Council Tax Collection Statistics, 2023-24

This statistics publication provides Council Tax collection figures for Scottish local authorities, up to and including the financial year 2023-24.

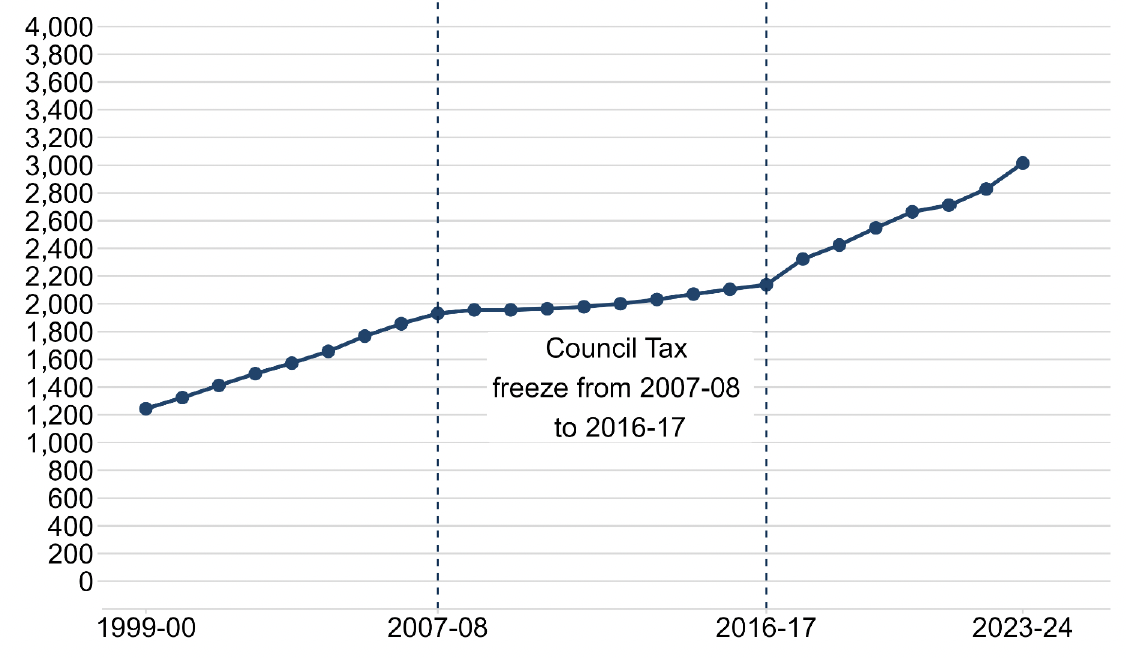

Council Tax Billed and Received

Figure 1: Council Tax Billed and Received

A table showing the amount of Council Tax billed and received for each year from 1999-00 to the latest year, 2023-24. As at 31 March 2024.

n/a |

Year to which bill refers |

Net amount billed (£000s) |

Amount recv'd (£000s) |

Amount uncollected (£000s) |

Percentage received |

|---|---|---|---|---|---|

Latest Year to 31 March 2024 |

2023-24 |

3,014,741 |

2,878,858 |

135,883 |

95.5% |

n/a |

2022-23 |

2,828,510 |

2,735,573 |

92,937 |

96.7% |

n/a |

2021-22 |

2,712,332 |

2,621,088 |

91,244 |

96.6% |

n/a |

2020-21 |

2,664,491 |

2,571,201 |

93,291 |

96.5% |

n/a |

2019-20 |

2,547,891 |

2,473,089 |

74,802 |

97.1% |

n/a |

2018-19 |

2,424,079 |

2,359,015 |

65,064 |

97.3% |

n/a |

2017-18 |

2,323,473 |

2,264,621 |

58,853 |

97.5% |

n/a |

2016-17 |

2,137,760 |

2,082,992 |

54,769 |

97.4% |

n/a |

2015-16 |

2,104,209 |

2,053,074 |

51,136 |

97.6% |

n/a |

2014-15 |

2,069,710 |

2,020,937 |

48,773 |

97.6% |

n/a |

2013-14 |

2,030,934 |

1,983,723 |

47,211 |

97.7% |

n/a |

2012-13 |

1,999,501 |

1,953,291 |

46,210 |

97.7% |

n/a |

2011-12 |

1,978,210 |

1,932,633 |

45,577 |

97.7% |

n/a |

2010-11 |

1,963,570 |

1,916,617 |

46,952 |

97.6% |

n/a |

2009-10 |

1,956,250 |

1,908,355 |

47,895 |

97.6% |

n/a |

2008-09 |

1,955,610 |

1,903,938 |

51,672 |

97.4% |

n/a |

2007-08 |

1,930,304 |

1,881,278 |

49,026 |

97.5% |

n/a |

2006-07 |

1,857,480 |

1,810,193 |

47,287 |

97.5% |

n/a |

2005-06 |

1,767,549 |

1,723,131 |

44,418 |

97.5% |

n/a |

2004-05 |

1,658,268 |

1,616,845 |

41,423 |

97.5% |

n/a |

2003-04 |

1,572,761 |

1,530,750 |

42,011 |

97.3% |

n/a |

2002-03 |

1,496,861 |

1,456,766 |

40,096 |

97.3% |

n/a |

2001-02 |

1,411,955 |

1,372,974 |

38,980 |

97.2% |

n/a |

2000-01 |

1,323,852 |

1,286,130 |

37,723 |

97.2% |

n/a |

1999-00 |

1,243,508 |

1,208,410 |

35,098 |

97.2% |

Total for previous years |

1999-00 to 2022-23 |

47,959,072 |

46,666,624 |

1,292,448 |

97.3% |

Total for all years to 31 March 2024 |

1999-00 to 2023-24 |

50,973,813 |

49,545,482 |

1,428,331 |

97.2% |

Notes

- The 2023-24 collection rate is typically lower since it is effectively the in-year collection rate (i.e. before any late payments).

- Years prior to 2023-24 are closer to final collection rates as local authorities have had longer to collect late payments.

- All figures are net of discounts (e.g. single person discount), exemptions and surcharges.

- The figures are before any amounts written off for bad or doubtful debt. They reflect any correction to liabilities following billing.

- Figures from 2005-06 onwards include additional amounts in respect of reduced Second Home/Long Term Empty property discounts.

Source: Council Tax Receipts Return (CTRR)

In Figure 1, the net Council Tax billed across Scotland and the amount received by 31 March 2024 are shown dating back to 1999-00. Earlier years, from 1993-94 when Council Tax was introduced to 1998-99 have been archived as collection data for these earlier years are now fairly static and are available in the publication tables.

The net amount billed rose sharply from £1.244 billion in 1999-00 to £1.930 billion (in cash terms) in 2007-08, principally due to increases in Council Tax levels, but with an additional smaller increase due to growth in the tax base (mainly due to an increase in the number of dwellings).

In 2007-08 Council Tax was frozen, which is reflected in the data where the net amount billed flattens off between 2007-08 and 2016-17 (Band D Council Tax levels each year are shown in the published Council Tax Datasets). The smaller increases in this period are due to growth in the tax base only, as a result of changes in the number and pattern of use of dwellings, as well as changes in household composition and awarding of Council Tax Benefit/Reduction.

After nine years of the Council Tax freeze, the Scottish Government secured the agreement of local authorities to cap locally determined Council Tax increases to three per cent in cash terms in both 2017-18 and 2018-19. In 2019-20 and 2020-21 Council Tax increases were capped at three per cent in real terms, which was 4.79 per cent and 4.84 per cent respectively in cash terms, and in 2021-22 Council Tax rates were frozen.

In 2022-23, the majority of local authorities increased their Council Tax rates by around three percent. Shetland council froze their rate at 2021-22 levels. In 2023-24, local authorities increased their Council Tax rates by between four and ten per cent.

The increase in net amount billed from 2016-17 reflects increased charges for properties in bands E-H effective from April 2017 and the end of the Council Tax freeze. This pattern is shown in Figure 2.

It should be noted that Figure 1 shows the amount and percentage collected as at 31 March 2024. For earlier years local authorities have had a longer time to collect any late payments. For example, payments relating to the 2012-13 billing year have been collected over the last twelve years whereas for more recent years (particularly the latest year), there has been less time for collection. This is the main reason why the ‘percentage received at 31 March 2024’ data show slightly lower percentages received for more recent years.

This is particularly the case in 2020-21 as collection rates were adversely affected by measures put in place to support Council Taxpayers in dealing with the economic impact of the Covid-19 pandemic. For the earlier years, it is unlikely that much more Council Tax will be collected; hence, for these years, the percentages received are close to final collection rates. Excluding the effect on later years described above, the collection rate for all years tends towards a value of just over 97 per cent.

A line chart showing the net amount of Council Tax billed each year (£ millions) from 1999-00 to the latest year 2023-24.

Contact

Email: lgfstats@gov.scot

There is a problem

Thanks for your feedback