Scottish 4G Infill Programme Evaluation

This report details findings of the Scottish 4G Infill Programme (S4GI) Evaluation, informed by the best practice set out in the Digital Appraisal Manual for Scotland (DAMS): https://www.gov.scot/publications/digital-appraisal-manual-for-scotland-guidance/

2 Overview of 4G

2.1 Introduction

2.1.1 In advance of discussing the benefits of improved digital connectivity, this section provides a basic overview of 4G and the services it enables and sets out further details on the S4GI Programme. The chapter also provides a background on the current level of 4G coverage in Scotland as well as how this relates to home broadband coverage. The distinction between mobile and home broadband connectivity is important as the benefits provided by the S4GI Programme will depend on the level of both mobile and home connectivity available to the individual prior to S4GI investment. This is discussed further in Chapter 3.

2.2 What is 4G?

2.2.1 4G is the fourth generation of mobile phone technology, following 3G and 2G, and enables mobile internet connectivity out with the range of a fixed broadband connection.

2.2.2 As shown in Table 2‑1, all activities available via a 4G connection are also in theory available via a 3G connection. However, a 4G connection provides a higher speed service and therefore improves access to activities which demand more capacity like video streaming, mapping, and social networking sites. According to Ofcom, for the typical user download speeds of initial 4G networks are around 5-7 times those for existing 3G networks. By way of an example, this means that a music album which takes around 20 minutes to download via a 3G phone connection would take just over 3 minutes via a 4G connection[4].

2.2.3 5G provides the next generation in mobile phone technology and is currently being rolled out in major cities and suburban areas across the UK. 5G will provide a step-change in provision, with data communication speeds in the Gbs (1Gbs = 1000Mbs) and download speeds up to 100 times that of 4G. It is envisaged that the delivery of 5G technology will broaden the role that mobile technology plays in society, enabling significantly more ‘smart’ devices which connect to the internet and one another.

Technology |

Definition |

Services enabled |

|---|---|---|

2G |

Second generation of mobile phone technology, launched in the UK in 1992. |

Supports voice calls, text messages, and very low speed data services. |

3G |

Third generation of mobile phone technology, launched in the UK in 2003. |

Supports voice calls, text messages, and mobile broadband, including music and video downloads |

4G |

Fourth generation of mobile phone technology, launched in the UK in 2012. |

As 3G but supports download speeds of more than 2Mbps (but often significantly more). Also supports VoIP services |

5G |

Fifth generation of mobile phone technology. Roll out in the UK started in 2019 and in the first instance is being rolled out as an upgrade on top of existing 4G infrastructure. |

As 4G but much faster upload and download speeds (in the Gbs where 1Gbs is equal to 1000Mbs). |

How is 4G provided?

2.2.4 The roll-out of mobile services in the UK is led by private Mobile Network Operators (MNOs) of which there are four:

- EE (owned by BT)

- VMO2 (a joint venture between O2 and Virgin Media)

- Three (Hutchinson 3G)

- Vodafone

2.2.5 There are also Virtual Mobile Network Operators (MVNOs) such as TalkTalk and GiffGaff. However, these do not have their own network infrastructure but rather have commercial agreements to use the infrastructure belonging to MNOs.

2.2.6 MNOs determine when and where to build masts and provide mobile services based on commercial considerations.

Fixed broadband

2.2.7 Mobile connectivity should not be confused with fixed broadband connectivity. Fixed broadband is provided to a premises usually via the phone line or through the provider’s network of cables. In the UK, broadband is delivered via various technologies (as set out in the list below), with each incremental improvement in technology providing faster speeds and a more reliable connection than the former:

- Copper (ADSL[5]) – copper cables used to connect from the exchange to the premises. Maximum download speed is 24Mbit/s. Speed diminishes with distance. Copper affected by poor weather and susceptible to faults.

- Fibre to the cabinet (FTTC) – Fibre cables to the cabinet and copper cables to the premises. Maximum download speed is usually 80 Mbit/s. As with ADSL, speed diminishes with distance and affected by poor weather / susceptible to faults.

- Hybrid fibre coaxial cable (HFC) – Fibre cables to the cabinet and coaxial cable from the street cabinet to the premises. Latest technology (DOCSIS 3.1) able to deliver speeds of up to 10Gbit/s and upload speeds of up to 1Gbit/s but in reality, below this as shared with multiple users.

- Full fibre or ‘fibre to the premises’ (FTTP) – Fibre cables to the cabinet and the premises. Unaffected by distance and less susceptible to faults / weather.

- Fixed Wireless Access (FWA) - Broadband to fixed locations can also be delivered wirelessly via radio signals between two points. This is known as Fixed Wireless Access (FWA). FWA broadband networks generally cover areas which are within set distances and line of sight of radio masts. If a property is too far away from a mast or there is no line of sight between the mast and the property because of e.g. hills or trees then it may be difficult a supplier to get a signal strong enough to provide a superfast broadband connection.

- 4G FWA – FWA can also be provided on licensed 4G and 5G networks. In this case a wi-fi router is installed with a mobile sim card and is connected by cable to an external aerial in a suitable outdoor location. 4G FWA is often used where wired connections or FWA is not available. However, like FWA, 4G FWA broadband networks cover areas which are within set distances and line of sight of mobile network radio masts and where a property is too far away from the mobile mast or there is no line of sight, it would be difficult for a supplier to get a signal strong enough to provide a superfast broadband connection. In addition, it’s possible that if lots of people are connected to the same mast (mobile and FWA users) at the same time, broadband speeds can drop. As a result, there may be areas of high mobile demand where a reliable FWA cannot be provided. Of the four MNOs, EE, Three, and Vodafone currently offer FWA services.

- Satellite broadband - Beyond wired and FWA connections, broadband can also be provided via satellite using a dish or antenna on the property. There are two types: Geostationary Orbit (GSO) Satellite and Low Earth Orbit (LEO) Satellites. While there are a range of providers offering GSO, LEO is relatively new and is currently only offered by Starlink[6]. Satellite connections do not require a wired connection or 4G and have proved popular in some rural areas where these options are limited or speeds / reliability is poor.

2.2.8 There are three broad categories of broadband available as set out in Table 2-2. As shown in, FWA can provide decent, superfast and gigabit speeds although actual speeds will be dependent on a range of factors.

Type of broadband |

Speed |

Use Cases |

Fixed broadband technologies that can provide this service |

|---|---|---|---|

Decent |

10 Mbit/s download; 1 Mbit/s upload |

Making a high-definition video call using applications like Zoom, Teams, WhatsApp, or Facetime. Downloading a 1-hour HD TV episode (1GB) in almost a quarter of an hour. |

|

Superfast |

At least 30 Mbit/s download |

One person streaming 4K/UHD video. Downloading 1 hour HD TV episode (1GB) in under 4 and half minutes. Several devices working simultaneously. |

|

Gigabit |

1 Gbit/s and above download |

It is feasible to download a full 4K film (100GB) in under 15mins. May be delivered over technologies that give greater reliability and that are future proofed as more high demand services are developed. |

|

2.3 How extensive is 4G coverage and broadband coverage across Scotland?

4G Coverage

2.3.1 Ofcom, the independent regulator responsible for the UK communications industries (including broadband providers and mobile network operators) report on the percentage of UK premises (residential and commercial properties) with access to 4G mobile connectivity on an annual basis via the Connected Nations report series[7]. The mobile coverage figures are based on predictions which the MNOs supply to Ofcom and the data is reported in four ways:

- Premises (outdoor coverage)

- Premises (indoor coverage)

- Geographical coverage i.e., outdoor coverage of the landmass

- Coverage across the road network

2.3.2 Table 2-3 provides a summary of the percentage of premises in Scotland with 4G access in each of the above categories split by urban and rural locations as recorded in the most recent (2023) Connected Nations report.

Locations |

Overall (all four Operators) |

Urban (all four Operators) |

Rural (all four Operators) |

Overall (at least one Operator) |

Urban (at least one Operator) |

Rural (at least one Operator) |

|---|---|---|---|---|---|---|

Premises (indoor) |

86% |

93% |

57% |

99% |

100% |

97% |

Premises (outdoor) |

97% |

100% |

86% |

100% |

100% |

99% |

Geographic |

48% |

97% |

47% |

84% |

100% |

84% |

Major roads[9] |

67% |

94% |

63% |

96% |

100% |

96% |

A and B roads |

60% |

94% |

55% |

94% |

100% |

93% |

All roads[10] |

61% |

94% |

56% |

94% |

100% |

93% |

2.3.3 There are clear differences between urban and rural locations, with far lower rates of coverage in the latter. In addition, while a large proportion of premises have access to good 4G coverage from at least one operator, the proportion with access to all four operators is much smaller, meaning that people may be tied to a single provider and therefore may pay more or have less options available to them than people who can access the whole of the market.

2.3.4 Overall, 84% of Scotland’s landmass has coverage from at least one operator, meaning that 16% of the landmass is a 4G ‘not-spot’.

Broadband Availability

2.3.5 Ofcom also reports on the percentage of UK premises (residential and commercial properties) with access to broadband, specifically superfast broadband, gigabit-capable, and full fibre[11]. Table 2‑4 provides a summary of this data for residential and commercial properties in urban and rural locations as reported in the most recent (2023) Connected Nations report.

Broadband |

Overall (Residential) |

Urban (Residential) |

Rural (Residential) |

Overall (Commercial) |

Urban (Commercial) |

Rural (Commercial) |

|---|---|---|---|---|---|---|

Superfast broadband |

95% |

99% |

79% |

85% |

91% |

63% |

Gigabit-capable |

72% |

80% |

34% |

45% |

54% |

16% |

Full fibre |

53% |

58% |

32% |

30% |

35% |

15% |

Not able to receive decent broadband |

2% |

0% |

11% |

7% |

3% |

22% |

2.3.6 Again, there are clear differences in access between urban and rural areas. In addition, a higher proportion of residential properties have access to broadband compared to commercial premises and there is generally a more pronounced divide between urban and rural coverage with respect to commercial properties as compared to residential properties.

2.3.7 Overall, Ofcom estimates that around 18,000 (0.6%) premises (homes and businesses combined) in Scotland do not have access to a decent broadband service via either a fixed or FWA network and around 6,600 premises cannot access either a decent fixed broadband service or get good 4G coverage indoors. Aside from a handful of exceptions, all of these premises are in rural Scotland[13].

2.4 The Scottish 4G Infill Programme

2.4.1 As set out above, the roll-out of mobile services in the UK is led by private MNOs who determine when and where to build masts based on commercial considerations, with the result that there is a clear division between connectivity levels in urban areas compared to more rural locations where lower population levels lead to a reduced commercial case for investment. S4GI aims to overcome this inequality by delivering 4G mobile infrastructure and services in locations where they would not otherwise be provided by the market.

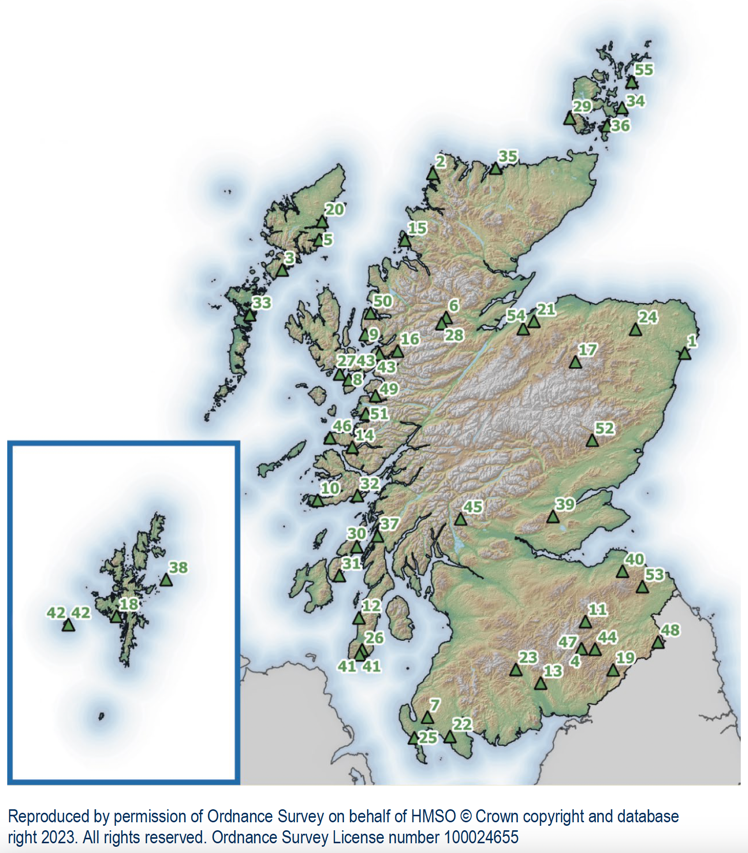

Mast Locations

2.4.2 In total, there are 55 mast locations within the S4GI Programme with approximately 2,211 premises (residential and business) identified as potential beneficiaries of S4GI. The location of the S4GI mast sites is shown geographically in

2.4.3 Figure 2‑1. Reproduced by permission of Ordnance Survey on behalf of HMSO © Crown copyright and database right 2023. All rights reserved. Ordnance Survey License number 100024655

Position on the sites map |

Site location |

|---|---|

1 |

Collieston |

2 |

Blairmore |

3 |

Manish |

4 |

Ettrick |

5 |

Lemreway |

6 |

Strathconon/ Inverchoran |

7 |

New Luce |

8 |

Tarskavaig |

9 |

Applecross |

10 |

Bunessan |

11 |

Traquair |

12 |

Glenbarr |

13 |

Ae |

14 |

Glenborrodale |

15 |

Polbain |

16 |

Killilan |

17 |

Chapeltown |

18 |

Reawick |

19 |

Whitropefoot |

20 |

Ranish |

21 |

Littlemill |

22 |

Loch Head |

23 |

Auchenhessnane |

24 |

Bogton Turriff |

25 |

Cairngarroch |

26 |

Brecklate |

27 |

Elgol |

28 |

Inverchoran |

29 |

Rackwick |

30 |

Ardlussa |

31 |

Craighouse |

32 |

Lochbuie |

33 |

Baymore |

34 |

Deerness |

35 |

Skerray |

36 |

Burray |

37 |

Crinan |

38 |

Bruray |

39 |

Condie |

40 |

Garvald |

41 |

Carrine |

42 |

Ham |

43 |

Balmacara |

44 |

Deanburnhaugh |

45 |

Stronachlachar |

46 |

Achosnich |

47 |

Corrie Common |

48 |

Sourhope |

49 |

Inverie |

50 |

Kenmore |

51 |

Druimindarroch |

52 |

Clova |

53 |

Ellemford |

54 |

Cawdor |

55 |

Stronsay |

2.4.4 All of the mast sites are in rural locations with 67% (n=37) in ‘very remote rural areas’, 18% (n=10) in ‘remote rural areas’, and 15% (n=8) in ‘accessible rural areas’. In terms of deprivation, while there are no mast sites in the 20% most deprived datazones in Scotland as defined by SIMD[14], all of the mast sites fall into the most deprived 10% when only the SIMD access domain is considered[15].

2.4.5 WHP Telecoms Ltd, the Scottish Government’s Infrastructure Provider was contracted to build the masts in the S4GI Programme. The design of all mast installations sought to take into account the local environmental topology and use sustainable construction methods, with the aim of reducing carbon emissions and delivering a mast build which was more sympathetic to the natural environment. As part of its contract, WHP Telecoms was required to achieve the necessary building consents[16] as well as a commitment from at least one MNO (EE, VMO2, Three, Vodafone) to provide 4G mobile services from the site.

2.4.6 The MNO EE entered into a partnership with Scottish Government, Scottish Futures Trust, the UK Home Office, and WHP Telecoms Ltd in 2020 to provide services as part of the S4GI Programme utilising EE’s Emergency Service Network (ESN). Across the S4GI Programme, EE is therefore the primary operator. However, there are mast sites from which several MNOs have elected to provide services. It is important to note that the number of MNOs signed up to each mast site is not static, with MNOs able to request to provide services at any point.

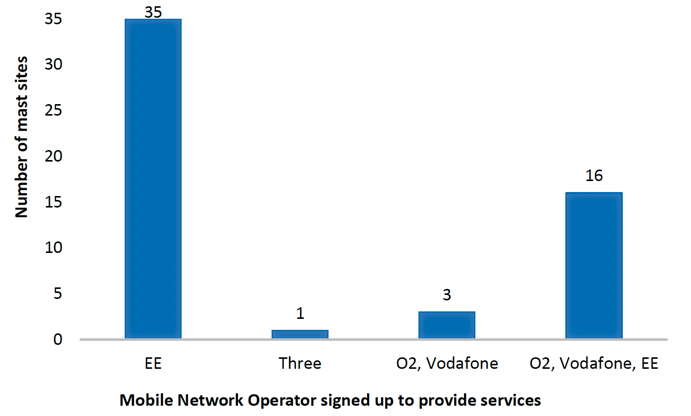

2.4.7 Figure 2‑2 shows the operators signed up to provide services across the 55 mast sites within the S4GI Programme as of January 2024.

2.4.8 In total, at this point, EE was providing services on 51 out of the 55 masts in the programme and was the only operator on 35 out of the 55 mast sites.

2.4.9 The number of MNOs signed up to each mast site is an important consideration, as those who have mobile phone or broadband contracts with an MNO who is not providing services from the mast will be unable to access 4G unless they change their mobile phone / broadband operator.

2.5 Coverage and take-up

2.5.1 It should be borne in mind that 4G coverage and broadband availability is only part of the story. This is because the coverage figures:

- measure access to a service as opposed to take-up – while 4G and broadband services may be available within an area, it is the consumer’s choice as to whether they take advantage of these services

- do not account for the quality of the service received, with anecdotal evidence suggesting that broadband and mobile speeds, particularly in rural areas, are often lower than advertised / and / or suffer with issues of reliability

2.5.2 The extent to which individuals and businesses take-up enhanced connectivity will depend on a range of factors. For example, results from the Scottish Household Survey (SHS) suggest that internet use differs amongst different socio-economic and demographic groups. A detailed breakdown of relevant data on this from the SHS is included in Appendix B . Overall, the data indicates that use of the internet is higher amongst those with higher incomes; those living in less deprived areas; amongst private renters as compared to social renters and owner occupiers; and amongst younger people as compared to older cohorts. The latter is an important point with respect to the S4GI Programme given that rural Scotland and particularly remote rural Scotland has a much higher proportion of people aged 65 and over[17].

2.5.3 There is also evidence that uptake of connectivity services varies across different types of industry. For example, the results from the evaluation of the UK’s Superfast Broadband Programme suggested that the chief beneficiaries of the enhanced connectivity were the education, health, and social work sectors whereas there appeared to be no effect on the performance of the finance and transport and storage sectors[18].

2.5.4 The extent of the benefits provided by the S4GI Programme will depend on overall uptake levels and this will need to be considered within the research.

Contact

Email: sean.murchie@gov.scot

There is a problem

Thanks for your feedback