Rural Scotland Business Panel Survey

This report presents findings from the second Rural Scotland Business Panel Survey carried out in February and March 2022.

5. Workforce

Key findings

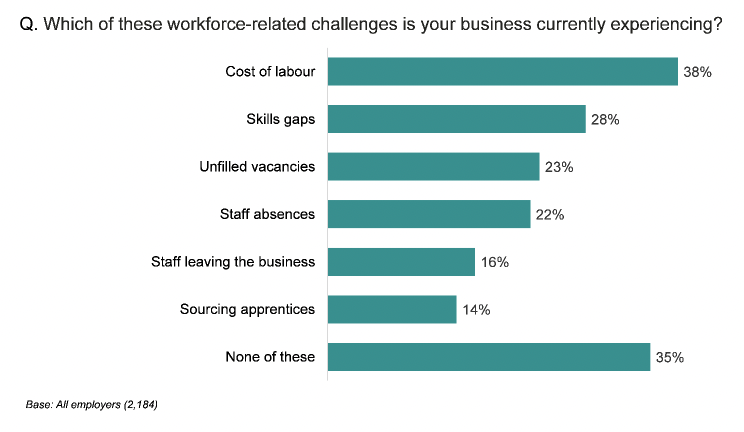

Almost two-thirds of employers (65%) were experiencing workforce related challenges. The most common challenge was the cost of labour (38%), followed by skills gaps (28%), unfilled vacancies (23%) and staff absences (22%).

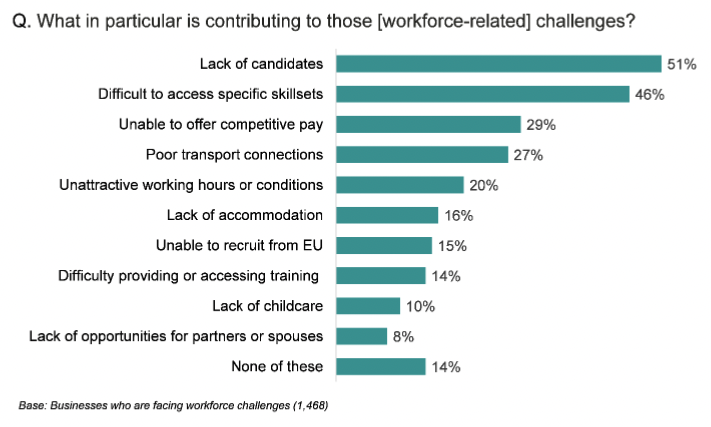

The top three issues contributing to workforce related challenges were: a lack of candidates (51%), difficulties accessing specific skillsets (46%) and being unable to offer competitive pay (29%).

The top actions employers were taking in relation to their workforce were: upskilling or re-skilling current workforce (50%), investing in new technology (39%), making pay and rewards more competitive (36%) and collaborating with other businesses (30%).

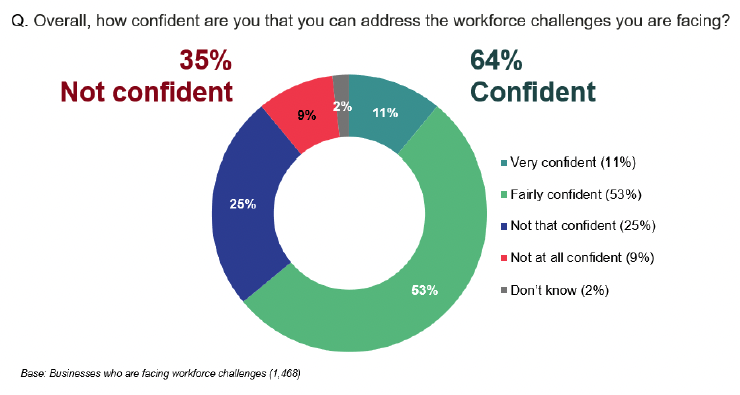

Two-thirds of employers were confident they could address their workforce challenges (64%), while one third were not (35%).

Women-led business

A quarter (24%) of businesses described themselves as women-led, while 74% did not[8].

Women-led businesses were higher than average among the tourism sector (32%), those operating below pre-pandemic levels (26%), and those striving for growth (27%) (though these latter two differences may be driven by tourism businesses, who themselves were more likely to be operating below their former levels and striving for growth).

Workforce-related challenges

Almost two-thirds of employers (65%) were experiencing workforce-related challenges. The most common challenge was the cost of labour (38%)[9], followed by skills gaps (28%), unfilled vacancies (23%), staff absences (22%), staff leaving the business (16%) and sourcing apprentices (14%) (Figure 5.1).

Variation in workforce related challenges

Overall, workforce related challenges were most common among those in the Highlands and Islands (70% were experiencing challenges), tourism businesses (73%) and employers with 11-24 (88%) and 25+ staff (92%).

Furthermore, specific challenges were more common than average among:

- Highlands and Islands businesses – cost of labour (42%), staff absences (25%), staff leaving the business (19%), unfilled vacancies (25%), and sourcing apprentices (19%).

- Island businesses – sourcing apprentices (20%).

- Tourism – cost of labour (50%), unfilled vacancies (33%) and staff leaving the business (22%).

- Those striving for growth - skills gaps (34%), unfilled vacancies (28%) and staff absences (23%).

- Those importing from outside the UK – cost (43%), skills gaps (33%) and staff absences (27%).

- Women-led businesses – staff absences (27% vs 20% of non-women led businesses).

Those businesses that were currently focussing on addressing labour challenges (see Figure 4.1) were also more likely to be experiencing each challenge, including: cost of labour (54%), skills gaps (42%), unfilled vacancies (38%), staff absences (33%), staff leaving (29%) and sourcing apprentices (22%).

Factors contributing to workforce challenges

The top three issues contributing to workforce related challenges were: a lack of candidates (51%), difficulties accessing specific skillsets (46%) and being unable to offer competitive pay (29%) (Figure 5.2).

Variation in factors contributing to workforce related challenges

Remote rural businesses were more likely than average to say a number of factors had an influence: poor transport connections (40%), lack of accommodation (32%), unattractive working hours or conditions (26%), being unable to recruit from the EU (20%), lack of childcare (16%) and lack of opportunities for partners and spouses (12%).

Each of these factors listed for remote rural businesses were also higher than average for businesses in the Highlands and Islands, and among island businesses specifically.

Further variation was seen among the following businesses:

- Food and drink – poor transport connections (33%), unattractive working hours or conditions (32%), lack of accommodation (26%), and unable to recruit from EU (25%).

- Tourism – poor transport connections (38%), unattractive working hours or conditions (36%), unable to recruit from EU (28%), lack of accommodation (24%), lack of childcare (18%).

- Financial and business services – difficult to access specific skillsets (60%).

- Creative industries – lack of childcare (27%).

- Large business (25+ staff) – unable to recruit from EU (25%).

- Businesses selling outside the UK – lack of candidates (57%), being unable to recruit from EU (22%) and lack of accommodation (21%).

Workforce actions

Most employers (79%) were taking actions in relation to their workforce. The top actions were: upskilling or re-skilling current staff (50%), investing in new technology (39%), making pay and rewards more competitive (36%), and collaborating with other businesses (30%) (Figure 5.3).

Variation in workforce actions

Businesses in the Highlands and Islands were more likely to be taking most of these actions, while businesses in the South of Scotland were more likely to say they were taking none of these actions (27%).

There were some differences in approach by level of rurality:

- Remote rural businesses were more likely to be recruiting from different markets (14%) and providing accommodation for staff (14%), and

- Businesses in small towns and peripheral urban areas were more likely to be recruiting staff with different skills (22%) and offering apprenticeships (21%).

In terms of further variation, the following businesses showed significant differences from the average:

- Tourism – recruiting staff from different markets (17%) and providing accommodation (15%).

- Food and drink – providing accommodation (21%).

- Women-led businesses – changing working practices (27%).

- Those operating above pre-pandemic levels – recruiting from different markets (16%), and making pay and rewards more competitive (46%).

A number of workforce-related actions were also more common than average among businesses importing and exporting outside the UK and those striving for growth (see Appendix A).

Confidence in ability to address workforce challenges

Two thirds of employers were confident they could address their workforce challenges (64%), while one third were not (35%) (Figure 5.4).

Confidence varied depending on the specific challenges businesses were facing. Those that were experiencing unfilled vacancies (52% not confident), staff leaving the businesses (43%) and skills gaps (41%) were more likely to say there were not confident they could address workforce challenges.

Businesses least likely to be confident were:

- in remote rural locations (43% not confident),

- operating below pre-pandemic levels (39%),

- not optimistic about their prospects (56%), and

- looking to downsize (48%).

Contact

Email: socialresearch@gov.scot

There is a problem

Thanks for your feedback