Scotland's Fiscal Outlook: The Scottish Government's Medium-Term Financial Strategy

This is the fifth Medium-Term Financial Strategy (MTFS) published by the Scottish Government and provides the context for the Scottish Budget and the Scottish Parliament. This context will also frame the Resource Spending Review.

Annex B: Fiscal Framework

This Annex sets out the implications of the Fiscal Framework for the Scottish Budget. The Fiscal Framework Technical Note sets out more detail on how the Fiscal Framework operates including the evolution of the fiscal powers of the Scottish Parliament, the timelines for reconciliations and how they affect the Scottish Budget, the limits of the borrowing powers and Scotland Reserve, and the Fiscal Framework Review.[36]

This Annex details the latest BGAs published alongside the UK Spring Statement 2022. The latest SFC revenue and expenditure forecasts have been published alongside this Medium-Term Financial Strategy.

Tax

Table B.1 shows the latest forecasts for tax revenues from the SFC and the latest BGA estimates following the UK Spring Statement 2022.

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | ||

|---|---|---|---|---|---|---|---|---|---|

| Income Tax | Revenue | 12,118 | 13,342 | 14,386 | 15,143 | 15,954 | 16,754 | 17,484 | 18,298 |

| BGA1 | -12,293 | -13,684 | -14,813 | -15,502 | -15,883 | -16,737 | -17,534 | N/A | |

| Difference | -175 | -342 | -428 | -359 | 71 | 18 | -50 | N/A | |

| LBTT2 | Revenue | 517 | 799 | 797 | 821 | 849 | 886 | 932 | 987 |

| BGA1 | -397 | -651 | -716 | -741 | -772 | -807 | -854 | N/A | |

| Difference | 121 | 148 | 81 | 80 | 77 | 79 | 78 | N/A | |

| SLfT2 | Revenue | 107 | 128 | 121 | 95 | 94 | 75 | 16 | 17 |

| BGA1 | -87 | -86 | -81 | -81 | -75 | -69 | -76 | N/A | |

| Difference | 20 | 41 | 41 | 14 | 19 | 6 | -59 | N/A | |

| Total | Revenue | 12,742 | 14,269 | 15,304 | 16,058 | 16,897 | 17,716 | 18,433 | 19,303 |

| BGA1 | -12,776 | -14,421 | -15,610 | -16,324 | -16,730 | -17,612 | -18,464 | N/A | |

| Difference | -35 | -153 | -306 | -265 | 167 | 103 | -31 | N/A | |

Note 1: The BGAs shown are calculated using the Indexed Per Capita (IPC) indexation method. This method in practice determines the BGAs applied to the budget.

Note 2: The 2020-21 LBTT and SLfT revenue and Block Grant Adjustment are outturn figures.

Figures may not sum due to rounding.

Forecasts of future years provide an indication of the level of revenues that the SFC anticipates, but these figures will not be used to set future budgets, which will draw upon updated SFC forecasts.

Social Security

Table B.2 shows the SFC's latest expenditure forecasts for social security benefits and the latest BGA estimates following the UK Spring Statement 2022 with the exception of the BGA for the Winter Fuel Payment. As executive competence for this is benefit is yet to be transferred to the Scottish Government, the OBR has not yet produced a forecast to inform the BGA. For the purposes of the MTFS, the Scottish Government have forecast the expected BGA. This will be updated following publication of OBR forecasts of Winter Fuel Payment expenditure, broken down by territory, when available

| 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025- 26 | 2026-27 | 2027-28 | ||

|---|---|---|---|---|---|---|---|---|

| Attendance Allowance | Expenditure | -521 | -539 | -591 | -642 | -691 | -728 | -764 |

| BGA1 | 515 | 539 | 594 | 626 | 649 | 672 | N/A | |

| Difference | -6 | -1 | 3 | -17 | -41 | -56 | N/A | |

| Adult Disability Payment 2 | Expenditure | -1,754 | -2,044 | -2,579 | -2,921 | -3,196 | -3,484 | -3,783 |

| BGA1 | 1,726 | 1,953 | 2,298 | 2,566 | 2,799 | 3,014 | N/A | |

| Difference | -28 | -90 | -280 | -355 | -396 | -469 | N/A | |

| Disability Living Allowance | Expenditure | -701 | -714 | -744 | -738 | -720 | -705 | -684 |

| BGA1 | 701 | 698 | 732 | 713 | 677 | 682 | N/A | |

| Difference | 0 | -16 | -12 | -25 | -43 | -22 | N/A | |

| Carer's Allowance 3 | Expenditure | -300 | -321 | -366 | -424 | -486 | -540 | -571 |

| BGA1 | 293 | 318 | 362 | 393 | 423 | 459 | N/A | |

| Difference | -7 | -3 | -4 | -31 | -63 | -80 | N/A | |

| Industrial Injuries Disablement Scheme | Expenditure | -80 | -80 | -83 | -84 | -83 | -83 | -83 |

| BGA1 | 79 | 79 | 83 | 82 | 80 | 79 | N/A | |

| Difference | -1 | -1 | -1 | -1 | -2 | -5 | N/A | |

| Severe Disablement Allowance | Expenditure | -7 | -6 | -6 | -5 | -5 | -4 | -4 |

| BGA1 | 7 | 6 | 6 | 5 | 5 | 4 | N/A | |

| Difference | 0 | 0 | 0 | 0 | 0 | 0 | N/A | |

| Cold Weather Payment | Expenditure | N/A | -20 | -20 | -20 | -20 | -20 | -20 |

| BGA1 | N/A | 8 | 8 | 7 | 7 | 7 | N/A | |

| Difference | N/A | -13 | -13 | -13 | -13 | -13 | N/A | |

| Winter Fuel Payment | Expenditure | N/A | N/A | N/A | -184 | -189 | -191 | -190 |

| BGA1 | N/A | N/A | N/A | 181 | 184 | 185 | N/A | |

| Difference | N/A | N/A | N/A | -3 | -5 | -6 | N/A | |

| TOTAL SS | Expenditure | -3,363 | -3,725 | -4,389 | -5,019 | -5,388 | -5,754 | -6,100 |

| BGA1 | 3,320 | 3,602 | 4,082 | 4,574 | 4,825 | 5,103 | N/A | |

| Difference | -42 | -123 | -307 | -446 | -563 | -651 | N/A | |

Note 1: The BGAs shown are calculated using the Indexed Per Capita (IPC) indexation method. This method in practice determines the BGAs applied to the budget. Note 2: Adult Disability Payment and Low Income Winter Heating Assistance are the replacement benefits for Personal Independence Payment and Cold Weather Payment respectively. Note 3: Carer's Allowance Expenditure Forecast does not include Carer's Allowance Supplement (CAS) expenditure, whereas the Scottish Fiscal Commission includes CAS as part of Carer's Allowance expenditure. Note 4: There are minor differences in the methodology used to calculate the SFC's spending forecasts and the BGA forecasts, which are based on expenditure outturn and OBR forecasts, so comparisons should be interpreted with caution. Figures may not sum due to rounding.

Benefits Yet to Commence

Responsibility for Winter Fuel Payment has yet to be transferred to the Scottish Government and therefore these payments will not be funded from within the Scottish Budget until executive competence is transferred. The Department for Work and Pensions will continue to make these payments to people in Scotland for winter 2022-23.

Reconciliations and implications for the Scottish Budget

The forecasts for Scottish tax revenues and social security expenditure, and the corresponding BGAs, are based on the latest available information at the time of the Budget. Once outturn data are available, reconciliations are made to the Scottish Budget to ensure that the funding available ultimately corresponds to actual revenues and the BGAs based on the outturn data.

Reconciliations are made for both the revenues and the BGA for Income Tax. For Fully Devolved Taxes (LBTT and Scottish Landfill Tax), Social Security, and Non-Tax Revenues (Fines, Forfeitures and Fixed Penalties - FFFP), reconciliations are only made to the BGA element of funding.

In relation to Income Tax, a reconciliation for both revenues and the BGA for the 2020-21 financial year will be calculated when outturn data are available in summer 2022 and applied to the Scottish Budget 2023-24. The updated forecasts for 2020-21, 2021-22 and 2022-23 do not have any immediate impact on the Scottish Budget. Under the Fiscal Framework, a single reconciliation takes place three years after the original Budget was set and the updated forecasts in the interim have no direct impact.

In relation to the Fully Devolved Taxes, Social Security benefits and FFFP, final reconciliations for the BGAs for the 2021-22 financial year will be calculated when outturn is available later this year and applied to the Scottish Budget 2023-24.

The Fully Devolved Taxes and Social Security BGAs are also subject to an additional in-year reconciliation which takes place within each financial year, based on the OBR forecasts produced alongside a UK Government fiscal event in the autumn. There is no in-year reconciliation for FFFP.

Income Tax

For Scottish Income Tax, outturn data are normally available around 16 months after the end of the financial year. Given this long lag of availability of outturn data, the Income Tax revenue and BGA are fixed for three years from the time the Budget is set. A single reconciliation is then applied to the Budget three financial years after the Budget is set, e.g the reconciliation for 2019-20 Income Tax was applied to the 2022-23 budget. Outturn data for 2020-21 Income Tax is due to be published in Summer 2022, which will allow the Scottish and UK Governments to calculate and agree the final 2020-21 Income Tax reconciliation, which will be applied to the Scottish Budget 2023-24.

Table B.3 shows the latest forecast 2020-21 Income Tax reconciliation is negative £221 million. The final position will not be known until outturn receipts are available in summer 2022.

| 2020-21 Income Tax | Revenues | BGA | Net Position | Forecast Reconciliation |

|---|---|---|---|---|

| Forecast as of Budget 2020-21 | 12,365 | -12,319 | +46 | |

| Outturn | 12,118 | -12,293 | -175 | -221 |

| Outturn against forecast | -247 | +26 |

Figures may not sum due to rounding.

The potential scale of the reconciliations applying to the 2024-25 and 2025-26 Budgets are shown in tables B.4 and B.5 using the latest forecasts.

| 2021-22 Income Tax | Revenues | BGA | Net Position | Forecast Reconciliation |

|---|---|---|---|---|

| Forecast as of Budget 2021-22 | 12,263 | -11,788 | +475 | |

| Latest forecast | 13,342 | -13,684 | -342 | -817 |

| Change | +1,078 | -1,896 |

Figures may not sum due to rounding.

| 2022-23 Income Tax | Revenues | BGA | Net Position | Forecast Reconciliation |

|---|---|---|---|---|

| Forecast as of Budget 2022-23 | 13,671 | -13,861 | -190 | |

| Latest forecast | 14,386 | -14,813 | -428 | -238 |

| Change | +715 | -952 |

Figures may not sum due to rounding.

Based on the latest forecasts, the reconciliation to the Scottish Budget 2024-25 for 2021-22 Income Tax is forecast to be negative £817 million.. A reconciliation of negative £238 million is expected to apply to the Scottish Budget 2025-26 to account for 2022-23 Income Tax.

However, these forecasts are not certain and the final position will not be known for sure until outturn receipts are available for 2021-22 in summer 2023, and for 2022-23 in summer 2024.

Fully Devolved Taxes

Revenue Scotland manages and collects Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax (SLfT) and these revenue streams feed in to the Scottish Budget as they are collected. There is no reconciliation required for these revenues; the Scottish Government manages any variance between what was forecast and actual revenues as part of its in-year budget management process. The latest 2022-23 revenue forecasts for LBTT and SLfT and the previous revenue forecasts are shown in table B.6.

| LBTT | SFC Revenue Forecast – Budget 2022-23 | 749 |

|---|---|---|

| SFC Revenue Forecast – MTFS 2022 | 797 | |

| Change | +48 | |

| SLfT | SFC Revenue Forecast – Budget 2022-23 | 101 |

| SFC Revenue Forecast – MTFS 2022 | 121 | |

| Change | +21 |

Figures may not sum due to rounding.

The BGAs for these taxes are reconciled in two stages. An in-year reconciliation is made within the same financial year. This is usually on the basis of OBR forecasts produced alongside the UK Autumn Budget. The forecast in-year reconciliations for 2022-23 LBTT and SLfT are shown in table B.7.

| LBTT | Forecast BGA – UK Budget October 2021 | -664 |

|---|---|---|

| Forecast BGA – UK Spring Statement 2022 | -716 | |

| Forecast In-year reconciliation to 2022-23 Budget | -53 | |

| SLfT | Forecast BGA – UK Budget October 2021 | -82 |

| Forecast BGA – UK Spring Statement 2022 | -81 | |

| Forecast In-year reconciliation to 2022-23 Budget | +2 |

Figures may not sum due to rounding.

As set out in table B.8, the forecast net effect on the Scottish Budget 2022-23 of the latest fully devolved revenue forecasts, when compared to the forecast in-year BGA reconciliations, is positive £17 million, (comprising negative £5 million for LBTT and positive £22 million for SLfT).

| Fully Devolved Tax | Forecast In-Year BGA Reconciliation | Change in SFC revenue forecast from Scottish Budget 2022-23 | Forecast Net Position |

|---|---|---|---|

| LBTT | -53 | 48 | -5 |

| SLfT | 2 | 21 | +22 |

| TOTAL | -51 | +68 | +17 |

Figures may not sum due to rounding

Outturn data becomes available in the autumn following the end of each financial year. Using these outturn figures, a final reconciliation will be applied to the Block Grant in the financial year two years after the Budget was set. Table B.9 shows the forecast final reconciliations for 2021-22 LBTT and SLfT BGAs applying to the 2023-24 Scottish Budget.

| LBTT | Forecast BGA – UK Budget October 2021 | -620 |

|---|---|---|

| Forecast BGA – UK Spring Statement 2022 | -651 | |

| Forecast Reconciliation to 2023-24 Budget | -32 | |

| SLfT | Forecast BGA – UK Budget October 2021 | -90 |

| Forecast BGA – UK Spring Statement 2022 | -86 | |

| Forecast Reconciliation to 2023-24 Budget | +3 |

Note 1: Ultimately, the final BGA reconciliation will calculate the difference between the in-year forecast of the BGA (used to calculate the in-year reconciliation) and the outturn data (when available). Figures may not sum due to rounding.

Table B.10 shows the forecast net effect on the budget for 2021-22 LBTT and SLfT by comparing the latest forecast revenues and BGAs to the forecast revenues and BGAs set at the time of the Scottish Budget 2021-22. The final net position will not be confirmed until final outturn is published later in the year.

| Revenues | BGA | Net Position | ||

|---|---|---|---|---|

| LBTT | Forecast as of Budget 2021-22 | 586 | -515 | +71 |

| Latest Forecast – MTFS 2022 | 799 | -651 | +148 | |

| Latest Forecast Net Position | 213 | -136 | +77 | |

| SLfT | Forecast as of Budget 2021-22 | 88 | -95 | -7 |

| Latest Forecast – MTFS 2022 | 128 | -86 | +41 | |

| Latest Forecast Net Position | +40 | +9 | +48 |

Figures may not sum due to rounding.

Social Security

The latest 2022-23 expenditure forecasts for Social Security and the previous expenditure forecasts are shown in table B.11.

| Attendance Allowance | SFC Expenditure Forecast – Budget 2022-23 | -545 |

|---|---|---|

| SFC Expenditure Forecast – MTFS 2022 | -539 | |

| Change | +5 | |

| Adult Disability Payment | SFC Expenditure Forecast – Budget 2022-23 | -1948 |

| SFC Expenditure Forecast – MTFS 2022 | -2044 | |

| Change | -95 | |

| Disability Living Allowance | SFC Expenditure Forecast – Budget 2022-23 | -710 |

| SFC Expenditure Forecast – MTFS 2022 | -714 | |

| Change | -4 | |

| Carer's Allowance1 | SFC Expenditure Forecast – Budget 2022-23 | -315 |

| SFC Expenditure Forecast – MTFS 2022 | -321 | |

| Change | -6 | |

| Industrial Injuries Disablement Scheme | SFC Expenditure Forecast – Budget 2022-23 | -81 |

| SFC Expenditure Forecast – MTFS 2022 | -80 | |

| Change | +0 | |

| Severe Disablement Allowance | SFC Expenditure Forecast – Budget 2022-23 | -6 |

| SFC Expenditure Forecast – MTFS 2022 | -6 | |

| Change | +0 | |

| Low Income Winter Heating Assistance | SFC Expenditure Forecast – Budget 2022-23 | -21 |

| SFC Expenditure Forecast – MTFS 2022 | -20 | |

| Change | +1 | |

| Total Social Security | SFC Expenditure Forecast – Budget 2022-23 | -3,626 |

| SFC Expenditure Forecast – MTFS 2022 | -3,725 | |

| Change | -99 |

Note 1: Carer's Allowance Expenditure Forecasts do not include Carer's Allowance Supplement (CAS) expenditure, whereas the Scottish Fiscal Commission includes CAS as part of Carer's Allowance Expenditure. Note 2: Adult Disability Payment and Low Income Winter Heating Assistance are the replacement benefits for Personal Independence Payment and Cold Weather Payment respectively. Figures may not sum due to rounding.

As with the fully devolved taxes, the BGAs for benefits are reconciled in two stages. An in-year reconciliation is made within the same financial year. This is usually on the basis of OBR forecasts produced alongside the UK Autumn Budget. The forecast in-year reconciliations to the 2022-23 Social Security BGAs are shown in table B.12.

| Attendance Allowance | Forecast BGA – UK Budget October 2021 | 545 |

|---|---|---|

| Forecast BGA – UK Spring Statement 2022 | 539 | |

| Forecast In-year reconciliation to 2022-23 Budget | -6 | |

| Personal Independence Payment | Forecast BGA – UK Budget October 2021 | 1,933 |

| Forecast BGA – UK Spring Statement 2022 | 1,953 | |

| Forecast In-year reconciliation to 2022-23 Budget | +20 | |

| Disability Living Allowance | Forecast BGA – UK Budget October 2021 | 687 |

| Forecast BGA – UK Spring Statement 2022 | 698 | |

| Forecast In-year reconciliation to 2022-23 Budget | +11 | |

| Carer's Allowance1 | Forecast BGA – UK Budget October 2021 | 323 |

| Forecast BGA – UK Spring Statement 2022 | 318 | |

| Forecast In-year reconciliation to 2022-23 Budget | -5 | |

| Industrial Injuries Disablement Scheme | Forecast BGA – UK Budget October 2021 | 79 |

| Forecast BGA – UK Spring Statement 2022 | 79 | |

| Forecast In-year reconciliation to 2022-23 Budget | +0 | |

| Severe Disablement Allowance | Forecast BGA – UK Budget October 2021 | 6 |

| Forecast BGA – UK Spring Statement 2022 | 6 | |

| Forecast In-year reconciliation to 2022-23 Budget | +0 | |

| Low Income Winter Heating Assistance | Forecast BGA – UK Budget October 2021 | 14 |

| Forecast BGA – UK Spring Statement 2022 | 8 | |

| Forecast In-year reconciliation to 2022-23 Budget | -7 | |

| Total social security | Forecast BGA – UK Budget October 2021 | 3,587 |

| Forecast BGA – UK Spring Statement 2022 | 3,602 | |

| Forecast In-year reconciliation to 2022-23 Budget | +14 |

Note 1: Carer's Allowance Expenditure Forecasts do not include Carer's Allowance Supplement (CAS) expenditure, whereas the Scottish Fiscal Commission includes CAS as part of Carer's Allowance Expenditure. Note 2: Adult Disability Payment and Low Income Winter Heating Assistance are the replacement benefits for Personal Independence Payment and Cold Weather Payment respectively. Figures may not sum due to rounding.

Table B.13 sets out the net effect on the Scottish Budget 2022-23 of the latest total devolved social security expenditure forecasts when compared to the total forecast in-year BGA reconciliations, is negative £85 million.

| Forecast In-Year BGA Reconciliation | Change in SFC expenditure forecast from 2022-23 Scottish Budget | Net Position | |

|---|---|---|---|

| Total social security benefits with a BGA1 | +14 | -99 | -85 |

1) Carer's Allowance, Attendance Allowance, Child Disability Payment, Disability Living Allowance, Adult Disability Payment, Industrial Injuries Disablement Allowance, Severe Disability Allowance, Cold Weather Payment Figures may not sum due to rounding

Outturn data becomes available in the autumn following the end of each financial year. Using these outturn figures, a final reconciliation is applied to the Block Grant in the financial year two years after the Budget was set. Table B.14 shows the forecast final reconciliation for the 2021-22 Social Security BGAs applying to the 2023-24 Scottish Budget.

| Attendance Allowance | Forecast BGA – UK Budget October 2021 | 521 |

|---|---|---|

| Forecast BGA – UK Spring Statement 2022 | 515 | |

| Forecast Reconciliation to 2023-24 Budget1 | -7 | |

| Adult Disability Payment | Forecast BGA – UK Budget October 2021 | 1,723 |

| Forecast BGA – UK Spring Statement 2022 | 1,726 | |

| Forecast Reconciliation to 2023-24 Budget | +2 | |

| Disability Living Allowance | Forecast BGA – UK Budget October 2021 | 687 |

| Forecast BGA – UK Spring Statement 2022 | 701 | |

| Forecast Reconciliation to 2023-24 Budget | +14 | |

| Carer's Allowance1 | Forecast BGA – UK Budget October 2021 | 295 |

| Forecast BGA – UK Spring Statement 2022 | 293 | |

| Forecast Reconciliation to 2023-24 Budget | -2 | |

| Industrial Injuries Disablement Scheme | Forecast BGA – UK Budget October 2021 | 79 |

| Forecast BGA – UK Spring Statement 2022 | 79 | |

| Forecast Reconciliation to 2023-24 Budget | 0 | |

| Severe Disablement Allowance | Forecast BGA – UK Budget October 2021 | 7 |

| Forecast BGA – UK Spring Statement 2022 | 7 | |

| Forecast Reconciliation to 2023-24 Budget | 0 | |

| Total Social Security | Forecast BGA – UK Budget October 2021 | 3,313 |

| Forecast BGA – UK Spring Statement 2022 | 3,320 | |

| Forecast Reconciliation to 2023-24 Budget | +8 |

Note 1: Carer's Allowance Expenditure Forecasts do not include Carer's Allowance Supplement (CAS) expenditure, whereas the Scottish Fiscal Commission includes CAS as part of Carer's Allowance Expenditure. Note 2: Adult Disability Payment is the replacement benefit for Personal Independence Payment. Note 3: Ultimately, the final BGA reconciliation will calculate the difference between the in-year forecast of the BGA (used to calculate the in-year reconciliation) and the outturn data (when available). Figures may not sum due to rounding.

Table B.15 shows the forecast net effect on the budget for 2021-22 Social Security benefits by comparing the latest forecast expenditure and BGAs to the forecast expenditure and BGAs set at the time of the Scottish Budget 2021-22. The final net position will not be confirmed until final outturn is published later in the year.

| Expenditure | BGA | Net Position | ||

|---|---|---|---|---|

| Attendance Allowance | Forecast as of Budget 2021-22 | -550 | 546 | -3 |

| Latest Forecast – MTFS 2022 | -521 | 515 | -6 | |

| Latest Forecast Net Position | +29 | -32 | -3 | |

| Adult Disability Payment | Forecast as of Budget 2021-22 | -1,669 | 1,682 | +12 |

| Latest Forecast – MTFS 2022 | -1,754 | 1,726 | -28 | |

| Latest Forecast Net Position | -85 | +44 | -40 | |

| Disability Living Allowance | Forecast as of Budget 2021-22 | -696 | 685 | -11 |

| Latest Forecast – MTFS 2022 | -701 | 701 | -0 | |

| Latest Forecast Net Position | -6 | +17 | +11 | |

| Carer's Allowance1 | Forecast as of Budget 2021-22 | -306 | 309 | +3 |

| Latest Forecast – MTFS 2022 | -300 | 293 | -7 | |

| Latest Forecast Net Position | +6 | -16 | -9 | |

| Industrial Injuries Disablement Scheme | Forecast as of Budget 2021-22 | -80 | 81 | +1 |

| Latest Forecast – MTFS 2022 | -80 | 79 | -1 | |

| Latest Forecast Net Position | +0 | -2 | -2 | |

| Severe Disablement Allowance | Forecast as of Budget 2021-22 | -7 | 7 | +1 |

| Latest Forecast – MTFS 2022 | -7 | 7 | -0 | |

| Latest Forecast Net Position | +0 | -1 | -1 | |

| Total Social Security | Forecast as of Budget 2021-22 | -3,308 | 3,310 | +1 |

| Latest Forecast – MTFS 2022 | -3,363 | 3,320 | -42 | |

| Latest Forecast Net Position | -55 | +11 | -44 |

Figures may not sum due to rounding. Note 1: Carer's Allowance Expenditure Forecasts do not include Carer's Allowance Supplement (CAS) expenditure, whereas the Scottish Fiscal Commission includes CAS as part of Carer's Allowance Expenditure. Note 2: Adult Disability Payment is the replacement benefit for Personal Independence Payment. Note 3: There are minor differences in the methodology used to calculate the SFC's spending forecasts and the BGA forecasts, which are based on expenditure outturn and OBR forecasts, so comparisons should be interpreted with caution

Non-Tax revenue

Fines, Forfeitures and Fixed Penalties

Revenue from Fines, Forfeitures and Fixed Penalties (FFFP) is paid into the Scottish Consolidated Fund after being collected by the Scottish Courts and Tribunals Service. No reconciliation takes place for revenue, as the Scottish Government deals with any variation between forecast and receipts through in-year budget management. The SFC does not provide revenue forecasts for FFFP and instead the Scottish Government calculates its own estimates.

The latest Scottish Government 2022-23 revenue forecast for FFFP and the previous revenue forecasts are shown in Table B.16.

| FFFP | SG Revenue Forecast – Budget 2022-23 | 25 |

|---|---|---|

| SG Revenue Forecast – MTFS 2022 | 25 | |

| Change | 0 |

Figures may not sum due to rounding.

Unlike the devolved taxes, there is only one reconciliation for the BGA. Outturn data are normally available three months after the end of the financial year, and the reconciliation is applied to the Block Grant for the financial year thereafter (i.e. two years after the Budget was set).

Table B.17 shows the forecast final reconciliation for the 2020-21 FFFP BGA applying to the 2022-23 Scottish Budget.

| FFFP | Forecast BGA – Budget 2021-22 | -28 |

|---|---|---|

| Forecast BGA – UK Spring Statement 2022 | -28 | |

| Forecast Reconciliation to 2023-24 Budget | 0 |

Figures may not sum due to rounding.

Table B.18 shows the forecast net effect on the budget for 2021-22 FFFP by comparing the latest forecast expenditure and BGAs to the forecast expenditure and BGAs set at the time of the Scottish Budget 2021-22. The final net position will not be confirmed until final outturn is published later in the year.

| Revenues | BGA | Net Position | ||

|---|---|---|---|---|

| FFFP | Forecast as of Budget 2021-22 | 25 | -28 | -3 |

| Latest Forecast – MTFS 2022 | 21 | -28 | -7 | |

| Latest Forecast Net Position | -4 | -0 | -4 |

Figures may not sum due to rounding.

Proceeds of Crime

Revenue seized under the Proceeds of Crime Act 2002 is also subject to a BGA. The basis on which this is carried out is currently the subject of dispute between the Scottish and UK Governments and the BGA remains at -£4m while the dispute remains unresolved.[37] The Scottish and UK Governments agreed to consider this issue as part of the review of the Fiscal Framework.

Outturn revenue for 2021-22 Proceeds of Crime will be published in winter 2022. The Scottish Government receives all revenues recovered under the Proceeds of Crime Act, however, outturn revenues are hypothecated for spend on community projects.[38] Due to this hypothecation of funds and the negative £4 million BGA, the net position for the Scottish Budget is negative £4 million while this BGA remains in force.

No reconciliation takes place while the BGA remains the subject of dispute between the Scottish and UK Governments.

Sources of Data

To view the various sources of data for Tax and Social Security that have been used to compile this Annex B, please see the data annex in the Fiscal Framework factsheet.[39]

Capital Borrowing

Chapter 4 sets out the Scottish Government's revised capital borrowing policy which is to assume £450 million of annual funding will be available through borrowing, the Scotland Reserve and Barnett consequentials. Of this £250 million will initially be assumed to be capital borrowing.

On the basis of existing and planned borrowing included in the table, the Scottish Government will have accumulated £1.976 billion in capital debt by the end of 2022-23, 71% of its overall limit. Based on the analysis in Table B.19, which assumes the £250 million borrowed annually is on a 15 year tenor, this policy can be sustained well beyond 2030-31 without exceeding the £3 billion limit imposed by the fiscal framework.

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 | 2030-31 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Debt Stock at the start of the Year | 606 | 1,036 | 1,258 | 1,617 | 1,744 | 1,814 | 1,976 | 2,128 | 2,266 | 2,389 | 2,498 | 2,591 | 2,669 | 2,744 |

| New In Year Borrowing | 450 | 250 | 405 | 200 | 150 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 |

| Principal Repayments | - | 7 | 26 | 52 | 60 | 67 | 71 | 72 | 73 | 74 | 75 | 75 | 63 | 51 |

| Interest Repayments | - | 8 | 11 | 13 | 14 | 16 | 15 | 14 | 13 | 13 | 12 | 11 | 10 | 9 |

| Existing Resource Cost | - | 15 | 37 | 64 | 74 | 83 | 86 | 86 | 86 | 86 | 86 | 86 | 73 | 60 |

| Resource Cost of Projected Borrowing | - | - | - | - | - | 0 | 14 | 35 | 57 | 79 | 101 | 124 | 146 | 169 |

| Projected Total Resource Cost | 0 | 15 | 37 | 64 | 74 | 83 | 100 | 122 | 144 | 166 | 188 | 210 | 219 | 229 |

| Debt Stock at end of Year | 1,036 | 1,258 | 1,617 | 1744 | 1,814 | 1,976 | 2,128 | 2,266 | 2,389 | 2,498 | 2,591 | 2,669 | 2,744 | 2,816 |

| Percentage of Debt Cap | 35% | 42% | 54% | 58% | 60% | 66% | 71% | 76% | 80% | 83% | 86% | 89% | 91% | 94% |

| Notional Borrowing Repayments | 9.4 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 | 20.5 |

| Headroom | 1,964 | 1,742 | 1,383 | 1,256 | 1,186 | 1,024 | 872 | 734 | 611 | 502 | 409 | 331 | 256 | 184 |

- *New In Year Borrowing from 2022-23 is projected borrowing based on the current Central Scenario.

Resource Borrowing

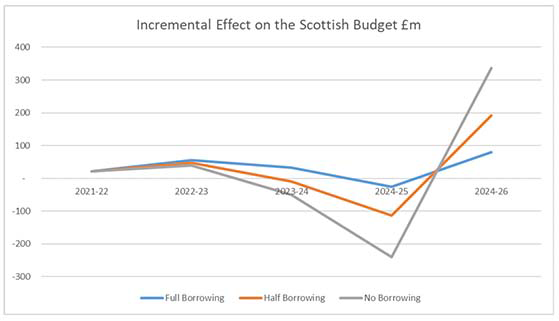

- As set out in Chapter 4, the Scottish Government will plan Resource Borrowing on the basis of minimising volatility to the Scottish Budget over the medium term. To achieve this outcome planning to borrow in full against forecast income tax reconciliations was the most effective approach as illustrated in previous MTFS documents and chart B2 below. However to achieve the same outcome borrowing closer to 50% of known and forecast reconciliations in 2023-24 is now the most effective approach h to minimise the volatility as a result of the £817m reconciliation in 2024-25. T. This situation arises because of the current circumstances Scotland specific shock rules expiring in the year before the largest forecast reconciliation in 2024-25.

- The scale of the forecast reconciliation in 2024-25 and the scale of change of that reconciliation.

Table B.20 below shows the full budget impact of borrowing and reconciliations over the period under the revised borrowing approach.

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | |

|---|---|---|---|---|---|---|

| Known and Forecast Reconciliations | - 207 | -319 | -15 | -221 | -817 | -238 |

| Planned Resource Borrowing | 207 | 319 | 15 | 110 | 300 | 119 |

| Projected Resource Cost of Resource Borrowing | - | - 21 | -77 | -110 | -124 | -169 |

| Net Impact | - | -21 | -76 | -221 | -641 | -288 |

| YOY Net Impact | -21 | -55 | 145 | -420 | 353 |

The incremental impact of resource borrowing, the costs of resource borrowing and known and forecast Income Tax reconciliations is as follows:

- The projected resource cost of borrowing line comprises repayments of both principal and interest, both of which impact the resource budget.

- All drawdowns are based on National Loans Fund (NLF) annuity structure loans, this is the only source of resource borrowing available to the Scottish Government under the Fiscal Framework.

- These loans are priced at 11 basis points above the equivalent UK par Gilt yield. Assumptions in Table B.20 use the implied forward rates as of 17 May 2022 plus a premium of 50 basis points.

- NLF annuity loans have principal deferred in the first (semi-annual repayment) period.

- A five-year tenor is assumed in all cases (the maximum allowable under the Fiscal Framework).

As stated in 4.2.2 The Scottish Government will assess all planned Resource Borrowing decisions to smoothen the funding trajectory over five years. Chart B.1 illustrates how the approach is assessed by comparing different borrowing strategies to assess which achieves the optimum outcome of minimising volatility. Three strategies being:

- Borrowing the full allowance

- Borrowing half the available allowance

- Borrowing nothing

The graphs below show the impact in the original and future budget years, taking into consideration actual or expected borrowing for reconciliations in each of the years as well as repayment of borrowing and interest in subsequent fiscal years.

In the case of 'no borrowing' the swings in the funding position are the most pronounced in 2023-24 and 2025-26. In the case of 'full borrowing' there's is now forecast to be a significant fluctuation in 2024-25. Borrowing half the allowance is forecast to reduce the volatility in the latter

The previous resource borrowing policy of borrowing 100% was the basis for the Scottish Budget 2022-23. Chart B. 2 illustrates the position at the time of the Budget, which was prior to confirmation of the forecast £817m tax reconciliation in 2024-25. As can be seen from the Chart the volatility at this point was significantly less than in the current circumstances which explained the approach at the time.

Contact

Email: sophie.osborn@gov.scot

There is a problem

Thanks for your feedback