Scottish Economic Bulletin July 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Inflation

Inflation has fallen to its 2% target over May and June, its lowest rate since July 2021.

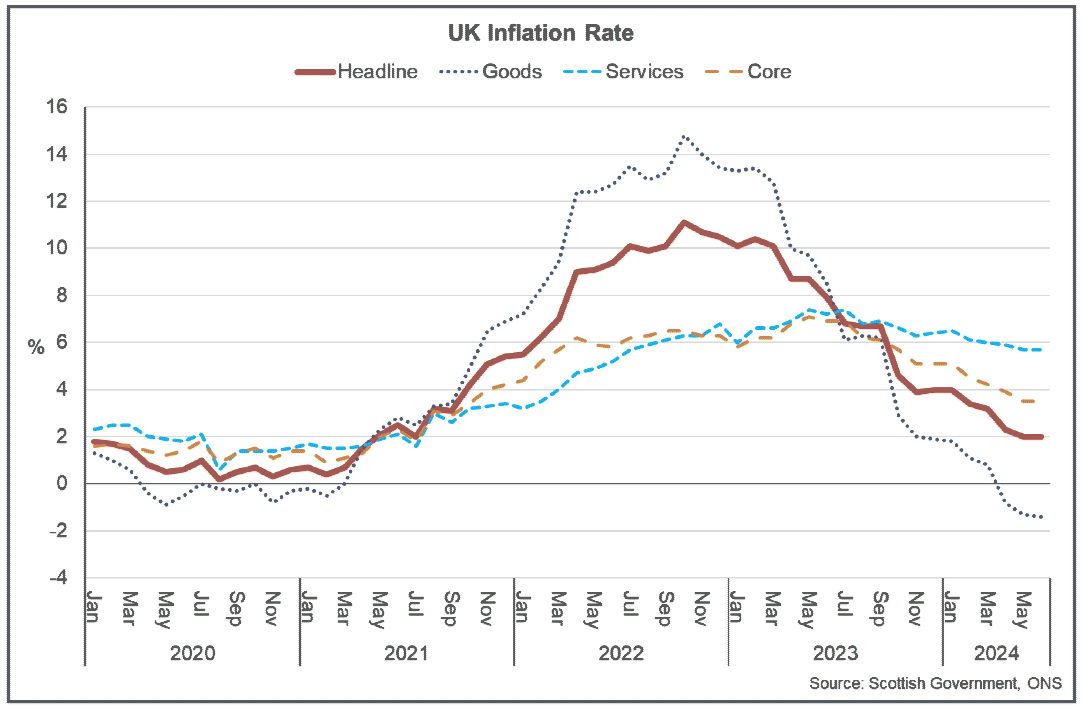

- The inflation rate fell to 2% in May and remained unchanged in June as inflationary pressures continued to stabilise and inflation fell back to its target rate for the first time since mid-2021.[2]

- The core inflation rate, which excludes energy, food, alcohol, and tobacco, was unchanged over the month in June at 3.5%, partly reflecting the stronger persistence of services prices inflation which remained at 5.7% while goods prices inflation fell from -1.3% to -1.4%.

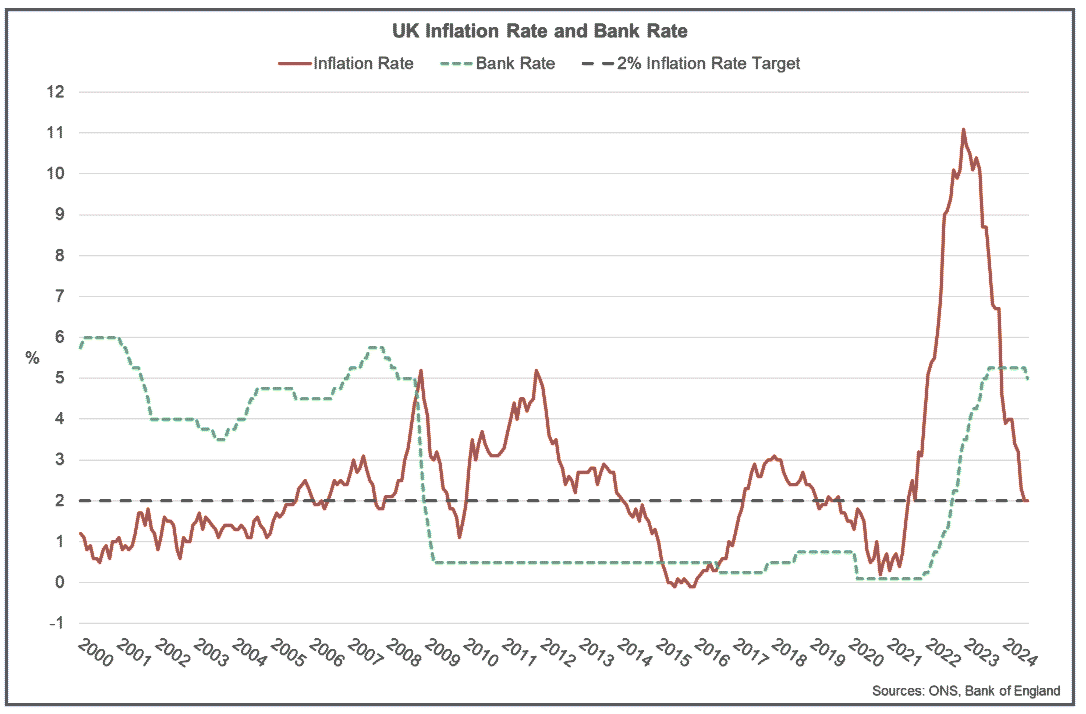

- In response to the easing in inflationary pressures, the Bank of England’s Monetary Policy Committee (MPC) reduced the Bank Rate by 0.25 percentage points in August from 5.25% to 5%, concluding that it was appropriate to reduce slightly the degree of monetary policy restrictiveness. The interest rate had been held at 5.25% since August 2023 and the decision to reduce the rate at this point reflected a range of judgements that the impacts from past external shocks had abated, the risks of inflation persistence had moderated, inflation expectations had continued to normalise and forward-looking indicators pointed to easing wage and price pressures.[3]

- However, the MPC set out that risks to the inflation outlook remain skewed to the upside and the risks of inflation persistence would continue to be a key factor in deciding the degree of monetary policy restrictiveness required to return inflation sustainably to the 2% target.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback