Scottish Aggregates Tax administration regulations: consultation

This consultation seeks views on the proposed regulations for Scottish Aggregates Tax (SAT). This will enable the Scottish Government to gain views from both the public and professional experts to inform the development of SAT policy in advance of the proposed introduction date of 1 April 2026.

1. Introduction

Background

1.1 The Aggregates Tax and Devolved Tax Administration (Scotland) Act 2024[1] (“the 2024 Act) provides for the key elements of a new devolved tax on the commercial exploitation of aggregates in Scotland - the Scottish Aggregates Tax (“SAT”). SAT will replace UK Aggregates Levy (UKAL)[2] in Scotland. The Scottish Government’s intended introduction for SAT is 1 April 2026. This is subject to the successful introduction of secondary legislation in Scotland and UK Government legislation on UKAL.

1.2 The Scotland Act 2016[3] provided the Scottish Parliament with the devolved competence to legislate for the introduction of SAT. When SAT commences, it will increase the proportion of Scotland’s budget raised from Scottish taxes.

1.3 The 2024 Act was introduced to the Scottish Parliament in November 2023 and approved by the Scottish Parliament in October 2024. The legislation received Royal Assent and became an Act of the Scottish Parliament on 12 November 2024.

1.4 As noted above, the intended introduction date of the Scottish Aggregates Tax is 1 April 2026. To ensure the introduction and effective operation of SAT, secondary legislation is required. This will specify the administration requirements associated with the tax, alongside required changes to the Revenue Scotland and Tax Powers Act 2014 (RSTPA) regulations[4] and the First-tier Tribunal for Scotland Tax Chamber regulations[5].

1.5 The intent of these regulations is to deliver an operationally effective SAT and ensure that the tax operates effectively in relation to the wider devolved taxes legislative regime, as set out in the Revenue Scotland and Tax Powers Act 2014[6] (RSTPA).

1.6 The Scottish Government plan to commence all relevant parts of the Act in advance of tax introduction, including provisions to switch on Revenue Scotland registration powers.

Purpose

1.7 This consultation seeks views on the proposed regulations for SAT. This will enable the Scottish Government to gain views from both the public and professional experts to inform the development of SAT policy in advance of the proposed introduction date of 1 April 2026.

Scope

1.8 This consultation will run for 8 weeks until 21 March 2025 and offers an opportunity to comment on the draft secondary legislation, to ensure that it achieves the policy intent and does not create unintended consequences.

1.9 Views are also sought on a range of issues to inform relevant impact assessments and ensure that these are fully considered. Responses are encouraged from all interested parties.

1.10 The Scottish Government will carefully consider all responses to the consultation, prior to finalising decisions on legislation for introduction to the Scottish Parliament.

1.11 The consultation document details the proposed SAT administration regulations, and amendments required to the RSTPA to ensure that SAT can be introduced on 1 April 2026. This information is included in sections 2, and 3, respectively. The impact assessments considered as part of the secondary legislation are noted in section 4 of the document. Section 5 contains further information on how to respond to the consultation. A copy of the draft legislative provisions is contained in Annex A. A copy of the partial Business and Regulatory Impact Assessment (BRIA) is included in Annex B.

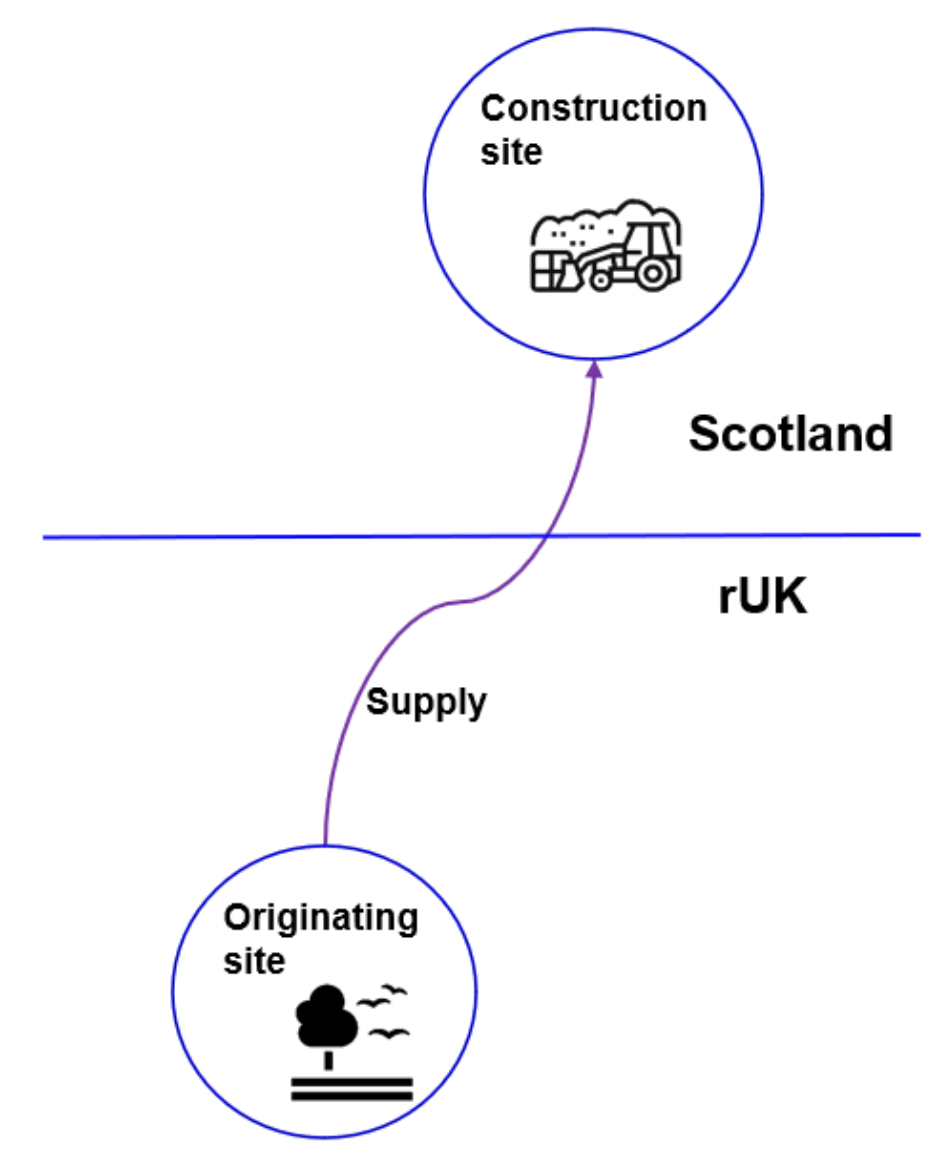

Cross-border movement of aggregate

1.12 Aggregate directly sold from a quarry situated elsewhere in the UK (rest of UK, or ‘rUK’) to a Scottish based customer is covered by the definition of commercial exploitation in Section 7(9) of the Scottish Aggregates Tax and Devolved Taxes Administration (Scotland) Act 202423.

1.13 In this scenario (See Diagram 1 below), the rUK quarry would register for SAT as well as for UKAL. HMRC has not yet announced the detail of how it intends to approach such cross-border movements in UKAL (i.e. the arrangements for tax credits).

Diagram 1

1.14 The policy memorandum[7] accompanying the Scottish Aggregates Tax and Devolved Taxes Administration (Scotland) Act 2024 noted that the Scottish Government intended to undertake continued engagement with industry stakeholders to ensure that all possible cross-border scenarios are taken into account in the arrangements for SAT.

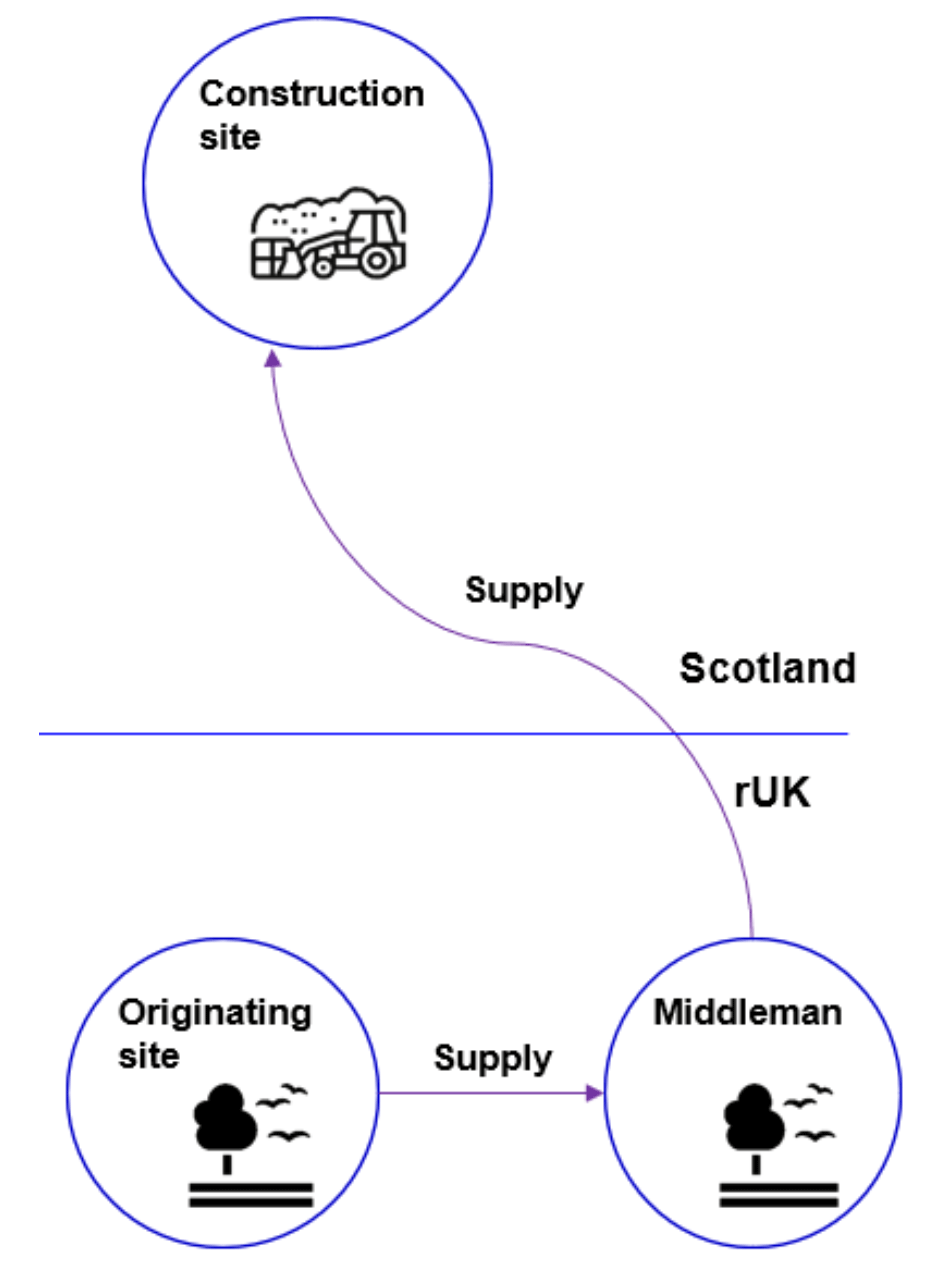

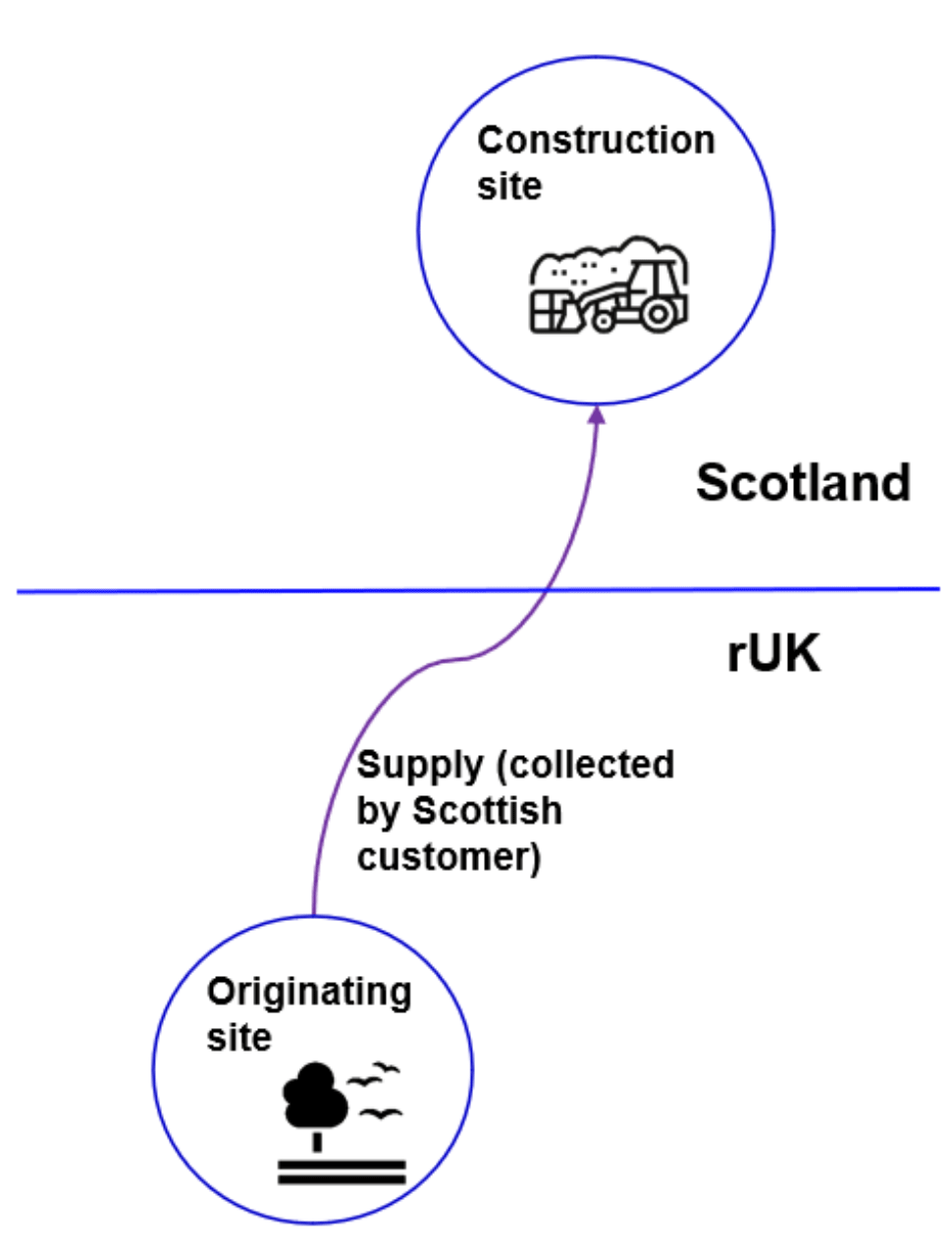

1.15 Scottish Government and Revenue Scotland’s subsequent engagement with industry representatives has identified several cross-border scenarios where aggregate may be transferred indirectly from a quarry to a customer, through the involvement of third parties. These scenarios include but are not limited to those where a rUK quarry supplies aggregate to a middleman in rUK who then sells the aggregate to a Scottish customer (see Diagram 2 below); and where a customer based in Scotland directly collects aggregate from a rUK quarry, for use in Scotland (see Diagram 3 below).

Diagram 2

Diagram 3

1.16 Engagement with industry is ongoing to allow for consideration of the most appropriate approach to accounting administratively for cross-border movement within the arrangements for SAT. This will include the scenarios above as well as other, less common, arrangements.

1.17 The Scottish Government also remains committed to collaborative working with the UK Government to explore complementary approaches to cross border taxation. As noted earlier, HMRC has not yet announced details on how they will approach this for UKAL.

1.18 Given this important interaction, and the ongoing industry engagement, questions on the cross-border movement of aggregate have not been included within the scope of this consultation. There will however be a separate process to seek views on the taxation of cross-border movement of aggregate.

Contact

Email: Devolvedtaxes@gov.scot

There is a problem

Thanks for your feedback