Publication - Research and analysis

Scottish economic bulletin: May 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Economic Outlook

Economic conditions are forecast to improve with stronger growth and lower inflation.

- The outlook for economic growth in 2024 remains relatively subdued however is expected to strengthen while inflationary pressures are forecast to moderate further. At the global level, the IMF’s World Economic Outlook published in April forecasts global growth to be steady at 3.2% in both 2024 and 2025, with growth in advanced economies averaging at 1.7% in 2024 and 1.8% in 2025.[18] Similarly, the OECD Economic Outlook for May forecasts the global economy to grow by 3.1% in 2024 and 3.2% in 2025, with the UK growing at 0.4% in 2024 and 1.1% in 2025. However, the UK 2025 figure is the lowest growth forecast among G7 economies with the OECD forecasting advanced economies will grow on average 1.7% in 2024 and 1.8% in 2025.[19]

- In December, the Scottish Fiscal Commission forecast Scotland’s economic growth to strengthen from 0.1% in 2023 to 0.7% in 2024, rising to 1.1% in 2025. [20] In March, the Fraser of Allander Institute forecast a similar pattern of strengthening growth of 0.6% in 2024, rising to 1.1% in 2025. [21] Most recently, KPMG forecast in their Scottish economic outlook in May growth of 0.4% in 2024 and 1% in 2025.[22] At a UK level, in March, the Office for Budget Responsibility forecast UK growth to strengthen to 0.8% in 2024 rising to 1.9% in 2025.[23]

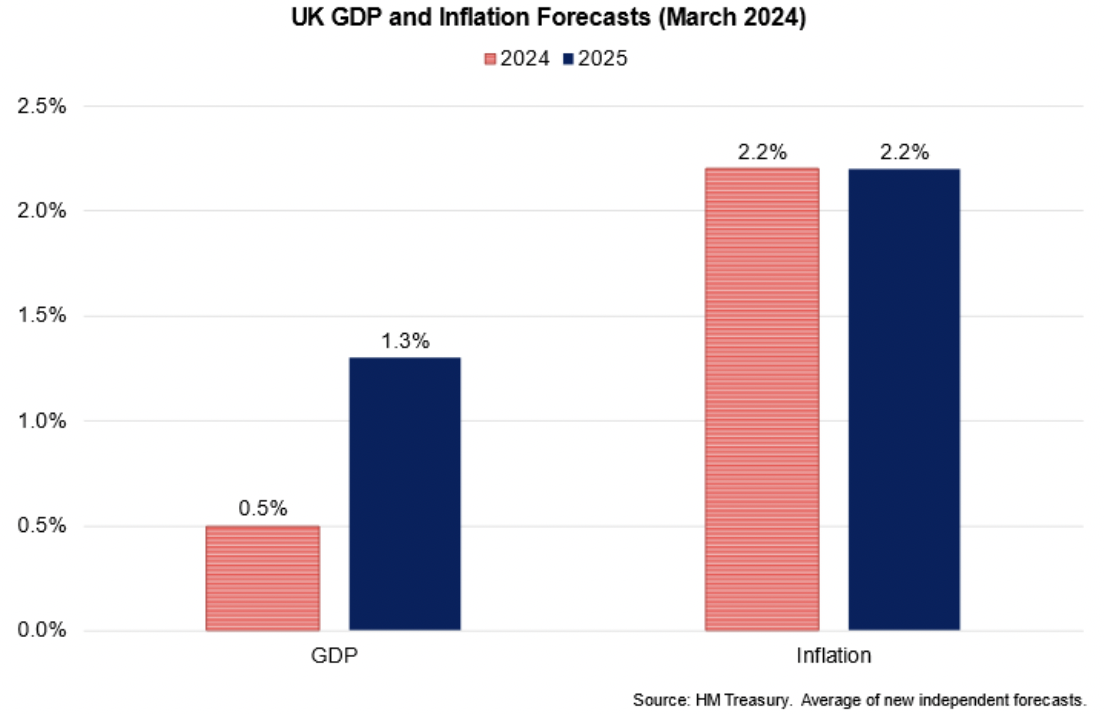

- The HMT April average of new independent UK forecasts further illustrates the expectation of stronger growth and falling inflation with UK GDP growth forecast on average to rise to 0.5% in 2024 and 1.3% in 2025, while inflation is forecast to fall on average to 2.2% in Q4 2024 and remain at 2.2% at the end of 2025.[24]

- In May, the Bank of England projected inflation to fall to 2.1% in April 2024 before rising slightly back above target during the second half of the year.[25] This reflects increased energy price inflation, which the bank forecasts will become less negative during the second half of the year. Inflation is then forecast to fall to around 1.9% in two years’ time, assuming interest rates follow market expectations.

- The Bank of England maintained the Bank Rate at 5.25% in May, however the projected fall in inflation this year has raised expectations that the Bank Rate will be reduced during the year, and that the pace at which these cuts may be implemented could be faster than in the US. This, alongside supportive fiscal policy and the falling energy prices, underpin the stronger growth outlook for the year ahead. Downside risks to the economic outlook remain, notably from developments in the Middle East, including disruption to shipping through the Red Sea and potential further oil market volatility.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback