Publication - Research and analysis

Scottish economic bulletin: December 2023

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Business Conditions

Business activity has weakened further in the third quarter of the year however business optimism for the year ahead has picked up slightly.

Business Activity

- The Purchasing Managers Index (PMI) business survey indicates that business activity in Scotland’s private sector has fallen during the third quarter of the year.[5]

- The business activity indicator was 47.1 in November, slightly improved from October, however was the third consecutive month indicating falling activity with a sharp fall in manufacturing activity (43.2) and a more moderate fall in services activity (48.0).

- A key driver of weaker business activity has been a broad based fall in new business orders across the manufacturing and services sectors, with businesses indicating that weakening demand and economic uncertainty are impacting negatively on sales.

- The findings in the PMI business survey are consistent with the Scottish Business Monitor business survey which also, on balance, indicated a fall in the volume of business activity (-1.2%) and volume of new business activity (-9.6%) in Q3 2023.[6]

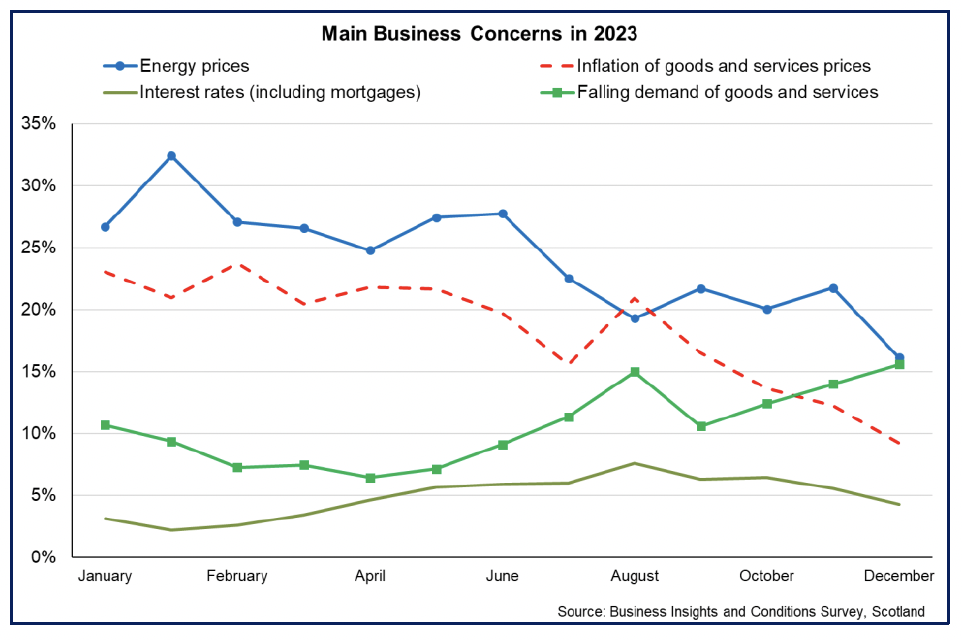

Business Concerns

- The factors weighing on demand reflect the broader concerns that business are currently reporting on business conditions.

- The main concerns reported by businesses in the Business Insights and Conditions survey (BICS) for December is energy prices (16.1%) and falling demand of goods and services (15.6%).[7]

- The former, alongside broader concerns about inflation, has been on a downward trend over the past year as inflationary pressures have eased and businesses have continued to adjust to the change in costs of energy, goods and services over this period.

- The Scottish Chambers of Commerce Quarterly Economic Indicator also showed that concern over inflation had eased in the third quarter, however concern remains high overall and across sectors, particularly in retail and tourism.[8]

- In contrast, there has been rising concern over falling demand for goods and services, reflecting the weakness in demand during the year and the uncertainty in the economic outlook for the year ahead.

- More broadly, the Scottish Business Monitor for Q3 2023 reported that 75% of firms are more concerned than normal about the availability of new staff and 71% about staff retention, while 68% of firms are more concerned than normal about the impact of interest rate rises (a similar proportion to the previous quarter).

- The Scottish Chambers of Commerce Quarterly Economic Indicator for Q3 2023 reported a sharp rise in business concern over interest rates (50%, up from 37%) reflecting the impacts this could have on demand/sales and the cost of borrowing.

- More recently, the BICS data during the fourth quarter of the year shows a declining share of businesses reporting interest rates as a main business concern and may reflect that interest rate expectations have stabilised in recent months with markets expecting that they are at, or near, their peak.

