Scottish economic bulletin: December 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Labour Market

The unemployment rate fell over the most recent quarter to 3.3% while real terms earnings growth remains robust.

Employment, Unemployment, and Inactivity

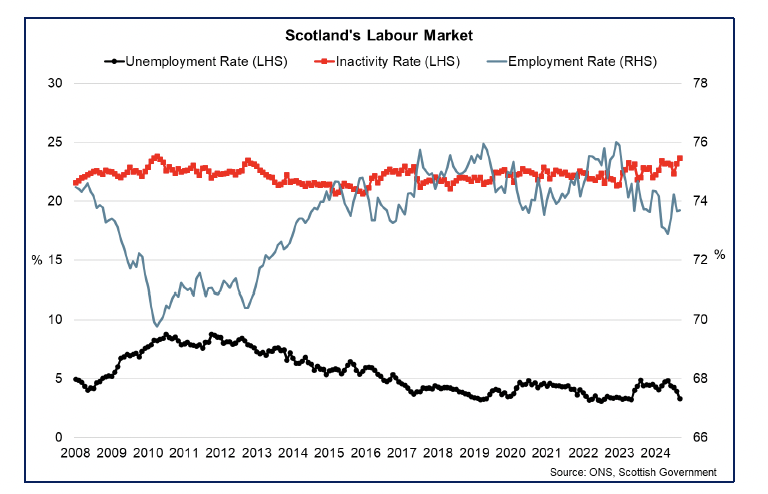

- The labour market in Scotland continues to show strength in the second half of 2024 with low unemployment and high, stable levels of employment, however there are indications that labour market tightness has eased from 2023.

- Latest Labour Force Survey data for July to September show that Scotland’s unemployment rate fell 1.1 percentage points over the quarter, and annually, to 3.3%. The employment rate rose 0.3 p.p over the quarter, while staying flat over the year, to 73.7%. The inactivity rate has increased by 0.6 p.p over the quarter and 0.8 p.p annually to 23.7%.[12]

- The ONS notes that the Labour Force Survey (LFS) estimates have been affected by increased volatility, resulting from smaller achieved sample sizes, meaning that estimates should be treated with caution. The Bank of England has stated that there remains considerable uncertainty over statistics derived from the LFS, making it more difficult to gauge the underlying state of the labour market. The Chief Statistician for the Scottish Government has noted that lower response rates to the survey following the pandemic have reduced our confidence in the estimates from the survey. The ONS are working towards an online-first Transformed Labour Force Survey (TLFS), which is viewed as the long-term solution to the falling response rate. [13],[14],[15]

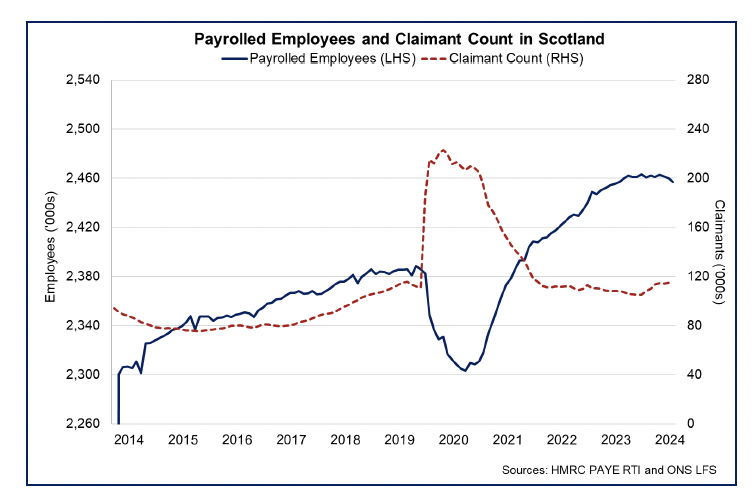

- Wider labour market data also continues to demonstrate robustness in the labour market in October and indicate some loosening in conditions. In October, the number of payrolled employees in Scotland decreased marginally over the month by 0.1% to 2.46 million, with growth flat over the year. Alongside this, Scotland’s claimant count unemployment rate increased slightly in October to 4% (up from 3.9% in September) with the number of claimants increasing by 6,572 over the year to 114,781.[16],[17]

Recruitment Activity

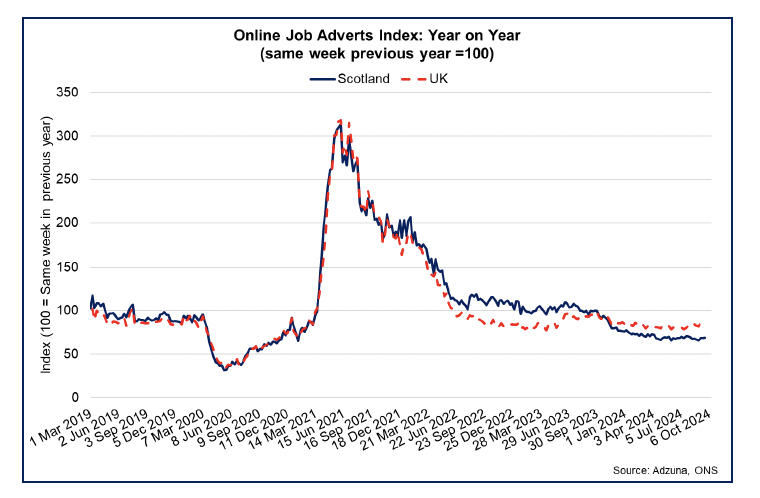

- Recruitment levels have broadly stabilised in the second half of 2024, with latest vacancies and business survey data remaining largely unchanged in recent months.

- Online job adverts continued to stabilise in October around their pre-pandemic levels, having fallen 30% over the past year from elevated levels in 2022 and 2023 and indicates a slight loosening in labour market conditions.

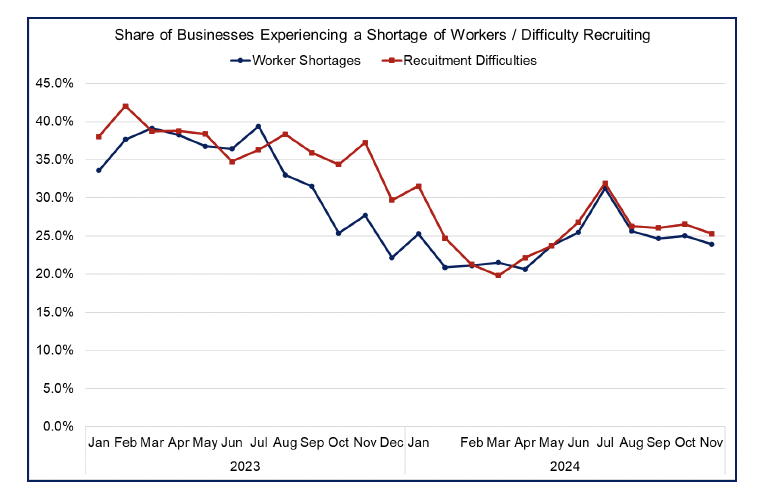

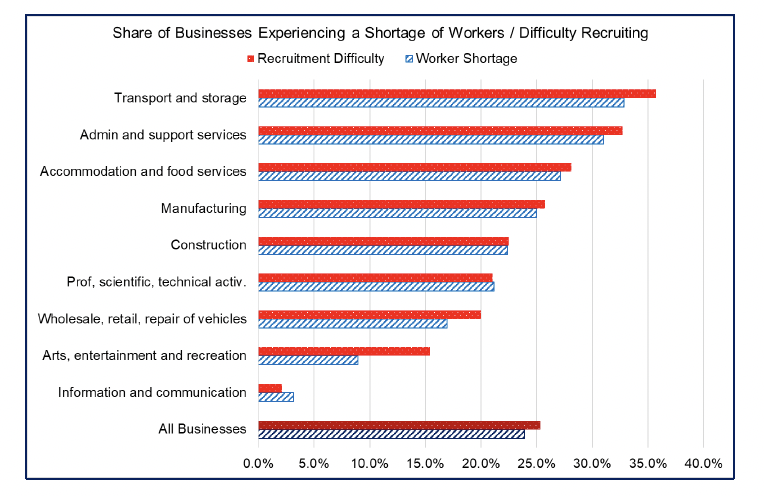

- Business surveys continue to indicate businesses are facing recruitment difficulties and worker shortages across different sectors. In November, BICS data show that 25.3% of businesses were experiencing recruitment difficulties and 23.9% were facing worker shortages. These indicators have broadly stabilised in recent months following an increase over the course of 2024, peaking in the middle of the year.

- At a sectoral level, worker shortages and recruitment difficulties in November were particularly concentrated in the transport and storage sector, admin and support services and accommodation and food services. In contrast, employers in the arts, entertainment and recreation sector, and the information and communication sector, were notably less likely to report these challenges.

- Latest data from July show most businesses responded that a lack of qualified applicants (46.9%) alongside a low number of applications (37.7%) underpinned their recruitment challenges, while 12% of businesses felt their business could not offer an attractive pay package to applicants.

Earnings

- Labour earnings have remained resilient despite the slight softening in the labour market over the past year. The pace of earnings growth alongside falling inflation has caused earnings to steadily grow in real terms.

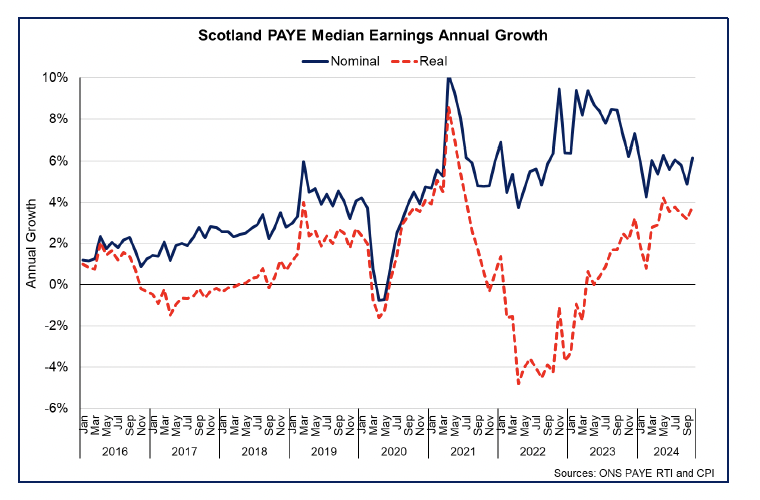

- Nominal median monthly PAYE pay in Scotland was £2,466 in October, and grew 6.2% on an annual basis. This was a rise from 4.9% annual growth in September and is above the average annual growth rate over the past nine years of 4.2%. While remaining strong, the pace of wage growth has decelerated from 9% growth seen in 2023.[18]

- In real-terms, adjusting for inflation, earnings grew by 3.8% on an annual basis in October. This is up from 3.2% annual real-terms growth in September and continued the current pattern of positive annual real terms growth following the period of falling real pay during 2022 and the start of 2023.

- The outlook for earnings growth is also one of continued real wage growth. At a UK level, the Bank of England Decision Maker’s Panel (DMP) indicates that wage growth remains strong albeit that the pace of growth is on a downward trajectory. On average, respondents in the three months to October anticipated year-ahead wage growth of 4.1%, having reported 5.6% annual wage growth in the 3-months to October.[19]

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback