Overcoming barriers to the engagement of supply-side actors in Scotland's peatland natural capital markets - Annexes Volume

Research with landowners and managers in Scotland to better understand their motivations and preferences to help inform the design of policy and finance mechanisms for high-integrity peatland natural capital markets.

Appendix 1: Evidence review

A narrative review based on identification of relevant literature by experts was used to conduct this evidence review. It was subsequently updated to include new and emerging markets, drawing on ongoing review work by Reed et al. (under review).

Natural capital policy in Scotland

Natural capital is “the renewable and non-renewable stocks of natural assets, including geology, soil, air, water and all living things, that combine to yield a flow of benefits to people” (Scottish Forum on Natural Capital, 2022). It is a concept that makes it possible to think of the natural environment as an asset that provides flows of ecosystem services which benefit society and the economy. By focusing on natural capital, Scottish Government seeks to recognise the role of the natural environment, alongside its intrinsic value, as an asset that provides flows of ecosystem services (e.g. clean water, carbon storage, recreational opportunities) which can benefit both society and the economy. Framing the natural environment in this way emphasises the need to invest in and manage this asset.

As a result of this approach, Scottish Government’s National Strategy for Economic Transformation (Scottish Government, 2022) includes commitments to “expanding and enhancing our green investment Portfolio” and “establishing a values-led, high-integrity market for responsible private investment in natural capital”. To deliver this commitment, a cross-portfolio public sector partnership programme with support from Scottish Government environmental and economic agencies was established. This has led to the publication of Interim Principles for Responsible Private Investment in Natural Capital (Scottish Government, 2022), which set out the government’s ambitions and expectations around the integrity and co-benefits for nature and communities that should arise from natural capital investment in Scotland. It has also led to the (ongoing) development of a Natural Capital Investment Framework for Scotland, which is exploring the development of biodiversity markets in Scotland, and funding mechanisms to create a pipeline of investible projects across multiple ecosystem services.

Barriers to scaling natural capital markets in Scotland

The task of meeting both net zero and nature recovery goals in the land use sector is significant. According to the Committee on Climate Change’s Land Use report (CCC, 2021), net zero will require a transformation in land use across the UK, including afforestation, peatland restoration and significant changes to farming practices. To achieve these goals, woodland and peatland carbon markets are now beginning to scale through the Woodland Carbon Code and Peatland Code, with nascent markets developing for arable and grassland soil carbon, hedgerows and other forms of agroforestry, saltmarsh, enhanced weathering and bioenergy with carbon capture and storage, and various forms of blue carbon. Alongside these, there are several voluntary and compliance biodiversity and other ecosystem markets, which if responsibly scaled, could collectively contribute towards net zero and nature recovery. However, responsibly scaling these markets is proving challenging due to problems with: i) a lack of investible projects outside carbon markets; ii) concerns around unsubstantiated claims and greenwashing; iii) negative unintended consequences from low integrity markets; and iv) limited supply of projects to the market.

Outside the voluntary carbon market, biodiversity markets are amongst the most promising, with indicative pricing for biodiversity credits under Biodiversity Net Gain (BNG) in England ranging from £42,000 to £650,000 per credit (Defra, 2023a). However, it remains to be seen how much developers will pay for biodiversity uplift to meet the biodiversity enhancement requirement under Scottish Government’s National Planning Framework 4. Moreover, beyond the BNG compliance market, there is no evidence of significant movement in voluntary biodiversity markets, and attention is turning to paying for biodiversity in explicit bundles with carbon (Wilder Carbon) or stacking biodiversity with carbon where additionality criteria can be met (currently being explored by the Woodland Carbon Code and Peatland Code). Similarly, the Woodland Carbon Code is developing a Woodland Water Code to market water quality benefits from woodland creation (though it is not yet clear if there will be an option to stack this with carbon).

To address concerns around unsubstantiated claims and greenwashing, buyer integrity tests have been proposed and discussions are taking place over the potential to directly apply the Voluntary Carbon Market Initiative (VCMI)’s Claims Code of Practice in the UK, or operationalise it via a new British Standards Institute (BSI) standard, adapted to the UK context. There is still debate over whether buyer integrity checks should be voluntary or mandatory, and who would be responsible for carrying out checks and ensuring compliance. A recent analysis by Trove of over 470 companies using carbon credits has shown that only 3.8% of firms would meet the VCMI silver criteria or above, mainly due to net zero commitments that do not meet VCMI’s requirements. As such, there are concerns about how to operationalise buyer integrity checks without significantly limiting market activity.

As ecosystem markets proliferate, there are growing concerns around the emergence of low-integrity markets, with the Committee on Climate Change (CCC, 2022) recommending that any expansion of carbon markets into new land uses and habitats should be limited until integrity can be ensured. Critiques have tended to focus on carbon markets, but often apply more widely across other types of ecosystem market (Committee on Climate Change, 2022; Reed et al., 2021). These include:

- The concern that companies will use low-integrity ecosystem market units to make unsubstantiated claims around their green credentials or about achieving ‘net zero’;

- Selling of units that are not robustly verified and so may not represent real climate or other benefits from nature; double-counting and selling of units or the sale of units from projects that would have happened anyway, and so are not additional;

- Challenges securing or demonstrating the permanence of nature-based solutions, which if reversed may not be reported or compensated for;

- Concerns around projects that focus on single outcomes, such as carbon, may have negative unintended outcomes for other ecosystem services or local communities. As such, there are now calls for ecosystem markets to go beyond ensuring that there is “no net harm”, to delivering net benefits for local communities and/or other ecosystem services (Scottish Government, 2022; BSI, 2023).

There are also concerns around the supply of projects to the market. Factors influencing supply-side actors’ engagement with ecosystem markets include concerns that existing market models may benefit intermediaries more than landowners, compatibility of practices funded by ecosystem markets with other economic activities, uncertainties around eligibility for future agri-environment schemes and tax reliefs, and concerns about liabilities for long-term maintenance. To address these issues, new financial models are being developed that blend public and private funding, for example via price floor guarantees that enable landowners to benefit from rising markets but protect them from downside risks, de-risking and incentivising market engagement (Hurley et al., 2022). By using repayable finance to pay for up-front capital costs, it is hoped to both reduce reliance on public funding and stimulate the supply of credits to markets as landowners sell credits to make repayments.

As the range of ecosystem markets expands and the marketplace becomes more complex, there is an urgent need to identify policy and governance options that could facilitate the design and operation of high-integrity ecosystem markets that generate real, verifiable, additional and effectively permanent nature and societal benefits. The International Council for Voluntary Carbon Markets have proposed core carbon principles (ICVCM, 2023), and there are a range of other international initiatives to increase the integrity of ecosystem markets (e.g. high level biodiversity principles proposed by Plan Vivo, 2023). These are now being implemented on a voluntary basis by a number of international voluntary market players, and UK governments are considering how to apply these principles within domestic offset markets and to insetting. As part of this, the British Standards Institute (BSI) are developing a suite of “nature investment standards” designed to set minimum requirements for high-integrity carbon, biodiversity and other ecosystem market codes and schemes. Once launched, codes and schemes will be able to certify to the standards to demonstrate their integrity, with certified codes and schemes signposted in the UK Environmental Reporting Guidelines, driving activity towards high-integrity markets. The emerging ecosystem of codes, schemes and standards is complex, so Box 1 provides definitions of these, alongside definitions of ecosystem markets, insetting, offsetting, stacking and bundling.

Box 1: Definitions

We refer to a code as a mechanism for issuing a unit from a project funded by an ecosystem market, including requirements for how projects are to be delivered and methodologies for quantifying ecosystem services. Codes can govern both voluntary markets (e.g., Plan Vivo’s PV Nature) and compliance markets (e.g., Defra’s Biodiversity Net Gain). Codes are often also referred to as schemes in the wider literature.

We reserve the term standard for quality assurance standards that contain principles, guidance and/or requirements that codes must adhere to, if they wish to be accredited to the standard (e.g., ISO standards for verification bodies and BSI standards being developed for nature markets).

Ecosystem markets enable businesses to invest with farmers and other landowners to enhance the ability of land and freshwater habitats to provide carbon, biodiversity uplift, clean water and other benefits, sometimes also reducing risks from climate change for vulnerable communities. To be classified as an ecosystem market, ecosystem services must be bought and sold with assurances over the delivery and quality of outcomes (adapted from Reed et al., 2023). This does not include nature investments or trades made for corporate social responsibility, or impact investment, where the transaction does not involve receiving specific and/or measurable credits in return for investment.

Insetting reduces emissions or sequesters and stores carbon along a company's own value chain whereas in offsetting, emissions are reduced or carbon sequestered and stored outside the company’s supply chain.

A bundle of ecosystem services is where multiple co-located functions/services are generated from the same activity and are marketed as a single commodity.

A stack is where multiple co-located functions/services are generated from the same activity and are traded as separate commodities.

Natural capital markets operating or close to operation in Scotland

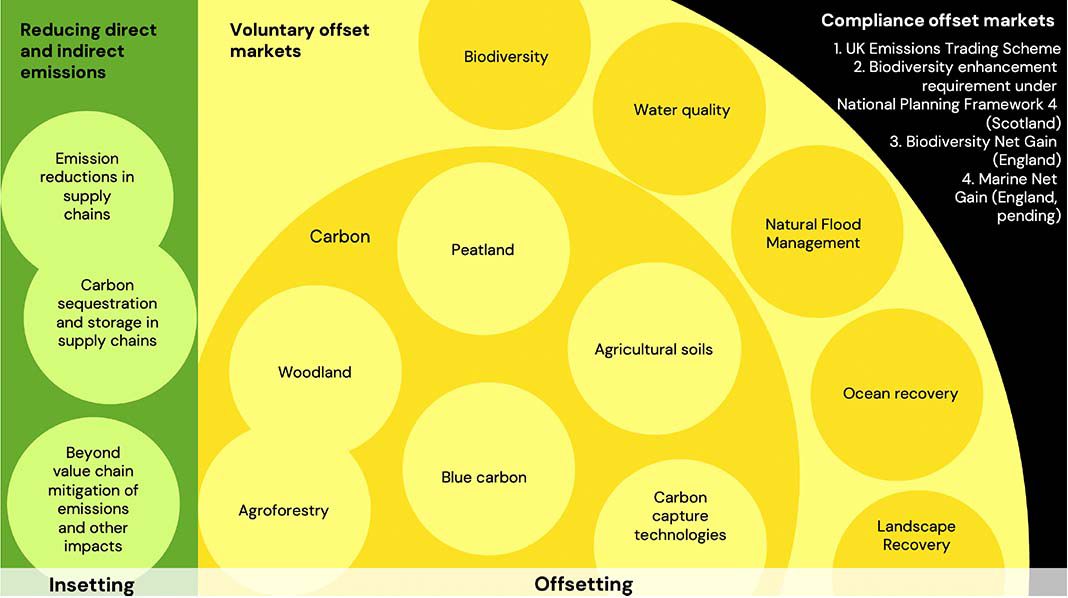

Broadly speaking, market activity can be split into insetting and offsetting (Figure 1). Insetting can take a number of forms. For example, shifts to regenerative farming practices and other methods that can reduce emissions or sequester and store carbon may be built into contracts between farmers and the companies they supply. In some cases, this may be a condition of contract that has no benefit for farmers other than giving them access to the ‘supply shed’ of a particular buyer. In other cases, contracts may include payments for costs of specific changes (e.g., seeds for cover crops, electric fencing and water systems for adaptive multi-paddock grazing), price premiums or (less commonly) carbon payments, alongside training and support. Alternatively, rather than contracting directly with farmers, companies seeking to reduce their scope 3 emissions may contract with groups of farmers through supply businesses or distributors e.g., a cereals group or milk cooperative. Another approach is to buy carbon abatement certificates through project developer intermediaries, typically from the commodity/sector the company is operating in (but without traceability to farm level), with farmers paid per unit of carbon via the intermediary. Although many use their own proprietary governance and MRV, there are a growing number that use internationally recognised protocols that are also used for offsetting, e.g. Verra VM0042.

Insetting activity is being driven by a range of environmental, social and governance performance metrics (e.g., carbon footprinting, energy and water consumption, ESG risk management) and reporting standards for different types of voluntary disclosures. For example, the Task Force on Climate-Related Financial Disclosures (TCFD) provides a standardized framework for companies to disclose climate-related risks and opportunities in their financial filings, and it has seen a five-fold increase in adoption since 2017. Building on this, the Task Force on Nature-Related Financial Disclosures (TNFD) has released a beta framework for businesses to report wider nature-related risks. More broadly still, the International Sustainability Standards Board (ISSB) aims to develop a global baseline of sustainability disclosures, and has created disclosure standards for sustainability-related financial information and climate-related disclosures. Other initiatives to guide ESG reporting include the Global Reporting Initiative, the Carbon Disclosure Project, the UK Green Taxonomy, the Competition and Market Authority Green Claims Code, and BSI’s PAS 2060 carbon neutrality standard.

Initiatives like the GHG Protocol and the Science-Based Targets Initiative can help companies link financial disclosures with science-based targets (that aim to limit global warming to well below 2 degrees Celsius above pre-industrial levels) and measurement protocols. They provide methods for target setting, risk assessment, measurement and reporting for Scope 1 (direct GHG emissions from sources that are owned or controlled by the reporting organization), Scope 2 (indirect GHG emissions associated with the generation of purchased electricity, heat, or steam consumed by the reporting organization) and Scope 3 (all other indirect GHG emissions that occur as a result of the organization's activities, including those along the organization's value chain) emissions. They include detailed guidance on how companies should account for and report GHG emissions and removals from land management, land use change and related activities (SBTi published revised Forest, Land and Agriculture Guidance in 2022 and GHG Protocol will publish their revised guidance later in mid-2024). SBTi is now developing guidance for Beyond Value Chain Mitigation (BVCM), to enable companies to go beyond their science-based targets and target climate action in projects that lie outside their supply chains.

In addition to these voluntary initiatives, there are a number of regulatory requirements around ESG in the UK. Under the Companies Act 2006 (Strategic Report and Directors' Report) Regulations 2013, large UK-incorporated companies are required to disclose environmental information in their annual reports, including greenhouse gas emissions, energy consumption, water usage and waste generation. Under the Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2021, these disclosures now have to align with TCFD guidelines. Financial Conduct Authority listing rules also require certain companies to state in annual reports whether they have made disclosures consistent with the TCFD framework.

In contrast to insetting, in offsetting, emissions are reduced or carbon sequestered and stored outside the company’s supply chain. Offset markets facilitate private investment in nature through the generation of units that can be bought and sold. They allow businesses to invest with farmers to enhance the ability of land and freshwater habitats to provide carbon, biodiversity uplift, clean water and other benefits.

Within offset markets, there are four compliance markets that operate alongside seven types of voluntary carbon market and five other ecosystem markets (Figure 1). Of the compliance markets, there is only one for carbon, the UK Emissions Trading Scheme. Regulated by law, this scheme requires participants to comply with emissions reductions on a ‘cap and trade’ basis. England also operates compliance markets for biodiversity and water pollution. Under England’s Biodiversity Net Gain, developers must follow the mitigation hierarchy by first trying to avoid and minimize habitat loss. Then, if this is not possible, they must create habitat either on-site or off-site (calculated using Natural England’s Biodiversity Metric 4.0; Natural England, 2021), purchase statutory credits from the government or purchase credits generated from habitat creation elsewhere in England. Defra are also developing Marine Net Gain in England that will work in a similar way to Biodiversity Net Gain, requiring all in-scope developments to leave the environment in a better state than before (Defra, 2023b).

There are numerous voluntary markets, either established or in development, in the UK (Figure 1). The majority of the codes that govern these markets focus on carbon, including woodland, peatland, agroforestry, carbon capture technologies, agricultural soils and blue carbon, although voluntary markets are also in development for biodiversity, freshwater resources, ocean recovery and landscape recovery. Most codes focus on one market type, although there are Landscape Enterprise Networks (LENs) and other catchment management trading schemes that integrate multiple voluntary market mechanisms together to provide a range of benefits and payments, for example, related to biodiversity, natural flood management and nutrient mitigation. Also, Version 2.0 of the Peatland Code addresses the potential for integration of biodiversity and community benefits, and work is underway to integrate explicit bundling and stacking with biodiversity credits in both the Peatland Code and Woodland Carbon Code (see “Stacking and bundling multiple sources of natural capital finance” section below).

Codes vary widely in their approach to ensuring market integrity. Some approaches do not have transparent or standardised approaches to MRV or have MRV for individual projects reviewed on a case-by-case basis. Others have the governance and MRV components you would expect to see in a code, although they are not all fully transparent. Some companies combine project development, codes and registries within the same operation instead of using independent verification and registries. For example, there are at least eight companies now offering agricultural soil carbon credits, and some of these integrate functions that are traditionally separated to avoid conflicts of interest. Efforts are underway to standardize methodologies (e.g., using Verra’s VM0042 methodology) and establish minimum requirements for agricultural soil carbon codes, which if adopted by BSI, could bring more consistency and rigour to this market.

Table 1 shows the range of ecosystem markets in operation and under development in Scotland. The most mature markets currently in operation (for more than five years) are the Peatland Code, Woodland Carbon Code and Landscape Enterprise Networks. The European Biochar Certificate has also been operating for more than five years and could be used in Scotland in future. Regional water markets, including Entrade, are primarily active in England and so are excluded from the table, although these could be developed in Scotland. Wilder Carbon Standards currently only operate in England, although they could expand their operation into Scotland in future, so have been excluded. The development of sea kelp and sea grass markets is being led by Sussex Bay (hosted at Adur District & Worthing Borough Councils) and Plymouth City Council respectively, although these markets may in time be available in Scotland.

Figure 1: Types of ecosystem market operating or close to market in the UK (adapted from Reed et al., under review)

| Ecosystem Market | Codes | Description | Owner/operator(s) operating in the UK |

|---|---|---|---|

| Compliance Markets | |||

| Carbon | UK Emissions Trading Scheme | (UK wide) Law requires scheme participants to comply with emissions reduction requirements on a ‘cap and trade’ basis, where a cap is set on the total GHGs that can be emitted by sectors covered by the scheme, which decreases over time. Within the cap, participants receive a free allowance and those who are unable to keep their emissions within this allowance can buy emission allowances at auction or on the secondary market from participants that have not fully used their allowance | BEIS and ESNZ |

| Biodiversity | Scottish National Planning Framework 4 | (Scotland only) Developers must protect, conserve, restore and enhance biodiversity in line with a mitigation hierarchy that prioritises biodiversity conservation and allows the restoration of degraded habitats to mitigate unavoidable damage. | Scottish Government |

| Voluntary Markets | |||

| Carbon - Woodland | Woodland Carbon Code | A voluntary carbon standard for woodland creation projects in the UK, generating independently verified carbon units. | Scottish Forestry |

| CSX Carbon | A supplier of carbon from projects that do not meet the additionality criteria of the Woodland Carbon Code or Peatland Code, including commercial forestry projects, preservation of healthy peatland and management of existing woodland to increase carbon storage | CSX Carbon | |

| Carbon -Peatland | Peatland Code | A voluntary carbon standard for UK peatland projects wishing to market the climate benefits of peatland restoration applicable to blanket bogs, raised bogs, lowland fens and wetland agriculture on lowland peats. | IUCN UK Peatland Programme |

| CSX Carbon | (see above) | ||

| Carbon - Agroforestry | Agroforestry Code* | A voluntary carbon standard for agroforestry projects (including hedgerow planting) that includes both above and below-ground carbon sequestration; applying to be included as a methodology under the Woodland Carbon Code. | Development is being led by the Soil Association |

| Hedgerow Code* | A voluntary carbon standard for hedgerow planting that includes carbon in above ground biomass and soils, alongside biodiversity uplift. | Development is being led by the Game and Wildlife Conservation Trust | |

| Carbon capture technologies | European Biochar Certificate | A voluntary carbon standard for biochar application in agriculture. | European Biochar Certificate |

| Biochar and Enhanced Weathering Credits* | A voluntary carbon standard for engineered carbon removal and storage, including biochar, enhanced rock weathering, woody biomass burial, and geologically stored carbon. | Puro Earth | |

| Carbon – Agricultural Soils | Agricultural Soil Carbon Schemes (various) | A range of companies are providing agricultural soil carbon credits with their own proprietary MRV methods, registries and associated governance. | For example, Agreena, BCarbon, Trinity AgTech, Ecometric via Respira International, Interational Future Food Solutions via BCarbon, UK Carbon Code of Conduct, BX Group (insets only), Soil Capital (insets only) |

| Verra VM0042 Methodology for Improved Agricultural Land Management* | A methodology using Verra’s voluntary carbon standard to issue credits for GHG emission reductions and soil organic carbon removals resulting from of improved agricultural land management practices such as reductions in fertilizer application and tillage, and improvements in water management, residue management, cash crop and cover crop planting and harvest, and grazing practices. | Operators planning to apply Verra’s VM0042 in the UK include Regenerate Outcomes, Soil Heroes, Ruumi and Sub 51 | |

| Carbon - Blue Carbon | UK Saltmarsh Code* | An initial feasibility study assessed the applicability of Verra’s VM0033 Methodology for Tidal Wetland and Seagrass Restoration (Emmer et al. 2021) in the UK and recommended development of a UK Saltmarsh Code focussed solely on managed realignment and aligned with existing domestic voluntary carbon markets and forthcoming UK market principles and governance. | Development is being led by Centre for Ecology and Hydrology |

| Sea Kelp* | Developing a kelp nature certificate to include carbon through an innovation partnership with The Crown Estate. Implementing a “Blue Natural Capital Lab” for developing and testing new models of regulation, seabed leasing and blue natural capital financing. | Development is being led by Sussex Bay hosted at Adur District & Worthing Borough Councils | |

| Sea Grass* | Developing a financial model and investment case based on actual restoration and management costs, habitat condition and carbon analysis of seagrass in the Plymouth Sound, which could in future be scaled to other sites. | Development is being led by Plymouth City Council | |

| Biodiversity | PV Nature* | Proposed biodiversity standards have been piloted in seven sites, including one in the UK to restore and improve management of saltmarsh, seagrass, oyster habitat and seabird nesting habitat. | Plan Vivo |

| Wilder Carbon Standards | Wilder Carbon use Natural England’s biodiversity metric 4.0 to quantify biodiversity alongside carbon in their projects. | Kent Wildlife Trust | |

| CreditNature | Offers Nature Impact Tokens using metrics that measure and forecast ecosystem recovery linked to land management commitments. | CreditNature | |

| Water quality | Woodland Water Code* | Developing a standard and new market for water-related benefits from woodland creation, including pollution mitigation, reducing flood risk and maintaining river flows | Scottish Forestry |

| Ocean recovery | Blue Impact Fund | Investing in enterprises producing sustainable seafood and aquatic plants that can generate attractive returns while delivering ocean resilience and recovery. | Finance Earth and WWF |

| Landscape recovery | Landscape Enterprise Networks (LENs) | LENs can integrate payments from multiple voluntary ecosystem markets alongside other benefits sought by regional investors, such as reducing climate risks to infrastructure or supply chains, for example via natural flood management or landscape recovery. Existing LENs have included payments for animal welfare and sustainable land management to protect the quality of milk supplies and payments from water companies for catchment management (Reed et al., 2021). | LENs Org (The LENS Organisation Community Interest Company) and Service Co (The LENs Service Company Ltd) |

| *Codes and standards are in development | |||

The majority of voluntary carbon market transactions in Scotland take place via the Woodland Carbon Code and the Peatland Code. Version 2.0 of the Peatland Code extended operation to lowland fens and wetland agriculture on lowland peats, and projects funded by NatureScot’s Investment Ready Nature Scotland fund are currently exploring the integration of biodiversity and community benefits with the Peatland Code (NatureScot, 2022b):

- Crichton Carbon Centre are leading a project with Forest Carbon Ltd and Andrew Moxey to show how forest to bog conversion can be done in a way that has clear climate benefits, with the goal of enabling integration of forest-to-bog conversion in a future version of the Peatland Code;

- UHI, NatureScot, RSPB and others are working on how to generate social and economic benefits from peatland restoration in the Flow Country;

- A number of projects are looking at quantifying and potentially monetising biodiversity benefits of peatland restoration:

- RSPB, SRUC and others are developing a Scottish Biodiversity Metric, and RSPB, Scottish Wildlife Trust and NTS are “exploring the concept of a ‘gold standard’ ethical investment model for Biodiversity Gain in Scotland that can be replicated by other eNGOs and landowners”;

- Loch Lomond & Trossachs National Park are leading a project to monetise biodiversity benefits from peatland restoration and other interventions.

Peatland policy and markets in Scotland

Peatlands are ecosystems with a peat soil, formed when decomposition of dead plant matter is incomplete as a result of near permanent water logging, and/or low temperatures. Although they only cover around 4% of the planet’s land surface, they contain one third of the world’s soil carbon and twice as much carbon as all the world’s forests (UNEP, 2022). Keeping their carbon locked away by keeping them wet and undisturbed is critical to achieve our climate goals.

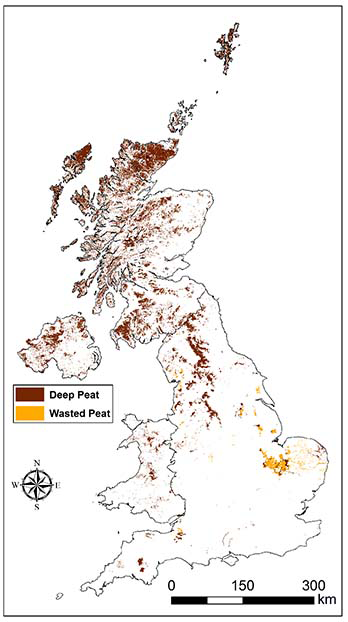

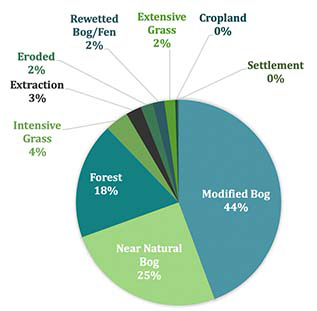

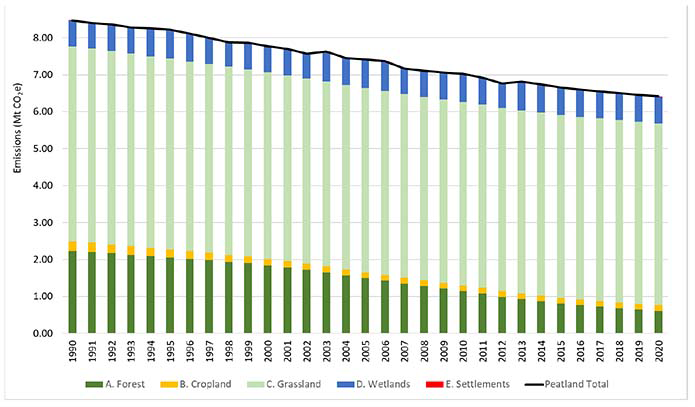

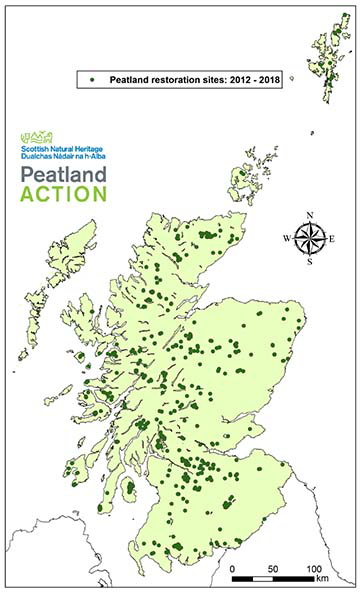

Scotland has a high proportional area of peat (25% of land area), representing ~66% of UK peatlands (Evans et al., 2017; Figure 2). The implementation of Wetlands Supplement (IPCC 2014) has increased the area of organic soils reported by ~8-times (Evans et al., 2017). However, ~75% of existing peatlands in Scotland are modified by human activity. Of this, the majority (44%) has been modified by drainage for agricultural improvement, overgrazing and inappropriate burning, or is under woodland (mainly plantation; 18%) (Figure 3). As a result, peatlands are currently responsible for emitting 6.63 Mt CO2e, including emissions from land use and land use change on peatlands and agricultural peatlands. Emissions from intensive grassland management on peatlands and extraction arise from just 5% of Scotland’s peatland area, but account for 41% peatland GHG emissions (Evans et al., 2017; Figure 4).

To achieve its net zero target by 2045, Scotland will need to restore 45,000 hectares per year from 2022, according to the Committee on Climate Change (2022), a significantly faster rate than the current 6,000 hectares per year. Despite committing £250m to this work between 2020-2030, there is a significant shortfall in the funding needed, which could potentially be made up with private finance via the Peatland Code.

The Peatland Code governs peatland restoration projects in the UK, and generates independently verified carbon units. Backed by Government and governed by an Executive Board and Technical Advisory Board with key experts from the industry, policy and research community, the Code offers the UK’s only official peatland carbon units that can be bought and retired by companies operating under the UK Government’s Environmental Reporting Guidelines. The Code has been approved for use by a number of accredited independent verification bodies by the UK Accreditation Service.

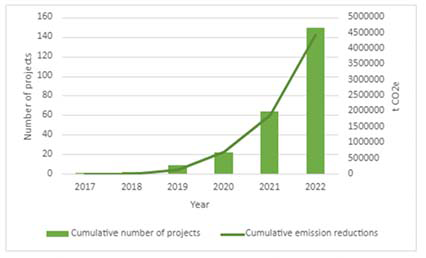

To date, the Peatland Code has 22 validated projects, which together are projected to avoid 737,515 tonnes of CO2e (Figure 5; IUCN UK Peatland Programme, 2022). Based on market data from the Peatland Code, it is reasonable to assume a unit price of £20 for Pending Issuance Units, which would place the total value of these units at £11.1m (after the 10% precision buffer and 15% risk buffer are deducted). None of these projects have reached their first verification point and generated verified Peatland Carbon Units to date (the projects will reach verification in 2023). A further 125 projects are registered and under development. For comparison, the Woodland Carbon Code has validated 366 projects that are expected to sequester 6.9m tonnes of CO2e, with PIUs selling for a similar unit price (Woodland Carbon Code, 2022).

Although the range of peatlands and management interventions eligible under the Peatland Code will increase in version 2.0, it is difficult to calculate the number of hectares of peatland likely to be eligible. However, based on the Climate Change Committee’s sixth carbon budget, targets were advised for peatland restoration in Scotland that could save 10 MtCO2e a year by 2050 (Committee on Climate Change, 2020). If this were financed through the sale of peatland carbon units via the Peatland Code, around 7.65m verified Peatland Carbon Units a year could in theory be generated, according to the Green Finance Institute (in press). At a price of £20 per unit, this could generate an average market size of £153m per annum. However, other estimates have incorporated prices ranging from £25 to £72 per tonne in the next 10 years, and potentially 120m credits available for sale, which could generate a market worth up to £3-8.6bn in total for Scottish Peatlands (Bidwells, 2021).

The majority of Peatland Code projects integrate private finance with public funding via Peatland Action. Up to 85% of project costs can be funded via public sources (including both capital works and maintenance, but not income foregone or costs associated with validation and verification). However, many projects do not take the full amount and some are fully covered by private finance. Funding through the Peatland Action Programme has led to the restoration of over 30,000 ha of peatland since 2012 (Figure 6). Until recently, full funding of projects by Peatland Action crowded out private investment via the Peatland Code, but in the last two years, Peatland Action officers have received training from the Peatland Code team, to make landowners aware of opportunities for integrating Peatland Action funding with private finance. Therefore, the current approach to blending public and private finance, simply makes room for private investment, with public funding helping reduce the amount of private finance needed to generate carbon units, generating them at a lower unit cost and increasing the likelihood that they will be sold in future at a profit. To more effectively and efficiently crowd-in private investment to peatland restoration, Hurley et al (2021) recommended the development of new blended finance mechanisms, which are reviewed in the next section.

Stacking and bundling multiple sources of natural capital finance

There are three ways that payments for multiple ecosystem services may be integrated:

- An implicit bundle of ecosystem services, where co-benefits like biodiversity are marketed but not quantified as a co-benefit of projects targeting other ecosystem services, typically carbon. Payments are made for the target ecosystem service, with prices reflecting the incorporation of co-benefits with limited specification, as is currently done in the Woodland Carbon Code and the Peatland Code;

- An explicit bundle, where co-benefits are quantified alongside other target ecosystem services. Multiple ecosystem services may be quantified under a single code, or, alternatively, could be quantified under multiple codes, so long as bundled units comply with the standards of each code. Payments could be made for any of the bundled target ecosystem services, but each bundled unit can only be sold once. It may be possible to charge a higher premium on the basis of the more clearly specified co-benefits, as is currently done under the Wilder Carbon Standards; and

- A stack of ecosystem services, where biodiversity is quantified and marketed separately to the other spatially overlapping target ecosystem services, to the same or different buyers, at a potentially higher rate than would be possible as part of an implicit or explicit bundle.

Stacking is not yet possible under high-integrity codes in the UK, but the potential to integrate payments for biodiversity outcomes with the Woodland Carbon Code and Peatland Code is currently being explored. If successful, this would create a precedent and method for high-integrity stacking that could be replicated across UK ecosystem markets. The two codes have laid out the following requirements that would need to be met prior to the integration of stacking (Defra, 2023):

- Changes to Additionality Calculators would be necessary, including integration of full cashflow for Peatland Code projects (this is already done in the Woodland Carbon Code), to demonstrate whether additional ecosystem market payments are necessary to make a project financially viable. Note that this would be challenging because unlike forestry costs, the costs of peatland restoration are highly variable, for example depending on degradation extent and accessibility;

- Governance and MRV for additional ecosystem services could be developed within existing codes (e.g. by integrating new methodologies for biodiversity uplift within the Peatland Code or Woodland Carbon Code, which could also be used to create explicit bundles within these codes), or existing external codes could be approved for stacking;

- Where external codes are used, the integrity of these codes would need to be assessed for each ecosystem service in the stack. The integrity of codes could be evaluated against the BSI standards that are currently under development. Where BSI standards do not yet exist, it would be necessary to develop methods to evaluate the integrity of codes prior to their approval for use in stacking with the two codes;

- Methods would need to be developed to distinguish bundled projects (in which other ecosystem services are sold as part of a bundle of benefits alongside the carbon) from stacked projects for buyers, including mechanisms to show this on the registries of all codes in the stack and ensure checks are made between registries to avoid double-counting, so that claims are clear and explicit; and

- Proposed measurement and crediting process for additional ecosystem services would need to be checked by the independent validators and verifiers working with each code to ensure ‘auditability’, and other financial implications would need to be considered, including the tax arrangements of selling biodiversity credits following HMRC’s current inheritance tax consultation.

Ultimately, stacking of payments for carbon and biodiversity via the two Codes would only be possible in two scenarios: i) Where additional work beyond the scope of the original restoration works for carbon is required to deliver additional biodiversity outcomes that would not have occurred as a result of the original restoration work (note that the MRV to determine additional outcomes may be complex); or ii) where carbon finance alone does not fully cover the costs of a project, and it can be shown that biodiversity finance is required to make the project financially viable.

Blending public funding with private finance for ecosystem services

A number of approaches are currently being developed to blending public and private finance for nature-based solutions to climate change, to help scale these markets. Scottish Government is designing post-Brexit support schemes, with the goal of making room for, and where possible de-risking and leveraging, private investment alongside public payments for ecosystem services. The current policy position is to allow blending of private finance on top of public payments where this meets the additionality criteria of a relevant code, for example where public funding alone is insufficient to make the change in land use or management possible. However, where the public funding is sufficient to make the necessary changes, blending with private payments for ecosystem services resulting from those changes would not be additional and so not viable. A range of options are therefore being considered (Reed et al., 2021; Hurley et al., 2022), including a Scotland Carbon Fund with an associated Price Floor Guarantee, to de-risk and leverage private finance for natural capital markets, with an initial focus on peatland carbon markets (for details of each mechanism, see Hurley et al., 2022):

- The Scotland Carbon Fund aims to attract private investment in peatland restoration, with income from the sale of carbon credits providing financial returns for private investors. A number of fund design features and criteria were analysed by Hurley et al. (2022), including fund type, investment mandate, capital structure, community benefit sharing mechanisms, and governance arrangements to identify how best to address key barriers in the market and unlock private finance at scale while ensuring that the Scottish Government’s just transition principles and principles for responsible investment are respected;

- A price floor guarantee mechanism was proposed to run alongside the Scotland Carbon Fund, as a price control mechanism designed to transfer risk and provide confidence in early stage markets (users of the price floor guarantee could use the Scotland Carbon Fund or other sources of finance). Price floors are used to accelerate market development by removing the risk that prices fall below a pre-agreed threshold. Hurley et al (2022) analysed how such a mechanism might be designed to maximise the efficiency of public spending and support specific desirable outcomes like carbon storage, biodiversity or community benefit; and

- Alternatively, a Contracts for Difference (CfD) mechanism could be developed, modelled on successful schemes that have been run to fund renewable energy projects with high up-front costs. In a CfD model the government would ‘top up’ any payments for carbon credits made by private buyers up to a certain pre-agreed reference price. These payments help ensure that the overall price per credit sale equals the value required for a peatland project to be economically viable. Through this model, as the market price of carbon increases, the level of government support required decreases. In order to enable the utilisation of a CfD model, there is a need to establish a reference price for peatland carbon.

Factors influencing supply-side actors’ engagement with peatland natural capital markets

Empirical evidence

There is growing empirical evidence on the preferences and attitudes of supply-side actors towards peatland restoration and carbon markets. This includes research to support the development of England’s Peat Strategy (Reed et al., 2020), alongside the consultation carried out by Hurley et al. (2022). This work is underpinned by a rich body of theoretical literature which attempts to explain why different supply-side actors behave as they do in response to economic, policy, social and cultural drivers (covered in the next sub-section). Initial insights from Hurley et al. (2022) and internal analysis by the Peatland Code team has identified a number of key barriers to the scaling of peatland carbon markets in Scotland. These may be grouped as concerns around supply-side issues with the current economic model, future uncertainties for supply-side actors, and project management risks.

Supply-side issues with the current economic model:

- Concerns that existing market models (especially those based on PIUs) benefit intermediaries more than landowners, capping upside benefits of rising prices for landowners and concentrating profits in the hands of current generations while creating long-term commitments for future generations. It is worth noting however that that revenue sharing models can help to resolve part of the issue by providing sellers of PIUs with a share of the future upside in carbon prices;

- The technical challenges of developing projects for the Peatland Code mean that most landowners work with advisors and other intermediaries, which reduces the profitability of projects;

- Concerns about restrictions on land management written into contracts with both Peatland Action and the Peatland Code being incompatible with other economic activities e.g. game shooting; and

- For some estates with highly diversified and profitable business models, there is no economic driver for the adoption of Peatland Code projects or no interest in generating a profit (i.e. estates managed for leisure by wealthy individuals not aiming to run them as a profitable business).

Future uncertainties for supply-side actors:

- A lack of certainty among the landowning, managing and advising community around eligibility for future agri-environment schemes on land entered into the Peatland Code;

- Concerns around the tax implications of a change of land use (e.g. agricultural relief for inheritance tax, which could be lost when changing land use away from agricultural production, as a result of removing sheep for peatland restoration);

- There are concerns, particularly amongst hill farmers, that future buyers of agricultural commodities may require carbon emission reductions as part of their “scope 3” insetting activities to reduce emissions in their supply chains. Where such requirements are integrated into contracts as a condition of sale, there are concerns that farmers who have already sold their emission reductions to third parties as offsets may not be able to meet buyer requirements and lose contracts;

- The minimum project length (30 years) may be a barrier for some landowners, although it should be noted that the average project length of validated Peatland Code projects to date is 83 years (with the majority opting for the maximum duration of 100 years); and

- There are broader concerns about the ethics of engaging with voluntary carbon markets, given the potential for greenwashing, which may deter some landowners from engaging until policy frameworks or market mechanisms can be put in place to increase the integrity of these markets, in particular to vet the integrity of buyers.

Project management risks:

- Projects that seek to rely entirely on private finance may experience cashflow problems due to the significant up-front costs of capital works. This is typically resolved via the sale of PIUs, investment by the landowner, a private finance facility or some combination of these mechanisms;

- Concerns among landowners about the likelihood of restoration works failing, given the unpredictable effects of deer grazing and movement, climate change leading to increasing frequency and severity of droughts and extreme weather events, public access rights, the short annual window in which to carry out restoration work, the short supply of quality contractors, and difficulties in accessing some peatland sites;

- Concerns about liabilities arising from long-term maintenance of restoration works. Given the typically long contract periods and that there are few peatland restoration sites older than 10 years in the UK, it is difficult to assess their long-term maintenance needs;

- Many tenant farmers and crofters are uncertain about carbon ownership rights and how rewards are likely to be split between tenants, landowners and investors, which could give tenants and crofters limited incentives to participate and maintain restoration works in the long-term; and

- Coordinating restoration with neighbouring properties may be necessary to ensure successful rewetting across a site, requiring collaborative management at scales beyond individual land holdings.

Awareness of opportunities from Peatland Action and the Peatland Code is generally high in the landowning and managing communities, and among their advisors. However, more information may be needed around the supply-side risks and uncertainties outlined above, to inform decision-making around restoration opportunities.

In addition to these concerns insights around how to better communicate with supply-side actors around restoration opportunities have emerged from work with supply-side actors in English peatland carbon markets (Reed et al., 2020). Given the relevance of this study to the present research, its key findings are summarised below:

- Place attachment and place identity were important in framing many of the values, beliefs and norms that were expressed by supply-side actors in interviews and workshops. Priorities around managing peatlands for climate change, water quality, biodiversity and food production were founded on a deep personal connection with, and experience in, the landscape. The prominence of both place attachment and identity was further emphasized in the way that land managers spoke about themselves as custodians of the land and its heritage, and many considered their practices intrinsically linked to this sense of identity;

- While supply-side actors were likely to speak about self-regarding and personal values linked to farm business viability and profitability, they were equally likely to emphasize social-altruistic and biospheric value orientations;

- Landowners and managers had a strong locus of control (defined as a perception that the individual has sufficient control over their circumstances and actions that they can achieve some kind of change), but this often felt threatened by policy change, with specific concerns expressed about the extent to which entering peatland restoration schemes might restrict management options and freedom of action;

- Land managers expressed pride in the value of their local knowledge, culture and tradition to guide decisions, linked to place-based identities. Approaches to restoration that drew explicitly on local knowledge were favoured, enabling land managers to find solutions that worked for their land adaptively, rather than following prescriptions. This respects their expertise and experience, feeding into their professional identity and locus of control. Participants emphasised the unique contexts in which they managed land and warned against one-size-fits-all approaches; and

- However, while many landowners and managers had a strong sense of self-efficacy around their skills and capacity to deliver public goods, others expressed doubts about the extent to which they could change their practices, and the level of support that would be available if things went wrong. This suggests advisory services may need to play a stronger role in supporting restoration management.

Although not directly relevant to supply-side actors, there are a number of other factors that will influence the supply of projects to peatland carbon markets, and these too must be taken into account in any strategy to upscale the operation of voluntary peatland carbon markets in the UK. These include demand side issues, such as growing concerns around the exclusion of avoided emissions in the Science-Based Targets Initiative, which could reduce demand for peatland carbon. In addition to this, there is a lack of clarity among project developers and other sellers around buyer demand because market data is not published on the UK Land Carbon Registry (the Woodland Carbon Code and Peatland Code are however currently investigating the potential to integrate Transparency Carbon Pricing for UK carbon credits into the UK Land Carbon Registry). Furthermore, there are a number of project delivery capacity issues that may slow the development and delivery of projects, including:

- Potential bottlenecks in the validation and verification of projects due to limited capacity of independent verification bodies;

- Capacity within the Peatland Code team itself to administer a significant increase in the number of projects; and

- A limited number of skilled contractors available to do restoration works.

What we can learn from theory

When considering whether or not to engage with peatland carbon markets, there are two components that supply-side actors must engage with:

1. Whether or not to restore their peatland; and

2. Whether or not they are willing to do this as part of a carbon market scheme, including an assessment of moral hazards (e.g. around the identity and motives of investors), technical and capacity considerations (e.g. project development skills) and the perception of risks and uncertainties associated with carbon markets (e.g. failure of restoration works or liabilities arising from long-term maintenance).

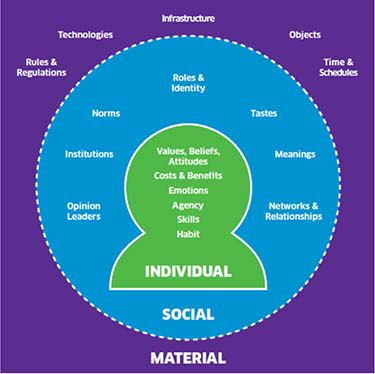

Material factors are more likely to influence whether a land manager is pre-disposed to consider restoring their peatland, whereas individual and social factors are more likely to influence attitudes towards engaging with carbon markets. According to the Individual-Social-Material model (ISM; Figure 7; Scottish Government, 2013):

- Individual factors constraining and shaping behaviour are internal to the individual, including values, skills and perceptions of risk;

- Social factors are influences from the social affiliations, networks and groups that a person is connected to, including social norms, beliefs and meanings attached to particular activities, as they are shaped through social interaction; and

- Material factors influencing behaviour are external to individuals, and may include ‘hard’ infrastructures, technologies and regulations, as well as ‘softer’ factors such political and institutional influences.

Individual factors that influence how supply-side actors are likely to engage with peatland carbon markets, include:

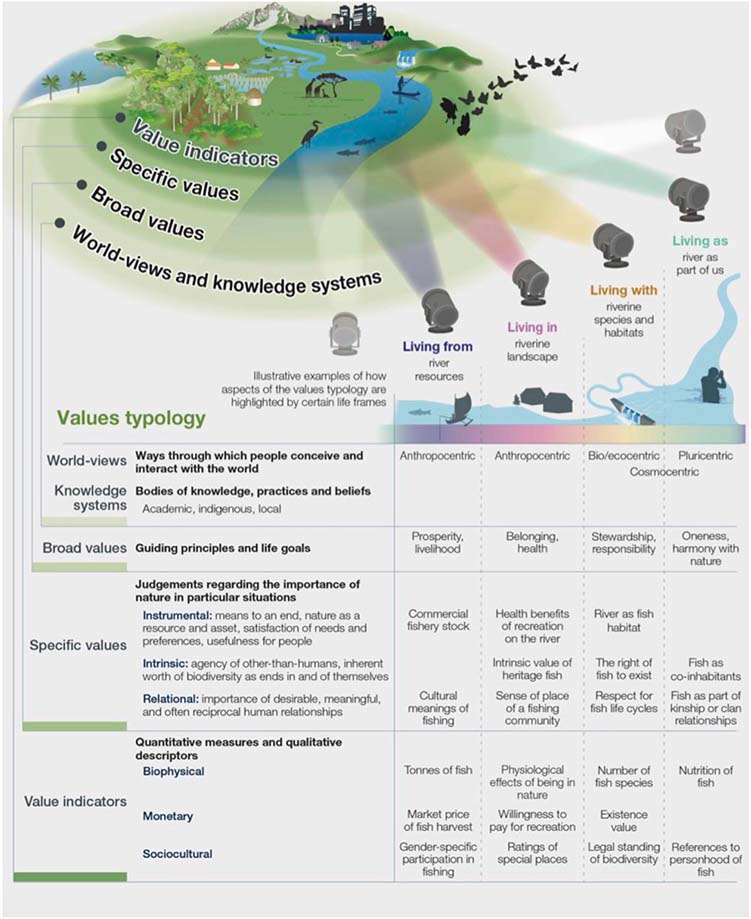

- Their instrumental values (the value of what humans can get from nature), relational values (how humans value their relationships with nature) and intrinsic values (the value of nature without reference to humans) (IPBES, 2022; Figure 8);

- The financial factors which influence decision making, as identified as part of the MPINC project (e.g., opportunity costs and long-term liabilities associated with restoration);

- The role of place attachment and place identity in shaping perceptions;

- Risk perception and attitudes towards new interventions, practices and schemes;

- Personal capabilities, skills and related demographic factors (e.g. knowledge, formal educational status, disabilities, age, gender and succession status), especially as these influence risk perception and perceived self-efficacy; and

- Levels of perceived self-efficacy (i.e. belief that it is possible to bring about change through an individual’s action) and agency (i.e. freedom of choice to opt in or out of an incentive-based scheme, versus feeling coerced by new regulation).

Social factors that influence individual decision-making, include:

- How individual values and beliefs interact with social norms and wider social and cultural values for the natural environment to influence decisions to restore peatland and engage with peatland carbon markets. These may be particularly influenced by opinion leaders who help shape social norms within their networks, as these interact with the roles and identities of the individual within a given social context;

- The shared attitudes, meanings and preferences of land managers as they are shaped by members of social groups that share similar values and land use objectives (e.g. one land user group versus another). Understanding the monetary and deeper ‘transcendental’ values, beliefs and norms that underpin land manager attitudes and preferences for peatland restoration options can enable smart targeting of options and tailoring of communication to meet the needs and preferences of contrasting groups of people; and

- The extent to which messages about peatland restoration funding options are framed in relation to the values, beliefs and norms of the individual or group receiving the message.

Material factors that influence the decisions of landowners and managers to engage with different peatland restoration funding options include, for example:

- Land tenure (e.g. owner-occupier, type of farm tenancy or croft);

- Farm characteristics (e.g. farm size, ratio of intensive to non-intensively farmed land, farm infrastructure and availability of relevant equipment, and the type and suitability of the land for the proposed policy measure);

- Wider features of the farming system or farm management plan that may make the restoration more or less compatible in a given context;

- Costs versus benefits of engaging with peatland carbon markets compared to business as usual, including non-monetary costs such as time and future liabilities arising from long-term maintenance commitments;

- Other features of the adoptability of restoration (in particular its perceived relative advantage over current practice, trialability, adaptability, observability and perceived complexity);

- Technological factors, where these overcome barriers to adoption; and

- Political and institutional factors (e.g. infrastructure, capacity, training and other forms of support that enable successful implementation of policy options on the ground), as these prescribe, incentivise or prohibit activities relevant to peatland restoration.

Given the importance of world-views, values, beliefs and norms in the ISM model, it is important to integrate the ISM model with a theoretical understanding of how individual and social values for the natural environment are shaped. This needs to go beyond anthropocentric and utilitarian conceptions of ecosystem services as drivers of ecosystem markets or human wellbeing. It is clear from the literature that profit maximisation assumptions about the behaviour of supply side actors, such as farmers, are ill-founded, and have limited predictive power over a range of decision-making processes (Gasson, 1973; Schwarze et al., 2014 ). Moreover, human-nature interactions driven by the desire to maximise human benefits have driven environmental degradation and inequitable outcomes for human populations with unequal access to ecosystem services (IPBES, 2019; Portner et al., 2021). Local communities, other rights holders and future generations may not be able to benefit directly from ecosystem markets, but they are likely to value their natural environment in diverse and important ways that are often overlooked in ecosystem service approaches (Loos et al., 2022).

This environmental justice perspective on ecosystem services requires us to engage deeply with groups who may have limited power, recognising their different ways of understanding and relating to nature, so that their non-market values can be represented alongside ecosystem market values in policy and governance frameworks (Jax et al. 2013; Kolinjivadi et al. 2015; IPBES 2022). By moving beyond instrumental values to consider relational and intrinsic values, it may be possible to make ecosystem markets more socially just (Diaz et al. 2018, Pascual et al. 2017a,b). To integrate this diversity of values in policymaking, IPBES (2022) proposed a typology of nature’s values (Figure 8) including:

- World-views that consider how people conceive and interact with the world, for example living from, with, in, and as nature;

- The knowledge systems, practices and beliefs (e.g. ranging from informal and context-specific to formal and generalised) that are embodied in world-views;

- The broad values, moral principles and life goals that guide people’s interactions with nature;

- Specific values and judgements about the importance of nature in specific contexts, grouped into:

- Instrumental values represent the utilitarian value of nature, for example the ecosystem services that can be generated;

- Relational values represent the meaning people derive from their relationships with nature;

- Intrinsic values are the value that nature has, independent of people and their judgements; and

- Value indicators are the quantitative measures and qualitative descriptors used to denote nature’s importance in terms of biophysical, monetary or sociocultural metrics e.g. tonnes of CO2 equivalent and the market value of each tonne.

This values typology is designed to help promote the consideration of values that have been under-represented in environmental decision-making, and consider how a wider diversity of human-nature relationships can be incorporated into policy decisions (IPBES, 2022). They argue that to achieve sustainable and just futures, policy needs to recognise and integrate diverse ways of valuing nature, tacking power asymmetries so that the values of diverse actors are considered in decision-making. In this way, it may also be possible to avoid or mitigate conflicts arising from value clashes and to avoid further marginalising local communities and other rights holders, whose interests are overlooked in ecosystem markets.

Acknowledgement

Thanks to Dr Cheng Chen from the Leibniz Centre for Agricultural Landscape Research (ZALF) for constructive inputs to the literature review.

References

Bidwells (2021) The £8.6bn opportunity? Available online at: https://www.bidwells.co.uk/what-we-think/the-8.6bn-opportunity/

Black, H.I.J., Reed, M.S., Kendall, H., Parkhurst, R., Cannon, N., Chapman, P.J., Orman, M., Phelps, J., Rudman, H., Whaley, S. and Yeluripati, J.B. (2022) What makes an operational Farm Soil Carbon Code? Insights from a global comparison of existing soil carbon codes using a structured analytical framework. Carbon Management 13: 554-580.

Committee on Climate Change (2020). The 6th Carbon Budget – the UK’s Path to Net Zero. Available online at: https://www.theccc.org.uk/wpcontent/uploads/2020/12/The-SixthCarbon-Budget-The-UKs-path-to-Net-Zero.pdf

Committee on Climate Change (2022) Scottish Emission Targets – first five-yearly review & progress in reducing emissions in Scotland – 2022 Report to Parliament. Available online at: https://www.theccc.org.uk/publication/scottish-emission-targets-progress-in-reducing-emissions-in-scotland-2022-report-to-parliament/

Cowap, C (in press) Natural capital and taxation: the current regime. Ecosystems Knowledge Network.

Dasgupta, P. (2021) The economics of biodiversity: the Dasgupta review. HM Treasury.

Defra (2023a) Guidance: Statutory biodiversity credit prices. Available online at: https://www.gov.uk/guidance/statutory-biodiversity-credit-prices

Defra (2023b) Nature markets: A framework for scaling up private investment in nature recovery an sustainable farming. Available online at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1147397/nature-markets.pdf

Diaz, S., U. Pascual, M. Stenseke, B. Martin-Lopez, R. Watson, Z. Molna ́r, R. Hill, K.M.A. Chan, et al. (2018) Assessing nature’s contributions to people. Science 359: 270–272.

Deutz, A., Heal, G. M., Niu, R., Swanson, E., Townshend, T., Zhu, L., Delmar, A., Meghji, A., Sethi, S. A., and Tobinde la Puente, J. (2020) Financing Nature: Closing the global biodiversity financing gap. The Paulson Institute, The Nature Conservancy, and the Cornell Atkinson Center for Sustainability.

Evans, C., Artz, R., Moxley, J., Smyth, M.A., Taylor, E., Archer, E., Burden, A., Williamson, J., Donnelly, D., Thomson, A. and Buys, G. (2017) Implementation of an emissions inventory for UK peatlands. Centre for Ecology and Hydrology.

Gasson, R. (1973) Goals and values of farmers. Journal of Agricultural Economics 24: 521-542.

Green Finance Institute (2021) Finance Gap for UK Nature Report. Available online at: https://www.greenfinanceinstitute.co.uk/news-and-insights/finance-gap-for-uk-nature-report/

Green Finance Institute (in press) State of Private Finance into UK Peatland Restoration

HMRC (2022) HMRC internal manual. VAT Supply and Consideration. Available online at: https://www.gov.uk/hmrc-internal-manuals/vat-supply-and-consideration/vatsc06580

Hurley G, Grandemange Y, Hume A, O’Halloran F (2022) Mobilising Private Investment in Natural Capital. Prepared by Finance Earth for the Scottish Government and NatureScot.

IPBES (2019) Global Assessment Report on Biodiversity and Ecosystem Services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. Brondizio, E.S., Settele, J., Díaz, S., and Ngo, H.T. (eds). IPBES secretariat, Bonn, Germany. https://doi.org/10.5281/zenodo.3831674

IPBES (2022) Summary for policymakers of the methodological assessment of the diverse values and valuation of nature of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. Pascual, U., P. Balvanera, M. Christie, B. Baptiste, D. Gonza ́lez-Jime ́nez, C.B. Anderson, S. Athayde, R. Chaplin-Kramer, et al. (eds). IPBES Secretariat, Bonn, Germany. 37 p. https://doi.org/10.5281/zenodo.6522392.

IUCN UK Peatland Programme (2022) Peatland Code Projects Summary. Available online at: https://www.iucn-uk-peatlandprogramme.org/peatland-code/introduction-peatland-code/peatland-code-projects-summary

Jax, K., D.N. Barton, K.M.A. Chan, R. de Groot, U. Doyle, U. Eser, C. Go ̈rg, E. Go ́mez-Baggethun, et al. (2013) Ecosystem services and ethics. Ecological Economics 93: 260–268.

Kolinjivadi, V., G. Gamboa, J. Adamowski, Kosoy, N. (2015) Capabilities as justice: Analysing the acceptability of payments for ecosystem services (PES) through ‘social multi-criteria evaluation. Ecological Economics 118: 99–113

Loos, J., Benra, F., Berbés-Blázquez, M., Bremer, L.L., Chan, K., Egoh, B., Felipe-Lucia, M., Geneletti, D., Keeler, B., Locatelli, B. and Loft, L. (2022) An environmental justice perspective on ecosystem services. Ambio 1-12.

NatureScot (2022a) Restoring Scotland's Peatlands. Available online at: https://www.nature.scot/professional-advice/land-and-sea-management/carbon-management/restoring-scotlands-peatlands

NatureScot (2022b) Investment Ready Nature Scotland (IRNS) Grant Scheme – successful projects. Available online at: https://www.nature.scot/doc/investment-ready-nature-scotland-irns-grant-scheme-successful-projects

Pascual, U., P. Balvanera, S. Diaz, G. Pataki, E. Roth, M. Stenseke, R.T. Watson, E. Basak Dessane et al. (2017a) Valuing nature’s contributions to people: The IPBES approach. Current Opinion in Environmental Sustainability 26: 7–16. https://doi.org/10. 1016/j.cosust.2016.12.006.

Pascual, U., I. Palomo, W.M. Adams, K.M.A. Chan, T.M. Daw, E. Garmendia, E. Gomez-Baggethun, R.S. de Groot, et al. (2017b) Off-stage ecosystem service burdens: A blind spot for global sustainability. Environmental Research Letters 12: 075001.

Peacock, M., Audet, J., Bastviken, D., Cook, S., Evans, C.D., Grinham, A., Holgerson, M.A., Högbom, L., Pickard, A.E., Zieliński, P. and Futter, M.N., (2021) Small artificial waterbodies are widespread and persistent emitters of methane and carbon dioxide. Global Change Biology 27:5109-5123.

Pörtner H. O., R.J. Scholes et al. (2021) IPBES-IPCC Co-Sponsored Workshop Report on Biodiversity and Climate Change; IPBES and IPCC, doi:10.5281/zenodo.4782538.

Reed, M.S., Curtis, T., Gosal, A., Kendall, H., Andersen, S.P., Ziv, G., Attlee, A., Fitton, R.G., Hay, M., Gibson, A.C. and Hume, A.C. (2022) Integrating ecosystem markets to co-ordinate landscape-scale public benefits from nature. PloS One 17(1), p.e0258334.

Reed, MS, Jensen E, McCarthy J, Rudman H (under review) Governing high-integrity markets for ecosystem services. Ecosystem Services

Scottish Forum on Natural Capital (2022) Introduction to the Scottish Forum. Available online at: https://naturalcapitalscotland.com/an-introduction-to-the-scottish-forum/

Scottish Government (2013) Influencing behaviours - moving beyond the individual: ISM user guide. Available online at: https://www.gov.scot/publications/influencing-behaviours-moving-beyond-individual-user-guide-ism-tool/pages/4/Sustainable Soils Alliance (2022) Report and recommendations on minimum requirements for high-integrity soil carbon markets in the UK, Version 1.0. Available online at: https://sustainablesoils.org/soil-carbon-code/minimum-requirements

TSVCM (2021) Taskforce on Scaling Voluntary Carbon Markets. Available online at: https://www.iif.com/tsvcm

Schwarze, J., Holst, G.S. and Mußhoff, O. (2014) Do farmers act like perfectly rational profit maximisers? Results of an extra-laboratory experiment. International Journal of Agricultural Management 4: 11-20.

Sustainable Soils Alliance (2022) Farm soil carbon. Available online at: https://sustainablesoils.org/soil-carbon-code

UNEP (2021). State of finance for nature—Tripling investments in nature-based solutions by 2030. United Nations Environment Program, World Economic Forum, ELD, Vivid Economics. Available online at: https://www.unep.org/resources/statefinance-nature

UNEP (2022). Global Peatlands Assessment – The State of the World’s Peatlands: Evidence for action toward the conservation, restoration, and sustainable management of peatlands. Global Peatlands Initiative. United Nations Environment Programme, Nairobi.

Verra (2023) VM0042 Methodology for Improved Agricultural Land Management, v2.0. Available online at: https://verra.org/methodologies/vm0042-methodology-for-improved-agricultural-land-management-v2-0/

Contact

Email: peter.phillips@gov.scot

There is a problem

Thanks for your feedback