Scottish economic bulletin: February 2025

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Business Conditions

Business activity and optimism weakened at the end of 2024.

Business Activity

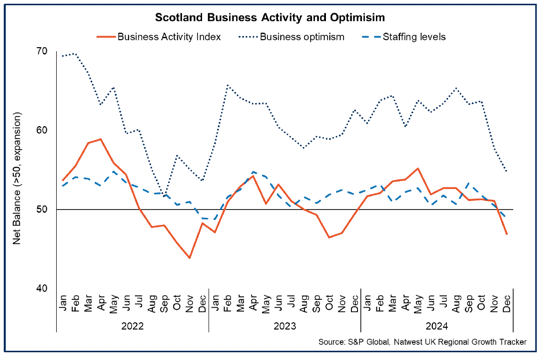

- The RBS Growth Tracker indicates that private sector business activity contracted in December with the business activity index falling to 46.9 (below 50 indicates a decrease in activity). This follows a period of growth across 2024 which started to moderate in the second half of the year.[4]

- The fall in reported business activity was the first contraction in 2024 and the sharpest drop in activity since October 2023 with both manufacturing and services businesses reporting decreases. New business activity also reported a decline in December for a third consecutive month (49.3).

- Broader Growth Tracker indicators also suggest weaker business activity with the employment index falling to 48.9 while business optimism fell for a second consecutive month in December to a 24-month low of 54.7, albeit remaining positive on balance.

Business Concerns

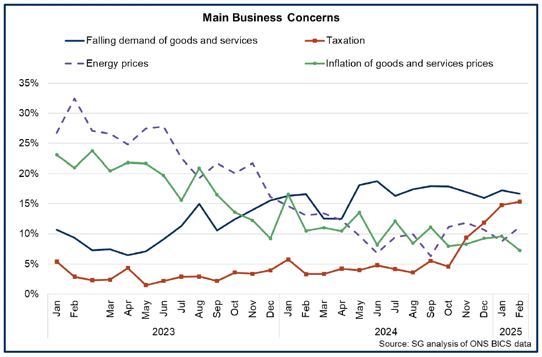

- The Business Insights and Conditions Survey (BICS) shows that falling demand for goods and services remains the most reported concern for businesses for February (16.7%) and has remained broadly stable since the second half of 2024.[5] The latest data also show the recent sharp increase in concern regarding taxation since October continued at the start of the year and is the second most commonly cited concern for businesses for February (15.4%).

- Issues that had been widespread concerns in previous years continue to be cited by fewer businesses. Energy prices were highlighted as a concern by 11.1% of businesses, which remains notably lower than in 2023, although this has picked up slightly from the second half of 2024, while concern regarding inflation of goods and services prices was reported by 7.3% of businesses and continued its general downward trend from 10.5% last year.

Business Costs

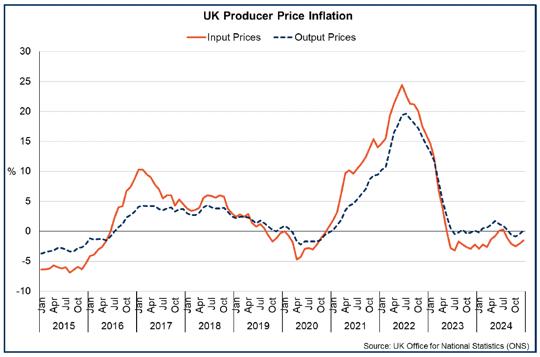

- Producer price inflation continued to stabilise in 2024 with input prices generally falling on an annual basis and feeding through to further output price stability.

- In December, producer input prices fell by 1.5% over the year (up from a fall of 2.1% in November). Key drivers of recent movements were input fuel prices which fell 15% annually in December, within which electricity and gas prices fell 13.8% and 21.3% respectively, while the price of crude oil inputs fell 10.2% and reflected a 13.7% fall in crude petroleum prices. The price of inputs of metals and minerals rose 0.6% over the year, and partly reflected an increase in the price of aluminium.

- In terms of the feed through to output prices, producer output prices rose marginally in December (0.1%) for the first time in four months following a fall of 0.5% in November.[6]

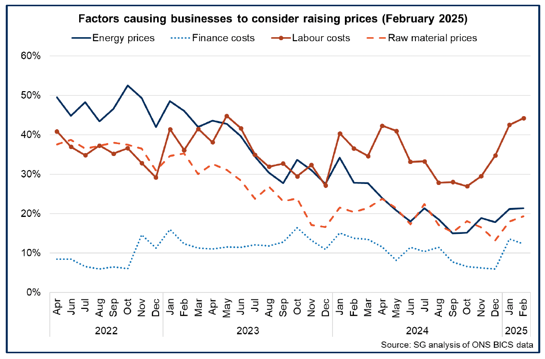

- More broadly, the RBS Growth Tracker indicated that the rate of input price inflation had remained stable in December and broadly in line with the average for 2024. This shows that businesses are continuing to face rising input costs, most recently driven by higher wages and higher supplier and material costs.[7]

- These factors were also identified in BICS data for February, showing a further increase in the share of businesses considering price rises because of labour costs (44.2%), energy prices (21.3%) and raw material costs (19.3%). 36.1% of businesses responded that they did not plan to increase prices, however this share has fallen notably through the turn of the year.

Business Investment

- Business concerns around demand, cost pressures and borrowing costs continue to impact business investment decision making.

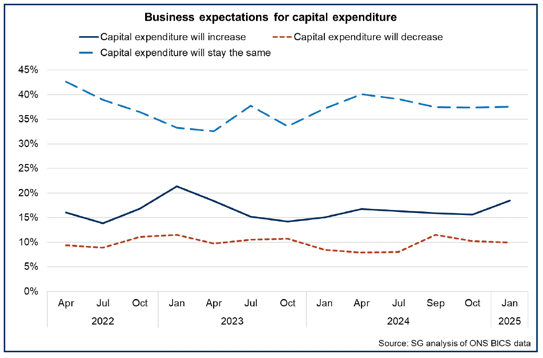

- BICS data indicate that business expectations for capital expenditure remained relatively stable over 2024 with latest data showing that 18.5% of businesses expect to increase their capital expenditure in the first quarter of 2025, up from 15.6% in the fourth quarter of 2024. The share of businesses expecting to maintain capital expenditure remained stable at 37.5%, while the number of businesses expecting to reduce capital expenditure marginally fell by 0.3 p.p to 9.9%.

- Of those businesses expecting to authorise capital expenditure, 53.9% reported that it would be for replacements, with fewer respondents intending to reach new customers (8%) or provide new services (3.9%). Business investment is also being directed to increase efficiency (16.8%) and expand capacity (13.4%).

- BICS data also indicates that various factors are placing limits on the amount of capital expenditure being authorised. The share of businesses reporting an inability to secure either internal or external finance (13.7% and 7.5% respectively) increased over the quarter while labour shortages (5.8%) and insufficient return on investment (5.3%) remained broadly stable over the quarter and 2024 as a whole. 45.4% of businesses reported that they were not expecting any limits to their capital expenditure.

Business Optimism

- RBS Growth Tracker data shows that businesses continue to expect positive growth over the next 12-months, however the level of optimism fell for a second month in December to 54.7, its lowest level in two years.

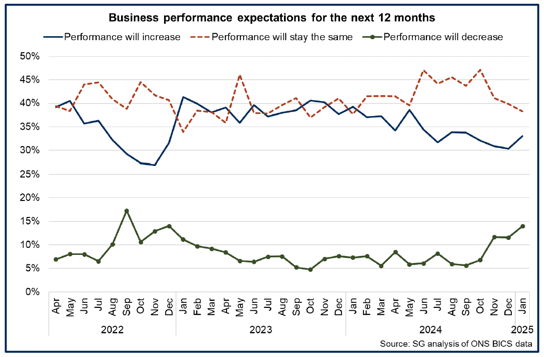

- BICS data for January also showed a softening in business sentiment. In recent months, there has been an increasing share of businesses expecting performance to decrease over the next 12 months (14% in January, up from 6% in September 2024). The share of businesses expecting performance to improve rose to 33% in January however remains below the average of 2024.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback