Scottish Building Safety Levy: consultation

This consultation invites views on the proposed introduction of a Building Safety Levy on new residential development in Scotland.

Part B: Operational Considerations – Returns and Payment

7. Taxable event

In order to provide certainty to the taxpayer and revenue authority, any tax should have a clear taxable event at which the taxpayer becomes liable to pay the tax.

The Order in Council which it is anticipated will provide for the devolution of powers to allow Scottish Ministers to introduce a Scottish BSL requires the taxable event (i.e. the trigger point for determining whether a taxpayer is liable to pay the levy) to be within the building standards process. The building standards process is a statutory requirement for housebuilders, and is a well-established process undertaken consistently encompassing the Scottish house building sector’s activity.

Alternative points, outwith the building standards process, such as the planning stage or certification of lawfulness were also considered but largely noted to not be as practical or efficient as if positioned in the building standards process. For example, applying the tax as part of the planning process could also exacerbate cashflow concerns in many residential property developments, an issue which was raised by stakeholders in response to the UK Government consultations.

Within the building standards process, the Scottish Government proposes the tax point for a Scottish BSL to be at acceptance of the completion certificate for relevant new construction work.

The completion certificate is a legal requirement that certifies that the work, or conversion, was carried out in accordance with the relevant building warrant, and the building, as constructed or converted, complies with the building regulations.

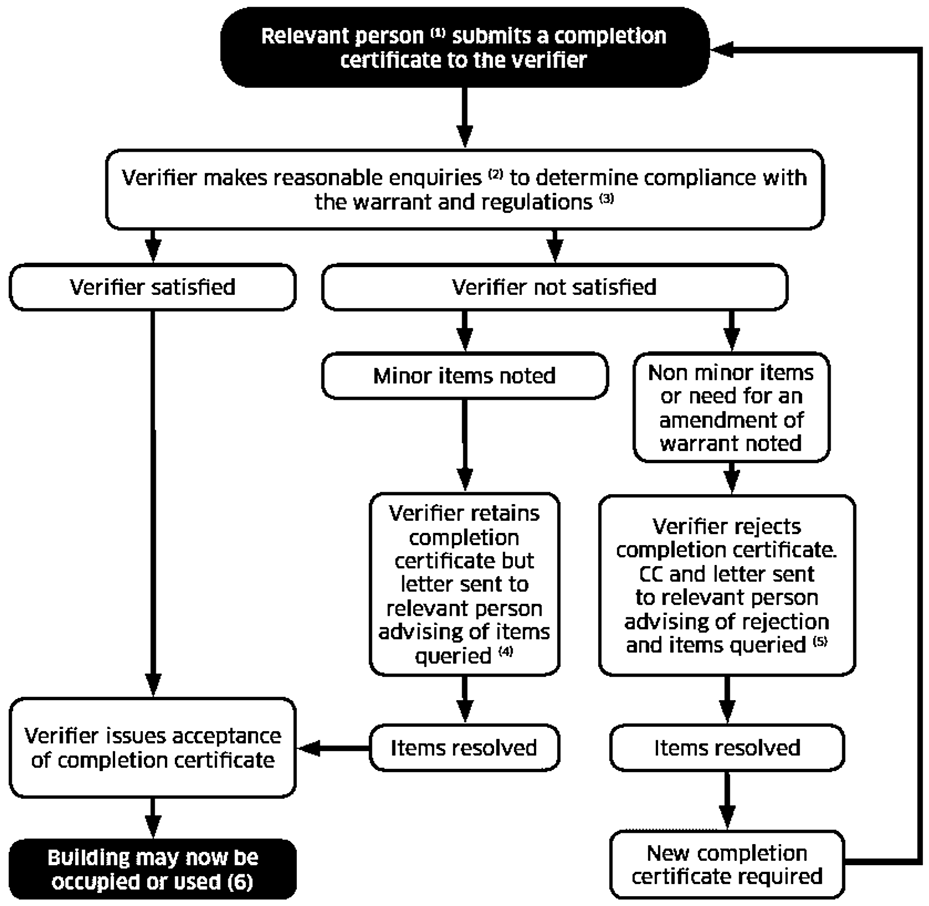

The process for submission and acceptance/rejection of a completion certificate is shown in Figure 1 and set out as follows: following completion of building work, the Relevant Person (usually the building owner) must complete, sign and submit a Completion Certificate, which is a statutory form, to the relevant local authority building standards department. The relevant local authority (as the verifier designated by Scottish Ministers) will then, after a processes to check compliance with the building warrant and regulations – known as ‘reasonable enquiry’, accept or reject the Completion Certificate. The local authority building standards department must notify the relevant person of their decision within 14 days.

For new dwellings, a completion certificate is required for each individual dwelling (in practice, completion certificate applications on developments are usually submitted in batches). On an estate of houses, a completion certificate must be submitted and accepted for each dwelling, provided the common services required by the building regulations for that dwelling have been completed. In other words, a completion certificate should not be accepted for a dwelling until it is connected to a suitable drainage system or until access to a suitable road is complete.

The Scottish Government considers the issuance of acceptance of a completion certificate to be a suitable tax point for a Scottish BSL, due to its status as a legal requirement for each new dwelling prior to use. Using the completion certificate process would also ensure that liability to the tax reflects what has been built, which may not be the case closer to the start of the building standards process. In addition, placing the tax point towards the end of the building standards process and closer to the point of sale will also assist in mitigating cash flow issues for developers.

An alternative option would be to use the application for a building warrant as the taxable event, which is required to be undertaken before construction can begin and therefore sits earlier in the building standards process. While the building warrant process would also capture all relevant building works at the time it is submitted, property developments can undergo changes in their design and development between warrant granted and completion.

If liability to a Scottish BSL was calculated at an early point in the building warrant process, then any changes between the building warrant and the completed development would likely require an amended tax position at a later stage, and potentially on more than one occasion. This would provide less certainty and convenience for both taxpayer and revenue authority in knowing how much tax is to be collected. In addition, applying a tax in the period between building warrant application and developers receiving funds from homebuyers may exacerbate cash flow concerns and cause inconvenience for homebuilders.

Question 13

Do you agree that liability for the Scottish Building Safety Levy should arise in relation to the issuance of acceptance of a completion certificate?

Please give reasons for your answer

8. Revenue authority

The Scottish Government is seeking views on which agency would be the most appropriate for collecting a Scottish BSL. The Scottish Government proposes that a Scottish BSL should operate on a self-assessed basis and as a national tax, whereas the UK Government proposals for its UK Levy would see a billing and collection method used.

Consideration has been given to designate local authorities as the collection agency for a Scottish BSL. This is the route proposed by the UK Government for its UK Levy. Although the Local Government Association in England is opposed to this, describing the proposal as “an unreasonable additional burden” for local authorities[22].

As local authorities are currently appointed by Scottish Ministers as verifiers under the Building (Scotland) Act 2003, they already deliver the building standards process. They will hold information which developers require by developers to submit as part of the building warrant and completion certificate process. This information can be used to determine tax liability, as well as eligibility for any exemptions or reliefs. A local authority, operating as a collection agency for the levy, would therefore have access to relevant building standards information for verification purposes without recourse to a third party.

On the other hand, designating local authorities as the collection agency would place a new administrative burden on local government, with resourcing implications but without any further fiscal autonomy. This could have impacts on local authority building standards services to process building warrant and building completion certificate applications. As a national tax, a Scottish BSL would also require standardisation of collection and administration processes across 32 local authorities. Consideration would need to be given on whether this approach is consistent with the Verity House Agreement[23] and our shared priorities with local government. In addition, a new administrative burden on local government would need to be fully funded in light of the Scottish Public Finance Manual[24]. In addition, if a proportionate market value were to be used as the calculation for the levy, then local authorities may not have access to all of the relevant information in order to determine the liability at that point.

Consideration has been given to designate Revenue Scotland as the revenue authority for the tax. Revenue Scotland is the tax authority responsible for the administration and collection of Scotland’s existing devolved taxes - Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax (SLfT). Revenue Scotland will also have responsibility for Scottish Aggregates Tax (SAT). Both LBTT and SLfT are, and SAT will be self-assessed taxes, where the responsibility falls to the taxpayer to complete and submit an accurate return, where required, and pay any tax due.

Revenue Scotland provides an online system for submitting returns for both taxes, alongside guidance for taxpayers.

Designating Revenue Scotland as the revenue authority would support a standardised process across Scotland, providing certainty and convenience to businesses and other stakeholders in the building standards process. It would also allow for the utilisation of RS experience in collecting and administering self-assesses taxes. Revenue Scotland would also be able to use the existing administrative framework for collecting national taxes - the Revenue Scotland and Tax Powers Act 2014 - to underpin the collection of a Scottish BSL.

The Scottish Government proposes that a Scottish BSL should be collected and administered by Revenue Scotland, due to the requirement to use funds for a national programme and to allow Revenue Scotland to utilise its experience and data with existing devolved taxes.

Question 14

Do you agree that Revenue Scotland should act as the revenue authority for the Scottish Building Safety Levy?

Please give reasons for your answer

9. Returns

As a self-assessed tax, a Scottish BSL will require taxpayers to assess their liability via a tax return.

The Scottish Government is seeking views on the frequency of returns taxpayers would be required to adhere to when submitting a tax return to the collecting authority. On the one hand, more frequent returns may increase the administrative burden on both taxpayer and tax authority. On the other hand, more frequent returns would ensure the point at which the tax is paid is more closely aligned to the point at which the tax is due, and would also allow for any errors in assessments to be identified and corrected at an earlier opportunity.

The UK Government has considered the frequency of returns for its proposed UK Levy. Its most proposals would see receipts of the UK Levy being provided by local authorities in England to the UK Government at regular intervals. From the UK Government’s second consultation on the UK Levy, 64% of respondents supported a quarterly timetable for submitting returns by local authorities, whilst 30% supported a six-monthly timetable. In its response to the consultation, the UK Government proposed to require returns on a quarterly basis, noting that this was also the timescale for many existing returns relating to planning and housing.

In considering return schedules for existing devolved taxes, the returns for the devolved SLfT are made quarterly, as is the proposed frequency for the to-be-devolved SAT.

Question 15

Which of the following schedules do you think is the most appropriate for the frequency of returns:

a) Per unit

b) Monthly

c) Quarterly

Please give reasons for your answer.

10. Tax Compliance

In order to ensure that the correct amounts of tax are paid at the right time it is important that a range of investigative and enforcement powers, with appropriate safeguards in place, are available.

10.1 UK Government proposals

In its technical consultation on the UK Levy[25], the UK Government proposed a conditional link between payment of tax and acceptance of the completion certificate for the relevant property:

“…that consequence for non-payment of the levy will be that the building control completion certificate will not be issued, or the final certificate accepted, by the building control authority.”

This compliance mechanism reflects the UK Government’s proposal for local authorities to act as the collection agency for the UK Levy, as they are also the building control authority in England.

As the Scottish Government is proposing that Revenue Scotland will administer a Scottish BSL, there is less rationale for including a conditional link with the completion certificate process as a compliance mechanism. Instead, the Scottish Government is proposing to utilise Revenue Scotland’s existing enforcement powers for compliance purposes.

10.2 Revenue Scotland powers

The Revenue Scotland and Tax Powers Act 2014 (RSTPA 2014) provides Revenue Scotland with a range of investigative and enforcement powers in relation to the two existing devolved taxes, including powers to open enquiries, issue determinations, make assessments and issue information notices, carry out inspections of business premises, and seek recovery of debt through the civil courts. These are in addition to the powers it has to impose civil penalties and interest.

These same investigatory and enforcement powers will also be available to Revenue Scotland in relation to a Scottish BSL. In relation to tax avoidance, the Scottish Government proposes that Revenue Scotland will utilise the Scottish General Anti-Avoidance Rule (GAAR), as established in RSTPA 2014. These powers are set out in Annex B.

The Scottish Government believes the use of these powers will reduce the need for an active conditional link between the issuance of a completion certificate and the payment of the levy, as is the case with the UK Levy. However, we recognise that in instances where there is persistent non-compliance from a developer in meeting its obligations under the Levy, there may be a need for additional sanctions to enforce these obligations.

One example of a sanction could be a process by which local authorities withhold access to the building standards system for developers that are persistently non-compliant. Such a measure of last resort would create an incentive for developers to comply with their obligations under the levy, or risk their ability to undertake future developments. However, such a measure would need careful consideration around the potential impacts on the building standards system and on the housebuilding sector more widely.

The Scottish Government is therefore seeking views on whether additional sanctions are needed in cases where there is persistent non-compliance.

Question 16

Do you agree that, in relation to the Scottish Building Safety Levy, the tax authority should have the investigatory and enforcement powers set out in Annex B?

If you answered no, please give reasons for your answer.

Question 17

Do you agree that there should be no active conditionality between the issuance of each completion certificate and payment of the Scottish Building Safety Levy?

If you answered no, please give reasons for your answer.

Question 18

What are your views on introducing additional sanctions for taxpayers where Revenue Scotland deem there to be persistent or major non-compliance in paying the Scottish Building Safety Levy?

Question 19

Are there specific aspects of the housebuilding industry that may require a different approach to compliance than set out above?

11. Appeals

The Scottish Government proposes that taxpayers (and their fiscal or administrative representatives, should these be provided for) who disagree with certain decisions by Revenue Scotland in relation to a Scottish BSL will have the statutory right to request that the tax authority carries out an internal review of that decision and to also appeal to an independent tribunal.

The Scottish Government proposes to use the provisions of Part 11 of RSTPA 2014 to establish the legislative framework for disputing decisions made by Revenue Scotland in relation to that tax. This will ensure that the dispute resolution system and process for a Scottish BSL is consistent with the other devolved taxes, with reviews carried out by Revenue Scotland and appeals decided by the Tax Chamber of the First-tier Tribunal for Scotland and onwards to Upper Tribunal for Scotland. Guidance on the dispute resolution process is available on the Revenue Scotland website.

The RSTPA 2014 defines as "appealable decisions” the list of Revenue Scotland decisions against which a person aggrieved by that decision has the right to give a notice of review or appeal. The current list of appealable decisions is:

- a decision to make adjustments to counteract a tax advantage;

- a decision in relation to the registration of any person in relation to any taxable activity;

- a decision which affects whether a person is chargeable to tax;

- a decision which affects the amount of tax to which a person is chargeable;

- a decision which affects the amount of tax a person is required to pay;

- a decision which affects the date by which any amount by way of tax, penalty or interest must be paid;

- a decision in relation to a penalty;

- subject to certain conditions and exceptions, a decision in relation to the giving of an information notice or in relation to the use of any other investigatory powers; and

- subject to certain conditions, a decision in relation to the giving of a notice to a third party requiring them to supply the contact details of a debtor.

The current list of Revenue Scotland decisions which are not appealable decisions are:

- giving a notice of proposed counteraction of a tax advantage under the Scottish GAAR;

- making a Revenue Scotland determination in the event of no tax return being submitted; and

- a decision to give a notice of enquiry.

Question 20

Do you agree with our proposals for dispute resolution in relation to the Scottish Building Safety Levy?

If you answered no, please give reasons for your answer.

12. Duration

The Scottish Government proposes that any revenue raised from a Scottish BSL should be used initially to support the funding of cladding remediation in Scotland. Once cladding remediation has been resolved in totality, the current rationale for a Scottish BSL to fund such measures would end. However, as it is not yet known how long the Cladding Remediation Programme will operate for, indicating an end date for a Scottish BSL may result in the revenue stream concluding before all remediation works are undertaken, with the risk of underfunding the Programme. The Scottish Government is therefore seeking views on a sunset clause for a Scottish BSL.

The Scottish Government is also considering the appropriateness of a regular review for a Scottish BSL, once implemented. A statutory review requirement can offer the opportunity to ensure the scheme is operating as intended against its objectives. When considering a review period, it is important to consider the length of time needed between implementation and the first review period, and the length of time in between review periods, as there should be sufficient time to allow for outputs to be meaningful.

The UK Government’s current proposals for the UK Levy do not include a sunset clause, but do propose to include a regular review every three years. The UK Government’s rationale for the three-yearly review is to ensure the UK Levy reflects the differences in house prices across English council areas, which the proposed UK Levy is based on. From the UK Government’s second consultation, 90% of who answered the question agreed there should be a regular review point. In terms of timescales, 53% of respondents who answered believed this should be annually, with 31% supporting 3-yearly and 15% supporting 5-yearly. The Scottish Government is therefore seeking views on whether a regular review of a Scottish BSL would be appropriate.

Question 21

What are your views on having a sunset clause or end date for the Scottish Building Safety Levy?

Question 22

Do you think there should be a regular review for the Scottish Building Safety Levy?

Please give reasons for your answer

Contact

There is a problem

Thanks for your feedback