Publication - Research and analysis

Scottish Economic Bulletin July 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Business Conditions

Business activity continued to grow through the second quarter of the year.

Business Activity

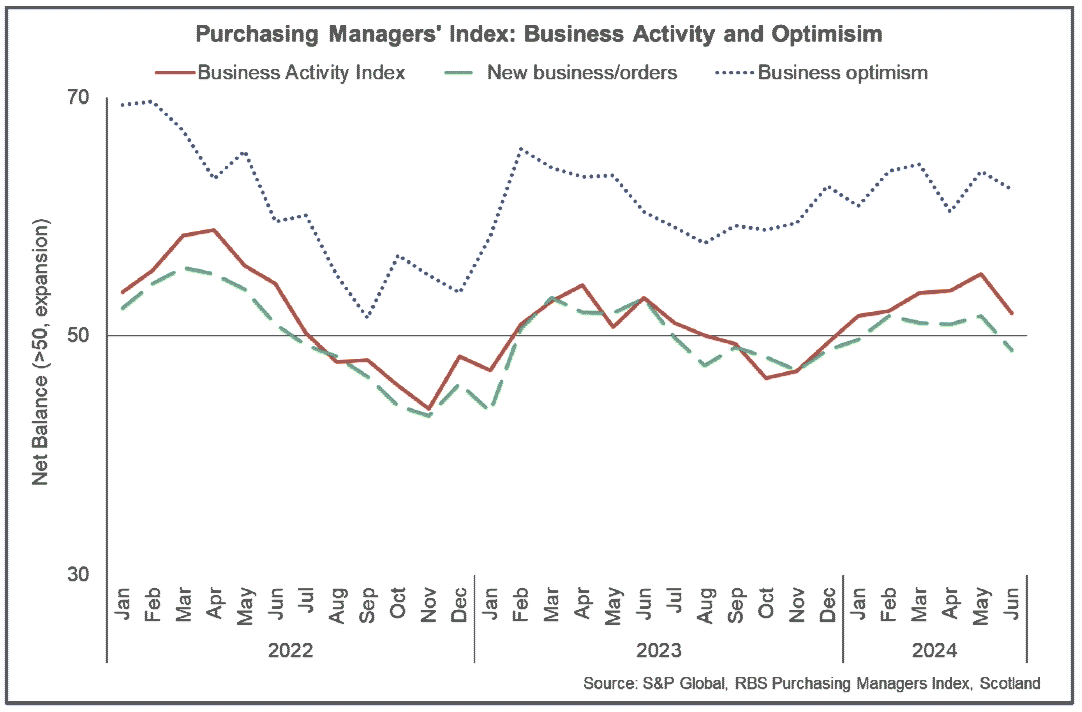

- The RBS Growth Tracker (PMI) business survey indicates that business activity in Scotland’s private sector continued to grow in June (51.9), albeit at its weakest pace since January.[4]

- As has been the case since the turn of the year, recent activity growth has been driven by the services sector offsetting falling manufacturing activity. However, both sectors faced a slight fall in new business orders in June with businesses reporting a weaker period of client activity. This has been reflected in a slight easing in business optimism in recent months albeit that business expectations for the outlook remain positive and broadly in line with the long run trend.

Business Concerns

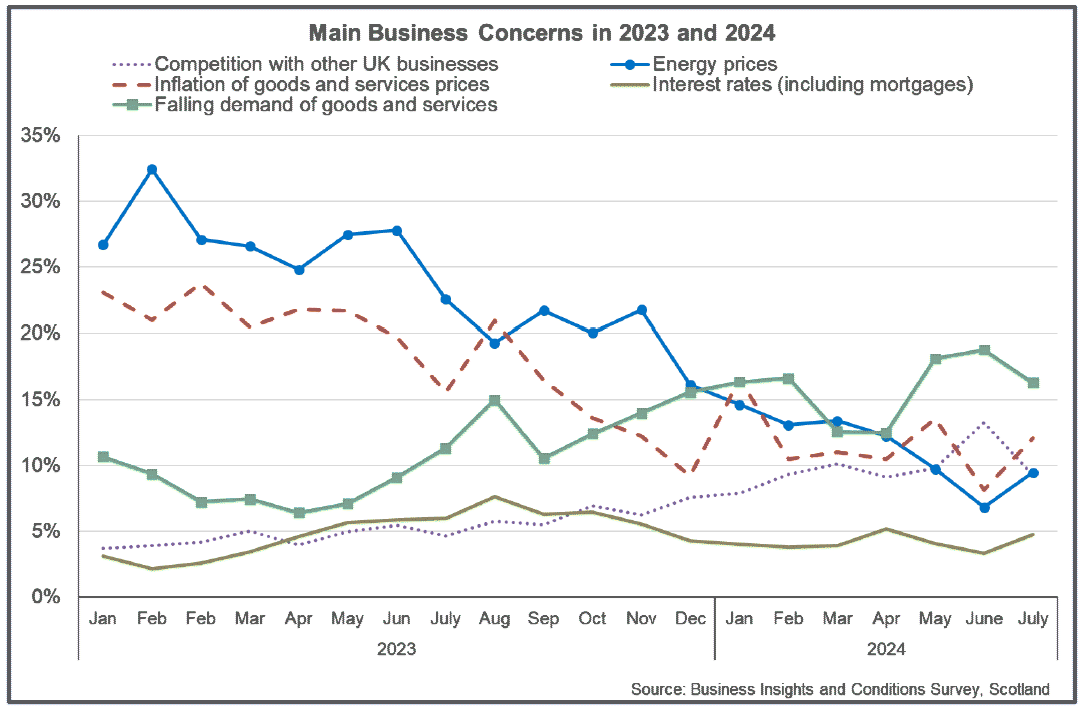

- The slight easing in new business orders in June is consistent with the recent rising share of businesses that report falling demand of goods and services as a main business concern. Business Insights and Conditions Survey (BICS) data show 16.3% of businesses reported this is a key concern in July, which has been on an upward trend over the past year as business concerns regarding inflation of goods/ services (12.1%) and energy prices (9.5%) has eased.[5]

- At a sector level, higher shares of business in Accommodation and Food Services continue to report inflation of goods and services prices (29.6%) and energy prices (17.3%) as their main concern. However, for falling demand for goods and services, this is a more prevalent concern in the manufacturing sector (26.8%), information and communication sector 25.5%) and arts, entertainment and recreation (24.8%).

- Concerns regarding interest rates have remained broadly stable since the start of the year (4.8%) as interest rates remained unchanged (until August) and markets have expected a slight reduction in interest rates during the second half of the year.

Business Costs

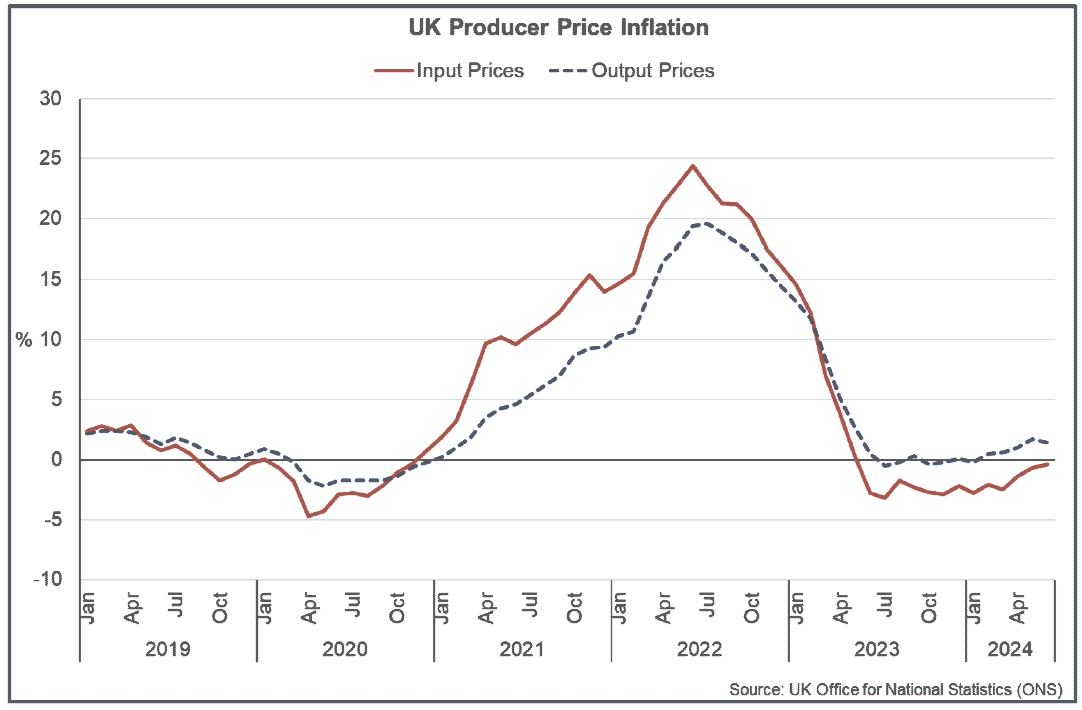

- At a headline level, producer input prices have fallen on an annual basis since June 2023 and fell 0.4% over the year to June 2024. A key driver of this has been a fall in fuel prices (-14.5%) and imported food prices (-3.2%) over the past year, partly reflecting Sterling appreciation over this period.[6]

- This has fed through to lower rates of producer output price inflation which rose 1.4% over the year to June, and is down from 1.7% in May but has picked up slightly from lower rates over the past year.

- Looking at a broader range of input costs across the manufacturing and services sectors, PMI business survey data indicates that raw materials and supplier costs continued to generate upward pressure on input costs in June, however the pace of growth had eased to its softest rate since February 2021.

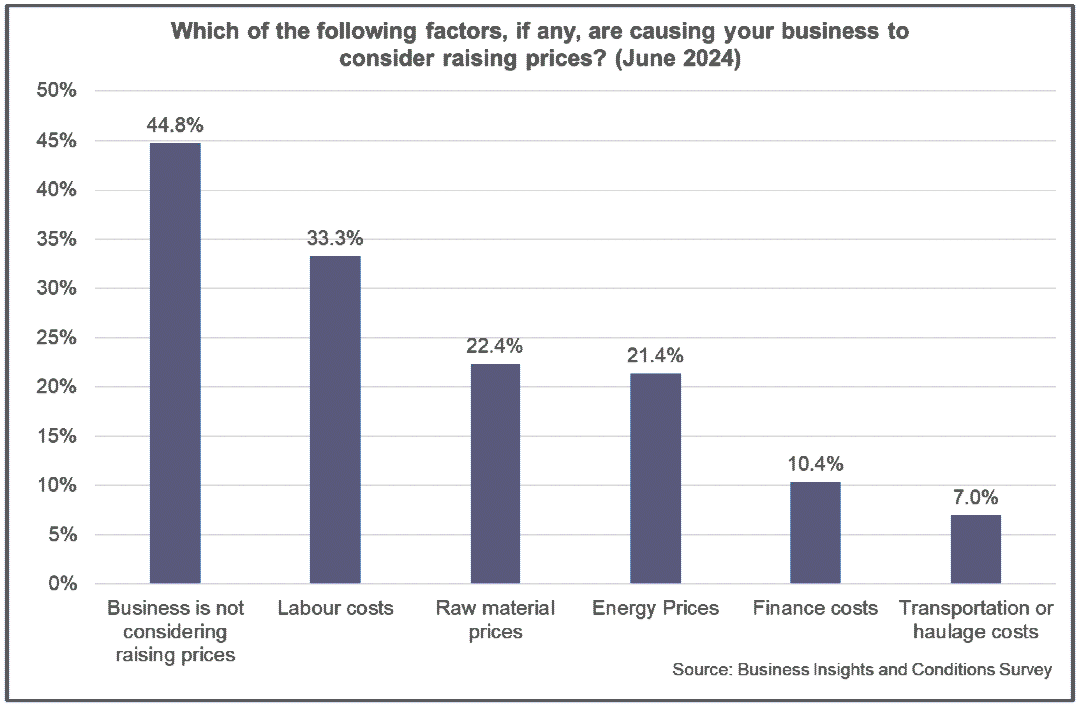

- In terms of the feed through to output prices, BICS data show that many businesses are not considering raising prices in July (45%), with the share rising from the start of the year reflecting that upward cost pressures have been easing. However, labour costs (33%) continues to be the main factor of considered price rises followed by raw materials (22.4%) and energy prices (21.4%).

Business Investment

- Latest business surveys for 2024 show that indicators of new capital investment have improved from 2023 however generally remain weak overall with the combination of business concerns around demand, cost pressures and borrowing costs continuing to weigh on business investment decision making.

- The Scottish Business Monitor reported that levels of new capital investment remained negative in Q2 2024 (-10.5) though has improved from 2023 while the SCC Quarterly Economic Indicator for Q2 2024 showed that investment trends are seeing positive growth across sectors and are expected to improve further going into the second half of 2024.[7],[8]

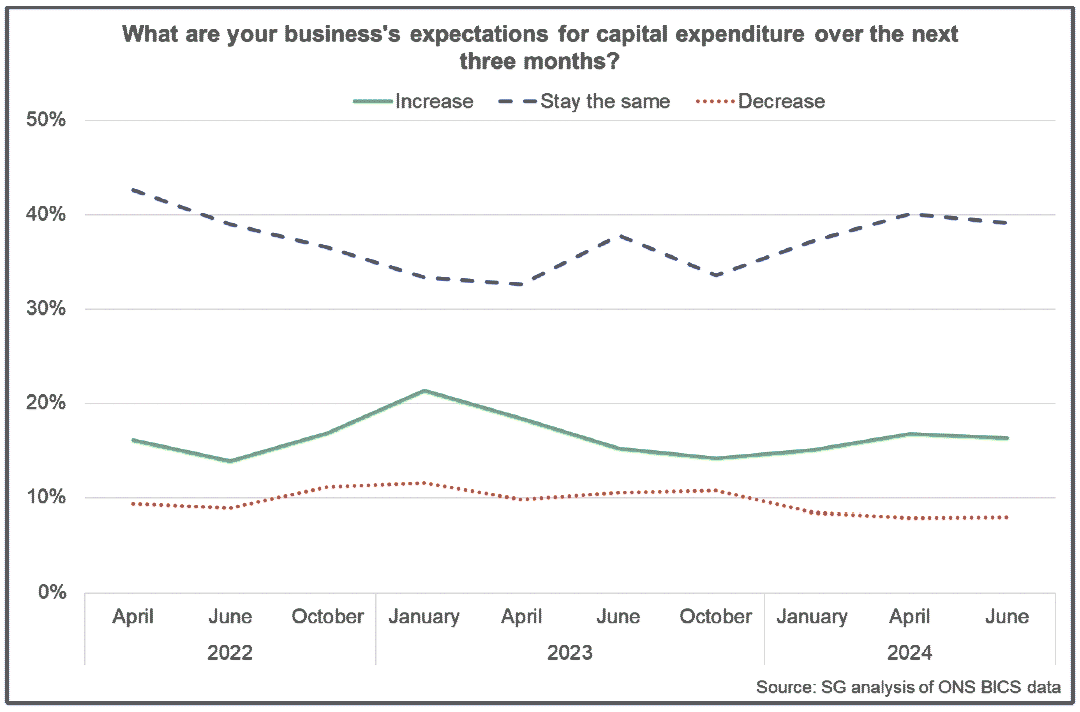

- BICS data indicate that there has been a slight increase in the share of businesses expecting to increase capital expenditure in 2024 (16.3%), compared to the second half of 2023 while the share of businesses expecting to decrease capital expenditure has fallen slightly (8%).

- However, most respondents report that they expect capital expenditure to remain the same (39%) indicating that investment expectations have improved only slightly at the start of the year.

- Of those expecting to authorise capital expenditure, 51.6% report that it will be for replacements, with a growing number of businesses expecting to authorise capital expenditure to increase efficiency (19.8%), expand capacity (15.9%) or to use new technology (12.7%). This suggests businesses remain cautious but increasingly optimistic about future economic conditions.

Business Optimism

- As shown above through the PMI data, business expectations for the year ahead have remained relatively stable since the start of the year as business activity has strengthened and cost inflation pressures have continued to moderate.

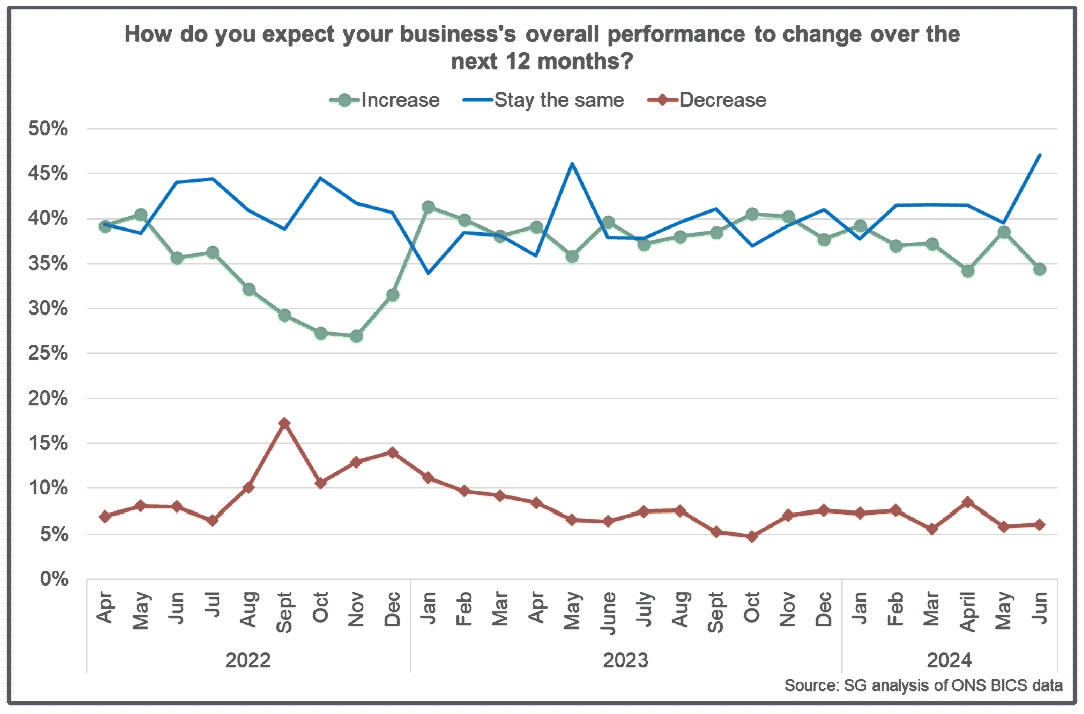

- BICS data for June indicates that most businesses expect their overall business performance to stay the same (47%) or increase (34.4%) over the coming year. On aggregate, this has remained broadly stable compared to the start of 2023, while the share of businesses expecting their performance to decrease has fallen to 6.1%.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback