Climate change monitoring report 2024

The fourth annual statutory monitoring report against the updated 2018 Climate Change Plan, as per the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019.

5. Chapter 4: Industry

5.1 Part A - Overview of sector

The 2021 annual emissions envelope published in the 2018 CCPu (Climate Change Plan Update) for this sector was for 11.3 MtCO2e and the outturn emission statistics for this year (published in June 2023) show a position of 9.6 MtCO2e. On the basis of comparing these figures, the sector was within its envelope in 2021.

The CCPu sets out the following two policy outcomes for the sector, the indicators for which are summarised below:

| Scotland’s industrial sector will be on a managed pathway to decarbonisation, whilst remaining highly competitive and on a sustainable growth trajectory. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Industrial energy productivity (£GVAm per GWh) | - | Yes | - |

| Industrial emissions intensity (tCO2e per £GVAm) | - | Yes | - |

| Technologies critical to further industrial emissions reduction (such as carbon capture and storage and production and injection of hydrogen into the gas grid) are operating at commercial scale by 2030. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| % of Scottish gas demand accounted for by biomethane and hydrogen blended into the gas network | - | - | Yes |

Just transition and cross economy impacts

We wish to understand and report on the broader just transition and cross-economy impacts of our emissions-reduction activities in addition to these sector specific policy outcomes and indicators. To do this, in this report we use data from the Office of National Statistics (ONS): Low Carbon Renewable Energy Economy (LCREE) publication. The LCREE data presented in this report is based on survey data of businesses which perform economic activities that deliver goods and services that are likely to help generate lower emissions of greenhouse gases, for example low carbon electricity, low emission vehicles and low carbon services.

The LCREE indicator is narrowly defined and, while useful within its limited scope, does not give us the full picture of the impacts on workforce, employers and communities and progress towards a just transition.

Over the next few years we will work to develop a more meaningful set of success outcomes and indicators aimed at tracking the impacts of our policies on a just transition to net zero.

Sector commentary on progress

There has been a considerable decline in Scotland’s industrial emissions since 1990, falling by 51% (to 9.6 MtCO2e) between 1990 and 2021. Research estimates[26] that emissions from Scotland’s large industrial sites could feasibly reduce by 80% or more by 2045, while maintaining output.

In 2020, 25% of total Scottish Greenhouse Gas (GHG) emissions came from the industry envelope. This dropped to 23% in 2021. 72% of emissions in 2020 in the industry envelope were associated with combustion (i.e. energy), suggesting 28% come from industrial processes. For 2021, 74% of emissions came from combustion, suggesting 26% came from industrial processes (chemical/mineral/metal production processes).

Our CCPu estimates that by 2032 industrial emissions need to decrease by 43% on 2018 levels to meet Scotland’s Climate Change targets, whilst ensuring Scottish industry remains globally sustainable and competitive. The latest data for 2021 suggest annual industrial emissions had reduced by 18% against 2018 levels (9.6MtCO2e from 11.7MtCO2e). However, caution should be made when interpreting the longer-term implications of this, given the substantial impact the COVID-19 pandemic had on the Scottish economy and overall emissions. A further reduction of 3.1MtCO2e from 2021 levels would be required to meet the 2032 target of 6.5MtCO2e, however large uncertainties exist around the immediate emissions trajectory.

The balance of reserved and devolved responsibilities for industrial decarbonisation means that progress is often dependent on UK Government and/or international policy and markets. For example, UK Government decision-making on where to focus its support to develop Carbon Capture, Utilisation and Storage (CCUS) infrastructure, and the lack of clarity this is delivering for Scottish projects, has direct implications on Scotland’s ability to reduce emissions and realise its net zero objectives.

Significant parts of the industrial sector are subject to the UK Emissions Trading Scheme (ETS), which remains the key carbon pricing tool across the UK. The UK ETS is managed by the ETS Authority, comprising of the UK Government and the three Devolved Governments. The Authority is currently consulting on strengthening the ETS through reviewing Free Allowances and introducing Market Stability Mechanisms and will respond to these consultations later this year.

There remains a significant risk of carbon leakage: if the Scottish industrial sector were to have a less supportive policy environment for decarbonisation than their competitors in the rest of the UK, Europe and beyond, they could be faced with higher costs as a result of carbon pricing mechanisms which could push production, and therefore jobs, overseas.

Developments in monitoring arrangements since last report

There have been no changes to the methodology since the last report.

5.2 Part B - Progress to Policy Outcome Indicators

Policy Outcome: Cross-sectoral social and economic

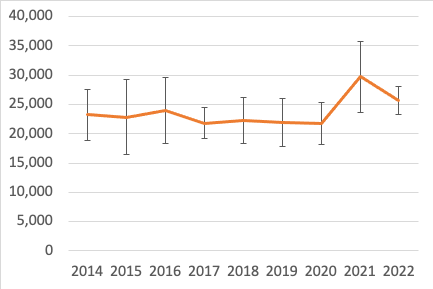

Indicator: FTE employment in Low Carbon Renewable Energy Economy Indicator

On-Track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 2022

Data Source(s): Low Carbon and Renewable Energy Estimates, Office of National Statistics

Assessment: Too Early to Say

Commentary:

- In 2022, the Scottish low carbon renewable energy economy (LCREE) sectors were estimated to provide 25,700 FTE jobs.

- The estimates of LCREE are based on a relatively small sample of businesses and hence are subject to a wide confidence interval.

- Scottish LCREE employment in 2022 is lower than in 2021 but the difference is not statistically significant and caution should be exercised when interpreting year on year changes due to a high degree of uncertainty in estimates.

Source: Office of National Statistics (ONS) Low Carbon and Renewable Energy Economy Estimates

- LCREE only shows employment in roles in Industries directly involved in the transition to Net Zero.

- The Office for National Statistics (ONS) also releases experimental statistics on a wider perspective of green activity in the economy with their experimental estimates of green jobs.

- These statistics reflect green activities in both LCREE and non-LCREE sectors. The latest publication was in September 2023.

- This found that 38% of working adults in Scotland described any part of their job as green in a survey carried out in May 2023. This was the highest across Great Britain, with 36% and 26% of working adults describing any part of their job as green in Wales and England respectively.

- Across Great Britain, the age group most likely to describe any part of their job as green were those in the 30-49 age bracket.

- The highest greenhouse gas emissions per employee were found in the electricity and gas sector, followed by the mining and quarrying sector and the agriculture, forestry, and fishing sector.

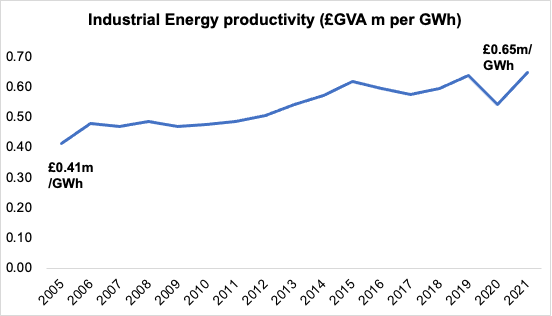

Policy Outcome: 1

Indicator: Industrial energy productivity (£GVAm per GWh)

On-track Assessment (Milestones/Targets): [Increase 30% by 2032, to £0.81m/GWh][27]

Most Recent Data: 2021

Data Source(s): Department for Energy Security and Net Zero (DESNZ) sub-national energy consumption statistics, DESNZ Energy

Consumption in the UK statistics, Scottish Government Quarterly National Accounts Sectoral breakdown (unpublished)

Assessment: Off track – however, it should be noted that there is a high level of uncertainty with this assessment rating. The most recent data for 2021 reflects some recovery from the significant disruption to Gross Value Added (GVA) across the Scottish economy during the COVID-19 pandemic, however this remains below the peak level recorded in 2019. In addition, fundamental decisions on the Scottish CCUS Cluster status could have a material impact on the assessment of this indicator.

Commentary:

- Industrial GVA comprises the manufacturing, construction and mining sectors.

- Industrial energy productivity in Scotland (the GVA obtained through each GWh of energy used in the industrial sector) grew steadily, by over 50%, from 2005-2015, followed by a 7.3% decline over the next two years. Despite a year-on-year decline of 15.3% in 2020, there was a recovery in 2021 with a 20.1% year-on-year increase.

- Compared to the 2015 baseline year industrial energy productivity has increased by 4.9% in 2021, this is compared to a 12.7% decline on the baseline in 2020. This is partly driven by a 13.7% increase in industrial GVA between 2020 and 2021, reflecting some recovery from the significant disruption to the Scottish economy during the COVID-19 pandemic. The period 2015 to 2019 saw an increase of 3% in industrial energy productivity.

- Industrial GVA increased by 5.3% over the period 2005 to 2021, in contrast to the relative decline seen in 2020.

- Despite recovery in industrial GVA, industrial energy consumption continued to fall in 2021, 5.1% lower compared to 2020 and 33.0% lower compared to 2005.

- Improvements on this indicator are likely to be stepped, or lumpy, rather than gradual year-year changes, as success depends on substantial process changes at a small number of large sites. We’ll continue to review the suitability of the indicators used to reflect success in the sector and refine these as needed.

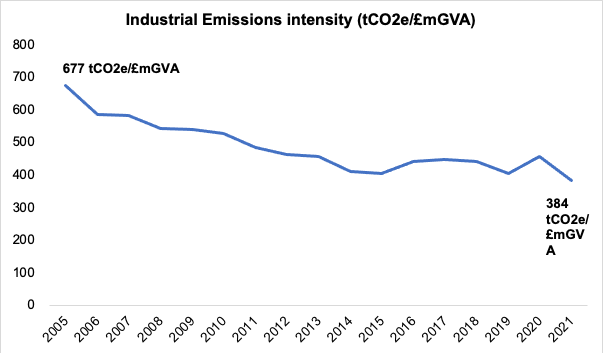

Policy Outcome: 1

Indicator: Industrial emissions intensity (tCO2e per £GVAm)

On-track Assessment (Milestones/Targets): [Reduce 30% by 2032, to 283 tCO2e per £GVAm][28]

Most Recent Data: 2021

Data Source(s): Scottish Government Greenhouse Gas Emissions publication,

Scottish Government Quarterly National Accounts Sectoral breakdown (unpublished)

Assessment: Off track – however, it should be noted that there is a high level of uncertainty with this assessment rating. The most recent data for 2021 reflects some recovery from the significant disruption to GVA across the Scottish economy during the COVID-19 pandemic, however this remains below the peak level recorded in 2019. In addition, fundamental decisions on the Scottish CCUS Cluster status could have a material impact on the assessment of this indicator.

Commentary:

- Industrial emissions intensity in Scotland (the volume of emissions produced through each £1m of GVA in the industrial sector) fell by 40.3% 2005- 2015, rose 10.5% to 2017 and decreased 9.5% to 2019. Year-on-year industrial emissions intensity rose again by 12.9% in 2020 reflecting a large decrease in overall GVA without an equivalent decline in emissions, but subsequently recovered in 2021 with a 15.9% decline.

- Improvements on this indicator are likely to be stepped, or lumpy, rather than gradual year-on-year changes, as success depends on substantial process changes at a small number of large sites.

- Compared to the 2015 baseline year industrial emissions intensity has decreased by 5.0%. This reflects a partial recovery in industrial GVA from the significant disruption to the Scottish economy during the COVID-19 pandemic, and a year-on-year decrease in industrial emissions.

- Total industrial emissions fell by 40.3% between 2005 and 2021. This is reassuring given the period 2014-2017 saw continuous year-on-year rises in industrial emissions before falling by 17% between 2017 and 2021.

- We’ll continue to review the suitability of the indicators used to reflect success in the sector and refine these as needed.

Policy Outcome: 2

Indicator: % of Scottish gas demand accounted for by biomethane and hydrogen blended into the gas network.

On-track Assessment (Milestones/Targets): Based on trend

Most Recent Data: Data published 2024 (covering up to 2023)

Data Source(s): Scottish Gas Network (SGN); Department for Energy Security and Net Zero (DESNZ) Sub-national Gas Consumption Statistics

Assessment: Too early to say

Commentary:

- In 2022, 2.1% of Scottish gas demand was accounted for by biomethane blended into the gas grid, up from 0.3% in 2015 and an increase on the 1.7% figure recorded for 2021.

- Although moderate, this growth in biomethane levels has contributed to a lower emissions intensity of the gas grid.

- The most recent data shows that there was 126 GWh of biomethane injected into the SGN in 2015 and 920 GWh in 2022, a 630% increase.

- Data for 2023 biomethane injections suggest that biomethane injection rates may have fallen, with 764 GWh being injected into the SGN. This still represents a 506% increase from 2015. This is likely to result in a smaller percentage of Scottish gas demand being accounted for by biomethane in 2023 than in 2022, depending on sub-national gas consumption statistics which are due to be released by DESNZ in December 2024.

5.3 Part C - Information on implementation of individual policies

Outcome 1: Scotland’s Industrial sector will be on a managed pathway to decarbonisation, whilst remaining highly competitive and on a sustainable growth trajectory.

Policy: The United Kingdom Emissions Trading Scheme (ETS): following EU Exit we will work with UK Government and other devolved administrations on maintaining carbon pricing that is at least as ambitious as the EU ETS. The Scottish Government’s preference is to establish a UK ETS which will have an interim cap of being 5% tighter than the EU ETS, and will be reviewed for consistency with Net Zero in 2021.

Date announced: June 2020

Progress on implementation since time of last report / CCPu: The UK ETS was established in January 2021 and is jointly administered by the four governments of the United Kingdom. Since establishment we have made a number of changes to strengthen the scheme, including better alignment with Net Zero objectives. We have recently announced our intention to continue the ETS for the long term until at least 2050. The UK ETS covers a large number of industrial emissions, as well as emissions from other sectors.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Further policy work to strengthen the UK ETS, including scope expansion to new sectors.

Policy: Deliver an Energy Transition Fund (ETF) to provide support for a sustainable, secure and inclusive energy transition in the North East.

Date announced: June 2020

Progress on implementation since time of last report / CCPu: All 4 funded projects are in full delivery. Notable deliveries since last update include:

1. Completion of the refurbishment of the WZero1 Building on the Energy Transition Zone Campus. This large building is now fully tenanted with organisations focused on technology to enable the transition to renewable energy. As part of this, the Offshore Renewable Energy (ORE) Catapult has installed an innovation centre for offshore floating wind – this was opened by the First Minister on 18th March 2024 and focuses on:

a. Development, testing & qualification of floating wind technologies including moorings, anchoring & dynamic cable systems.

b. Design & optimisation of floating offshore wind technologies & projects including project construction, operations & maintenance.

2. Completion of the “Digital Ecosystem” project for the Global Underwater Hub – this system enables effective remote learning and collaboration opportunities for subsea supply chain organisations throughout the UK from 3 bases (Aberdeen, Newcastle and Bristol). This presents Scottish supply chain companies with the opportunity to engage with the whole UK market, and form collaborations with other UK companies to bid for UK and international business.

3. Delivery of a successful “NZTTP - the success so far” event in Mid February. This event provided energy sector companies the opportunity to engage with the Net Zero Technology Transition Programme (NZTTP) suite of 7 projects. Ranging from digital infrastructure to alternative fuel gas turbines, the projects presented a number of ways for companies to operationalise carbon reduction and move towards Net Zero. Offshore Energies UK (OEUK) members were particularly proactive in discussing implementation.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: All projects have ongoing monitoring against agreed outcomes and outputs. These are monitored on a quarterly basis, and in some cases may extend beyond the funding timescales for the Exchange Traded Fund (ETF). It is the intention to draw together the quarterly updates for 2023/24 into an overall monitoring report for 2023/24.

Timeframe and expected next steps: The Fund is now in the last full year (2024/25) of its planned lifespan, with the four main projects continuing in full delivery

Policy: Establish and deliver a Scottish Industrial Energy Transformation Fund (SIETF) – to support the decarbonisation of industrial manufacturing through a green economic recovery.

Date announced: June 2020

Progress on implementation since time of last report / CCPu: Our £34m SIETF programme continues to receive significant applications from a wide range of industrial manufacturing sectors across the country. By enhancing energy efficiency it cuts energy costs, in particular for Scotland’s diverse food and drink sector. As of end of February 2024, 27 projects have been offered grants totalling £16m, as part of an overall £43m investment.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The 2023 Programme for Government committed us to continue SIETF which should leverage c£90m of total investment to directly reduce emissions from industrial processes. The fund in its current form should cut emissions by c.0.15 MtCO2e. Estimates of annual cumulative carbon savings resultant from co-investment from SIETF will be annually reviewed. However actual savings will begin to evidence from 2024 once significant energy efficiency or decarbonisation deployments are operational.

Timeframe and expected next steps: The programme continues to review the number and value of projects supported, projected emissions and energy productivity savings, and consider impacts against policy objectives within public sector financial constraints. Further grants are due to be awarded in Spring 2024 and programme development work continues on the next iteration of the programme.

Policy: Making Scotland’s Future: multi-faceted programme will boost manufacturing productivity, innovation, and competitiveness, supporting manufacturing businesses to make the transition to net zero and realise the opportunities of a low carbon economy.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Making Scotland’s Future, as a framework for collaboration, was implemented at the beginning of 2020. The programme refresh cited in the previous update was completed in Summer 2023 and partners now align their activities to this.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Delivery of the National Manufacturing Institute Scotland (NMIS) was a key milestone for this Programme. This completed with the formal opening of NMIS’ flagship building in Renfrew on 21st June by the First Minister. The programme framework has been refreshed and includes a Just Transition and Net Zero horizontal theme to ensure partners consider the opportunities and challenges presented by the low carbon transition. Beyond the delivery of NMIS, Making Scotlands Future (MSF) is a collaboration programme designed to bring key public sector partners together to deliver a more collective approach to supporting the manufacturing sector. MSF helps partners cohere under the key priorities of the sector to shape and deliver projects against its joint objectives. Indicators and milestones vary across partners and their individual projects.

Timeframe and expected next steps: Project timeframes are tied to partner leads who are accountable for delivery of their own projects.

Policy: Low Carbon Manufacturing Challenge Fund: to support innovation in low carbon technology, products and processes. This will be delivered as a Research and development scheme with focus on implementing product circularity through design, reducing product/process waste and reducing emissions through product lifecycle

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: The Fund is now closed as a result of a need within Scottish Government to make budgetary savings.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: For projects of over 0.5 million the gross impacts of the project are estimated, in particular Gross Value Added (GVA) and employment. Additionality adjustments are then made to drive the net impacts of each intervention. Impact ratio (net GVA per £1 of support) cost per job created or safeguarded. Due to the status of the funding, and the nature of the projects being longer term, indicators/outcomes will not be realised until a later date.

Timeframe and expected next steps: SE intend to manage the contracts for awarded projects from alternative budgets – the length of these will vary across projects until the end of FY 2025/26.

Policy: The Renewable Heat Incentive (RHI) is a GB-wide scheme created by the UK Government (with the agreement of the Scottish Government).

Date announced: August 2020

Progress on implementation since time of last report / CCPu: 1,133.3 MW of accredited capacity under the non-domestic RHI and the Non-Domestic Renewable Heat Incentive Scheme (NDRHI) between November 2011 and March 2023.[29]

1, 813 GWh of heat had been paid for between April 2014 and March 2023 under the domestic RHI scheme in Scotland.[30]

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The domestic RHI has now closed from 31 March 2022. The non-domestic RHI closed to new applicants on 31 March 2021, but the UK Government extended the deadline for commissioning for eligible tariff guarantee or extension applications from 31 March 2022 to 31 March 2023.

Policy: Scottish Industrial Decarbonisation Partnership (SIDP): Scottish Government convened cross-sector energy-intensive industrial (EII) stakeholder forum with representatives from manufacturing sites. Initial objectives: bring together other initiatives; build a shared narrative between government/industry on decarbonisation’ and disseminate best practice

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: SIDP development was stopped because many of the proposed co-ordination or convening functions began to be carried out by other partnerships or groups. The NECCUS alliance of industry government and experts which is driving changes needed to cut industrial carbon emissions, and the Grangemouth Future Industry Board (GFIB) continue to capture industry and wider views and commission vital evidence.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Too early to set indicators or milestones.

Timeframe and expected next steps: The proposal’s purpose will be reviewed as industrial decarbonisation policy develops during 2024, noting how other partnerships or groups are operating in this policy area.

Policy: Deliver a Net Zero Transition Managers Programme to embed Managers in

organisations tasked with identifying, quantifying and recommending decarbonisation opportunities for the business.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Programme development was paused following initial engagement with partners from Scotland’s food and drink sector.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Feedback from early engagement with industry will inform policy development to tackle the challenges which manufacturing businesses face when raising capacity to design then deliver site-specific industrial decarbonisation projects.

Policy: Establish a Grangemouth Future Industry Board (GFIB) – forum to coordinate public sector initiatives on growing economic activity at the Grangemouth industrial cluster, whilst supporting its transition to our low carbon future.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Co-designed a draft vision for the Grangemouth cluster at 2045. This vision will be used to inform the development of the Industrial Just Transition plan for Grangemouth a draft of which will be published 31 May 2024, ahead of the final draft by December 2024. We have set up the Industrial Just Transition Leadership Forum as part of GFIB bringing Senior leaders from Industry, Academia, Government Agencies, Local Government, Unions and Community together with Ministers from Scottish and U/K Government to develop and direct a programme of activity for GFIB to deliver aligned to realising a just transition for Grangemouth.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Publication of Just Transition Plan (JTP).

Timeframe and expected next steps: GFIB to publish JTP Vision / Plan. GFIB will also seek to support net zero projects aligned to the JT(Just Transition) vision for Grangemouth over the next reporting period.

Policy: Develop policy on providing market-benefit for Scottish industries that invest to decarbonise production.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: In December 2023, UK Government outlined its intention to implement a carbon border adjustment mechanism (CBAM) by 2027. We remain engaged with UK Government (UKG) on related impacts on Scottish production including products standards.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Sector or product specific benchmarking is noted in 2021 Scottish Government research: Improving the market benefits for lower-carbon industrial production in Scotland (climatexchange.org.uk).

Timeframe and expected next steps: We will focus on promoting lower carbon intensity production in Scotland whilst liaising with UK Government who intend to consult on product standards during 2024.

Policy: Green Jobs Fund, to help businesses create new, green jobs, working with enterprise agencies to fund businesses that provide sustainable or low carbon products and services to help them develop, grow and create jobs. Further funding will help to ensure that businesses and supply chains across Scotland can capitalise on our investment in low carbon infrastructure such as the decarbonisation of heating and green transport.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: Published forecast figures on green job numbers are derived from projects where funding from the Green Jobs Fund has already been agreed and, in financial year 2024-25, support will continue for projects where commitments have been contractually agreed.

Latest figures to be quoted are: Between the Enterprise Agencies and Scottish Ministers, 118 projects have been supported with grant funding of £28.2 million through the Green Jobs Fund. Figures provided by the recipients of these awards estimated this fund will support up to 6,956 jobs over the life of the individual projects.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: ONS release of their “Green jobs update, current and upcoming work: March 2023” on the 13th March 2023, defined a green job as: “Employment in an activity that contributes to protecting or restoring the environment, including those that mitigate or adapt to climate change”.

The Green Jobs Fund is a five year capital fund of up to £100 million. Over the five year term up to £50 million is baselined to the Enterprise Agencies and up to a further £50 million allocated to Scottish Ministers.

Timeframe and expected next steps Green Jobs Fund is expected to have awarded up to £100 million by 2026 to support businesses and their supply chains to help them better transition to a low carbon economy and create new green jobs.

Policy: Seizing the economic opportunity, we will work across government, enterprise agencies and the innovation system to identify strengths that can be built on as part of the decarbonisation journey, for example on The Clyde Mission and continued support for the Michelin Scotland Innovation Parc (MSIP).

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The Scottish Government and Scottish Enterprise continue to support MSIP. In November 2023, MSIP opened its Innovation Hub, adding to its assets that support business development and innovation in low carbon technologies. The other assets include its Innovation Labs, that are hosting companies seeking to research and test new products, and Skills Academy that is providing training in skills to support the green economy.

MSIP has also recently concluded its 4th business Accelerator cohort, providing access to skills, knowledge, networks and advice for 10 new businesses that are developing a range of future-thinking products and services, including sustainable mobility technology, innovative climate action products and services, sustainable manufacturing technology, wind power, energy efficiency and biotech for net zero.

Glasgow City Region partners have taken over leadership of the Clyde Mission, with Scottish Government continuing to support the work, including through £25 million capital funding for heat decarbonisation and £1.5 million revenue for a master planning exercise.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No dates set for Clyde Mission work. No specific dates set for MSIP.

Timeframe and expected next steps: For Clyde Mission, Glasgow City Region partners are to begin work to identify project(s) and work on the masterplan is anticipated to start during the coming year. Planning for MSIP’s 5th business Accelerator cohort is underway.

Outcome 2: Technologies critical to further industrial emissions reduction (such as carbon capture and storage and production and injection of hydrogen into the gas grid) are operating at commercial scale by 2030

Policy: ACORN CCS Project: support the delivery of the Carbon Capture Storage (CCS) and Hydrogen capability at St. Fergus Gas Processing complex by 2025.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The Scottish Government has provided funding and policy support to the Acorn CCS project positioned at St. Fergus, Aberdeenshire, through its feasibility and development phases. The UK Government have published their CCUS Vision which has further acknowledged that the Acorn project is best placed for ‘Track 2’ deployment.

Acorn will be asked to submit ‘anchor phase’ plans for assessment which will detail the initial emitter projects which aim to deploy by 2028/29, subject to technical, affordability and value for money assessments. This must include at least 2 emitter projects plus a provisional cluster expansion plan (‘buildout phase’).

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No milestones have been set. The UK Government are dictating the pace of deployment; the Scottish Government continue to push for the process to be expedited.

Timeframe and expected next steps: Continued support of Acorn, the Scottish Cluster and internationalisation of CCUS, aiming for CCS to be functioning at Acorn by 2029. Blue Hydrogen production from Acorn relies on CCS infrastructure being in place.

Policy: Establish and deliver a Carbon Capture and Utilisation (CCU) Challenge Fund.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: We made available up to £5 million of financial support for Carbon Capture and Utilisation through our CO2 Utilisation Challenge Fund which ran from 2022 to 2024. No applications were received and so the money has been reprioritised. As targeted market engagement did not identify a single specific reason for this lack of applications, a range of issues are thought to be potential contributors, including other funding streams in this area, industry difficulties with building project consortia and changes and challenges to the global supply chain.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Emerging Energy Technologies Fund – to support the development of Hydrogen, CCUS and Negative emissions technologies.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: The first tranche of our hydrogen investment programme, the Hydrogen Innovation Scheme (HIS), was launched in June 2022. The HIS is targeted at supporting innovation under the themes of renewable hydrogen production, hydrogen storage and distribution, and integration of hydrogen into our energy system. Allocations from the first round of the HIS totalled over £7m and were announced in May 2023; 31 projects are now underway.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The second tranche of the hydrogen investment programme, the Green Hydrogen Fund (GHF), was planned to have been launched by the end of 2023; this was trailed in Ministerial speeches and published documents. Due to the budget in December 2023, there are no imminent plans to launch the fund.

Timeframe and expected next steps: Whilst there are no immediate plans to open the Green Hydrogen Fund, the Scottish Government is working with Scottish Enterprise to consider delivery options for funding support to the hydrogen sector on a case-by-case basis, and to engage with projects as they come forward.

Policy: Carbon Capture Utilisation and Storage (CCUS): work closely with the UK Government to achieve commercial, policy and regulatory frameworks required to support CCUS at scale in the UK.

Date announced: 2020-2021

Progress on implementation since time of last report / CCPu: The Scottish Government continues to work closely with the UK Government at official and Ministerial level, with the aim of accelerating deployment of CCUS within Scotland. A Ministerial forum for CCUS has been established and had an inaugural meeting on 18 December 2023.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No indicators set.

Timeframe and expected next steps: A forward plan for the Ministerial forum on CCUS is being refined.

Policy: Forums for CCUS and Blue (low-carbon) Hydrogen: to bring together industry, academics and membership organisations to promote and attract investment in CCUS and Blue Hydrogen.

Date announced: NECCUS 2019

Progress on implementation since time of last report / CCPu: The second annual DecarbScotland event was hosted by NECCUS at Murrayfield, Edinburgh on Thursday 1 February 2024 bringing a national and international audience across industry, academia, government and other membership organisations to showcase the opportunities and discuss the challenges of industrial decarbonisation, with a focus on CCUS, in Scotland.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No indicators set

Timeframe and expected next steps: The remit of NECCUS will be discussed with the Scottish Government and Industry bodies in the context of the Scottish Cluster over 2024 and strengthened where needed.

Policy: Evidence for CCUS and Blue Hydrogen: building the evidence base on impact of technology, regulatory and market barriers.

Date announced: 2020/21 PfG

Progress on implementation since time of last report / CCPu: The Scottish Government continue to improve our evidence base for CCUS on transport, storage, skills, infrastructure and growing international markets, utilising the ClimateXChange framework amongst others.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No indicators set

Timeframe and expected next steps: A study on ‘near shore’ storage potential is being conducted in the first half of 2024 to look at the potential for storage which may be under the jurisdiction of Scottish Ministers.

Policy: Strategic development of Scotland’s hydrogen economy - This is a cross-portfolio proposal that will impact on the delivery of multiple outcomes.

Date announced: Hydrogen Assessment and Policy Statement 2020, draft Hydrogen Action Plan 2022

Progress on implementation since time of last report / CCPu: Working with our enterprise agencies we have established a hydrogen programme internal board to take forward the hydrogen action plan deployment in a programmed approach. The board has been in place for almost 12 months.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: We have established the Scottish Hydrogen Industry Forum chaired by the energy minister and composed of senior industry stakeholders, to provide insight in this emerging sector, to inform policy, and help the realisation of our hydrogen ambitions.

Timeframe and expected next steps:The Scottish Hydrogen Industry Forum meets quarterly – next meeting in in May 2024

Policy: Hydrogen Demonstration: to replicate and scale-up demonstration projects and the evidence base for hydrogen based technologies.

Date announced: Hydrogen Assessment and Policy Statement 2020, draft Hydrogen Action Plan 2021, final Hydrogen Action Plan 2022

Progress on implementation since time of last report / CCPu: The £10m EETF Innovation Scheme (HIS), launched in 2022. The HIS is aimed at providing support for the production, storage and integration of renewable hydrogen including feasibility and demonstration projects. Allocations from the first round of the HIS totalled over £7m and were announced in May 2023; 31 projects are now underway.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: There are no specific indicators in the CCPu.

Timeframe and expected next steps: Some HIS projects will conclude in 2024; the remainder will continue into 2025. The Scottish Government is considering further delivery options for funding support to the hydrogen sector.

Contact

Email: climate.change@gov.scot

There is a problem

Thanks for your feedback