Alcohol - minimum unit pricing - continuation and future pricing: interim business and regulatory impact assessment

This business and regulatory impact assessment (BRIA) contains an assessment of two policy proposals: 1) continuing the effect of the minimum unit pricing (MUP) legislation and 2) in the event of continuation, an increase in the price per unit, to 65ppu.

6. Regulatory and EU Alignment Impacts

The UK Internal Market Act 2020

The United Kingdom Internal Market Act 2020 (IMA) introduced two market access principles for goods – the principles of mutual recognition and non-discrimination. The current MUP requirements are not subject to the principles, as the requirements were in place on 30 December 2020.

However, the proposed change in price would be a substantive change to the policy and bring it within the scope of the IMA. As such, consideration has been given to how MUP at the proposed price would comply with the market access principles.

MUP is excluded from the scope of the mutual recognition principle as it is a manner of sale requirement within the meaning of the Act. It does, however, fall within the scope of the principle of non-discrimination for goods and so the Scottish Government has considered whether the measures could either directly or indirectly discriminate against incoming goods with a relevant connection with another part of the UK. A good has a relevant connection with a part of the UK if it (or any of its components) is produced in, produced by a business based in, comes through or passes through that part of the UK before reaching the part of the UK in which it is sold.

The proposed requirements would not directly discriminate. MUP applies to the sale of all alcoholic beverages in the on-trade and off-trade in Scotland, irrespective of the product's location of origin, import or ownership. Local and incoming goods are therefore not treated any differently, with the requirements placed on incoming goods also applying to locally produced good or goods which otherwise have a relevant connection with Scotland

The Scottish Ministers have also considered whether the proposals could indirectly discriminate against incoming goods. This would be the case if the requirements do not directly discriminate but apply to, or in relation to, the incoming goods in a way that puts it at a disadvantage, and has an adverse market effect, and cannot be reasonably considered a necessary means of achieving a legitimate aim. An "adverse market effect" would arise if incoming goods are put at a disadvantage by MUP but comparable goods with a relevant connection to Scotland (and no other part of the UK) are not put at that disadvantage and as a result, it causes a significant adverse effect on competition of those goods in the UK.

The Scottish Ministers do not consider the proposals would indirectly discriminate against incoming goods. In particular, they are considered a necessary means of achieving the legitimate aim of protecting the life and health of humans.

Intra-UK Trade

MUP still has the potential to impact on intra-UK trade if it impacts the demand from Scottish consumers for products with a connection to other parts of the UK. This would primarily be down to a change in sales in Scotland, but a price divergence between parts of the UK also has the potential to result in a change in cross-border sales.

A survey by the Office for the Internal Market[84] found that most of the respondents that trade with other UK nations said that doing so was either fairly or very easy, and difficulties were primarily general difficulties rather than regulatory differences.

However, a notable number of firms identified some existing differences in regulations likely to affect their sales (42 out of 337 who trade across UK nations), and regulations relating to food and drink, including alcohol policies such as MUP, was one of the four most frequently cited areas, cited by medium and large producers and accommodation providers.

The UK alcoholic beverage production industry is highly integrated, with a number of businesses with operations across different countries in the UK. Production in the UK, particularly of beer, is dominated by a small number of global multinational companies, following a trend of consolidation over the previous decades[85].

This section of the BRIA sets out information relevant to potential impacts on intra-UK trade.

Production location of top selling brands in Scotland

The ability to identify any potential significant impacts on intra-UK trade as a result of the proposals is limited by the lack of available data on the location of production within, or import into or within, the UK, of products sold in the Scottish on- and off-trade.

To understand more about the potential for differential impacts of MUP on products originating from other parts of the UK, or internationally, the Scottish Government has sought to identify the production location of the top selling alcoholic beverage products in the Scottish off-trade using publicly available information such as product and supermarket websites, industry journals and news articles. Brands which have production locations in Scotland as well as the rest of the UK are classified as Scotland, to reflect the likelihood that this will be used to meet domestic demand.

The top 50 selling brands in the supermarket and convenience sectors[86], along with their average price, sales volume and value in 2022, have been identified through analysis of market data purchased by the Scottish Government[87]. These products made up 59.2% of off-sales in Scotland by volume in 2022.

