Green industrial strategy

This publication identifies areas of strength and opportunity for Scotland to grow globally competitive industries in the transition to net zero. It outlines what government and partners will do to support stakeholders to create an enabling environment for investment and growth.

Part Two: Opportunity Areas

Opportunity 1: Wind

Maximising Scotland’s wind economy: making the most of our natural resources and established onshore and offshore wind sectors; building on our first-mover advantage in floating offshore wind to generate clean electricity for domestic use and export; participating in global supply chains as well as expanding our domestic supply chain capacity and seizing opportunities across the offshore wind supply chain, from infrastructure to manufacturing; and positioning Scotland as a leader in material circularity of wind turbines and components.

Scotland’s climate and natural resources provide ideal conditions to sustain a thriving renewable energy economy with wind energy at its core. Established onshore and offshore wind technologies generated 78% of domestic renewable electricity in 2023 (25.8TWh)[7] and the global ambition for wind energy installations (onshore and offshore) to triple by 2030[8] presents an opportunity for Scotland to play its part on the global stage.

Offshore Wind

The UK signed the Ostend Declaration of Energy Ministers on The North Seas as Europe’s Green Power Plant[9] in April 2023. Nine countries have set combined targets for north seas offshore wind of 120 GW by 2030, and at least 300 GW by 2050 and Scotland’s offshore wind industry is central to the achievement of UK commitments.

Investible Project Pipeline

Offshore wind is the single most important immediate opportunity for attracting mobile capital to Scotland at scale and raising Scotland’s wider investment profile[10]. Scotland currently has a potential pipeline of over 40 GW[11] of offshore wind projects, on top of the 3.0 GW of projects in operation[12]. The ScotWind leasing round reflects significant market ambition for offshore wind in Scottish waters – around 28 GW across 20 projects[13]. The INTOG leasing round could potentially add around 5.4 GW of capacity - up to 449 MW for innovation projects and 5 GW for targeted oil and gas decarbonisation[14] .

The scale of this ambition brings an opportunity for collaboration and investment in port infrastructure, manufacturing and fabrication projects, as demonstrated by the strong pipeline of projects which have emerged through the industry-led Strategic Investment Model (SIM) process.

Ports have a particularly critical role to play in supporting the growth of Scotland’s offshore wind sector and accelerating investment in related infrastructure, manufacturing and fabrication. The Scottish Government is engaging and collaborating with the sector and key industry bodies including the recently formed Scottish Offshore Wind Ports Alliance (SOWPA) and the British Ports Association’s Scottish Ports Group to realise the opportunities that offshore wind presents and tackle barriers to growth.

Supply Chain

The offshore wind supply chain has immense growth potential, with UK Supply Chain Capability Analysis suggesting that the offshore wind supply chain will contribute £92bn GVA to the UK economy to 2040[15]. The ‘2024 Offshore Wind Industrial Growth Plan’[16] (UK) indicates priority opportunities for UK suppliers to provide global technology leadership in advanced turbine technology; industrialised foundations and substructures, future electrical systems and cables; smart environmental services; and next generation installation and O&M.

Based on evidence available across a number of individual studies, Scotland’s Offshore wind supply chain could support between 10,400 - 54,000 jobs in the coming decades. Through the Supply Chain Development Statement (SCDS)[17] process, ScotWind developers have already made significant commitments to spend in Scotland: an average of £1.5bn per project (of 20 projects).

The offshore workforce is highly skilled. Growth in technical, managerial, and a wide range of diverse, professional roles is anticipated. Our existing world leading subsea engineering capabilities that are in great part a valued legacy of the North Sea oil and gas production skills base, are an asset to our offshore wind development and highly exportable. As an early mover in floating wind design, there is potential to assume a leadership role in setting global standards in this rapidly expanding technology.

Clusters

The Strategic Investment Assessment (2021), OWIC Supply Chain Assessment, Offshore Wind Champion Report (2023) and Renewables UK Roadmap to 2040 (2023) highlight the importance of clustering activities for the offshore wind sector. Regional clusters which respond to opportunities to anchor wider renewables activity, such as hydrogen production, are essential. Scotland’s Green Freeports, Investment Zones and the world’s first National Floating Wind Innovation Centre (FLOWIC), located in Scotland’s Northeast Energy Transition Zone, provide opportunities to cluster activities to support accelerated commercialisation of floating offshore wind, and offer further opportunities for private capital investment.

Onshore Wind

Onshore wind is the biggest single technology in Scotland’s current mix of renewable electricity generation, comprising 62% of installed capacity[18]. A thriving onshore wind sector is therefore critical to the decarbonisation in Scotland and the UK. As set out in our 2022 Onshore Wind Policy Statement, government and industry are focused on delivering at least 20 GW of onshore wind by 2030 (doubling current capacity) and recent pipeline analysis[19] shows that we should be on track to deliver this. This trajectory is underpinned by the Onshore Wind Sector Deal[20] which sets out a set of specific collaborative actions which include commitments by both the Scottish Government and the onshore wind industry to help deliver the 20 GW ambition. A supportive policy environment and successful industry collaboration via the Onshore Wind Strategic Leadership Group confirms the shared commitment of Government and industry to achieve this successful and responsible growth.

The onshore wind workforce is highly skilled and opportunities in installation, consulting, operations and maintenance are anticipated to rise in response to growth ambitions. Specialised engineering consultancy services such as wind farm design and financial due diligence related to onshore developments are expected to grow and offer additional, export potential[21]. There is commercial opportunity in circular supply chains related to the UK wind industry[22]. Scotland’s established, and now ageing onshore wind assets may also offer opportunities for innovative solutions in remanufacturing, recycling, and decommissioning end of life assets[23].

Approach

1. Support investment to improve essential infrastructure, expand supply chains and secure manufacturing opportunities.

a. Scottish Government will invest up to £500m over five years to anchor our offshore wind supply-chain in Scotland.

b. Offshore wind developers and investors will work together to support and accelerate projects critical to the offshore wind sector in Scotland. The industry- led Strategic Investment Model (SIM) has identified projects with a combined total Capital Expenditure of around £6.5bn. Current published SIM projects include port facilities, supply chain proposals, and an equipment project[24].

c. Through the onshore wind sector deal, Scotland’s enterprise agencies will focus on onshore supply chain development, business diversification and transition.

2. Develop and maintain a pipeline of investment propositions backed by information about the timing and nature of renewable energy opportunities. This will include our priorities for investment in supply chains and enabling infrastructure, such as ports and harbours. It will be backed by a commitment from enterprise agencies to provide detailed analysis of specific supply chain opportunities, share information with SMEs and facilitate connections between developers and suppliers, such as through ‘meet the buyer’ events.

3. Deliver planning and consenting improvements which enable Scotland’s net zero development pipeline. We will maximise the economic opportunity from the transition to net zero by delivering a robust and coherent, policy, planning, consenting and licensing framework, where we have devolved responsibility. This will ensure our processes are time-efficient and responsive to continuous improvement enabling sustainable development of our land and sea. As part of this, we will work with the Improvement Service to establish Scotland’s first Planning Hub to build capacity, resilience and improve consistency in decisions.

4. Work with UK Government, Ofgem and the National Energy System Operator to ensure that the interests of Scotland are best represented. Markets, policies, and regulation affecting the electricity sector are largely reserved to the UK Government under the UK Electricity Act (1989). We are working with the UK Government to enable a faster, more efficient, and strategic approach to designing and regulating the net zero energy system, in particular for accelerating grid connections and network build.

5. Work with the UK Government to maximise benefits to Scotland from key UK-wide funding schemes. The Scottish Government, enterprise agencies and the Scottish National Investment Bank will continue to pursue funding opportunities throughout the supply chain. This includes collaborating with the UK Government to help ensure maximum impact from investment and support, for example through GB Energy, to deliver for Scotland’s industries, businesses, and communities and complement the substantial work already taking place in Scotland in renewable generation and community energy.

6. Engage productively in domestic and international partnerships. The Scottish Offshore Wind Energy Council and Offshore and Onshore Sector Deals are effective examples of public-private industrial policy collaborations. Scottish Government will ensure it continues to support and prioritise engagement in this way as an essential modern industrial policy approach. We also form strategic partnerships with other countries where we can identify mutual benefit from working together, creating opportunities for supply chains, capacity building, and research, development and innovation (RD&I).

7. Explore the circularity opportunity in Onshore Wind. As some of Scotland’s first wind farms reach the end of their consented life and are decommissioned, further action with industrial partners to assess and target commercial opportunities is needed. The Onshore Wind Sector Deal commits industry to deliver at least one specialist blade treatment facility in Scotland by 2030 and commits the Scottish Government to explore the role a regulatory stimulus could play in driving behavioural change in the circularity of materials, including blades and the use of refurbished or remanufactured components.

Ardersier

Our “commercial first” approach to investment of up to £500 million over five years will anchor our offshore wind supply chain by leveraging private investment into essential infrastructure and by securing new manufacturing opportunities. We are working with partners to attract significant inward investors and Tier 1 suppliers to support Scotland’s energy transition and grow supply chains in Scotland. We are also supportive of the industry-led Strategic Investment Model, which aims to encourage investment in ports and harbours, critical infrastructure and the supply chain.

In early 2024, Ardersier port announced that it had received a £300m capital commitment by Quantum Capital Group. The Scottish National Investment Bank provided a £50m credit facility alongside £50m from the UK Infrastructure Bank to accelerate the Ardersier port development. This £100m investment will underpin one of the largest regeneration projects in the Highlands for decades. Once fully operational, Ardersier will be the largest dedicated offshore wind facility in Scotland and will underpin the creation of a nationally significant infrastructure facility to support industrial-scale deployment of fixed and floating offshore wind. The facility will significantly increase Scotland’s offshore wind port capacity to support the transition to net zero and will re-establish the port as a major local employer. At full capacity, it is estimated that the site has potential to enable around 3,000 jobs and reskilling opportunities

Opportunity 2: Carbon Capture Utilisation and Storage (CCUS)

Developing a self-sustaining carbon capture, utilisation and storage sector: building on our geological CO2 storage potential, expertise in subsea engineering and a highly-trained workforce, enabling low carbon products and aiming to capture a portion of the European market for carbon storage which is both an economic opportunity as well as assisting our European neighbours to decarbonise.

Scotland’s Potential

Carbon Capture, Utilisation and Storage (CCUS) captures waste carbon dioxide (CO2) from point sources such as industrial processes and power plants, and either utilises this in industrial processes or transports it for safe and permanent storage. The UK’s independent advisor on climate change, the Climate Change Committee (CCC), states that “to avoid being left behind in a race to the top, the UK should ensure that timely policy development and investor clarity in sectors such as CCS is prioritised.”[25]

Deploying, accelerating and scaling cost- effective carbon capture and storage is both an environmental necessity and an economic opportunity. The global market for industry CCUS & CO2 transport & storage could be worth an estimated £181bn and £54bn per annum in turnover by 2050[26]. Investing domestically secures the benefits of a robust CCUS supply chain, allowing the UK to benefit from this large potential global market share.

Scotland is well-placed to become a key European market player in CCUS due to having over 50% of the UK’s potential total CO2 storage capacity and 18% of Europe’s potential total storage capacity[27]. Our vast geological CO2 storage, when combined with opportunities to repurpose existing oil and gas infrastructure assets for CO2 transport and storage, and our skilled workforce in adjacent sectors provide Scotland with a potential comparative advantage in deploying decarbonisation pathways for existing and emerging industries. Our storage capacity could also enable Scotland to play a key part in Europe’s decarbonisation.

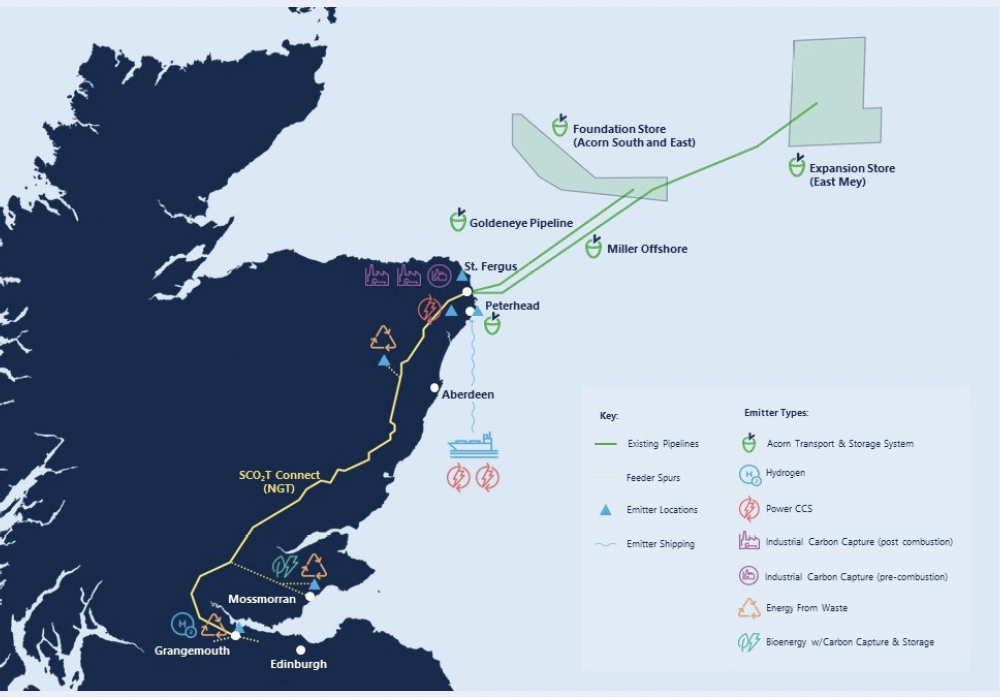

Scotland is already demonstrating abilities at a local level, with several distilleries and a biogas plant currently capturing, or enroute to capturing CO2, initially for utilisation, offsetting CO2 from fossil sources, with a potential for future storage[28]. At a national level, larger, industrial sites including Grangemouth and Mossmorran form part of a Scottish Cluster – a group of industrial emitters which will be linked to the Acorn Transport and Storage (T&S) system by pipeline. Such sites will produce the initial supply of CO2 for storage in the Acorn Project which is expected to store at least 5 megatonnes of CO2 per year by 2030, with an estimated total storage capacity of around 240 megatonnes.[29] Internationally, Scotland is already exporting CCUS expertise, manufactured products, intellectual property, and academia.

