Government Expenditure and Revenue Scotland (GERS) 2023-24

Government Expenditure and Revenue Scotland (GERS) is an Accredited Official Statistics publication. It estimates the revenue raised in Scotland and the cost of public services provided for Scotland.

Chapter 1: Public Sector Revenue

Introduction

This chapter provides detailed estimates of Scottish public sector revenue.

The majority of public sector revenue payable by Scottish residents and enterprises is collected at the UK level. Generally it is not possible to identify separately the proportion of revenue receivable from Scotland. GERS therefore uses a number of different methodologies to apportion revenue to Scotland. These are discussed in the methodology paper on the GERS website.[11]

Following the implementation of the Scotland Act 2012 and Scotland Act 2016, an increasing amount of revenue is being devolved to the Scottish Parliament, and direct Scottish measures of these revenues are becoming available. To date, landfill tax, property transaction taxes, and non-savings non-dividend income tax have been devolved. Chapter 4 provides more information on current and future devolved taxes. Note that the income tax figures in this chapter cover all income tax, whilst those in Chapter 4 cover only non-savings and non-dividend income tax.

For taxes where there is no direct measure of Scottish revenue, GERS uses a set of data sources and methodologies developed over a number of years following consultation with, and feedback from users and experts. In some cases, a variety of methodologies could be applied, each leading to different estimates of public sector revenue in Scotland. Table A.5 in Annex A provides analysis of the confidence intervals around revenue estimates based on survey data.

GERS reports tax and non-tax revenue separately. Non-tax revenues are primarily non-cash items such as capital consumption, included for accounting purposes in gross operating surplus, and the operating surplus of public corporations such as Scottish Water. These are discussed in more detail below.

Revenue 2023-24

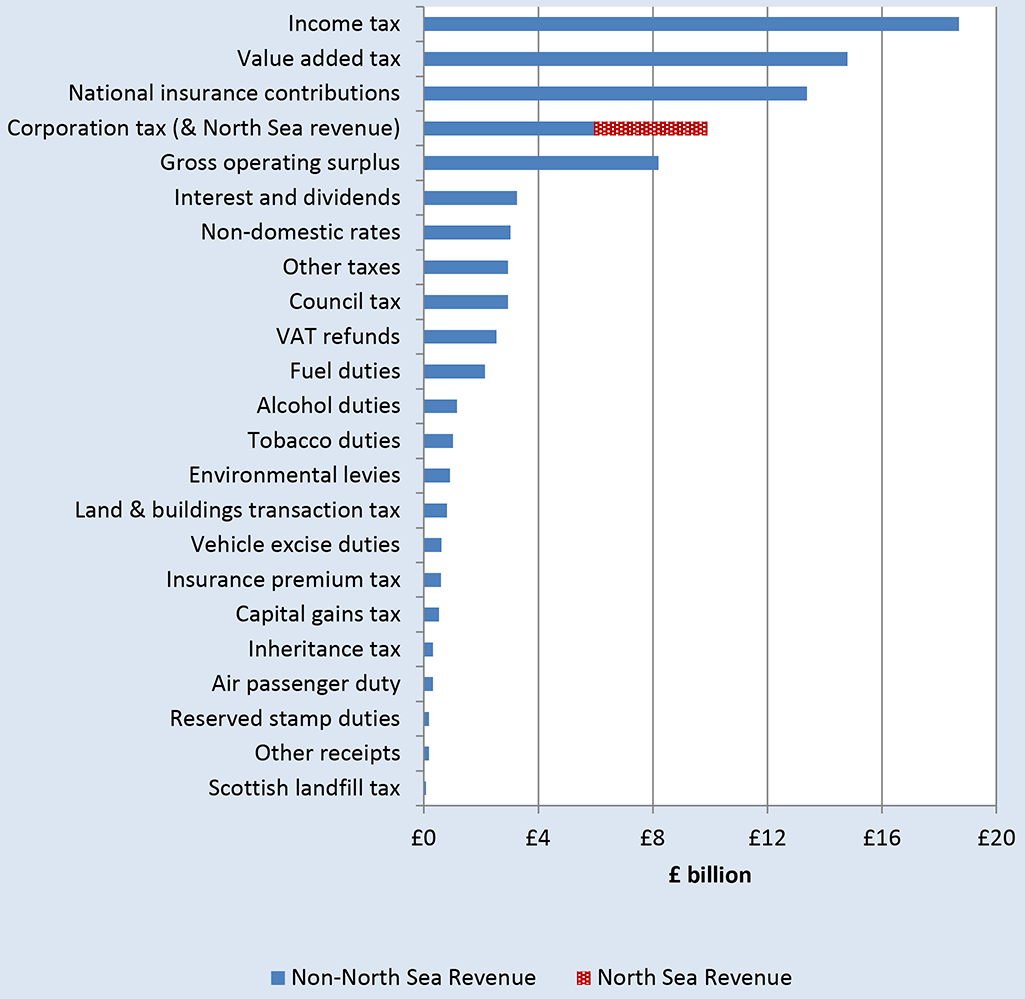

Table 1.1 reports estimated public sector revenue in Scotland and the preliminary outturn data for the UK in 2023-24. The contribution of each element of revenue to the Scottish total, and the proportion of UK revenue raised in Scotland, are also included in the table. The three largest taxes, income tax, national insurance contributions, and value added tax account for around two thirds of total non-North Sea revenue.

Overall, Scotland raised £88.5 billion in 2023-24, or 8.1% of total UK revenue. This represents a fall from a share of 8.4% in 2022-23, reflecting the decline in North Sea revenue, which fell to £4.0 billion from £7.9 billion in 2022-23. Scotland has around 80% of the total UK North Sea revenue. This is discussed further in Chapter 2.

Excluding the North Sea revenue, Scotland’s revenue increased to £84.6 billion, an increase of 7.2%. Scotland saw stronger growth in non-North Sea revenue than the UK, primarily due to stronger growth in income tax revenue and onshore corporation tax.

For income tax, overall income tax grew by 12%. This was driven by relatively strong growth in the Pay As You Earn (PAYE) component, where data from HMRC’s Real Time Information system show where Scottish PAYE receipts grew by 14.4% in 2023-24 compared to growth of 12.2% for the UK as a whole.

For onshore corporation tax, this reflects the impact of the Electricity Generator Levy, which came into effect from 1 January 2023, with 2023-24 its first full year of operation. Scotland received £238 million in revenue from the levy, 20% of the UK total.

In order to report revenue on a National Accounts basis, an international reporting standard used by governments, a number of accounting adjustments are included in the total revenue estimate. These are primarily symmetric adjustments that also form part of expenditure, and therefore have little impact on the net fiscal balance.

| Scotland | UK | Scotland as % of UK | ||

|---|---|---|---|---|

| £ million | % of total non-North Sea taxes | £ million | ||

| Income tax (gross of tax credits) | 18,691 | 25.6% | 276,005 | 6.8% |

| National insurance contributions | 13,392 | 18.4% | 178,927 | 7.5% |

| Value added tax | 14,794 | 20.3% | 169,523 | 8.7% |

| Onshore Corporation tax | 5,944 | 8.1% | 96,168 | 6.2% |

| Fuel duties | 2,137 | 2.9% | 24,828 | 8.6% |

| Non-domestic rates | 3,035 | 4.2% | 30,248 | 10.0% |

| Council tax | 2,933 | 4.0% | 44,546 | 6.6% |

| VAT refunds | 2,540 | 3.5% | 27,901 | 9.1% |

| Capital gains tax | 525 | 0.7% | 15,026 | 3.5% |

| Inheritance tax | 327 | 0.4% | 7,535 | 4.3% |

| Reserved stamp duties | 178 | 0.2% | 16,789 | 1.1% |

| Scottish land & buildings transaction tax | 803 | 1.1% | 803 | 100% |

| Scottish landfill tax | 69 | 0.1% | 69 | 100% |

| Air passenger duty | 325 | 0.4% | 3,884 | 8.4% |

| Tobacco duties | 1,027 | 1.4% | 8,969 | 11.5% |

| Alcohol duties | 1,165 | 1.6% | 12,592 | 9.2% |

| Insurance premium tax | 593 | 0.8% | 8,379 | 7.1% |

| Vehicle excise duties | 611 | 0.8% | 7,853 | 7.8% |

| Environmental levies | 922 | 1.3% | 8,080 | 11.4% |

| Other taxes1 | 2,940 | 4.0% | 35,684 | 8.2% |

| Total Non-North Sea taxes | 72,950 | 100% | 973,808 | 7.5% |

| North Sea Revenue | ||||

| Population share | 398 | 4,940 | 8.1% | |

| Geographical share | 3,958 | 4,940 | 80.1% | |

| Other receipts | ||||

| Interest and dividends | 3,262 | 40,428 | 8.1% | |

| Gross operating surplus | 8,200 | 73,603 | 11.1% | |

| Other receipts | 177 | 1,891 | 9.3% | |

| Total revenue | ||||

| Excluding North Sea | 84,588 | 1,089,730 | 7.8% | |

| Including population share of North Sea | 84,987 | 1,094,670 | 7.8% | |

| Including geographical share of North Sea | 88,546 | 1,094,670 | 8.1% | |

| of which: revenue accounting adjustments | 9,162 | 94,346 | 9.7% | |

1 A description of the other taxes line is provided in the detailed methodology paper on the GERS website.

Unlike the expenditure accounting adjustments, which are shown in a separate expenditure line, the revenue accounting adjustments are included within different revenue lines, as is set out in Table A.9 in Annex A. In order to aid transparency, a revenue accounting adjustments line is shown at the bottom of Table 1.1 and 1.4. This is a sub-total of revenue, and is not additional to the revenue totals reported in these tables.

Scotland’s share of UK total non-North Sea revenue in 2023-24 was 7.8% which is 0.3 percentage points lower than Scotland’s share of the UK population. In general, Scotland’s share of revenue has been declining over time in line with its declining population share.

Scotland’s share of most large revenues is close to either its population or GDP share. However, there are some exceptions to this, discussed below.

Revenues where Scotland’s share of UK revenue is relatively low are those associated with property or assets, such as capital gains tax (3.5%), and inheritance tax (4.3%). This reflects the fact that properties and assets in Scotland tend to have lower values than the UK average.[12] Scotland’s share of income tax (6.8%) is also relatively low. In part, this reflects the increasingly progressive nature of income tax, following the introduction of the additional rate of income tax and increases in the personal allowance. Scotland has relatively fewer additional rate tax payers, with only around 4% of the UK total.

Revenues where Scotland has a relatively large share include gross operating surplus (GOS), which includes the surpluses of public corporations. Scotland is estimated to generate approximately 11.1% of UK public sector GOS, higher than Scotland’s population share. Scotland’s GOS includes Scottish Water, which is a large contributor to UK public corporations’ GOS. The equivalent water companies in England and Wales are outside the public sector and hence do not contribute to UK GOS.

Scotland tends to also have relatively high shares of duties associated with tobacco and alcohol. This reflects the greater incidence of smoking in Scotland,[13] and also the fact that Scotland has higher consumption of spirits than the rest of the UK.[14]

Table 1.2 below shows Scotland’s share of the largest UK revenues.

| 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|

| Income Tax | 6.5% | 6.7% | 6.8% |

| Corporation tax (excl North Sea) | 6.0% | 6.1% | 6.2% |

| National insurance contributions | 7.6% | 7.5% | 7.5% |

| Value added tax | 8.7% | 8.7% | 8.7% |

| Council tax and non-domestic rates | 7.2% | 7.9% | 8.0% |

| All other revenue | 8.8% | 8.7% | 8.8% |

| Total current non-North Sea revenue | 7.7% | 7.7% | 7.8% |

Estimated Revenue: Scotland and the UK, 2021-22 to 2023-24

Table 1.4 shows estimated revenue in Scotland and the UK between 2021-22 and 2023-24. Over this period, Non-North Sea revenue in Scotland is estimated to have grown by 19.8% in nominal terms, slightly faster than the UK as a whole (18.7%). The largest single factor explaining this difference is stronger growth in receipts from income tax in Scotland, which is likely to reflect policy divergence between Scotland and the UK. Growth in other important revenues, such as National Insurance Contributions, has been weaker over this period.

Table 1.3 shows estimates of revenue per person for Scotland and the UK between 2021-22 and 2023-24. Revenue per person in Scotland is higher than in the UK by £60 in 2023-24, down from £721 higher in 2022-23. Excluding North Sea revenue, Scottish revenue is £594 lower.

| 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|

| Scotland | |||

| Excluding North Sea revenue | 12,909 | 14,490 | 15,527 |

| Including North Sea revenue (population) | 12,949 | 14,636 | 15,600 |

| Including North Sea revenue (geographical) | 13,350 | 15,948 | 16,254 |

| UK | |||

| Excluding North Sea revenue | 13,671 | 15,080 | 16,121 |

| Including North Sea revenue | 13,711 | 15,227 | 16,194 |

| Difference (Scotland minus UK) | |||

| Excluding North Sea revenue | -762 | -590 | -594 |

| Including North Sea revenue (population) | -762 | -590 | -594 |

| Including North Sea revenue (geographical) | -361 | 721 | 60 |

| Scotland | UK | |||||

|---|---|---|---|---|---|---|

| 2021-22 | 2022-23 | 2023-24 | 2021-22 | 2022-23 | 2023-24 | |

| Income tax | 14,704 | 16,696 | 18,691 | 224,779 | 250,489 | 276,005 |

| National insurance contributions | 12,201 | 13,339 | 13,392 | 161,335 | 177,838 | 178,927 |

| Value added tax | 12,491 | 14,171 | 14,794 | 143,415 | 162,214 | 169,523 |

| Onshore Corporation tax | 4,147 | 4,620 | 5,944 | 69,007 | 76,257 | 96,168 |

| Fuel duties | 2,171 | 2,194 | 2,137 | 25,943 | 25,098 | 24,828 |

| Non-domestic rates | 2,108 | 2,792 | 3,035 | 25,312 | 28,380 | 30,248 |

| Council tax | 2,621 | 2,760 | 2,933 | 39,969 | 41,967 | 44,546 |

| VAT refunds | 2,135 | 2,275 | 2,540 | 23,161 | 25,097 | 27,901 |

| Capital gains tax | 584 | 591 | 525 | 15,267 | 16,929 | 15,026 |

| Inheritance tax | 264 | 309 | 327 | 6,080 | 7,121 | 7,535 |

| UK stamp duties | 305 | 210 | 178 | 18,877 | 19,132 | 16,789 |

| Land & buildings transaction tax | 813 | 839 | 803 | 813 | 839 | 803 |

| Scottish landfill tax | 122 | 110 | 69 | 122 | 110 | 69 |

| Air passenger duty | 95 | 252 | 325 | 1,189 | 3,268 | 3,884 |

| Tobacco duties | 1,170 | 1,073 | 1,027 | 10,191 | 9,375 | 8,969 |

| Alcohol duties | 1,222 | 1,145 | 1,165 | 13,179 | 12,384 | 12,592 |

| Insurance premium tax | 481 | 528 | 593 | 6,792 | 7,455 | 8,379 |

| Vehicle excise duties | 557 | 571 | 611 | 7,149 | 7,341 | 7,853 |

| Environmental levies | 783 | 817 | 922 | 6,655 | 7,200 | 8,080 |

| Other taxes | 2,486 | 3,081 | 2,940 | 30,710 | 37,539 | 35,684 |

| Total Non-North Sea taxes | 61,460 | 68,372 | 72,950 | 829,945 | 916,033 | 973,808 |

| North Sea taxes | ||||||

| Population share | 217 | 799 | 398 | 2,662 | 9,928 | 4,940 |

| Geographical share | 2,414 | 7,942 | 3,958 | 2,662 | 9,928 | 4,940 |

| Other receipts | ||||||

| Interest and dividends | 2,041 | 2,604 | 3,262 | 24,109 | 32,264 | 40,428 |

| Gross operating surplus | 6,952 | 7,788 | 8,200 | 62,114 | 69,225 | 73,603 |

| Other receipts | 183 | 171 | 177 | 2,101 | 1,831 | 1,891 |

| Total revenue | ||||||

| Excluding North Sea | 70,636 | 78,936 | 84,588 | 918,269 | 1,019,353 | 1,089,730 |

| Population share North Sea | 70,852 | 79,735 | 84,987 | 920,931 | 1,029,281 | 1,094,670 |

| Geographic share North Sea | 73,050 | 86,878 | 88,546 | 920,931 | 1,029,281 | 1,094,670 |

| Of which, revenue accounting adjustment | 7,692 | 8,344 | 9,162 | 78,640 | 86,059 | 94,346 |

Comparison between GERS and ONS estimates

Any analysis of public sector receipts in Scotland relies on estimation, and as such alternative estimates are possible. As discussed in the Preface, GERS estimates revenue using a set of apportionment methodologies, refined over a number of years following consultation with, and feedback from, users.

The Office for National Statistics (ONS) publishes public sector finances for the countries and regions of the UK. The latest estimates covering the period to 2022-23 were published on 7 June 2024.[15]

The table below compares the estimates in GERS with those published by ONS. There are some differences between the ONS and GERS numbers. For non-North Sea taxes, these primarily relate to VAT. The estimates of VAT in GERS are consistent with those published by HMRC for Scottish Assigned VAT, whilst the ONS use a methodology which produces results for all UK country and regions. The ONS, HMRC and the devolved administrations are working together to reconcile, and where possible align, methodologies for estimating tax receipts for the UK countries and regions

The differences in other non-North Sea receipts are primarily due to using different data sources for interest and dividends, where GERS uses specific data for interest income from Scottish student loans.

| 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|

| Non-North Sea taxes | |||

| GERS | 61,460 | 68,372 | 72,950 |

| ONS | 61,233 | 67,153 | n/a |

| Difference | 227 | 1,219 | n/a |

| Other non-North Sea receipts | |||

| GERS | 9,176 | 10,564 | 11,638 |

| ONS | 10,454 | 11,682 | n/a |

| Difference | -1,278 | -1,118 | n/a |

| Geographical share of North Sea revenues | |||

| GERS | 2,414 | 7,942 | 3,958 |

| ONS | 2,499 | 7,944 | n/a |

| Difference | -85 | -2 | n/a |

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback