Scottish economic bulletin: January 2025

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Inflation

Inflation increased to 2.6% in November, slightly higher than forecast.

- The inflation rate rose from 2.3% in October to 2.6% in November. While slightly higher than forecast in the Bank of England’s latest Monetary Policy Report, it is broadly in line with forecasts of higher inflation in the final quarter of the year and leading into 2025.[2],[3]

- The latest increase was mainly driven by an increase from transport in which there were upward price effects from motor fuels and second-hand cars which partially offset downward effects from air fares.

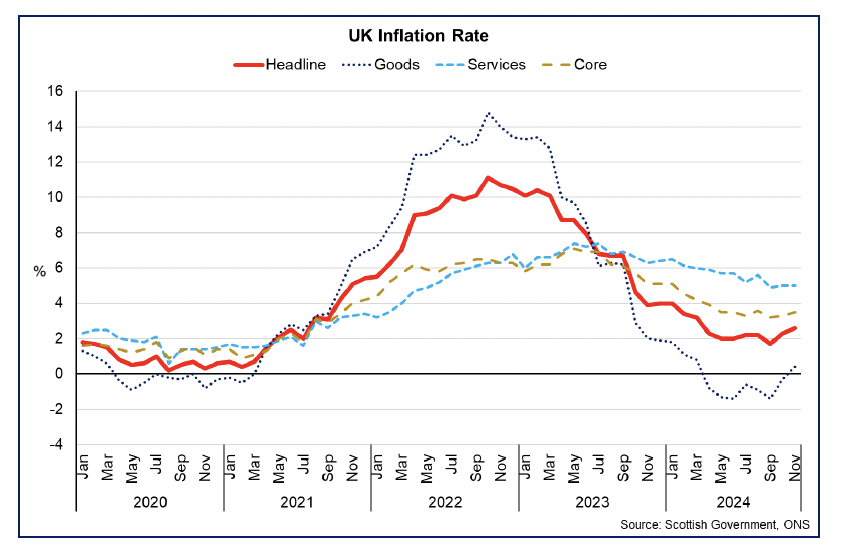

- The core inflation rate, which excludes energy, food, alcohol, and tobacco, rose from 3.3% in October to 3.5% in November. While there continues to be a notable difference in goods and services price inflation, goods prices rose for the first time in November following seven consecutive months of annual deflation rates. Goods prices rose by 0.4% in the 12 months to November, up from -0.3%, while services price inflation remained unchanged at 5.0%.

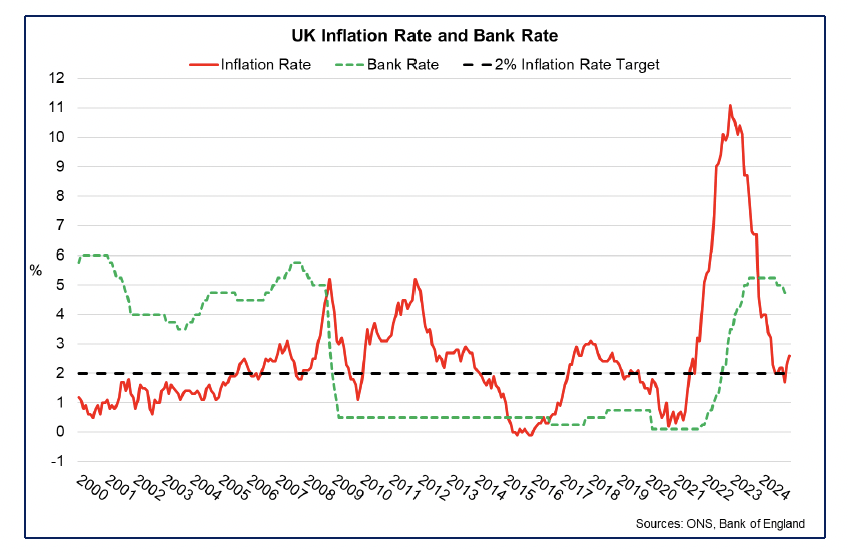

- Reflecting on latest inflation data and wider price drivers, the Bank of England’s Monetary Policy Committee (MPC) maintained the Bank Rate at 4.75% in December citing that domestic inflationary pressures are resolving slower than anticipated.

- The MPC is gradually loosening monetary policy as inflationary pressures continue to stabilise and has reduced the Bank Rate twice in the second half of 2024 from its recent peak of 5.25% to 5.00% in August and to its current rate of 4.75% in November. Markets continue to expect further gradual reductions in 2025, although these will be dependent on inflation being seen as on a path to return sustainably to target.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback