Monthly economic brief: June 2023

The monthly economic brief provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Business conditions

Business activity has improved during the first half of the year however uncertainty continues to temper optimism.

Business activity

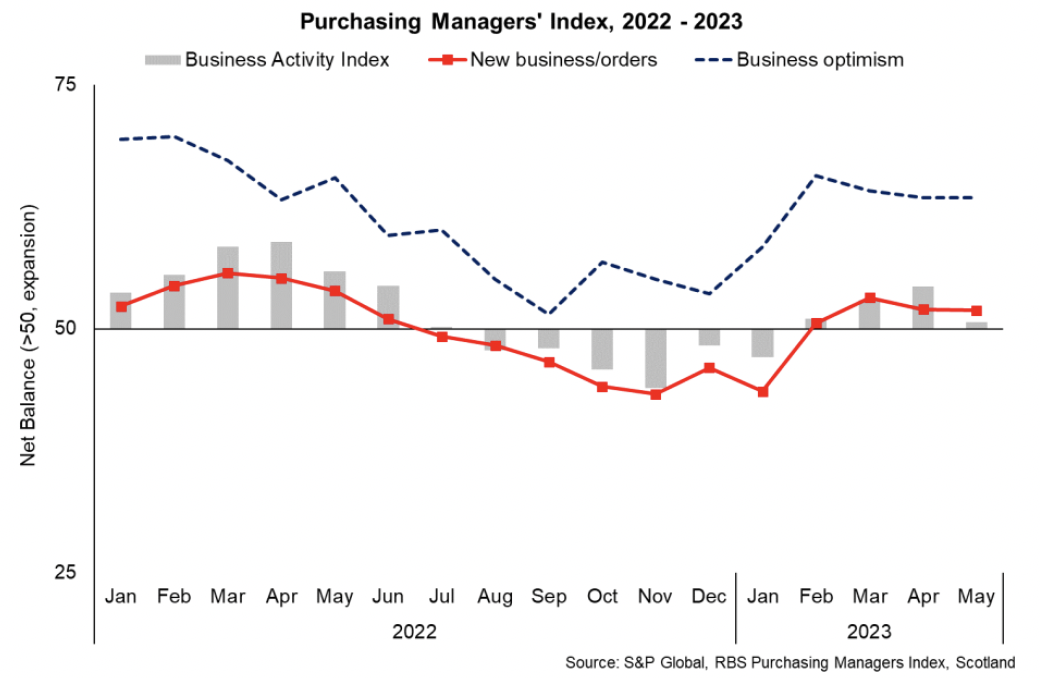

- The Purchasing Managers Index (PMI) business survey indicates that business activity in Scotland's private sector has improved from the slowdown in the second half of 2022, however the momentum has stabilised during the second quarter of the year.[7]

- Business activity continued to grow in May, though at its slowest rate since January and was moderate overall (51.9). As has been evident in recent GDP data, this moderation has been particularly driven by the manufacturing sector which has seen a fall in new order book volumes while service sector activity has remained relatively more robust.

- This has also been reflected in a slight easing in business optimism, which remains positive overall, however has softened in the manufacturing sector while remaining broadly stable in the services sector.

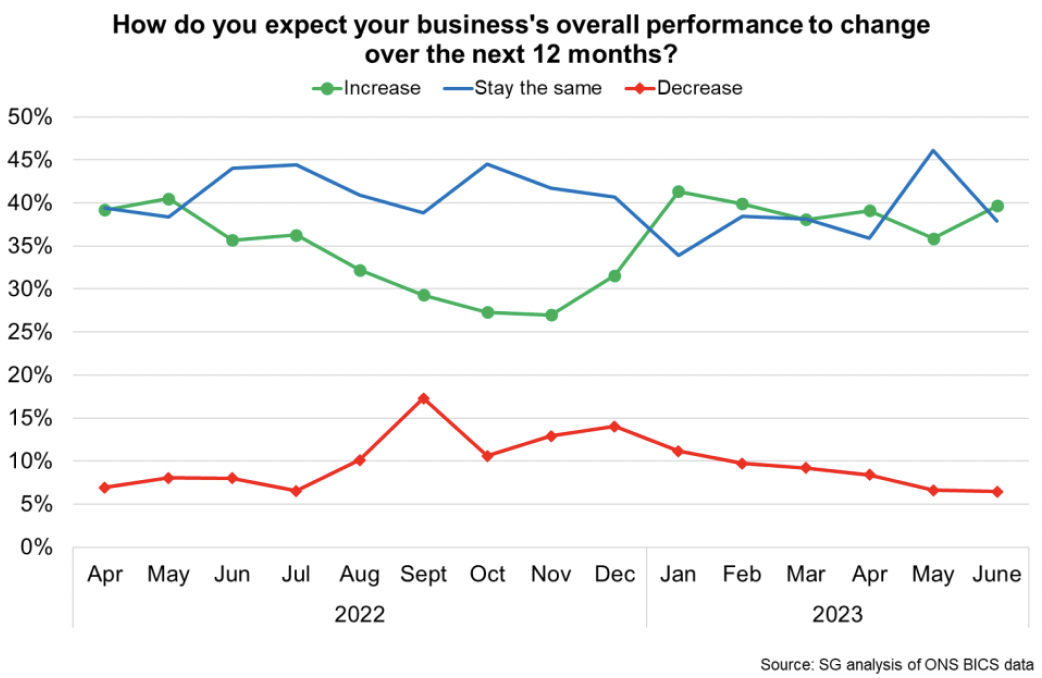

- Business Insights and Conditions Survey (BICS) data for Scotland also indicates that the level of business optimism for the coming year has stabilised. In June, 39.7% of respondents thought their business's performance would increase over the next 12 months, broadly in line with the average since the start of the year (39%), while 6.4% thought it would decrease (slightly lower than the year to date average of 8.6%).[8]

Business costs

- Businesses are continuing to adjust to higher energy, materials and staffing costs and remain key concerns reported by business. There are indications that the pace of some input cost increases facing producers has moderated.

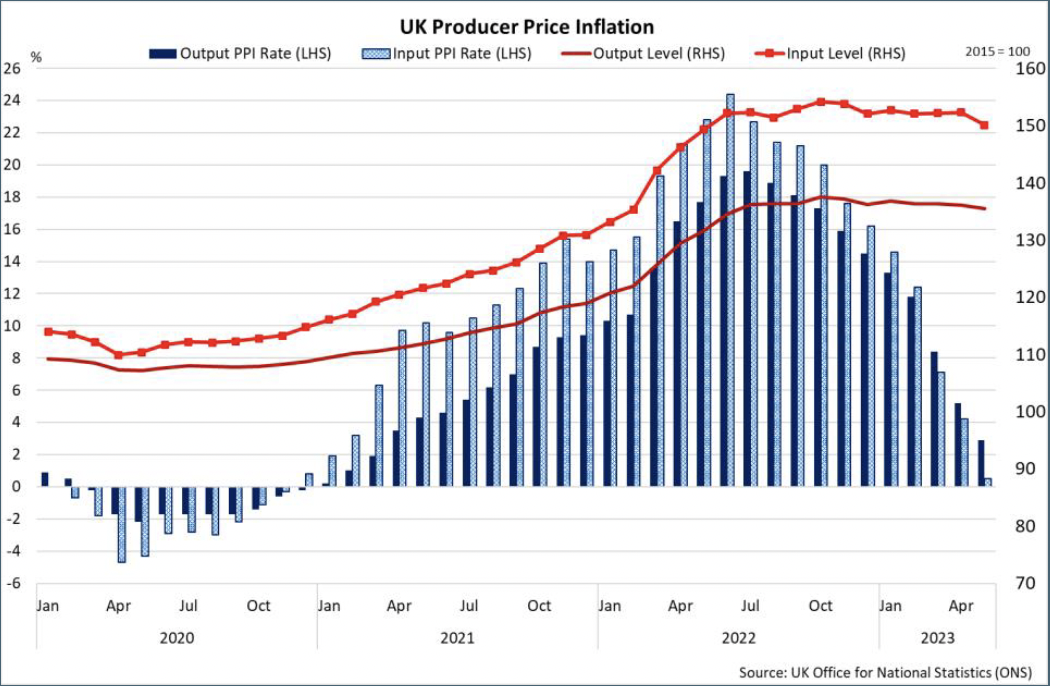

- Producer price inflation (changes in the prices of goods bought and sold by UK manufacturers, including price indices of materials and fuels purchased and factory gate prices) rose by 0.5% over the year to May, its lowest annual rate since November 2020 and slowed for the eleventh consecutive month from its recent peak of 24.4% in June last year. Similarly, producer output price inflation also continued to fall to 2.9% in May, down from the recent peak of 19.9% last July and to its lowest rate since March 2021. [9]

- The moderation of energy and wider commodity price inflation has been a key driver of falling producer price inflation with crude oil inputs costs falling 34.7% over the year, while petroleum products output costs fell 30.6% over the year. However, food commodity prices have not fallen to the same extent and food materials continued to provide upward cost pressure with imported food materials costs rising 24% over the year while the output price of food products rose 11.5%.

- Wider business surveys also indicate the pace of input price rises are moderating. The PMI business survey input price indicator moderated further in May to a net balance of 67.3, remaining elevated but below last year's average.

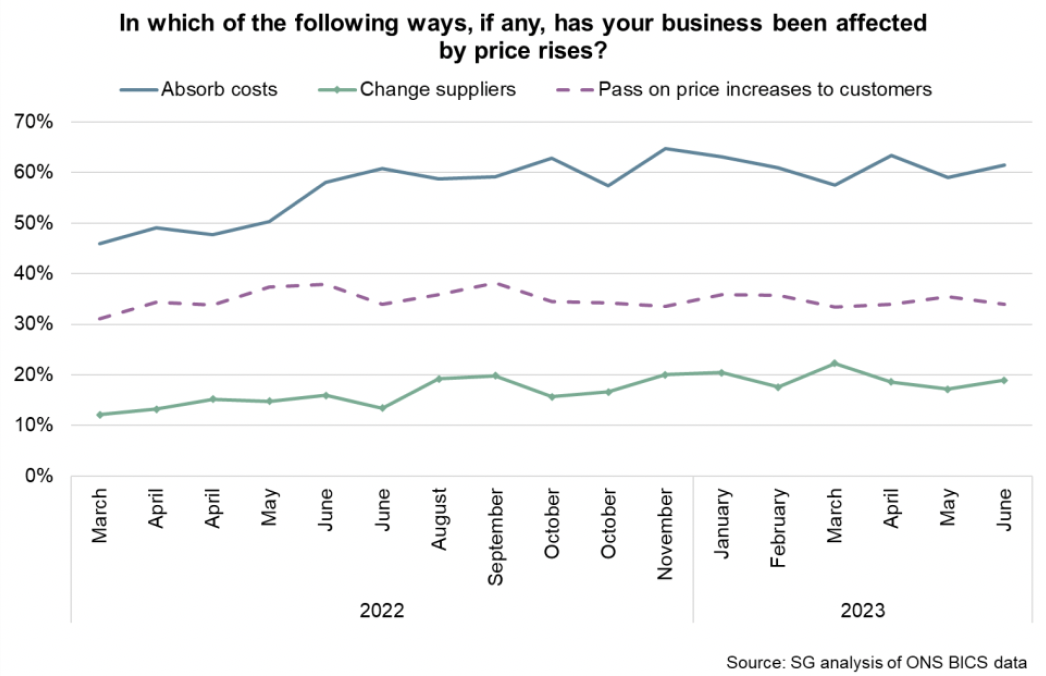

- BICS data for Scotland provide latest insights into the effects on business of price rises. At the start of June, 61.5% of businesses reported that they had to absorb costs, 34% reported having to pass on price increases to customers and 18.9% had to change suppliers. A much lower percentage of firms reported having to access more financial support (4.9%) and having to reduce staff work hours (6.7%). [10]

- While each of these effects have remained broadly stable over the past year, there continues to be notable differences across sectors. For example, 22% of accommodation and food sector businesses reported having to reduce staff work hours (compared to 6.7% for all businesses). Furthermore, 48.3% of firms in the accommodation and food sector, 44.1% of manufacturing businesses and 47.1% of wholesale, retail and repair of vehicles businesses reported passing prices onto customers (compared to 34% for all businesses).

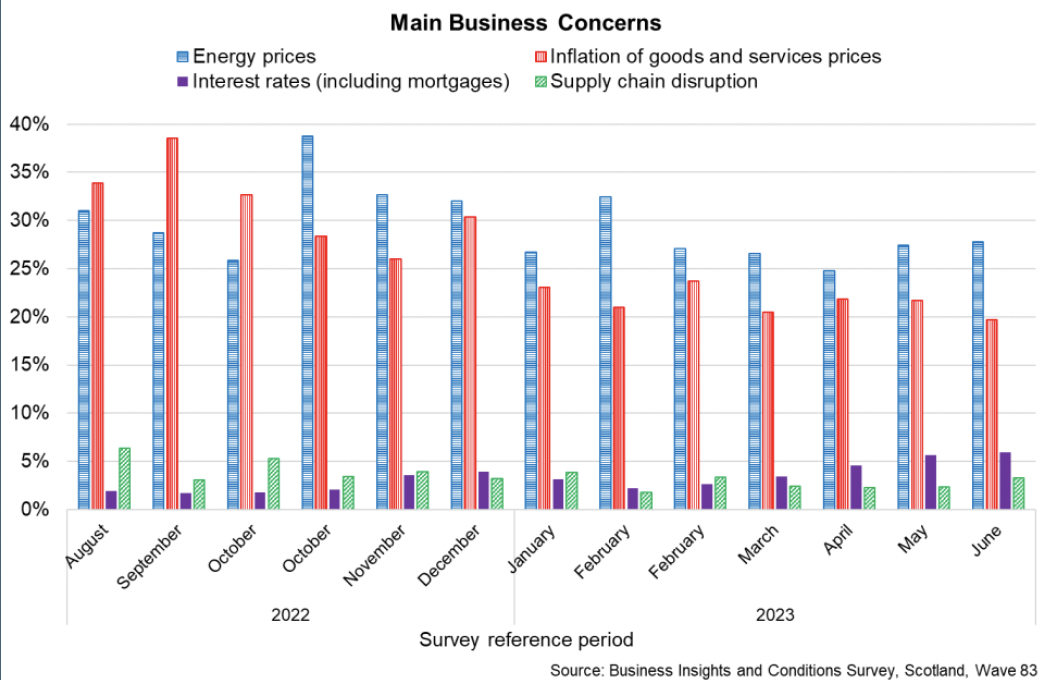

- Overall, the main concerns for businesses in June continues to be energy prices (27.8%), which has reduced from 38.7% in October last year, and inflation of good and services prices (19.7%), which is on a gradual downward trend. Much lower and declining percentages of businesses are concerned about supply chain disruption (3.3%), which reflects wider business survey evidence showing improvements in suppliers' delivery times.[11] 5.9% of respondents noted interest rates as the main concern for their business which has been on a slight upward trend over the past year (up from 1.7% in September) and likely reflects the increase in Bank Rate over this period. Furthermore, 9.1% of businesses are concerned about falling demand of goods and services, reflecting the subdued economic outlook.

- This chimes with the Scottish Business Monitor for Q1 2023 which indicates the main business concerns over the coming year remain around the costs of energy, price of inputs and availability of staff.[12] This is likely to reflect a combination of concerns for further inflationary pressures and ongoing adjustment to recent price rises.

- While the pace of producer cost inflation has moderated sharply, the index level has remained broadly flat since June 2022 reflecting that some of the fall in the inflation rate over the past year is a base effect as the sharp price rises last year fall out of the annual comparison. As such, producer input costs remain 23% higher than in May 2021.

Business Investment

- The combination of these business concerns is impacting on decision making including on business investment. The Scottish Business Monitor indicates business investment remained weak in the first quarter of 2023, although improved from the second half of last year.

- More recently at a UK level, the Bank of England Agents' Summary of Business Conditions for Q2 2023 indicated that business investment intentions, particularly in buildings and construction, remained subdued due to higher investment costs and the uncertain economic outlook, while investment intentions in IT, digital and automation remained relatively stronger. [13]

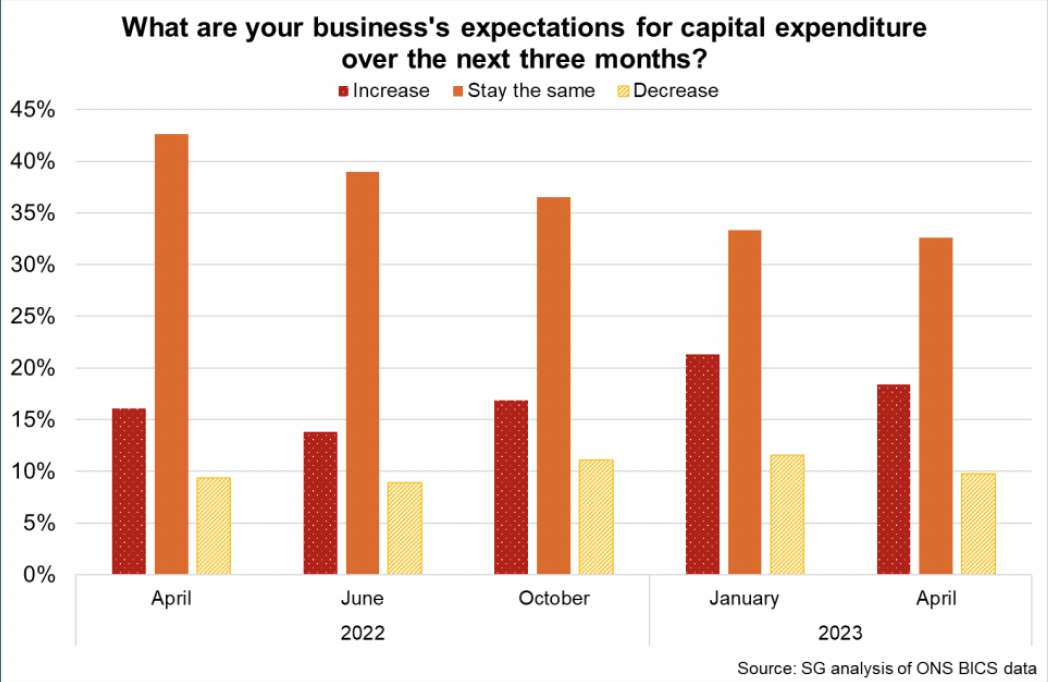

- BICS data for Scotland in April show 18.4% of respondents thought their capital expenditure would increase over the next three months, showing a slight improvement from the middle of last year, while around 10% of respondents continue to expect to decrease capital expenditure over the coming year.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback