National innovation strategy: scorecard - 2024 update

The national innovation strategy first published an innovation scorecard in 2023, tracking Scotland's performance against key metrics compiled from publicly available data. In the first annual update to the scorecard, Scotland’s innovation performance is compared to UK and global peers.

8. Later-Stage Equity (Deals £10 million and Above)

8.1 Ecosystem

- Commercialise

8.2 Performance Assessment

- Performance Worsening

8.3 Description

- Later-stage investment (for example, venture capital) is an indicator that the projects behind the deals are seen by investors to offer strong opportunities for return.

- Although not all deals are innovation driven, this is a strong proxy for innovation as the data shows the top sectors for deals are generally those associated with innovation, with university spinouts particularly associated with innovation.

- The term “Deal" is used to describe risk capital obtained during announced and unannounced equity investment rounds.

- All figures are in cash, nominal terms. Performance assessment based on real terms performance.

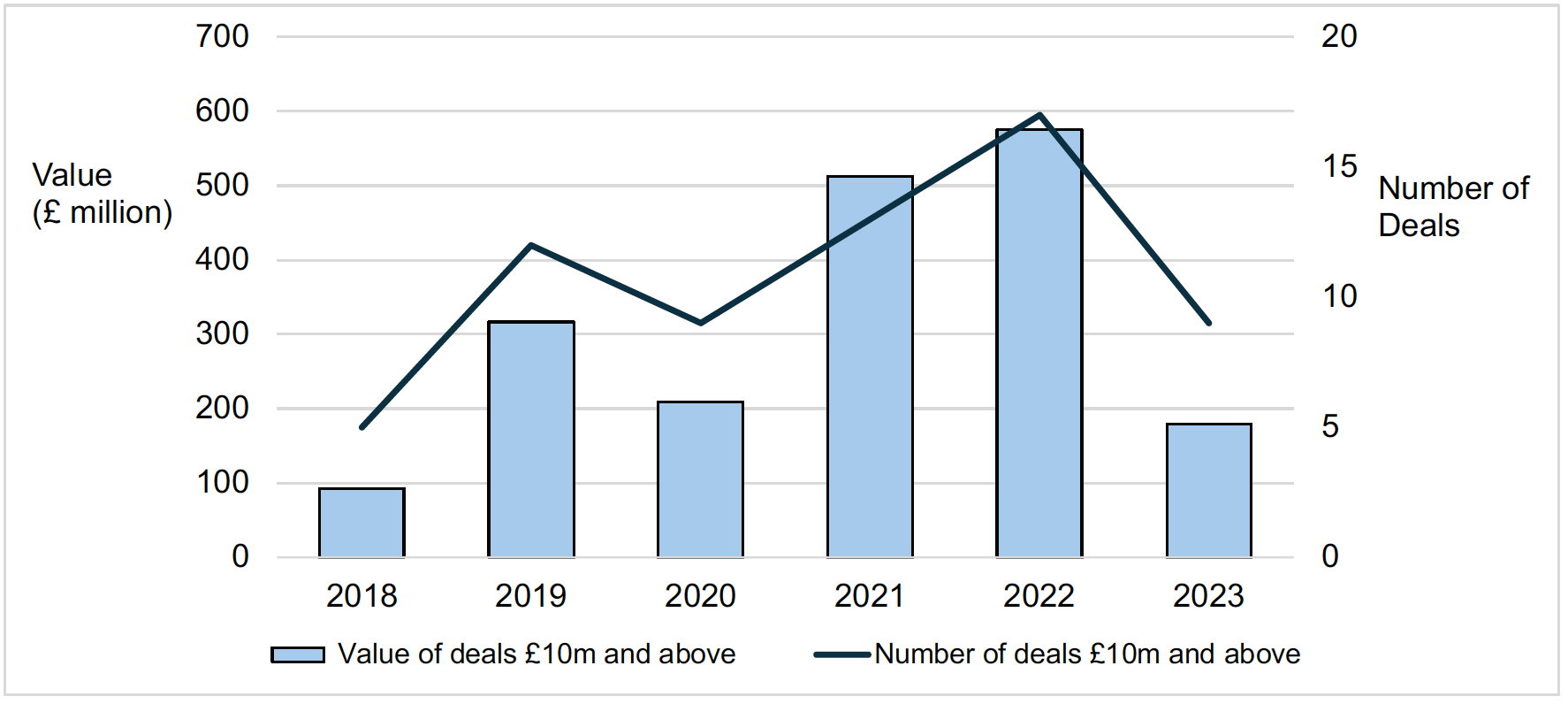

8.4 Time Series

- In line with the decline in very large deals in the UK overall, and indeed globally, the Scottish market above £10m saw a decrease in both deal numbers and value (down 47% and 69%, respectively).

8.5 Current Performance

- In 2023, there were 9 deals in Scotland with values £10m and above, with a total value of £179m.

- 3 university spinout deals were £10m or above, totalling £85.2m.

8.6 Previous Year Performance

- The number of deals £10m and above declined by 47% in 2023 from 17 in 2022.

- The value of Scottish deals £10m and above fell by 69% from £575m in 2022 (a fall of 71% in real terms).

- These are the largest falls in the last 5 years.

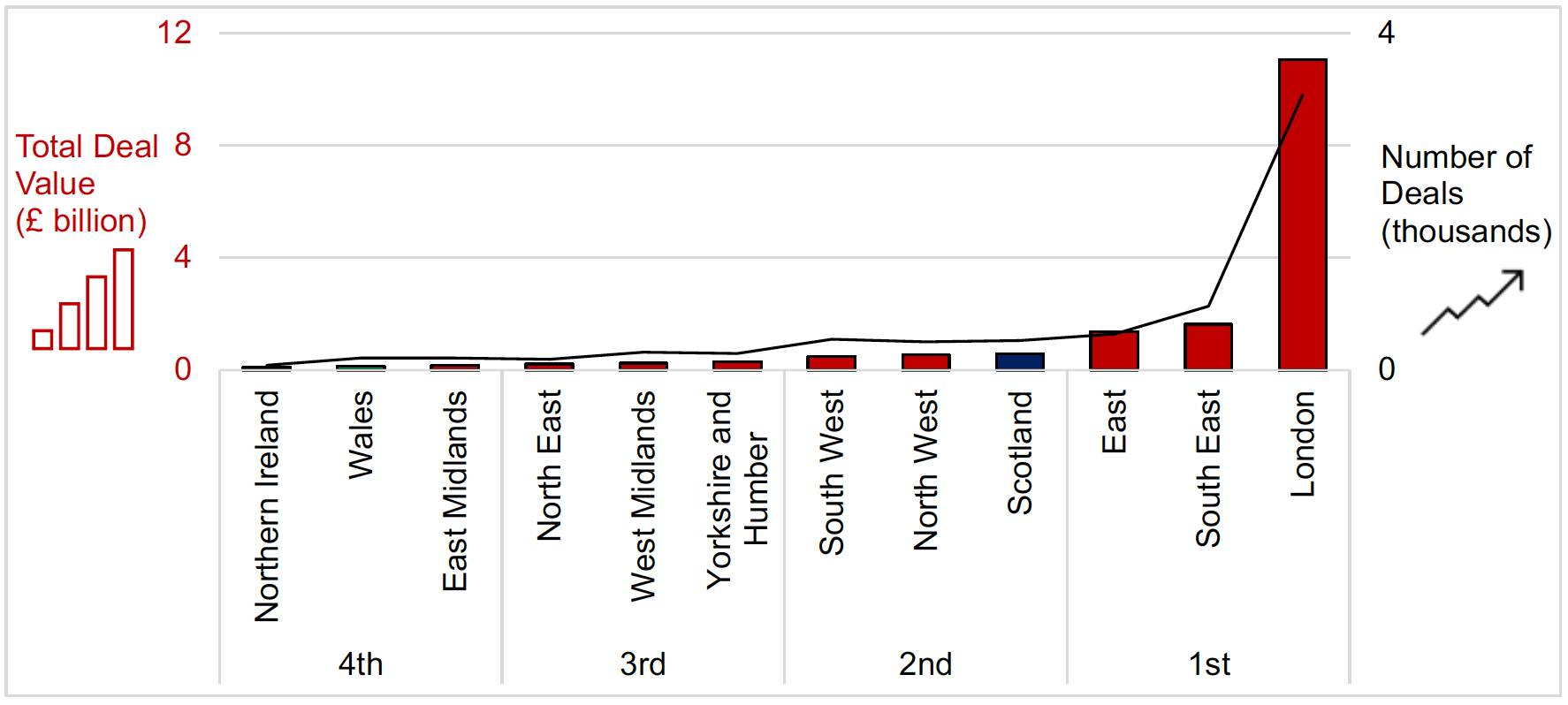

8.7 UK Regional Benchmark

- Scotland ranks 4th in terms of the total value of all deals (of any value).

8.8 International Benchmark

- Limited international comparability.

- In 2023, the UK retained its position as the most active European market, coming in after the US and China globally (HSBC Innovation Banking and Dealroom.co.uk, UK Innovation 2024 Forward Look, Jan 2024).

- Within this context, Scotland have maintained its relative position compared to the UK.

8.9 About the Data

- Current Dataset: Scottish Enterprise (SEnt): Scotland’s Risk Capital Market – Benchmark Analysis 2023 (Released 22 July 2024)

- Next Release: July 2025

Contact

Email: innovation@gov.scot

There is a problem

Thanks for your feedback