Natural Capital Market Framework

Scotland's natural environment is at the heart of our identity, economy, and communities. This document supports responsible, values-led investment in natural capital through the expansion of high-integrity voluntary carbon markets, and development of opportunities to invest in biodiversity.

Section 1: Attracting more high-integrity private investment in Scotland’s natural capital

Mobilising investment into Scotland:

The Scottish Government is clear that delivering climate and nature targets will require public and private investment on an unprecedented scale over many years, at a time when public finances are extremely stretched. We are also clear that such investment has the potential to generate significant economic growth and create new jobs and industries right across Scotland. We understand that to attract the necessary investment and to realise associated economic and environmental opportunities, private investment is essential and that the providers of this finance require a competitive reward for the risks that they take.

In November 2023, the investor panel, co-chaired by the former First Minister and the Chief Executive of Noble & Co, made recommendations to the Scottish Government for mobilising capital to finance Scotland’s transition to net zero.[6] Most of these recommendations are relevant to developing natural capital markets. In its response to these recommendations,[7] the Scottish Government and its agencies committed to exploring new approaches for attracting the scale of capital required.

Furthermore, the Green Industrial Strategy was published in September 2024 and sets out the economic opportunity of net zero in Scotland. It describes economic priorities and provides clarity to industry, business, investors and workers about where policy and levers will focus.[8] Likewise, the third Scottish National Adaptation Plan[9], also published in September 2024, emphasises investment in nature recovery will be key to building our resilience to the locked-in impacts of climate change.

Scotland has its own national development bank, the Scottish National Investment Bank (the bank). One of its three missions focuses on driving green and sustainable investment to support Scotland’s transition to a low carbon, net zero economy. In its first three years the bank has, delivered £0.65 billion of impact investment and crowded in another £1.4 billion of private investment into net zero (addressing the climate crisis, through growing a fair and sustainable economy), place (transforming communities, making them places where everyone thrives) and innovation (scaling up innovation and technology, for a more competitive and productive economy). It plays a critical role in enabling the delivery of commercial investment and mission impacts by providing long-term, patient debt or equity. The bank has already invested in woodland creation[10] and will continue to work closely to support the development of high quality private investment in natural capital.

This section of the market framework describes the specific context for Scotland’s carbon and biodiversity markets. It provides an investment outlook and details seven key interventions designed to drive high-integrity investment.

Current context for Scotland’s voluntary carbon market

Carbon credits generated through the WCC and PC form the backbone of the UK’s voluntary carbon market, which is currently the main high-integrity natural capital market in Scotland.

The WCC and PC have been in operation for 13 and seven years respectively. They generate high-integrity, independently verified carbon units[11] from woodland creation and peatland restoration respectively. Companies can use these units to support appropriate neutrality or net zero claims on their UK-based carbon emissions.

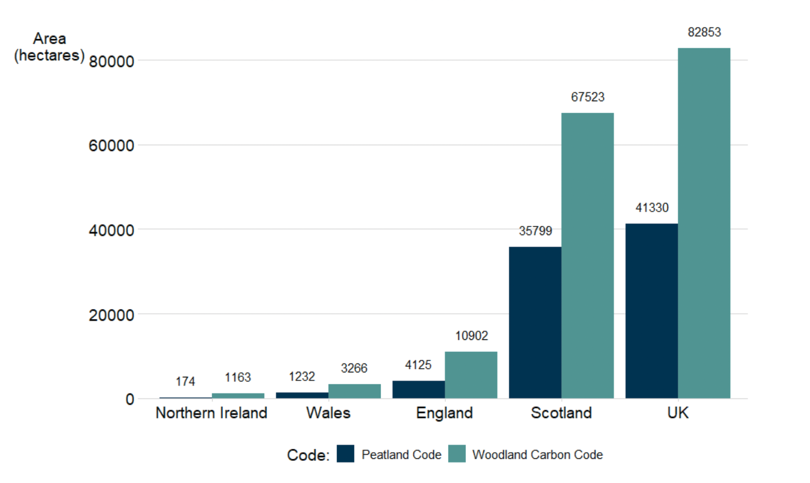

Box 1: Woodland Carbon Code and Peatland Code - analysis of UK land carbon registry data

Engagement with both the WCC and PC has increased substantially in recent years with most of the land covered by the projects located in Scotland (see Figure 1). The average area of PC projects is around 3.6 times greater than WCC projects and tends to cover up to 200 hectares. PC projects in Scotland are predicted to prevent 8.36 million tonnes of CO2e emissions over their project lifetimes, whereas WCC projects in Scotland are projected to sequester 21 million tonnes of CO2e.[12] Around 1.4 million PC pending issuance units (PIUs)[13] and 10.6 million WCC PIUs have been issued.

Sources: IUCN (August 2024) and WCC interim summary statistics (July 2024).

In 2023, the average price of a WCC PIU was estimated to be £25.36 while in 2022 the average cost of a PC PIU was £23.95 (2022). This is significantly higher than average global prices for carbon credits, but it is not yet high enough to be the single source of revenue for most projects. As a result, projects are often built around diversified revenue streams (i.e. nature credits, timber, agriculture, and public grants).

To be registered under the PC or WCC codes, projects must meet additionality requirements[14], including financial additionality tests.[15] When both private investment and public funding are involved in generating WCC or PC credits, this is referred to as ‘blended finance’.

Currently, 88% of validated PC projects in Scotland have received some level of public funding (usually via Peatland Action)[16], with the median public funding amounting to approximately 70% (mean: 56%). WCC projects are also usually supported by public funding, via the forestry grant scheme subject to the additionality test. The woodland carbon market is becoming a major player in woodland creation, approximately a third of woodland creation schemes are currently supported through the WCC. The financial value of the WCC is also increasingly evident and is providing new options for blending public and private funding. For example, in 2024, the forestry grant scheme has introduced a new category for woodland creation schemes exceeding 50 hectares to receive a lower rate of grant intervention.

Current context for Scotland’s nature and biodiversity market

The Scottish Biodiversity Strategy outlines an ambitious vision, with goals to halt biodiversity loss by 2030 and to restore and regenerate Scotland’s biodiversity by 2045. To drive the transformative change needed, it is crucial that Scotland moves from ambitious commitments to concrete actions and investments of sufficient scale and impact. The Government’s biodiversity investment plan will outline actions to facilitate the flow of investment to move towards a nature positive future.

Currently, private investment in Scotland’s nature and biodiversity predominantly flows as a co-benefit from carbon market investment in woodland creation and peatland restoration through the WCC and PC. While these codes focus primarily on delivering high-integrity carbon units, they do encourage co-benefits that often lead to biodiversity improvements. However, the focus of this carbon market investment on land suitable for woodland creation and peatland restoration means there are many other habitats in Scotland that currently do not have a market mechanism for attracting private investment.

Access to a broader range of codes and standards – beyond ecosystem or habitat specific carbon codes – will be important for supporting delivery of the Scottish Biodiversity Strategy vision of a nature positive future across all of Scotland’s terrestrial, aquatic and marine ecosystems.

We welcome the development of high-integrity environmental markets. Additionally, the Scottish Government is actively supporting the development of robust and credible pathways for private investment in nature restoration and biodiversity. We believe such efforts can help Scotland make meaningful strides toward its environmental objectives.

Investment outlook

In general, natural capital markets are at an early stage in their development and, globally, their rapid growth has slowed recently, partly due to concerns over low standards in international carbon markets.

Despite the UK’s comparative ability to supply high-integrity credits, natural capital markets are still viewed as riskier than other markets due to factors like the lack of comparable insurance options and the uncertainty of carbon pricing. As a result, natural capital projects tend to demand higher risk premiums. In the near term, investment in Scotland's natural capital markets is likely to mainly come from market pioneers or the following sources:

- values driven investors: investors accept a lower rate of return and higher risks for environmental or social impacts;

- philanthropists: wealthy individuals or charitable trust that fund natural capital projects because it fits with their values and objectives;

- off-takers and insetters: companies or land-managers directly fund projects to offset their own impact, either voluntarily or because of regulation;

- diversified projects: investments in projects with multiple revenue streams (for example nature credits, timber, meat or public grants);

- long-term, patient – oftentimes equity – investors: recent initiatives like the UK Government’s ‘mansion house compact’[17] may well boost investment from pension funds and insurance assets.

Box 2: The Facility for Investment Ready Nature in Scotland (FIRNS)

The Scottish Government and the National Lottery Heritage Fund (NLHF) co-fund FIRNS, delivering £4.7M to support the development of a pipeline of investable, nature-based projects that meet demand from responsible buyers and investors.

The fund, administered by NatureScot and NLHF, and supported by the Green Finance Institute, helps to develop high-integrity natural capital markets by:

1. funding the development of high-integrity natural capital projects to become ready to receive private investment;

2. supporting the development of tools and initiatives that improve the integrity of natural capital markets.

Since its inception in 2022, FIRNS has provided essential seed funding for 35 projects aimed at securing private investment into Scotland’s natural capital markets. All funded projects work to Scotland’s principles for responsible investment in natural capital. Project partners include private individuals and companies, community organisations, charities and trusts, and public bodies. The 90 plus named organisations are located all over Scotland.

Seven key interventions by 2026 to increase high-integrity investment:

1. To enhance investment in natural carbon, Scotland’s private investment in natural capital programme will coordinate a 'peatland pilot' to explore approaches to integrating public and private funding for peatland restoration.

Scotland’s 2 million hectares of peatlands play a vital role as a carbon store and in providing nature-based solutions to climate risks. However, with an estimated 75% of Scotland’s peatlands degraded, they currently emit around 6.3 megatons of carbon annually – approximately 15% of Scotland’s total emissions.

To help address this, the Scottish Government has set ambitious goals to restore 250,000 hectares of degraded peatlands by 2030, backed by a commitment of £250 million in public funding. This goal and public funding have mobilised a sector but it will require new blended finance approaches that combine public and private funding for peatland restoration to maximise the value of public spending and support increased restoration activity. Private investment channelled via the high-integrity PC has the potential to support private investment.

Scotland aims to restore more peatland to deliver more benefits (carbon storage, and also water management and biodiversity) with the same or less public expenditure by de-risking private sector engagement with peatland carbon markets.

2. The planning system helps to secure positive effects for biodiversity from development.

National planning framework 4 (NPF4) signals a turning point for planning, placing climate and nature at the centre of our planning system and is a significant step forward towards helping to achieve a net zero, nature positive Scotland.

Policy 1 makes clear that significant weight will be given to the global climate and nature crises through planning decisions. Policy 3b for national, major and environmental impact assessment (EIA) developments, sets out that proposals will only be supported where it can be demonstrated they conserve, restore, and enhance biodiversity, including nature networks, so that they are in a demonstrably better state than without intervention. It further states that, wherever possible, measures for enhancing biodiversity should be provided within the development site, where the loss of, or damage to, biodiversity is taking place. Where relevant policy tests cannot be fully met onsite, offsite provision may be considered alongside on-site. In these circumstances, offsite delivery should be as close as possible to the development site.[18]

NatureScot are developing a biodiversity metric for use in Scotland’s planning system. This metric will be based on England's statutory biodiversity metric but adapted for the Scottish context. Once available this will be suitable for use in supporting delivery of NPF4 policy 3b. Early signalling of the proposed metric will be communicated to stakeholders as soon as they are available, to enable preparations for adopting the new Scottish biodiversity metric to begin.

3. The WCC and PC will be developed to increase investment in both carbon and biodiversity.

The Scottish Government, through FIRNS, is funding initiatives to explore the potential to add biodiversity and community benefit indicators to the WCC and PC. Such indicators could help to differentiate projects based on their ability to deliver genuine, measurable benefits to communities and biodiversity. Success in this area will increase transparency, elevate standards, build trust among investors, buyers, and communities, and potentially boost project revenue. Similarly, Department for Environment, Food and Rural Affairs (DEFRA) is funding a project to develop a Woodland Water Code as a crediting mechanism, integrated with the WCC, to encourage private investment in trees for the improvement of the freshwater environment.

The PC and WCC will also seek further market recognition as high-integrity standards for carbon credits and environmental restoration to further demonstrate their capacity to deliver real, high-quality, and verifiable carbon reduction outcomes. Specifically, the IUCN UK Peatland Programme will seek ISO accreditation.[19] It will also seek ICROA approval,[20] and compliance with the ICVCM Core Carbon Principles[21] for the PC. The WCC, which is already accredited by ISO and ICROA, will also apply for ICVCM Core Carbon Principles certification.

4. To capitalise on the potential growth of voluntary nature and biodiversity markets, the Scottish Government will support the development of an ecosystem restoration code.

Over time, initiatives such as the Taskforce on Nature-related Financial Disclosures (TNFD)[22] could increase demand in voluntary nature and biodiversity markets as UK companies increasingly incorporate nature-based solutions into their long-term strategies for financial disclosure, transition planning and supply chain management. To ensure that companies seeking these opportunities have the chance to invest in high-integrity ecosystem restoration and biodiversity initiatives the Scottish Government will explore options for an ecosystem restoration code. This code would ensure the high-integrity governance, measurement, reporting, and verification required to help channel responsible private investment into projects that enhance the structure, function, and resilience of ecosystems. By 2026 the Scottish Government aims to have fully tested options for a new ecosystem restoration code, including its objectives, ownership and governance structure, approach to monitoring, reporting and verification, and the process for nature credit issuance. The new code would be co-developed with stakeholders. The work will be informed by the outputs of the recently completed CivTech contract with CreditNature.[23]

5. We will assess whether the UK emissions trading scheme (ETS) could play a role in securing more consistent demand for accredited carbon projects.

The Scottish Government, together with the UK Government, the Welsh Government, and the Department of Agriculture, Environment and Rural Affairs for Northern Ireland, recently consulted jointly on whether high-quality, nature-based greenhouse gas removals could be integrated into the UK ETS. The four governments are working together to decide whether or not to integrate nature-based solutions for greenhouse gas removal into the ETS, which could potentially create a more consistent demand for accredited nature-based projects and the valuable environmental services they provide. As this work progresses, the Scottish Government will ensure its six high-integrity investment principles (section 2) are considered and inform future decisions. The four governments will publish a response to the consultation in due course.

6. Scotland’s Private Investment in Natural Capital (PINC) programme will support industries with their investments into natural capital

Some industries invest in nature as a condition of doing business. Scottish Government’s PINC programme will work with national and local partners, across both the private and public sector to develop sustainable, efficient processes and connect available funds with a pipeline of high-integrity natural capital projects.

7. The PINC programme will promote initiatives contributing to the creation of large-scale investment opportunities.

Scotland boasts a wide array of institutions, strategies, networks, and projects that are well-positioned to identify and develop the large-scale investment opportunities many investors seek. Developing projects at scale offers numerous advantages, particularly in maximising environmental benefits across ecosystems. Moreover, these projects can amplify economic and social gains. The PINC programme will promote private investment in large-scale landscape projects, including:

- Supporting a project pipeline: The FIRNS fund supports land-scape scale projects to develop viable business cases. For example:

- The Leven landscape enterprise network[24] uses FIRNS funding in its efforts to match investors with local activities and projects that preserve and enhance the Leven catchment’s natural assets. Currently, work is underway to pool private and public investment into the delivery of regenerative agriculture and other activities that improve water quality, mitigate climate change and deliver biodiversity across the catchment;

- The Edinburgh garden city programme[25] uses FIRNS funds to calculate the socioeconomic opportunity of investing in Edinburgh’s nature network and green blue network; Fisheries Management Scotland’s river catchment restoration portfolio[26] uses FIRNS funds to explore ways to attract private investment into fishery management plans; and

- The Eddleston water project[27], led by the Tweed Forum, is using FIRNS funds to develop an investment portfolio of natural flood management projects.

- Regional Land Use Partnerships (RLUPs): These are collaborations between local and national governments, communities, landowners, and other stakeholders. These partnerships focus on optimising land use across large areas to address the twin crises of climate change and biodiversity loss. Investors and project developers operating within these RLUP areas should engage with the partnerships to align with local land use priorities. Scotland's first four RLUPs cover: Cairngorms national park, Highland council area, Loch Lomond and the Trossachs national park and south of Scotland (Dumfries and Galloway and Scottish Borders councils).

- Regional adaptation partnerships: These partnerships help to foster the collaborations needed for effective climate adaptation, including action to restore nature. Partnerships help drive adaptation investment for their region and can help investors identify opportunities of significant scale and size. As set out in the third Scottish National Adaptation Plan[28] regional adaptation partnerships and collaborations will cover all regions in Scotland by 2029. Their work includes the identification of natural capital enhancements. Notable examples include ‘Climate Ready Clyde’[29] and ‘Highland Adapts’[30].

- Nature Networks: Nature networks can help investors to identify local priorities and are embedded within the policies of the NPF4. A nature network is a high-quality, well-connected area designed to support wildlife and biodiversity, help mitigate climate change, and help create climate-resilient places. There is a target to establish nature networks in every local authority area by 2030, improving ecological connectivity across Scotland. They will play a crucial role in delivering the Scottish Biodiversity Strategy and the 30x30 commitment to protect or conserve at least 30% of our land and sea for nature by 2030.

- Scotland’s investment portfolio: In 2025, NatureScot will produce a prospectus of the known landscape scale nature restoration projects in Scotland, informing investors of Scotland’s priority landscape-scale nature restoration projects, including the Flow Country and Scotland’s rainforest. The work will also help project developers and agencies identify where there are geographic gaps in nature restoration activity and to generate new projects and partnerships to fill those gaps.

- Publicly owned land : The Scottish Government, NatureScot, and Forestry and Land Scotland (FLS) are collaborating on a project to strengthen the role of publicly owned land in advancing Scotland’s land use policy goals, particularly in addressing climate change and biodiversity. Public land, including the Scottish Crown Estate, makes up 11% of Scotland and has an important role to play. This project aims to develop a framework of policies, financial mechanisms, measurement, data, and governance that will collectively accelerate land use policy delivery at the pace and scale needed to significantly contribute to Scotland's climate change and biodiversity targets. A key focus will be on exploring financial mechanisms to support nature-based projects on public land, including opportunities for responsible private investment.

- Nature Investment Partnership : The nature investment partnership[31] continues its efforts to attract private investment into landscape scale nature restoration projects in Scotland, including the ‘Wild heart expansion project’[32] in the Scottish Borders.

Contact

Email: PINC@gov.scot

There is a problem

Thanks for your feedback