Scottish economic bulletin: December 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Consumer Activity

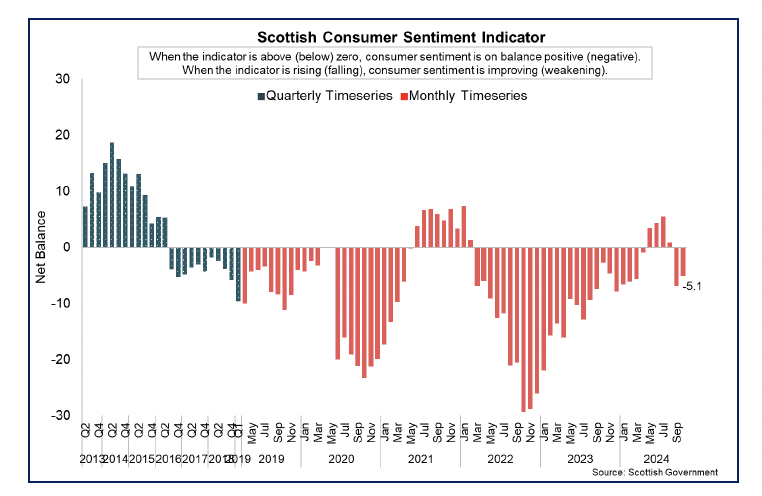

Consumer sentiment has improved significantly from last year, and latest data suggests negative but improving sentiment at the end of the year.

Consumer Sentiment

- The Scottish Consumer Sentiment Indicator reflects how households think the economy is performing, how secure they feel about their household finances and how relaxed they feel about spending money.

- Consumer sentiment has improved from -6.9 points in September to -5.1 in October, an increase of 1.8 points, although remains negative. This means that on balance, consumer sentiment is still negative, but less so than in September and remains higher than it was during the opening months of 2024.[20]

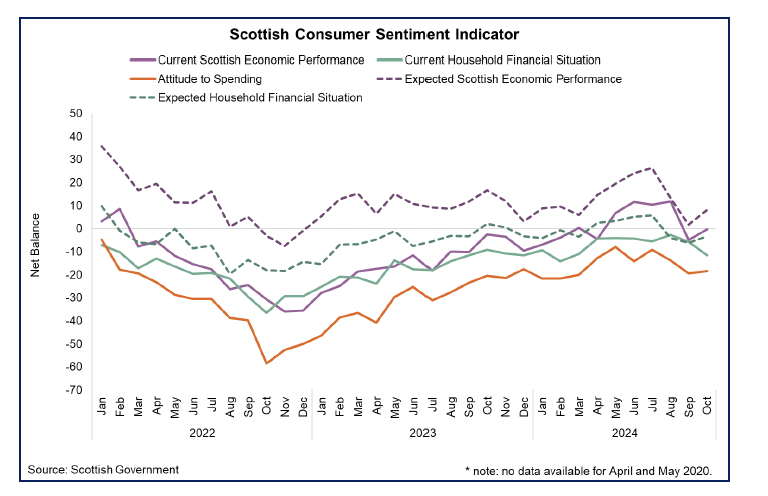

- The main driver of the rise in sentiment over the month was increasing sentiment regarding economic performance. The current economic performance indicator increased by 4.6 points to ‑0.4 while the economic expectations indicator increased by 6.4 points to 8.2 points, indicating that respondents expect the economy to strengthen over the coming year, and to a greater extent than last month.

- Attitudes to spending and expectations of household financial security also improved in October. The attitude to spending indicator increased by 1 point to -18.5 while the expected household financial security indicator increased by 2.8 points to -3.3. While these indictors have strengthened, they remain in negative territory and alongside the 5.9 point fall in current financial security to -11.7, they collectively continue to reflect the challenges facing household finances.

- The latest movements are in line with consumer sentiment indicators at a UK level, with the GfK Consumer Sentiment Indicator also rising slightly in November while remaining in overall negative territory, which they attribute to reduced levels of uncertainty over the month.[21]

Cost of Living and Spending

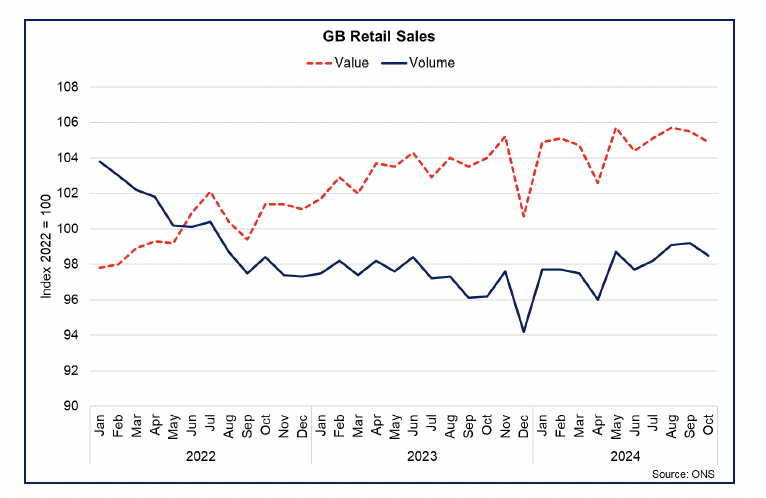

- Inflation has broadly returned to near its target rate, however the sharp rise in the cost of living over 2022 and 2023 and the increase in interest rates over that period, continue to impact households and their spending, saving and borrowing behaviour.

- Retail sales volumes in Great Britain have dipped slightly in the latest data for October, having gradually returned to around their mid-2022 level over the course of this year. Retail sales volumes grew 0.8% in the three months to October and have grown 2.5% when compared to the same period last year, its fastest rate of growth since March 2022. In value terms, retail sales grew 0.3% in the three months to October and 1.5% over the year.[22]

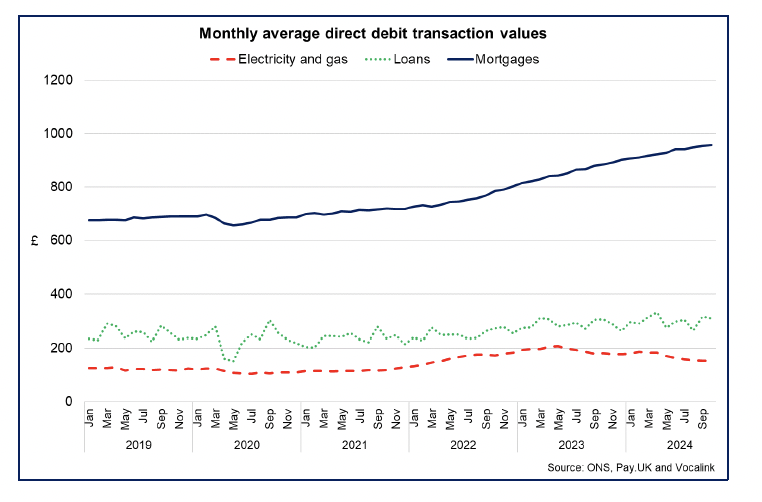

- Easing inflation and changes to monetary policy and borrowing costs have also impacted wider consumption, influencing the amount households are paying on mortgages, energy bills and other loans. The average UK direct debit transaction value for electricity and gas rose 0.8% in October to £154.59. This coincides with the increase in the energy price cap for Q4 2024, however the average electricity and gas transaction value fell 14.7% over the year.[23]

- Mortgage direct debits also rose in October, albeit more moderately by 0.3% to £957.88 (an 8.2% annual increase). Direct debits for other loans have remained largely stable in this period, rising by 1.6% over the year to £309.14 in October.

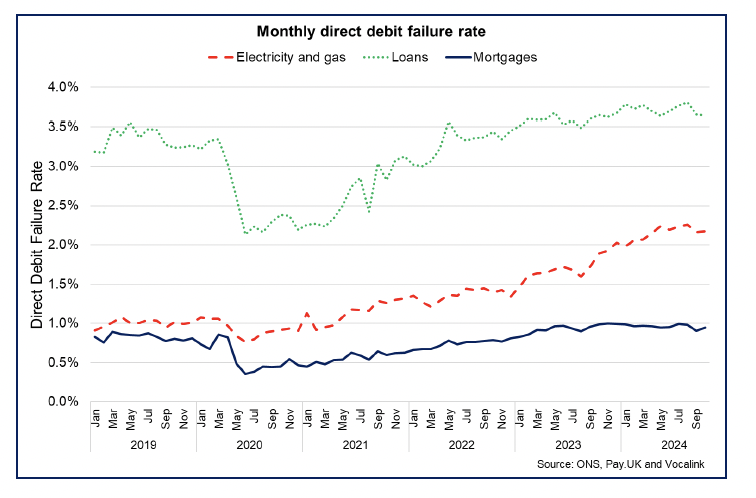

- The increased costs of mortgages and energy bills relative to previous years have also affected the rate of direct debit failures (the percentage of transactions that fail due to insufficient funds), demonstrating the pressure these changes have had on household finances. For electricity and gas payments, the payment failure rate was at 2.18% in October (up from 1.89% in October 2023), while for mortgages the payment failure rate has remained relatively more stable over the year, falling to 0.90% (down from 0.99% in October 2023).

- More broadly in October, the ONS Public Opinions and Social Trends survey showed that 33% of respondents found it very or somewhat difficult to afford energy bill payments (down from a peak of 49% in 2023) while 35% of respondents said the same for mortgage and rent payments (down from a peak of 46% in July 2023).[24]

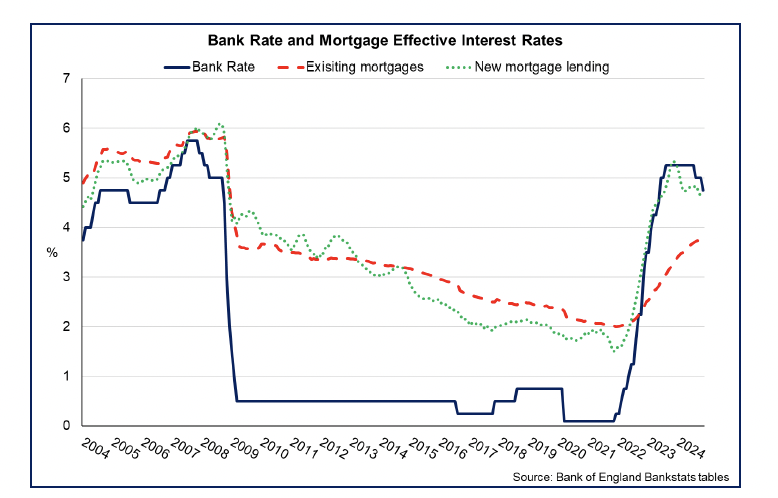

- The more gradual and persistent impacts of higher interest rates on mortgage payment challenges compared to energy payments reflects the sharp rise in the Bank Rate between the end of 2021 and middle of 2023 and the time it takes for the impacts of interest rate changes to be felt at an aggregate level. This is because of the high share of mortgages that are on a fixed rate.

- Reflecting this, the ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages fell to 4.61% in October, down from 5.25% at the same time last year, in line with falling interest rates. However, with an increasing number of households refinancing existing mortgages at higher interest rates than previously, the effective interest on the outstanding stock of mortgages continues to rise, standing at 3.78% in October 2024 compared to 3.2% in October 2023.[25]

- Latest analysis from the Bank of England Financial Stability Report shows that the share of UK households in arrears or with high debt-servicing burdens has remained relatively low. The report notes that the outlook for mortgage borrower resilience has improved in line with the domestic economic outlook. While around half of mortgagors in the UK are likely to experience greater borrowing costs over the next three years as they refinance onto higher rates, around a quarter of borrowers are expected to benefit from lower rates. [26]

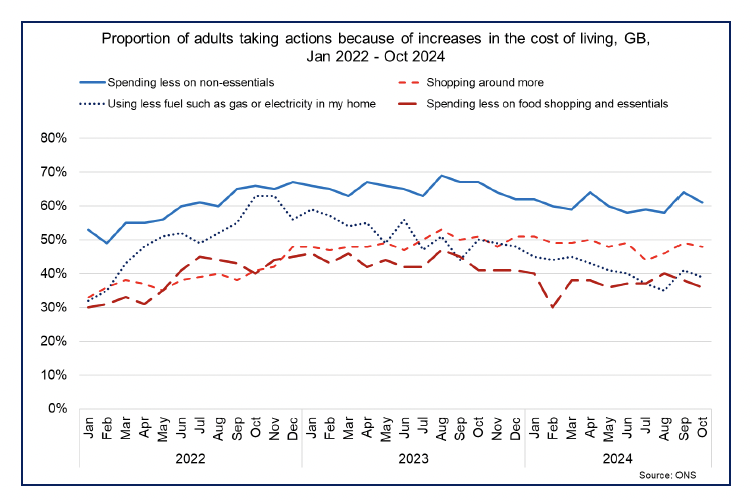

- In response to the change in cost pressures facing households, ONS Public Opinions and Social Trends survey data from October show that the most common actions people are taking in response to the increased cost of living continue to be spending less on non-essentials (61%) and shopping around more (48%). A further 39% reported using less fuel such as gas or electricity in their home and 36% reported spending less on food shopping and essentials.

- These figures have remained broadly consistent over the course of 2024. However, a longer-term view of this data suggests that, following a relatively sharper uptake in these actions over 2022 and 2023, the flatter downward trajectory over 2024 indicates that cost of living continues to be a challenge to household budgets, and that it will take time for a stabilising price environment and strong earnings growth to influence consumer behaviour.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback