatibility, and understanding the appropriate pace of new smart metering installations. The UK Government is also envisaging consulting on regulatory options for encouraging new installations in the near future.

Policy: Work with the Scottish Cities’ Alliance and the seven cities on the opportunities to accelerate activity on heat and energy efficiency.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Verity House Agreement was signed by the Scottish Government and Convention of Scottish Local Authorities (COSLA) on 30 June 2023, setting out a vision for a more collaborative approach to delivering shared priorities for the people of Scotland. Aligned with the Verity House Agreement, we have worked with the Scottish Cities Alliance and COSLA to develop a Climate Delivery Framework between national and local government to agree shared approaches to delivering action on climate change. The framework will enable better alignment between national and local targets and to jointly address the challenges and barriers to delivery. This includes the establishing of the Scottish Climate Intelligence Service (SCIS), which will help councils build capacity and capability for the development of area-wide programmes of emissions reduction. SCIS is being delivered by a partnership between Edinburgh Climate Change Institute and the Improvement Service.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Ongoing

Policy: Provide capital investment for Scottish colleges for equipment to deliver training for energy efficiency and heat.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Thanks to previous investment, infrastructure in Scottish Colleges broadly matches the current levels of training demand. However, training is not equally available across all geographic areas. The Scottish Government has therefore invested in a new mobile heat pump training centre which launched in August 2023 and is available to any college in Scotland to deliver on site heat pump training.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The Scottish Government will continue to work in partnership with the sector to ensure that appropriate support and training provision are aligned at a local level with business needs and future local demands.

Policy: Respond to the recommendations of the Expert Advisory Group on a heat pump sector deal for Scotland, by Q1 2022

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Scottish Government’s response was published on 11 November 2022.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Complete

Policy: Bring forward and support demonstrator projects, such as: hybrids and high temperature heat pumps; the use of hydrogen for space and water heating; projects to understand the impact of heat transition on existing energy networks.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: In November 2022 the Scottish Government launched the Green Heat Innovation Support Programme that makes available funding for Scottish based companies to develop ideas that support growth of the clean heat sector. This includes funding for feasibility studies as well as large-scale research & development and capital investment projects.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: As at February 2024 the programme has provided £912,000 in funding to support the research and development of innovation projects within the clean heat and energy efficiency sector.

Timeframe and expected next steps: Through the programme we will continue to identify opportunities that can support research and development in Scotland's heat transition.