Monthly economic brief: June 2023

The monthly economic brief provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Labour Market

Unemployment remains at a near record low amid tight labour market conditions, however recruitment activity continues to ease.

Official labour market statistics

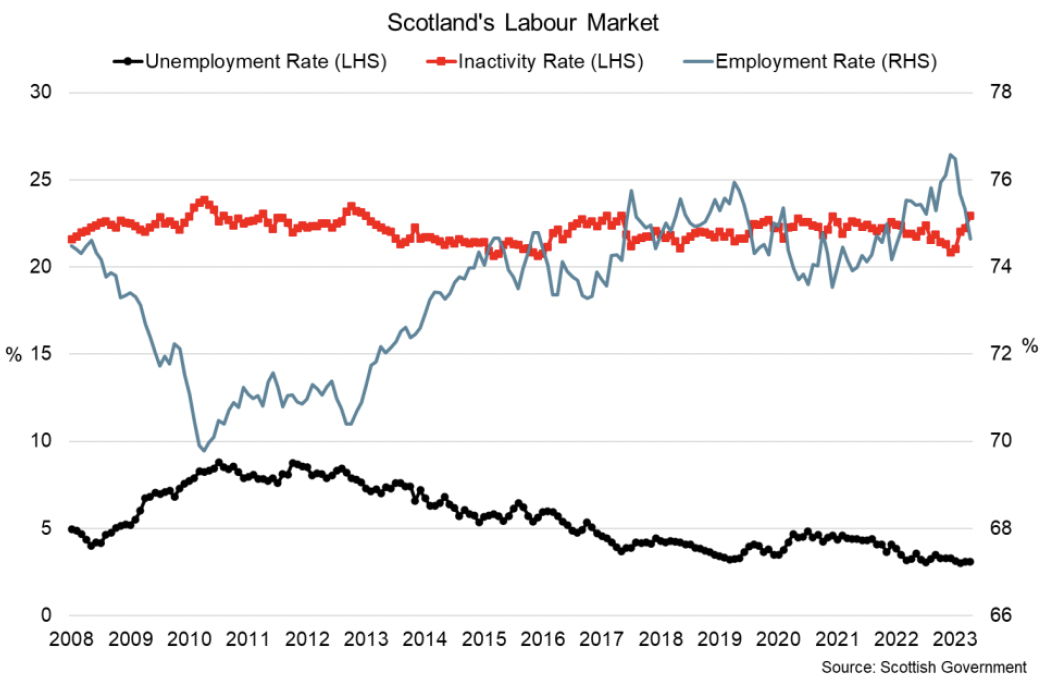

- The latest labour market statistics for February to April 2023 show Scotland's labour market performing well with the unemployment rate unchanged over the quarter at a near record low of 3.1% (UK: 3.8%) and is 0.1 percentage points lower over the year.[14]

- Recent movement in employment and inactivity rates indicates that there has been some cooling in the labour market with the employment rate falling 0.9 percentage points over the year to 74.6% and the inactivity rate increasing by 1 percentage point to 22.9%. This indicates that people have moved from employment into inactivity with the latest changes being particularly driven by women, however it is too early to conclude whether this represents a more persistent weakening.

Demand and supply of staff

- Business surveys signal that labour market conditions have remained tight in May however there are further signs that recruitment activity has moderated. The RBS report on Jobs for May signalled that growth in permanent staff placements fell for a fourth consecutive month (net balance of 49) however, the rate of decrease was only marginal.[15]

- The fall in staff placements partly reflects uncertainty in the economic outlook for the coming year weighing on both the demand and availability of labour. Growth in demand for staff remained positive (53.2) but slowed to its softest rate in over two years, while businesses seeking to recruit continued to face supply side challenges with candidate availability continuing to fall (47.4) albeit at notably more moderate rates than over the past 2 years.

- The underlying tightness in the labour market continued to provide upward pressure to starting salaries in May, however the pace of growth did continue its downward trend to the softest rate since the start of 2021. Labour shortages are continuing to affect a range of sectors with BICS data indicating 36.8% of businesses experienced a shortage of workers in May.[16] The overall share has fallen from the start of September when it was 44.5%, however, along with recruitment struggles, remains most prominent in the construction (50.1%) and accommodation and food services (44.4%) sectors.

- Latest data for April show most businesses responded that a low number of applications (62.9%) and a lack of qualified applicants (60.7%) were reasons for why they experienced difficulties in recruiting employees, while 26.5% reported not being able to afford an attractive pay package to applicants.

Earnings

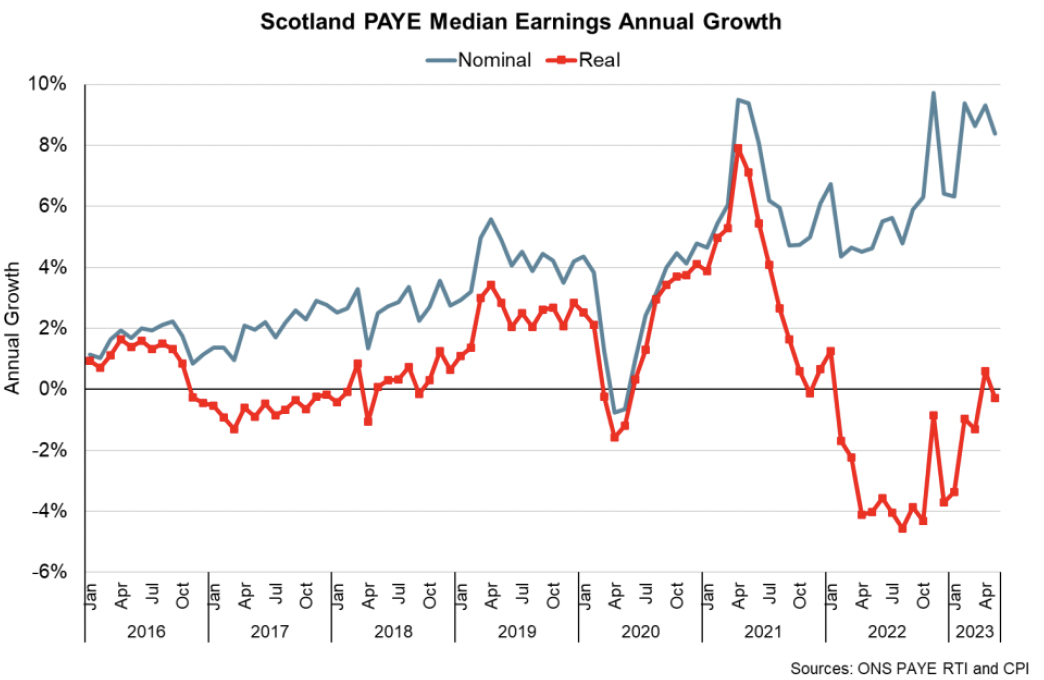

- As set out above, business survey evidence indicates that growth in starting salary pressures have eased over recent months. Considering earnings more broadly, nominal median monthly PAYE earnings in Scotland were £2,275, down 0.2% over the month but grew 8.4% over the past year. [17]

- However, adjusting for inflation, which was 8.7% in May, real median earnings fell 0.3% on an annual basis.

- The rate of annual real terms falls in earnings has moderated in recent months as annual growth in nominal earnings has continued its rising trend while the inflation rate has fallen from its recent peak of 11.1% in October to 8.7% in May. However, it continues to reflect the challenges that high inflation is having on incomes.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback