Scottish Budget 2024 to 2025: distributional analysis

Analysis of the impact on household incomes of tax and social security decisions taken in the 2024-25 Scottish Budget.

Part One: overall impact of the tax and social security system

The tax and social security system in Scotland is progressive – the higher a household's income, the greater the share of their income they pay in tax. This enables redistribution of income from higher income to lower income households, both in the form of direct payments – the focus of this analysis – and the funding of public services.

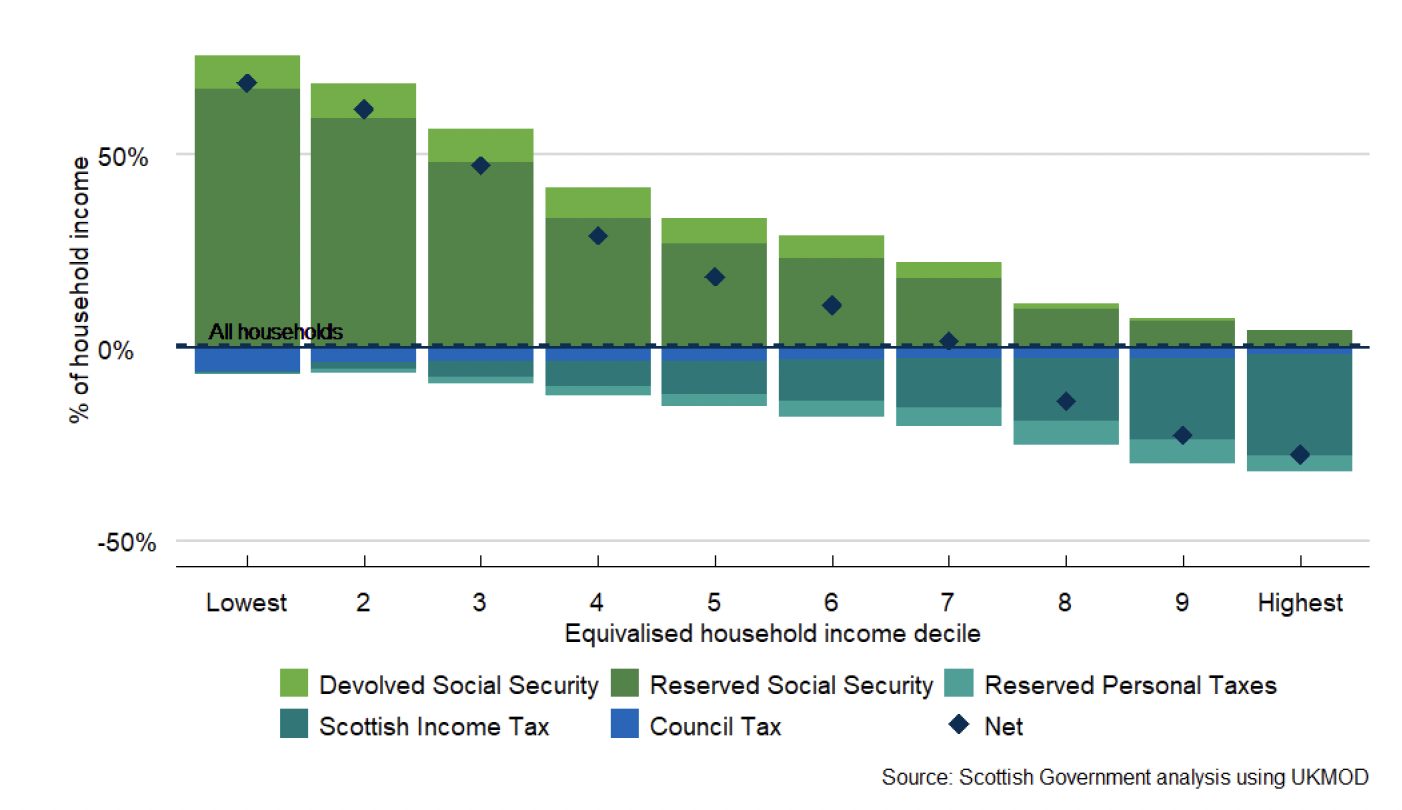

Figure 1 shows this through the total impact of personal taxes and social security payments in 2024-25 on household incomes. It includes both devolved taxes (Scottish Income Tax and Council Tax), reserved taxes (National Insurance Contributions and Income Tax on savings and dividends), and devolved and reserved social security payments.

As Figure 1 shows, the impact of Scottish Income Tax on households increases with household income. The benefits of social security payments are greatest for the lowest income households, although the bulk of these – notably Universal Credit and the State Pension – remain reserved to the UK Government. Council Tax (after accounting for the impact of the Council Tax reduction scheme and Council Tax discounts) has a proportionally greater impact on lower income households, with higher income households paying a lower share of their income. Nevertheless, the tax and social security system as a whole remains progressive and (on average) the seven lowest income deciles receive a net benefit.

The average impact of the tax and social security system across all households (shown as a horizontal line on the chart) is close to zero. However, this need not be the case, and it is important to note that the taxes included in this analysis do not directly or exclusively fund the social security payments shown.

This analysis excludes significant sources of spending which benefit all households – such as health, education and transport – and significant sources of tax revenue not levied directly on households, such as VAT and corporation tax. Whether the average household receives a net benefit from social security payments and personal taxes will depend on both UK Government and Scottish Government decisions on the balance between social security and other types of spending; and between direct personal taxes, and other forms of taxation.

Differences between Scotland and the rest of the UK

Since further powers over some taxes and social security payments were devolved to the Scottish Parliament in 2016, there has been increased divergence between the tax and social security systems in Scotland and the rest of the UK.

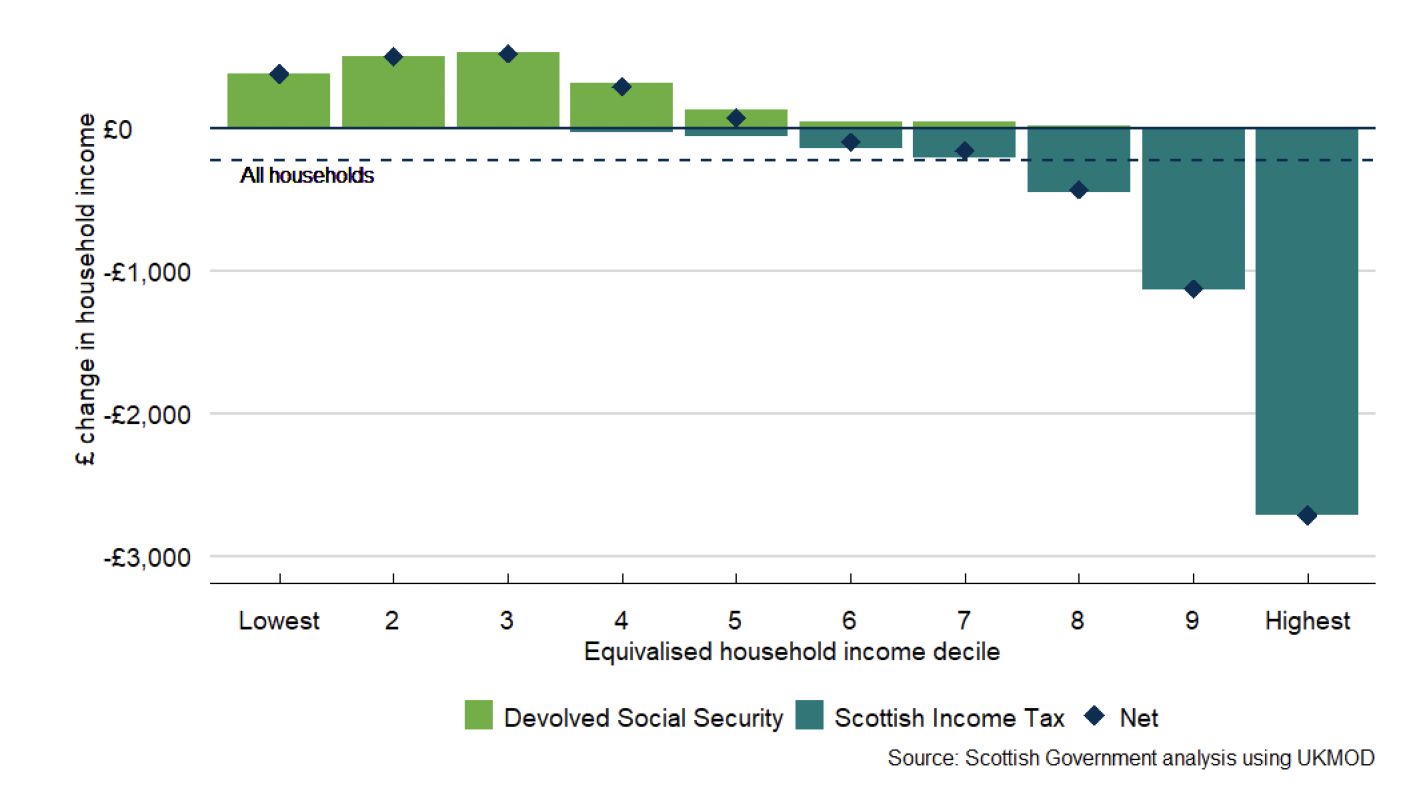

Figures 2 and 3 below show how Scotland's tax and social security system compares to the system currently in place in the rest of the UK, including the impact of policy changes announced in the 2024-25 Scottish Budget.[3] The charts show the impact as a share of net household income and in cash terms, respectively.

As a result of divergence between Scottish and UK Government policies, on average, the lowest earning five deciles are better off in Scotland than in the rest of the UK. The Scottish Child Payment is the largest single contributor to the improved financial resources of low-income households relative to the rest of the UK, while the impact on higher income households is driven by the introduction of – as of 2024-25 – a six band Income Tax system in Scotland that levies higher rates of Income Tax on higher incomes, with slightly lower rates on those earning less than £28,850.

Taking changes to the tax and social security system together, 58% of households are better off under the Scottish system than in rUK, with the majority of these in the bottom half of the income distribution.

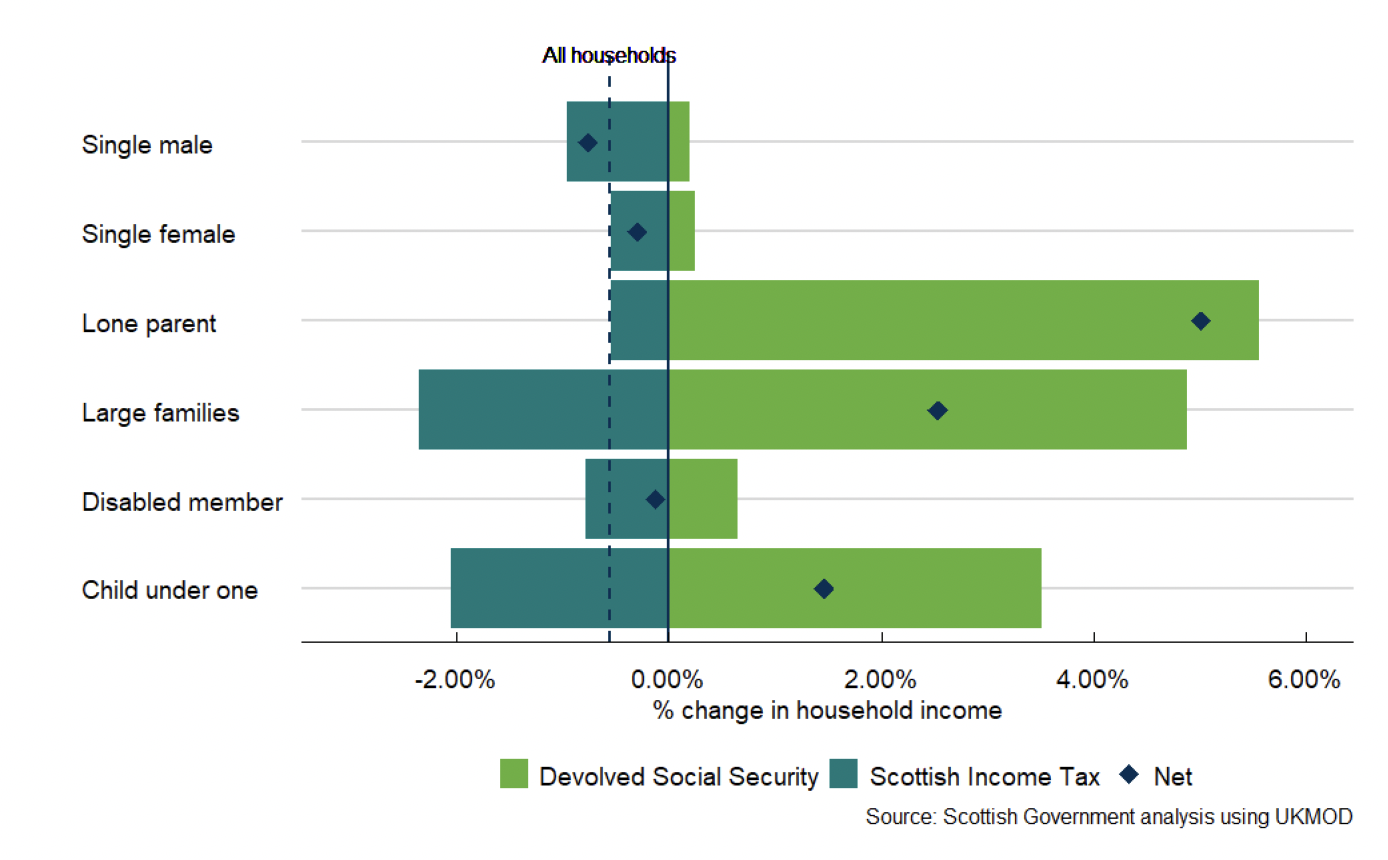

In addition to considering the impact across the income distribution, we can also consider the impact of policy changes on specific household types. Figure 4 shows the difference between Scotland and the rest of the UK's policies on tax and social security by six household types. These household types have been selected with reference to protected characteristics as defined in the Equalities Act 2010, and the priority household types used in Scottish child poverty analysis.[4]

Again, largely driven by the Scottish Child Payment, households with children generally see the greatest benefit relative to their income.

The impacts of differences between the tax and social security systems also vary by age. Figure 5 below shows the impact of differences based on the age of the household reference person.[6]

Figure 5 shows that the impact of differences in income tax policy is greatest in the middle age cohorts (those aged 35 to 54) where average incomes are highest. In older age cohorts, increasing numbers of workers retire or reduce their working hours, causing average incomes to fall. The impact of differences in social security payments is greatest in younger age cohorts, again due to the impact of the Scottish Child Payment.

Contact

Email: angus.hawkins@gov.scot

There is a problem

Thanks for your feedback