Cost of living - effects on debt: review of emerging evidence

This report considers the evidence on the effects of the cost of living crisis on problem debt in Scotland

5. Characteristics of households and individuals in debt and changes over the cost of living crisis

A recent review of the evidence shows that the following groups are at greater risk of being in problem debt; people of working age,[258] [259] [260] [261] [262] [263] people in low socio-economic groups, [264] [265] [266] [267] [268] [269] renters, [270] [271] [272] [273] [274] [275] [276] ethnic minorities,[277] [278] [279] and disabled people and people with ill health.[280] [281] [282]

The profile of groups most likely to experience problem debt has stayed relatively stable over recent years, but there have been some recent notable shifts. This section considers some of these developments, focussing mainly on problem debt amongst those working full-time and working age single person households, but also considering recent changes for women and mortgage holders.

5.1 People working full-time

Being in full-time employment does not protect households from financial difficulties and problem debt

The latest Wealth and Assets survey found that unemployed and inactive (but not retired) households were most likely to have unmanageable debt in Scotland.[283] This covers the period April 2018 to March 2020 and so predates the pandemic and cost of living crisis.

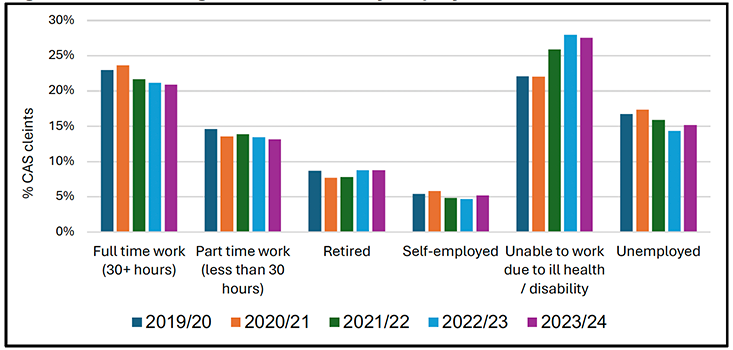

However, over the last five years a range of evidence from debt advice services shows that an increasing proportion of their clients are in full-time work. CAS data shows that most of their debt clients (28% in 2023/24) are those unable to work due to a disability or ill health, but this is followed by those working full-time (21% in 2023/24), followed by unemployed clients (15% in 2023/24).[284] CAS clients who work full-time are therefore not a new client group, and have been the second largest cohort of clients consistently since 2019/20.

Source: CAS Network Data, September 2024

The latest Scottish data from StepChange shows a rise in the proportion of clients in full-time work, which is now at a five-year high of 41%, compared to 34% in 2019.[285] The report found that 27% of their full-time clients and 28% of part-time clients cited the cost of living crisis as their main reason for debt, with those in full-time employment more likely to mention the need for using credit to cover their living costs as the main reason for being in debt.[286]

Elevated levels of those working full-time with outstanding debt is also shown in the YouGov survey findings for the Scottish Government, which show that over the last three waves of the survey combined (September, July and March 2024), the percentage of respondents borrowing in the previous three months who still have money to pay back is higher among those who are working full-time (53% vs 43% overall).[287]

At the UK level, StepChange published a report (2024) on the rise in clients in full-time employment seeking debt advice (the findings of which are also reflected in their monthly client reports and yearly data) which showed that the proportion of clients working full-time rose from 38% in 2021 to 44% in 2023.[288] Compared to all working age clients, clients working full-time are particularly likely to have:

- higher average unsecured debt amounts by 36% (£16,114 compared with £11,808) and higher than average credit card and personal loan debts by 20%. The report suggests that full-time clients have greater access to consumer credit debt as a result of their higher income.

- higher average arrears for rent and council tax. Clients working full-time had fewer arrears across all household bills, and lower arrears amounts than working age clients. However, they had higher than average arrears amounts for rent and council tax, many of whom live in more expensive housing and who may not be eligible for benefits that are required for council tax support.

The report found that their clients working full-time tend to be younger (aged under 40), are equally likely to be men and women (whereas debt clients overall are more likely to be women), and more likely to be renting privately or have a mortgage. Male clients held a higher average credit card debt amount (£9,025) when compared to women (£7,560). Clients aged 18-24 owed the smallest amount of debt, which increased for those aged 25-34, then again for those aged 35-49. Clients aged 50-64 owed the largest amount.

Lastly, the Money and Pensions Service (MaPS) latest UK Debt Need Survey (2023) reports on people who need debt advice and those at risk of needing it if their situation does not improve. The research did not consider full-time work specifically, but did find that both the ‘at-risk’ and ‘need debt advice’ groups are mainly in paid employment, as most of them are still of working age. They are more likely to be working on fixed term or zero hours contracts or doing gig economy or casual work than the UK population as a whole.[289]

“I sometimes lose hours as I am just an agency worker. If there is not enough work we get sent home without pay. This makes it hard to keep accurate track of how much I should expect each week.” (Man, aged 25-34, in full-time employment). StepChange (2024). In Work. But still in debt.

The StepChange report on clients in full-time work highlights key risk factors contributing to in-work indebtedness amongst clients working full-time. Rising costs (26%) was the primary reason cited for debt among clients in full-time employment. Other factors include: insufficient incomes (from benefits and work); unstable employment, challenges with housing costs, age-related challenges and gender disparities (with women facing greater financial fragility).

5.2 Single Adult Working-Age Households

While households with children are more likely overall to be in problem debt, there is emerging evidence to suggest that single adult working-age households are struggling with debt. These households have long been acutely affected by inadequate living standards, are particularly vulnerable to the cost of living crisis and are increasingly likely to seek support from debt advice services.

A number of population surveys show that households with children are more likely to be in problem debt. The Wealth and Assets survey found that in 2018-2020, lone parent households in Scotland were most likely to have unmanageable debt.[290] More recently, YouGov’s survey for the Scottish Government [291] (September 2024) showed that the proportion of adults borrowing in the past 3 months who still have money to pay back is higher among parents/guardians of children aged 17 and under (58%) compared to 45% overall.[292] MaPS reported that UK households who need debt advice are typically households with children and low incomes [293], and JRF’s UK cost of living tracker (2024) found that low income households in arrears were most likely to have children.[294]

However, low income working-age single households are one of the groups most affected by the cost of living crisis who are also particularly affected by inadequate living standards and problem debt.

Working-age single person households were one of the groups identified as most affected by the cost of living crisis, as they spend a higher percentage of their net income on housing, fuel and food than other households.[295] [296] Households with two or more adults have a lower cost of living than single person households without children.[297]

The Minimum Income Standard (MIS) is the income that people need to reach a minimum socially acceptable standard of living in the UK today, based on what members of the public think. It includes food, clothes and shelter but also the opportunities and choices necessary to participate in society.[298] There is evidence that working-age single households have long been affected by inadequate living standards.[299] [300] JRF research (2024) found that between 2017/18 and 2020/21, single working age adults were one of the groups most likely to experience persistent very deep poverty.[301]

Research for CAP by Loughborough University (2023) explores the link between debt, poverty and living standards, through analysis of the last four waves of the Wealth and Assets survey (predating Covid-19 and the cost of living crisis).[302] The report considers ‘depth of income inadequacy’ for households that are living below MIS – ‘across all household types, the depth of income inadequacy means households are below 75% of the MIS budget, the point at which material hardship becomes far more likely’.[303] It finds that of all household types, working-age singles exhibit the greatest depth of income inadequacy, which is further compounded if they have burdensome debt.[304]

“While we have seen that lone parents tend to fare worst in most of the analyses… and are the group most likely to have an income below MIS overall, when we look at depth below MIS, it is working-age singles who are falling deepest below the benchmark income level; this is the case particularly if they have debts that they report are a financial burden, with these individuals on average having an income that is less than half the MIS budget.” Debt, poverty and living standards in Great Britain. A report for CAP by Loughborough University (2024)

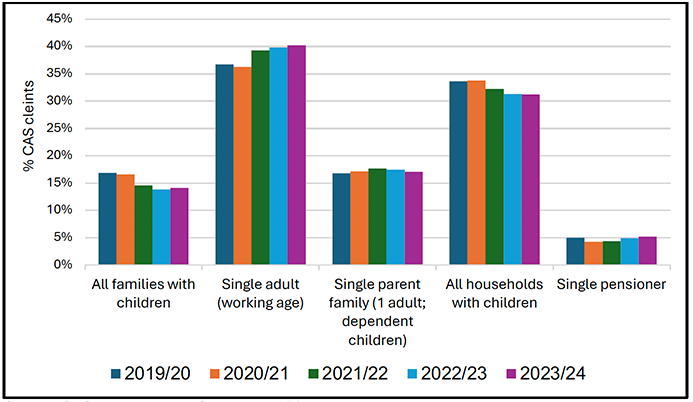

Data from debt services show that single adult working age households are increasingly likely to seek debt advice. CAS data shows that these are the most likely household type to be their clients. Figure 5.2 shows that this has been the case since 2019/20, increasing from 36% of clients in 2020/21 to 40% of clients in 2023/24. All households with children are the next most likely group to be CAS clients, however this has been decreasing gradually since 2020/21.[305]

Source: CAS Network Data, September 2024

The latest StepChange Scotland and Christians Against Poverty (CAP) data reports on ‘single’ clients and so is likely to include pensioners. However, the latest CAP client report (2024) found that 86% of their new clients in 2023 were in single households – 57% have no children (29% single women and 28% single man), and 29% single parents (27% single mother and 2% single father).[306]

Scottish StepChange data shows that in 2023 households with children accounted for 43% of their client households (up from 36% in 2019), but the proportion of clients who are single without children was also 43% (down from 49% in 2019).

‘Many single adult households fall outside measures that the Scottish Government is taking to reduce child poverty, and this group still faces significant difficulty with less help available to them.’ StepChange, Scotland in the Red (2023)

Lastly, research from 2022 found that single female adult households that are black, Asian or other ethnic minority households experience costs that are substantially higher than their male and white counterparts (respectively) as a portion of their income.[307]

There is likely to be some overlap between single person households with problem debt and people working full-time. Some of these households will be affected by the “cliff-edge” effect, whereby they earn just too much to qualify for UC, and so would not have qualified for cost of living payments or council tax reductions.

5.3 Women

Recent evidence suggests that problem debt amongst women may have worsened as a result of the cost of living crisis.

The latest Wealth and Assets survey data show that between 2018-2020, male and female headed households were similarly likely to have unmanageable debt.[308] However, more recent evidence shows that women are more likely than men to be in debt, and certain groups of women are particularly affected, such as black and minority ethnic women, disabled women, young women, lone parents and mothers of young children.[309] [310] [311] [312] [313] [314]

Several reports highlight the gendered nature of debt and how women are disproportionately affected by a range of wealth inequalities and unique challenges in managing their finances. These include having lower income levels, additional expenditure due to childcare and higher household arrears amounts.[315] [316] The FCA Financial Lives 2022 survey shows that compared to men, women had lower levels of financial capability and confidence, financial resilience, fewer investable assets and were more likely to be turned down for a credit application.[317]

Recent evidence suggests that women have been disproportionately affected by the cost of living crisis.[318] [319] Research by the Poverty Alliance and the Scottish Women’s Budget Group (SWBG) (2022), illustrates how many women struggled to repay existing debts or were at risk of accumulating more debt as a result of rising costs, inadequate incomes through the social security system and low-paid work.[320] The SWBG survey on the experiences of the cost of living (2023) found that 23% of the women who responded were taking on more debt (40% for single parents).[321] The Financial Lives 2024 cost of living survey shows that 12% of women had fallen behind on or missed any payments for credit commitments or domestic bills in the last 6 months, compared to 9% of men.[322]

“I receive about £329 in Universal Credit twice a month so after spending on food and bills most of the time I run out of money very quickly therefore I have to fall back on credit cards and debt” (lone mother, aged 35-44)

Poverty Alliance and the Scottish Women’s Budget Group (2022)

In terms of debt advice, women have long been overrepresented amongst StepChange’s client base,[323] [324] but a report on the impact of the cost of living crisis on women in Scotland by StepChange (2023) demonstrates how this has exacerbated the debt burden for women, who are more likely to have energy debt and to pay more on household essentials.[325] The analysis of client data shows that in 2022, 13% of women said an increase in the cost of living was the driver of their debt problems, which more than doubled to 28% in 2023.[326] More men have also been citing price rises as the cause of their debt, but less steeply (from 11% in 2022 to 20% in 2023). The report also finds that of those seeking debt advice in the first half of 2023, 62% were women (up from 60% in 2021) and women were more likely to have arrears on their energy bills (51% of women compared to 40% of men). Among clients with energy debt, the average arrears for women (£1,736) exceeds those of men by £216.[327]

5.4 Mortgage holders and people with higher incomes

There is some recent evidence that groups of people not previously in debt are at risk of falling into debt, such as mortgage holders and people with higher incomes.

There is some UK evidence that households with mortgages have started to seek debt advice.[328] Research by MaPS (2023) found that while most people in need of debt advice rent their home from a social landlord or private landlord, a third of the ‘at-risk’ group have a mortgage (35%). This means they will have some exposure to changes in interest rates now or in the future.[329] MaPS highlighted concerns around the 7% of mortgage holders on variable rate mortgages who are exposed to changes in rates, and 4% who are tied into fixed rates of 5% or more. Overall MaPS concluded it was unlikely that there will be a significant increase in the proportion of people with mortgages and higher incomes seeking debt advice in the near future.[330]

However, this is an area of concern for Citizens Advice, who have seen an increase in demand for debt advice amongst mortgage holders, some of whom are prioritising mortgage payments but cutting back on other essentials.[331] Citizens Advice data for England and Wales shows that while previously the service did not see many clients with mortgages in negative budgets, this has changed. In 2019/20, 25% of the mortgage holders they helped with debt advice were in a negative budget, whereas in January 2024, 62% of mortgage holders were in a negative budget.[332] Over the course of 2024 mortgage holders became their client group (by housing tenure) most affected by negative budgets (see definitions), overtaking private renters who have experienced substantial rent increases over the last year (see Section 3.3). However, the latest data shows that this gap between mortgage holders and private renters has largely closed.[333] Citizens Advice analysis finds that mortgage holders are prioritising mortgage payments but cutting back on other essentials.

“Due to the increase in mortgage rates we are now £350 worse off which has impacted us immensely. This would otherwise be our emergency fund which we don’t have the option anymore to save for.” (Woman, aged 25-34, in full-time employment) StepChange (2024). In Work. But still in debt.

Contact

Email: Fran.warren@gov.scot

There is a problem

Thanks for your feedback