Future Growth

The EU recently published its Carbon Management Strategy and Net Zero Industry Act[30] in which it proposes to develop at least 50 million tonnes per year of CO2 storage capacity by 2030. Based on the impact assessment of the EU recommended climate target for 2040, this figure will need to grow to around 280 million tonnes by 2040.

Studies, including through Robert Gordon University’s Energy Transition Institute, suggest that operational CCUS activities are likely to be focused around key geographical clusters, providing a starting point for a new carbon capture industry with a sizeable export potential. Existing port infrastructure, for example at Peterhead and Sullom Voe, could facilitate the importation of CO2 for storage via shipping routes, with further potential for international pipeline transportation at a future point.

An economic assessment undertaken on behalf of the Acorn Project and the Scottish Cluster highlights significant economic impacts during the development, construction and operations phases. This includes “CO2 captured from sources in other parts of the UK or internationally to be shipped to Acorn via Peterhead – providing an option for emitters across the UK without immediate access to CO2 storage and the potential to create substantial international trade opportunities”[31].

Scotland can embrace the opportunity of new green industry (e.g. biofuels, sustainable aviation fuel) locating in established industrial areas.

For example, utilisation companies locating in Grangemouth will have access to an abundance of locally produced CO2 and energy. An example is the production of low carbon fuels, which as a sector already provided around £35m GVA to Scotland in 2020, a figure which could increase up to £360m by 2050 if sufficient capital investment is secured.[32] This projected value is separate to analysis of the CCUS sector itself.

Smaller scale carbon capture and utilisation will play a proportionate but significant role in the emerging green industrial economy in Scotland. From capture to transportation and use, there will be local supply chain benefits as well as exportable skills, products, and expertise. Critically, the sector can also drive the greening of existing industries, which, due to Scotland’s carbon management offer, can remain competitive internationally, and enhance the potential to attract new clean industries[33]. The sector will also drive sustainable manufacturing through the utilisation of captured CO2, including in the production of synthetic fuels, the chemicals sector, the food and beverage industry and the construction sector. CO2 utilisation will help develop new investment and market opportunities for Scottish businesses.

As with all emerging opportunities, there will be hurdles to overcome, including a potential shortfall of skilled workers (including planning, engineering and specialist work such as subsurface geological modelling) and supply chain constraints as the Acorn Project and the Scottish Cluster compete for talent with other energy projects and progress to a similar timeframe to the development of other CCUS clusters in the UK[34] However, analysis undertaken by Vivid Economics suggests there are no major technical skills gaps for the development of a CCUS industry in Scotland.[35]

Approach

1. Focus on the key dependencies for a competitive CCUS sector. The economic success of CCUS in Scotland is dependent on effective collaboration between the Scottish Government, the UK Government and industry. We will work with the UK Government to is the production of low carbon fuels, which as a sector already provided around £35m GVA to Scotland in 2020, a figure which could increase up to £360m by 2050 if sufficient capital investment is secured.32 This projected value is separate to analysis of the CCUS sector itself.

2. Support CCUS growth in Scotland and internationally by maximising our comparative advantages around infrastructure, skills and storage. This will be achieved through the deployment of the Acorn Project and the expansion of the Scottish Cluster, as well as working collaboratively with our European neighbours to ensure the necessary regulatory and policy enablers are in place for cross-border transportation and storage.

3. Coordinate local and national government and agencies to leverage our fourth National Planning Framework (NPF4) commitment to supporting net zero. We will work closely with the Acorn project and the Scottish Cluster to ensure timely decision-making and communication between industry, local authorities and agencies, ensuring local planners and licencing authorities have the necessary skills and support. The Scottish Cluster is already recognised as an Industrial Green Transition Zone (National Development 15).

4. Building a market framework for CCUS is in development. We will work constructively with the UK Government and other EU nations, to achieve our shared long-term goal of a self-sustaining international market for CCUS.

The Scottish Cluster is made up of Acorn transport and storage project, National Gas SCO2T Connect Project (a pipeline project which links the Central Belt with North-East Scotland), and a group of industrial, power, hydrogen, bioenergy and waste-to-energy businesses across Scotland who are committed to cutting the country’s carbon emissions and making a vital contribution to achieving net zero, attracting significant investment and providing high-quality, sustainable jobs. Together the projects in the Scottish Cluster have the potential to capture and store 5-10 million tonnes of CO2 per year by 2030.

Opportunity 3: Green Economy Financial and Professional Services

Supporting green economy professional and financial services, with global reach: building on our strengths in high-value tradable services sectors and considering how SG can support future innovation and growth.

Scotland’s energy supply chain and services have developed particularly around our offshore oil and gas sector[36]. This includes activities such as mining/drilling support services, machinery and equipment, financial services, repair and maintenance services and many others.[37]Our most up to date data conservatively estimates that the O&G supply chain supports around 32,000 jobs in Scotland[38]. Evidence also suggests that a significant proportion of these companies are already diversifying their operations into low carbon and renewable energy sectors, including offshore wind, CCUS and hydrogen.[39] Scotland’s world-class existing capability in oil and gas services will be key in attracting investment in the energy transition and ensuring capacity is retained and developed. The ESJTP sets out more detail on the opportunities for energy supply chains and services and the actions being taken by Scottish Government in this space.

Green Financial and Professional Services

The Financial and Professional Services (FPS) industry is one of Scotland’s competitive strengths. We are the UK’s second financial centre after London; the sector accounts for 9.8% of the national economy and employs around 144,000 people[40]. Edinburgh and Glasgow are rated within the top 50 in both the Global Financial Centres Index and the Global Green Finance Index[41] and the sector has a central role to play in attracting and deploying the capital required to deliver this Green Industrial Strategy.

The potential for Scotland to grow its market share of Green Financial Services was identified by the Scottish Government in the 2021 Programme for Government, which announced the establishment of an industry-led Scottish Taskforce for Green and Sustainable Financial Services. The scale of the opportunity was set out further in the Scottish Financial Enterprise-led industry growth strategy, which noted that “Scotland has many of the underlying fundamentals needed to be a global leader in this area.”

The final report and recommendations of the Taskforce, which will be published in September 2024, represents a critical inflection point in establishing Scotland as a truly competitive global hub for green and sustainable finance. It will accelerate the wider transition of the economy to net zero, create good jobs at home and, as we build up domestic expertise, boost services exports abroad. It will build on our history, the legacy of COP26 where the Glasgow Finance Alliance for Net Zero (GFANZ) was launched, a wealth of natural capital, a world-class higher education system, a strong UK-wide regulatory regime and a burgeoning FinTech ecosystem. It will also look forward, with an ongoing commitment to innovate and evolve our business model to compete with other emerging green financial centres.

Approach

1. Promote Scotland globally as a leading centre for green financial and professional services. This will be delivered through a combination of the marketing expertise of the Brand Scotland programme, the Scottish Government’s international network, Scottish Enterprise and industry partners including Scottish Financial Enterprise and the Global Ethical Finance Initiative.

2. Harness innovation through Scotland’s FinTech Community. This will be achieved through FinTech Scotland’s Climate Finance innovation programme, part of the FinTech 10 year Research and Innovation Roadmap, and through the Financial Regulation Innovation Lab (FRIL), whose work in regulatory innovation is accelerating the capabilities of fintechs, financial services and markets, in the UK and globally, to deliver positive climate outcomes.

3. Open up new market opportunities in Natural Capital. Scotland can have comparative advantage in a value-led, high-integrity market for private Natural Capital. To ensure that Scotland capitalises this opportunity, we will support development of natural capital markets that are valued for their environmental and financial integrity by publishing and implementing a Market Framework for Natural Capital – setting out the expectations and actions that will develop opportunities provided by responsible investment in natural capital. We will also test mechanisms to attract responsible private investment to help public funding go further.

4. Create domestic demand for green financial services. This will be achieved by accelerating work to attract globally mobile private capital to Scotland through delivery of the recommendations of the First Minister’s Investor Panel. By providing overarching policy clarity and certainty, we will unlock public and private capital at scale through predictable and durable industrial and energy policy frameworks. Behind every transaction and project, financial, legal, data and accountancy experts are needed to move deals through to completion. By boosting investment, we will stimulate demand for Scottish Green Financial and Professional Business Services.

5. Work with UK Government on the delivery of its Green Finance Strategy. While green finance policy and regulation is reserved and applies across the UK, the Scottish Government has and will continue to engage proactively and collaboratively with work at a UK level. We will seek to influence regulatory initiatives where Scotland’s needs or interests are distinct and ensure that Scotland’s offer is a key component of the UK’s global pitch to attract investment and become a world leading net zero aligned financial centre.

6. Deliver on the Scottish Government’s formal bilateral partnership with the City of London Corporation. This will support a range of engagement and policy activities, encouraging growth of Scotland as a thriving financial centre, including through international promotion; championing the Global Investment Futures campaign to support the Scottish FS Industry’s target to double AUM in Scotland to £1tn by 2030; and by participating in the City’s annual Net Zero Delivery Summit.

7. Support Scotland’s world class education sector to nurture domestic and global talent. The sector is already innovating, with several Scottish Universities offering highly regarded postgraduate courses in Sustainable Finance and Investment. Through our International Education Strategy, the Scottish Government will seek to promote and export our international education offer through Connected Scotland – working together to promote our country as a destination to study, live and work in areas of opportunity, like the Green transition.

Financial Regulation Innovation Lab (FRIL)

FinTech Scotland is actively involved in promoting climate finance. Through their Climate Finance Innovation Programme and FRIL, they launched a three-month innovation challenge in June 2024, focused on “Shaping the future of Environmental, Social, and Governance (ESG) in Financial Services”.

In collaboration with leading financial services organisations, the challenge statements encourage innovative entrepreneurs to create data-driven solutions and technology-enabled approaches to meet new ESG regulatory requirements, promoting responsible outcomes for people, the climate, and the environment.

A sample of the challenges includes: utilising technology to identify existing and new ESG regulatory requirements in a sustainable way; reviewing data quality, regulatory compatibility, and common data points to support decision-making; technology to help FS firms understand and track evolving climate science and manage their sustainability strategies and products; leveraging GenAI and emerging tech to help with ESG data including greenwashing.

This is FRIL’s second innovation call since it was established in Dec 2023. The first innovation challenge focused on Simplifying AI in Compliance through the use of AI and other emerging technologies.

Note: The Climate Innovation Programme is part of the FinTech Research and Innovation Roadmap Scotland-FinTech-Roadmap-March-2022-lowres.pdf (fintechscotland.com)

Opportunity 4: Hydrogen

Growing our hydrogen sector: building on our comparative advantage of renewable electricity generation, becoming a leading hydrogen nation in the production and export of reliable, competitive, sustainable hydrogen, hydrogen products and related skills and services for domestic decarbonisation, and export to European markets and beyond.

International Energy Agency (IEA) forecasting suggests global demand for renewable and low carbon hydrogen could reach 70 Mt (million tonnes) in 2030 and over 400 Mt by 2050[42] and a significant portion of this will be internationally traded. Much of this international demand is likely to develop in close geographic areas with the European Commission targeting 330 TWh (10 Mt) of imported hydrogen by 2030.

Scotland’s comparative advantage in the hydrogen sector is enhanced by our ability to develop the wind and CCUS sector opportunities described in this strategy. Our onshore and offshore wind resources provide the potential to support the large-scale production of renewable hydrogen via electrolysis and enable us to become a major competitor for the export of hydrogen into European markets. Our CCUS capabilities provide the potential to make industrial production of hydrogen cleaner and scale up the use of hydrogen within high carbon industries. Our other strengths include:

- our proximity to anticipated centres of demand in Europe, which means lower transport costs and shorter distances than potential competing hydrogen exporting nations[43];

- our industry expertise and skills, with world-class expertise in developing energy infrastructure, a high-quality academic knowledge base and a highly skilled workforce;

- a stable and supportive political environment and policy framework, and commitment to ensuring a supportive regulatory framework and UK and Scottish investment programmes;

- success in supporting and advancing innovation in hydrogen and other energy technologies, with several pioneering renewables projects including the world’s first fleet of double decker hydrogen buses and hydrogen production hubs in Aberdeen.

Scottish Government’s Hydrogen Policy Statement[44] and Hydrogen Action Plan[45] set out the evidence base and policy support to develop a hydrogen economy in Scotland with an ambition to achieve 5 GW of hydrogen production capacity by 2030 and 25 GW by 2045. These describe a commitment to helping the Scottish hydrogen sector develop, grow and endure, and there is already a pipeline of more than 90 hydrogen production projects in varying stages of development in Scotland. We will take a pragmatic approach in which we prepare now for the opportunities that will come as the hydrogen sector matures and the production of clean energy from an expanded wind sector grows beyond current domestic demand.

Scotland already has over 150 companies actively involved in the hydrogen sector and c.1,000 others with relevant skills and capabilities delivering products, solutions, and services across the supply chain, many of which are making plans to enter the sector imminently. There are several dependencies to scaling the sector successfully, which we will address in partnership, in particular through the Scottish Hydrogen Industry Forum which offers a platform for engagement with the sector and a means to identify and overcome barriers to deployment.

Scottish ports will play a crucial role in growing the hydrogen sector to facilitate the export of hydrogen and hydrogen products to external markets in the UK and in Northern Europe, either via pipeline or through shipping.

Approach

1. Identify barriers to hydrogen production development and work with the UKG to prioritise the production of renewable and low carbon hydrogen and hydrogen products. This will exploit the comparative advantage offered by the potential of using the renewable energy generated by the wind sector to produce renewable hydrogen and hydrogen products such as ‘green’ ammonia and sustainable aviation fuels, and the development of the CCUS sector which will facilitate the production of low carbon hydrogen.

2. Encourage domestic demand for renewable and low carbon hydrogen and hydrogen products. This will be achieved by helping to support the switching of hydrogen use in traditional areas such as refining and the chemical industry away from grey hydrogen (produced from unabated fossil fuels) and working through our enterprise agencies to attract and develop businesses focused on hydrogen products and derivatives. As a starting point, we are currently taking forward research to understand Scottish production capabilities for low and no carbon hydrogen products and demand for these both domestically and internationally.

3. Support the sector to develop new place- based hubs of co-located hydrogen production and demand. We will work with local authorities and the private sector to develop hydrogen hubs, like the Aberdeen Hydrogen Hub, close to demand centres including industrial central clusters and transport centres. We will also support the development of renewable hydrogen production with the Inverness and Cromarty Firth and the Forth Green Freeports, leveraging the opportunities these provide to crowd in private investment.

4. Maximise export opportunities for hydrogen and hydrogen products. Led by the pathway set out in our forthcoming Hydrogen Sector Export Plan, we will:

a. Promote Scotland’s proximity and potential infrastructure connectivity to key hydrogen import locations in northern Europe, to become an export hub linking the North Sea region and the north of Europe.

b. Continue to support the Net Zero Technology Centre to develop the case for a hydrogen pipeline between Scotland and continental Europe, integrating hydrogen production and pipeline infrastructure from North Sea neighbouring regions.

c. Build on the Memorandums of Understanding that have been signed already with Denmark, priority states in Germany, and Occitania in France, and continue engaging with strategic key European partners such as the European Hydrogen Backbone, Hydrogen Europe, and the Clean Hydrogen Partnership.

d. Seek opportunities for International Regulatory Cooperation (IRC) with like- minded trading partners to support Scottish exports of hydrogen, and where regulatory barriers to international trade are identified, we will utilise mechanisms for IRC within our competence to help reduce these.

e. Look to develop a new framework to identify the critical success factors, enablers and sequential steps required to create a successful international hydrogen sector in Scotland.

f. Collaborate with the UK Government to ensure the UK’s standards, regulations and certification schemes support the needs of Scotland’s hydrogen sector and are strategically aligned with Scotland’s priority trading partners. Europe, and the EU’s role as a globally significant regulator, will be of particular importance in this respect and we will seek international alignment where required.

5. Support the development of the goods and services sectors across the hydrogen supply chain. In tandem with our enterprise agencies and key industry stakeholders, we will:

a. Strengthen our knowledge of Scotland’s existing supply chain capabilities and capacity, and its relevance to hydrogen, by focusing on company engagement and publishing and maintaining an up to date, accurate and complete map of this information.

b. Develop practical reports and fact sheets to share with Scottish companies detailing the nature, scale and timelines of the emerging commercial opportunities that these companies can take advantage of as the hydrogen sector in Scotland matures.

c. Deliver a supply chain programme of activity to identify and support companies active in or with ambitions to get involved in hydrogen projects. Through this programme we will provide access to supply chain support and engage with SE’s new Energy Transition Integrated Supply Chain programme of activity.

d. Identify hydrogen supply chain opportunities by working with Scottish Development International and Scottish Government hubs to better understand where hydrogen developments in global markets represent opportunities for Scottish supply chain companies, and disseminating these opportunities via regular and targeted communications, as well as one-to-many and one-to-few events and webinars designed to maximise Scottish content in hydrogen projects.

e. Provide direct support to Scottish supply chain companies, helping them to identify and overcome barriers to entry into the hydrogen market and build their capacity to work in the sector in areas including skills, training & recruitment, market assessment, internationalisation, business planning and strategy, innovation and investment.

6. Support R&D, innovation and early-stage demonstration across the value chain. We will work with our enterprise agencies to:

a. Support innovative companies and growth of test and demonstration facilities, building on those which have been funded through the Hydrogen Innovation Scheme.

b. Support the Scottish Hydrogen Innovation Network (SHINe) which aims to increase collaboration, attract funding and provide a single entry point to the Scottish hydrogen innovation ecosystem.

c. Provide R&D funding to companies and assist companies to attract UK and EU level R&D funding.

d. Help innovative start-ups to develop business plans, make partnerships and secure seed investment.

Grangemouth

The Grangemouth industrial cluster plays an important role in Scotland’s current energy system. However, it has been estimated that the Grangemouth cluster was responsible for 7.2% of Scotland’s total carbon emissions in 2022 [1]. Investment in a world-scale low-carbon hydrogen plant here is at the heart of the Ineos Grangemouth net zero route map [2] that commits to deliver emissions savings of more than 60% across the site by 2030.

Given the critical role of Grangemouth, both for the Scottish and wider UK economy and climate change targets, our ambition is to secure a long-term sustainable future that is significantly decarbonised. Grangemouth industrial cluster presents a clear opportunity to achieve this through an extensive range of knowledge, skills and experience. The designation of a Green Freeport tax site at Grangemouth, which aims to focus on low carbon fuel manufacturing, will support our ambitions for its future. Early investor activity supported in part by the Green Freeport incentives includes the planned green hydrogen investment announced by RWE in May 2024.

In addition to reducing emissions, investing in locally produced low-carbon hydrogen will benefit other assets at the Grangemouth site, fuelling the existing combined heat and power plant and ethylene cracker. The design provides capability to link the low-carbon hydrogen produced to other users in the local area and support development of a local hydrogen hub. The site is also well placed to produce future fuel products in a net zero economy, and the region can support decarbonisation across other regions and sectors within Scotland. There is significant potential for carbon intensive industrial clusters, such as Grangemouth and Mossmorran to unlock deeper decarbonisation across Scotland

1. UK Emissions Trading Registry - GOV.UK (view-emissions-trading-registry.service.gov.uk)

2. Ongoing Emissions reduction at INEOS Grangemouth - Project Examples | INEOS Grangemouth Sustainability Stories

Opportunity 5: Building Clean Industries

Establishing Scotland as a competitive centre for the clean Energy Intensive Industries of the future: Supporting the electrification of our existing energy intensive industries where appropriate, and making Scotland internationally attractive as a location for existing and new clean Energy Intensive Industries which will benefit from our growing capacity in renewable electricity production.

The strong pipeline of renewables in Scotland today could mean that our renewable electricity capacity in 2030 is more than double current levels, potentially generating more than double Scotland’s electricity demand by 2030 and more than treble by 2045. This creates a potential opportunity for Scotland to become a highly attractive location for clean energy intensive industries (EIIs), and for existing EIIs in Scotland to decarbonise.

Energy intensive sectors include, but are not limited to, traditional industries such as chemicals, paper, steel, and emerging industries such as datacentres. Across Europe, these are often located in areas with limited potential for wind or solar power, leading to the active consideration of relocation. Already regions such as Andalusia in Spain [46] and demonstration hydrogen steel plants have been deployed near to wind farms on the coast of Northern Germany[47]

EIIs bring significant value to Scotland and are well-placed to innovate and grow in our future energy system. The alternative of preventing innovation and forcing the closure of mature manufacturing bases in Scotland will not aid Scotland or the global economy’s race towards net zero. An EII entity relocating to a location with a less climate-focused policy stance displaces both the emissions and the added economic value, harming the planet and our economy.

New and existing energy intensive industries are also a potential source of demand for clean energy in our future system, contributing to incentives to invest in renewables build-out and creating green jobs. As we consider how to support clean EIIs in Scotland we will remain mindful of all the potential impacts on communities.

In some areas work to understand the drivers for establishing new clean EIIs in Scotland is underway and clear direction has been set. Green datacentres offer an example: global data demand is growing exponentially as a result of energy intensive computer processing such as generative Artificial Intelligence (AI). There is an urgent market need for renewable energy supply direct to datacentres (supported for resilience by grid connections) to allow the industry to prepare for sustainability disclosures due to come into effect in 2025. There is therefore an opportunity for Scotland to utilise its renewable energy generating capacity to service that demand. A vision and action plan[48] set out Scotland’s market development actions as well as the drivers for success (‘pillars’) including low cost renewable energy, terrestrial wholesale fibre connectivity, and international subsea fibre connectivity. The Scottish Government has also commissioned, through its agencies, research into the potential economic impact of the sector in Scotland.

Approach

1. Tackle the barriers to decarbonisation faced by Energy Intensive Industries. We will work with the UK Government to plan and secure the delivery of the substantial infrastructure, as well as new energy generation and conversion assets, that need to be developed before industrial fuel switching (to renewable hydrogen and/or to electrification) and CCUS can be deployed on a large scale. We will also continue working with the UK Government and the National Energy System Operator (NESO – currently the ESO) to address disincentives to electrification for existing industry, such as costs and availability of grid connections. Alongside this, we continue to match-fund a range of industrial decarbonisation projects via the Scottish Industrial Energy Transformation Fund (SIETF), and develop a delivery plan that draws on research commissioned by Scottish Enterprise to understand the most appropriate fuel- switching options for businesses in a range of energy intensive industries.

2. Work with UK Government to explore options for reducing electricity costs for large-scale consumers. The current wholesale market is not fit for purpose to deliver a net zero electricity system. We will continue to engage with the UK Government to ensure that any future wholesale market reforms support continued deployment of renewable generation and adequate protection to consumers. This includes exploring options for reducing electricity costs for large-scale consumers through Private Wire and PPAs. We will also continue to work closely with the UK Government to understand the potential impacts of locational pricing and other market reform options on electricity costs and Scotland’s energy ambitions. The Energy Strategy and Just Transition Plan sets out more detail on locational pricing and broader market reforms. Through Scottish Development International, we are working with DESNZ on the triage service for network connections, which considers optimal locations for large consumers and may offer opportunities for prioritising connections for industries in Scotland.

3. Develop and resource a delivery plan which will identify, target and enable new clean EIIs to locate in Scotland. Working with our enterprise agencies, we will further explore Scotland’s competitive advantages in attracting new clean EIIs, to better understand which industries to target and develop a delivery plan for “Team Scotland”. Where appropriate, this will include site analysis to build an understanding of optimal locations which take account of natural resources and economic factors such as the availability of a skilled workforce and the accessibility of critical supply chains.

4. Attract a significant pipeline of inward investment in Green Data Centres. Working with our enterprise agencies we will assess and support commercial efforts to locate new data centre sites that utilise our renewable energy sources while exploring opportunities to recycle waste heat from these facilities into the wider community. This will target both hyperscale datacentre opportunities and smaller scale (edge) datacentre deployments.

Contact

There is a problem

Thanks for your feedback