Climate change monitoring report 2024

The fourth annual statutory monitoring report against the updated 2018 Climate Change Plan, as per the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019.

7. Chapter 6: LULUCF

7.1 Part A - Overview of sector

The 2021 annual emissions envelope published in the CCPu this sector was for 0.5 MtCO2e, whereas the outturn emission statistics for this year (published in June 2023) show a position of 0.4 MtCO2e. On the basis of comparing these figures, the sector was within its envelope in 2021.

The CCPu sets out the following three policy outcomes for the sector, the indicators for which are summarised below:

| We will introduce a stepped increase in the annual woodland creation rates from 2020-2021 to enhance the contribution that trees make to reducing emissions through sequestering carbon. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Hectares of woodland created per year | - | Yes | - |

| Woodland ecological condition | - | - | Yes |

| Woodland Carbon Code: Projected carbon sequestration (validated credits) | Yes | - | - |

| Increase the use of sustainably sourced wood fibre to reduce emissions by encouraging the construction industry to increase its use of wood products where appropriate. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Annual volume (in millions of cubic metres) of Scottish produced sawn wood and panel boards used in construction | - | - | Yes |

| To enhance the contribution of peatland to carbon storage, we will support an increase in the annual rate of peatland restoration. | On Track | Off Track | Too Early to Say |

|---|---|---|---|

| Hectares of peatland restored per year | - | Yes | - |

| Peatland Code: Projected emissions reduction (validated units) | - | Yes | - |

We will establish pilot Regional Land Use partnerships (RLUPs) over the course of 2021.

Just transition and cross economy impacts

We wish to understand and report on the broader just transition and cross-economy impacts of our emissions-reduction activities in addition to these sector specific policy outcomes and indicators. To do this, in this report we use data from the Office of National Statistics (ONS): Low Carbon Renewable Energy Economy (LCREE) publication. The LCREE data presented in this report is based on survey data of businesses which perform economic activities that deliver goods and services that are likely to help generate lower emissions of greenhouse gases, for example low carbon electricity, low emission vehicles and low carbon services.

The LCREE indicator is narrowly defined and, while useful within its limited scope, does not give us the full picture of the impacts on workforce, employers and communities and progress towards a just transition. Over the next few years we will work to develop a more meaningful set of success outcomes and indicators aimed at tracking the impacts of our policies on a just transition to net zero.

Sector commentary on progress

Forestry - There were 8,190 hectares of new planting in in 2022-23 despite 11,000 hectares of new planting being approved by Scottish Forestry. The unusually high proportion of projects were paused or called off (about 25%) was thought to be related to skills and capacity in the sector. Nevertheless, new planting in Scotland represented almost two thirds of all new planting across the UK in 2022-23.

A forestry summit with leaders from across the forestry sector was held in December 2023 to examine how to put levels of woodland creation back on track. Following the summit, a roadmap is being put together to set out actions to stimulate woodland creation and further discussions are being held with stakeholders. These discussions are also examining how funding from the Forestry Grant Scheme (FGS) and through the Woodland Carbon Code can be blended most effectively to maximise woodland creation in future, particularly in light of a significant reduction in FGS funding for woodland creation in 2024-25. Approximately, 14,000 hectares of woodland creation have been approved for 2023-24.

Private sector finance in woodland creation through the Woodland Carbon Code. Interim statistics show that 9.2M woodland carbon credits had been validated in Scotland at December 2023, with a 30% increase between April and December 2023.

Peatland - Scottish Government has committed £250 million over 10 years to restore 250,000 hectares of degraded peatlands by 2030. To date, we have achieved around 65,000 hectares of this, and the First Minister’s April 2023 policy prospectus commits us to reaching 110,000 hectares by 2026.

Recent restoration rates average around 6,000 hectares annually over the past three years, falling well below our current annual target of at least 20,000 hectares. Our 10,700 ha target for 2023-24 represents a 40% increase over the 7,500 ha restored last year (2022-23), which itself was a 35% increase over the 5,400 ha restored in 2021-22. This growth rate in restoration is welcome and promising, but we are still behind the pace required to meet our CCP commitment on emissions from degraded peatland.

The key challenges to peatland restoration fall into the following three broad categories.

1. Operational issues - There are a number of challenges which make peatland restoration difficult – rising costs; physical limitations imposed by weather, access and ecological constraints; and ongoing development of skills and capacity requirements throughout the entire project lifecycle in this young industry. Developing competent contractor and consultancy capacity to cope with the scale up required for 2030 targets is of particular concern with new entrants finding it challenging to win restoration contracts and a lack of visible project pipeline.

2. Policy uncertainty – Restoration currently relies on land owners offering their land on a voluntary basis. Demand has been varied across Scotland and we are seeing increasing demand from landowners, particularly in southern Scotland and the Cairngorms. However there is uncertainty around post-CAP financial support and the emerging carbon market.

3. Financial Model – Market mechanisms for generating a return on investment in peatland restoration are either relatively new or largely absent. The administration of the Peatland Code is especially resource intensive for IUCN but is intended to be a vital part of the financing model generating returns for land owners. We are seeing projects being delayed at the validation stage of the Peatland Code.

A detailed delivery improvement plan is in place and aims to accelerate rates of restoration, focusing on increasing sector capacity and addressing key bottlenecks. We are working hard with our delivery partners through the Peatland Action partnership to tackle the many barriers to upscaling peatland restoration in this relatively young sector.

Peatland Code is a well-regarded standard and used by investors, but operational challenges remain which threaten the pace and scale of adoption of this standard in Scotland (and UK). IUCN (who administer the Peatland Code) are investing in operational capacity and improving their processes but a lot of work remains to be done before we can get to the scale needed to meet our private finance policy objectives in the context of peatland restoration.

Based on registration data, as of March 2024, a total of 201 projects have registered under the Peatland Code in Scotland with a total of 4.47 million units (tCO2e) registered. This represents about 76% of all registrations in the UK. However, only 33% of the registered projects are so far validated, which does create a risk for new project developers if they end up facing significant waiting times to get their projects validated. IUCN, who administer the Peatland Code are onboarding additional validation capacity, but it is too early to say whether that has worked as expected.

Work has progressed on establishing a pilot for peatland restoration on crofting land.

RPID manage 46 crofting estates/land holdings extending to over 95,000 hectares mainly across the Highlands and Islands and have landlord responsibility for 1,524 tenanted crofts (10% of Scotland’s total tenanted crofts) and around 80 miscellaneous tenancies including windfarms). RPID manage the 120 hectare Crofting Bull Stud at Knocknagael (providing subsidised bull hire to groups of crofters), and the starter farm at Balrobert (130 hectare). As the majority of the Scottish Ministers crofting and agricultural land holding interests is under either crofting or agriculture tenure, there is little influence we as landlords have on how our tenants should manage it. Influencing management change on land under crofting tenure is even more complicated, as this is governed by the Crofters (Scotland) Act 1993 and the Crofting Reform (Scotland) Act 2010. However crofting is a low intensity form of agriculture and this means our crofting land holdings already contribute a lot of Scotland’s natural capital.

Across the wider estate we have been working to identify and determine areas and condition of peatland to identify areas of degraded peatland for restoration. We have concluded desk based assessments on over 90% of our holdings with peatland, and work is ongoing with the remaining 10%. This has helped identify sites that would benefit from restoration activities. We are currently engaging with various crofting tenants and grazings committees with the aim of developing a practical collaborative approach between land owner, crofting tenant and Peatland Action for restoration and long-term management of peatland on croft land. This work includes exploring the reason for past and present degraded peatland and identifying different restoration options.

NatureScot, one of our key delivery partners in the Peatland ACTION partnership, have also progressed work on engaging with landowners through their Communications Plan and on increasing the capacity of designers and implementers of restoration works through their Peatland Skills Plan.

Through the CivTech challenge we have worked with Environment Systems Ltd to develop a tool utilising technology to identify and prioritise peatland sites that will optimise costs and benefits. The solution – PeatSCOPE – is a web based portal which can enable better targeting of peatland sites for restoration to maximum benefits. We are currently gathering feedback from users to determine how we proceed with PeatSCOPE.

Between February and May 2023, we ran a consultation on “Ending the Sale of Peat in Scotland”. Whilst the central focus of the consultation was on horticulture, as the main commercial use of peat, we also considered other uses of peat that drive commercial extraction and sought wider views through the consultation and stakeholder engagement. An analysis of responses was published in December 2023 and this, together with stakeholder engagements and impact assessments, will inform plans and timescales for moving away from using peat products in order to protect peatlands from further damage.

Developments in monitoring arrangements since last report

NatureScot-Peatland ACTION have developed a monitoring strategy - Peatland ACTION Monitoring Strategy 2023-2030 - which is now available through their site: Peatland ACTION - Monitoring strategy | NatureScot. The Monitoring Strategy was first implemented in 2019 and has been revised to improve the structure in 2023.

7.2 Part B - Progress to Policy Outcome Indicators

Policy Outcome: Cross-sectoral social and economic

Indicator: FTE employment in Low Carbon Renewable Energy Economy Indicator

On-Track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 2022

Data Source(s): Low Carbon and Renewable Energy Estimates, Office of National Statistics

Assessment: Too Early to Say

Commentary:

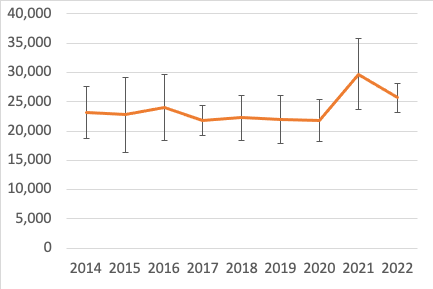

- In 2022, the Scottish low carbon renewable energy economy (LCREE) sectors were estimated to provide 25,700 FTE jobs.

- The estimates of LCREE are based on a relatively small sample of businesses and hence are subject to a wide confidence interval.

- Scottish LCREE employment in 2022 is lower than in 2021 but the difference is not statistically significant and caution should be exercised when interpreting year on year changes due to a high degree of uncertainty in estimates.

Source: Office of National Statistics (ONS) Low Carbon and Renewable Energy Economy Estimates

Policy Outcome: 1

Indicator: Hectares of woodland created per year

On-track Assessment (Milestones/Targets): 2020/21 = 12,000 ha/yr, 2021/22=13,500 ha/yr, 2022/23 = 15,000 ha/yr, 2023/24 = 16,500 ha/yr,

2024/25 = 18,000 ha/yr

Most Recent Data: Forestry Statistics 2023

Data Source(s): Forestry Statistics

Assessment: Off track

Commentary:

There was a dip in woodland creation in 2022-23 although 11,000 hectares of woodland creation applications had been approved for that year. Delivery is dependent upon land managers implementing their projects once approved by Scottish Forestry. Over 14,000 hectares of woodland creation have been approved for 2023-24. Official data on woodland creation for 2023-24 will be released in June 2024.

Policy Outcome: 1

Indicator: Woodland ecological condition

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: Published February 2020

Data Source(s): National Forest Inventory

Assessment: Too early to say

Commentary:

Published as official statistics by the National Forest Inventory (NFI), the study into Woodland Ecological Condition (WEC) is the largest and most in-depth assessment of the ecological condition of any habitat in Great Britain.

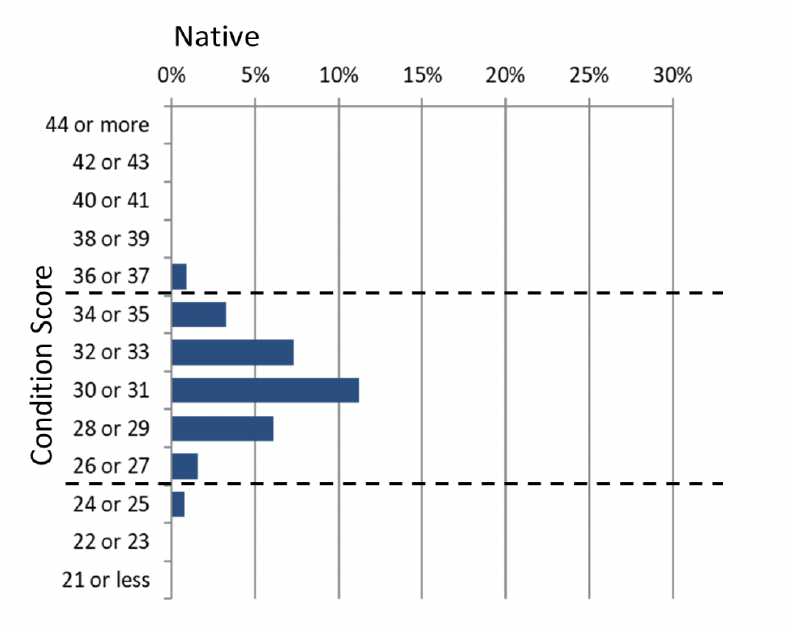

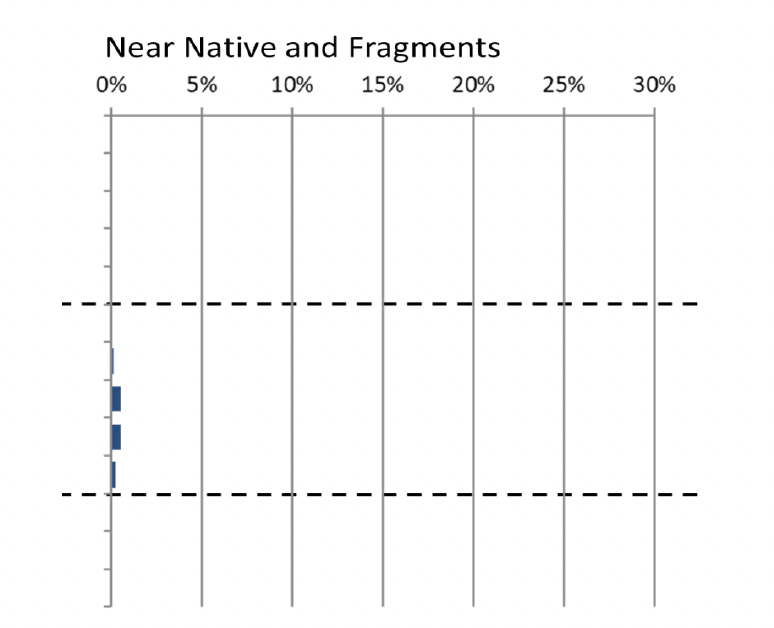

It reveals that in Scotland 442,611 hectares are now classified as native woodland and that the majority of this is North East and West Scotland. The statistics reveal that over 430,000 ha of these native woodlands are in overall ‘favourable’ or ‘intermediate’ condition.

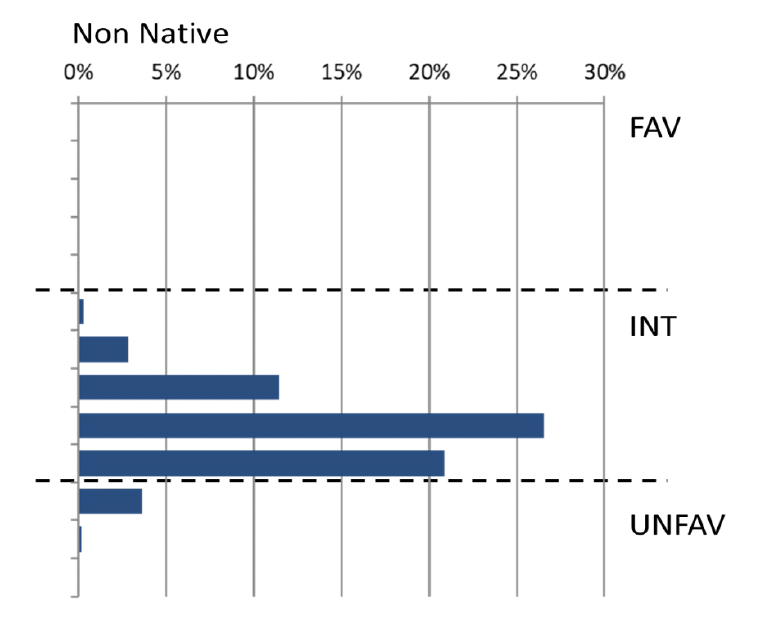

They also show that Scotland’s non-native woodlands make a positive ecological contribution, with less than 6% in ‘unfavourable’ ecological condition.

Furthermore, the survey demonstrates that the active management of a forest for wood production delivers higher biodiversity as well as a renewable supply of wood to help sustain an industry that benefits climate change mitigation, jobs and the economy - at minimal cost to the public purse.

The last WEC report was published in 2019 and was based on data collected in the first cycle of field survey 2010 to 2015, so the analysis has a time stamp of 2013 (the average age of the data). The plan is for the next report on WEC in 2024/25.

Notes: 1. Native = native woodland area, Near native and fragments = Near native woodland area and fragments, non-native = non-native woodland area. 2. The NFI calculator is used to score each of the 15 ecological condition indicators that can then be combined and used to give an overall score, and classification as favourable (fav) score 36-45, intermediate (int) score 26-35 or unfavourable (unfav) score 16-25 by woodland type. 3. Dashed line = threshold of each condition classification. To inform where to set the thresholds for each of the three classification categories published evidence was used. 4. Woodland types are defined in Section 1.3.6. 5. Refer to the methodology report for more information.

Policy Outcome: 1

Indicator: Woodland Carbon Code: Projected Progress to target carbon sequestration (validated credits).

On-track Assessment (Milestones/Targets): Progress to target (increase 50% by 2025)[33]

Most Recent Data: Forestry Statistics 2023, and Woodland Carbon website for latest unofficial data

Data Source(s): UK Land Carbon Registry, Forestry Statistics (Forest Research)

Assessment: On track

Commentary:

- There has been a 30% increase in the number of validated credits in Scotland under the Woodland Carbon Code between April and December 2023.

- Interim Statistics note that 9.2M carbon credits had been validated in Scotland at December 2023.

- Data for 2023-24 will be released in in the publication of Forestry Statistics in June 2024.

Policy Outcome: 1

Indicator: Annual volume (in millions of cubic metres) of Scottish produced sawn wood and panel boards used in construction.

On-track Assessment (Milestones/Targets): Progress to Targets [2020/21 = 2.6 million m3, 2026/27 = 2.8 million m3, 2031/32 = 3.0 million m3]

Most Recent Data: 2.25 million m3 estimated in construction in 2022

Data Source(s): Forestry Statistics 2023

Assessment: Too early to say

Commentary:

- Official Statistics on timber are published annually in September. These provide the best dataset to estimate volume of Scottish timber used in construction.

- The figure reported here, of 2.25 million cubic metres of timber used in construction in 2022, is based on these statistics.

- The decline in timber used in construction in 2022 compared to 2021 reflects the general state of the UK economy. In this situation, where builders are not struggling to source timber, domestic suppliers of timber are finding it difficult to penetrate the house building sector against strong competition from imported timber.

Policy Outcome: 3

Indicator: Hectares of peatland restored per year

On-track Assessment (Milestones/Targets): 20,000 ha/y[34]

Most Recent Data: Most recent estimates from delivery partner put restoration figures for 2023-2024 at 9600-9900 hectares. Final verified figures for the year will be available from NatureScot from 10 May 2024

Data Source(s): NatureScot published annual restoration figures

Assessment: Off track

Commentary:Scottish Government has committed £250 million over 10 years to restore 250,000 hectares of degraded peatlands by 2030. To date, we have achieved around 65,000 hectares of this, and the First Minister’s April 2023 policy prospectus commits us to reaching 110,000 hectares by 2026.

Recent restoration rates average around 6,000 hectares annually over the past three years, falling well below our current annual target of at least 20,000 hectares.

Our 10,700 ha target for 2023-24 represents a 40% increase over the 7,500 ha restored last year (2022-23), which itself was a 35% increase over the 5,400 ha restored in 2021-22. This growth rate in restoration is welcome and promising, but we are still behind the pace required to meet our CCP commitment on emissions from degraded peatland.

Policy Outcome: 3

Indicator: Peatland Code: Projected emissions reduction (validated units)

On-track Assessment (Milestones/Targets): Year-to-year change

Most Recent Data: 1,483,021 validated units from 42 Peatland Code projects in Scotland in 2023-24.

Data Source(s): Peatland Code, IUCN Peatland Programme

Assessment: Off track

Commentary: Based on registration data, as of 31st July 2023, a total of 174 projects have registered under the Peatland Code in Scotland with a total of 4.9 million units (tCO2e) registered. This represents about 80% of all registrations in the UK. However, only 30% of the registered projects are so far validated, which does create a risk for new project developers if they end up facing significant waiting times to get their projects validated. IUCN, who administer the Peatland Code are onboarding additional validation capacity, but it is too early to say whether that has worked as expected

7.3 Part C - Information on implementation of individual policies

Outcome 1: We will introduce a stepped increase in the annual woodland creation rates from 2020-2021 to enhance the contribution that trees make to reducing emissions through sequestering carbon.

Policy: Forestry grants: we will provide funding via a grant scheme, to support eligible land owners establish appropriate woodlands.

Date announced: 2020-2021 PfG

Progress on implementation since time of last report / CCPu: This policy was been boosted through an additional £100M of funding (announced in the PfG in 2020) to support an increase in woodland creation up to 2025, although there has been a 50% reduction in FGS funding for woodland creation in 2024-25. There is a currently a strong pipeline of woodland creation projects.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The indicator for woodland creation is hectares planted per year. Approvals by Scottish Forestry indicate a sustained high level of applications for woodland creation.

Timeframe and expected next steps: The targets for woodland creation consist of stepped increases until 2024-25 when the target will reach 18,000 hectares per year. SF is examining how FGS funding can best be used, alongside finance from the Woodland Carbon Code, to maximise woodland creation in future.

Policy: Woodland creation on Scotland’s national forests and land: Forestry and Land Scotland will deliver an annual contribution towards the overall woodland creation target by creating new sustainable woodland on Scotland’s national forests and land, including through partnerships with external organisations to scale carbon capture opportunities.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: FLS continues to create woodlands and is developing partnerships with a range of potential partners to undertake woodland creation for carbon capture

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: In 23/24 FLS will create around 900 ha of woodland

Timeframe and expected next steps: FLS will continue to create woodlands each year on an ongoing basis.

Policy: Awareness-raising: We will continue to deliver a programme of farm based events to demonstrate and support improved productivity through integration of farming and forestry enterprises.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: This policy has been maintained, with a series of events to demonstrate the benefits of trees on farms. These aim to encourage more farmers and crofters to plant trees and to raise awareness of the multiple benefits that planting trees can bring to agricultural businesses. The benefits include but are not limited to: providing shelter for livestock; habitat for wildlife; increasing biodiversity; reducing carbon footprint; providing diversification opportunities for future income; and prevention of flooding

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No hard indicators. But a series of events is underway associated with the establishment of a monitor farm network that includes farm forestry. Sharing first hand experiences and providing wide-ranging advice including on the practicalities of accessing funding, where to plant the trees, and the multiple business and environmental benefits.

Timeframe and expected next steps: Ongoing – annual series of events and developments to increase uptake of farm forestry eg through the Integrating Trees Network. Encouraging more trees to be planted, in the right place, for the right reason, and to give guidance on how this can be practically achieved.

Policy: Woodland standards: The Scottish Government will lead on the work with the UK and other UK Governments to maintain and develop a UK Forestry Standard that articulates the consistent UK wide approach to sustainable forestry. The Standard defines how woodland should be created and managed to meet sustainable forest management principles and provides a basis for monitoring.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: The four administrations of the UK have revised the UK Forestry Standard (UKFS). The review takes place every five years. The revised version was published in 2023. The review ensured the UKFS is up to date and continues to safeguard and promote sustainable forestry practice in the UK, whilst reflecting the international context in which forestry operates. The UKFS is the technical standard which underpins the delivery of the forestry policies of the four UK countries.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: A 12-month transition period is in place to allow guidance to be updated, users to become familiar with the new edition of the UKFS, and draft woodland plans to be finalised. The new edition of the UK Forestry Standard published in 2023 will be operational from 1st October 2024.

Policy: Woodland carbon capture: The Scottish Government will further develop and promote the Woodland Carbon Code in partnership with the forestry sector, and will work with investors, carbon buyers, landowners and market intermediaries to attract additional investment into woodland creation projects and increase the woodland carbon market by 50% by 2025.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Scottish Forestry is providing technical support to private sector investors, land managers and advisors, and intermediaries in the woodland carbon market. We are taking further measures to develop the Code to facilitate further expansion of the market.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Quantity of validated carbon units under the Woodland Carbon Code

Timeframe and expected next steps: 50% increase in validated carbon units by 2025 (already met)

Policy: Forestry and woodland strategies: Forestry and woodland strategies continue to be prepared by planning authorities, with support from Scottish Forestry. They provide a framework for forestry expansion through identifying preferred areas where forestry can have a positive impact on the environment, landscape, economy and local people.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu: A number of current strategies are being reviewed and updated. The Forestry Strategy Implementation Plan 2022-25 has an action to review the Scottish Government Forestry and Woodland Strategy(FWS) guidance by 31 March 2025.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Support forestry sector on plant and seed supply strategy to help meet the increased planting targets: A programme of technical innovation to develop and adapt modern horticultural practices will help improve seed preparation and handling, techniques to reduce environmental impacts, and increase nursery production. Funding to support increased production of young trees is available through the Harvesting and Processing grant.

Date announced: Scottish Forestry Implementation Plan

Progress on implementation since time of last report / CCPu: There has been good take up of the grant scheme. We are still working with the UK Confederation of Forest Industries (Confor) and other stakeholders to obtain better data on plant production. Defra has introduced its own grant support scheme for the forest nursery sector that will also support the forest nursery sector

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: No

Timeframe and expected next steps: N/A

Policy: Forestry and Land Scotland will begin development of a new approach to woodland investment with a view to acquiring more land to establish further woodland on Scotland’s national forests and land for the benefit of future generations and to optimise carbon sequestration. This includes partnering with private sector and other organisations to enhance scale and funding of carbon capture projects.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Acquisition Strategy has been prepared setting out FLS approach to investing in new woodland and is being applied. Disposal criteria are being reviewed to reflect FLS’ strategic asset management approach and sustainability objective.

Scottish Government funds from LCIF have been allocated against new land purchases along with left-over NWIP funds which FLS now holds in a Strategic Acquisition Fund for strategic land and asset purchases.

A number of carbon off-setting agreements and partnerships are being explored and are at various stages of discussion. Variations in market pricing along with a strong demand for land make this a challenging area of business.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Key indicator for land acquisition is to fully invest the Scottish Government funds available. For FY 22/23 this is projected to be £15.5M. The largest acquisition in FY 22/23 was the purchase of the 3434 hectare Glenprosen Estate in the Angus Glens. The immediate adjacency of Glenprosen to Scotland’s national forests and land, and that of other public bodies will result in Scottish Ministers owning a 10,400 hectare block of land, much within the Cairngorm National Park. Providing landscape scale land management / restoration opportunities. The estate has the potential for the creation of approximately 2000 hectares of woodland, making a significant contribution to the Scottish Government’s woodland creation target and/or the target for native woodland creation. In addition, it has the potential for peatland restoration and/or significant habitat restoration opportunities

Timeframe and expected next steps: New Governance and business Rules have been set up and are now being implemented. Monitoring is undertaken by the Strategic Acquisition Board.

Outcome 2: Increase the use of sustainably sourced wood fibre to reduce emissions by encouraging the construction industry to increase its use of wood products where appropriate.

Policy: In collaboration with the private forest sector and other public sector bodies the Scottish Government will implement the Timber Development Programme through an annual programme of projects that support the promotion and development of wood products for use in construction.

Date announced: CCP 2018

Progress on implementation since time of last report / CCPu:

SF have funded a number of projects this year arising from the Roots for Further Growth economic strategy produced by SFTT ILG, including:

- Research project by Edinburgh Napier University into domestic potential for Wood Fibre Insulation (£23.5k)

- Ongoing co-funding for 3 PhDs – 2 in biorefining and 1 around tree genetics (2 * £7k = £14k)

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: On-going

Outcome 3: To enhance the contribution of peatland to carbon storage, we will support an increase in the annual rate of peatland restoration

Policy: Restoration grants: We will provide grant funding to support eligible land managers to deliver peatland restoration. Levels of funding will enable at least 20,000 hectares of peatland restoration per year. We will undertake research to inform where restoration can deliver the greatest emission savings per hectare

Date announced: Budget 2020/21, Reinforced in 2020-2021 PfG

Progress on implementation since time of last report / CCPu: CCPu 2020

We are three years into our ten-year commitment to invest more than £250 million to restore at least 250,000 hectares of degraded peatlands by 2030.

Our 10,700 hectares restored target for 2023-24 represents a 40% increase over the 7,500 ha restored last year (22-23), which itself was a 35% increase over the 5,400 ha restored in 21-22. This growth rate trajectory in restoration is encouraging, but we are still behind the pace required to meet our CCP commitment on emissions from degraded peatland.

We need to further accelerate the rates of restoration if we are to reach the 2030 CCP target of 250,000 hectares. The 2023/24 peatland budget is the highest ever at £30m which is 26% increase over last year.

This will enable multi-year, large scale projects to be planned and delivered, boosting restoration rates and increasing the confidence of contractors to invest in machinery, jobs, training and skills. Our investment sends a clear message to delivery partners, including landowners and contractors, that we are absolutely committed to this important activity in the long term.

We know that a blend of public and private investment in Scotland’s natural capital will be essential to meet our emissions reduction targets. We are working across government and with partners to use our funding commitment to leverage increased private investment into peatlands.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Awareness raising: Working through partnership, we will put in place tools and information to promote peatland restoration and develop the capacity, skills and knowledge of land owners, land managers, contractors and others to deliver peatland restoration.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu:

The NatureScot-led Peatland Skills Plan focuses on increasing workforce capacity for design of restoration schemes and growth in the contracting sector to ensure delivery.

Recent notable highlights include:

- NatureScot and Crichton Carbon Centre led training events and open days have been attended by more than 440 people so far in 2023/24. Many of the 440 attendees on training events were contractors looking to enter the sector by enhancing their skills and understanding. In-person and online events have focused on the theory and principles of restoration, successful tendering for Peatland ACTION-funded work and technical site visits to look at the success of particular techniques.

- Events have stretched from Shetland to Galloway and have been complemented by a range of online technically focused CPD training. The focus on increasing design – the key tool for developing the long-term pipeline of projects required to meet ambitious targets – is being met not only by in-person and online CPD training, but also via the short course on Peatland Restoration at Scotland’s Rural College (SRUC).

- Three courses will run at SRUC over the winter, in Dumfries and in Inverness, with 2 fully booked and a third course nearly full. Between these three courses, 45 people will have entry-levels skills for the design sector.

- A New Entrants Machine Operator Training Scheme which was introduced to support training and mentoring of operators new to peatland restoration. 10 training placements have been offered to existing, experienced contractors, with 8 of these currently underway and the final 2 depending on the business securing PA-funded work this f/y.

As a result of these efforts the previous concern about contractor capacity as a barrier to delivery of restoration is much reduce.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: With partners, refresh our vision for Scotland’s peatlands and review peatland restoration support mechanisms to overcome embedded barriers and improve how we fund and deliver this activity.

Date announced: 2020/21 PfG

Progress on implementation since time of last report / CCPu:

Caring for our peatlands through protection, management and restoration is critical to mitigating and adapting to the linked climate and nature emergencies and achieving a Just Transition to net zero.

Recognising the challenges around upscaling peatland restoration, and noting that because different types of degraded peat emit different levels of greenhouse gases hectares restored is only a proxy for emissions reduced, we are working towards shifting our primary focus away from outputs (hectares restored) to outcomes (emissions reduced).

In time, and after further research, this new focus will allow us to extend the peatland emissions savings associated with restoration by counting the additional emissions reductions potentially available from a wider set of measures including reduced grazing, full or partial rewetting of cropland and/or grassland and/or extraction sites, and the downward emissions correction from the misclassification of grassland on peat.

This wider package includes measures that we are working towards through agriculture and deer management reform, our peat sales ban and introducing stricter controls on development on peat.

We are therefore working, through multiple channels, on a broader suite of measures to protect, manage and restore Scotland’s peatlands.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Phase out the use of peat in horticulture by increasing uptake of alternative materials, undertaking stakeholder engagement to understand transitional challenges, to improve the uptake of alternatives and develop a timescale plan.

Date announced: 2019-2020 PfG

Progress on implementation since time of last report / CCPu: Consultation responses have been analysed independently and the consultation analysis report has been published. Stakeholder engagement continues, both on a one-one basis with peat users and through group discussions, providing support where transition is challenging. A suite of impact assessments are near completion, and these will help to understand and manage the effects of transition for businesses, individuals and the environment. Using the accrued evidence, Ministers will consider scope and timescales and we intend to legislate within this parliamentary term. Scottish Ministers have formally initiated the process of exclusion from the IMA to ensure that legislation in this devolved area is effective.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: Policy development is keeping pace with the legislative process. Major milestones including public consultation (February – May 2023); publication of consultation analysis report (Dec 2023) have been completed.

Timeframe and expected next steps: We intend to legislate within the current parliamentary term and will progress with the legislative process, impact assessments and stakeholder engagement.

Policy: Our Position Statement on NPF4 confirmed our current thinking that through the planning system we will not support applications for planning permission for

new commercial peat extraction for horticultural purposes, we are looking at strengthening controls on development on peatland and we will help facilitate restoration through permitted development rights.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: NPF4, was published and adopted in February 2023, making clear that development proposals for new commercial peat extraction, including extensions to existing sites, will only be supported where: the extracted peat is supporting the Scottish whisky industry will only be supported in certain limited circumstances. NPF4 policy 5 seeks to protect carbon rich soils which have a critical role to play in helping the country reach its net zero target by sequestering and storing carbon. NPF4 policy 5 also sets

out that local development plans should protect locally, regionally, nationally and internationally valued soils. Development proposals on peatland, carbon rich soils and priority peatland habitat will only be supported in a limited range of circumstances.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Develop opportunities for private sector investment in peat restoration, engaging with sectors to establish investment pathways, enabling both public and private sector to invest in a range of measures to help mitigate effects of climate change.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: 1,483,021 validated units from 42 Peatland Code projects in Scotland in 2023-24. The total validated units for this year represents an increase of 326% on the previous year.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: The indicator Peatland Code: projected emissions reduction (validated units) shows that there have been 1,483,021 tCO2e net emissions reductions from Peatland Code projects in 2023-24.

Timeframe and expected next steps: Scottish Government is currently exploring options for spending models on nature restoration that can encourage greater responsible private investment while maximising the value of public spending. This includes consideration of ‘blended finance’ mechanisms where public funding is used in a more targeted way to support increased nature restoration activity by ‘crowding-in’ responsible private investment.

Policy: Explore how best to restore all degraded peat in the public estate and also within formally designated nature conservation sites, including through statutory mandate.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Scottish Government is working with the six[35] main landowning public bodies in Scotland to explore how activity on public land and the Scottish Crown Estate can be scaled up to maximise benefits for communities, climate change and biodiversity.

This includes consideration of how strategic nature restoration activity can be delivered at the landscape scale, by different public landowners coming together to work collaboratively across ownership boundaries.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Policy: Explore the development of a Peatland Restoration Standard to ensure best practice and continuous development in the success and effectiveness of peatland restoration.

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Actions to develop a Peatland Restoration Standard are being tracked through the Peatland Action ‘One Plan’ – a set of priority actions agreed across the Peatland Action partnership. This work is being led by NatureScot through the Technical Advice workstream in collaboration with the Peatland Action Delivery Partners, IUCN and others.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: N/A

Outcome 4: We will establish pilot Regional Land Use partnerships (RLUPs) over the course of 2021.

Policy: Establishment of pilot Regional Land Use Partnerships to help ensure that we maximise the potential of Scotland’s land to help achieve net zero.

Date announced: CCPU 2020

Progress on implementation since time of last report / CCPu: Five pilot regions were established in 2021 with the aim to facilitate collaboration between local and national government, communities, landowners, land managers and wider stakeholders. These pilots have been working across their respective regions to enable natural capital-led consideration of how to maximise the contribution that our land can make to addressing the climate and environmental crises as they sought to develop draft Regional Land Use Frameworks. Following on from the experiences of the pilot the Scottish Government has announced the establishment Regional Land Use Partnerships (RLUPs) as a national initiative beginning with the recruitment of up to three new regions in financial year 2024/25.

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: The Scottish government is currently working with the Regional Land Use Partnerships (RLUPs) as we seek to understand and evaluate the progress of the pilot programme. This approach will allow Scottish Ministers to take forward a fully informed decision on the future of the pilot programme.

Policy: Publication of Scotland’s third Land Use Strategy (LUS3) by statutory deadline of 31 March 2021

Date announced: CCPu 2020

Progress on implementation since time of last report / CCPu: Scotland’s third Land Use Strategy was published 24 March 2021

Have any implementation indicators / milestones been set for this policy? If so, most recent data for progress against these: N/A

Timeframe and expected next steps: Scotland’s fourth Land Use Strategy is due for publication by 31 March 2026.

Contact

Email: climate.change@gov.scot

There is a problem

Thanks for your feedback