Council Tax Reduction in Scotland: 2021-2022

Council Tax Reduction (CTR) awarded by age, household structure, income sources and employment status, deprivation index, and Council Tax band in the financial year from April 2021 to March 2022. It makes references to the previously published March 2021 for comparative purposes.

Council Tax Reduction in Scotland, 2021-22

(Published 21 June 2022)

This publication provides statistics on the Council Tax Reduction (CTR) scheme, which reduces the Council Tax (CT) liability of lower income households in Scotland. A Council Tax Reduction 'recipient' can be a single person or a couple, with or without children, since Council Tax is charged on a per-dwelling basis, rather than to individuals.

The statistics are based on monthly data extracts from local authorities, and cover the time period April 2021 to March 2022. This publication therefore covers the period when the Coronavirus (Covid-19) pandemic was ongoing and makes references to the previously published March 2021 statistics for comparative purposes.

Key Points

- There were 462,670 Council Tax Reduction recipients in Scotland in March 2022, a decrease of 7 per cent from 496,580 in March 2021. These recipients live in almost one‑fifth of the chargeable dwellings.

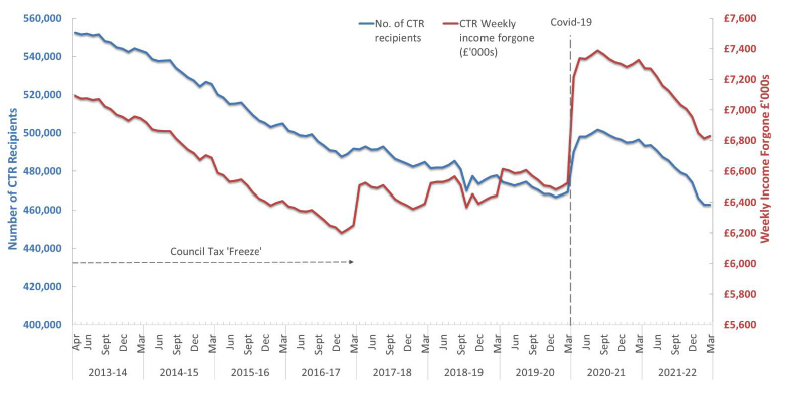

- From the introduction of the CTR scheme in April 2013 to March 2020, the number of Council Tax Reduction recipients in Scotland gradually decreased. However there were large rises in caseload in 2020 due to the initial economic impact of Covid-19 before continuing its gradual decrease to March 2022. The number of CTR recipients was 16 per cent (89,710 recipients) lower in March 2022 than when the scheme began. Council Tax and Council Tax Reduction reforms, alongside increases in Council Tax since April 2017 (excluding 2021 where there was a council tax freeze), have also resulted in increases in the total weekly Council Tax Reduction awarded.

- As shown in Chart 1, the total number of CTR recipients in Scotland decreased over the course of 2021-22 with the largest decrease of 1.7 per cent observed in January 2022 compared to the previous month. The total number of CTR recipients in Scotland increased marginally to 462,670 in March 2022 which halts the downward trend observed in the previous nine months but still means the number of CTR recipients is only slightly above the lowest level ever recorded, which occurred in February 2022. This is likely driven by economic and employment conditions recovering after the pandemic.

- The weekly income forgone by local authorities due to the Council Tax Reduction scheme was £6.829 million in March 2022, compared to £7.328 million in March 2021.

- The provisional income forgone on Council Tax Reduction in Scotland in 2021-22 was £358.8 million.

- On average, CTR recipients saved over £750 a year on Council Tax as at March 2022.

- Of all Council Tax Reduction recipients in March 2022:

- 58 per cent (265,810 recipients) were in one of the 30 per cent most deprived areas in Scotland compared to 57 per cent in March 2021;

- 36 per cent (165,820 recipients) were aged 65 or over compared to 34 per cent in March 2021; and

- 16 per cent (72,710 recipients) were lone parents, the same as in March 2021.

Changes in Council Tax and CTR changes since 1 April 2017

Chart 1 also shows the impact the following changes have had on the Council Tax Reduction scheme:

- The end of the Council Tax "freeze" which can be seen with the increase in Council Tax income forgone due to CTR in April annually since 2017 (excluding 2021);

- The continued roll out of Universal Credit (UC).

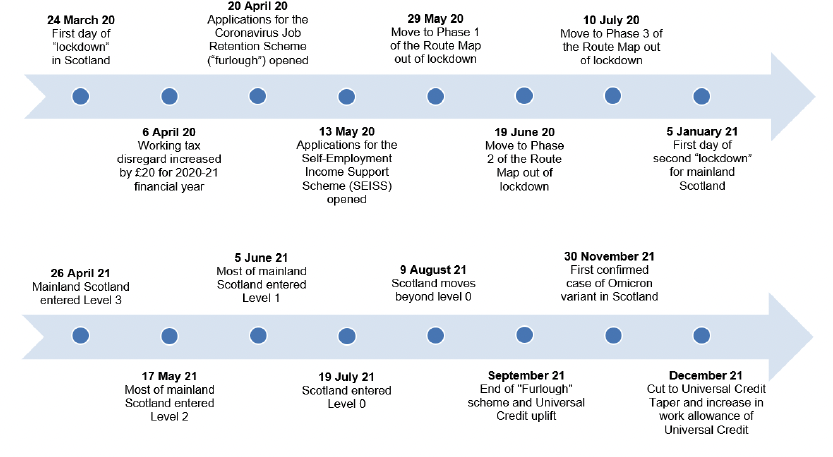

The figures reported in this publication should be viewed in light of the economic impacts of the Covid-19 pandemic. Some of the wider UK policy interventions introduced can be seen from the timeline in Figure 1. More information can be found on the Coronavirus in Scotland webpage.

Contact

Email: eddie.chan@gov.scot

There is a problem

Thanks for your feedback