Public sector pay strategy 2023 to 2024

Public sector pay strategy for the year 2023 to 2024 which applies to staff in the Scottish Government and its associated departments, agencies, non-departmental public bodies (NDPBs) and public corporations.

Section 2: Economic and Fiscal

Economic Context

The Scottish Government’s approach to public sector pay for 2023-24 must take account of a wide range of factors, including the economic context in which we operate.

Inflation

Scottish households are experiencing significant pressures on their finances due to inflation, as the economy faces a challenging outlook. The Scottish Consumer Sentiment Index fell to its lowest level in the last quarter of 2022, with households’ assessment of their financial security also at record lows. Sentiment has strengthened slightly in January; however, it remains significantly negative overall.

The UK inflation rate fell to 10.1% in January, down for a third month from 11.1% in October which was its highest rate since 1981 and indicates that inflation may have peaked. The fall over the month was driven by a further fall in the price of transport, particularly motor fuels. The largest upward contribution over the month came from alcohol and tobacco.

Source: Macrobond, U.K. Office for National Statistics (ONS)

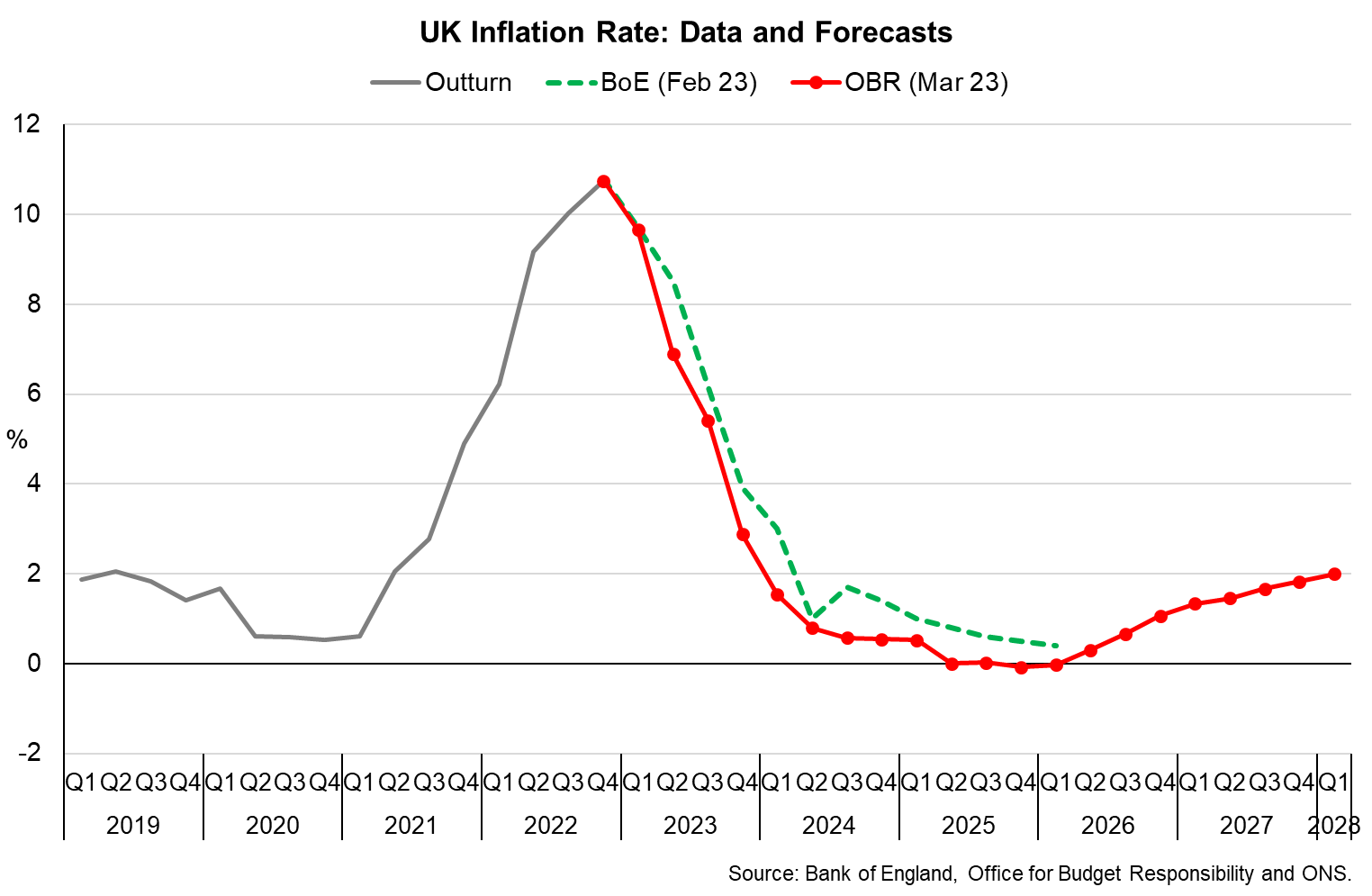

Both the Office for Budget Responsibility (March 2023) and Bank of England (February 2023) forecast inflation to fall significantly over 2023, with forecast rates of inflation at the end of 2023 of 2.9% (Office for Budget Responsibility) and 3.9% (Bank of England) (see Figure 2). On average, independent forecasters expect inflation of 3.7% at the end of 2023.

The OBR forecast inflation to average 4.1% across 2023-24 as a whole and more broadly prices in 2023-24 will be around 20% higher than they were in 2020-21.

The potential for quicker falls in inflation may in part reflect the fact that the Office for National Statistics have increased the importance of gas and electricity prices, which means these will feed through to quicker falls in inflation than previously estimated.

Further detail on public and private sector earnings growthand labour market earnings outlook is provided in Annex A.

Fiscal Context

UK Public Finances and Public Sector Pay

Following the improvement in economic data since the autumn, there has been a strengthening in the underlying public sector finances and economic outlook. However, in his Spring Budget the Chancellor used the improvement to fund reforms that were aimed at supporting the economy, particularly increasing childcare and tax incentives for business investment, rather than providing additional funding for public sector pay.

The UK Government announced on 22 February that they have recommended that judges, police officers, teachers, nurses, doctors, and dentists to be offered a 3.5% pay increase. These recommendations will be considered by the UK independent pay review bodies.

The 2023-24 Scottish Budget defines the budgetary envelope and affordability for public sector pay deals. In the 2022-23 pay round this Government spent around £900 million over and above what was budgeted for on pay deals at the expense of other priorities. These choices were made in part because the Scottish Government has no capacity to borrow to fund additional day to day public expenditure.

Under the fiscal framework agreement, the Scottish Government may only undertake resource borrowing to address forecast variances in devolved tax and social security. Resource Borrowing is further constrained by the annual restrictions and short repayment periods and therefore there is no capacity to increase Scottish Budget funding availability in-year.

Contact

Email: financepaypolicy@gov.scot

There is a problem

Thanks for your feedback