Scottish economic bulletin: January 2025

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Labour Market

The unemployment rate fell over the most recent quarter to 3.6%.

Employment, Unemployment, and Inactivity

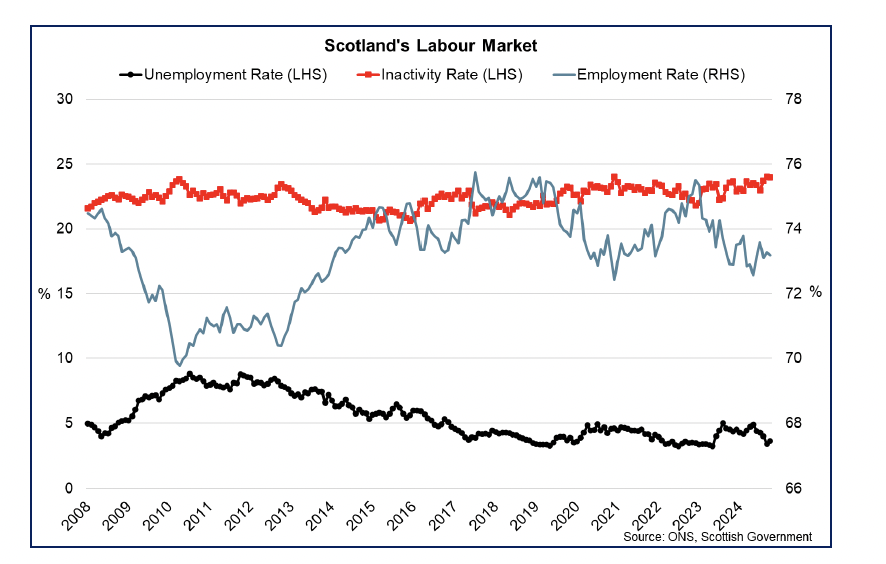

- The labour market in Scotland continued to show strength in the second half of 2024 with low unemployment and high, stable levels of employment, however there are indications that labour market tightness continues to ease.

- Latest Labour Force Survey data for August to October show that Scotland’s unemployment rate fell 0.7 percentage points over the quarter, and fell 0.9 p.p annually, to 3.6%. The employment rate fell 0.4 p.p over the quarter, and rose 0.3 p.p over the year, to 73.2%. The inactivity rate fell by 1.0 p.p over the quarter and rose by 0.4 p.p annually to 24.0%.[8],[9]

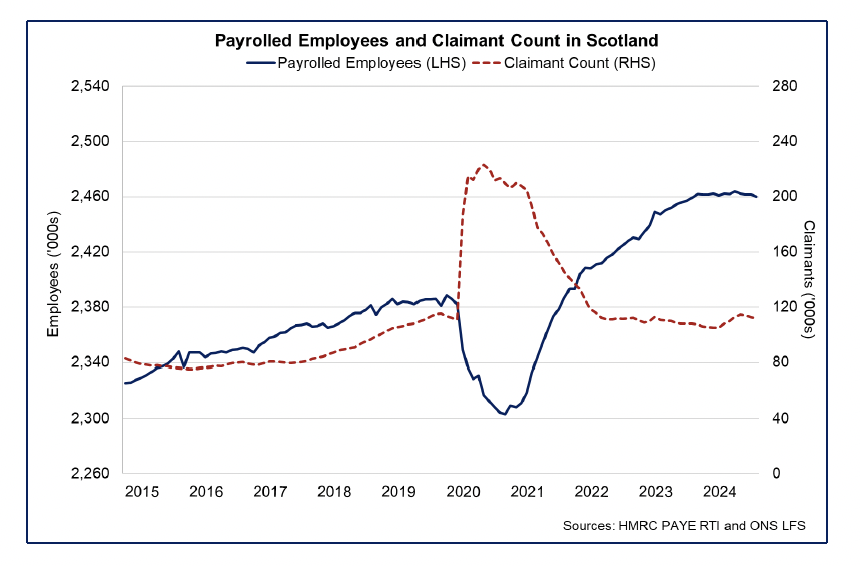

- Wider labour market data also continues to demonstrate robustness in the labour market while indicating some loosening in conditions. In November, the number of payrolled employees in Scotland fell marginally over the month by 0.1% to 2.46 million, with growth flat over the year. Alongside this, Scotland’s claimant count unemployment rate remained flat in November at 3.9% with the number of claimants increasing by 3,829 over the year to 111,927.[10],[11]

Recruitment Activity

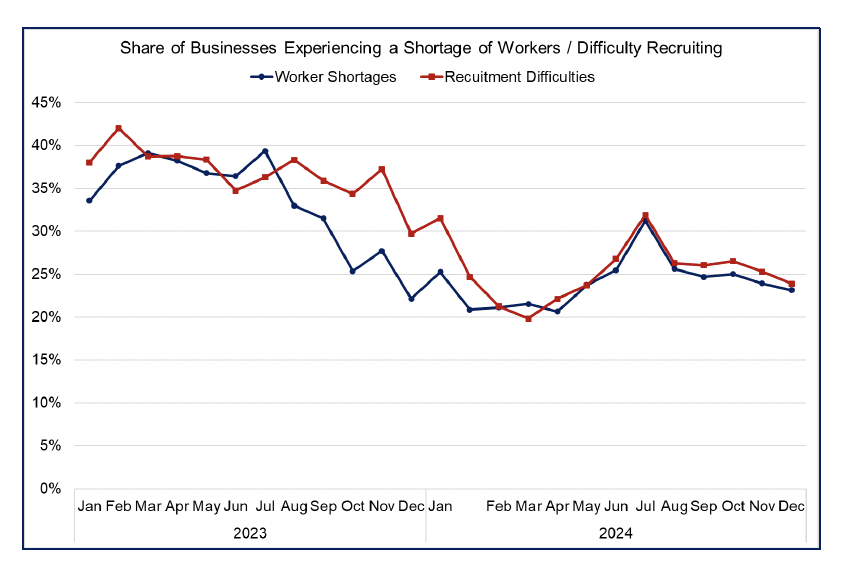

- Recruitment activity continued to stabilise and loosen during the second half of 2024 to around pre-pandemic levels, having fallen from elevated activity levels in 2022 and 2023.[12]

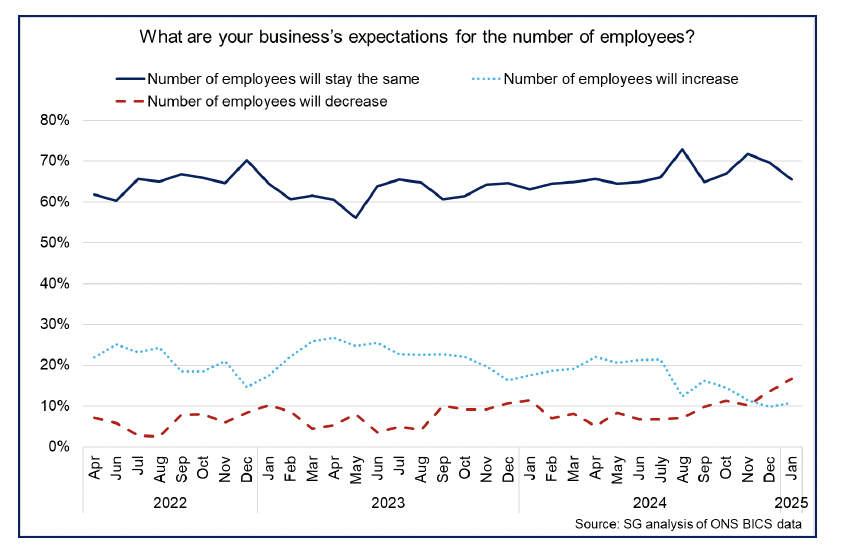

- Wider business survey data also indicates further loosening through the turn of the year. RBS Growth Tracker data for November indicated that private sector businesses continued to increase staffing levels across 2024, however the pace had eased to one of its lowest rates since the middle of 2023.

- BICS data also shows the share of businesses expecting employment to decrease had been on an upward trend since the second half of 2024 rising to 16.7% in January, while the share of businesses expecting to increase employee numbers has been on a downward trend, though rose slightly in January to 10.8%. Most businesses (65.6%) expect the number of employees to remain the same.

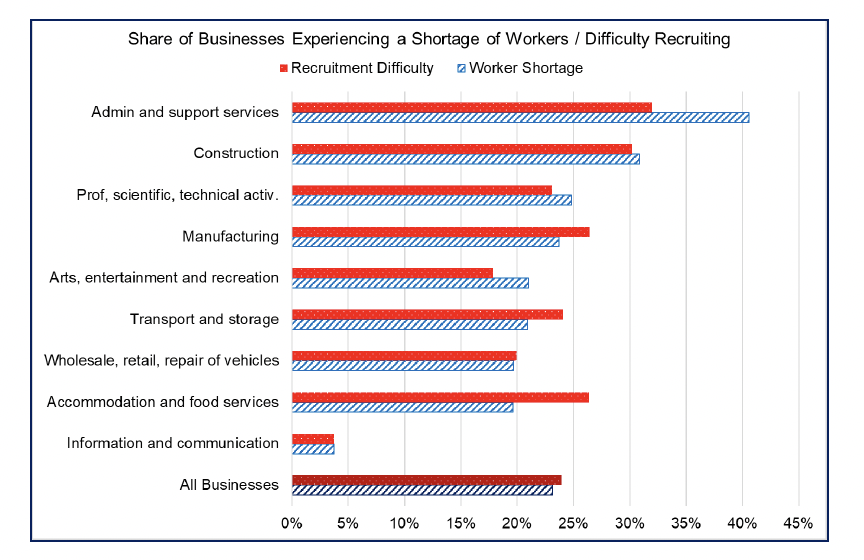

- Business surveys continue to indicate businesses are facing recruitment difficulties and worker shortages across different sectors. In December, BICS data show that 23.9% of businesses were experiencing recruitment difficulties and 23.1% were facing worker shortages. These indicators have broadly stabilised in recent months following an increase over the course of 2024, peaking in the middle of the year.

- At a sectoral level, worker shortages and recruitment difficulties in December were particularly concentrated in the admin and support services sector, construction, and professional, scientific and technical activities sectors. In contrast, employers in the accommodation and food services and information and communication sectors were less likely to report these challenges.

- Latest data covering October show most businesses responded that a lack of qualified applicants (48.6%) alongside a low number of applications (37.5%) underpinned their recruitment challenges, while 18.4% of businesses felt their business could not offer an attractive pay package to applicants.

Earnings

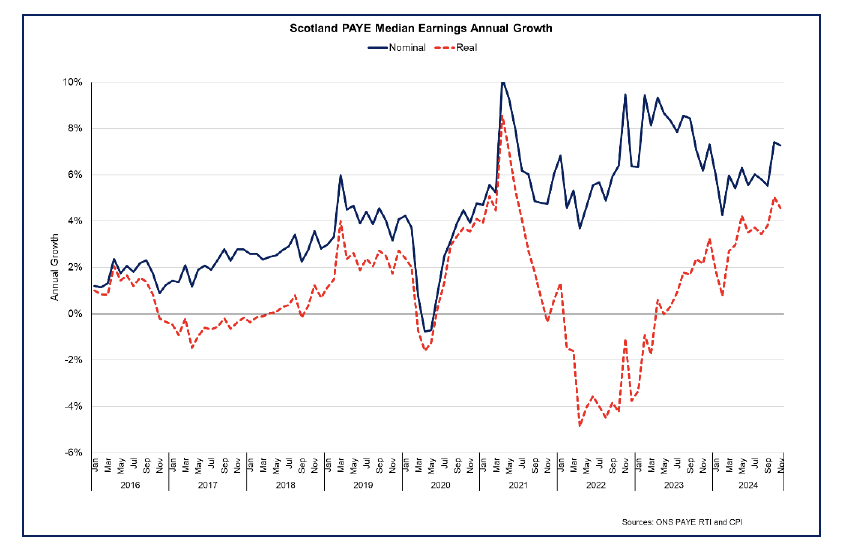

- Labour earnings have remained resilient despite the slight softening in the labour market over the past year. The pace of earnings growth alongside falling inflation has resulted in earnings continuing to grow in real terms.

- Nominal median monthly PAYE pay in Scotland was £2,526 in November, and grew 7.3% on an annual basis. This was its second highest annual rate of the year, although it was affected by backdated NHS paydeals and overall remains slightly slower than more elevated rates in 2023.[13]

- Adjusting for inflation, earnings grew by 4.6% in real terms on an annual basis in November. This is down from 5.0% annual growth in October but continues the current pattern of positive annual real terms growth following the period of falling real pay during 2022 and the start of 2023.

- The outlook is also one of continued real wage growth albeit at a slower pace. The Bank of England Decision Maker’s Panel (DMP) reported annual UK wage growth of 5.4% in the 3-months to December and anticipated year-ahead wage growth of 4.0% (unchanged from November), signalling wage growth to decline by 1.4 percentage points over the next year.[14]

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback