Grangemouth Industrial Cluster - draft Just Transition plan: consultation

We are seeking views on the proposed vision and Just Transition Plan for the Grangemouth Industrial Cluster (Supporting a fair transition for Scotland's core manufacturing cluster), which we have set out in the draft document. We want the views of community, business, third sector and all those with an interest in Grangemouth to shape the final publication in 2025.

Grangemouth Industrial Baseline Summary

Introduction

This section of the Just Transition Plan summarises our Grangemouth Industrial Baseline, providing a comprehensive overview of the current Grangemouth Industrial cluster in Scotland, mapping where possible, industrial activity and production, as well as some of the wider impacts on the surrounding town and people of Grangemouth.

This baseline has been developed to provide a clear and comprehensive outline of how the industrial cluster operates today, which will in turn help in identifying both how the cluster can reach net zero and how this might impact on businesses, people and places in the process. Taken collectively alongside the vision, it will also help to shape the policies and actions we can collectively take to ensure that such a transition is as fair as possible.

Finally, and most importantly, the baseline will provide an agreed reference point for monitoring efforts as GFIB progresses this work, providing early headline metrics.

For ease, this section provides an overview of the Baseline. A more detailed outline is provided at Annex A.

Cluster Overview

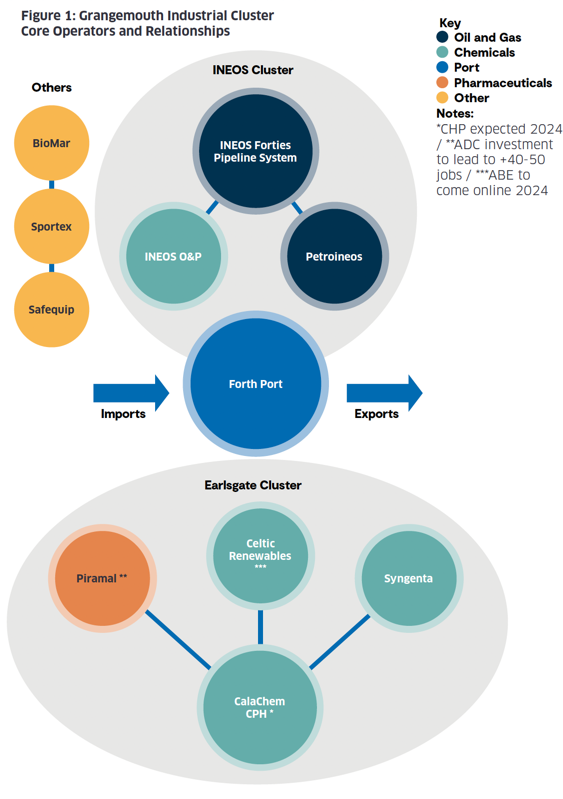

GFIB defines the Grangemouth Industrial Cluster as a collection of the following major industrial operators:

Currently, whilst the operators are geographically close to one another, their day-to-day activity is relatively separate, with little intra-cluster integration. The cluster can be broken down into three sub-clusters of activity, largely defined by energy/utilities and some shared infrastructure. As outlined below, this includes the INEOS/Petroineos and Earlsgate clusters, as well as the Port.

Whilst these key operators form the core of large-scale industrial activity in Grangemouth there is also a wider network of manufacturing businesses in the area, in some cases forming a critical part of the cluster's local supply chain. For this reason, we have not limited consideration of impacts and activity to the core operators in isolation. A wider map of operators across the Grangemouth area is shown below.

Recent Developments

There has been a number of recent announcements which may impact on the Grangemouth industrial footprint in the future:

- In June 2023, Fujifilm announced the closure of its dye manufacturing facility at Grangemouth, one part of its operation there and affecting 31 roles. In March 2024, a consultation on the closure of the entire facility was announced, affecting a further 62 roles.

- In November 2023, Petroineos announced that the Grangemouth oil refinery will commence preparatory works to convert to an import terminal for finished fuels. The potential future conversion of this site would see a reduction of roughly 400 staff. In a recent statement in September 2024, Petroineos has subsequently confirmed it's intention to cease refining at Grangemouth in quarter 2 of 2025.

- In December 2023, Versalis announced their intention to permanently close their Grangemouth site, with the loss of all employee jobs (c. 135).

The above sites have been included in the 2023 figures set out in this report.

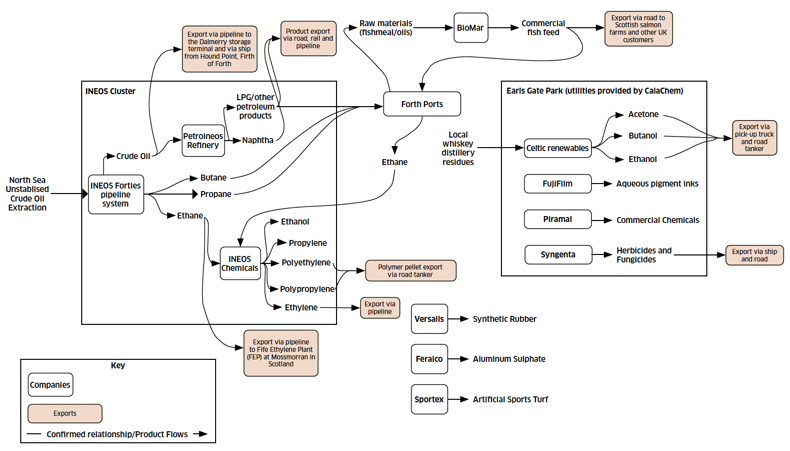

Manufacturing Activity

Grangemouth encompasses a range of manufacturing processes, across a number of industrial sectors, showing a diverse and complex ecosystem, producing a variety of important products. Through a series of interviews and data gathering exercises we have provided a summary of the core products manufactured at Grangemouth and their destinations.

Detailed Baseline

Emissions

Greenhouse gas emissions (GHG) are the leading measure for decarbonisation. By analysing the scale of GHG emissions from Grangemouth operators we can begin to understand and estimate how complex a transition to net zero may be for the site.

We have estimated that the Grangemouth cluster is responsible for 2.92MtCO2e or 7.2% of Scotland's total territorial emissions in 2022. This figure will be used as the basis for measuring emissions reductions across the cluster. In addition to considering progress against emissions reductions, GFIB shall also consider on an ongoing basis approaches which improve oversight of scope 2 and 3 emissions where possible.

Company |

Carbon Emissions (kt) |

Main source of emissions |

% of total emissions |

|---|---|---|---|

Avondale Non-Hazardous Landfill, Polmont |

42.3 |

1.47 |

|

Grangemouth CHP, Bo'ness Road, Grangemouth |

513.62 |

SCOPE 1 |

17.9 |

INEOS Chemicals Grangemouth Ltd, Grangemouth |

601.92 |

SCOPE 1 |

20.9 |

INEOS FPS Ltd, Kinneil Terminal, Grangemouth |

251 |

SCOPE 1 |

8.75 |

INEOS Infrastructure (Grangemouth)Ltd |

563.65 |

SCOPE 1 |

19.64 |

Petroineos Manufacturing, Grangemouth Refinery |

774.8 |

SCOPE 1 |

27 |

Veolia CHP Plant, Earls Road, Grangemouth |

23.03 |

SCOPE 1 |

0.8 |

Versalis UK Ltd |

56.66 |

SCOPE 1 |

1.97 |

Calachem |

19.506 |

SCOPE 1 |

0.68 |

Syngenta |

1.8 SCOPE 1 21.1 SCOPE 2 |

SCOPE 2 |

0.06 SCOPE 1 0.74 SCOPE 2 |

Whilst Grangemouth remains one of the key sources of industrial emissions in Scotland, progress is being made. For example, INEOS has reduced net emissions by 37% since 2005 and Syngeta is working towards a net zero target by 2030.

Economic Impact

GVA

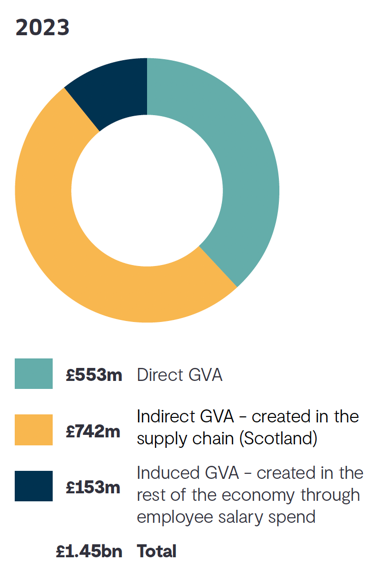

GVA is a key indicator of the state of the whole economy and gives a picture of the state of economic activity from the supply side perspective. It measures the contribution to the economy of each individual producer, industry or sector in Scotland and is used in the estimation of GDP. GVA is the difference between the value of goods and services produced and the cost of raw materials and other inputs, which are used up in production.

The total direct, indirect, and induced GVA for the cluster was estimated at £895 million in 2023.

Source: analysis using the Scottish Government Input-Output Tables, using the relevant Type I and Type II multipliers for each company in the cluster. Compiled using company accounts data and responses from data requests.

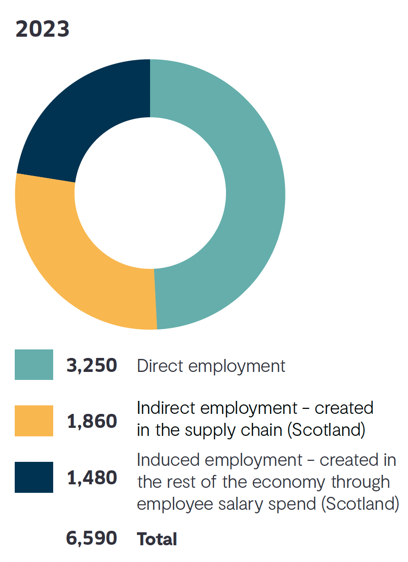

Employment

The Grangemouth industrial cluster, comprised of the companies set out in the cluster overview (page 13), had approximately 3,250 employees in 2023.

In 2023, the average wage for a worker in the cluster was:

- 1.4 times higher than the average wage for a full-time worker in the Falkirk local authority area; and

- 1.5 times higher than the average wage for a full-time worker in Scotland.

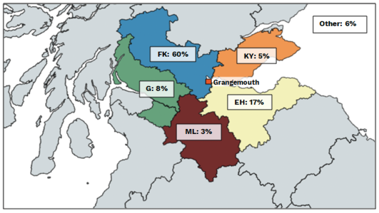

Most employees within the cluster live within the immediate local area: more than half have a home address within the Falkirk local authority area (around 57%, FK1-FK6) and a further 11% in West Lothian (EH48-EH55).

The vast majority of employees (95%) are on full-time hours (30+ hours per week).

The workforce is predominantly male (85% of the total).

Taking direct employment in the Grangemouth industrial cluster as 3,250 jobs, we can use Scottish Government economic data to estimate the wider impact on the economy, both in terms of indirect jobs in the supply chain, and those induced through employee salary spend. This shows around 6,590 jobs supported in the chemicals cluster.

Source: analysis using the Scottish Government Input-Output Tables, using the relevant Type I and Type II multipliers for each company in the cluster.

Supply Chain

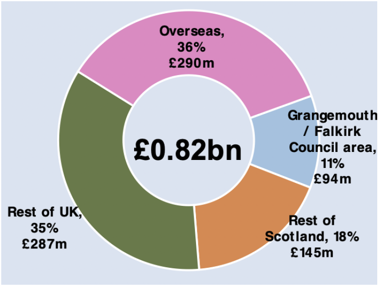

The Overall Picture

Companies responding to the data request provided a geographic breakdown of their procurement and supply chain spending for the most recent financial year. This is shown in the pie chart below.

The overall purchasing figures are dominated by purchase of feedstocks for the INEOS chemicals manufacturing business and natural gas for on-site power generation, and are particularly high in the given year (2023), given the steep increase in commodity prices from early 2022.

The Local Picture

Those responding to the data request were asked to provide information on the suppliers or contractors with which they have the highest spend. As noted, feedstocks and natural gas are the highest areas of spend.

Maintaining and developing on-site infrastructure is also a major area of cost, with tens of millions spent each year with construction and engineering companies, many of which maintain a local presence.

The following companies have a base in Grangemouth or Falkirk and were identified by the six respondents to the data request:

- Altrad Babcock / Altrad Services (engineering / construction / maintenance)

- Bilfinger (industrial construction and maintenance)

- Luddon (civil engineering and construction)

- Veolia/Suez (waste)

- MRC Global (pipes, valves and fittings)

- BGen (engineering and design)

- Applus+ UK (safety and environmental testing)

- Ainscough Crane Hire (crane hire)

- Aramark (canteen services)

- Polymer Logistics Scotland (logistics)

- Swan Analytical (electrical services)

- Trillium Flow Technologies (pumps and valves)

- Denholm Environmental (industrial cleaning)

- Scottish Fuels (fuel)

- Poole Process Equipment (heat/pressure equipment supply)

- Enigma Industrial Services (scaffolding and insulation/painting)

- Engenda Group (engineering)

- H.W Coates (chemical warehousing and transport)

- ERIKS Industrial Services (mechanical engineering components and logistics)

- PFP Contracting (fireproofing)

- Sunbelt Rentals Industrial (vehicle and equipment hire).

Total annual spend across the above local companies comes to £132m. Purchases with each company ranged from £100,000 to £50m. Each area of spend was generally identified as recurring on an annual basis, although some construction / engineering contractor costs related to a specific capital project and will tail off on completion.

In most cases, these companies are national or international firms and have multiple locations. In some cases, their Grangemouth location is within the INEOS or Forth Ports perimeter, while others have a base in the wider area.

Exports

The extent to which manufacturers in the cluster are exporting goods overseas or selling into domestic markets varies considerably, reflecting the diverse range of intermediate and final products manufactured in the cluster and associated customers.

Data aggregated from five manufacturers (Biomar, Versalis, Syngenta, INEOS O&P and Fujifilm) representing around £994m turnover. This does not include the Petroineos refinery, which largely manufactures fuel for domestic use.

Skills

The Grangemouth Industrial Cluster has a significantly wide-ranging highly skilled labour base considering the breadth of operations across multiple operators. Both the active workforce, and education providers support a world-class workforce across multiple sectors, that is mobile and adaptable should opportunities arise elsewhere. An example of some of the job types if outlined below:

Grangemouth Industrial Cluster Job Types

Engineer/ technical manager

Technicians and planners

Engineering support functions

Manufacturing support functions

Skilled operatives in manufacturing

Semi-skilled operatives in manufacturing

Clerical and Administrative – HR, Admin, Learning and Development, Finance, Quality Control, supply chain, manufacturing development operatives

Health and Safety operator

Graduate roles

Apprentice roles

Managerial postings

Supervisory postings

Mariner

Stevedores

Key themes emerging from engagement has shown that:

Skills for the future may look similar – Safe and sustainable operation of sites in the future, for example at a hydrogen manufacturing facility or a bio-refinery will likely require similar skills sets to those that exist on-site today. Rather than requiring complete transformation, the same skills will likely be applied with tailoring to specific low-carbon processes. In order to shape appropriate support, this area will require further examination in future as the specific operational activities across the cluster are known in greater detail. Where either new skills or skills adaptations are required, options for how this can be deployed flexibly in support of the existing workforce should be considered.

Skills shortages are a priority – Stakeholder feedback has consistently flagged that skills shortages were the more immediate priority. Recruitment of engineers was proving more difficult for the petrochemicals industry as well as shortages of data scientists, IT specialists and welders and pipefitters.

Highly skilled workers are in demand – The world-class training of many of Grangemouth's staff means that opportunities are readily available across the UK and indeed further afield. This presents a risk to preserving skills and knowledge through the transition in Grangemouth.

Standardisation of accreditation may be needed – technicians in oil and gas will require specific licences, but the pathways to transition into low-carbon sectors are less clear and more needs to be done to consider and support the transition of the workforce.

There is a strong gender imbalance – Recent research shows that the workforce at Grangemouth is largely dominated by men. Whilst there is a more even gender balance at the graduate level, it is clear that less women are applying to jobs in Grangemouth. This should be considered in any activity promoting the future activity and jobs at the industrial cluster in outreach to schools, colleges and universities.

'We are trying to make sure that where the skills that already exist and the qualifications for the existing workforce already exist that money and time and energy hasn't been wasted on doubling up … a welder is a welder! We need to ensure that if people have good skills that we are avoiding barriers to getting them into the workplace.'

Socio-Economic Overview

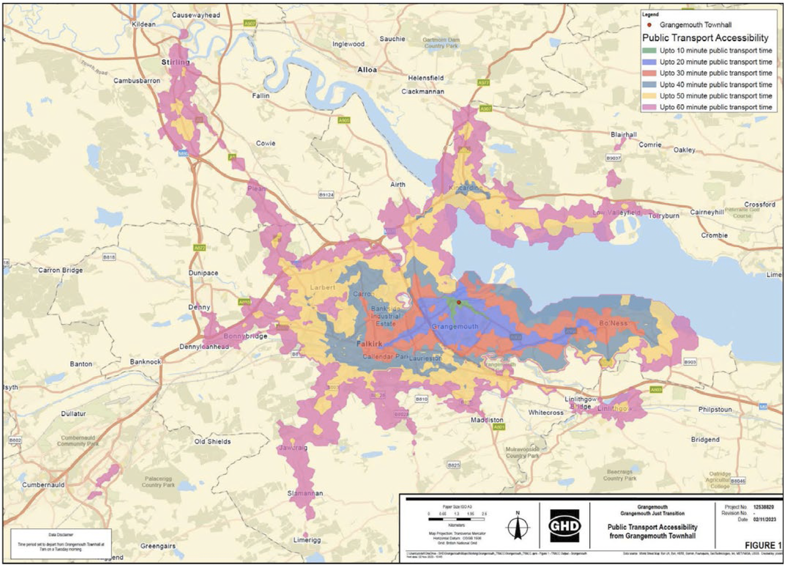

Access to Public Transport

The town of Grangemouth has a poor public transport offering. This presents a number of barriers for residents in terms of access to labour markets or job opportunities offered by the industrial cluster, education providers and links to the wider central belt of Scotland. Overall, connectivity in the town incentivises greater use of private transport, which is assumed to increase transport emissions levels.

For workers at the industrial cluster who do not live in Grangemouth, this will most likely incentivise higher rates of commuting by car, than by public transport.

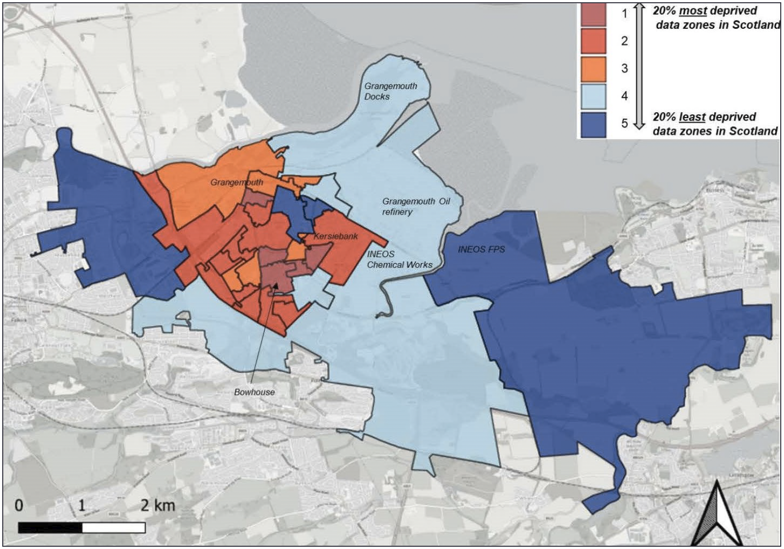

Poverty

The Scottish Index of Multiple Deprivation (SIMD) provides insights based on income, employment, education, health, access to services, crime, and housing. Grangemouth has five data zones in the 20% most deprived areas of Scotland. Areas across the town centre and residential communities in Bowhouse and Kersiebank are notable. However, the surrounding area is significantly less deprived. A Just Transition for Grangemouth should consider how the localised deprivation in the centre of Grangemouth can be addressed.

Participation

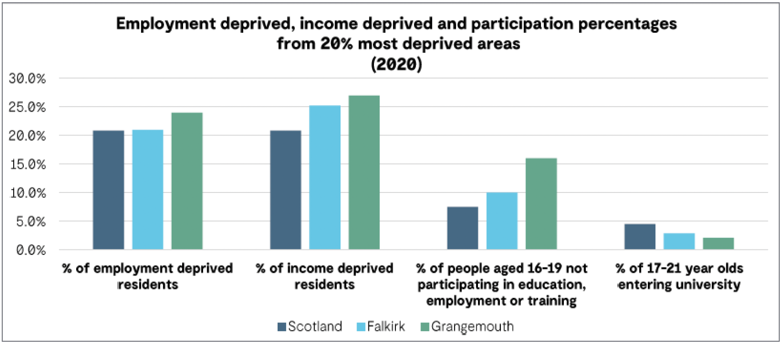

Looking further into Grangemouth's most deprived areas, approximately 27% of people were income deprived, 24% were employment deprived, and only 2.1% of young adults (17-21 years old) had entered into full-time higher education. Concurrently, 16% of young people (16-19 years old) were not participating in education, employment or training. Overall, these areas in Grangemouth rank lower than equivalently deprived areas in both Falkirk and Scotland more broadly.

Community Perspective

From the data outlined, it is clear that the industrial cluster has a clear economic and place-making role that impacts the wider town of Grangemouth.

However, engagement with community representatives has highlighted a general perspective that there is little benefit for the wider town in being situated so close to the cluster.

Whilst our baseline does indicate that a significant portion of the industrial workforce does live in the local area, the areas of deprivation, coupled with the general sentiment of Grangemouth as in decline, indicates that more could be done to harness the opportunities from industrial transition in support of economic regeneration for Grangemouth.

Given the intrinsic links between the industrial cluster and the wider town of Grangemouth, it is clear that whatever changes lie ahead through the transition to net zero, they will have an impact on the social, natural and built environment of the town.

It is the aim of GFIB, through the Just Transition planning process to support a new relationship of participation with the community of Grangemouth, as decisions are taken in support of the cluster. In doing so, we have conducted extensive work with the support of consultants GHD to synthesise community views and priorities in the context of the transition to net zero. A detailed outline, including persona building, is provided at Annex B, we have summarised key perspectives and priorities below. These should act as a benchmark for addressing community perspectives.

Additionally, the Scottish Government is funding a recognised Community Engagement and Participation Manager, who will act as the local community champion, who will engage with communities, local leaders and influencers to raise awareness and empower the community. They will represent community perspectives on GFIB.

"[Local community members] are a really important stakeholder. I think we need to bring them along."

Community Views

Community Priorities

Overall, we have distilled our findings into the following priority areas for action, based on community input:

- Create well paid job opportunities for local people

- Review the existing skills development pipeline and address attainment outcomes for local people

- Alignment of the community, industry and public sector relationship

- Develop a collective vision for Grangemouth that boosts a national understanding of the area's strategic importance

- Identify tangible opportunities to address the quality of life in Grangemouth, linked to the industrial cluster's transition

'[Grangemouth has a] real massive sense of pride, of being part of something, of being part of that revolution, industrial revolution and all this.'

Contact

There is a problem

Thanks for your feedback