Water Industry - Scottish Government Investment Group - Committed List performance progress report: quarter one 2023-2024

This sets out how Scottish Water is progressing with the delivery of projects and programmes included on the ‘Committed List’ and confirms the position up to the end of September 2023 (Q1 2023/24).

3. Indicator of Progress of Overall Delivery

The Indicator of Progress of Overall Delivery (IPOD) provides a high-level measurement of Scottish Water’s progress in delivering the Committed List for projects over £1m[3]. It assesses the progress of these investment projects monitored across 3 delivery gates combining this information to give an overall score.

When projects are added to the Committed List, each milestone is allocated 1 point. Each quarter, the number of points achieved by reaching gates is assessed against the baseline[4] level for the previous quarter (lower limit) and the subsequent quarter (upper limit). These points are shown as absolute scores. Scottish Water is considered to be within the target range where the number of points gained lies within the lower and upper limits.

At the end of June 2023 (Q1 2023/24), Scottish Water's IPOD position was on track at 651 points, against a target range of 632 to 751 points. (Figure 1).

The green line in the figure above shows the aggregate of the forecast dates in the Committed List (the baseline). The solid blue bars show Scottish Water’s actual position, and the light blue bars show the forecast position for future months. The green area above shows the + or – 3 months target range (i.e., the baseline from the previous and subsequent quarters respectively). Being above this shows that Scottish Water is more than 3 months ahead of the baseline and being below this shows that Scottish water is more than 3 months behind the baseline.

Figures 2, 3 and 4 below show the IPOD position at Q1 2023/2024 by individual milestone.

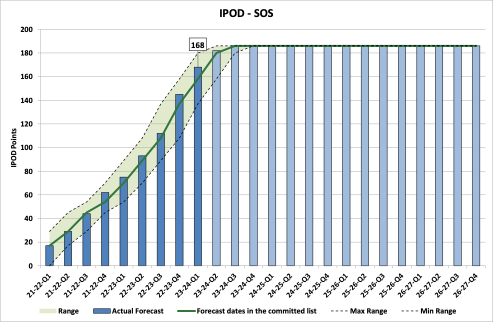

IPOD – Start On Site

23 projects started on site during Q1 with performance on the Start On Site (SOS) milestone being in the top half of the target range at 168 points against a range of 137 to 180 points.

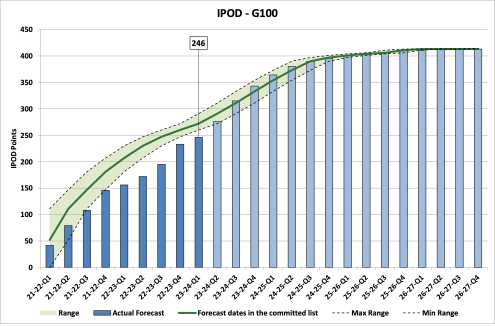

IPOD – Acceptance

13 projects achieved acceptance during Q1, bringing the total number of completed projects delivering benefit for customers to 246 which is out with the target range of 260 to 291. This remains a consistent position of 14 projects below the target range which is the same as Q4 2022/23 which is encouraging as performance is stable. This position is forecast to gradually improve and be within target range at end of Q2. This Q2 forecast is set to be achieved through 15 projects (30 in total) that have not yet had acceptance signed off but now substantially complete and are forecasting acceptance within the quarter. IPOD Acceptance is forecast to reach the mid-point of the target range in Q3 with a further 7 projects forecasting acceptance. Explanation of this movement can be found in Sections 4 & 5. Full details of the projects on the water and wastewater portfolios are now shared regularly with DWQR and SEPA.

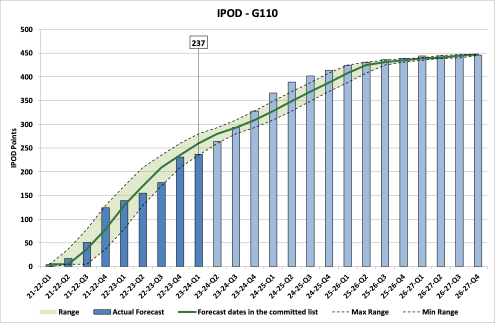

IPOD – Financial Completion

6 projects achieved financial completion during Q1 taking the total achieved to 237 points. This is broadly in line with the previous quarter expectation and within the target range of 235 to 280 points. The performance of progressing projects from G100 to G110 remains healthy with projects getting to financial completion within targeted timescales. The forecast at the end of Q3 for this indicator is that it will be at the mid-point.

Contact

Email: waterindustry@gov.scot

There is a problem

Thanks for your feedback