Private Sector Rent Statistics, Scotland, 2010 to 2022

This publication presents statistics on average private sector rent levels in Scotland by Broad Rental Market Area and size of property, for the years 2010 to 2022.

6. Main Findings for 4 Bedroom Properties

Note that some areas have a relatively low number of 4 bedroom property records recorded, and therefore some caution is needed when interpreting the findings given that the averages presented can be based on a small number of underlying records.

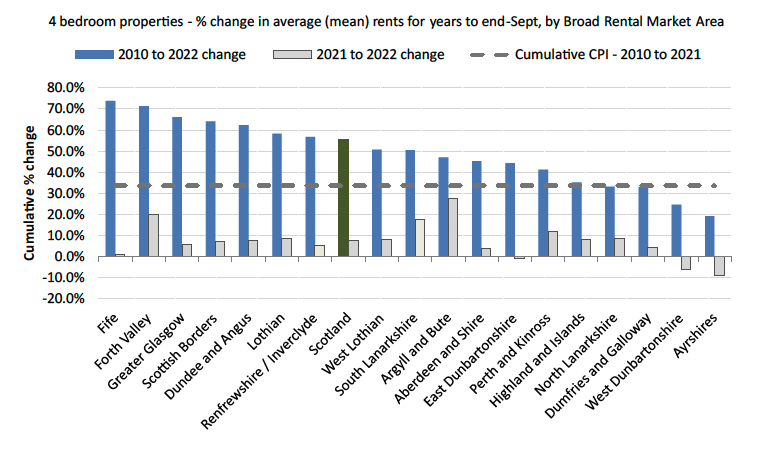

In the year to end September 2022, average 4 bedroom rents increased above the average 12 month UK CPI inflation rate of 7.6% in 8 out of 18 areas, ranging from an increaes of 7.9% in Highland and Islands up to 27.7% in Argyll and Bute.

A further seven areas saw increases in average rents but below CPI, and three areas saw decreases in average rents, including East Dunbartonshire, the Ayrshires and West Dunbartonshire.

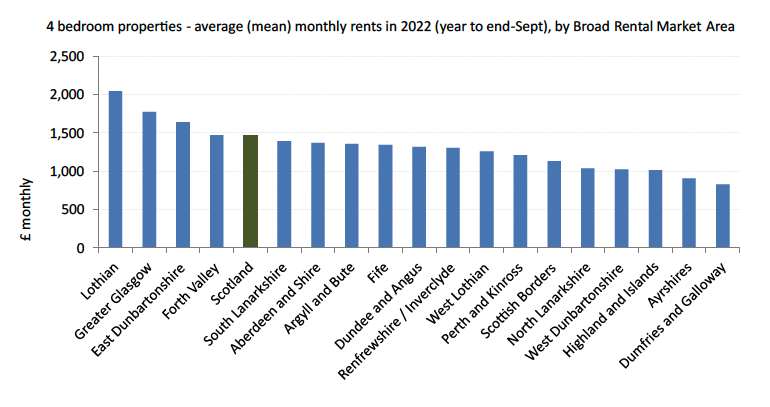

Average rents for 4 bedroom properties at the Scotland level were estimated to increase by 7.5% between 2021 and 2022, to reach £1,460 in 2022, which compares to an average increase in UK CPI of 7.6% across the year to September 2022.

Figures on longer term changes to rents for 4 bedroom properties over the period from 2010 to 2022 should be considered in the context of the cumulative increase in UK CPI of 33.7% from the year to end September 2010 to the year to end September 2022.

Over the 12 year period from 2010 to 2022, 14 out of 18 areas have seen rent increases above the level of CPI inflation for 4 bedroom properties, ranging from an increase of 35.2% in Highland and Islands up to 73.9% in Fife.

These cumulative increases equate to a range of annualised growth rates between 2.5% in Highland and Islands to 4.7% in Fife, when calculated on a compound annual increase basis between 2010 and 2022.

For the remaining four areas of Scotland, cumulative increases have been below CPI inflation, ranging from a 19.2% increase in the Ayrshires up to a 33.1% increase in North Lanarkshire.

These regional trends combine to show an estimated 55.6% cumulative increase for 4 bedroom properties between 2010 and 2022 (equating to an annualised growth rate of 3.8%), to reach £1,460 in 2022. See Table 4 and Chart 8 below.

| Broad Rental Market Area |

2010 |

2021 |

2022 |

2010 to 2022 change |

2021 to 2022 change |

|---|---|---|---|---|---|

| Fife |

773 |

1,330 |

1,345 |

73.9% |

1.1% |

| Forth Valley |

857 |

1,225 |

1,469 |

71.4% |

19.9% |

| Greater Glasgow |

1,067 |

1,677 |

1,773 |

66.2% |

5.7% |

| Scottish Borders |

690 |

1,057 |

1,132 |

64.1% |

7.1% |

| Dundee and Angus |

811 |

1,224 |

1,317 |

62.4% |

7.6% |

| Lothian |

1,291 |

1,879 |

2,044 |

58.3% |

8.8% |

| Renfrewshire / Inverclyde |

834 |

1,238 |

1,306 |

56.7% |

5.5% |

| Scotland |

939 |

1,358 |

1,460 |

55.6% |

7.5% |

| West Lothian |

834 |

1,162 |

1,258 |

50.8% |

8.3% |

| South Lanarkshire |

924 |

1,181 |

1,390 |

50.4% |

17.7% |

| Argyll and Bute |

924 |

1,063 |

1,357 |

46.9% |

27.7% |

| Aberdeen and Shire |

944 |

1,319 |

1,371 |

45.3% |

3.9% |

| East Dunbartonshire |

1,135 |

1,651 |

1,638 |

44.2% |

-0.8% |

| Perth and Kinross |

858 |

1,080 |

1,210 |

41.2% |

12.1% |

| Highland and Islands |

751 |

940 |

1,015 |

35.2% |

7.9% |

| North Lanarkshire |

776 |

952 |

1,033 |

33.1% |

8.5% |

| Dumfries and Galloway |

620 |

790 |

824 |

33.0% |

4.4% |

| West Dunbartonshire |

821 |

1,092 |

1,024 |

24.7% |

-6.2% |

| Ayrshires |

758 |

994 |

903 |

19.2% |

-9.1% |

Note: See the Supporting Documents Excel Workbook Table 7 for a more detailed breakdown of quartile and average rents for each year. Also note that the Scotland figures have been calculated using a weighted stock approach, with further information on this available in Section 8 and Annex C.

Contact

Email: housingstatistics@gov.scot

There is a problem

Thanks for your feedback