Cost of living - effects on debt: review of emerging evidence

This report considers the evidence on the effects of the cost of living crisis on problem debt in Scotland

6. Demands on debt advice services and changes over the cost of living crisis

Levels of demand for debt advice services have increased over recent years, suggesting that the cost of living crisis has played a role in increasing debt problems for households. This section draws on the latest evidence produced by debt advice services; Citizens Advice (data on England and Wales), Citizens Advice Scotland (CAS), StepChange, CAP and reports by MaPS, FCA and PIC.

It is important to note that figures from debt services will not reflect those people in debt who do not seek advice. FCA research shows that only 21% adults who felt heavily burdened by their debts and 29% of adults who had fallen behind on or missed paying their bills sought help in the last year.[334] This can be for reasons such as shame and stigma around being in debt, wanting to resolve the problem independently, mental health difficulties, other vulnerabilities, or other reasons.[335]

There are a number of caveats around the data in this section, for example some services measure numbers of new clients only while others measure numbers of both new and existing clients. Some of these figures may also be underestimates as it is likely that not everyone who needs advice will have been able to access debt advice services, which are overstretched and dealing with increasingly complex cases with lower volunteer numbers.[336] [337] [338]

Evidence from a number of debt advice services show that demand for debt advice has increased since the start of the cost of living crisis. This can be seen in both annual and monthly data on demand for services.

6.1 Levels of demand for debt advice

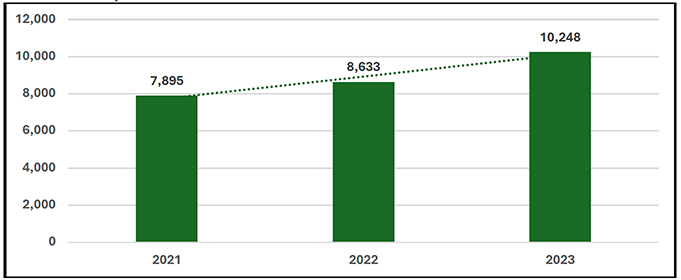

Annual changes in demand for debt advice (number of clients) - StepChange UK and Scottish data shows a year-on-year rise in the number of clients completing a first full debt advice session (between 2021 and 2023).[339] There were 183,403 new clients across the UK in 2023, up from 167,351 in 2022, ‘the equivalent of one new client every three minutes’.[340] Between 2022 and 2023 StepChange provided full debt advice to 16,000 more clients, an increase of 10% year-on-year.[341] Figure 6.1 shows the equivalent StepChange figures for Scotland, which also show the number of new clients in Scotland year increased year-on-year from 2021.

Source: StepChange Scotland data, September 2024

Citizens Advice data for England and Wales also shows the increased demand for debt advice year-on-year since 2022.[342]

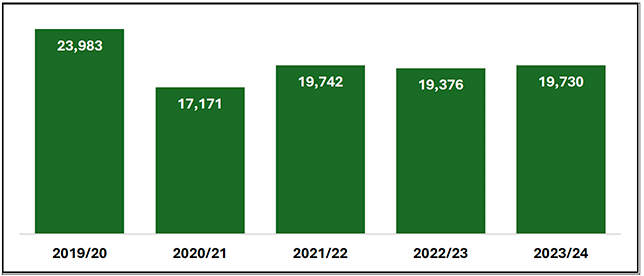

CAS data, however, does not show year-on-year increases in the number of CAS clients receiving debt advice. This was highest in 2019/20, dropped during the pandemic, increased again in 2021/22 and has remained around that level since.[343] This may be partly due to capacity issues as opposed to no genuine increase in debt advice need.

Source: CAS Network Data, September 2024

Monthly changes in demand for debt advice (number of clients) - Monthly client data is important as it shows year-on-year changes when comparing individual months that are not reflected to the same extent in annual data. StepChange UK level monthly client data (April 2024) shows that 16,046 new clients were seeking debt advice, which is 11% higher than April 2023 (14,512).[344]

Citizens Advice data for England and Wales shows that debt advice was given to 35,475 clients in January 2022, 43,963 in January 2023 and a record 48,482 in January 2024, before falling to 43,006 in June 2024.[345]

6.2 Amounts of debt amongst clients

Numerous reports by debt advice services published since 2022 show increases in the average amount of unsecured debts and arrears

Average unsecured debt amounts - StepChange data found that across the UK clients had £14,654 debt in 2023, and this had increased from an average debt of £11,000 in 2021.[346] Average unsecured debts amongst Scottish StepChange clients have also increased from £12,730 in 2021 to £16,337 in 2023. Client average arrears have also increased and are now the highest they have been over the past five years, increasing 30% between 2019 and 2023.[347]

Citizens Advice data from England and Wales shows growing levels of debt among their debt advice clients with average levels of energy debt at record levels, while rent and council tax debt are at near-record levels.[348] [349]

6.3 Other estimates of debt advice need

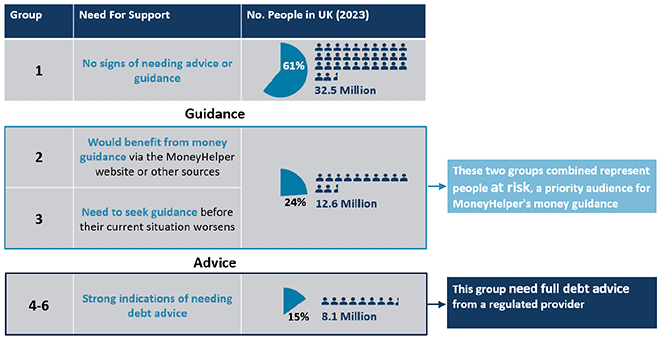

The MaPS Debt Need Survey highlights the need for debt advice across a nationally representative cross section of the UK population. The measure identifies both people who need debt advice and those at risk of needing it if their situation does not improve. Figure 6.1 shows that in 2023 most UK adults did not need debt advice, but over a third (39%) either need debt advice or are at risk of needing it soon and 15% (equivalent to 8.1 million people) needed debt advice to avoid their current situation worsening. [350]

Source: The UK’s debt landscape in 2023, Money and Pensions Service

The report found that there was not a substantive change to the amount of people who need debt advice between 2022-2023. However: (i) there was an increase in those ‘at risk’ of needing debt advice between 2022-23; and (ii) since 2020 there has been a steady decline in the proportion of people with ‘no problems’, and an increase in the cohorts of those ‘at risk’ and ‘need advice’. Need for debt advice in Scotland has been lower than the UK since 2020, but the trend over time in Scotland is similar to the UK.[351]

6.4 Impacts of the cost of living crisis on debt clients and debt services

Several recent reports highlight that problem debt is now driven by low income, and people are falling into debt in order to pay for essentials or for pre-existing arrears.

JRF’s report ‘Minimum Income Standard for the UK in 2024’ suggests there has been a recent shift in ‘the nature and causes of indebtedness’, with debt being taken on to cover food, energy and rent costs rather than ‘to accumulate assets’.[352] The evidence reviewed demonstrates that many on the lowest incomes do not have sufficient income to cover their essential costs, leading either to arrears, loans or forms of high cost credit to cover these costs, or else going without the basics.[353] [354] [355] [356] The latest CAP client report (2024) found that 59% of their new clients in 2023 had an equivalised income level below the poverty line.[357]

Low income households in problem debt are also borrowing money to repay existing debts, and debt repayments constitute a greater share of their income than for households with higher incomes.[358]

‘Debt and poverty are interwoven issues, with low incomes leading households to accrue debt in the form of credit, payment advances and bill arrears, and these debts, in turn, limit households’ capacity to meet every day essential needs.’ Debt, poverty and living standards in Great Britain. A report for CAP by Loughborough University (2024)

In 2023, a report by Citizens Advice based on UK polling asserted that cost of living pressures have accelerated a longer term trend of household bill debt and have also changed the way that credit is used. The report found that 21% of people had borrowed to pay for essentials in the last 6 months.[359]

Deficit or negative budgets have been a feature of debt advice for several years. However service providers have reported significant growth in the prevalence of deficit budgets, as well as multiple and complex debt types.

There has been an increase in households who cannot afford to pay household bills as a consequence of being in ‘deficit or negative budgets’ and so either run down their savings (if they have them) or go further into debt each month.[360] [361] The latest StepChange data shows that one in three of their UK (32%) new clients had a deficit budget (up from 30% of new clients in 2022),[362] and in Scotland this increased from 27% of clients in 2022 to 31% in 2023.[363] A StepChange report on clients working full-time (2024) showed that 21% of full-time employed clients had a deficit budget in 2023.[364]

Figures for Citizens Advice in England and Wales (2024)[365] and CAP (2023)[366] are higher – with around half of the people they helped with debt advice in a negative budget, even after help from debt advisers.

‘Despite the debt advice sector’s familiarity with these clients [clients with deficit budgets], achieving good outcomes for them is not easy and this creates challenges not just for the clients themselves, but for advisers and the sector’s overall capacity’. Money and Pensions Service, Findings from call for evidence on debt advice clients with deficit budgets (2023)

StepChange data shows a shift in the number of clients citing ‘cost of living increases’ as the main reason for their debt problem, with one in four (25%) new UK StepChange clients citing this (an increase of seven percentage points compared to 2022, and 19 percentage points compared to 2021 (6%). It was also cited by 25% of new Scottish StepChange clients in 2023, an increase of 2% since 2022.[367]

Debt advice services are dealing with increased numbers of clients and increasingly complex cases, both of which are adding to pressure on services and a backlog of cases.

The PIC briefing on the Cost of Living crisis (2022)[368] showed rising demand for services in response to the cost of living crisis and the ongoing impact of the pandemic. Their 2023 cost of living briefing drew on insights and views from 11 advice organisations in 10 local authority areas (between August 2022 and March 2023) that provide money advice and other support to people across Scotland. The report found that advice services are experiencing the ‘twin challenges’ of both a ‘surging number of cases’, and increasing complexity of the average case both of which are adding to pressure on services and creating a backlog of cases.[369]

The increasing complexity of cases can be seen in an example from the latest CAS data on numbers of clients with housing debt. The number of clients receiving advice in relation to local authority rent arrears has not changed much since 2020/21, with only a slight yearly increase. However, when CAS data on ‘pieces of advice’ given on housing debt is considered,[370] there has been an increase of 21% for LA rent arrears between 2019/20 and 2023/24.[371] Therefore, while the number of clients has not increased, the breadth of advice clients have required on LA rent arrears has increased by 21%, suggesting that these cases have become increasingly complex.

Recent reports show that increased workloads, the complexity of cases, and limits to what advice can be given to help clients who are out of options to stretch their budgets any further, are all having a detrimental impact on debt advisers.[372] [373] [374] A recent survey of 300 money advisers (2023) found that half (52%) of respondents 'often' feel stressed or anxious at work and more than half (54%) of respondents perceive that workload requirements have had a 'major' impact on stress levels and the mental health of colleagues in their workplace.[375]

‘Episodes of acute crisis being experienced by clients of advice services is taking its toll on advisers, who, for some clients, are running out of support options to offer. As a consequence the negative impact on staff wellbeing is a huge issue for services.’ Poverty and Inequality Commission Cost of Living Briefing (2023)

Contact

Email: Fran.warren@gov.scot

There is a problem

Thanks for your feedback