Publication - Research and analysis

Scottish economic bulletin: December 2023

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Consumer Activity

Consumer sentiment has strengthened over the year, however consumers continue to be impacted by inflation and higher interest rates.

Consumer Sentiment

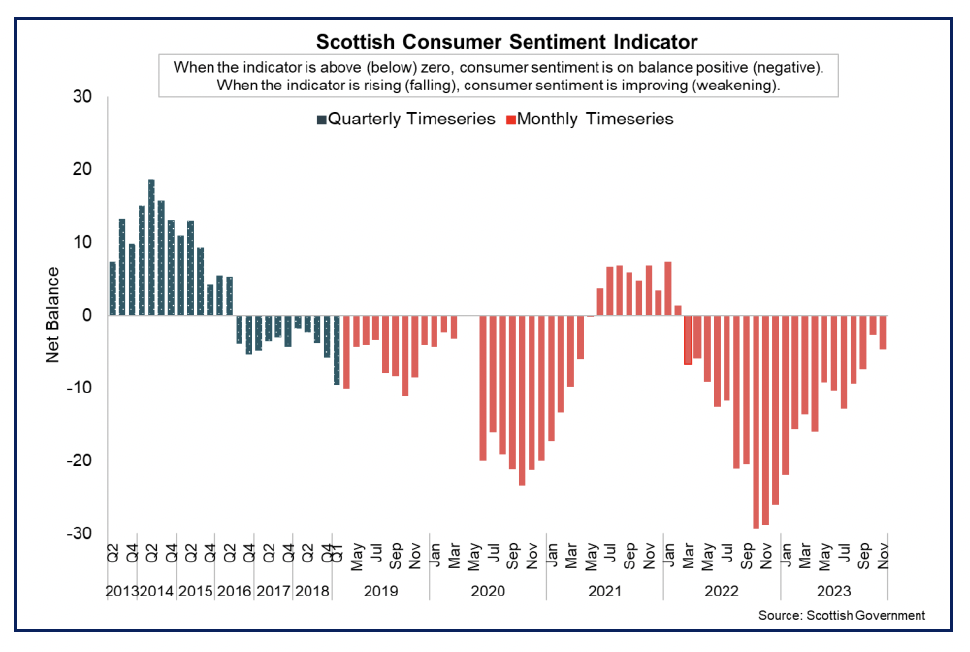

- Consumer sentiment indicators currently reflect the pressures that households face from higher inflation and interest rates and highlight the risks of weak consumer confidence to the economic outlook.

- Following a sharp drop in sentiment to -29.4 in October 2022, consumer sentiment has strengthened significantly over the past year with latest data for November 2023 showing the consumer sentiment indicator at -4.6, having fallen by 1.9 points over the month.[16]

- Consumer sentiment has improved significantly from last year, however it remains negative overall and reflects the concerns that households have for the economy, their household finances and how relaxed they feel about spending money.

- Repondents continue to report on balance that circumstances regarding the economy and their household finances are weaker than a year ago. While these sentiment indicators are generally on an upward trend, their negative scores (-3.6 and -10.7 respectively) reflect the challenging cost of living circumstances that households currently face.

- This is reflected in the spend indicator (-21.5) which remains significantly negative and reflects that respondents are not currently relaxed about spending money.

- Looking ahead, respondents expect the economy and their household finances to improve over the coming year with both indicators reporting a positive net balance (12.1 and 0.5 respectively).

Cost of Living and Spending

- The rise in cost of living and higher interest rates have progressively fed through to household decisions on spending (essential and non-essential) saving, and borrowing (including financing outstanding borrowing).

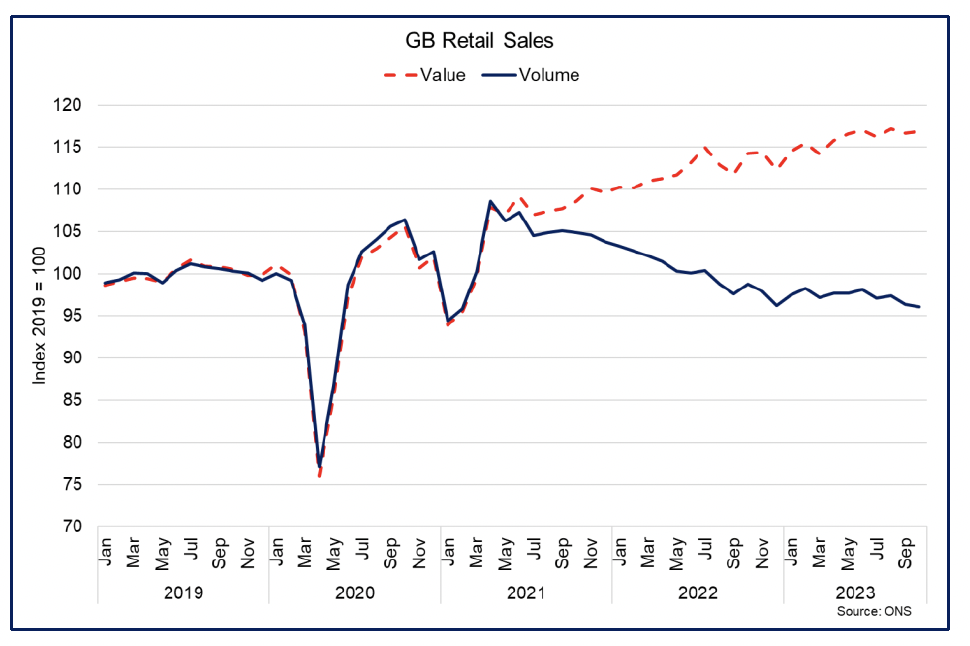

- For example, retail sales volumes in Great Britain have broadly stabilised over 2023 having adjusted back towards pre-pandemic levels over 2022. Latest data show sales volumes fell 2.7% over the year to October, however sales value grew 2.2%, with the divergence continuing to reflect the pace of rising prices.[17]

- Similarly the rise in prices and interest rates have had a significant impact on the amount UK conumers are paying for their energy costs, mortgages and other loans. In November the average monthly direct debit payment for electricity and gas was £177.49 (up 42% compared to November 2021), however has fallen 1% compared to November 2022.[18]

- More broadly, the average monthly direct debit payment for mortgages was £891 in November (up 13% over the year and 24% since 2021) and £252 for loans (up 4% over the year and 19% since 2021).

- The sharp increase in prices has been accompanied by an increase in the direct debit failure rate (the percentage of transactions that fail due to insufficient funds), reflecting the challenges facing some household budgets. For electricity and gas payments, the payment failure rate has risen to 1.21% (up from 0.93% in November 2022), while for mortgages it has risen to 0.47% (up from 0.37% in November 2022), though has remained broadly stable since May.

- More broadly in November/December, the ONS Public Opinions and Social Trends survey showed that 41% of respondents were finding it very or somewhat difficult affording energy bill payments and 37% for mortgage and rent payments. For energy bills, this was slightly lower than at the same point in 2022 (c. 47%), however has risen for mortgages payments from c.33% and potentially reflects the changing composition of inflationary pressures.[19]

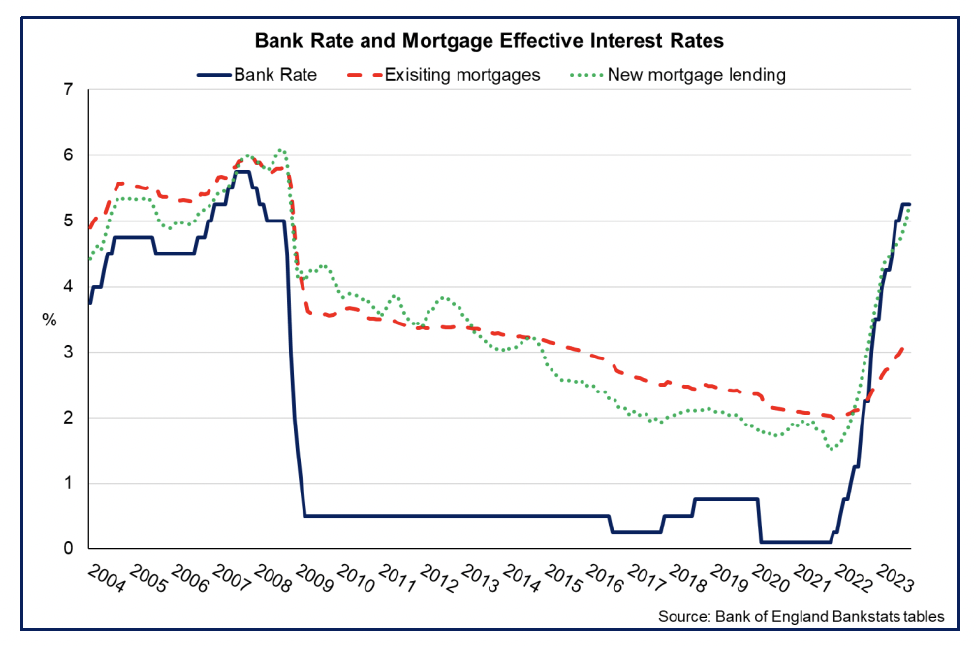

- The more gradual but recent impacts of rising interest rates on mortgage payment challenges compared to energy payments, reflects the rise in interest rates over the past year but also the time it takes for the full impact of the increase in Bank Rate to be felt at an aggregate level due to the high share of mortgages that are on a fixed rate.

- Reflecting this, the ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages rose from 5.01% in September to 5.25% in October while the rate on the outstanding stock of mortgages rose from 3.14% to 3.2%.[20]

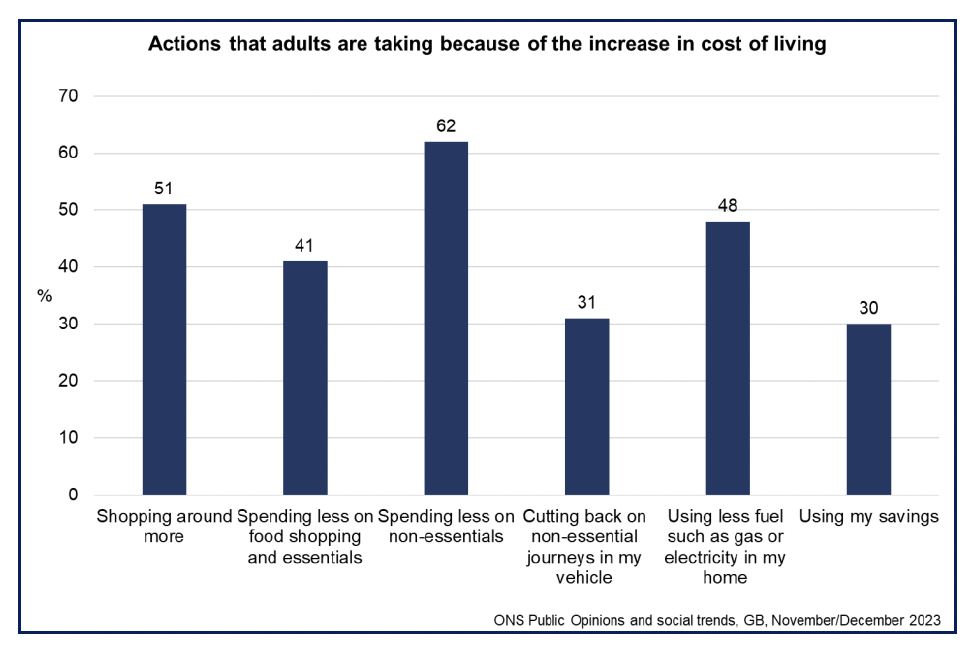

- In response to the change in cost pressures facing households, ONS Public Opinions and Social Trends survey data from November/December show that the most common actions people were taking in response to the increased cost of living were spending less on non-essentials (62%) and shopping around more (51%). 48% reported using less fuel such as gas or electricity in their home and 41% reported spending less on food shopping and essentials.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback