Scottish economic bulletin: January 2025

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Consumer Activity

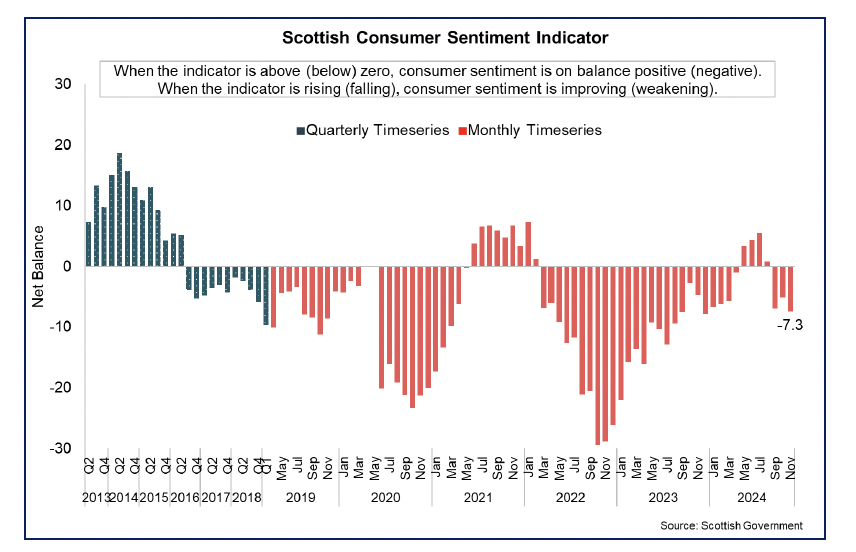

Consumer sentiment remained negative in November and fell to its lowest level of the year.

Consumer Sentiment

- The Scottish Consumer Sentiment Indicator reflects how households think the economy is performing, how secure they feel about their household finances and how relaxed they feel about spending money.

- Latest data show consumer sentiment in Scotland fell 2.2 points in November to -7.3. This is its lowest level since December 2023 and continues a downward trend in sentiment during the second half of 2024 following a period of strengthening sentiment over 2023 and the first half of 2024.[15]

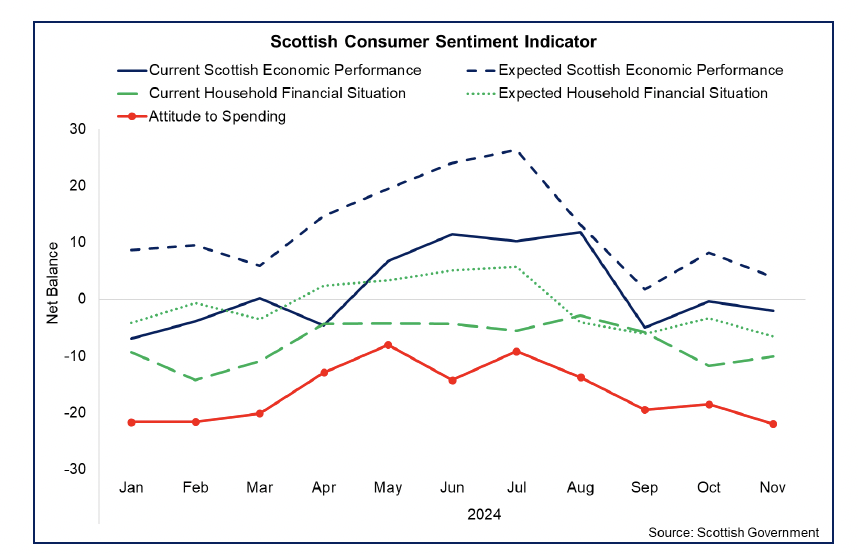

- The fall in sentiment in November was mainly driven by weakening expectations for economic performance (down 4.3 points to 3.9) and household financial security (down 3.3 points to -6.6) over the coming year, alongside respondents becoming less relaxed about spending money (down 3.5 points to -22.0).

- Compared to last year, respondents also reported that current economic performance had continued to weaken in November (down 1.6 points to -2.1) however that their current household financial security had improved (up 1.7 points to -10.0).

- The weakening in sentiment during the second half of 2024 is broadly consistent with consumer sentiment at a UK level, with the GfK Consumer Sentiment Indicator falling over September and October before picking up slightly in November and December.[16]

Spending and Cost of Living

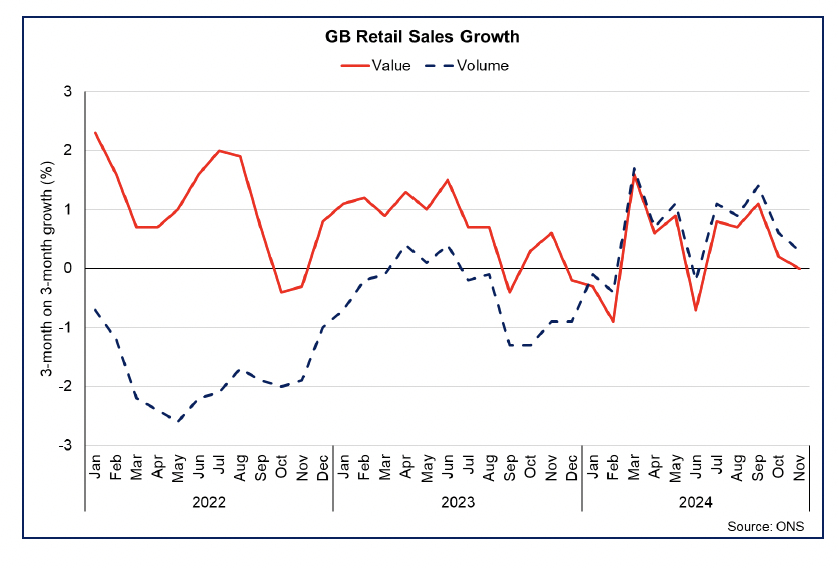

- Retail sales in Great Britain have grown over the past year in both volume and value terms (1.9% and 0.6% respectively) however latest data indicates the pace of growth has slowed in recent months. Retail sales volumes grew 0.3% in the three months to November and were flat (0.0%) in value terms.[17]

- More recently, Retail Sales Monitor data indcate that retail sales growth remained generally subdued over the fourth quarter as a whole albeit that Black Friday at the end of November coupled with Christmas trading in December boosted in person and online sales.[18]

- Lower and more stable inflation and reductions in interest rates are providing improving conditions for consumption, though the full benefits are gradually feeding through, and cost of living challenges are continuing to impact households.

- In November, the ONS Public Opinions and Social Trends survey showed that 32% of respondents found it very or somewhat difficult to afford energy bill payments (down from a peak of 49% in 2023) while 30% of respondents said the same for mortgage and rent payments (down from a peak of 46% in 2023).[19]

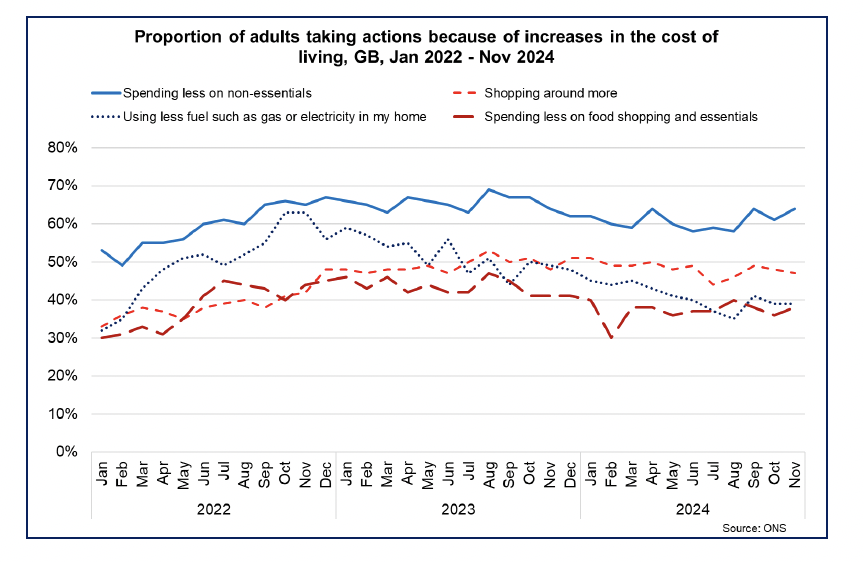

- The most common actions people are taking in response to the increased cost of living continue to be spending less on non-essentials (64%) and shopping around more (47%). 39% reported using less fuel such as gas or electricity in their home and 38% reported spending less on food shopping and essentials.

- These figures have remained broadly consistent over the course of 2024. However, over the longer term, following a relatively sharper uptake in these actions over 2022 and 2023, the flatter downward trajectory over 2024 indicates that cost of living continues to be a challenge to household budgets, and that it will take time for a stabilising price environment and stronger earnings growth to influence consumer behaviour.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback