Scottish economic bulletin: December 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Business Conditions

Business activity has continued to grow in the second half of the year though the pace of growth has eased.

Business Activity

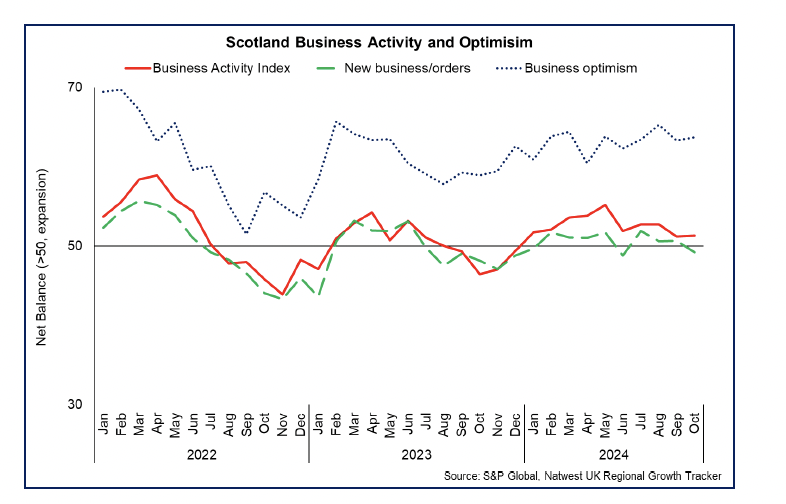

- The RBS Growth Tracker business survey indicates that business activity in Scotland’s private sector continued to grow in October (51.3) and further extended the current pattern of positive growth since the start of the year.[5]

- However, the indicator was broadly unchanged from September and remains weaker than in recent months, reflecting that the pace of activity growth has eased in the second half of the year. Furthermore, the services sector continued to drive growth in new business which offset a fall in new orders in the manufacturing sector.

- This remains consistent with the Fraser of Allander Institute’s Scottish Business Monitor for Q3 2024, which reports that businesses in Scotland experienced a slight fall in activity over the quarter, with the Volume of Business Activity indicator falling from 4.5 points in Q2 2024 to -0.8 in the third quarter.[6]

Business Concerns

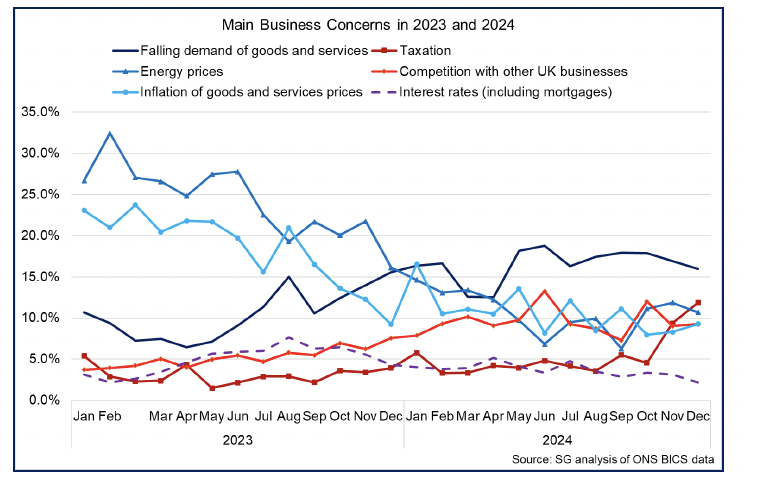

- Slowing activity is reflected in the latest Business Insights and Conditions Survey (BICS) data on business concerns going into December, with the most commonly cited concern being falling demand of goods and services (16.0%). While this is down slightly from recent months, the level of concern remains higher than in 2023.[7]

- Concerns around some issues have fallen over the course of 2024 as inflationary pressures have eased and interest rates have been reduced. In December, 10.7% of businesses flagged energy prices as a concern, down from 16.1% in December 2023 and a significantly lower share than during the energy price shock in 2022 and 2023. However, these concerns have increased in recent months, from their low of 6.3% in August.

- Furthermore, businesses have decreasingly cited inflation of goods and services (9.3%) and interest rates (2.2%) as causes for concern. Similarly, the Scottish Business Monitor for Q3 2024 reported that the cost of credit has become less of a concern for businesses, with 30% of firms reporting this as their key cost driver (down from 38% last year).

- In contrast, business concerns around taxation have picked up in recent months, with 11.9% of businesses reporting this as a concern in December, its highest rate in the timeseries. This sharp increase since October follows the announcements impacting businesses in the UK budget on 30th October, such as the changes to the employer National Insurance Contributions. The Box below presents new analysis on the impact of changes to employer National Insurance Contributions on different industries in Scotland.

- Business concerns vary at a sector level, with accommodation and food services businesses more commonly reporting worries around energy prices (21.0%) and inflation (20.7%), while key concerns for the information and communication sector are falling demand (18.0%), and taxation (17.5%).

Business Costs

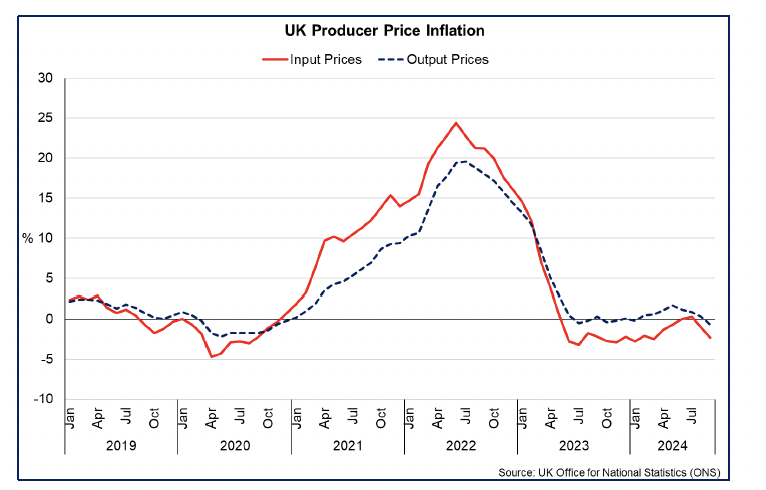

- At a headline level, producer input prices fell by 2.3% over the year to October 2024, down from a fall of 1.9% in September. The key driver of this was the fall in the input price of crude oil (down 22.5% annually). In terms of the feed through to output prices, producer output prices fell 0.8% over the year to October and at their fastest rate since August 2023.[8]

- More broadly, Scottish business survey data from the RBS Growth Tracker also indicates that the growth in input and output cost pressures has been more stable in the second half of the year, with the measures in October at 58.8 and 54.4 respectively. This indicates that input and output costs are continuing to rise, driven by a combination of labour and material costs, however the pace of change is more stable compared to recent years.[9]

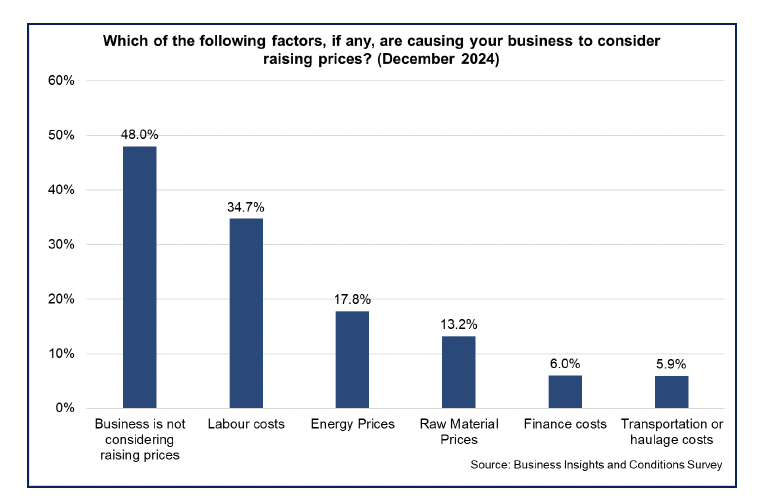

- Looking ahead, latest BICS data show 48% of businesses are not considering raising prices, however labour costs (34.7%), energy prices (17.8%) and raw material prices (13.2%) are the most commonly cited factors for businesses to consider raising prices.

Box: Impact of changes to employers National Insurance Contributions on different industries

As set out above, the number of businesses reporting taxation as a concern has increased since October. This follows the increase in the rate of employer National Insurance Contributions (NICs) from 13.8% to 15% and a reduction in the NICs threshold from £9,100 to £5,000 from April 2025 announced in the Autumn Budget. This was expected to result in private sector businesses in the UK facing increased costs of around £19 billion in increased employer NICs, prior to any behaviour change.

To help mitigate some of the impact of this change on small businesses, the UK Government also increased the employment allowance, which is the amount of employers’ NICs which businesses can incur before they have to start making payments. This threshold is being raised from £5,000 to £10,000 a year.

According to the Office for Budget Responsibility (OBR), HMRC has estimated that these changes will affect 1.2 million employers in the UK. Of these, 250,000 will be better off and 940,000 will be worse off. A further 820,000 will see no change. After the changes, they estimate that 865,000 of businesses will pay no NICs at all. The impact of the changes is therefore likely to be concentrated on larger employers. However, although many businesses will not be affected, those that are affected will account for the majority of employment.

Directly estimating the impact of the employer NICs changes on businesses is difficult, as the impact will vary depending on a range of factors, such as their use of part time staff. To look at the impact in Scotland at the aggregate level, we use data on Employer NICs from the Scottish Annual Business Survey for 2022, which provides data on most private businesses, apart from the financial services sector and some parts of agriculture.

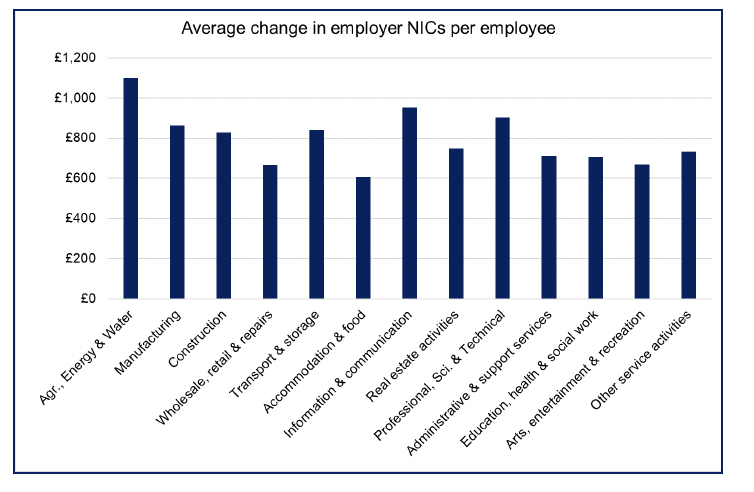

In order to focus on the impact on firms most affected by the policy changes, we look at the impact on firms that have 10 or more employees. This captures around 1 in 4 businesses in the survey, although they account for around 80% of private sector employees. We further assume that 10% of employees in all industries will not attract employer NICs. These broad assumptions mean that, for affected businesses, the average increase in NICs per employee is estimated to cost a business £850 and the total cost to the average business is around £24,500. These are broadly similar to the OBR’s estimates of ‘in excess of £800 per employee’ and around £26,000 per business.

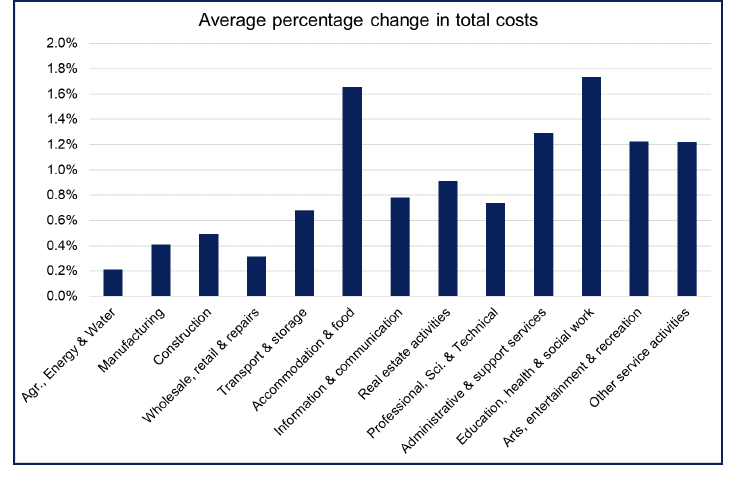

As shown in the chart below, the distribution of costs associated with the changes in employer NICs is not expected to be felt equally across industries. Looking at cost per employee, the impact is likely to be lowest in the accommodation and food services sector, where staff on average earn less, with a higher prevalence of part time staff.

However, looking at the change in total costs, this sector sees one of the largest impacts. Here the pattern reflects the importance of staff costs across different industries. It also highlights that the decision to reduce the threshold at which employers start paying NICs means that businesses with relatively more lower earning staff will see a proportionately greater increase in their costs. Total costs for a business in the accommodation and food services industry are estimated to increase by 1.7%, or around £15,500 per business. Similarly, affected businesses within the Education, Human Health, and Social Work industry will face an estimated increase in costs of around £30,000 per business. These differences reflect differences in the average number of employees per business in the different industries.

It should be noted that there are a number of limitations to this analysis. Estimates of employer NICs are based on the wage and salary of the average employee. In industries with high levels of part time staff, this will be a weaker approximation of the actual costs per employee, which will vary based on the actual wages and salaries paid. It also does not assume any behavioural change such as changing business models, substitution of capital for labour (automation) or reduction in staff hours or employment. However, the analysis gives a broad indication of how impacts are likely to vary across different industries.

Business Investment

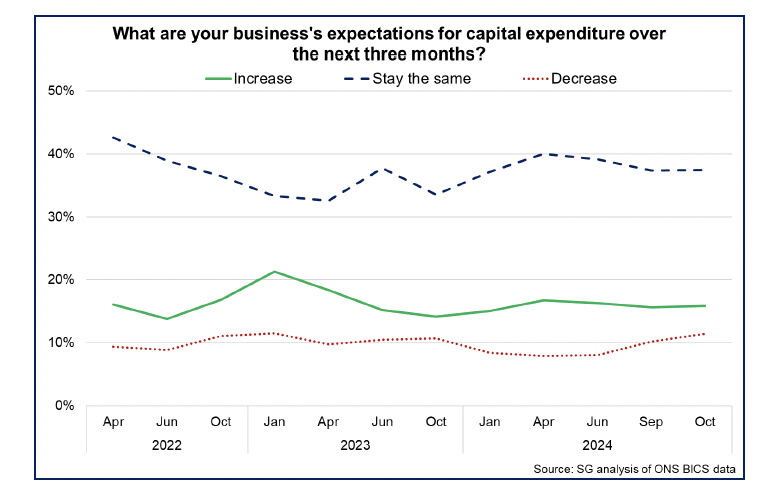

- Latest business surveys for 2024 show that indicators of new capital investment have improved from 2023 but generally remain weak overall with the combination of business concerns around demand, cost pressures and borrowing costs continuing to weigh on business investment decision making.

- BICS data indicate that the majority of businesses continue to expect capital expenditure to remain the same (37.4%) or increase (15.6%) in the final quarter of the year. However there has been a slight increase in the share of businesses expecting to decrease capital expenditure in the second half of 2024 (10.2%), compared to the first half of 2024.

- Of those businesses expecting to authorise capital expenditure, 48.1% report that it will be for replacements, with fewer respondents intending to provide new services ( 6.8%) or purchase new technology (8.4%). Business investment is also being directed to increase efficiency (18.3%) and expand capacity (15.1%).

- The Scottish Business Monitor reported that levels of new capital investment remained negative in Q3 2024 (-5.4) though has improved in recent quarters and is it at its highest level since Q1 2023.[10] Additionally, the Scottish Chambers of Commerce Quarterly Economic Indicator for Q3 2024 suggests that investment trends are seeing positive growth across most sectors.[11]

Business Optimism

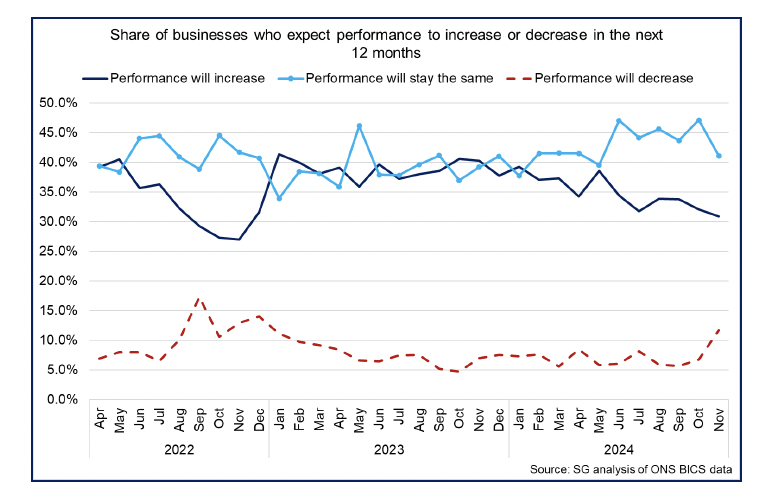

- As outlined above, RBS Growth Tracker data shows that the outlook for businesses in Scotland over the next 12 months remains positive in October (63.7), with the measure on an upward trend over the past year and most recently increasing marginally from September.

- Similarly, BICS data for November indicates that most businesses expect their overall business performance to stay the same (41.1%) or increase (30.9%) over the coming year. However, in the second half of the year, the share of businesses expecting performance to increase has fallen, with more businesses expecting performance to remain stable over the next twelve months. Furthermore, there has been an uptick in the proportion of businesses expecting their performance to decrease in the coming year, rising from 6.8% in October to 11.7% in November, its highest level since December 2022 (14%).

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback