Rented sector reform: Housing (Scotland) Bill: business and regulatory impact assessment

Business and Regulatory Impact Assessment (BRIA) for the Rented Sector Reform provisions in the Housing (Scotland) Bill

Background

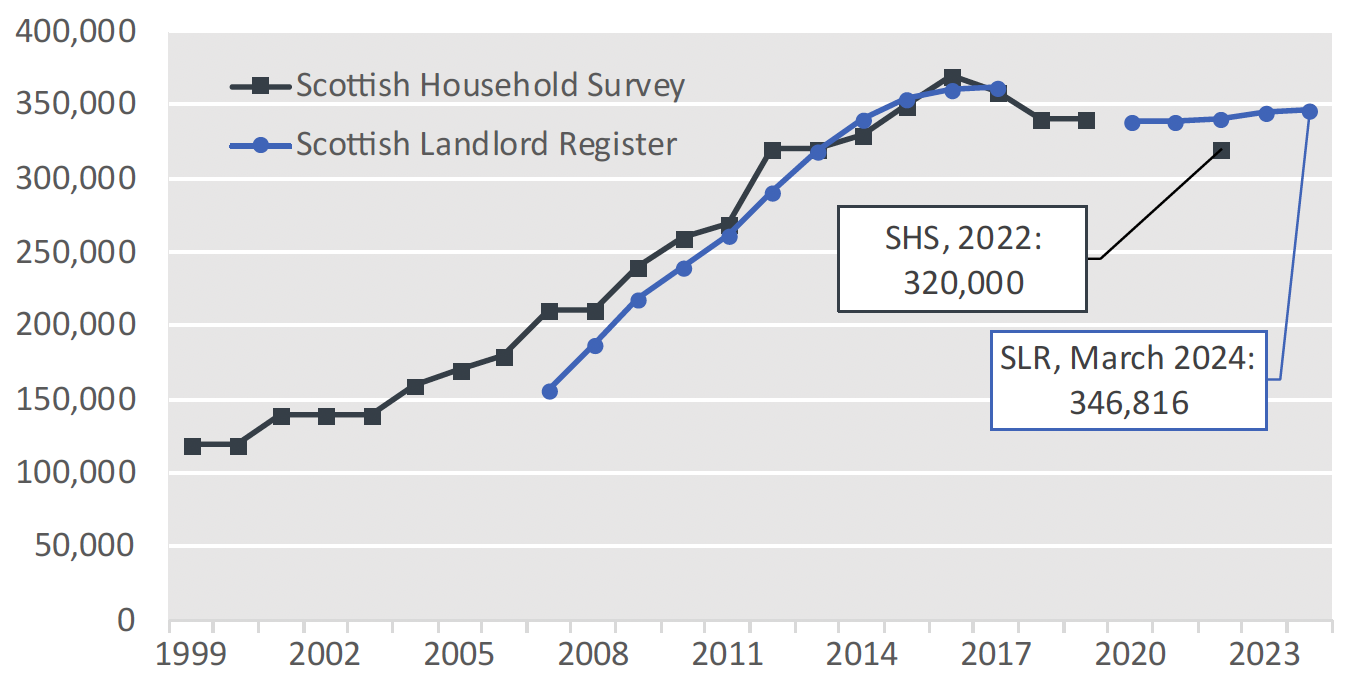

There has been considerable growth in the size of the PRS in Scotland during the last two decades.[4] According to the Scottish Household Survey (“SHS”),[5] the number of Private Rented Sector (“PRS”) properties in Scotland increased from 120,000 in 1999 to a peak of 370,000 in 2016. The number of properties registered on the Scottish Landlord Register (“SLR”) [6] also shows long-term growth, from 156,000 when the register was established in 2007 to a peak of 362,000 in January 2017.

More recent estimates from the SHS suggest somewhat of a fall from the peak of 370,000, although the 2022 estimate of 320,000 may be slightly low due to some tenure bias in the survey. Data from the SLR also show some decrease from the peak of 362,000 to 340,000 in December 2020. However, the level of registrations remained stable around that level in December 2021 and December 2022. More recently there has been a small increase, with 346,816 properties on the register in March 2024.

While the SHS and SLR data show the size of the sector is somewhat below its peak, it remains significantly larger than it was in the early 2000s, as is illustrated in Figure 1.

Sources: Estimates from the Scottish Household Survey are based on the estimated number of households living in the PRS in each calendar year. Data from 2020 and 2021 are excluded due to the impact of Covid-19 on survey responses from different tenures. Data from the 2022 SHS is included, but there is evidence to suggest that the rented sectors may be slightly underrepresented in the 2022 achieved sample and this estimate should be treated with caution. Scottish Landlord Register data relates to properties on the register and in most cases relates to December of the relevant year; March 2024 is also shown to provide a more up-to-date figure. Due to a change in IT system which affected data quality, figures for 2018 and 2019 are omitted.

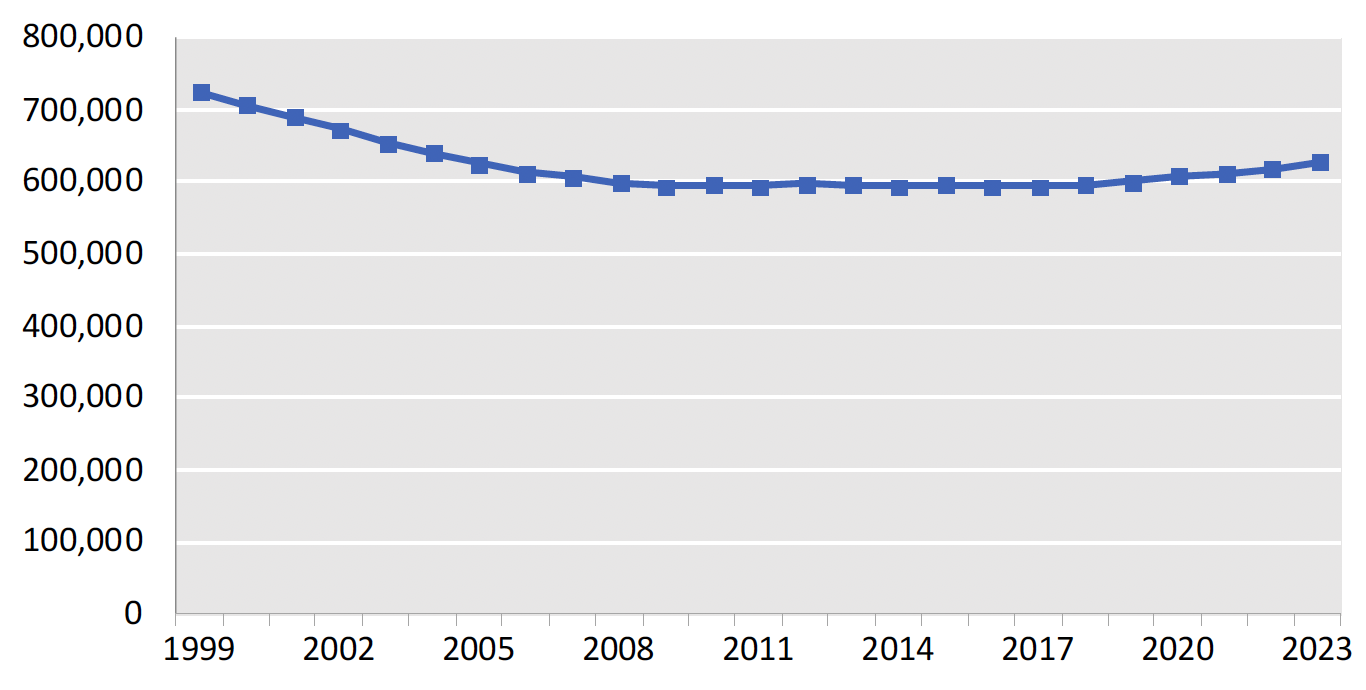

In terms of the social rented sector, social housing dwelling stock administrative data published by the Scottish Government[7] and the Scottish Housing Regulator[8] show that, following the ending of the Right to Buy (a major contributor to the previously declining trend in stock) on 31 July 2016, the number of social rented properties has increased from 593,835 in 2017 to 600,083 in 2019 and 618,559 in 2022. The growth in properties has matched the growth in total dwelling stock, meaning that the percentage of dwellings in the social rented sector (at 24%) has been stable from 2017 to 2022.

Source: Housing Statistics 2022 & 2023: Key Trends Summary, Chart 7.

The rented sectors have a larger share of households on lower incomes than households who own with a mortgage – according to the SHS 2022,[9] 53% of social rented and 31% of private rented households have a net income of £20,000 or less, compared with 10% of households owning with a mortgage. The share for households who own outright (35%) is somewhat higher than for private rented but below the share for social rented households.

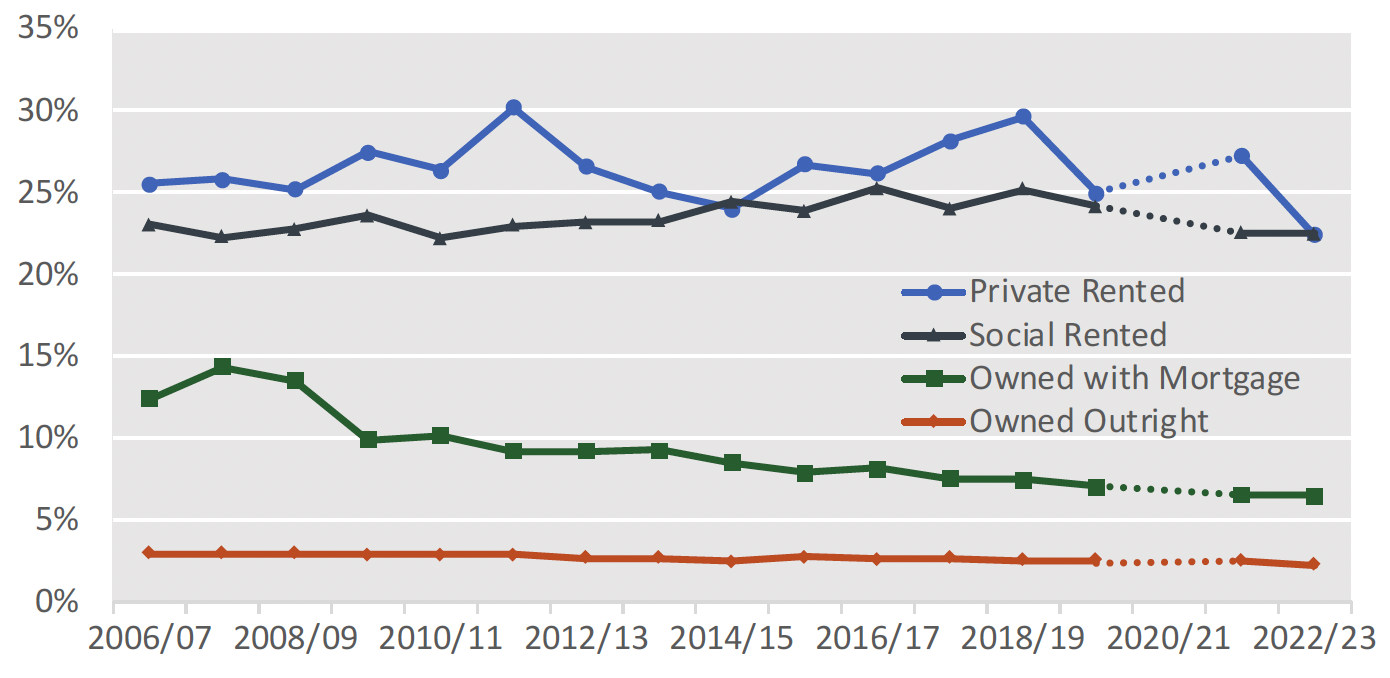

Households in the rented sectors spend a greater proportion of their income on housing costs[10] than owner occupiers: the average (median) share is similar for households who rent socially (22.5% in 2022-23) and privately (22.4%), which is significantly higher than households owning with a mortgage (6.5%) and owning outright (2.2%).[11]

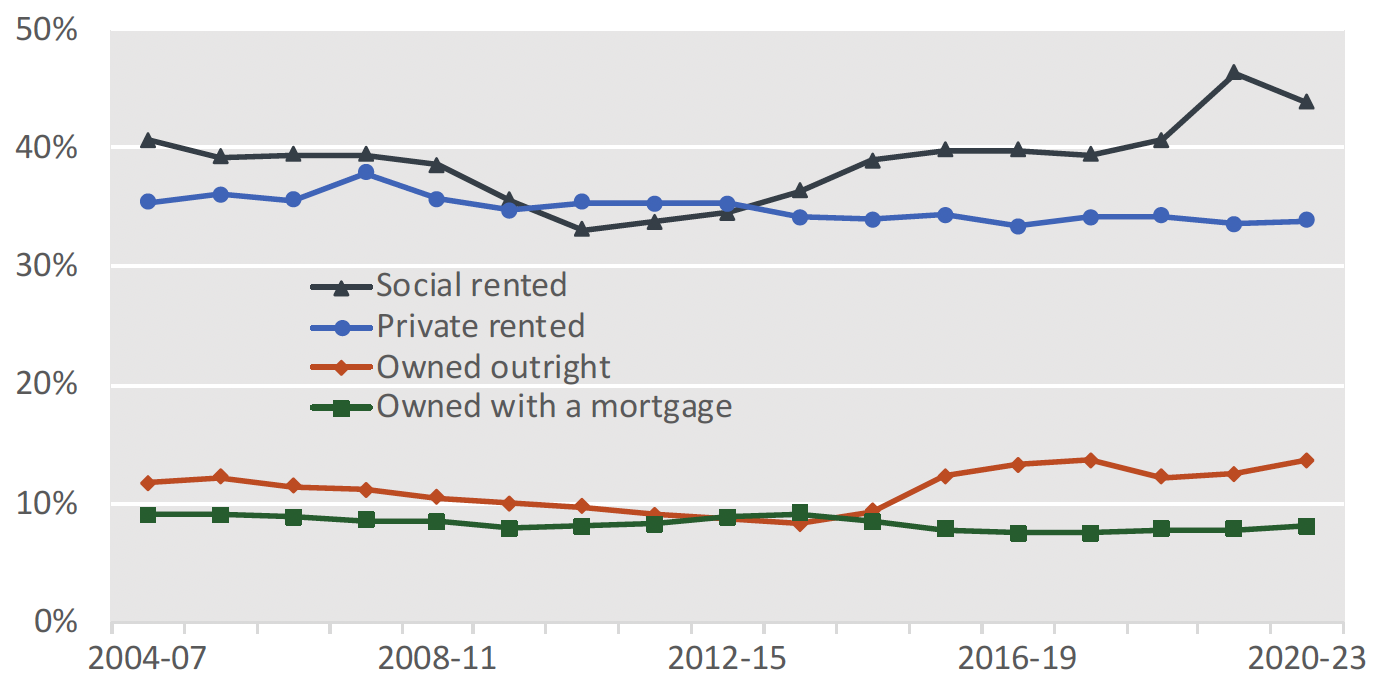

Figure 3 shows the trends in the median ratio over time. Looking at the period from 2006-07 to 2021-2022 (the financial year immediately prior to the introduction of emergency rent controls under the Cost of Living (Tenant Protection) (Scotland) Act 2022 (“2022 Act”), the ratio was little changed in the social rented sector, down by only 0.5% points from 23.1% in 2006-07 to 22.6% in 2021-22, while in the PRS it increased by 1.7% points from 25.6% to 27.3%. In contrast, for households owning with a mortgage the median ratio has fallen by a substantial 5.9% points from 12.4% to 6.5%.

Source: Additional Scottish Government analysis of the Family Resources Survey. Data for 2020/21 is omitted (shown by the dotted line) because it was not possible to obtain a representative sample for Scotland in 2020/21 because of the impact of Covid-19 on the survey.

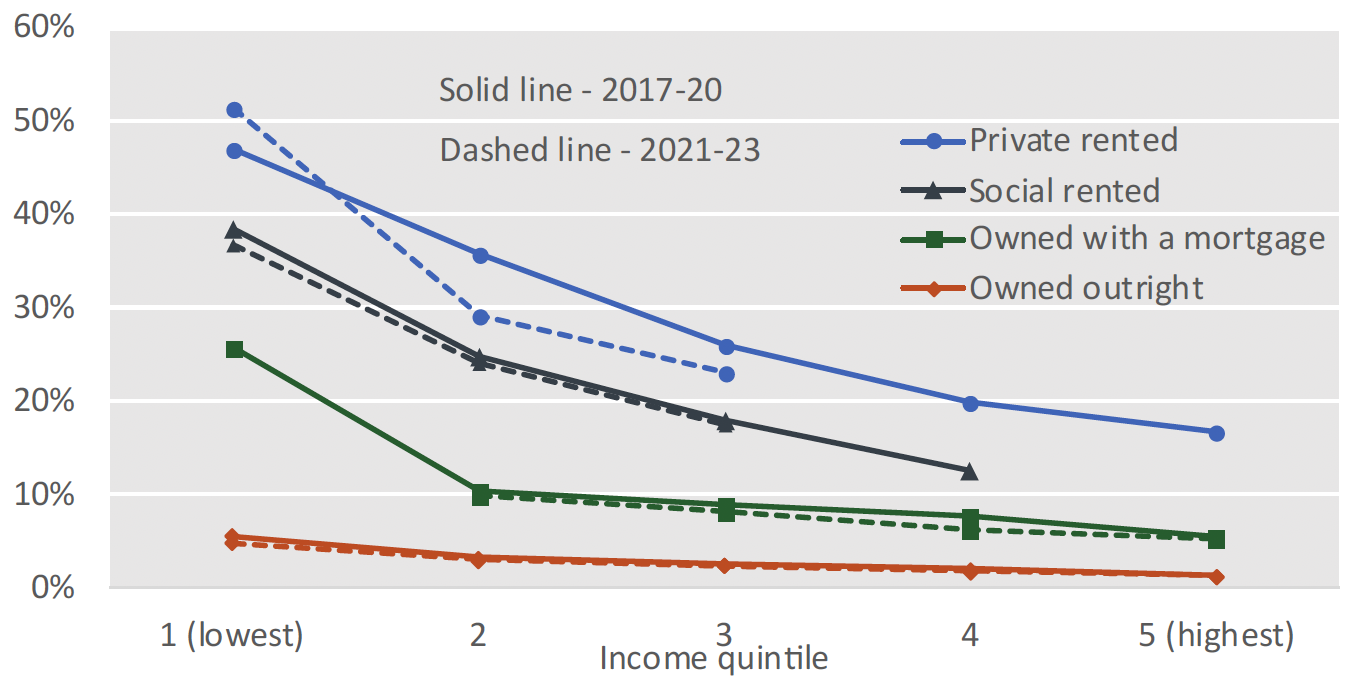

As set out above, the income profile of households in the various tenures differs appreciably; therefore, it is useful to look at the share of housing costs for different income levels. Figure 4 controls for income by dividing all Scottish households into five groups of equal size, where the first income quintile consists of the 20% of Scottish household who have the lowest income, and so forth. Figure 4 shows that households who fall in the lowest income quintile in Scotland and who rent privately spend on average over half their income (51% in the period 2021 to 2023), which is higher than the social rented sector (37%). Across the income distribution, the share of income taken by housing costs is significantly higher in the rented sectors than for those who own with a mortgage.

