Water Industry - Scottish Government Investment Group - Committed List performance progress report: quarter one 2023-2024

This sets out how Scottish Water is progressing with the delivery of projects and programmes included on the ‘Committed List’ and confirms the position up to the end of September 2023 (Q1 2023/24).

5. Overall Project Progress Wastewater Portfolio

The Wastewater Portfolio comprises 3 sub portfolios: SR15 Completion; Wastewater Treatment; and Wastewater Network. Detail on progress can be found in Appendix B. At Q1 2023/24 performance in the Wastewater portfolio is just outside the target range (Figure 9). 265 points have been achieved to date compared with a target range of 270 to 309.

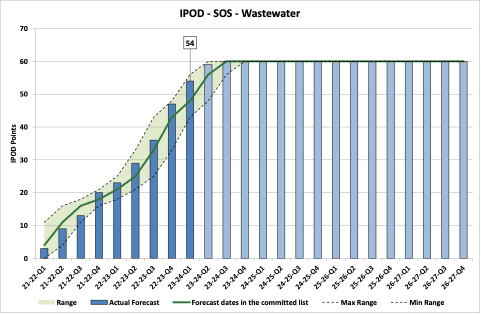

Start On Site

Performance on the Start On Site milestone (Figure 10) remains strong. 54 projects have now started on site, 7 of these in Q1, compared to target range of 43 to 56.

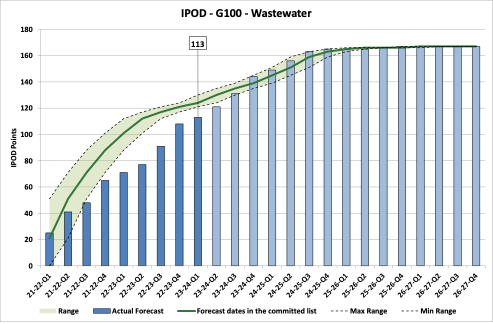

Acceptance

5 projects achieved acceptance in Q1, delivering benefit to customers and bringing the total to 113 projects that have achieved acceptance against a target range of 121 to 130 at the time of commitment (Figure 11).

In the SR15 Completion sub-programme, the acceptance of 5 projects have been reforecast. 2 of these are now substantially complete and forecasting acceptance in Q2. Reasons for reforecasting:

- 5 projects have been impacted by third party delays: UID Westbank Quadrant at Eldon Street Bridge CSO, Wellgate Lanark, Main St Newtonmore, UID Cambuslang Road Richmond Laundry and UID - Scotwood Overflow North East of Lay-by Busby Road

In the Wastewater Network sub-programme, the acceptance of 5 projects have been reforecast. One of these projects is now substantially complete and forecasting acceptance in Q2 with a further project forecasting acceptance in Q3. Reasons for reforecasting:

- 4 projects have been impacted by third party issues including land, power supply and road access: Forres Strategic Wastewater upgrade, Infra-Kingdom Park, Dunfermline Wellwood Wastewater Infrastructure, and IR18 CAS Compliance Improvements - Networks East & North, Complex.

- Construction risks have been realised for one project: Shieldhall WWTW Grade 5 HC Sewer Ph1.

The acceptance of 7 projects in the Wastewater Treatment programme have also been reforecast. 4 of these projects are now substantially complete and forecasting acceptance in Q2 with a further 1 forecasting acceptance in Q3. Reasons for reforecasting:

- 4 of these due to third party issues: Kennethmont WwTW Growth, Burrelton WwTW – Growth, Forres WWTW and Banchory WwTW – Growth.

- 2 are due to general construction risks being realised: Dalderse WWTW and Carstairs Village WWTW.

- 1 is due to additional scope being required to complete the project: Alloa STW.

We continue to work to understand and learn from risks to improve the forecast and delivery of new projects. When committing to the delivery of a project, we balance the likelihood of delay due to risks against setting an over-cautious target with the potential to lose focus on the need to drive delivery.

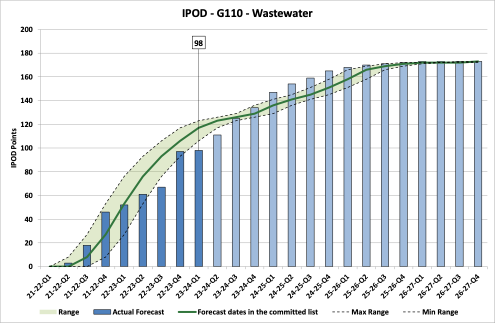

Financial Completion

Performance on the Gate 110 Financial Completion milestone (Figure 12) is below the bottom of the target range. 98 projects have now achieved Gate 110 against a target range of 106 to 123. One of these was achieved in Q1 2023/24,

Contact

Email: waterindustry@gov.scot

There is a problem

Thanks for your feedback