Council Tax Collection Statistics, 2023-24

This statistics publication provides Council Tax collection figures for Scottish local authorities, up to and including the financial year 2023-24.

Council Tax Collection Rates

Figure 3: In-year Council Tax percentage received, by year to which the bill refers by local authority

A table showing in-year Council Tax percentage received, by year to which the bill refers by local authority, from 2020-21 to the latest year 2023-24. This is a demonstration table and the full table showing more years can be found in the accompanying Excel workbook.

Local Authority |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

|---|---|---|---|---|

Scotland |

94.8 |

95.7 |

96.2 |

95.5 |

Aberdeen City |

91.9 |

92.8 |

93.8 |

92.5 |

Aberdeenshire |

95.5 |

96.5 |

96.9 |

96.2 |

Angus |

96.9 |

97.2 |

97.5 |

96.9 |

Argyll and Bute |

96.1 |

96.4 |

96.8 |

96.3 |

City of Edinburgh |

95.7 |

96.7 |

96.9 |

96.1 |

Clackmannanshire |

94.7 |

96.0 |

96.7 |

95.8 |

Dumfries and Galloway |

95.4 |

96.1 |

97.0 |

96.7 |

Dundee City |

93.7 |

95.0 |

95.4 |

94.6 |

East Ayrshire |

93.2 |

95.3 |

95.9 |

95.4 |

East Dunbartonshire |

96.7 |

97.5 |

97.7 |

97.6 |

East Lothian |

95.5 |

97.7 |

97.6 |

96.8 |

East Renfrewshire |

96.4 |

96.8 |

97.6 |

97.5 |

Falkirk |

95.9 |

96.5 |

96.9 |

96.6 |

Fife |

94.4 |

95.3 |

95.8 |

95.2 |

Glasgow City |

92.1 |

93.9 |

94.5 |

93.8 |

Highland |

95.7 |

96.5 |

96.7 |

95.9 |

Inverclyde |

94.4 |

95.6 |

95.9 |

94.7 |

Midlothian |

94.2 |

94.2 |

94.5 |

93.8 |

Moray |

95.8 |

96.7 |

96.9 |

96.2 |

Na h-Eileanan Siar |

95.4 |

96.1 |

96.4 |

95.6 |

North Ayrshire |

92.1 |

93.3 |

94.7 |

93.6 |

North Lanarkshire |

93.3 |

94.6 |

94.9 |

94.1 |

Orkney Islands |

96.3 |

93.8 |

95.5 |

96.5 |

Perth and Kinross |

96.6 |

97.7 |

98.4 |

97.5 |

Renfrewshire |

95.0 |

95.5 |

95.3 |

94.3 |

Scottish Borders |

96.0 |

96.5 |

96.6 |

96.2 |

Shetland Islands |

97.0 |

97.2 |

97.9 |

97.7 |

South Ayrshire |

94.1 |

95.0 |

95.5 |

95.0 |

South Lanarkshire |

95.6 |

96.2 |

97.0 |

96.3 |

Stirling |

97.1 |

97.7 |

97.8 |

97.5 |

West Dunbartonshire |

94.2 |

94.4 |

92.7 |

93.2 |

West Lothian |

96.1 |

96.8 |

97.1 |

96.6 |

Source: Council Tax Receipts Return (CTRR). Figures exclude CTB/CTR and Water and Sewerage Charges but include any Cost of Living payments used to meet individual CT liabilities. They are before any amounts written off for bad or doubtful debt and reflect any correction to liabilities following billing. Figures for 2023-24 are provisional. The accompanying Excel table indicates which Local authorities have reported their collection rates on a 'line by line' accounting basis

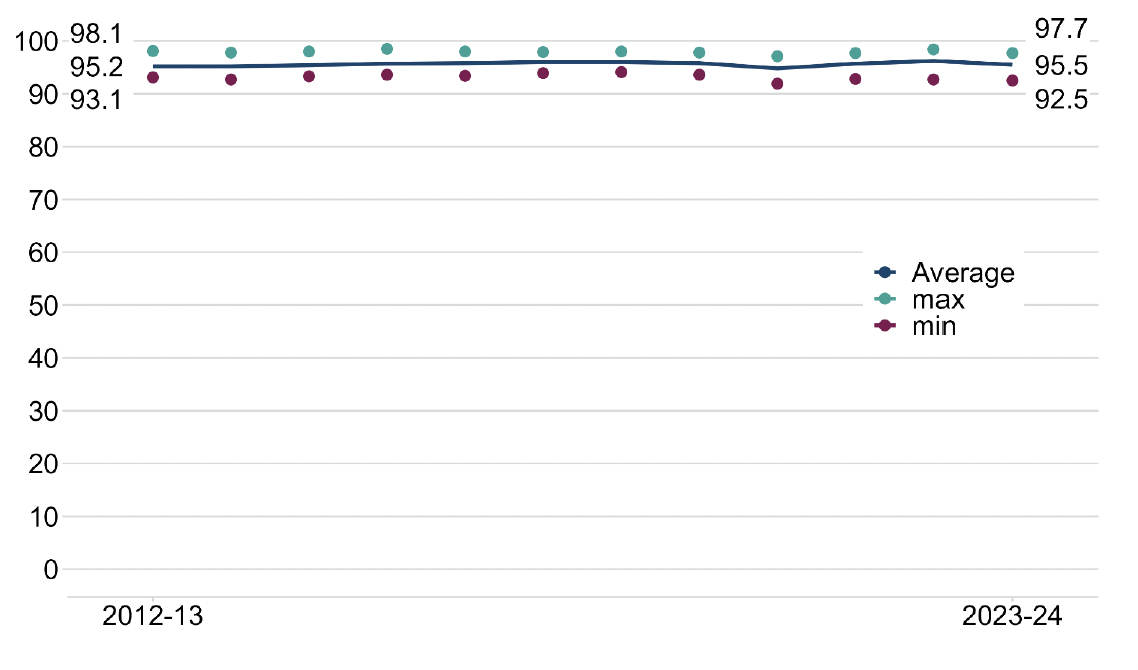

Figure 3 shows the Council Tax in-year collection rates - that is, the amount of Council Tax collected by the end of the relevant billing year, as a percentage of billed Council Tax. In-year collection rates have increased steadily from 87.2 per cent for Scotland as a whole in 1998-99; to 95.1 per cent in 2011-12; to 95.5 per cent in 2023-24. The 2020-21 in-year collection rate (94.8 per cent) was affected by the Covid-19 pandemic as councils suspended debt recovery process and actions to avoid contributing to financial pressure on Council Taxpayers.

The higher collection rate in 2022-23 may be due, in part at least, to the £150 Cost of Living payments made by local authorities that year on behalf of the Scottish Government. For most eligible households, these payments were made as a credit to Council Tax accounts. The longer-term trend may in part be due to local authorities’ more efficient and timely collection methods (for example, increasing use of direct debit and other ‘electronic’ methods). The trends described above are illustrated in Figure 4.

A line chart showing in-year Council Tax percentage received, by year to which the bill refers for Scotland and minimum and maximum, for local authorities. The chart shows the years from 2012-13 to the latest year 2023-24

Figure 5: Percentage of Council Tax received as at 31 March 2024, by year to which the bill refers and local authority

A table showing the percentage of Council Tax received as at 31 March 2024, by year to which the bill refers and local authority. The table shows the years from 2020-21 to the latest year 2023-24. This is a demonstration table and the full table showing more years can be found in the accompanying Excel workbook.

Local Authority |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

|---|---|---|---|---|

Scotland |

96.5 |

96.6 |

96.7 |

95.5 |

Aberdeen City |

95.6 |

95.6 |

95.5 |

92.5 |

Aberdeenshire |

97.7 |

97.7 |

97.6 |

96.2 |

Angus |

98.0 |

97.8 |

97.8 |

96.9 |

Argyll and Bute |

97.8 |

97.7 |

97.6 |

96.3 |

City of Edinburgh |

96.7 |

97.1 |

97.1 |

96.1 |

Clackmannanshire |

96.9 |

96.9 |

97.2 |

95.8 |

Dumfries and Galloway |

97.4 |

97.4 |

97.6 |

96.7 |

Dundee City |

96.0 |

96.4 |

96.3 |

94.6 |

East Ayrshire |

94.9 |

95.7 |

95.9 |

95.4 |

East Dunbartonshire |

98.1 |

98.2 |

98.2 |

97.6 |

East Lothian |

97.4 |

97.6 |

97.7 |

96.8 |

East Renfrewshire |

98.1 |

97.5 |

97.9 |

97.5 |

Falkirk |

97.7 |

97.6 |

97.6 |

96.6 |

Fife |

96.4 |

96.4 |

96.5 |

95.2 |

Glasgow City |

94.3 |

94.9 |

95.0 |

93.8 |

Highland |

97.4 |

97.6 |

97.3 |

95.9 |

Inverclyde |

96.6 |

96.6 |

96.5 |

94.7 |

Midlothian |

96.3 |

96.1 |

95.7 |

93.8 |

Moray |

97.5 |

97.5 |

97.5 |

96.2 |

Na h-Eileanan Siar |

98.0 |

97.9 |

97.5 |

95.6 |

North Ayrshire |

94.5 |

94.6 |

95.1 |

93.6 |

North Lanarkshire |

95.4 |

95.7 |

95.9 |

94.1 |

Orkney Islands |

97.9 |

97.2 |

98.1 |

96.5 |

Perth and Kinross |

97.3 |

97.5 |

98.0 |

97.5 |

Renfrewshire |

95.8 |

95.8 |

95.6 |

94.3 |

Scottish Borders |

97.6 |

97.6 |

97.3 |

96.2 |

Shetland Islands |

98.6 |

98.5 |

98.6 |

97.7 |

South Ayrshire |

95.9 |

95.9 |

96.1 |

95.0 |

South Lanarkshire |

97.2 |

97.1 |

97.5 |

96.3 |

Stirling |

98.6 |

98.6 |

98.6 |

97.5 |

West Dunbartonshire |

90.7 |

91.0 |

92.1 |

93.2 |

West Lothian |

97.0 |

97.1 |

97.2 |

96.6 |

Source: Council Tax Receipts Return (CTRR) All figures are net of discounts (e.g. single person discount), exemptions and surcharges. The figures exclude Council Tax Benefit/Reduction and Water and Sewerage Charges but will include any Cost of Living payments used to meet individual Council Tax liabilities. They are before any amounts written off for bad or doubtful debt and reflect any correction to liabilities following billing.

Figure 5 shows the percentage of Council Tax for specific billing years, received by 31 March 2024. For 2023-24 this is the same as the in-year collection rate but, for other years, this includes late payments collected and adjustments to previous years bills in years after the billing year. For the earlier years, it is unlikely that much more Council Tax will be collected - hence, for these years, the percentages received are converging towards final collection rates. Previous research has indicated that deprivation is linked to non-payment of Council Tax and this is likely to be a factor in variations between local authorities of these near-final collection rates for earlier years.

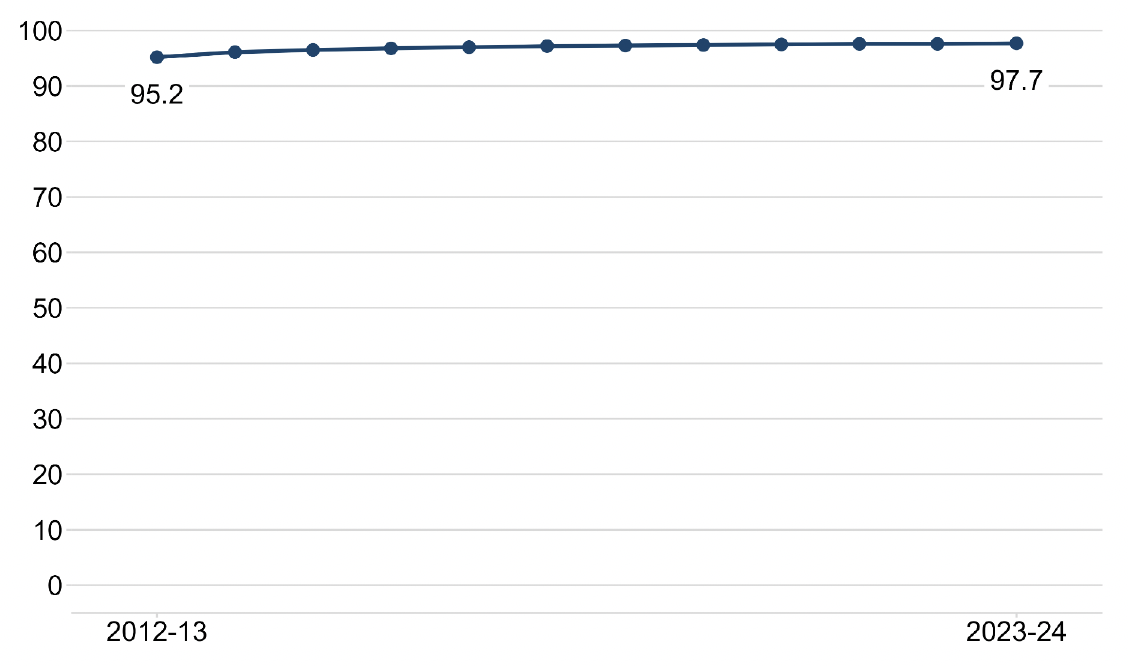

Figure 7 gives a further representation of improvements in the in-year collection rate over the last decade, from 95.2 per cent for Scotland as a whole in 2012-13 to 96.0 per cent or just under in the years 2015-16 to 2021-22 (with the exception of 2020-21, as a result of the effects of the Covid-19 pandemic). The 2022-23 collection rate was affected as eligible households received £150 Cost of Living payment to reduce their Council Tax liability. The 2023-24 collection rate is 95.5 per cent.

Correspondingly, the percentages of Council Tax being collected after each billing year tends to fall, for example from 1.3 per cent for the 2019-20 billing year to 0.5 per cent for the 2022-23 billing year. This pattern is a direct consequence of two factors – there is less Council Tax still left to collect, and less time has elapsed to collect it in.

Figure 8 shows an alternative presentation of in-year and subsequent collection rates. The upper diagonal shows the in-year collection rate for Scotland as a whole and the table should be read by selecting a column and reading downwards. For example, for billing year 2020-21 (the left-most column of figures) the in-year collection rate was 94.8 per cent. By the end of the next year (2021-22), the collection rate had risen to 95.8 per cent. It had risen to 96.2 per cent by the end of 2022-23 and it was up to 96.5 in 2023-24. A longer pattern is shown, for the year 2012-13, in Figure 6.

Taking these collection rates together, the overall pattern for Scotland is:

- The in-year collection is now over 95 per cent, with the exception of 2020-21 when the collection rate dipped below 95 per cent due to being adversely impacted by measures put in place to support Council Taxpayers during the Covid-19 pandemic.

- A further 0.5 per cent or so is collected in the following year.

- ‘Final’ collection rate can reasonably be expected to exceed 97 per cent.

A line chart showing the 2012-13 Council Tax percentage received as at 31 March each year, from the year 2012-13 to the latest year 2023-24

Figure 7: In-year Council Tax percentage received and total Council Tax percentage received as at 31 March 2024, by year to which the bill refers

A table showing in-year Council Tax percentage received and total Council Tax percentage received as at 31 March 2024, by year to which the bill refers. The table shows the years from 2019-20 to the latest year 2023-24. This is a demonstration table and the full table can be found in the accompanying Excel workbook.

Local Authority |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

|---|---|---|---|---|---|

Percentage collected in billing year |

95.8 |

94.8 |

95.7 |

96.2 |

95.5 |

Percentage collected after billing year |

1.3 |

1.7 |

0.9 |

0.5 |

0.0 |

Percentage received as at 31 March 2024 |

97.1 |

96.5 |

96.6 |

96.7 |

95.5 |

Source: Council Tax Receipts Return (CTRR). All figures are net of discounts (e.g. single person discount), exemptions and surcharges. The figures exclude Council Tax Benefit/Reduction and Water and Sewerage Charges but will include any Cost of Living payments used to meet individual Council Tax liabilities. They are before any amounts written off for bad or doubtful debt and reflect any correction to liabilities following billing

Figure 8: Percentage of Council Tax received as at 31 March each year, by year to which the bill refers

A table showing the Percentage of Council Tax received as at 31 March each year, by year to which the bill refers. The table shows the years from 2020-21 to the latest year 2023-24. This is a demonstration table and the full table can be found in the accompanying Excel workbook.

n/a |

Year |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

|---|---|---|---|---|---|

Percentage |

2020-21 |

94.8 |

n/a |

n/a |

n/a |

Received |

2021-22 |

95.8 |

95.7 |

n/a |

n/a |

At year end |

2022-23 |

96.2 |

96.3 |

96.2 |

n/a |

(31 March) |

2023-24 |

96.5 |

96.6 |

96.7 |

95.5 |

Source: Council Tax Receipts Return (CTRR). All figures are net of discounts (e.g. single person discount), exemptions and surcharges. The figures exclude Council Tax Benefit/Reduction and Water and Sewerage Charges but will include any Cost of Living payments used to meet individual Council Tax liabilities. They are before any amounts written off for bad or doubtful debt and reflect any correction to liabilities following billing.

Contact

Email: lgfstats@gov.scot

There is a problem

Thanks for your feedback