Publication - Research and analysis

Scottish economic bulletin: May 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Inflation

Inflation fell to 3.2% in March, its lowest rate since September 2021.

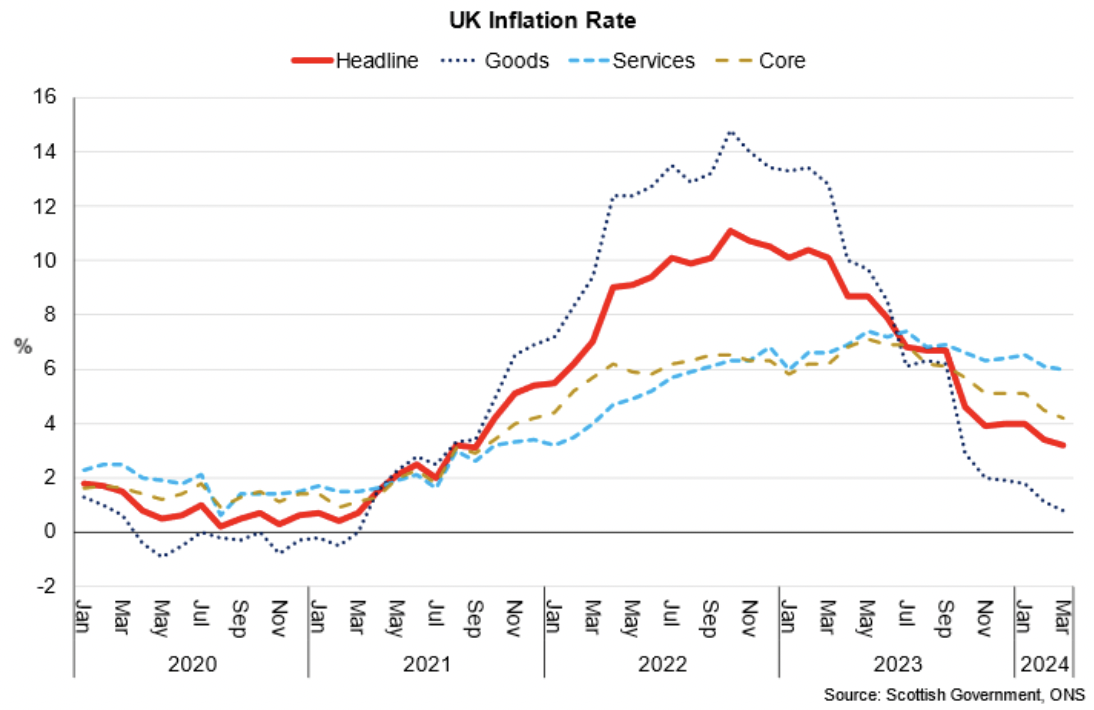

- The inflation rate fell to 3.2% in March, down from 3.4% in February, and is at its lowest rate since September 2021 as inflationary pressures continue to stabilise.[2]

- The largest downward contributions to the monthly change in the annual inflation rate came from food and non-alcoholic beverages, furniture and household goods, and clothing and footwear. The inflation rate for food fell for its twelfth consecutive month in March to 4% (down from 5% in February), as clothing and footwear inflation also fell from 5% to 4% in the same period. The largest upward contribution came from communication and transport, in which the annual inflation rates rose from 5.6% to 7.5% and -0.1% to 0.1% respectively.

- Core inflation, which excludes energy, food, alcohol, and tobacco, fell in March to 4.2% and continues to partly reflect the current persistence of services prices inflation which fell from 6.1% to 6%, while goods prices inflation fell from 1.1% to 0.8%.

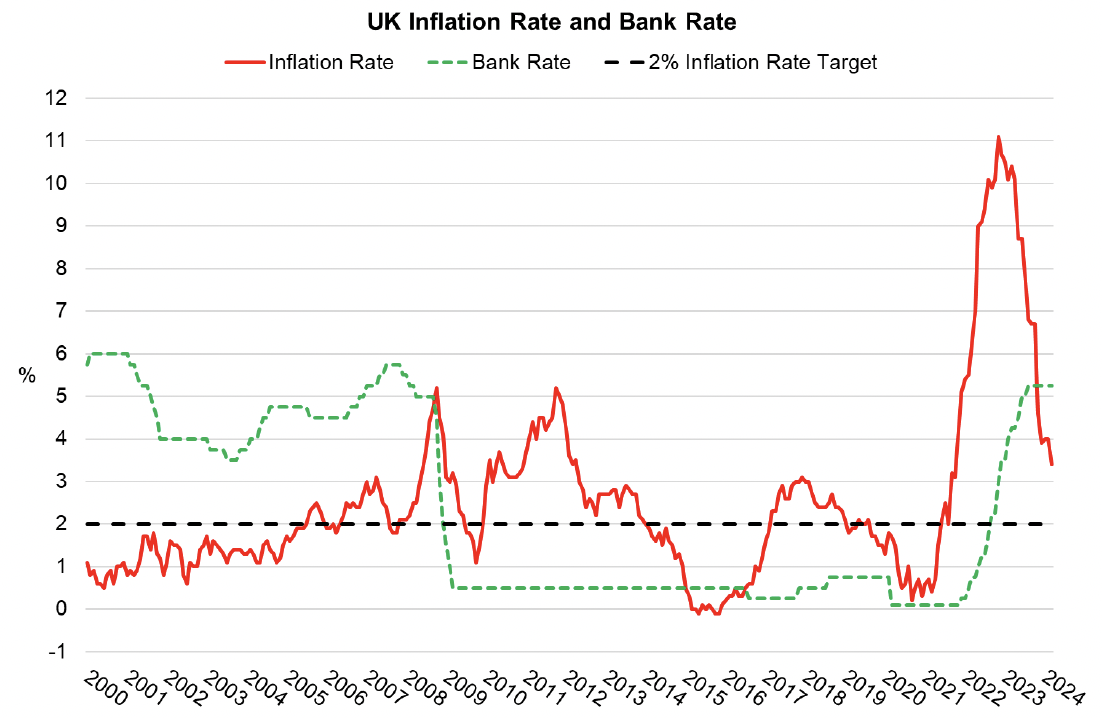

- In response to recent inflation and wider economic data, the Bank of England’s Monetary Policy Committee (MPC) maintained the Bank Rate at 5.25% in May, unchanged since August 2023. The Bank set out that, while key indicators of inflation persistence are easing broadly in line with their expectations, the MPC will continue to monitor underlying tightness of labour market conditions, wage growth and services price inflation when considering future changes to the Bank rate.[3]

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback