Scotland National Strategy for Economic Transformation: industry leadership groups and sector groups - evidence

This paper provides summary evidence received from Scotland's industry leadership groups and other economic sector groups as part of the National Strategy for Economic Transformation engagement process.

10. Food and Drink Industry Leadership Group

Industry Aspirations to 2030

Industry ambition include:

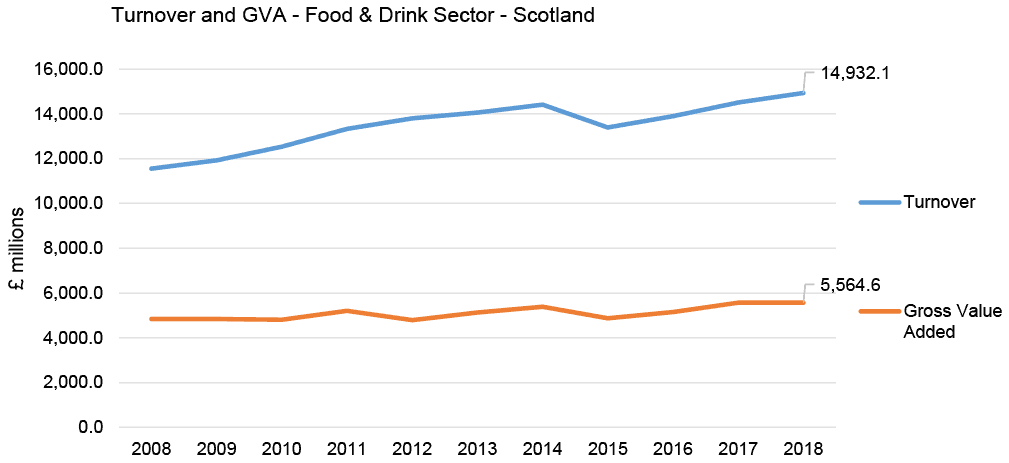

- doubling the value of the sector to £30 billion, up from £15 billion in 2020 and £10 billion in 2007. A refresh of the national strategy, Ambition 2030, has begun and will be complete by Summer 2022; and,

- supporting the sector to capitalise on the opportunities arising from the pandemic. Food and drink (F&D) is uniquely placed to emerge strongly from the pandemic and, if supported accordingly, will have a disproportionately larger role to play in facilitating economic recovery across the whole of Scotland in light of geographical spread and relative importance toisland, rural and remote communities.

Industry Opportunities

The industry has identified opportunities in:

- the increased popularity of localism combined with the international growing middle class, particularly in Asia, which means the demand for high-quality premium food is;

- Scotland’s reputation for food and drink, which is renowned for its quality, safety, sustainability and provenance, providing opportunities to driving inward investment and trade; And,

- the collaborative nature of the sector, with individual businesses already working collectively on shared opportunities, whether on raising awareness of their product category or jointly investing in export.

The industry faces challenges from:

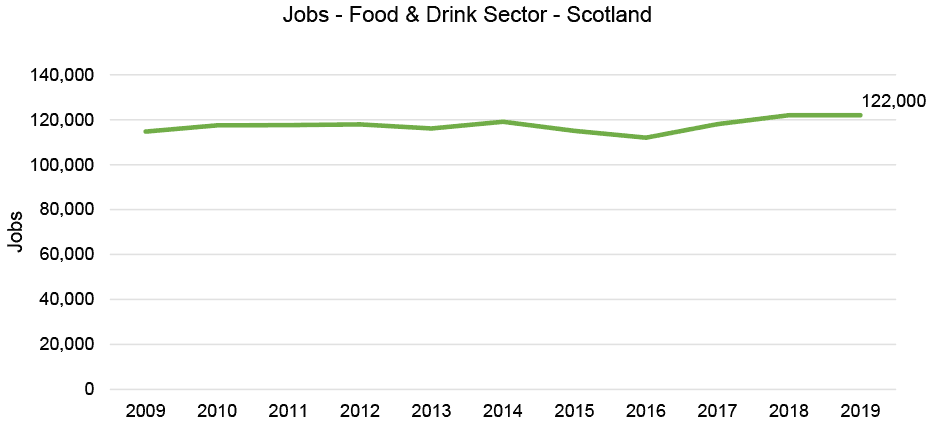

- labour shortages. F&D is more reliant on foreign labour than almost every other sector and in some parts of Scotland, such as the North East, EU nationals account for more than 60% of the workforce. This shortage has the potential to develop into a deeply damaging crisis

- prevailing market conditions. The UK retail environment is one of the most competitive anywhere in the world with a desire to keep consumer prices low, putting significant pressure on producers’ margins. Coupled with this, production and operational costs have typically increased 20% over the past year.

- trading conditions. Post EU Exit, trading with the EU, the largest market and destination of 70% of food exports, is now more challenging with increased costs, and more complexity with it taking longer to get fresh product to market which impacts on its value.

- the complexity of the support landscape.

Ongoing and Planned Activity for Industry

There is a strong relationship with agri-food research institutions which is bearing fruit, but the industry’s next steps involve working to strengthen relations more widely at the most senior and strategic level, between academia and SMEs, and to align associated investment to support the priorities of the industry, and completing a refresh of the national strategy, Ambition 2030, which has begun and will be complete by Summer 2022.

Contact

Email: Cornilius.Chikwama@gov.scot

There is a problem

Thanks for your feedback