Fair Work First - conditionality in public sector grants: business and regulatory impact assessment

This business and regulatory impact assessment (BRIA) builds on the BRIA of the refreshed Fair Work action plan and anti-racist employment strategy (April 2023) which considered the impacts of Fair Work First (FWF) conditionality alongside the other actions in the action plan and strategy. This further BRIA looks at the impacts of FWF.

2. Purpose and Intended Effect

This Business and Regulatory Impact Assessment (BRIA) of FWF conditionality in public sector grants assesses the impact on businesses of the requirement to:

- pay apprentices and 16-17 year old workers at least the rLW; and,

- provide effective workers’ voice.

This BRIA builds on the BRIA of the refreshed Fair Work Action Plan and Anti-Racist Employment Strategy (April 2023) which considered the impacts of FWF conditionality alongside the other actions in the action plan and strategy. This further BRIA has been conducted to better understand and articulate the impacts of FWF l and focuses on issues arising during the early implementation phase of the policy, as follows:

- the affordability of meeting the rLW condition for apprentices and 16-17 year old workers, including the knock-on effect of maintaining appropriate grade/band wage differentials if uplifting lowest paid workers to the rLW;

- the risk of a reduction in the number of apprenticeship opportunities and opportunities for young workers;

- the additional administrative burden on organisations in requesting an exception to meeting the rLW condition;

- confusion regarding the definition of effective voice ;

- the administrative burden on organisations in providing evidence of effective voice to meet the condition and for this to be verified by a worker representative;

- concern that the evidence and verification process for FWF conditionality was being used to drive wider employment/industrial relations issues and issues that might be considered a part of the wider fair work agenda but that lay outwith the scope of FWF.

The BRIA also supports Ministers’ commitment to reviewing, after the first year of FWF conditionality implementation and as part of ongoing policy development, the number of agreed exceptions to the rLW condition and the reasons for them.

2.1 Background

This section outlines the objective of our Fair Work policy and the current situation and policy framework.. It sets out the FWF approach, including conditionality; information on the rLW, minimum apprenticeship pay and effective workers’ voice; and provides an overview of the issues raised by stakeholders in the initial implementation period of FWF conditionality. An overview of the labour market is at Annex A.

2.1.1 Objective of the Fair Work Policy

Our vision has been for Scotland to be a leading Fair Work Nation by 2025, where Fair Work drives success, wellbeing and prosperity for individuals, organisations and society. The Scottish Government shares this vision with the Fair Work Convention, the independent body which advises government on Fair Work, and whose Fair Work Framework underpins Scotland’s Fair Work policy.

Allied to this, Scotland is leading the way in creating a wellbeing economy; delivering sustainable and inclusive growth for the people of Scotland.

Importance of Fair Work

How workers experience work has implications beyond the workplace and throughout life. Fair Work means increased financial security, better physical health and mental wellbeing. It means equal opportunities at work, including to learn, develop and progress, and to enjoy a culture and environment free of bullying and discrimination, helping people live more fulfilling lives. We know that the best decisions for workers and employers are those made collaboratively. We know that jobs providing security of work, hours and income, reduce inequality. They enable people to exercise choice and control over their lives and reduce stress. More than this, Fair Work will mean different things to different people at different points in their working lives. As labour market and workplace needs evolve, everyone should continue to be able to get and keep a good job and progress in their career and provide the foundation for a secure and satisfying retirement.

Fair Work is also a model for innovation and success, with many employers in Scotland already implementing Fair Work practices, providing safe and secure working environments and promoting positive workplace cultures where staff are engaged and have their voices heard. Evidence makes clear that employers will reap the benefits of a fairly rewarded, respected, engaged, committed, diverse and more agile workforce, through improved recruitment and retention, performance, innovation and productivity. Ensuring workers feel valued, respected and supported can improve wellbeing and help an organisation become an employer of choice. Fair Work supports a more committed, better skilled and adaptable workforce who can spot challenges and opportunities, solve problems, offer insight and ideas for improvement, therefore creating real value. This will be particularly important as we make the changes required to transition to a net-zero carbon economy, ensuring that change is fair for Scotland’s workforce.

Achieving our Fair Work vision has benefits for us all but relies on leadership and support from right across our economy, and particularly from the public sector which as a significant employer and administrators of funding has a key role to play in demonstrating the standards the Scottish Government wants to see that will make a positive difference to people and the economy.

2.1.2 Fair Work First Approach

Introduced in 2019-20 as part of the Scottish Government’s broader Fair Work policy, FWF is the government’s flagship policy for driving high quality and fair work, and workforce diversity and inclusion across the labour market in Scotland by applying FWF criteria to public sector grants (described as discretionary grants), other funding and public contracts. Through this policy, recipients of grants and other funding and suppliers have been encouraged to adopt specific Fair Work criteria which seek to address particular labour market challenges. The policy has been implemented across the public sector in Scotland through an incremental approach and in 2021 the FWF criteria were expanded to help address labour market issues that emerged during the pandemic (* below indicates the new criteria added in 2021). Fair Work First Guidance is available to support those support those seeking/awarding public sector grants.

The FWF criteria, at the time of undertaking the BRIA, are:

- payment of at least the real Living Wage;

- provide appropriate channels for effective workers’ voice, such as trade union recognition;

- investment in workforce development;

- no inappropriate use of zero hours contracts;

- action to tackle the gender pay gap and create a more diverse and inclusive workplace[1];

- *offer flexible and family friendly working practices for all workers from day one of employment; and,

- *oppose the use of fire and rehire practice.

FWF leverage public sector funding to influence employer behaviour, aiming to improve workplace standards to at least a minimum standard across the FWF criteria. It contributes to the goals of growing the economy, eradicating child poverty, and ensuring high quality and sustainable public services, specifically by linking Fair Work outcomes to large amounts of government expenditure. This is a key aspect of the Scottish Government’s broader, more aspirational, Fair Work agenda and it is hoped that this can provide a catalyst for employers to embark or progress on a longer term Fair Work journey as part of their organisation’s continuous improvement

The Scottish Government has a limited budget and chooses to target public sector support via grants, which are ultimately funded by taxpayers, to deliver public good in line with Ministerial priorities. Part of that public good is FWF which intends, among other things, to improve the lives of people in Scotland. FWF seeks to deliver Ministers’ expectation that those employers who are committed to providing Fair Work, while adhering to FWF criteria, will be able to access grants, other funding and contracts while those who are unable or unwilling to make such a commitment may not.

2.1.3 Fair Work First Conditionality

t, The policy was further strengthened from 1 July 2023 with the introduction of FWF conditionality in public sector grants. As a result, recipients of public sector grants awarded on or after this date are required to pay at least the rLW and provide appropriate channels for effective worker voice in order to access grant funding. Recipients continue to be encouraged to commit to working towards the remaining five FWF criteria (see bullets above).

FWF does not apply to non-discretionary funding, such as grant-in-aid funding to public bodies, or to local government general revenue funding. Nor does it apply to emergency grants, such as those awarded to help mitigate the impacts of the COVID19 pandemic, or to alleviate negative effects of other UK government-mandated actions.

FWF in public procurement differs from the application of FWF in grants and Guidance on Fair Work First in public procurement exercises is available from Procurement Reform (Scotland) Act 2014: statutory guidance and Best Practice Guidance.

The introduction of rLW and effective voice conditionality clearly signal that the Scottish Government is using FWF to increase workers’ wages – prioritising low pay workers – and to ensure workers have an effective voice. FWF recognises that meeting the rLW conditionality in a public sector grant will bring an additional cost to those organisations paying their workers below the rLW. It also recognises that organisations do not need to apply for public sector grants and that they can choose whether to accept a grant or not. If an organisation determines that the cost outweighs the benefit, it may decide not to seek a grant

The scope for FWF conditionality, at the time of undertaking the BRIA, is set out below.[2]

Payment of at least the rLW

- In general, a grant recipient must demonstrate it is paying at least the rLW before it can access a grant.

- All staff who are directly employed by the grant recipient and work in Scotland must be paid at least the rLW. This applies to all directly employed staff aged 16 and over, including apprentices.

- In addition, all workers who are directly engaged in delivering the grant funded activity, even those not directly employed by the grant recipient such as sub-contractors and agency staff, must also be paid at least the rLW. This applies to workers aged 16 and over, including apprentices, who are based anywhere in the UK, not just those who work in Scotland.

- Funders may apply limited exceptions to meeting the rLW condition where the potential grant recipient genuinely cannot afford to pay the rLW to part(s) or all of its workforce. A limited exception should be considered in the first instance for targeted parts of the workforce while continuing to require payment of at least the rLW to the rest of the workforce.

Provide appropriate channels for effective workers’ voice

- All grant recipients with a workforce must be able to demonstrate, before they can access a grant, that all workers employed within that organisation have access to effective voice channel(s), including agency workers.

- Voice exists at both collective and individual levels and organisations will be expected to show how genuine and effective voice is evidenced. For organisations of fewer than 21 employees, only individual voice must be evidenced, however the collective element is still encouraged.

- Funders may apply flexibility to recognise the different forms of voice that are appropriate for different organisations. Fair Work First Guidance provides examples of how effective voice can be evidenced.

Potential grant recipients are required to provide evidence to the relevant funder that they are meeting the FWF conditions. The FWF Guidance sets out appropriate forms of evidence for each condition.

2.1.4 Real Living Wage

Background

The rLW refers to the hourly pay rate calculated annually by the Resolution Foundation and overseen by the Living Wage Commission, and is the only UK wage rate based on, and designed to reflect the cost of living through a calculation based on the prices of goods and services[3]. It is a voluntary rate which applies to people aged 18 and over, excluding apprentices. FWF conditionality goes beyond this as it requires that grant recipients pay at least the rLW to apprentices and 16-17 year old workers.

The rLW rate is updated annually in October and adjusted for inflation.. It applies immediately but accredited Living Wage employers have until 1 May of the following year to implement the new rate. The rLW rate for 2022-23 was £10.90 per hour (£11.95 per hour in London); the rate for 2023-24, announced in October 2023, is £12 per hour (£13.15 per hour in London); and, the rate for 2024-25, announced in October 2024 is £12.60 per hour (£13.85 per hour in London). The rLW rate is applicable to grants awarded during the period the BRIA was undertaken were therefore £10.90 for grants awarded between 1 July 2023 and 24 October 2023 and £12 for those awarded between 25 October 2023 and 31 March 2024.

UK National Minimum Wage Rates

Currently the UK Government sets the national minimum wage rates based on recommendations from the Low Pay Commission (LPC). The LPC has a remit to recommend a wage rate consistent with reaching a target rate equal to two-thirds of median hourly earnings by October 2024[4]. Details of the UK Government’s National Living Wage rates for 2023, 2024 and 2025 are provided in Table 1 below, and for comparison, the rLW rate for these periods is also provided. With the exception of the rLW, these rates apply across all parts of the UK and are enforced in law.

| Year | National Living Wage (NLW) | Adult | Youth development (18-20) | Under 18 | Apprentice | RLW[6] |

|---|---|---|---|---|---|---|

| April 2023 | £10.42 (23+) | £10.18 (21-22) | £7.49 | £5.28 | £5.28 | £10.90 (from Oct 22) |

| April 2024 | £11.44 (21+) | See NLW | £8.60 | £6.40 | £6.40 | £12.00 (from Oct 23) |

| April 2025 | £12.21 (21+) | See NLW | £10.00 | £7.55 | £7.55 | £12.60 (from Oct 24) |

Source: UK Government, National minimum wage and national living wage rates;

Living Wage Foundation, What is the real Living Wage?

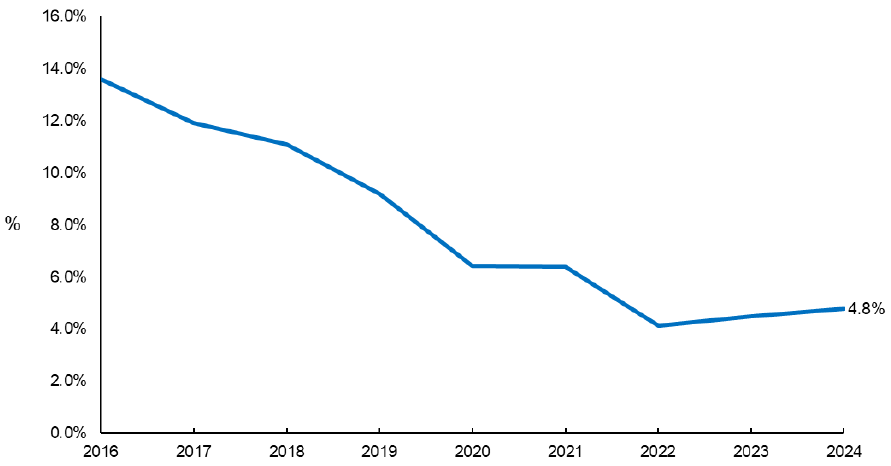

The NLW and rLW have been converging over time, with the gap between the rLW and the NLW decreasing from 13.6% in 2016 to 4.8% in 2024, see Chart 1. Following the UK government’s announcement of the April 2025 NLW rate, the gap will decrease further to 4.0%.

Source: UK Government, National minimum wage and national living wage rates;

Living Wage Foundation, What is the real Living Wage?

Living Wage Employer Accreditation

The rLW rate is part of the Living Wage Employer Accreditation scheme run by the Living Wage Foundation and delivered in Scotland by Living Wage Scotland, through funding support from the Scottish Government. This is a voluntary scheme, which employers are encouraged to sign up to. It covers all workers aged 18 and over. Apprentices and 16-17 year old workers are not included as criteria for the scheme, therefore, accredited employers can pay the minimum rates set for these groups. This may be the statutory rate set by the UK Government or the rate agreed jointly by the relevant trade body and trade union/s for the sector. More information on the application of rLW in Scotland can be found here. Detail on how the rate is calculated can be found here.

2.1.5 Minimum Apprentice Pay

Subject to the statutory minimum wage described below, apprenticeship pay is negotiated with employers.

In 2023/24 Apprentices were entitled to the statutory minimum wage of £6.40 per hour if aged under 19 or 21 and over and are in the first year of their apprenticeship. Those aged 19 or over who have passed their first year of apprenticeship are entitled to the minimum wage for their age (as set out in Table 1: Minimum wage rates).

Table 2 below sets out the rates apprentices are entitled to under UK employment law; this is compared with the current rLW rate of £12.60. Table 3 and Table 4 provide the published statistics for 2022/23 and 2023/24 by age group of Modern Apprenticeship starts, and the number of Modern Apprenticeships in training respectively. Approximately 13,000 employers offer Modern Apprenticeships in Scotland, with around 12% of employers supporting at least one apprentice[7].

| Apprentice age | April 2023 to March 2024 | April 2024 to March 2025 |

|---|---|---|

| Under 19 | £5.28 | £6.40 |

| 19 or over and in the first year of their apprenticeship | £5.28 | £6.40 |

| 19 or over and have completed the first year of their apprenticeship | Relevant minimum wage for their age:

|

Relevant minimum wage for their age:

|

Source: UK government, National minimum wage and national living wage rates, 2024

| Age Group | MA Starts in 2022/23 | Percentage | MA Starts in 2023/24 | Percentage |

|---|---|---|---|---|

| 16-19 | 9,836 | 38.7% | 10,130 | 39.9% |

| 20-24 | 5,156 | 20.3% | 5,001 | 19.7% |

| 25+ | 10,455 | 41.1% | 10,234 | 40.3% |

| Total | 25,447 | 25,365 |

Sources: Skills Development Scotland (2023) Modern Apprenticeship Statistics, up to the end of Q4 2022/23 (skillsdevelopmentscotland.co.uk)

Skills Development Scotland (2024) Modern Apprenticeship Statistics, up to the end of Q4 2023/24

| Age group | MA in training 2022/23 | Percentage | MA in training 2022/23 | Percentage |

|---|---|---|---|---|

| 16-19 | 19,158 | 49.1% | 19,413 | 50.3% |

| 20-24 | 7,713 | 19.8% | 7,592 | 19.7% |

| 25+ | 12,135 | 31.1% | 11,602 | 30.0% |

| Total | 39,006 | 38,607 |

Source: Skills Development Scotland (2024) Modern Apprenticeship Statistics, up to the end of Q4 2023/24

Some apprentices are paid above the statutory minimum rates. Pay rates for certain trade apprenticeships are negotiated between trade associations and trade unions. An illustrative example showing Scottish and Northern Ireland Joint Industry Board for the Plumbing, Heating and Mechanical Engineering Industry (SNIJIB) pay rates for apprentices is included in Table 5 below. Rates rise from £6.40 to £10.39 through the four years of a typical apprenticeship, with £6.40 being equivalent to the National Minimum Wage rate for apprentices as of 1 April 2024.

| Apprentice Stage | Hourly rate of pay |

|---|---|

| 1st Year Apprentice | £6.40 |

| 2nd Year Apprentice | £6.84 |

| 3rd Year Apprentice | £8.17 |

| 4th Year Apprentice | £10.39 |

Source: Scottish and Northern Ireland Joint Industry Board for the Plumbing, Heating and Mechanical Engineering Industry (2024). SNIJIB graded wage rates 2024/2025

However, if the applicable National Minimum or National Living Wage rate is higher than the agreed association apprentice rate, the National Minimum or National Living Wage rate must be paid. For example, a 22-year old apprentice in their second year would be entitled to the National Living Wage rate for their age (£11.44, effective from 1 April 2024) rather than the SNIJIB rate of £10.39.

Apprentice pay rates can also vary depending on whether the training is in college or the in the workplace. An example from the Scottish Joint Industry Board for the Electrical Contracting Industry (SJIB) is given in Table 6, showing the difference in pay rate for apprentice electricians based on where there learning is taking place.

| Apprentice stage | At work | At college |

|---|---|---|

| Stage 1 | £6.40 | £6.40 |

| Stage 2 | £8.60 | £8.60 |

| Stage 3 | £10.87 | £10.18 |

| Stage 3: FICA | £12.42 | £11.65 |

Source: Scottish Joint Industry Board (2024) SJIB National Rates & Allowances 2024

2.1.5 Effective Voice

Background

Effective voice - extends beyond working practices and can exist at both individual and collective levels, enabling workers to express their opinions, concerns and suggestions, and to influence decisions at work through direct and indirect involvement and participation. It requires a safe environment where dialogue and challenge are dealt with constructively and where workers’ views are sought out, listened to and can make a difference. Effective voice is also more than a channel of communication available within workplaces: it requires workers, their representatives and employers to work in partnership to make sure the right decisions are made to ensure workers are treated fairly and equitably.

Effective voice is fundamental to Fair Work and is key to delivering all dimensions of Fair Work effectively. While FWF recognises different forms of voice will exist at individual and collective levels, trade union access and recognition are promoted as part of this policy as it is recognised that they can ensure a strong collective voice for workers.

2.2 Objective of Fair Work First Conditionality

Introduction of Conditionality in Public Sector Grants

The introduction of FWF conditionality in public sector grants strengthens the Scottish Government’s FWF policy by using its funding levers to drive key aspects of Fair Work - making it a requirement for grant recipients to meet rLW and effective workers’ voice conditions in order to access grant funding. The policy is intended to have an impact on grant recipients and has been deliberately designed to raise wages for low pay workers and improve the voice of workers in Scotland, which it is hoped can provide a catalyst for employers to embark or progress on a broader and more aspirational Fair Work journey as part of their organisation’s continuous improvement.

Real Living Wage

The focus on requiring grant recipients to pay their workforce at least the rLW rate is designed to support a decent standard of living and help reduce the level of in-work poverty across Scotland. It is the only UK wage rate based on and designed to reflect the cost of living. As such, the Scottish Government has long championed for it as a key mechanism for driving fair pay in Scottish workplaces. Furthermore, research shows the rLW can enhance productivity, reduce absenteeism and improve staff morale.[11]

In relation to including apprentices and 16-17 year old workers in scope of the rLW conditionality. The policy intent is to improve pay for apprentices at any age and young people aged 16-17, not least due to the low rate of the UK Government’s Apprentice National Minimum Wage.

It was understood that not all organisations would be able to meet the rLW condition at the outset of the policy being introduced, not least due to the challenges many employers particularly small businesses, faced due to the rising cost of doing business. However, the cost of living crisis is exactly why Fair Work, including fair pay is more important than ever.

In recognition of these financial challenges and to ensure the policy remains proportionate, the policy design for FWF conditionality includes the scope for a limited exception to meeting the rLW condition to be agreed on grounds of affordability. Therefore, it is appropriate for grant funders to use the provision for a limited exception where a potential grant recipient genuinely cannot afford to pay at least the rLW to all or parts of its workforce and so would be unable to accept the standard grant conditions regarding payment of the rLW.

Effective Voice

The focus on requiring grant recipients to provide appropriate voice channels through which their workforce can influence their job, role and related pay and terms and conditions as well as the wider work of their organisation is designed to drive higher workplace standards which, in turn, can help improve the organisation’s productivity level.

While many larger organisations, especially in the public sector have long established collective bargaining arrangements and should, in theory, be able to easily evidence collective voice. It is important to evidence that individual voice channels are also in existence to deliver a fully effective voice in the workplace.

By contrast, smaller organisations are less likely to be unionised or to have voice channels in place at both individual and collective levels, and as such terms and conditions and working practices can be less favourable. Establishing an effective voice in these smaller organisations will benefit workers and ultimately, productivity levels. It is accepted that some smaller organisations (with fewer than 21 workers) may find establishing and evidencing collective voice to be particularly challenging, and FWF conditionality offers flexibility for such organisations to only evidence individual voice where this is the case.

2.3 Rationale for Government Intervention through Conditionality

Fair Work sits at the heart of Scotland’s National Performance Framework and links clearly to the United Nation’s Sustainable Development Goals. It is an important aspect of the Scottish Government’s National Strategy for Economic Transformation.

Power over employment law is reserved to the UK Parliament. This includes power to set minimum wage rates and over industrial relations. While employment law remains reserved, the Scottish Government has no executive role, locus or legislative powers in this space so is committed to use non-legislative means to deliver our Fair Work policy to promote fairer work practices across the labour market in Scotland. This includes through the strengthening of our FWF approach by applying FWF conditionality to public sector grants.

The Scottish Government believes that public sector funding should leverager in wider societal benefits, such as the promotion of Fair Work, in order to support the development of a sustainable and a successful wellbeing economy over the long term that is fair, green and growing.

As outlined above, the FWF policy was first introduced in 2019. The FWF criteria build on the longstanding approach to considering Fair Work practices in public procurement exercises by extending this to public sector grants and other funding with a focus on particular challenges in the labour market in Scotland. The conditionality for the rLW and effective workers’ voice that was introduced to public sector grants in 2023 seeks to strengthen the policy approach.

2.4 Issues Raised in the Initial Implementation Phase of the Policy

Real Living Wage

A range of stakeholders, primarily COSLA, the enterprise agencies, Skills Development Scotland but also some business organisations raised concerns in the lead up to and in the early stages of implementation of FWF conditionality.

These concerns, particularly regarding apprentices and 16-17 year old workers, focused predominantly on affordability, including maintaining grade/band wage differentials if uplifting lowest paid workers to the rLW; and potential impacts on the number of apprenticeship opportunities and opportunities for young workers. It was also noted that while the policy includes the scope for funders to agree limited exceptions, there would be an administrative burden on organisations to request such an exception.

Effective Workers Voice

FWF recognises the importance of effective voice in delivering all aspects of Fair Work; accordingly, a minimum level of effective voice must be provided, taking account of the different types and size of organisations across Scotland and the different forms of voice that are appropriate and effective in relation to these different contexts.

Concerns raised by stakeholders included confusion about what effective voice is and the administrative burden on potential grant recipients to provide evidence of effective voice in order to meet the condition and for this to be verified by an appropriate worker representative.

Concern was also raised by trade unions who felt employers were not complying with wider Fair Work practices and there was misunderstanding that the verification process could be used to negotiate an improvement in this regard. This led to situations where trade unions would not verify accurate FWF evidence because of on-going disputes on matters that were beyond the scope of the FWF criteria.

Contact

There is a problem

Thanks for your feedback