Source: Additional Scottish Government analysis of the Family Resources Survey The more recent estimate is based on a two-year average due to the impact of Covid-19 on the survey.[14]

There is also a higher proportion of people who are in relative poverty in the rented sectors, with 44% of those in social rented sector in relative poverty after housing costs in the two-year period 2021-22 to 2022-2023,[15] 34% of those in the PRS, 14% of those who own outright, and 8% of those who own with a mortgage.

Source: Poverty and Income Inequality in Scotland 2020-23, Data tables – 3-year averages, Table 14a. Note that 3-year averages are for financial years (so 2003-06 covers the period 2003-04 to 2005-06) with the exception of 3-year periods which include 2020-21 which are two-year averages (2020-21 data is omitted due to the impact of Covid-19 on the survey).

A higher share of rented households are financially vulnerable: the most recently published data (covering the period 2018 to 2020) shows that 63% of social rented households and 40% of private rented households in Scotland were estimated to be financially vulnerable,[16] as compared to 24% of households owning with a mortgage and 9% of households owning outright.[17]

Within the social rented sector, rents are set by social landlords, who must comply with their obligations under the Scottish Social Charter, which requires social landlords to consult with tenants about rent levels, and set the rent so that “a balance is struck between the level of services provided, the cost of the services, and how far current and prospective tenants and service users can afford them”.[18] Within the PRS, rents are generally not subject to regulation and are constrained only by market forces,[19] with the exception to this being the temporary restrictions applied to rent increases within many tenancies from September 2022 by the 2022 Act,[20] and the transitional modifications to the rent adjudication process applied from April 2024 by the Rent Adjudication (Temporary Modifications) (Scotland) Regulations 2024.[21]

Although rental data is collected on a somewhat different basis in the private and social rented sectors, the available data shows that social rents are generally significantly lower than private rents: the average advertised monthly rent for a two-bedroom private sector rent in the year to September 2023 was £841[22], as compared with an average three-apartment monthly rent of £374 (for new and existing tenants) in the social rented sector in 2022-23.[23]

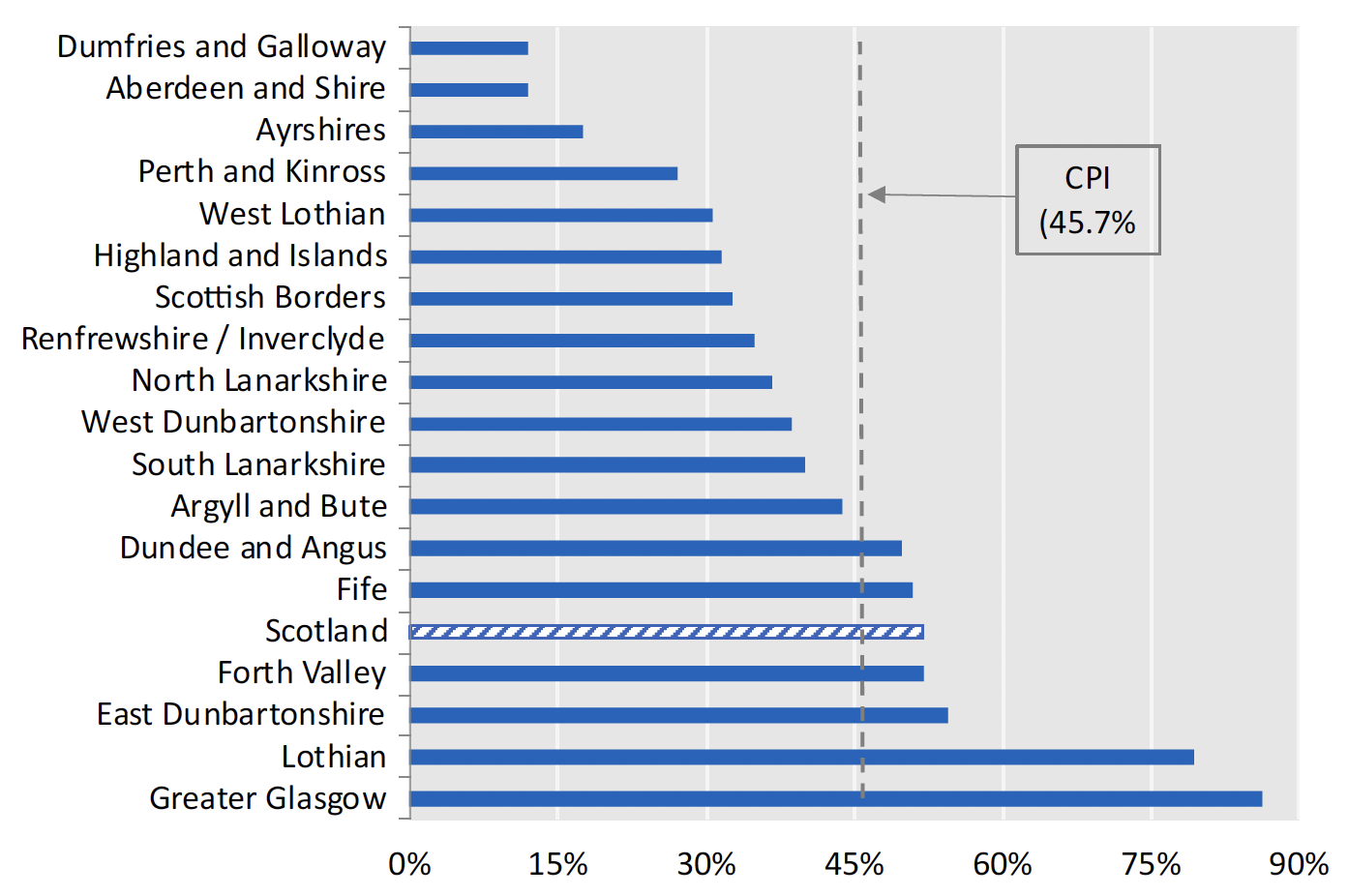

Figure 6 shows that over the period 2010 to 2023, the growth in private sector advertised rents has varied widely across Scotland, but across the Scottish PRS as a whole, rental growth for two-bedroom properties (the most common size) has been above the rate of Consumer Price Index (“CPI”) inflation, and significantly so in the Greater Glasgow as well as the Lothian Broad Rental Market Areas (“BRMAs”).

Source: Scottish Government, Private Sector Rent Statistics, Scotland, 2010 to 2023, Chart 2.

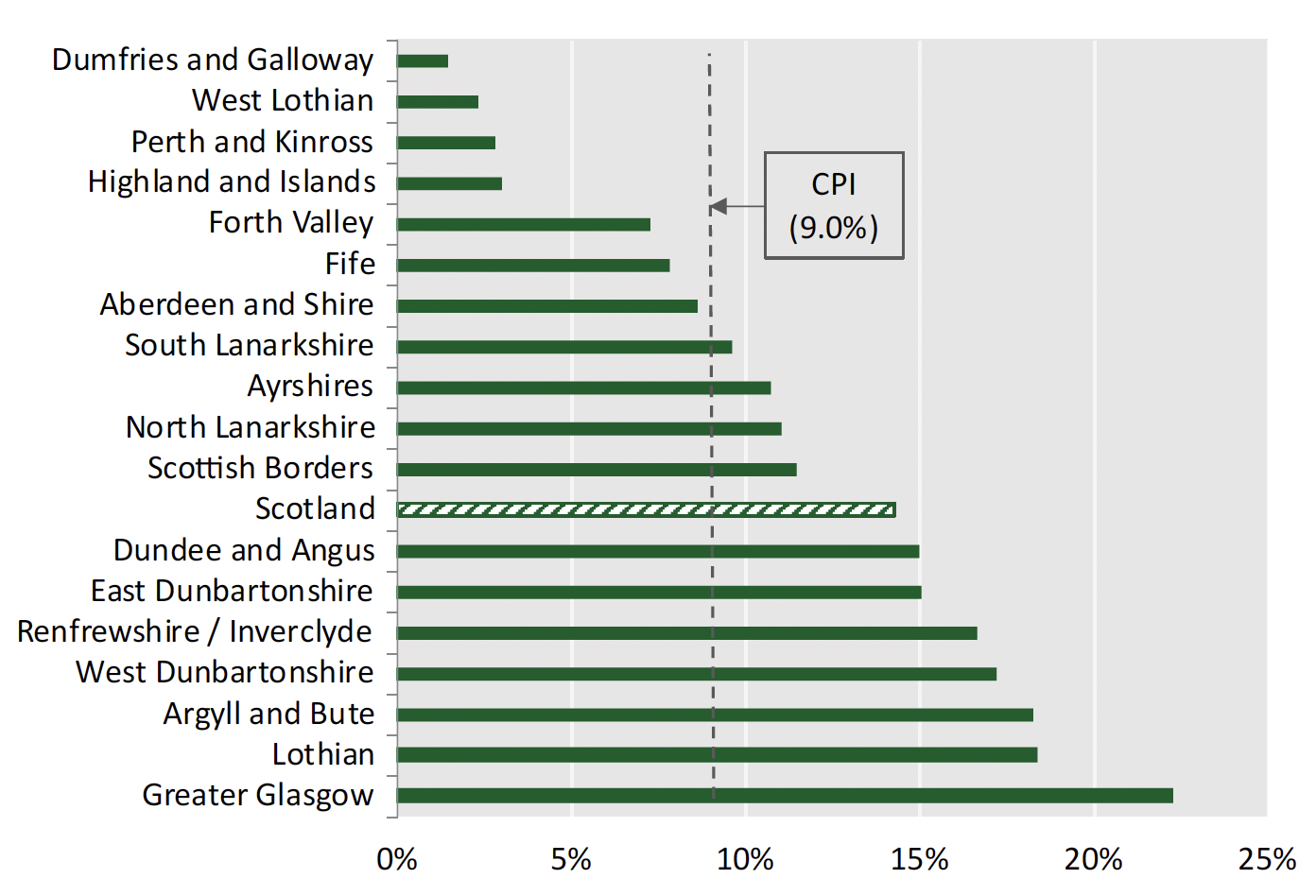

Figure 7 focusses on the most recent data, and shows that over the year to September 2023, in 11 of the 18 BRMAs in Scotland average advertised two-bedroom rents increased above the rate of CPI inflation for the corresponding period (9.0%), with the highest increase (22.3%) in the Greater Glasgow BRMA.

Source: Scottish Government, Private Sector Rent Statistics, Scotland, 2010 to 2023, Chart 5.

A 2022 study by the UK Collaborative Centre for Housing Evidence (“CaCHE”) for the Joseph Rowntree Foundation and the Scottish Government[24] found that many private renters, particularly those on lower incomes, are renting not through choice, but because they feel it is their only option. In fact, 44% of tenants in the survey reported they were renting privately because it was their only option, and this figure rose to 54% for those respondents on lower incomes.

In the PRS, we have already strengthened tenants’ rights through tenancy reform under the Private Housing (Tenancies) (Scotland) Act 2016 (“2016 Act”) providing private tenants with increased stability and security. This represented the most significant change in private renting in Scotland for almost 30 years, but we know more needs to be done.

Our vision[25] is for everyone living in Scotland to have access to a safe, warm, affordable, high quality and energy efficient home that meets their needs in the place they want to be, in a community they feel part of, and proud of, no matter their circumstances or where they live. Housing to 2040, our first long-term national strategy for housing, alongside the Bute House Agreement Shared Policy Programme, set out how we intend to achieve this vision.

Our New Deal for Tenants draft strategy consultation[26] set out our commitment to deliver a successful and high quality, affordable and fair rented sector and sought views on a number of potential areas for reform to achieve this aim. Following further stakeholder engagement, the Bill[27] was introduced on 26 March 2024 to take forward a range of the measures consulted on as part of the New Deal for Tenants draft strategy.

Contact

Email: housing.legislation@gov.scot

There is a problem

Thanks for your feedback