Of the top selling 50 brands, we estimate that 15 were produced in Scotland, 15 produced in the rest of the UK, and 20 internationally. The products produced in Scotland make up a larger share of the total volume and value of sales compared to those from the rest of the UK and internationally (Table 56).

| Products | Volume (units) | % of Volume | Value (£) | % of Value | |

|---|---|---|---|---|---|

| Scotland | 15 | 690,886,162 | 48% | 387,608,832 | 44% |

| rUK | 15 | 427,724,806 | 29% | 264,059,804 | 30% |

| International | 20 | 332,515,613 | 23% | 223,330,988 | 26% |

| Total | 50 | 1,451,126,581 | 100% | 874,999,624 | 100% |

Source: Scottish Government analysis of Circana Ltd data.

Average price and distribution of top selling brands in Scotland

The potential impact of a change in the level of MUP on intra-UK trade is dependent on the extent to which incoming goods would have to adjust their price to meet the new requirements and the resulting impact on demand – both absolutely and relative to products with a relevant connection to Scotland.

The average unit price of the top selling brands in Scotland by production location is shown in Table 57.

| Production location | Average Unit Price 2022 (by volume) |

|---|---|

| Scotland | 0.56 |

| rUK | 0.62 |

| International | 0.67 |

| Total | 0.60 |

Of the top 50 selling brands, Scottish produced brands are sold at the lowest price per unit on average (Table 58) where average unit price is calculated weighted by the volume of sales of each product.

While limited to the top selling products, the lower average unit price for products produced in Scotland compared to the rest of the UK in this analysis suggests that changes to the MUP level would not disproportionally impact the overall level of trade of products produced in the rest of the UK over these produced in Scotland.

The average price masks the variation in the specific brand prices originating from different locations. This price distribution of the top selling products helps identify the share of products (in both absolute number and by volume of sales) which could potentially be impacted by a different level of MUP. The share of products priced below a section of unit prices is presented in Table 58 across different production locations.

| Scotland | rUK | International | ||

|---|---|---|---|---|

| Share sold below £0.55 per unit | By brands | 40% | 27% | 10% |

| By volume | 28% | 15% | 11% | |

| Share sold below £0.60 per unit | By brands | 87% | 53% | 25% |

| By volume | 95% | 56% | 22% | |

| Share sold below £0.65 per unit | By brands | 93% | 67% | 40% |

| By volume | 97% | 64% | 34% |

The price distribution for products produced in Scotland is more skewed towards the lower price per unit than products from the rest of the UK for both the relative share of products and also when taking into account the volume of alcohol in the sales.

For instance, at the preferred minimum unit price of 65p, 93% of Scottish produced top selling products (i.e. 14 of the 15 top selling Scottish produced brands), and 97% of the volume of sales, were sold for lower than this on average in 2022. Comparatively, only 67% of brands produced in the rest of the UK, and 64% of the volume of sales were sold below 65ppu on average in 2022.

At the overall level the price distribution of the top selling products suggests that increasing the level of MUP to 65p per unit would impact a smaller proportion of products from the rest of the UK than those produced in Scotland, all else equal.

Business location of top selling brands in Scotland

In addition to the location of production, goods may have a connection with another part of the UK by virtue of the location of their business.

Using the same sales data as for production location above, an assessment has been made of the location of the UK registered address of the companies producing the top selling brands in Scotland. This assessment is based on searching publicly available resources, and for the purposes of this consultation is based on the UK registered address of the brand owner or subsidiary company. For a number of imported products, primarily wines, the UK address of the botting company or distributor identified has been used.

This assessment sees brands such as Heineken and Strongbow, both Heineken brands, which are assessed to be produced in the rest of the UK assigned to Scotland as the parent company's UK registered address is in Edinburgh. Alternatively, Diageo owned brands such as Smirnoff vodka and Bells whisky are assigned to rUK as Diageo's UK registered address is in London.

When just considering the location of the business address in the UK, the share of top selling off-trade brands from a business with a Scottish address is considerably smaller than those with an address in the rest of the UK – see Table 59.

| Products | Volume (units) | % of Volume | Value (£) | % of Value | |

|---|---|---|---|---|---|

| Scotland | 11 | 467,448,735 | 32% | 269,508,641 | 31% |

| rUK | 39 | 983,677,846 | 68% | 605,490,983 | 69% |

| Total | 50 | 1,451,126,581 | 100% | 874,999,624 | 100% |

As with the location of production, the average price per unit of off-trade brands from Scottish located businesses is smaller than that of those from the rest of the UK (58ppu compared to 62ppu in 2022). See Table 60.

| Business location | Average Unit Price 2022 (by volume) |

|---|---|

| Scotland | 0.58 |

| rUK | 0.62 |

| Total | 0.60 |

The average price masks the variation in the specific brand prices from businesses located in Scotland and rUK. This price distribution of the top selling off-trade brands helps identify the share of products (in both absolute number and by volume of sales) which could potentially be impacted by a different level of MUP. The share of products priced below a section of unit prices is presented in Table 61 across brands from different business locations.

| Scotland | rUK | Total | ||

|---|---|---|---|---|

| Share sold below £0.55 per unit | By brands | 36% | 21% | 24% |

| By volume | 36% | 13% | 20% | |

| Share sold below £0.60 per unit | By brands | 64% | 49% | 52% |

| By volume | 82% | 60% | 67% | |

| Share sold below £0.65 per unit | By brands | 73% | 62% | 64% |

| By volume | 85% | 67% | 73% |

The price distribution for brands whose business address is located in Scotland is more skewed towards the lower price per unit than brands from businesses located in the rest of the UK for both the relative share of products and also when taking into account the volume of alcohol in the sales.

For instance, at our preferred minimum unit price of 65p, 73% of the brands from Scottish addressed businesses, and 85% of the volume of sales, were sold for lower than this on average in 2022. Comparatively, only 62% of brands from businesses addressed in the rest of the UK, and 67% of the volume of sales, were sold below 65ppu on average in 2022.

At the overall level the price distribution of the top selling products suggests that increasing the level of MUP to 65p per unit would impact a smaller proportion of products produced by businesses addressed in the rest of the UK than those produced by businesses addressed in Scotland, all else equal.

Product (brand) level impacts

While at the overall level (based on analysis of the Top 50 selling brands) there is no indication that brands produced outwith or by a business located outwith Scotland are disadvantaged in comparison to brands produced in or by a business located in Scotland at the preferred MUP, this does not mean that individual products with a connection to the rest of the UK will not be impacted by a change in the price of MUP to 65p per unit.

For the Top-50 off-sales brands, Table 62 groups the brands by their production location and highlights which brand sold for an average unit price of below 65p in 2022.

| Sales Rank (Volume) | Brand | Average Unit Price (2022) | Type | Production location | UK business address* |

|---|---|---|---|---|---|

| 1 | Smirnoff | 0.553 | Spirit | Scotland | rUK |

| 2 | Tennents | 0.562 | Beer | Scotland | Scotland |

| 4 | Stella Artois | 0.58 | Beer | Scotland | rUK |

| 6 | Glens | 0.547 | Spirit | Scotland | Scotland |

| 7 | The Famous Grouse | 0.538 | Spirit | Scotland | Scotland |

| 9 | Gordons | 0.558 | Spirit | Scotland | rUK |

| 10 | Whyte & Mackay | 0.522 | Spirit | Scotland | Scotland |

| 17 | Smirnoff Red Label | 0.56 | Spirit | Scotland | rUK |

| 18 | Grants Vodka | 0.545 | Spirit | Scotland | Scotland |

| 22 | Brewdog | 0.74 | Beer | Scotland | Scotland |

| 25 | Glen Catrine | 0.522 | Spirit | Scotland | Scotland |

| 29 | Gordons Premium Pink | 0.581 | Spirit | Scotland | rUK |

| 35 | McEwans | 0.538 | Beer | Scotland | rUK |

| 43 | Bells Scotch Whisky | 0.524 | Spirit | Scotland | rUK |

| 49 | Innis & Gunn | 0.589 | Beer | Scotland | Scotland |

| 3 | Budweiser | 0.553 | Beer | rUK | rUK |

| 5 | Strongbow | 0.57 | Cider | rUK | Scotland |

| 8 | Buckfast Tonic Wine | 0.76 | FW | rUK | rUK |

| 11 | Corona Extra | 0.662 | Beer | rUK | rUK |

| 13 | Captain Morgan Original | 0.513 | Spirit | rUK | rUK |

| 16 | Birra Moretti | 0.742 | Beer | rUK | Scotland |

| 19 | Heineken | 0.655 | Beer | rUK | Scotland |

| 20 | Fosters | 0.604 | Beer | rUK | rUK |

| 23 | San Miguel | 0.585 | Beer | rUK | rUK |

| 30 | Dragon Soop | 0.752 | RTD | rUK | rUK |

| 41 | Bombay Sapphire | 0.595 | Spirit | rUK | rUK |

| 39 | Kronenbourg 1664 | 0.518 | Beer | rUK | rUK |

| 42 | Coors Light | 0.536 | Beer | rUK | rUK |

| 50 | Thatchers | 0.605 | Cider | rUK | rUK |

| 46 | Carling | 0.52 | Beer | rUK | rUK |

| 12 | Barefoot | 0.694 | Wine | International | rUK |

| 14 | Yellow Tail | 0.713 | Wine | International | rUK |

| 15 | Casillero Del Diablo | 0.697 | Wine | International | rUK |

| 21 | Bacardi | 0.535 | Spirit | International | rUK |

| 24 | Kopparberg | 0.92 | Cider | International | rUK |

| 26 | I Heart | 0.728 | Wine | International | rUK |

| 28 | Peroni Nastro Azzurro | 0.772 | Beer | International | rUK |

| 31 | Absolut Vodka Blue Label | 0.576 | Spirit | International | rUK |

| 32 | Trivento | 0.663 | Wine | International | rUK |

| 34 | Mcguigan Black Label | 0.615 | Wine | International | rUK |

| 27 | Guinness | 0.666 | Beer | International | rUK |

| 33 | 19 Crimes | 0.699 | Wine | International | rUK |

| 36 | Magners | 0.543 | Cider | International | rUK |

| 37 | Isla Negra Seashore | 0.584 | Wine | International | rUK |

| 38 | Jam Shed | 0.641 | Wine | International | rUK |

| 40 | Blossom Hill | 0.694 | Wine | International | rUK |

| 44 | Hardys Varietal Range | 0.612 | Wine | International | rUK |

| 45 | Hardys Stamp | 0.564 | Wine | International | rUK |

| 47 | Echo Falls | 0.701 | Wine | International | rUK |

| 48 | Jack Daniels Tennessee | 0.634 | Spirit | International | rUK |

Source: Scottish Government analysis of Circana Ltd market sales data

Beyond manually researching location information for top selling brands there is limited information or data on the movement of alcoholic products between different parts of the UK. Large corporations will often operate across all parts of the UK and there is no recent published information on the flow of final or intermediate products by different drink type within the UK internal market. There is particularly limited information about the origin or movement of the components or ingredients of alcoholic products.

Certain categories of alcoholic drink are, however, known to be more commonly produced in the rest of the UK than in Scotland. For instance, cider in particular is more likely to be produced in the rest of the UK than Scotland where there are only a small number of independent cideries. Vodka and whisky on the other hand is more likely to be produced domestically in Scotland.

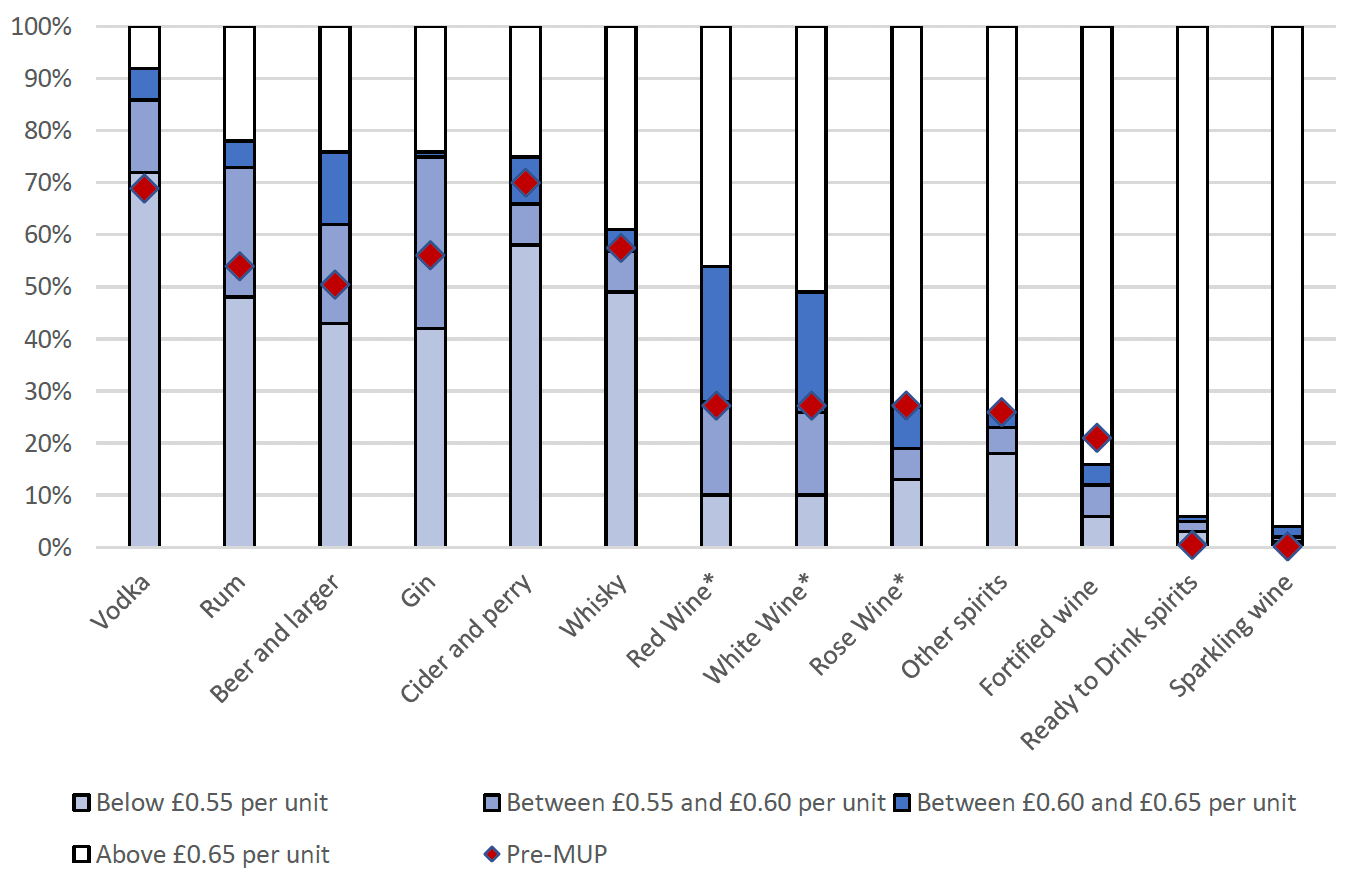

Figure 11 shows the share of different products (by volume) sold below the preferred MUP price (in 2022). The top of the dark shaded blue bar represents the share of the volume of each drink type sold below 65ppu and therefore likely to be directly impacted by the increase in the MUP level.

It should be noted that the share of products sold below the preferred price level is based on the volume of sales (by unit of alcohol) and therefore is weighted by consumers purchasing the relatively cheaper products in higher volume. It does not mean that this is the percentage of all individual products which were priced below this price. Within it category, individual products may be impacted to a greater or lesser degree.

The preferred price of 65ppu MUP would have the largest direct impact on vodka based on the most recent sales data, with 92% of vodka sales in the off-trade being under 65ppu in 2022. Vodka was the second most impacted category with the introduction of MUP when 69% of sales had been below 50ppu in 2017.

Three quarters of gin and rum off-sales (76% and 78% respectively) were sold under 65ppu on average in 2022 and would be impacted by the price floor, both above their share of sales under 50ppu ahead of MUPs introduction, when it was 56% and 54% respectively. 76% of beer and larger was sold under 65ppu in the off-trade in 2022. This compares to 51% in 2017 below 50ppu.

A MUP at 65ppu would impact a slightly larger share of cider and perry sales compared to when MUP was first introduced at 50ppu. In 2022 75% of off-trade cider and perry sales were under 65ppu compared to 70% of sales in 2017.

Whisky would see a similar share of products impacted at a 65ppu as was the case when MUP was introduced, at 61% in 2022 and 58% in 2017. However, this combines blended and malt whisky and may mask price changes at the lower end of the category.

Fortified Wines and Ready-To-Drink spirits would see little direct impact from a 65ppu MUP.

Imports to Scotland via the rest of the UK

Product level information is not available for the location at which imported products sold in Scotland entered into the UK. Data is however available on the port of entry of all imports into the UK since the start of 2022, although not its final destination. This can provide an illustration of the potential scale of imports which might pass through other parts of the UK before being sold in Scotland.

Table 63 shows that in the year to September 2022 there was over £100 million worth of alcoholic beverages imported into the UK through Scottish ports, the majority of which was from EU countries. For context, the total sales value of alcoholic drinks in Scotland in 2021 was estimated at £4.3 billion[88].

| EU Imports | Non-EU imports | Total imports | |

|---|---|---|---|

| Scottish ports | 69,617,612 | 38,792,031 | 108,409,643 |

| UK total* | 2,319,829,488 | 730,798,464 | 3,050,627,952 |

| Scottish ports % of total | 3% | 5% | 4% |

*UK total excludes inland clearance, not collected, PoC unknown

Imports through Scottish ports make up 4% of the total imports of alcoholic beverages into the UK over the period. With Scotland's population share of the UK around 8.5%, this suggests a large share of imported products consumed in Scotland may have been imported via ports in the rest of the UK.

| Year | SIC | Industry or product group | Total output of products at basic prices (£m) |

Rest of UK imports (£m) |

Rest of world imports (£m) |

|---|---|---|---|---|---|

| 2019 | 11.01-04 | Spirits & wines | 4,054.0 | 932.7 | 648.7 |

| 2019 | 11.05-06 | Beer & malt | 427.2 | 331.5 | 137.8 |

Table 64 provides estimates of the level of imports from the rest of the UK and rest of the world used in the production of the two primary alcohol product groups. This is a balanced estimate derived from the Supply and Use Tables[90] and it should be noted that imports data, especially within the UK, are difficult to estimate.

It should also be noted that the majority of domestically produced alcoholic beverages overall, are exported and not consumed domestically.

Common Frameworks

The Scottish Ministers are not aware of MUP as a policy being covered in any common framework under the UK Common Frameworks [91].

International trade and investment

Considerations for assessing impacts on international tradeA Does this measure have the potential to affect imports or exports of a specific good or service, or groups of goods or services?

Yes

B Does this measure have the potential to affect trade flows with one or more countries?

Yes

C Does this measure include different requirements for domestic and foreign businesses? - i.e. are imported and locally produced goods/services treated equally? - i.e. are any particular countries disadvantaged compared to others?

No

D If the answer to C is Yes, is the basis for different treatment anything other than it enables foreign businesses to operate on a level playing field in Scotland?

No

The Scottish Ministers must ensure that any new policy or legislation complies with the UK's international obligations, including World Trade Organization (WTO) agreements and free trade agreements.

Minimum unit pricing legislation will continue to apply equally to international producers, wholesalers[92] and retailers selling products in Scotland. Any firms wanting to import alcoholic beverages would have to ensure their retail prices comply with the MUP legislation.

A change in the minimum price level could impact on a foreign company's ability to compete for Scottish consumption if the company was currently benefitting from low costs of production and selling at low margins relative to other imports or domestic products.

However, analysis of the top selling products purchased in the Scottish supermarket and convenience sector demonstrates that the largest share of the impact would likely be on domestically produced products (i.e. from within Scotland or the rest of the UK).

As shown in Table 56, 23% of the volume of the top selling alcohol purchased in the off-trade in Scotland is thought to be produced outwith the UK.

The premium nature of imported products in the top selling list is reflected in the average price of international products in the top selling list, 67ppu compared to 56ppu for Scottish products and 62ppu for products from the rest of the UK – see Table 57.

Only around 40% of the top selling international products were sold below our preferred MUP level of 65ppu on average in 2022 – see Table 58.

The categories of product most likely to be affected by the proposed new price, as shown in Figure 11, are spirits, beer, perry and cider. Scotch whisky would, in accordance with its registered geographical indication, be produced in Scotland; the most popular white spirits (by volume) (Smirnoff vodka, Glen's Vodka and Gordon's gin) are produced in the UK and the majority of beer and cider affected is also likely to be domestic production (see Table 62).

The Scottish Government recognises that there are certain categories of imported products which may be disproportionally affected, although they make up a very small part of the overall Scottish market. In 2021, although brandy constitutes only 1% of off-sales, 92 per cent of it was sold under 65p per unit. Conversely, no champagne would be directly impacted by any level of MUP below 85p per unit.

International standards and WTO notification requirements

The legal obligation to notify technical regulations under the WTO Technical Barriers to Trade Agreement[93] is not considered to apply to the proposals to continue the effect of the MUP provisions or to amend the minimum price per unit.

The proposals do not amount to technical regulations within the definition of Annex 1.1 of the TBT agreement, as they would not lay down product characteristics or their related processes and production methods.

The Scottish Ministers do not consider MUP is covered by an International Standard.

EU Alignment

The proposed continuation of the MUP provisions and the proposed change in price are not considered likely to impact on the Scottish Government's policy to maintain alignment with the EU. MUP was introduced when the UK was still an EU Member State.

Contact

Email: MUP@gov.scot

There is a problem

Thanks for your feedback