Scottish economic bulletin: December 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Inflation

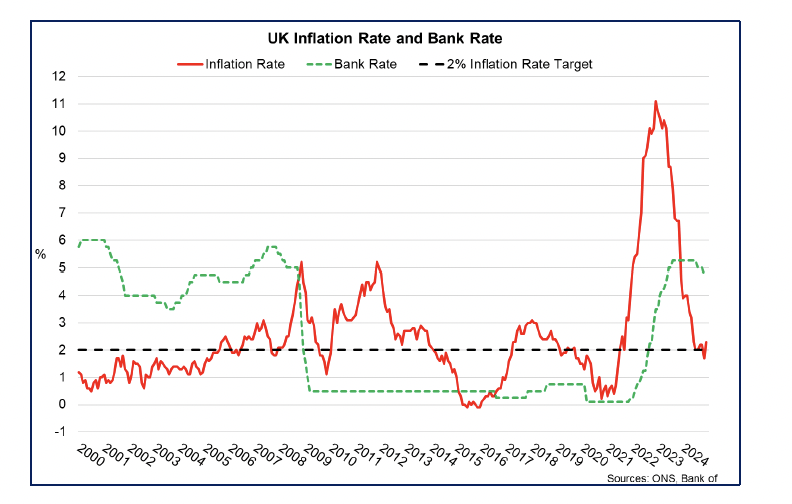

Inflation increased to 2.3% in October, broadly in line with forecasts of above target inflation over the fourth quarter.

- The inflation rate rose from 1.7% in September to 2.3% in October. This rise above the 2% target rate was in line with expectations of slightly above target inflation going into the final quarter of 2024.[2]

- The latest increase was partly driven by an increase in electricity (7.7%) and gas (11.7%) prices in October although both are lower compared to last year, by 6.3% and 7.3% respectively. The recent movements partly reflect the 1.2% rise in the Ofgem energy price cap for the final quarter of the year.[3]

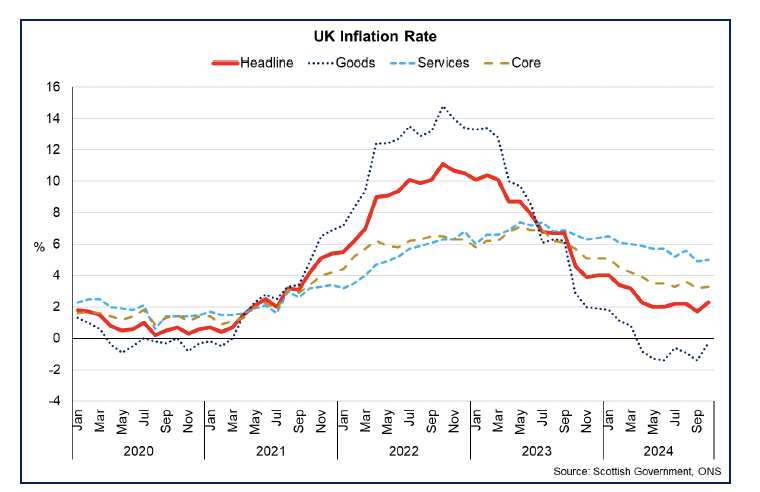

- The core inflation rate, which excludes energy, food, alcohol, and tobacco, rose from 3.2% in September to 3.3% in October, although it remains below the average annual rate over the past year of 4%. More broadly, the divergence in goods and services inflation continues to persist with further deflation in goods prices (-0.3%, up from -1.4%) while services price inflation remained elevated and increased from 4.9% to 5%.

- In response to lower and more stable inflation, the Bank of England’s Monetary Policy Committee (MPC) have started to gradually loosen monetary policy in the second half of the year, reducing interest rates on two occasions from their recent peak of 5.25% in August to 4.75% in November. Markets expect further gradual reductions in the new year, however the combination of domestic fiscal changes alongside global factors continues to present uncertainty for the inflation outlook.[4]

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback