Scottish economic bulletin: May 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Business Conditions

Business activity has strengthened at the start of the year and business optimism is at its highest for 13 months.

Business Activity

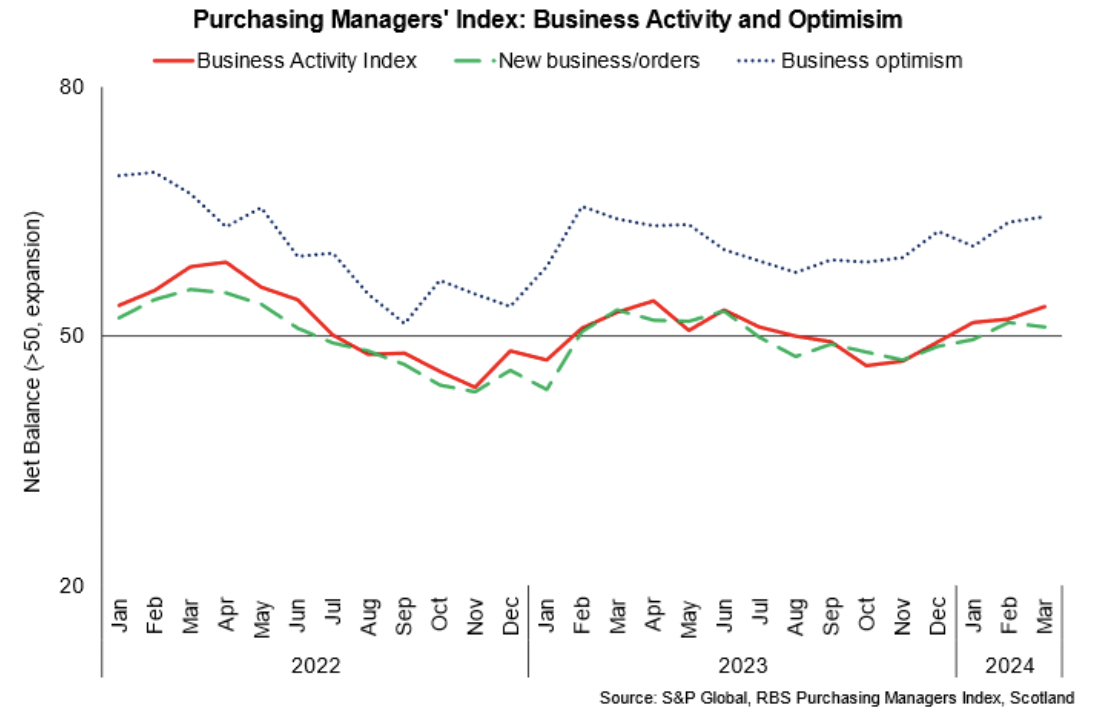

- The Purchasing Managers Index (PMI) business survey indicates that business activity in Scotland’s private sector has strengthened at the start of the year and increased for the third consecutive month in March (53.6). This was partly underpinned by an increase in new business for the second consecutive month (51.1), however this was driven by growth in the services sector while manufacturing activity continued to weaken, though to a lesser extent than in recent months.[4]

- Reflecting the pick-up in activity, business optimism for the year ahead rose to a 13-month high (64.4), with reports indicating hopes of improved economic conditions underpinning expectations.

Business Concerns

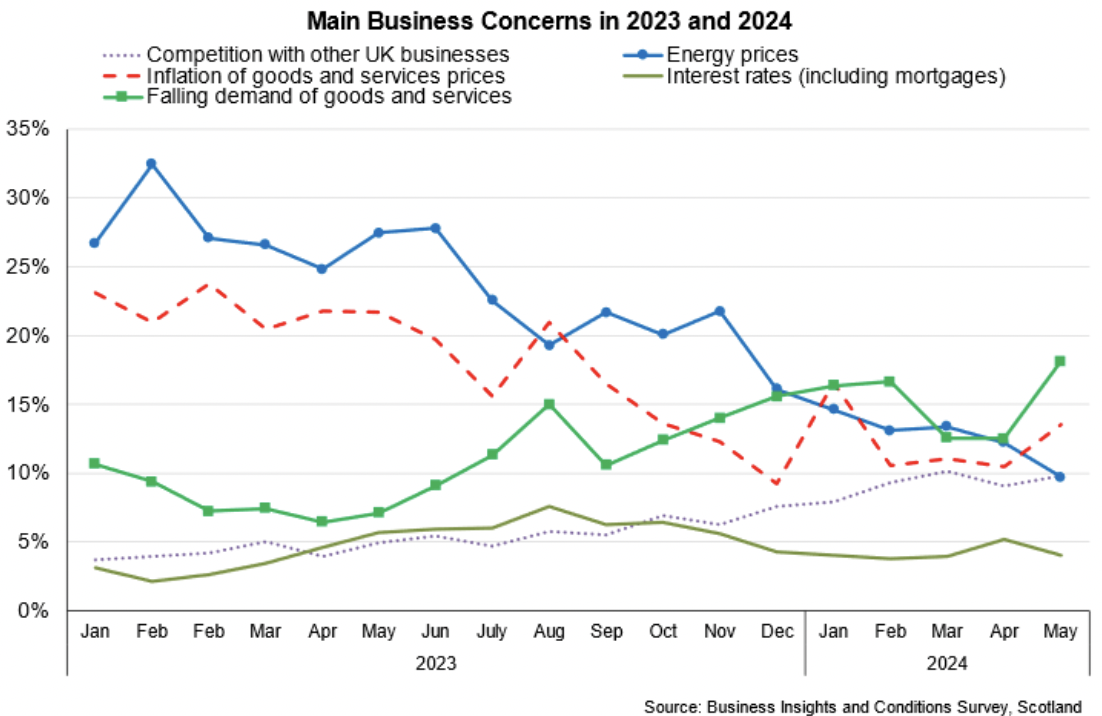

- Reporting of key business concerns have continued to converge through the first quarter of the year as inflationary pressures have eased and increased expectations for improved trading conditions for the year ahead have emerged.

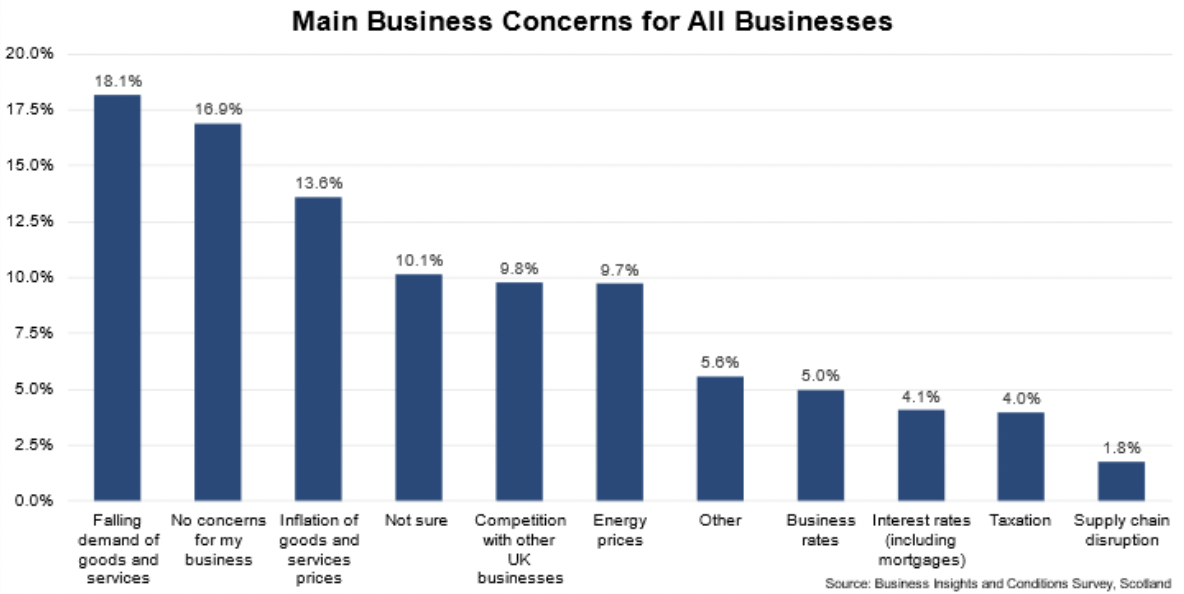

- The Business Insights and Conditions Survey (BICS) for May indicates that businesses’ concerns around energy prices (9.7%) and inflation of goods and services (13.6%) have stabilised in recent months following their downward trend over 2023 and have converged with concerns of competition with other UK businesses (9.8%). Concerns around falling demand have increased somewhat in the latest data, rising to become the most common concern among businesses (18.1%), although many businesses have reported having no concerns (16.9%).[5]

- The rise in the share of businesses reporting falling demand of goods and services in May was broad based across industries, and is consistent with the weakening in the PMI for new business. Concerns regarding interest rates eased over the second half of 2023 likely reflecting increased expectations that interest rates may fall during the coming year and have broadly stabilised at the start of 2024, increasing slightly over the recent month to 4.1%.

Business Costs

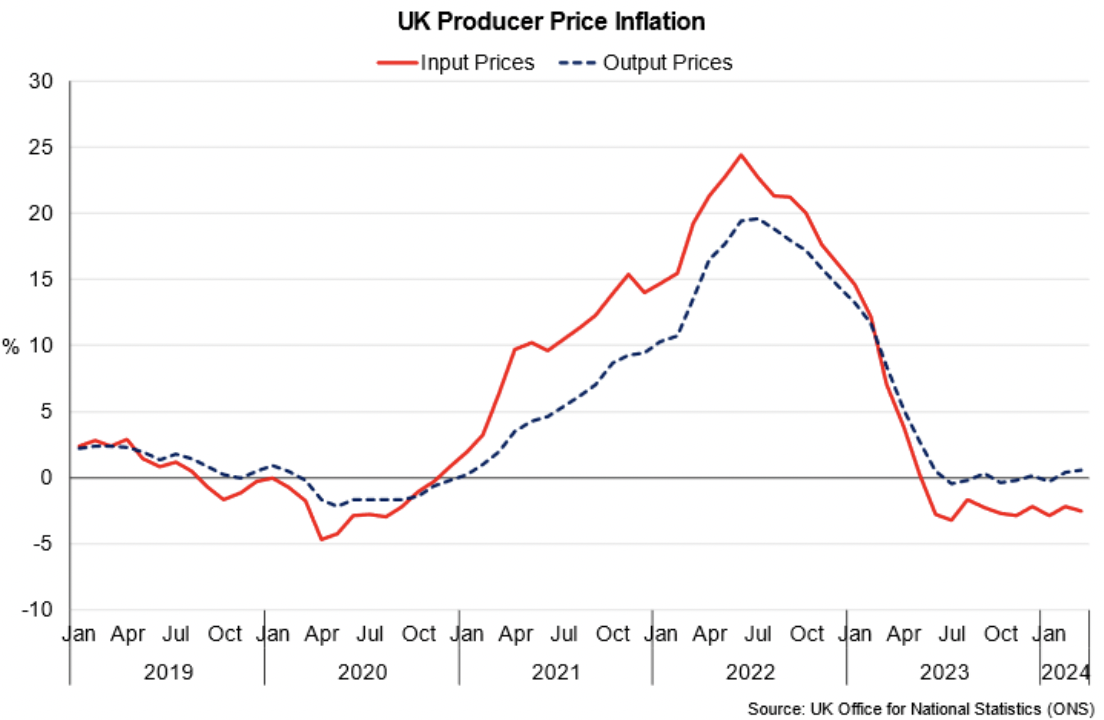

- At a headline level, producer input prices continued to decline in March on an annual basis for a tenth consecutive month, which is feeding through to significantly lower rates of output price inflation. The input price index fell 2.5% on an annual basis in March, while producer output prices rose 0.6%, an increase from the 0.4% recorded last month. [6]

- Overall, input and output price levels have been relatively more stable since June 2023, albeit they are significantly higher than at the start of 2021 (c. +25%) prior to the spike in inflation.

- The largest downward contributions to the annual input inflation rate for producers in March came from inputs of chemicals (-6.9%, up from -7.1%) and other parts and equipment (0.0%, down from 0.1%). Domestic food input prices have also continued to fall on an annual basis (-2.5%), and imported food input price inflation has now also contributed to producer input disinflation in March, with prices falling 1.7% annually. Fuel prices have been the largest upward contributor to producer input prices, with an annual inflation rate of 4.1% in March.

- Looking at a broader range of input costs across the manufacturing and services sectors, PMI business survey data indicates that input prices continued to rise in March, however this indicator is at its lowest level since around the start of 2021.

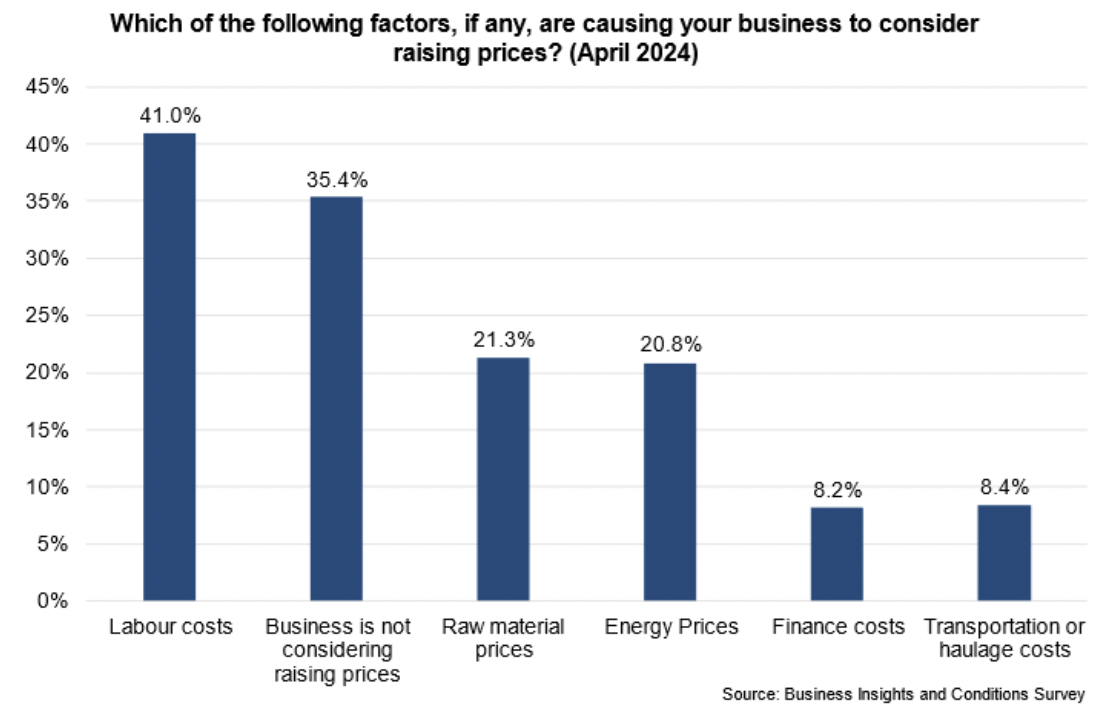

- In terms of the feed through to output prices, BICS data show that many businesses are not considering raising prices in May (35.4%). However, it also provides insights on which costs remain the most challenging to absorb, with the main factor of considered price rises being labour costs (41%), followed by raw materials prices (21.3%) and energy prices (20.8%).

- At the beginning of April, around 8.4% of businesses reported that transportation or haulage costs are causing business to consider raising prices. This potentially partially reflects the increase in shipping and supply chain costs and delivery times that businesses are facing due to the attacks on commercial shipping in the Red Sea and the rerouting of shipping routes from Asia to Europe round the Cape of Good Hope rather than through the Suez Canal.

- There remains uncertainty over the persistence and impacts of the current supply chain disruption. BICS data show that only 3.4% of businesses in March experienced global supply chain disruption, remaining below the average for the past year (7.5%). Supply-chain disruptions in the Manufacturing sector have also sharply declined from the 11.1% of business reporting concerns in February to 3.7% reporting similar concerns in March.

Business Investment

- The combination of business concerns around demand, cost pressures and higher interest rates continues to weigh on business investment decision making.

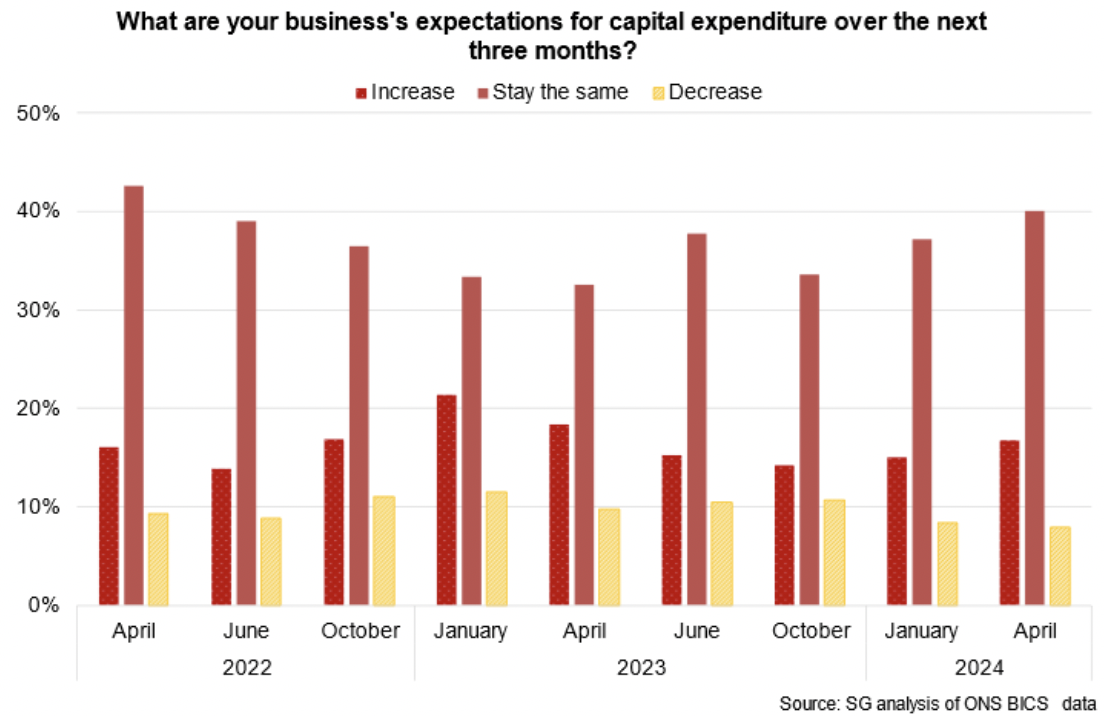

- BICS data from March show that capital expenditure expectations have increased slightly over recent months, with 16.8% of respondents expecting their capital expenditure to increase between April and June (up from the 15% reported in February 2024) while a slightly smaller share of businesses expect their capital expenditure to decrease (7.9% down from 8.4%). Of those expecting to authorise capital expenditure, 54.1% report that it will be for replacements, with a growing number of businesses reporting to authorise capital expenditure to increase efficiency (18.7%), expand capacity (15.5%) or to use new technology (12.5%). This suggests businesses remain cautious but increasingly optimistic about future economic conditions.

- The Scottish Chambers of Commerce Quarterly Economic Indicator for the first quarter of 2024, however, indicates a level of caution reporting that business investment trends remain largely frozen. Over half of businesses (53%) reported no change to total investment and 52% no change to training investment.[7]

Business Optimism

- Despite the challenging conditions continuing to face businesses, the recent pick-up in business activity and easing of some cost inflation pressures have been reflected in a further improvement in business optimism.

- The PMI business survey data indicates that business optimism for the year ahead rose to a 13‑month high in March, continuing its upward trend since the middle of 2023 amid business hopes of improved economic conditions.

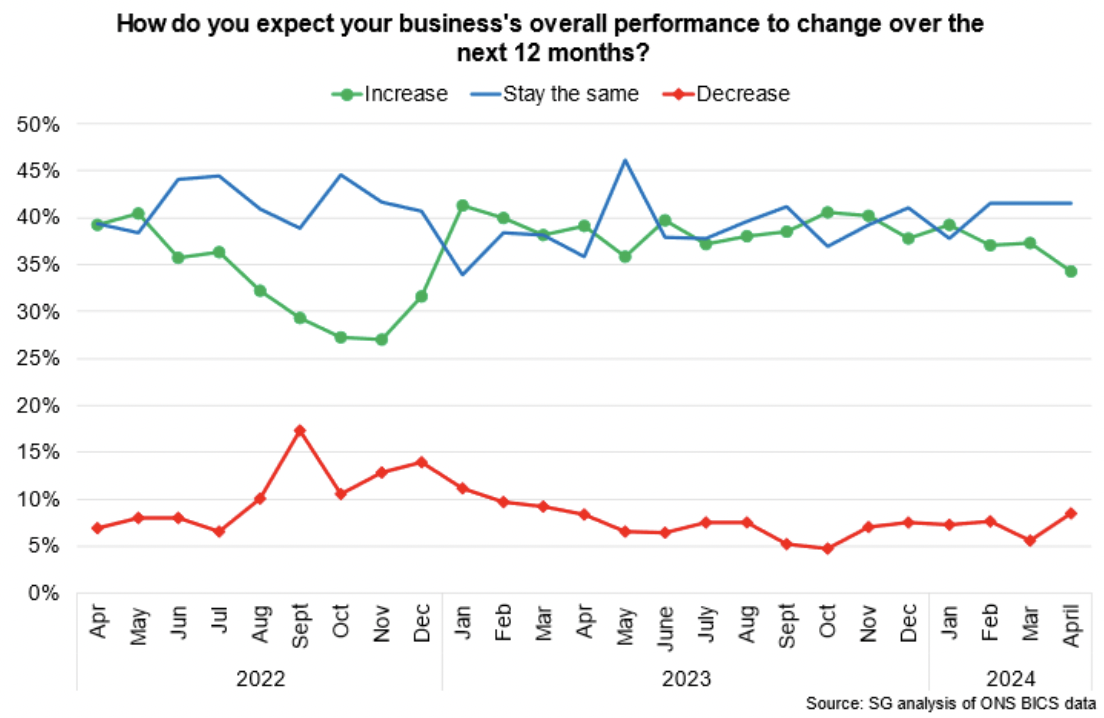

- BICS data for April indicates that most businesses expect their overall business performance to stay the same (41.5%) or increase (34.2%) over the coming year. On aggregate, this has remained broadly stable compared to the start of 2023, while the share of businesses expecting their performance to decrease has fallen to 8.5%.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback