Climate change monitoring report 2024

The fourth annual statutory monitoring report against the updated 2018 Climate Change Plan, as per the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019.

4. Chapter 3: Transport

4.1 Part A - Overview of sector

The 2021 annual emissions envelope published in the Climate Change Plan update (CCPu) for this sector was for 10.2 MtCO2e, whereas outturn emission statistics for this year (published in June 2023) show a position of 11.6 MtCO2e. On the basis of comparing these figures, the sector was outside its envelope in 2021.

The CCPu sets out the following eight policy outcomes for the sector, the indicators for which are summarised below:

| To address our overreliance on cars, we will reduce car kilometres by 20% by 2030 | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % reduction in car kilometres | - | Yes | - |

| We will phase out the need for new petrol and diesel cars and vans by 2030 | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of new car registrations that are Ultra Low Emission Vehicles (ULEV) | Yes | - | - |

| % of new van registrations that are ULEV | - | Yes | - |

| To reduce emissions in the freight sector, we will work with the industry to understand the most efficient methods and remove the need for new petrol and diesel heavy vehicles by 2035 | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of new heavy goods vehicle (HGV) registrations that are ULEV | - | - | Yes |

| We will work with the newly formed Bus Decarbonisation Taskforce, comprised of leaders from the bus, energy and finance sectors, to ensure that the majority of new buses purchased from 2024 are zero-emission, and to bring this date forward if possible. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of new bus registrations that are ULEV | - | - | Yes |

| We will work to decarbonise scheduled flights within Scotland by 2040. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % reduction in emissions from scheduled flights within Scotland | - | - | Yes |

| Proportion of ferries in Scottish Government ownership which are low emission has increased to 30% by 2032 | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of ferries that are low emissions | Yes | - | - |

There are no indicators for this policy outcome. More information is provided in Part C.

| Scotland’s passenger rail services will be decarbonised by 2035. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of single track kilometres electrified | - | Yes | - |

| % of train kilometres powered by alternative traction | - | Yes | - |

Just transition and cross economy impacts

We wish to understand and report on the broader just transition and cross-economy impacts of our emissions-reduction activities in addition to these sector specific policy outcomes and indicators. To do this, in this report we use data from the Office of National Statistics (ONS): Low Carbon Renewable Energy Economy (LCREE) publication. The LCREE data presented in this report is based on survey data of businesses which perform economic activities that deliver goods and services that are likely to help generate lower emissions of greenhouse gases, such as low carbon electricity, low emission vehicles and low carbon services.

The LCREE indicator is narrowly defined and, while useful within its limited scope, does not give us the full picture of the impacts on workforce, employers and communities and progress towards a just transition. Over the next few years we will work to develop a more meaningful set of success outcomes and indicators aimed at tracking the impacts of our policies on a just transition to net zero.

Sector commentary on progress

Transport emissions partially bounced back in 2021 as COVID-19 lockdowns and restrictions started to ease, resulting in the sector’s emissions falling outside its envelope (10.2 MtCO2e). This reinforces the magnitude of work still to be done to ensure transport emissions are consistently within its envelope.

Again the main source of transport emissions in 2021 was cars – accounting for over 40%. Following a draft route map, and the undertaking of a consultation, the Scottish Government will bring forward publication of the final route map for 20% car use reduction in car use in autumn 2024 to include a timeline for implementing demand management.

ULEV uptake is also crucial in driving down emissions from cars. ULEV cars represented 16.2% of all new car registrations made in Scotland in the 12 month period to September 2023, this is an increase on the year before which suggests progress is being made in meeting the overall target of phasing out new petrol and diesel cars by 2030. To date over £180 million funding through the Low Carbon Transport Loan has supported the switch to low carbon vehicles, and over £65 million has been invested in growing and developing the ChargePlace Scotland network. By 2023, there was over 2,600 charge points available in Scotland.

Scotland’s Zero Emission Truck Taskforce published its HGV Decarbonisation Pathway for Scotland in March 2024 following a series of meetings over the past 18 months. The group consisting of senior leaders across government, haulage, manufacturing, energy, union and finance sectors have identified 4 key challenges posed by the transition to zero emission trucks:

- Energy infrastructure

- Financial models

- Confidence in technological and commercial change

- Workforce skills

Key messages from the task force include working collaboratively, embracing proven and commercially viable technology, and enabling smaller fleet operators to collaborate in order to reduce risk and create opportunities. The taskforce also published milestones, with the aim that all new HGVs sold in the UK must be zero emission by 2040.

There will be investment of over £370 million in 2024-25 to support concessionary bus travel for children, young people aged under 22, disabled people and everyone aged 60 and over. Overall, investment to-date means more than 2 million people in Scotland can now travel for free on buses. Since the introduction of the Young Person’s Free Bus Travel Scheme in January 2022, over 116 million journeys have been made by young people across Scotland.

The 2023 Programme for Government included an amendment to the 2021 Bute House Agreement which committed to an Active Travel budget of £320 million by 2024-25. We have now put in place a more sustained and stable growth plan for Active Travel with a record amount of £220 million proposed in the draft budget for 2024-25, building on the investment already made in recent years. The Active Travel Transformation Project was established to ensure that our increasing investment in Active Travel results in transformative change – one which delivers infrastructure quickly and efficiently to a high standard and in a planned and cohesive fashion, enabling people to make walking, wheeling and cycling their primary mode of transport for short, everyday journeys.

Rail continues to improve and performs very well compared with other mode types with average emissions of 35.5 gCO2e per passenger kilometre in 2022 (UK data).

The figures for rail cover both diesel and electric trains. Other than coach travel, rail remains the most carbon- efficient means of transport in 2022, generating circa 80% less carbon per passenger kilometre than private cars.

Additionally, each tonne of freight moved by rail generates circa 75% less carbon emissions than heavy goods vehicles.

Developments in monitoring arrangements since last report

N/A

4.2 Part B - Progress to Policy Outcome Indicators

Policy Outcome: Cross-sectoral social and economic

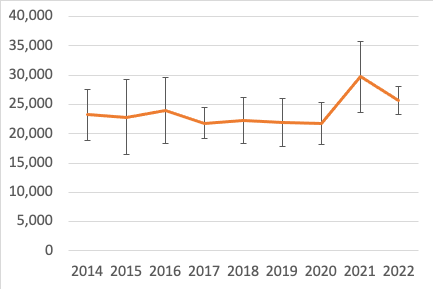

Indicator: Full Time Equivalent (FTE) employment in Low Carbon Renewable Energy Economy Indicator

On-Track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 2022

Data Source(s): Low Carbon and Renewable Energy Estimates, Office of National Statistics (ONS)

Assessment: Too early to say

Commentary:

- In 2022, the Scottish low carbon renewable energy economy (LCREE) sectors were estimated to provide 25,700 FTE jobs.

- The estimates of LCREE are based on a relatively small sample of businesses and hence are subject to a wide confidence interval.

- Scottish LCREE employment in 2022 is lower than in 2021 but the difference is not statistically significant and caution should be exercised when interpreting year on year changes due to a high degree of uncertainty in estimates.

Source: Office of National Statistics (ONS) Low Carbon and Renewable Energy Economy Estimates

Policy Outcome: 1

Indicator: % reduction in car kilometres

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: -6.3% (2019-2022)

Data Source(s): Scottish Transport Statistics 2023

Assessment: Off track

Commentary: Following significant pandemic-related car traffic reductions in 2020, the latest figures show that car use continued to rebound with car kilometres increasing by 10.7% between 2021 and 2022. Nevertheless the 6.3% reduction against the 2019 baseline reflects ongoing changes to travel patterns, including increased use of digital connectivity which enables people to work and connect with others remotely.

There remains uncertainty regarding travel patterns in the longer term, but it is expected car traffic will continue to rise in subsequent years before interventions to deliver reductions in car traffic start to make an impact.

Sustained reductions in car use could occur towards the end of 2020s, if large-scale urban demand management measures are designed and implemented in the intervening period.

We also have in place our early route map interventions, including free bus travel for the under-22s and Low Emission Zones. These will be supported by further enhancements to transport, place based interventions, and digital connectivity.

Policy Outcome: 2

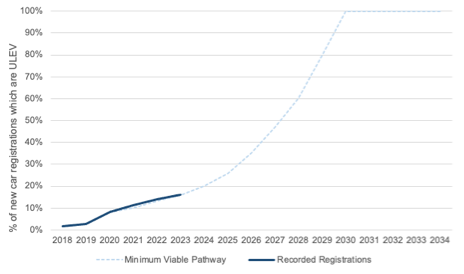

Indicator: % of new car registrations that are Ultra Low Emissions Vehicles (ULEV)

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 16.2% (Year to Q3 2023)

Data Source(s): Department for Transport (DfT) and Driver and Vehicle Licencing Agency (DVLA)

Assessment: On track

Commentary: ULEVs accounted for 16.2% of new car registrations in the 12 months to September 2023, up from 14.0% in the previous 12-month period.

More than 25,000 new ULEV car registrations made in Scotland over the 12 months to September 2023 was a new record high. Compared to the previous year, that is an increase of 33% and means that the number of new ULEV car registrations in Scotland has increased annually since records began in 2010.

As of Q3 2023, the rate of ULEV car registrations was slightly above the minimum viable pathway (the minimum rate of ULEV car registrations considered to be required to remain on-track for achieving this policy outcome). Therefore, this policy outcome is deemed to be on-track. This pathway may be reviewed and amended in future years.

Policy Outcome: 2

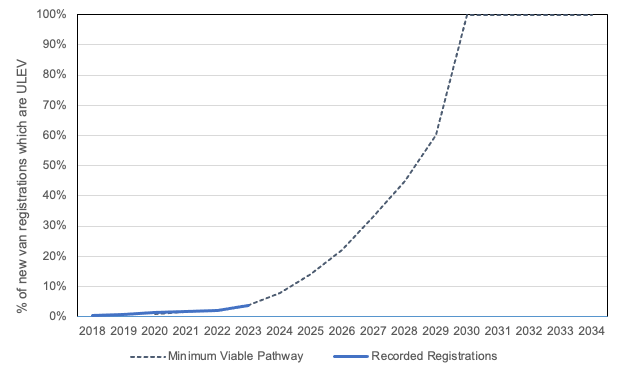

Indicator: % of new van registrations that are ULEV

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 3.8% (Year to Q3 2023)

Data Source(s): Department for Transport (DfT) and Driver and Vehicle Licensing Agency (DVLA)

Assessment: Off track

Commentary: ULEV van registrations was 3.8% of all new van registrations in the 12 months to September 2023, up from 2.1% in the previous 12-month period.

Despite accounting for a small proportion of all new van registrations, ULEV van registrations rose by around 72% compared with the previous 12-month period. Overall, this was in the region of 850 new ULEV vans.

ULEV van registration fell slightly below the minimum viable pathway in 2023 (4.0%), meaning that progress towards this policy outcome should be marked as off-track. This pathway may be reviewed and amended in future years.

Policy Outcome: 3

Indicator: % of new HGV registrations that are ULEV

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 0.7%

Data Source(s): Department for Transport (DfT) and Driver and Vehicle Licensing Agency (DVLA)

Assessment: Too early to say.

Commentary: There was only 27 ULEV HGV registrations made in the 12 months to September 2023. Technological and energy infrastructure development for HGVs is still in its infancy with long distance vehicles not yet commercially available, hence the minimal progress made to date (less than 1% of all new HGV registrations each year have been ULEV).

However, Scotland’s Zero Emission Truck Taskforce published its HGV Decarbonisation Pathway for Scotland in March 2024, setting out actions for the public and private sector to increase the rate of transition to zero emission HGVs.

Policy Outcome: 4

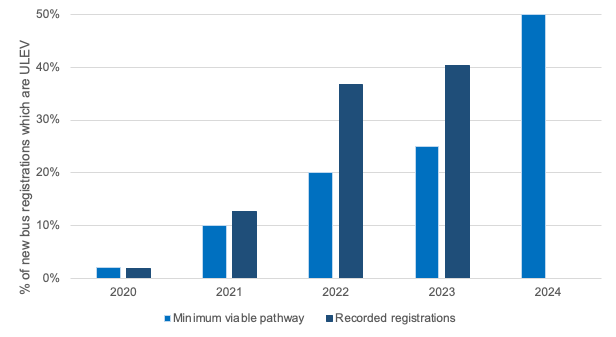

Indicator: % of new bus registrations that are ULEV

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 40.4% (Year to Q3 2023)

Data Source(s): Department for Transport (DfT) and Driver and Vehicle Licensing Agency (DVLA)

Assessment: On track

Commentary: ULEVs accounted for more than 40% of new bus registrations in the 12 months to September 2023, up from 37% in the previous 12-month period. Since the last update there was a total of 281 new ULEV buses registered, an increase of 45%.

Currently the rate of new ULEV buses is comfortably above the minimum viable pathway (25% in 2023) - the minimum rate of new ULEV buses required each year in order to remain on track for achieving this policy outcome. Therefore, progress towards this policy outcome is considered to be on track.

Through the Scottish Ultra Low Emission Bus Scheme (SULEBS) and the Scottish Zero Emission Bus Challenge Fund (ScotZEB), almost £113 million has been awarded from the Scottish Government to bus operators in Scotland to support the acquisition of 548 new zero-emission buses and their supporting infrastructure.

Policy Outcome: 5

Indicator: % reduction in emissions from scheduled flights within Scotland

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: +4% (2022-2023)

Data Source(s): Loganair

Assessment: Too early to say

Commentary:Emissions from Loganair’s scheduled flights within Scotland increased by 4% over the year to 2023 while the number of scheduled flights fell by 4% over the same period. Data provided by Loganair does not provide conclusive explanations for these trends.

Connectivity with the Highlands and Islands is vital for many reasons, for example, helping to reduce inequalities, deliver inclusive economic growth and enable access to lifeline services such as healthcare. It is equally important that emissions from flying be reduced, which will require new or upgraded aircraft (such as hydrogen, electric or hybrid) and significantly increased use of Sustainable Aviation Fuels (SAF).

Loganair operates the vast majority of flights across the Highlands and Islands and it is therefore welcome that it recently signed a Memorandum of Understanding with Cranfield Aerospace Solutions that aims to have the first operational hydrogen-electric aircraft flying in Kirkwall by 2027. According to reports, this could become the world’s first commercial zero emission air service. Loganair’s goal remains for its entire fleet to comprise zero-emission aircraft by 2040.

The Scottish Government’s Aviation Statement is expected to be published shortly after this Monitoring Report. It will build on a public consultation that highlighted strong support for decarbonising aviation through the development of low and zero emission aircraft and investing in SAF. As aviation is reserved, the Statement will also take into account the UK Government’s ‘Jet Zero strategy’ for decarbonisation, which applies throughout the UK and therefore influences the policy choices the Scottish Government can make. The Scottish Government will continue to be in dialogue with the UK Government so that Scotland can fully benefit from Jet Zero, including by helping us to achieve our target of domestic flights emission being Net Zero by 2040.

Policy Outcome: 6

Indicator: % of Government owned ferries that are low emissions

On-track Assessment (Milestones/Targets): Progress to target [30% by 2032]

Most Recent Data: 8% of the current Scottish Government Fleet consists of low emission vessels.

Data Source(s): Caledonian Maritime Assets Ltd (CMAL) & Transport Scotland

Assessment: On track

Commentary: A final draft version of the Vessels and Ports plan was published for consultation in January 2024, as a first part of the Islands Connectivity Plan. This set out proposals for fleet modernisation and port upgrades to 2045 and includes a section on emissions and environmental impact.

The Small Vessel Replacement Programme, which is approaching business case decision, will increase the number of low emission vessels within the Scottish Government's ferry fleet. Delays to the business case process have altered the trajectory slightly from that suggested last year, but should not affect the achievability of the target. The programme will deliver vessels that utilise the latest proven battery and on shore charging technologies.

The indicative share of low emission ferries in each year is set out below. This trajectory has been updated to align with current programme timelines, but as plans and programmes are in place to deliver a sufficient number of low emissions vessels by 2032, progress towards the target is currently considered to be on-track.

Expected share of vessels in Scottish Government fleet that are low/zero emission:

2018 - 8%

2019 - 8%

2020 - 8%

2021 - 8%

2022 - 8%

2023 - 8%

2024 - 8%

2025 - 7%

2026 - 7%

2027 - 14%

2028 - 21%

2029 - 24%

2030 - 24%

2031 - 24%

2032 - 30%

Policy Outcome: 8

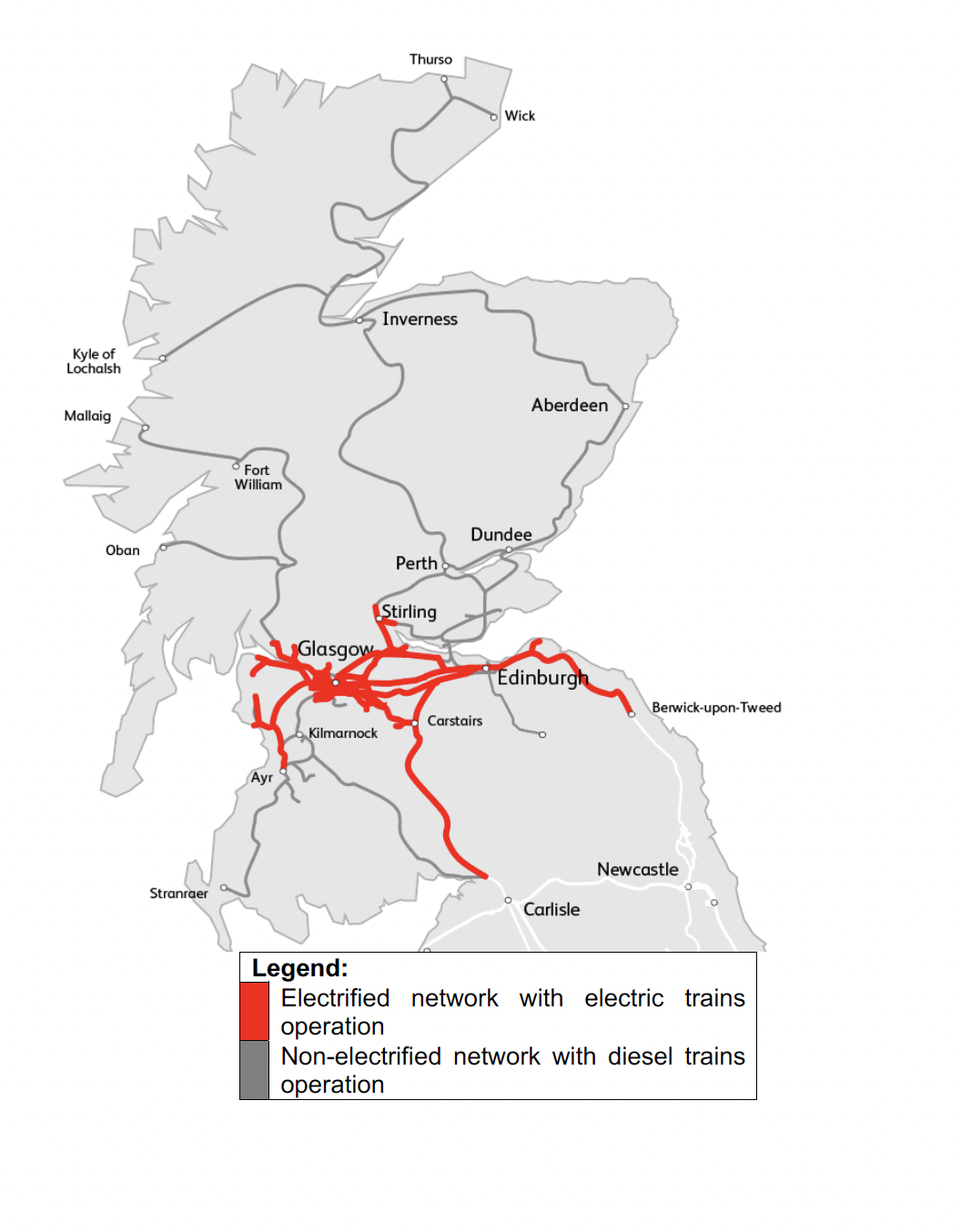

Indicator: % of single track kilometres electrified

On-track Assessment (Milestones/Targets): Progress to target [70% by 2034]

Most Recent Data: In December 2023 27 single track kilometres of electrification was commissioned as part of the Barrhead Electrification project. This increased the length of electrified route from 885[20] single track kilometres to 912 single track kilometres. The total route length in Scotland is 2,695[21] single track kilometres. Electric train operations already make up 76% of passenger journeys and 58% of passenger vehicle miles in Scotland.

Data Source(s): Office of Rail and Road

Assessment: Off track

Commentary: Scotland has already proved successful in delivering electrification projects efficiently. However, significant upfront capital investment is required to electrify the network. The major infrastructure cost components of electrification are:

- Clearance of structures and route.

- Installation of Overhead line electrification.

- Power feeding and substations.

- Development, design and project management.

These can limit the routes on which electrification can be cost effective and provide value for money. The economic case for electrification is best on lines which are more intensively used. This is because capital costs for electrification are driven by the extent of electrification whilst benefits are driven by the utilisation of this infrastructure.

Significant delivery challenges exist in respect of available budget given that the capital cost of the rail decarbonisation (including electrification) programme is forecast to exceed available budgets.

Policy Outcome: 8

Indicator: % of train kilometres powered by alternative traction

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: While untested on the Scottish network, battery trains are increasingly being operated internationally. Scotland is uniquely positioned to become a leading nation in the production of reliable, competitive, sustainable hydrogen owing to the combination of its natural resources, infrastructure and skilled energy workforce. The Hydrogen Policy Statement[22] published in 2020 confirmed that both renewable and low-carbon hydrogen will play an increasingly important role in Scotland’s energy transition to net zero.

Data Source(s): Transport Scotland, The Hydrogen Action Plan

Assessment: Off track

Commentary: The Hydrogen Action Plan[23] provides an overview of some of the sectors where hydrogen might be more or less likely adopted as a route to decarbonisation based on current alternatives and available opportunities. Subject to price and availability, hydrogen in the transport sector could act as a complementary energy source alongside electrification, providing an option for heavy duty vehicles and parts of the rail network, where full electrification is challenging.

The use of battery-electric trains with discontinuous electrification as the end-state for routes where freight does not operate is an option for decarbonisation. This approach offers the opportunity to decarbonise the railway at a lower capital cost than with full electrification. Depending on the extent of electrification required to operate these hybrid trains, for some routes where freight is a factor, this provides an interim or transitional solution which would allow early benefits realisation and optimisation of value for money by significantly reducing capital costs to the taxpayer.

Testing to date has shown that Hydrogen trains only deliver 34% of the efficiency of electric trains (though this is an improvement over diesel). It is expected that technology advancements will be made in the coming years to improve the efficiency of hydrogen fuel cells but it remains a considerable way behind electrification.

4.3 Part C - Information on implementation of individual policies

Outcome 1: To address our overreliance on cars, we will reduce car kilometres by 20% by 2030

Policy: If the health pandemic has moved to a phase to allow more certainty on future transport trends and people’s behaviours – and work and lifestyle choices future forecasting – in 2021 we will publish a route-map to meet the 20% reduction by 2030.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Following a public consultation, Transport Scotland is currently working with local authority partners to prepare a final post-consultation version of the route map for publication later this year, and are developing a resource guide to aid local authorities and partners to deliver car reduction in their area.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The only indicator to-date is year to year change in % car km reduction, publication of the draft route map, and commitment to publication of the final route map. We will publish a monitoring and evaluation framework alongside publication of the final route map.

Timeframe and expected next steps: The finalised route map, consultation analysis, monitoring and evaluation framework, and resource guide for local authorities will be published in autumn 2024.

Policy: Commit to exploring options around remote working, in connection with our work on 20-minute neighbourhoods and work local programme.

Date announced: 2020-2021 Programme for Government (PfG)

Progress on implementation since time of last report / CCPu: Transport Scotland and the Scottish Government commissioned and published research through which we explored options around remote options: one a socio-economic analysis of home working (published October 2021), and another on the emissions impact of home working (published August 2021).

The National Planning Framework 4 (NPF4), adopted February 2023, sets out a series of spatial principles for Scotland 2045 including ‘local living’, bringing thinking about 20 Minute Neighbourhoods into everyday decisions in the future planning of our places.

We consulted on a draft of Local living and 20 minute neighbourhoods – planning guidance in April 2023. Following an analysis of consultation responses, revised Planning Guidance: Local living and 20 minute neighbourhoods was published in April 2024. The guidance has been developed to support the implementation of NPF4 Policy 15: Local living and 20 minute neighbourhoods . The guidance includes resources and support on how to deliver neighbourhoods that support the ability to live well locally.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: Following the publication of Planning Guidance: Local living and 20 minute neighbourhoods the case studies contained within will be updated as practice emerges and projects develop. These will be hosted, alongside other practice examples of place based interventions that support local living, on the Ourplace.scot website.

Policy: COVID-19 has impacted on how we work. We launched a Work Local Challenge to drive innovation in work place choices and remote working to support flexible working and our Net Zero objectives.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: The Work Local Challenge Programme ran between July 2020 and March 2022 to support innovation and address the challenges caused by the shift in workplace settings and working patterns resulting from the COVID-19 pandemic. The programme is now closed – funding came to an end and the projects are all concluded.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: We will work with the UK Government on options to review fuel duty proposals, in the context of the need to reduce demand for unsustainable travel and the potential for revenue generation.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Scottish Ministers have written on several occasions to UK Government ministers requesting meaningful engagement on plans for structural reform of reserved motoring taxation, which the UK Government itself acknowledged is inevitable and required in their recent Net Zero Review. To date, the UK Government has been unwilling to set out its plans or a timescale for engagement.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: Timeframes on engagement are at the discretion of the UK Government, who have so far been unwilling to discuss. However, Scottish Government ministers and officials will continue to press for meaningful dialogue.

Policy: We will work with local authorities to continue to ensure that their parking and local transport strategies have proper appreciation of climate change, as well as the impact on all road users, including public transport operators, disabled motorists, cyclists and pedestrians.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Transport Scotland has engaged with local authority and Regional Transport Partnerships (RTP) stakeholders on development of updated Local Transport Strategy (LTS) guidance. Draft guidance was published 22 March 2023 for stakeholder review until 15 June and a working group with stakeholders was formed to finalise the guidance post consultation.

Additionally, Transport Scotland has commissioned research through ClimateXChange to better understand the environmental, social and economic benefits of sustainable travel to local highstreets and town centres. The findings will be particularly valuable to local policy makers, local businesses and individuals and will support the Scottish Government policy to reduce car km in Scotland by 20% by 2030. ClimateXChange recently published research commissioned by Transport Scotland on ‘Reducing car use through parking policies’. The research identified five parking intervention types as having an impact on car KM reduction, modal split and car ownership, four (parking standards, parking pricing, parking levies and parking capacity reductions) positively and one (park and ride) negatively.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: The finalised LTS Guidance is due to be published by mid 2024. Stakeholder engagement was carried out during the drafting process to ensure the guidance is suitable for those developing a LTS. Transport Scotland officials will be available to guide local authorities through the development of their LTS if required post publication.

Policy: To support the monitoring requirement for the National Transport Strategy set out in the Transport (Scotland) Act 2019, and to further our understanding of how and why people travel, we will develop a data strategy and invest in data.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: None

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: None

Timeframe and expected next steps: On hold, no current plan.

Policy: Continue to support the Smarter Choices, Smarter Places (SCSP) programme to encourage behaviour change. Continue to support the provision of child and adult cycle training, and safety programmes including driver cycling awareness training through Bikeability.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Smarter Choices, Smarter Places (SCSP) programme was brought to a close at the end of March 2024 as part of wider changes delivered through the Active Travel Transformation Programme.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No.

Timeframe and expected next steps: N/A

Policy: We will grant fund CoMoUK to increase awareness of the role and benefits of shared transport and look at the barriers to uptake of car clubs

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: CoMoUK’s Scotland Co-Mobility Programme did not secure ongoing funding and was phased out at the end of June 2023.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No.

Timeframe and expected next steps: N/A

Policy: Support transformational active travel projects with a £500 million investment, over five years, for active travel infrastructure, access to bikes and behaviour change schemes. Enabling the delivery of high quality, safe walking, wheeling and cycling infrastructure alongside behaviour change, education and advocacy to encourage more people to choose active and sustainable travel. Support the use of E-bikes and adapted bikes through interest free loans, grants and trials

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: This commitment will be completed in next FY: Active travel budgets over recent years have been used to deliver a range of infrastructure projects (Places for Everyone, National Cycle Network, Cycling Walking Safer Routes), behaviour change projects (Cycling Friendly, Bikeability etc) and Access to Bikes Programmes (free bikes for children projects, etc):

2020-21 - £100.5m

2021-22 - £115m

2022-23 - £150m

2023-24 - £189m

2024-25 - £220m (proposed in draft budget)

Programme for Government 2023 further committed to £320m of Active Travel investmentby 2024-25. We have now put in place a more sustained and stable growth plan for Active Travel with a record amount of £220 million proposed in the draft budget for 2024-25, building on the investment already made in recent years.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: We have re-purposed almost £39 million of active travel funding for the Spaces for People; this is enabling local authorities to put in place the temporary measures such as pop-up cycle lanes and widening walkways that are needed to allow people to physically distance during transition out of the COVID-19 lockdown.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Programme has delivered changes and is now closed.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Support increased access to bikes for all including the provision of public bike and e-bike share.

Date announced: National Transport Strategy 2 (NTS2) Delivery Plan 2021

Progress on implementation since time of last report / CCPu:

Under Access to Bikes we funded the Free Bikes for Schoolchildren commitment. The pilot programme funded 10 pilot projects to test various delivery models and informed the creation of the Free Bikes Partnership run by Cycling Scotland. The pilot projects delivered 3800 bikes and the Free Bikes Partnership a further 612 in FY 2023-24. In FY 2023-24, the Energy Saving Trust provided interest free loans for the purchase of 439 e-bikes.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: N/A

Policy: Mobility as a Service and increased use of peer to peer car sharing which will help reduce the number journeys made by car. To do this we are harnessing innovation within our transport system through investing up to £2 million over three years to develop ‘Mobility as a Service’ (MaaS) in Scotland.

Date announced: PfG 2018

Progress on implementation since time of last report / CCPu: Launched in 2019, our £2 million MaaS Investment Fund is now closed for applications. Funds were awarded to five MaaS projects, all of whom have now submitted their final reports to Transport Scotland. Programme valuation in now underway and due to complete in Spring 2024 whereon findings will be used to inform future policy and investment requirements.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: TBC

Policy: We will work to improve road safety, ensuring people feel safe with appropriate measures in place to enable that. We will publish Scotland’s Road Safety Framework to 2030, following consultation on an ambitious and compelling long-term vision for road safety where there are zero fatalities or serious injuries on Scotland’s roads by 2050.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu:

The Road Safety Framework to 2030 was publish in February 2021.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these:

The framework sets out a vision for Scotland to have the best road safety performance in the world by 2030 and an ambitious long term goal where no one is seriously injured or killed on our roads by 2050. It sets challenging targets for the years ahead as we strive to meet our vision to 2030. The targets, along with our progress as of 2022 (which is comparative to the 2014-18 baseline), can be found below.

We expected an increase in road casualties due to traffic returning to our roads following the pandemic. However, the rise in fatalities has been higher than anticipated, hence the reason why there is a zero percent achievement in the number of people killed in 2022.

50% reduction in people killed (achieved – 0%)

50% reduction in people seriously injured (achieved – 36%)

60% reduction in children (aged <16) killed (achieved – 17%)

60% reduction in children (aged <16) seriously injured (achieved – 33%)

For the first time, mode and user specific targets for key priority groups (listed below) have been created to focus attention by partners on our priority areas:

40% reduction in pedestrians killed or seriously injured (achieved – 42%)

20% reduction in cyclists killed or seriously injured (achieved – 36%)

30% reduction in motorcyclists killed or seriously injured (achieved – 28%)

20% reduction in road users aged 70 and over killed or seriously injured (achieved – 18%)

70% reduction in road users aged between 17 to 25 killed or seriously injured (achieved – 40%)

Percentage of motorists driving/riding within the posted speed limit

The casualty rate for the most deprived 10% SIMD areas is reduced to equal to the least deprived 10% SIMD areas

Timeframe and expected next steps: We are continuing to monitor progress through our governance groups and delivering a number of road safety initiatives to reverse the rise in fatalities. We will continue to monitor progress via our Annual Delivery Report.

Policy: We are committed to taking forward policy consultation in advance of drafting supporting regulations and guidance to enable local authorities to implement workplace parking levy (WPL) schemes that suit their local circumstances.

Date announced: 2019-2020

Progress on implementation since time of last report / CCPu: Regulations came into force in March 2022 and guidance was published in June 2022, so local authorities are now able to use their discretionary powers to implement WPL schemes.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The milestones (regulations in force and guidance published) have been completed in 2022.

Timeframe and expected next steps: The policy milestones have been completed. It is now a decision for local authorities whether to take forward local schemes.

Policy: We will bring forward a step change in investment with over £500 million to improve bus priority infrastructure to tackle the impacts of congestion on bus services and raise bus usage. We will launch the Bus Partnership Fund in the coming months to support local authorities’ ambitions around tackling congestion.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: We have provided £26.9 million of funding for bus priority through the Bus Partnership Fund since it commenced. This has delivered bus gates, enforcement cameras and traffic light equipment to help buses get through them more quickly in North Ayrshire, Glasgow, Inverness and Edinburgh. It has also made a number of temporary measures, such as bus lanes, permanent in Edinburgh and Glasgow. Bus gates in Aberdeen City Centre have reduced journey times for passengers by up to 25% benefitting over 600,000 passengers each month. A bus gate at Raigmore Hospital in Inverness is also due to open at the end of March. A number of business cases have also been completed which identify further bus priority measures.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Monitoring and evaluation plans are being developed and undertaken for bus priority measures.

Timeframe and expected next steps: Due to budget constraints the Bus Partnership Fund has been paused for 2024-25. However, future funding availability will be considered as part of annual budget setting processes and prioritisation exercises. This pausing presents an opportunity to recast bus priority work within a longer term more integrated public transport vision.

Policy: We remain committed to delivering a national concessionary travel scheme for free bus travel for under 19s, and have begun the necessary preparations including planning, research, legal review and due diligence.

Date announced: 2020/21 PfG & Budget 2020

Progress on implementation since time of last report / CCPu:

The Young Persons Free bus Travel Scheme was extended to all aged under 22. The Scheme went live on 31 January 2022 with the potential to benefit up to 930,000 young people.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these. By the end of January 2024, there were over 715,000 valid Young Scot or National Entitlement Card (NEC) cardholders able to access free bus travel. Since that time, over 116 million journeys have been made under the scheme, showing huge interest and usage of the scheme and representing significant cost savings for young people accessing education and work.

Timeframe and expected next steps: Scottish Government focus remains on encouraging as many young people as possible to take advantage of the free bus travel offer.

To understand the impact of the young persons’ scheme, the Scottish Government have committed to ongoing evaluation of the scheme during the first five years of its operation.

The Year One Evaluation of the scheme was conducted between April and August 2023, and follows on from the Baseline Study which took place prior to scheme commencement to allow for comparison and measuring of progress against outcomes. The Year One Evaluation was published on 14 December 2023 and can be found on the Transport Scotland website.

Policy: We are also carrying out a review of discounts available on public transport to those under the age of 26 – due for completion end of December 2020 (with consultation planned on young people’s views on the impacts of COVID 19 and post lockdown measures on public transport usage and behaviour).

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Scottish Government has carried out analysis on a range of options including the cost of extending free bus travel and on concessionary travel across all modes of public transport to those under the age of 26. This included cost and benefit analysis. The review has concluded and was published on the Transport Scotland website on 22 September 2022 at Under 26 Concessionary Fares Review | Transport Scotland.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A - Completed.

Policy: Delivery of our first Active Freeways – segregated active travel routes on main travel corridors connecting communities and major trip attractors.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: A high level transport appraisal has been undertaken as part of the second Strategic Transport Projects Review, with Active Freeways forming on of 45 recommendations for future transport infrastructure investment.The outcomes from the review were published in December 2022.Dundee City Council is working on development of a network of Active Freeways and Aberdeen, Glasgow and Edinburgh are working on their own high quality active travel networks for their respective cities.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Local indicators may be developed by respective local authorities. The impact of improved local active travel infrastructure will be included in wider national monitoring.

Timeframe and expected next steps: Further development and delivery to be supported as part of wider increase in funding of active travel projects and programmes.

Outcome 2: We will phase out the need for new petrol and diesel cars and vans by 2030

Policy: We will consider and develop new financing and delivery models for electric vehicle charging infrastructure in Scotland and work with the Scottish Future Trust (SFT) to do so.

Date announced: Boosted 2019-2020 PfG

Progress on implementation since time of last report / CCPu: We have worked with SFT and local authorities to develop public EV charging strategies and expansion plans that identify alternative financing and operating models for public EV charging, shifting the focus to a network that is invested in and operated by the private sector.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: £30 million of private sector investment in public EV charging to be levered though the programme, supporting growth of the public charging network to 6,000 chargers by 2026.

Timeframe and expected next steps: Procurement of private sector charge point operators to work with local authorities to grow and operate the public charging network in Scotland.

Policy: We have invested over £30 million to grow and develop the ChargePlace Scotland network which is now the 4th largest in the UK. We will continue to develop the capacity of the electric vehicle charging network.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: Complete – we have now invested over £65 million to develop the Charge Place Scotland network.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Complete.

Timeframe and expected next steps: N/A

Policy: Our Low Carbon Transport Loan has provided over £220 million of funding to date to support the switch to low carbon vehicles. We will continue to support the demand for ultra-low emission vehicles (ULEVs) through our Low Carbon Transport Loan scheme, which is now focused on used electric vehicles.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: This scheme is now focused on supporting the nascent used EV market.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No, this is an ongoing support package.

Timeframe and expected next steps: Ongoing monitoring of this scheme to ensure is meets its intended policy objective.

Policy: We will continue to promote the uptake of ULEVs in the taxi and private hire sector.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: We continue to promote and support the taxi sector make the change to ULEVs, we have expanded the loan scheme to support both used private hire and hackney vehicles.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No, this is an ongoing support package.

Timeframe and expected next steps: Ongoing monitoring of this scheme to ensure is meets its intended policy objective.

Policy: Continue to promote the benefits of EVs to individuals and fleet operators (exact nature of promotion to be decided annually).

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: We continue to promote and support the uptake of EVs through a range of consumer incentive schemes.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No, this is an ongoing support package.

Timeframe and expected next steps: Ongoing monitoring of this scheme to ensure is meets its intended policy objective.

Policy: We will work with public bodies to phase out the need for any new petrol and diesel light commercial vehicles by 2025.

Date announced: 2019-2020 PfG

Progress on implementation since time of last report / CCPu: We have continued to support public bodies to decarbonise their fleets, through funding installation of EV charging infrastructure for fleets and working with the Energy Savings Trust to provide guidance and tools. Through the Fleet Manager Forum have promoted best practice and provided opportunities for fleet managers to learn from peers and understand the range of services and technologies available from the private sector.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: This policy relates to new vehicles entering the public fleet after 2025.

Timeframe and expected next steps: We will continue to work with the public sector on actions that continue to decarbonise public sector fleets, shifting our focus to pilot projects that demonstrate alternative financing and operating models and the value of aggregating transport across the public sector and more widely.

Policy: We will support the public sector to lead the way in transitioning to EVs, putting in place procurement practices that encourage EVs. In the Programme for Government we committed to work with public bodies to phase out the need for any new petrol and diesel light commercial vehicles by 2025.

Date announced: 2019-2020 PfG

Progress on implementation since time of last report / CCPu: :We have continued to support the public sector to explore new approaches to procuring works and services that support the uptake of EVs, including supporting Scotland’s emergency services to establish a new EV charging back office framework that will make it easier to share access to EV charging across organisations and supporting fleet pathfinder projects exploring options to lever private finance into installation of fleet EV charging infrastructure.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: This policy relates to new vehicles entering the public fleet after 2025.

Timeframe and expected next steps: We will continue to support actions that demonstrate new approaches to procuring and operating zero emission fleets and infrastructure across the public sector.

Policy: Create the conditions to phase out the need for all new petrol and diesel vehicles in Scotland’s public sector fleet by 2030.

Date announced: 2019-2020 PfG

Progress on implementation since time of last report / CCPu: We have continued to provide financial support to the public sector to decarbonise their fleets and have provided additional technical support and guidance through the Energy Savings Trust.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: This policy relates to new vehicles entering the public fleet after 2030.

Timeframe and expected next steps: We will continue to work with public bodies providing support and guidance, identifying projects that demonstrate how to continue decarbonisation of public sector fleets.

Policy: We will continue to invest in innovation to support the development of ULEV technologies and their adoption.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: Transport Scotland worked closely with Scottish Enterprise to fund innovation through the Can Do Innovation Fund as well as providing funding via a Zero Emission Mobility Innovation Fund. In total over 15 projects were funded supporting small to medium-sized enterprises (SMEs) and large companies to innovate. Transport Scotland also created an Academic Network providing early stage funding for businesses to work with academic expertise across Scotland’s universities.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A –funding for innovation programmes ceased in FY23/24 following a reprioritisation of limited government funding and resources to support the adoption of existing zero emission technologies such as Electric Vehicles.

Policy: Take forward the initiatives in respect of connected and autonomous vehicles set out in A Connected and Autonomous Vehicles (CAV) Roadmap for Scotland.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Project CAV Forth trial commenced in May 2023 with Transport Scotland taking part as a partner until its completion in July 2023. This saw the launch of a globally significant self-driving commercial bus service on Scotland's trunk road network. Transport Scotland were a partner and provided a monitoring function from the Traffic Scotland Control Centre during the time period noted and were able to gain significant learning as the roads authority for much of the route. The service continues as CAVForth 2 in which Transport Scotland are not a partner but remain a supportive roads authority and we continue to access project information and learning.

Transport Scotland has also continued to liaise with UK Government in relation to the Autonomous Vehicles Bill, which was launched in November 2023, that will provide the legal framework for the deployment of autonomous vehicles in the UK.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A - Transport Scotland has delivered all of its commitments as a partner in Project CAV Forth.

Timeframe and expected next steps: Transport Scotland will continue to look for opportunities to take forward the initiatives set out in the CAV Roadmap for Scotland including liaison with UK Government on the Autonomous Vehicles Bill.

Policy: With local authorities and others, evaluate the scope for incentivising more rapid uptake of electric and ultra-low emission cars and vans.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: Through our EV Infrastructure Fund we have continued to support local authorities to develop local and regional EV charging strategies that identify where additional EV charging is required to meet future needs and support development of EV charging tariffs that are fair, sustainable and enabling.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Procurement and delivery of EV Infrastructure Fund projects and implementation of fair, sustainable and enabling tariffs over the next 18 to 24 months.

Outcome 3: To reduce emissions in the freight sector, we will work with the industry to understand the most efficient methods and remove the need for new petrol and diesel heavy vehicles by 2035.

Policy: To support businesses we will establish a Zero Emission heavy duty vehicle (ZE HDV) programme and will invest in a new zero drivetrain testing facility in 2021.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: The ZE HDV programme consisted of policy analysis, supply chain analysis, the funding of innovation using Scottish Enterprise’s Can Do Innovation fund and the creation of two projects to create vehicle and component testing facilities in Scotland. The component testing facility, DER-IC is located at the University of Strathclyde and is on track to open in 2024. This is a facility for testing of vehicle components required for transport decarbonisation.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Milestones were set for the various projects.

Timeframe and expected next steps: The ZE HDV programme is continuing but has been refocused due to financial and resource constraints to look at fleets, buses and road haulage in particular.

Policy: Explore the development of green finance models to help business and industry to invest in new road transport technologies.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Research commissioned to better understand new financing models to include an assessment of how developed/mature the markets are for different business models. Various actions within the HGV Decarbonisation Pathway (published March 2024) focus on this topic. Development of the Scottish Zero Emission Bus Challenge Fund 2 predicated on involvement of green finance in addition to public investment. Work underway with public sector fleet to encourage greater engagement with commercial finance.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: Continued engagement with the finance, energy and vehicle sectors.

Policy: We will engage with industry to understand how changing technologies and innovations in logistics (including consolidation centres) can help to reduce carbon emissions, particularly in response to the increase in e-commerce.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Zero Emission Truck Taskforce published its HGV Decarbonisation Pathway for Scotland in March 2024 with collaborative actions focusing on unlocking transition. This was a collaboration among senior industry leaders alongside government.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: Implementation of actions for Scottish Government and others within the pathway; expectation to update the pathway in 3 years as technology matures.

Policy: Continue to investigate the role that other alternative fuels, such as hydrogen, and biofuel can play in the transition to a decarbonised road transport sector. Consider the scope for testing approaches to alternative fuels infrastructure and supply.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: We commissioned research on the potential opportunities for Scotland in alternative fuels in the decarbonisation of transport. The research suggested the most promising opportunities were around alternative fuels for aviation and maritime. Exploration of the opportunity around sustainable aviation fuel is ongoing with industry (as noted in Outcome 5 below).

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: Aviation and maritime sector teams to continue to explore the role of alternative fuels.

Policy: Launched the new Hydrogen Accelerator (H2A) Programme to attract technical experts to help scale up and quicken the deployment of hydrogen technologies across Scotland.

Date announced: CCPu 2018

Progress on implementation since time of last report / CCPu: The Hydrogen Accelerator ran from 2020 to March 2024 and supported projects in the development of hydrogen for transport including a hydrogen rail demonstrator which was showcased at COP26.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: Funding for the Hydrogen Accelerator ended in March 2024.

Outcome 4: We will work with the newly formed Bus Decarbonisation Taskforce, comprised of leaders from the bus, energy and finance sectors, to ensure that the majority of new buses purchased from 2024 are zero-emission, and to bring this date forward if possible.

Policy: We have introduced a revised green incentive of the Bus Service Operators Grant.

Date announced: April 2019

Progress on implementation since time of last report / CCPu: this policy ran until 31 March 2022 when the Network Support Grant replaced the Bus Service Operators Grant, where there is no longer a green incentive given the numbers of zero emission buses now coming into operation.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: a five year transition period was introduced for any qualifying buses that came into operation prior to 1 April 2022.

Timeframe and expected next steps: the incentive will totally cease from 31 March 2027.

Policy: We launched a £9 million Scottish Ultra Low Emission Bus Scheme (SULEBS).

Date announced: August 2020

Progress on implementation since time of last report / CCPu: SULEBS ran in 2020 and 2021.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Through SULEBS, 272 zero-emission vehicles and their supporting infrastructure were acquired by Scottish bus operators, supported by over £50 million of government subsidy.

Timeframe and expected next steps: Scheme was superseded by the Scottish Zero Emission Bus Challenge fund (ScotZEB).

Policy: In the context of the National Transport Strategy Delivery Plan and Transport Act, we will examine the scope for climate change policies, in relation to buses, across the public sector in high-level transport legislation strategies and policies.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu:

The Scottish Government has now delivered all the bus powers within the 2019 Act to enable local transport authorities to consider all the powers available to them, including partnership working, franchising and local authority run services which sits alongside their ability to subsidise services.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Further regulations will be laid throughout 2024 alongside guidance, which will give the partnership and franchising powers full effect.

Policy: We will work to align government financial support of £120 million over the next 5 years with private sector investment to drive forward a fully decarbonised future for Scotland’s bus fleet and support the Scottish supply chain.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The first round of the Scottish Zero Emission Bus Challenge Fund (ScotZEB) awarded £62m to bus operators to acquire 276 zero-emission buses and their supporting infrastructure. In May 2023, ScotZEB 2 was launched with an initial budget of up to £58m available.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Through Scottish Government interventions SULEBS and ScotZEB, we have supported the acquisition of zero emission buses and their supporting infrastructure, bringing the total number of zero emission buses up from 20 to nearly 600. The Bus Decarbonisation Taskforce, of which the Scottish Government was a member, published the Pathway to Zero Emission Buses in Scotland in 2022. The Pathway outlines the roadmap by which bus operators, manufacturers, energy companies and financiers and government can work together to bring about a rapid, substantive shift towards a zero emission bus market in Scotland. ScotZEB 2 is government’s contribution to that roadmap.

Timeframe and expected next steps: ScotZEB 2 is in the final stages of decision making and an announcement is expected in the coming weeks.

Outcome 5: We will work to decarbonise scheduled flights within Scotland by 2040

Policy: We will aim to create the world’s first zero emission aviation region in partnership with Highlands and Islands Airports Limited (HIAL). This will include taking action to decarbonise airport operations in the HIAL region.

Date announced: Green New Deal 2019

Progress on implementation since time of last report / CCPu: HIAL continues to lead on our commitment to make the Highlands and Islands a zero emission aviation region. Following the publication of its Sustainability Strategy and completion of a Net Zero Roadmap and energy audit at Inverness Airport, HIAL continues with its programme of activity to decarbonise airport operations and infrastructure.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: We will continue to support HIAL to complete decarbonisation of its airport operations and to develop the infrastructure, equipment and training needed for hydrogen and electric aircraft. We will explore options for accessing UK Government funding, through its JetZero strategy, for these purposes.

Policy: We will begin trialling low or zero emission planes in 2021.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: As noted in the 2020 report, this commitment has been delivered with a test flight taking place in 2021.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: The Scottish Government will continue to engage with Aviation sector to encourage sustainable growth post COVID-19.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

Transport Scotland continues to lead on route development support in line with our PfG commitment to work with Scotland’s airports to help restore lost connectivity and grow international connectivity, while not returning to previous levels of emissions. This involves close working with Scotland's airports and in 2023 we supported the launch of new routes to Atlanta with Delta Air Lines, and Calgary with WestJet, with further new routes beginning in 2024. Many of these services will be operated using the latest generation aircraft, which are less polluting.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: We intend to publish an Aviation Statement soon which will set out the further steps we will take to try to improve connectivity while reducing aviation emissions.

Policy: Explore the potential for the purchase of zero/low emission aircraft by the Scottish Government, for lease back to operators, with more detailed assessment in the forthcoming Aviation Strategy.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

This option was explored in our consultation on the aviation strategy, with mixed support. Zero/low emission aircraft are not yet commercially available and we will make a decision at a later date taking into account budgetary and environmental considerations.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: This is noted above. Any purchase of hydrogen/electric aircraft would be for use on our public service obligation (PSO) routes to replace the aircraft that are current owned by Highlands and Islands Airports Limited (HIAL).

Policy: Explore options for incentivising the use of more sustainable aviation fuel (SAF) as we develop our Aviation Strategy, recognising that significant levers in this area are reserved.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Ministers have established an expert working group on SAF to provide advice on possible policy options, recognising that many relevant levers are reserved. It involves stakeholders from the aviation sector and officials from across the Scottish Government and agencies, and will take account of a SAF supply chain mapping study published by Scottish Enterprise.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps:The Group will report in time to inform the Scottish Government’s next Climate Change Plan.

Outcome 6: Proportion of ferries in Scottish Government ownership which are low emission has increased to 30% by 2032.

Policy: Continue to examine the scope for utilising hybrid and low carbon energy sources in the public sector marine fleet as part of our vessel replacement programme.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu:

The forthcoming Islands Connectivity Plan (ICP) will set out the Scottish Government’s long-term objectives and policies for ensuring necessary and sustainable transport links for our islands.

The first of the ICP documents – namely the ICP Strategic Approach and the Vessels and Ports Plan, have now been published for formal public consultation. Following this, the ICP will consider further elements including onward and connecting travel and carbon reduction.

The long-term decarbonisation of the fleet relies on one or more emerging technologies reaching technical and commercial maturity in the coming years – a challenge faced by the whole maritime transport sector.

Where zero emission technology is not currently feasible, new vessels can take advantage of the latest technology and design concepts to maximise efficiency and reduce emissions

The Scottish government will continue to monitor developments and opportunities to harness the benefits of alternative fuel to lower emissions and contribute towards meeting Net Zero targets.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: This is an ongoing process.

Timeframe and expected next steps: N/A

Policy: Working with the UK Government to support proposals at the International Maritime Organisation (IMO) to significantly lower shipping carbon emissions in the global sector, including the option of introducing a global levy on marine fuel to fund research in cleaner technologies and fuels.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Transport Scotland officials continue to work with UK Government officials in the Department for Transport to support consultations and calls for evidence into a number of options for reducing shipping emissions across UK waters, and to support the UK Government position as a member state at IMO to support global shipping decarbonisation proposals.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: This is an on-going process.

Timeframe and expected next steps: N/A

Outcome 7: By 2032 low emission solutions have been widely adopted at Scottish ports

Policy: Working with individual ports and the British Ports Association to consider a process for encouraging shared best practice initiatives for reducing emissions across the sector.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

The Scottish Government continue to work closely with the main ports trade association, the British Ports Association (BPA), along with individual ports, to assess technology developments to assist ports to reduce emissions. Additionally, we have also worked with the Department for Transport and our maritime stakeholders to share UK Government funding packages through the UKSHORE initiative, with many Scottish stakeholders successful in being awarded grants.

Various key large port operators (including Aberdeen, Clydeport and Forth Ports) have also published plans to transfer their operations to Net Zero.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: On-going process, with funding restrictions for smaller port operators an issue, along with the technology limitations in terms of viability of clean fuels and ship design.

Timeframe and expected next steps: Transport Scotland officials hold regular meetings with BPA, with an additional three meetings per annum with Scottish ports to discuss a range of issues affecting the sector, including how they are working towards decarbonising their facilities.

Policy: Working with the ports sector and with its statutory consultees through the Harbour Order process to ensure future port developments are environmentally underpinned.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

Ensuring key environmental agencies are fully consulted before considering any Harbour Order applications.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: On-going process.

Timeframe and expected next steps: There are currently a number of draft Harbour Order applications being considered, and the environmental impact of any proposed works is fully explored by statutory consultees Scottish Environment Protection Agency (SEPA), NatureScot and the Local Authority.

Outcome 8: Scotland’s passenger rail services will be decarbonised by 2035.

Policy: Our commitment to decarbonise (the traction element of) Scotland’s railways by 2035 will be delivered through investment in electrification and complementary alternative traction systems. Transport Scotland has published the Rail Services Decarbonisation Action Plan (July 2020) which will be updated as appropriate. Work is ongoing by industry partners to develop the initial schemes.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: The Glasgow – Barrhead Railway Line has been electrified with, electrically powered trains operating from December 2023. Construction work to electrify the line to East Kilbride is underway.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The milestone for this policy is rail decarbonisation by 2035. 27 single track kilometres of electrification was commissioned as part of the Barrhead Electrification project. This increased the length of electrified route from 885[24] single track kilometres to 912 single track kilometres. The total route length in Scotland is 2,695[25] single track kilometres.

Timeframe and expected next steps: The Rail Services Decarbonisation Action Plan is in the process of being refreshed. Significant delivery challenges exist in respect of available budget on the basis that the capital cost of the rail decarbonisation programme is forecast to exceed available budgets.

Policy: We will establish an international rail cluster in Scotland to unlock supply chain opportunities using the interest at Longannet as a catalyst. This will be built around existing strengths in rail in Scotland and will seek to enhance the innovation and supply chain in the decarbonisation of our rolling stock and wider network.

Date announced: Rail Services Decarbonisation Action Plan July 2020.

Progress on implementation since time of last report / CCPu: To date 693 individuals have registered with the rail cluster project, 470 registered companies and 287 SME’s registered.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A - Scottish Enterprise are leading on the potential redevelopment of the former Longannet Power Station site.

Timeframe and expected next steps: Rail Cluster Builder Phase 2 contract is due to complete summer 2025

Policy: Continue to deliver our Rail Freight Strategy.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: On-going work continues, in conjunction with industry partners and third-party investors, to increase rail freight on the Scottish network.

We have also been working with Network Rail on their delivery plans. These plans show how the industry will deliver the Scottish Ministers specification (HLOS) for rail, which have many benefits for rail freight and include a number of targets. Included is the requirement to grow rail freight by 8.7% with an expectation that 10% may be achievable in the current rail control period (2024-2029). Network Rail has also started work on the industry’s longer-term rail freight growth plan.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: There are no official annual targets or indicators but Network Rail monitors the targets for the control periods, including the control period just finished (2019 – 2024) on a quarterly basis. For the last rail control period (just finished) targets included a requirement to grow rail freight on the Scottish network by 7.5% by end March 2024. This target was previously on track to be met but factors including the Covid-19 pandemic, recessions, industrial action, the cost of living crisis and slowing down of investment have impacted progress.

Timeframe and expected next steps: There are no defined or specific Scottish Government/Transport Scotland timescales for completing the actions. Network Rail's regulatory targets have their own associated milestones and timescales and evaluation will take place at the end of the control period (post end March 2024). Work has started on the long term industry plan for rail freight growth in Scotland.

Contact

Email: climate.change@gov.scot

There is a problem

Thanks for your feedback