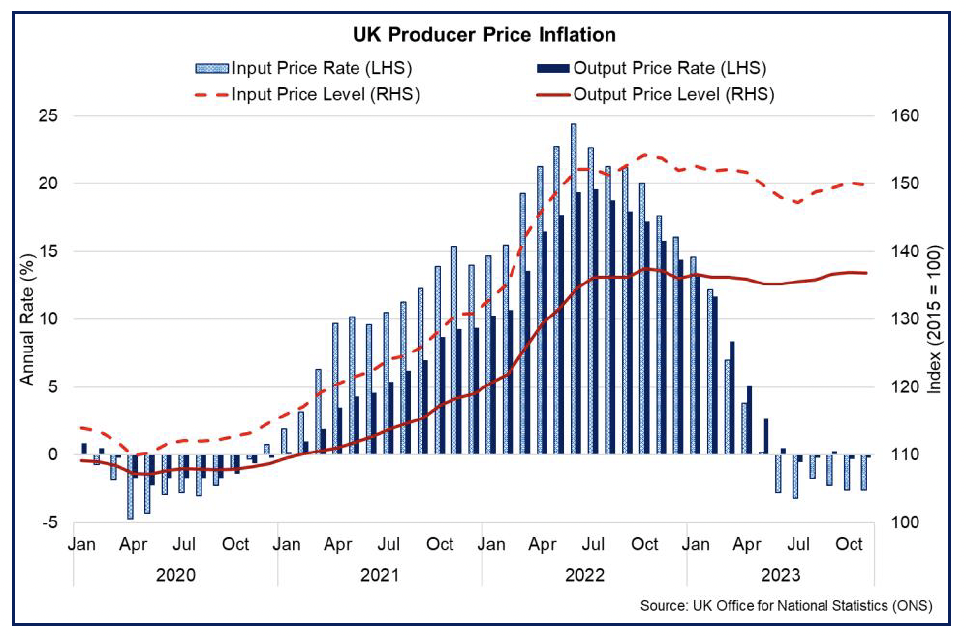

Business Costs

- Cost pressures remain a key concern for businesses following the rapid increase in costs faced by businesses since the start of 2022. In Q3 2023, the Scottish Business Monitor reported that 83% of firms were more concerned than normal about the costs facing business.

- Producer input price inflation (prices of goods bought and sold by UK manufacturers, including price indices of materials and fuels purchased and factory gate prices) fell by 2.6% over the year to November, their sixth consecutive month of annual decline with input price inflation having recently peaked at 24.4% in June last year.[9]

- The change in input prices has also been reflected in producer output prices which fell by 0.2% in the year to November, down from the recent output price inflation peak of 19.6% last July.

- The moderation of energy and wider commodity price inflation has been a key driver of falling producer price inflation with crude oil input costs falling 6.3%, however imported food material costs rose 8.1% over the year.

- Overall, while annual producer price inflation rates have turned negative, with prices in some sectors falling, the index levels for input and output prices are 29% and 25% higher than at the start of 2021, illustrating the rapid rise in producer price levels over this period as a whole.

- Looking across a broader range of input costs (energy, materials and staffing) the PMI business survey indicates that business input costs continued to rise in November, though at one of its slowest rates since the start of 2021.

- The Scottish Chambers of Commerce Quarterly Economic Indicator and the Scottish Business Monitor report that labour costs remained the main cost pressure for businesses in Q3 2023, followed by energy, and are expected to remain so during the coming year.

- BICS data for Scotland provide latest insights into the changing effects on businesses of price rises. In November, 53.9% of businesses reported that they had to absorb costs, 23.1% reported having to pass on price increases to customers and 14.5% had to change suppliers. A much lower percentage of firms reported having to make redundancies (2.4%).

- The slight downward trend in the share of businesses reporting to be absorbing costs potentially reflects the slowing pace of input cost rises while the recent downward trend in businesses reporting to pass on price increases to customers could partly reflect weakening demand facing businesses in the third quarter of the year.

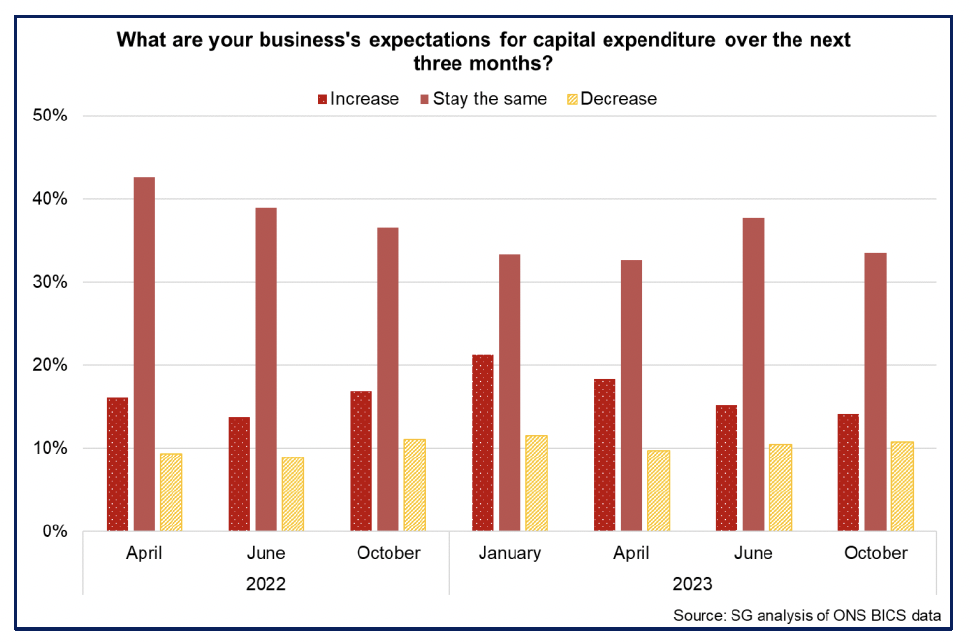

Business Investment

- The combination of business concerns around inflationary pressures, higher interest rates and weakening demand is impacting on business investment decision making.

- The Scottish Business Monitor indicates business investment remained weak in Q3 2023, with 47% of businesses cancelling or delaying planned investment over the last 12 months, up from 40% in the previous quarter. Reported reasons were economic uncertainty (71%), affordability (66%) and borrowing costs (40%).

- The Scottish Chambers of Commerce Quarterly Economic Indicator for Q3 2023 reported a similar stalling in businesses investment (particularly in training investment) with over half of businesses reporting no change. Construction firms, on balance, reported a contraction across all investment trends for the first time in three years, while 70% of manufacturing firms reported no changes to total investment. In the services sector, investment remained positive on balance in the financial and business services sectors, albeit that at least half of firms indicated no changes to investment while half of firms in the retail and wholesale sector expect investment to fall in the next quarter.

- BICS data for Scotland in October show 14.2% of respondents thought their capital expenditure would increase over the next three months, showing a slight improvement from the middle of last year but lower than the start of this year, while around 10.7% of respondents continue to expect to decrease capital expenditure over the coming year.

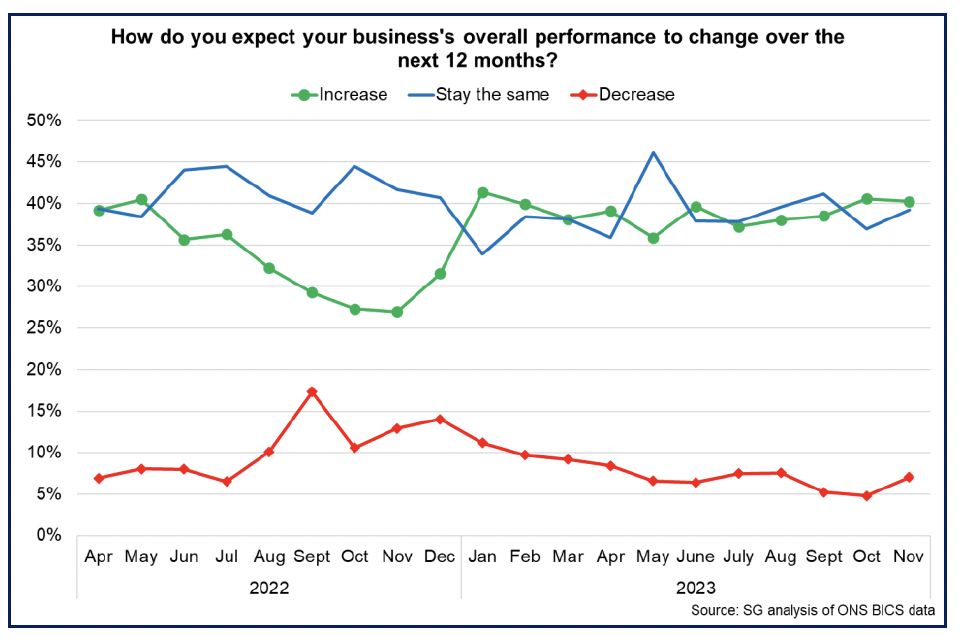

Business Optimism

- Looking ahead, PMI business survey data indicates that business optimism for growth over the coming year remains positive on balance, however the level remains below the series average despite rising to a 5-month high in November.

- This optimism for strengthening demand is partly reflected in the PMI data indicating that firms have continued to add to their staffing numbers and at the strongest pace in six months.

- BICS data for Scotland also indicates that during the second half of the year, there has been a slight increase in the share of firms expecting their business performance to increase over the coming year (40.3%) or stay the same (39.2) while 7% of businesses expect performance to decrease.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback