Rural enterprise support: evaluation report

Findings of the evaluation of a pilot project of integrated, place based business support provided by GrowBiz, sponsored by Scottish Government and others.

5. The views of participants: Survey findings

Key Points

A total of 135 businesses responded to our survey, equating to 18% of the total businesses supported during the intervention.

A large majority of the respondents reported they had found the pilot ‘very valuable’. A further 16% rated it as ‘somewhat valuable’. All interventions received strong praise from the respondents.

In terms of the primary barriers experienced in business development, disruption caused by Coronavirus (COVID-19) was the most prominent barrier.

Networking events and peer learning were the most common forms of support received.

‘Increased confidence’ was the most common benefit of the intervention cited by participants.

5.1 Response rate

There were a total of 135 responses to our survey, which equates to 18% of the total number of businesses supported during the intervention. The survey was distributed by the provider to participants who had used their business support within the timeframe of the intervention. For this reason, while the sample size is appropriate to the intervention population, the distribution by the provider may bias the sample towards positive views of the intervention.

5.2 Participant demographics

134 participants provided information on their age. The largest group of respondents – 50% - were aged between 50 and 64, with 10% between 18 and 39 (and slightly less than 1% were 18-29). A further 31% were between 40 and 49, with 10% over 65.

Of the 132 respondents who listed their gender, 77% were female, compared to 22% male and 1% described themselves as ‘other’. As above, 64% of the total intervention pilot that received one to one support were female. This suggests that, while our sample may over-represent women, the higher number of women is consistent with the overall distribution of support.

An overwhelming percentage of the participants - 85% - were from Perth and Kinross. This is unsurprising, given the location of the provider. In addition, 4% of the participants were from Angus, 1% from Fife and 8% from the Highlands; these are all local authorities that directly border Perth & Kinross.

5.3 The business of participants

87% of respondents had started their own business, while 13% were planning to. Of those who had started their business, almost a quarter – 22% of the respondents – had started their businesses less than a year ago. 53% of the respondents had operated their businesses for over four years (approximately half of whom had operated it for over ten years). Of those who had started a business, 69% had no employees, while the next largest group – 36% - had between one and five. 3% of the respondents reported having more than 9 employees – and are therefore small businesses rather than micro-enterprises – and 2% had between six and nine.

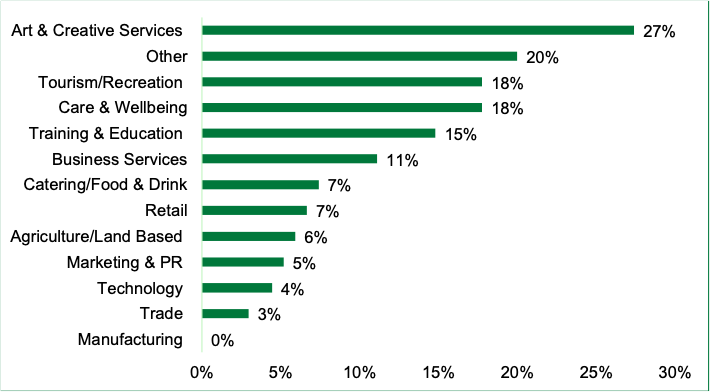

For 58% of participants, this was their first business, with 34% having previously operated a business of their own (the remainder being those who had not yet started, who had not previously operated a business). In terms of the sectors in which participants were starting businesses, these are shown in Figure 5. As we can see, 27% are in art and creative services, while 20% said ‘other’.[28]

In terms of turnover, over half the participants reported a turnover of less than £15,000 with 14% exceeding £100,000.

In terms of the business aspirations of the sample, less than half – 48% - of those operating the business were full time. While this partly reflects the impacts of Coronavirus (COVID-19) – 19% had suspended operations at the time of the survey – it may also reflects the part time nature of many of the enterprises. 12% of respondents were working on their business in their spare time, and a further 22% were working on their business part-time. When asked about their business aspirations, 74% reported that they intended for their business to be their main source of income. In addition, 54% ascribed a ‘high’ priority to growth, while it was a ‘slight priority’ for 29% and either neither or not a priority for the remaining 17%.

5.4 Overall sentiments on quality

On the question of the overall value of participating in the pilot, a large majority (72%) of the participants reported that they had found the pilot ‘very valuable’, with a further 16% rating it as ‘somewhat valuable’, and only 2% rating it as ‘not valuable’. When asked in more detail about the specific interventions they had taken part in, all interventions received strong praise from the respondents, with ratings of ‘very good’ only falling below 70% in the context of networking and peer support (see Figure 6).

5.5 Views on other sources of business support

The majority of the participants - 64% - had sought business support elsewhere, in addition to working with the provider. The largest number of these - 49% - sought support from Business Gateway. A further 16% had sought local authority support and 13% had used Scottish Enterprise. At the same time, 37% had not sought other forms of support.

We were interested to understand how the support provided through the project compared to other forms of business support. Overall, 31% of respondents said the help was ‘about the same level of help as GrowBiz’, while 31% thought other services were ‘somewhat’ less helpful than GrowBiz and 26% regarded other services as ‘much less’ helpful than GrowBiz. The remaining 12% rated alternative services as better. While the majority preferred the support provided by GrowBiz – and the reasons why are explored in the qualitative findings – it is worth noting that, for 43% of the respondents, other services were perceived as either equally useful or better than GrowBiz.

5.6 What are the challenges faced by participants?

The main support needs of the participations can be observed in Figure 7.

Participants sought a wide range of benefits from these interventions, ranging from support in developing digital capacity to help in applying for funding. In terms of the primary barriers experienced in business development (see Figure 8), disruption caused by Coronavirus (COVID-19) was the most prominent barrier, cited by 64% of the participants. Some of these challenges are familiar from existing literature and evidence on rural challenges, such as a lack of digital infrastructure and a lack of physical infrastructure. We can also see a range of areas where policy could support improvements in Figure 8, for example access to grant funding and tailored support in running an enterprise.[30]

5.7 Support received and perceptions of quality

Participants were asked about the support they had received from the provider. Of these, networking events were the most common answer, followed by peer learning (see Figure 9).

Participants were also asked about the specific benefits that they had received as a result of these interventions. These can be seen in Figure 10 below, which takes an average of the values from each of the six interventions described above. As we see, ‘increased confidence’ is the most common benefit, which is consistent with the qualitative findings in the next chapter, as is the emphasis on networking and collaboration.

Further questions were asked about the more general benefits that participants had received, which can be seen in Figure 11.

As this indicates, the social benefits of GrowBiz – such as reduced isolation, and improved support networks – were most prevalent. This further reinforces the finding in the evaluation that the connective and social elements of the support pilot were a key part of what made this intervention valuable to participants.

5.8 Digital skills

The project aimed to use a digital platform so questions were also asked about the extent to which the intervention had supported digital skills through the survey. The results of this can be seen in Figure 12. Just under three-quarters reported that the pilot had improved their digital abilities with 14% saying they were improved to a ‘great extent’.

The specific digital skills learned are noted in Figure 13. As this indicates, the use of social media was, by a considerable margin, the most commonly reported benefit.

5.9 Conclusion

Overall, we can see that the participants viewed the intervention favourably and perceived themselves to have benefitted from it. In particular, the survey findings emphasise the importance of supporting rural business people in developing their confidence and reducing their isolation. It is clear that the interventions were well regarded by respondents to the survey.

Contact

Email: socialresearch@gov.scot

There is a problem

Thanks for your feedback